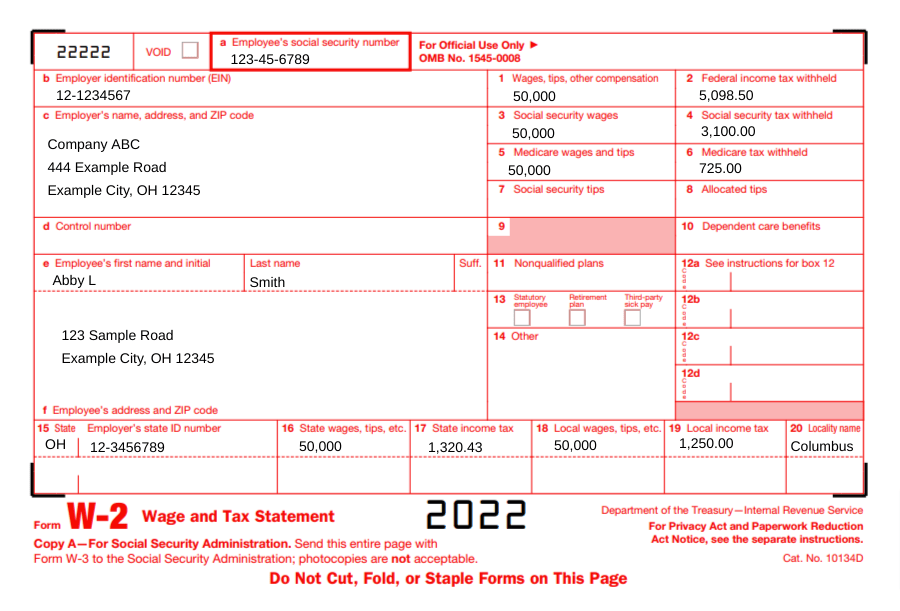

W2 Form Florida Printable Employer Form W 2 is filed by employers to report wages tips and other compensation paid to employees as well as FICA and withheld income taxes

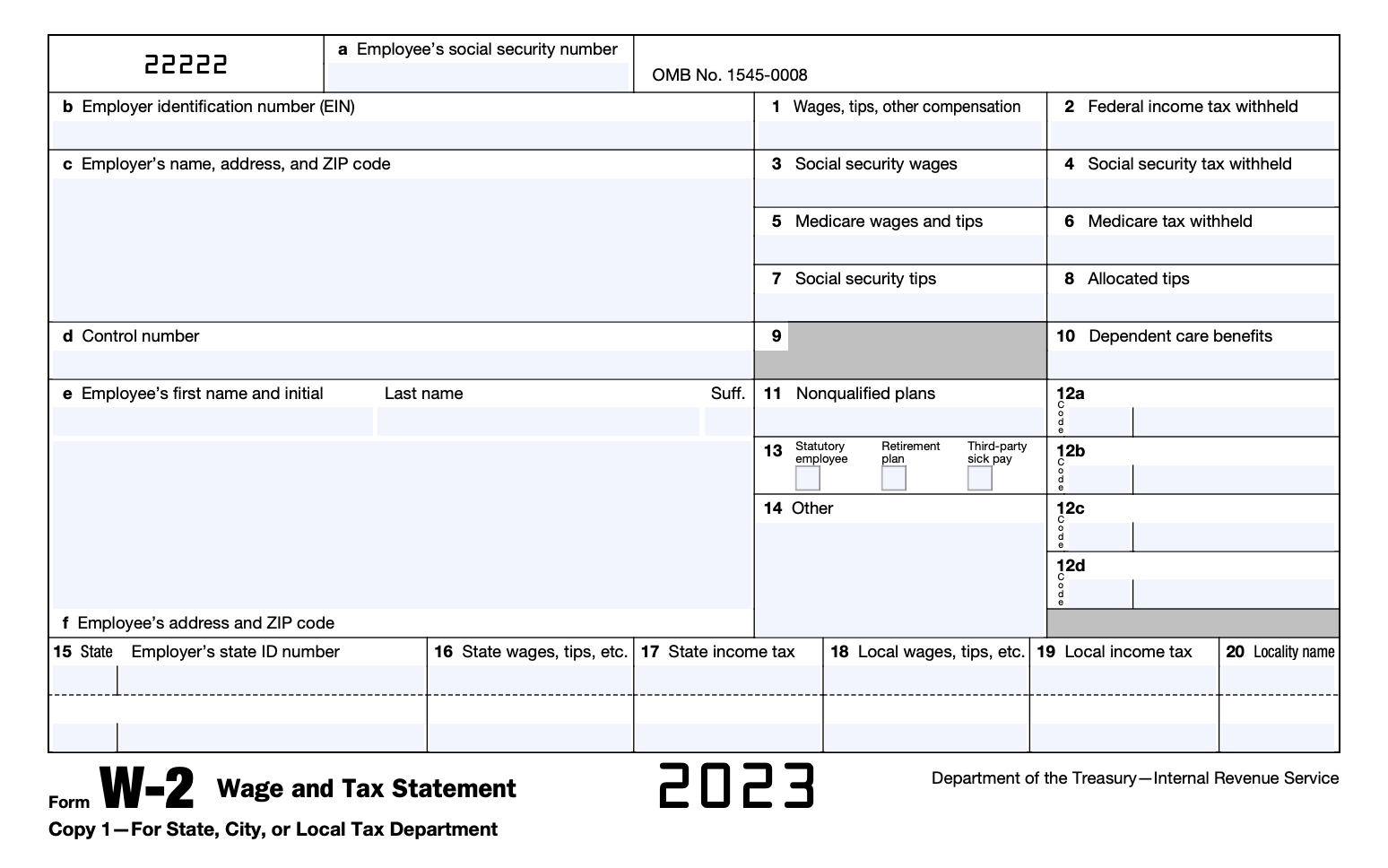

2023 Form W 2 Attention You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA Employees must register and accept all terms and conditions within the EIC website to receive W 2 forms electronically Direct Deposit EFT State Employees Did you know that through People First you can request that your salary be deposited directly into your bank account

W2 Form Florida Printable Employer

W2 Form Florida Printable Employer

https://www.patriotsoftware.com/wp-content/uploads/2022/12/image.png

W 2 Form Legal Templates

https://legaltemplates.net/wp-content/uploads/Form-W-2-for-2023.png

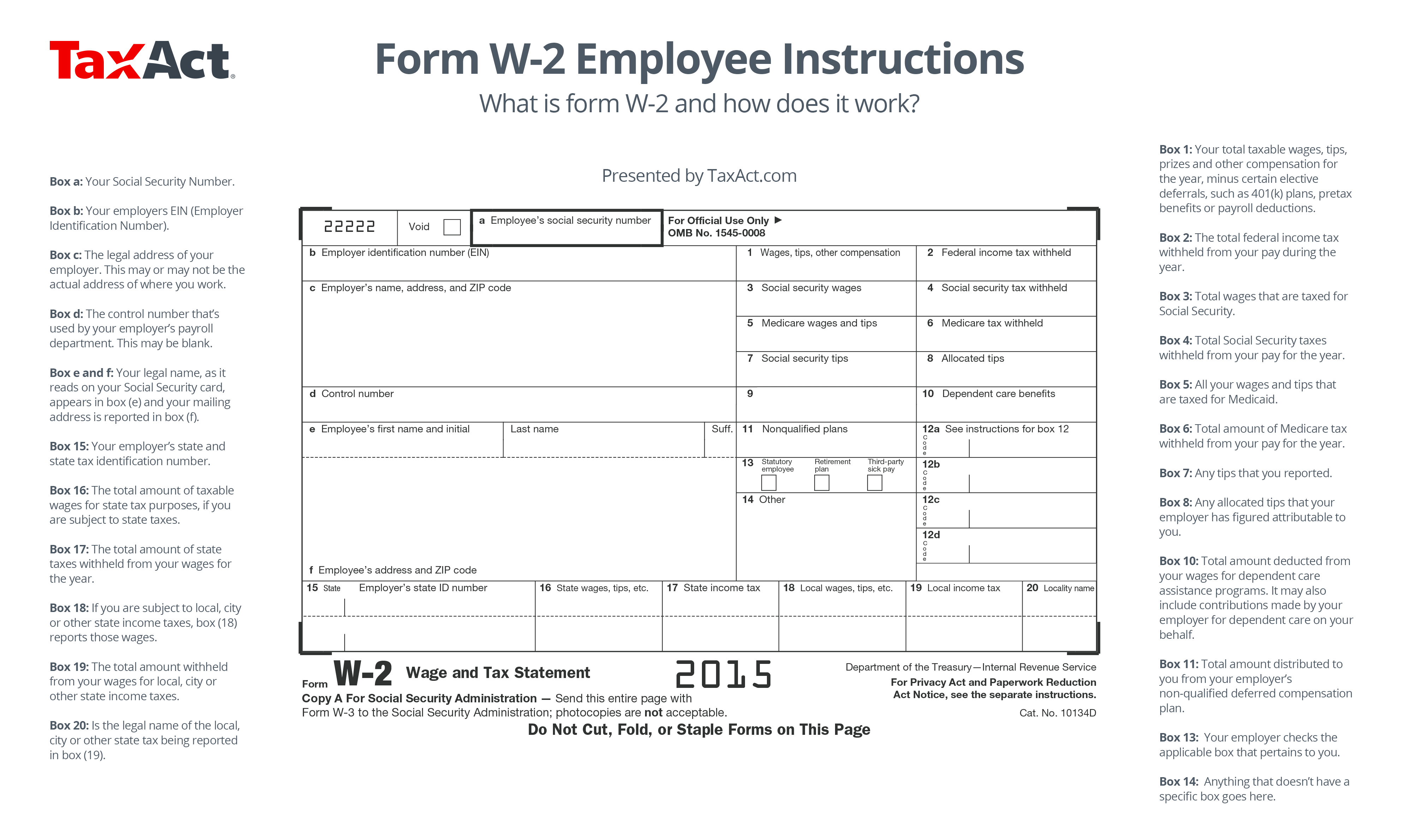

What Is W 2 Form And How Does It Work TaxAct Blog

https://blog.taxact.com/wp-content/uploads/Form-W-2-Employee-Instructions-1.png

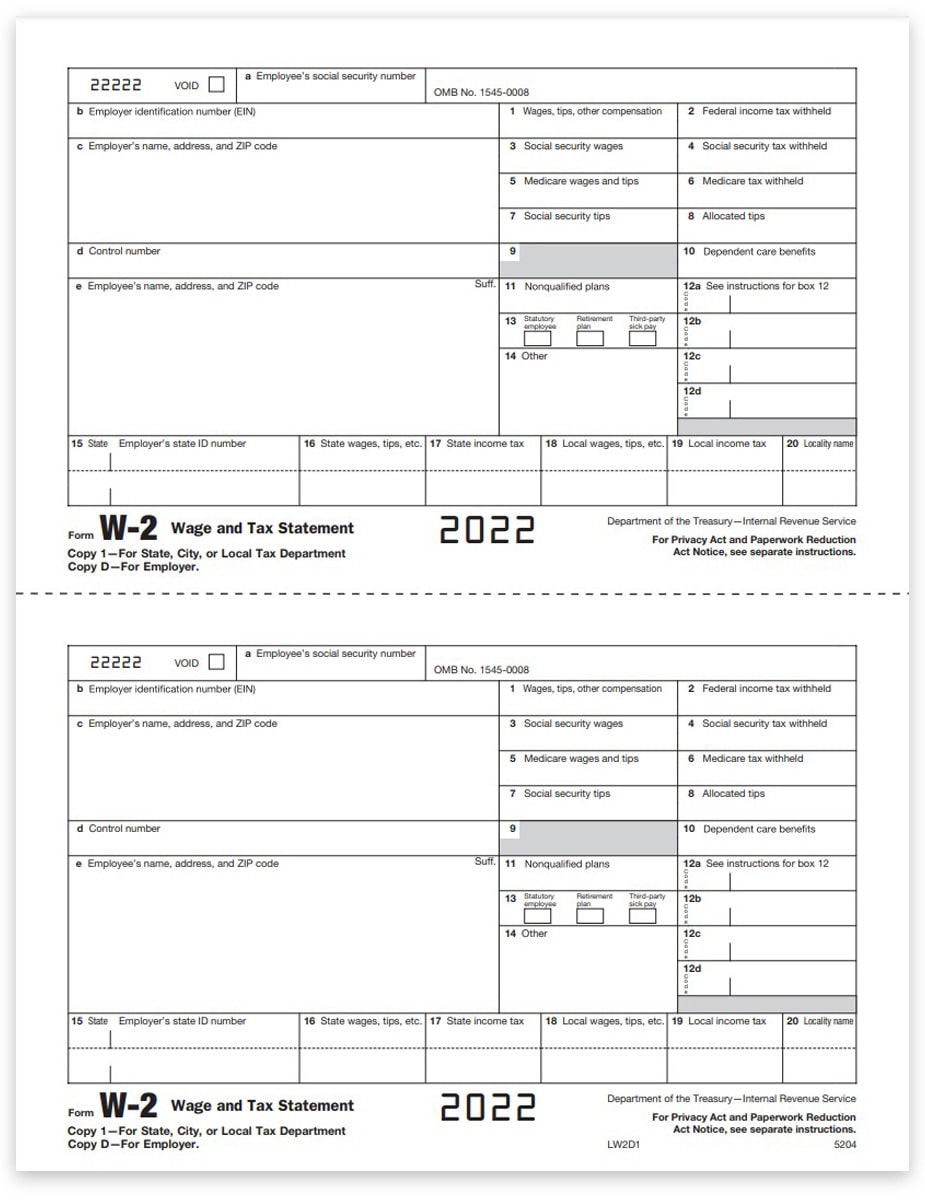

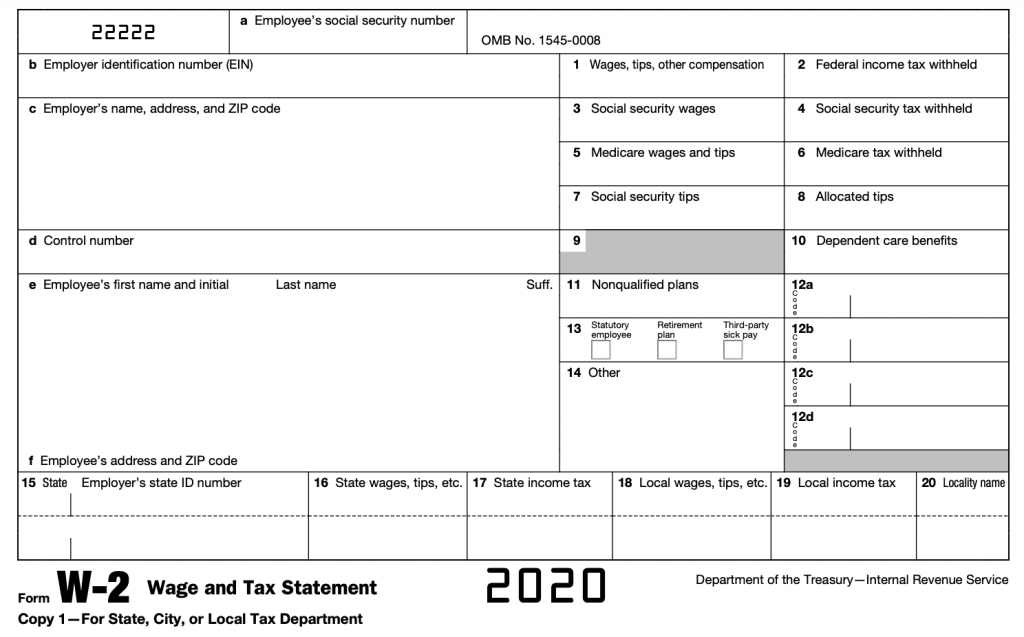

Requirements for Forms W 2 Requirements for Forms W 2c New box 12 code II for Medicaid waiver payments excluded from gross income under Notice 2014 7 Form and publication changes for 2024 Publications 51 80 and 179 Form 941 SS MSRRA changes Forms W 2c and W 3c have been updated SECURE 2 0 Act changes Employers must complete a W 2 form for each employee to whom they pay a salary wage or other compensation as part of the employment relationship Availability Dates for 2023 W 2 electronic by January 19 2024 W 2 printed mailed by January 31 2024 1042 S by March 15 2024 General FAQs W 2 Current Employees W 2 Former

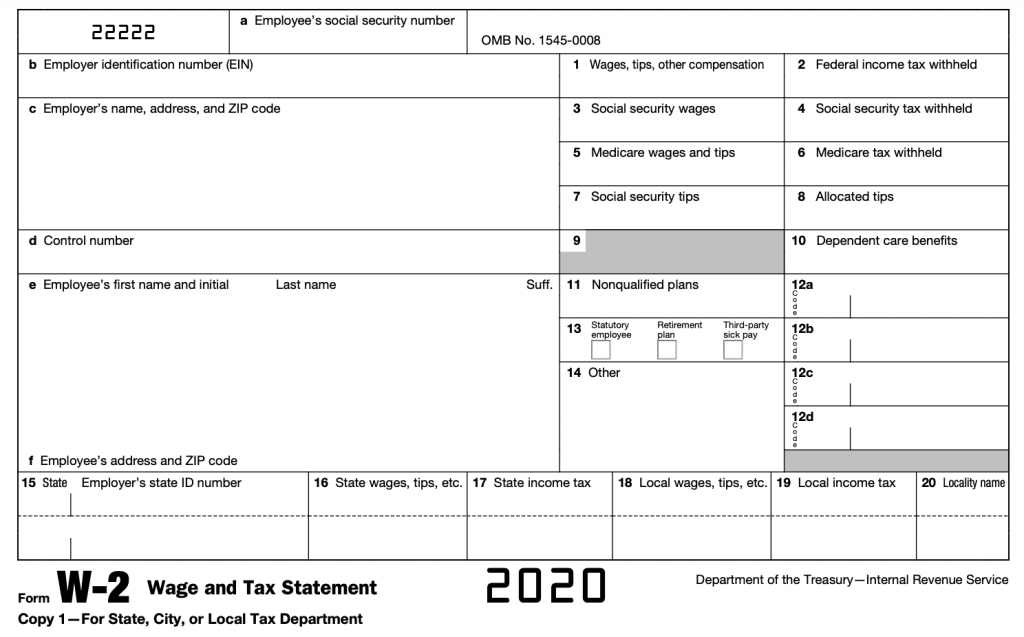

Forms W 2 must be prepared and provided to employees with copies sent to the Social Security Administration on or before Wednesday February 1 2023 Don t worry if you re not quite prepared we ll explain everything you need to know What is a W 2 Form W 2 forms are an important part of employees tax filings There s a reason why a W 2 is referred to as a wage and tax statement Put simply it s a form that shows how much money an employee has earned for the year and the amount of taxes that employers have already handed over to the IRS Not everyone needs a W 2 form Independent contractors and folks who are self employed need a 1099 form instead

More picture related to W2 Form Florida Printable Employer

What Is Form W 2 An Employer s Guide To The W 2 Tax Form Gusto

https://gusto.com/wp-content/uploads/2019/12/Form-W-2-Box-14.jpg

Understanding Your IRS Form W 2

https://www.taxdefensenetwork.com/wp-content/uploads/2022/02/form-w2-instructions.jpg

How To Fill Out A W 2 Form Everything Else Employers Need To Know

https://fitsmallbusiness.com/wp-content/uploads/2022/07/Screenshot_of_W2_Form_2022.jpg

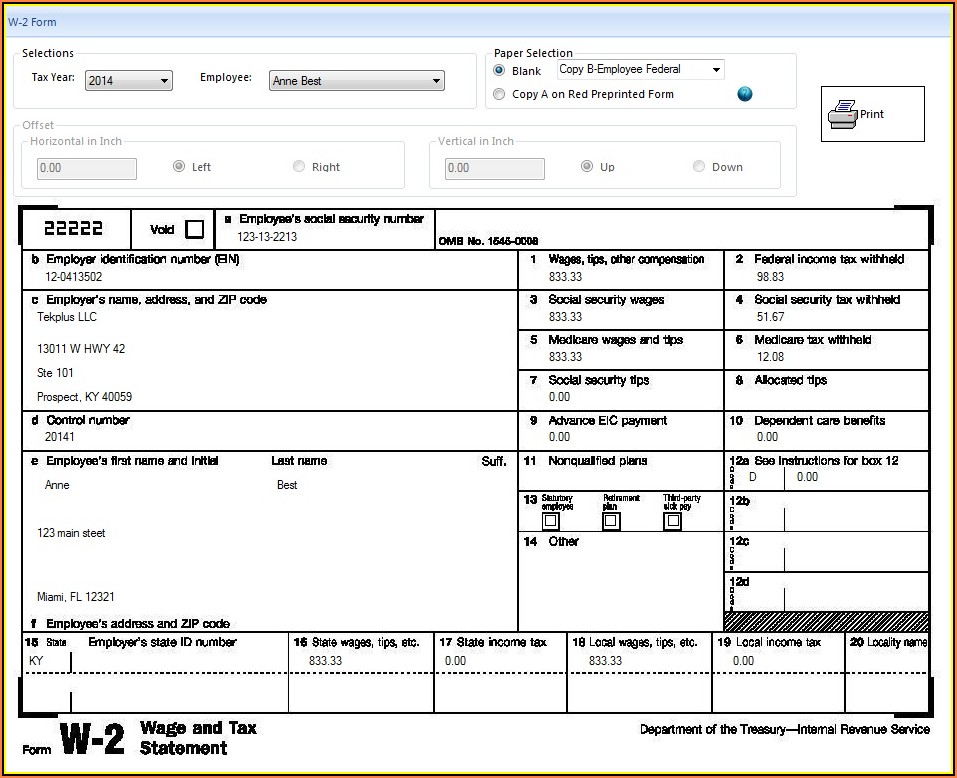

W 2 Form The W 2 form is the form that an employer must send to an employee and the Internal Revenue Service IRS at the end of the year The W 2 form reports an employee s annual wages and the This service offers fast free and secure online W 2 filing options to CPAs accountants enrolled agents and individuals who process W 2s the Wage and Tax Statement and W 2Cs Statement of Corrected Income and Tax Amounts Verify Employees Social Security Numbers

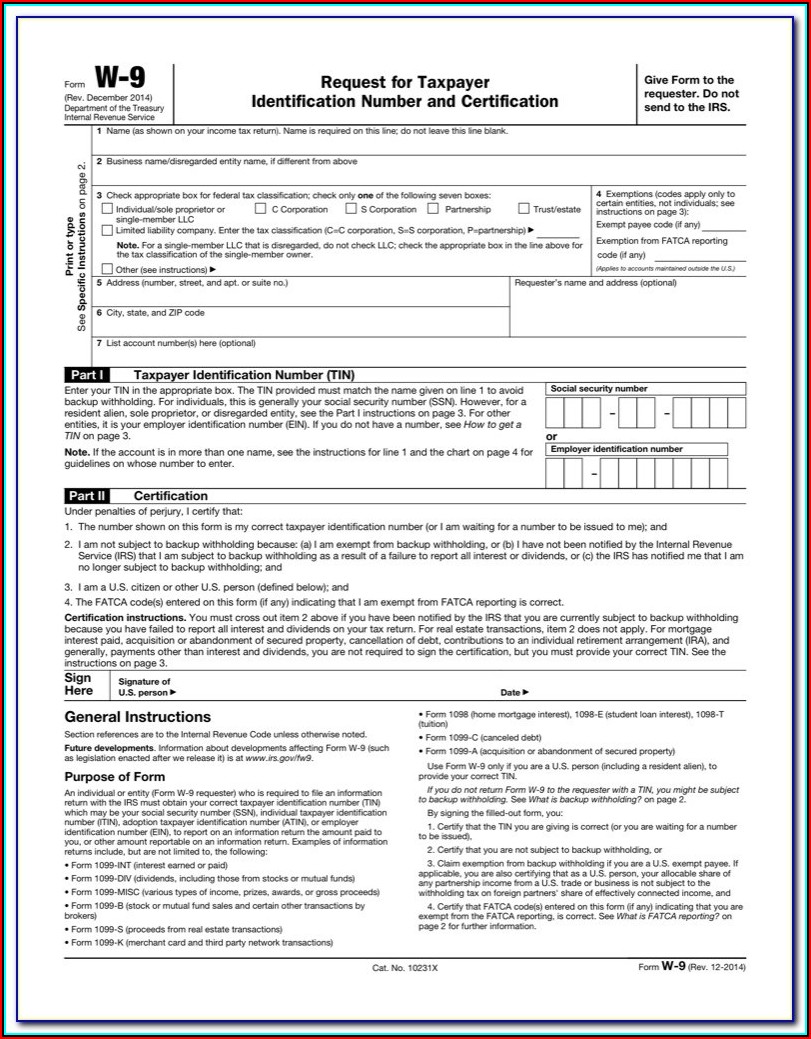

What to Expect Your employer is required to provide you with Form W 2 Wage and Tax Statement If your employer does not provide online access to your W 2 they must mail or hand deliver your W 2 to you no later than January 31st If you are not sure if you have online access please check with your company HR or Payroll department If you received Reemployment Assistance benefits in calendar year 2023 you will receive a Form 1099 G The 1099 G will detail the amount of benefits paid to you during a specific year as well as any amounts withheld and paid to the IRS Form 1099 Gs are are made available by January 31st for the prior tax year

What Is A W2 Form Wage And Tax Statement Guide

https://cashjargon.com/wp-content/uploads/2021/02/form-w2-1-1-1024x637.png

W2 Tax Forms Copy D 1 For Employer State File DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2017/10/W2-Form-Copy-D-1-Employer-State-Local-File-LW2D1-FINAL-min.jpg

https://www.irs.gov/forms-pubs/about-form-w-2

Form W 2 is filed by employers to report wages tips and other compensation paid to employees as well as FICA and withheld income taxes

https://www.irs.gov/pub/irs-access/fw2_accessible.pdf

2023 Form W 2 Attention You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA

Form W2 Everything You Ever Wanted To Know

What Is A W2 Form Wage And Tax Statement Guide

An Employer s Guide To Easily Completing A W 2 Form Gift CPAs Expert Small Business Advisors

Printable W2 Forms

State Of Florida W2 Form Form Resume Examples qeYz0wo28X

Florida State Employee W2 Form Form Resume Examples 6V3Rrlr37b

Florida State Employee W2 Form Form Resume Examples 6V3Rrlr37b

Fl W2 Form Form Resume Examples AjYd67W2l0

How To Print W2 Forms On White Paper

Sample W2 Tax Forms

W2 Form Florida Printable Employer - Florida New Hire Reporting Form Please type or print neatly Employer Business Information Federal Employer ID Number FEIN Please use the same FEIN that appears on your quarterly wage reports you submit to the state Is health insurance available to the employee Y N Florida Employer Reemployment Tax Account RT 6 Number