W2 Form For Az Printable Electronically submitting federal Forms W 2 W 2c W 2G and 1099 to the Department Through AZTaxes to use the Manual data input method or to upload the supported federal forms as a formatted txt file Through AZ Web File AZFSET to upload the supported federal forms as a txt file

Corporate Tax Forms 120A Arizona Corporation Income Tax Return Short Form Corporate Tax Forms 120S Arizona S Corporation Income Tax Return Corporate Tax Forms 120S Schedule K 1 Resident Shareholder s Information Schedule Form with Instructions 2024 Form W 2 Attention You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA

W2 Form For Az Printable

W2 Form For Az Printable

https://www.patriotsoftware.com/wp-content/uploads/2022/12/image.png

Printable W2 Forms

https://gusto.com/wp-content/uploads/2019/12/Form-W-2-Box-14.jpg

W2 Printable Forms

http://www.ekcsk12.org/cms/lib07/NY01913389/Centricity/Domain/113/w2-example.jpg

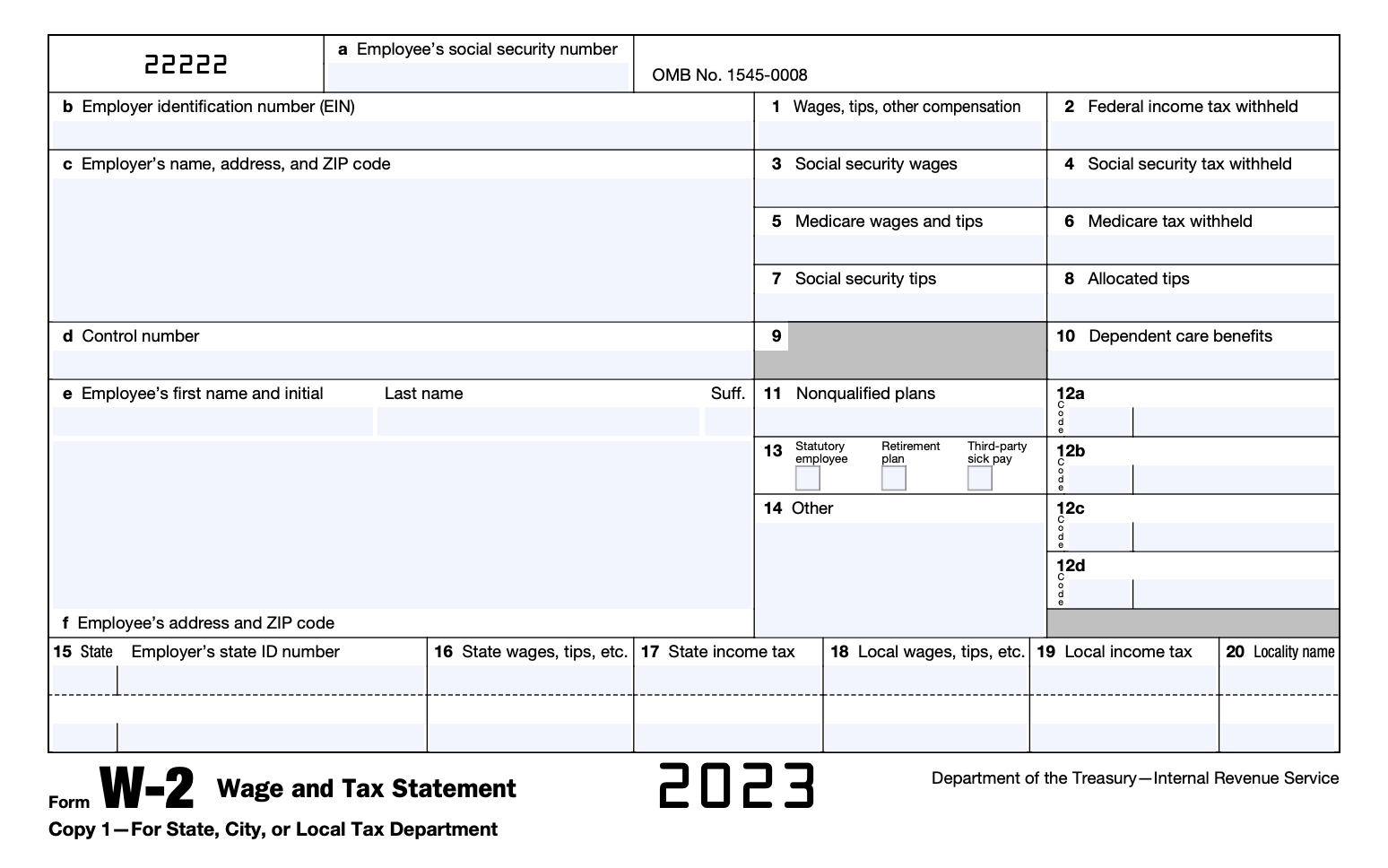

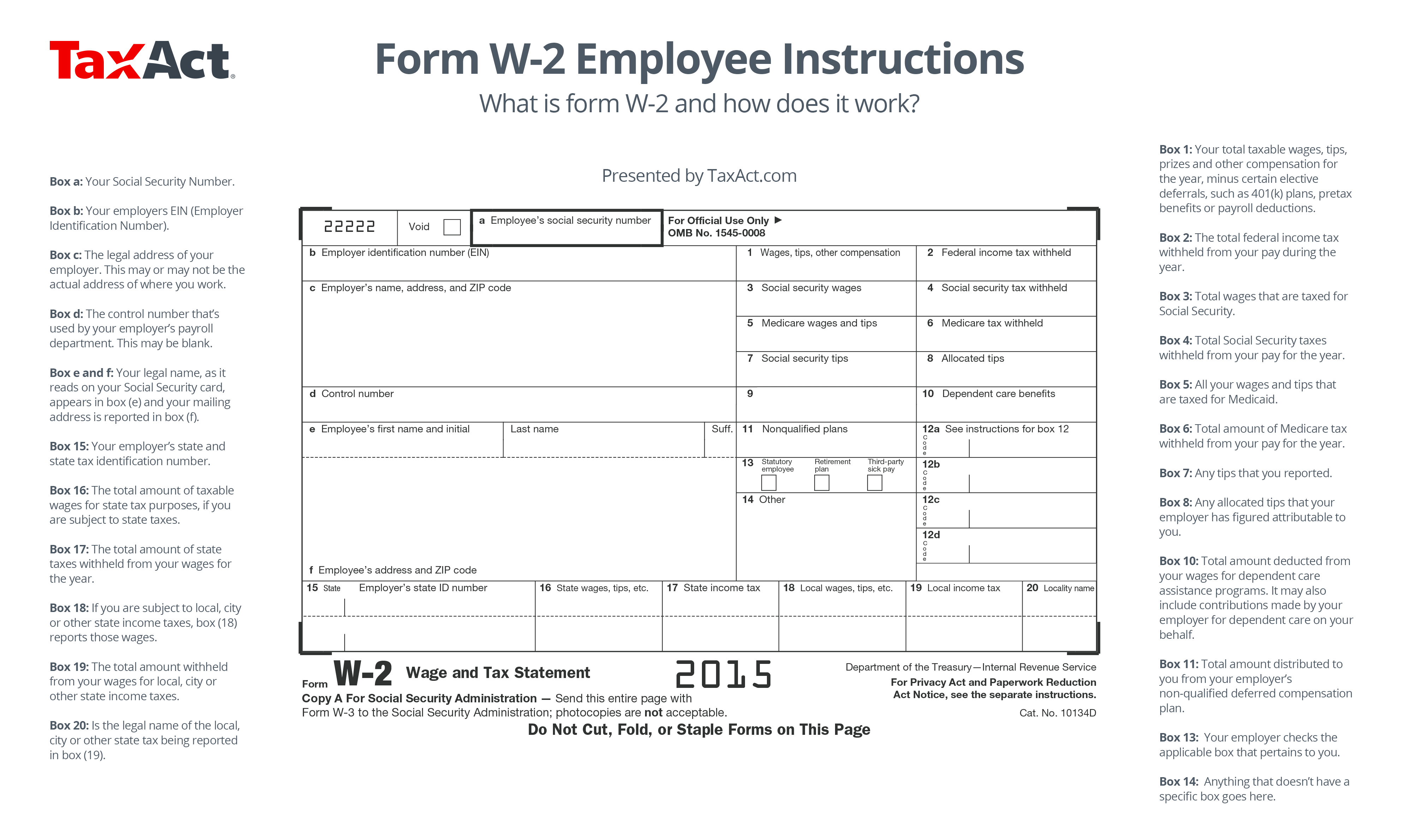

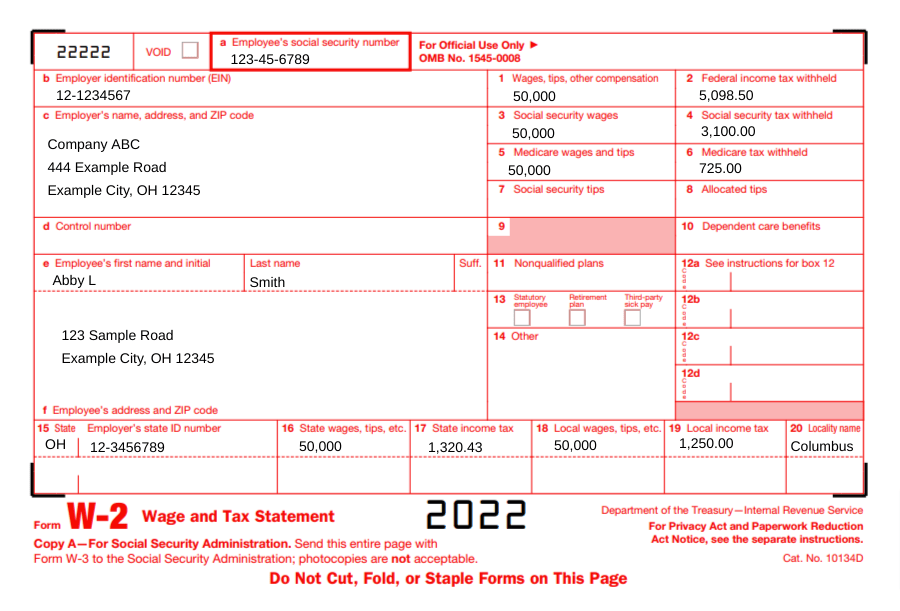

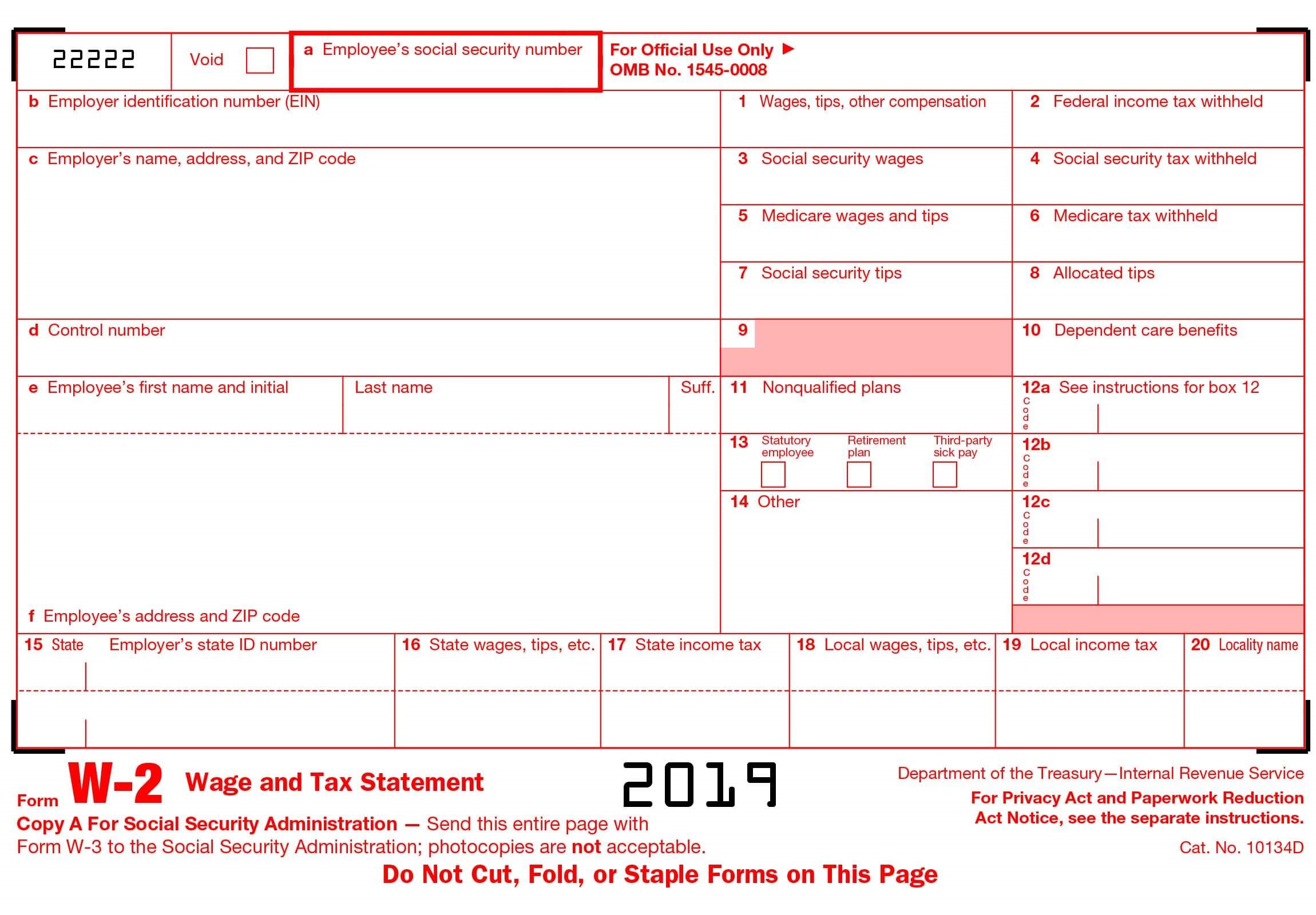

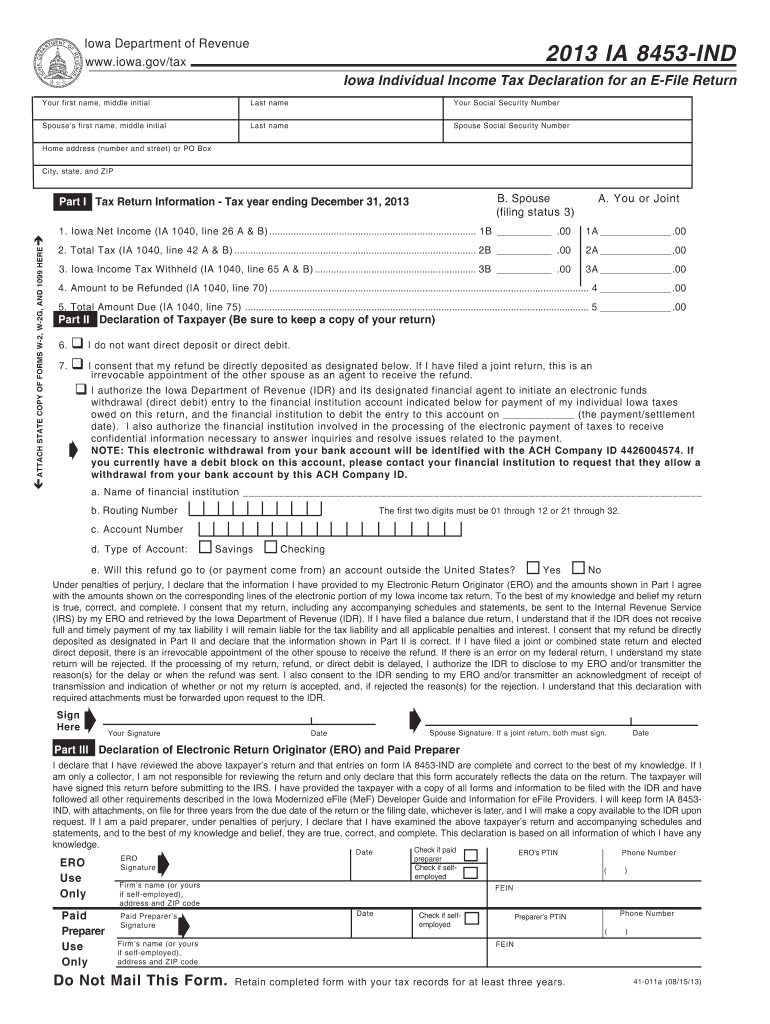

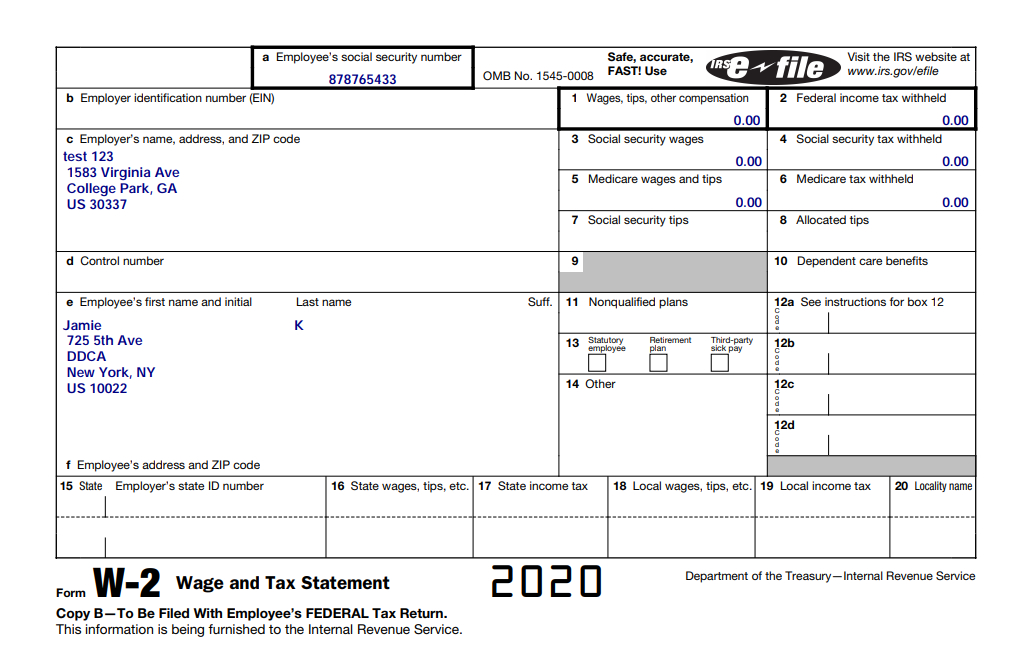

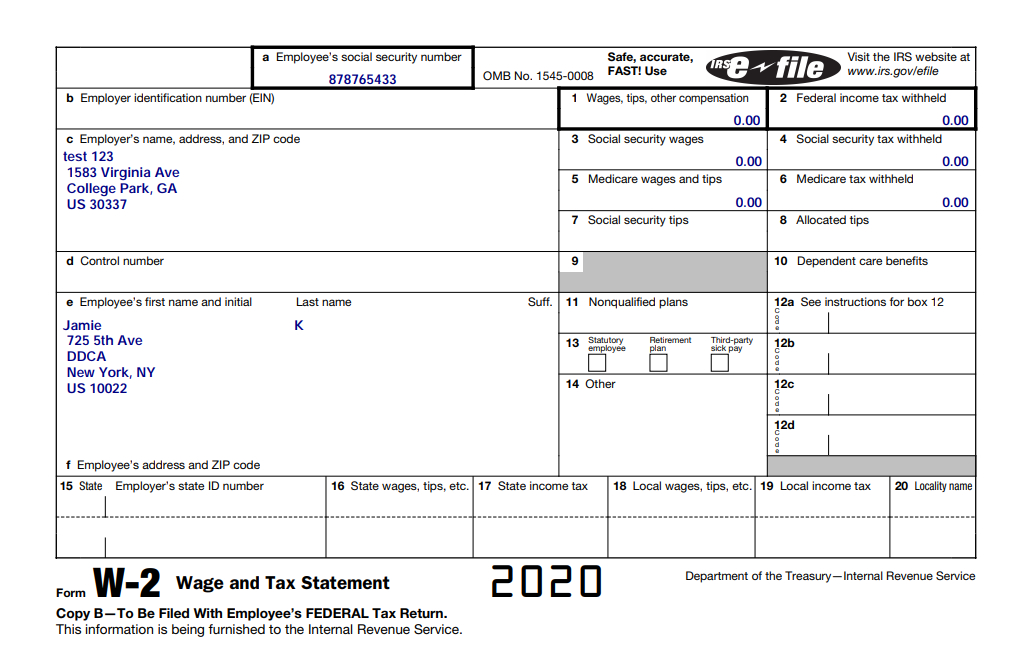

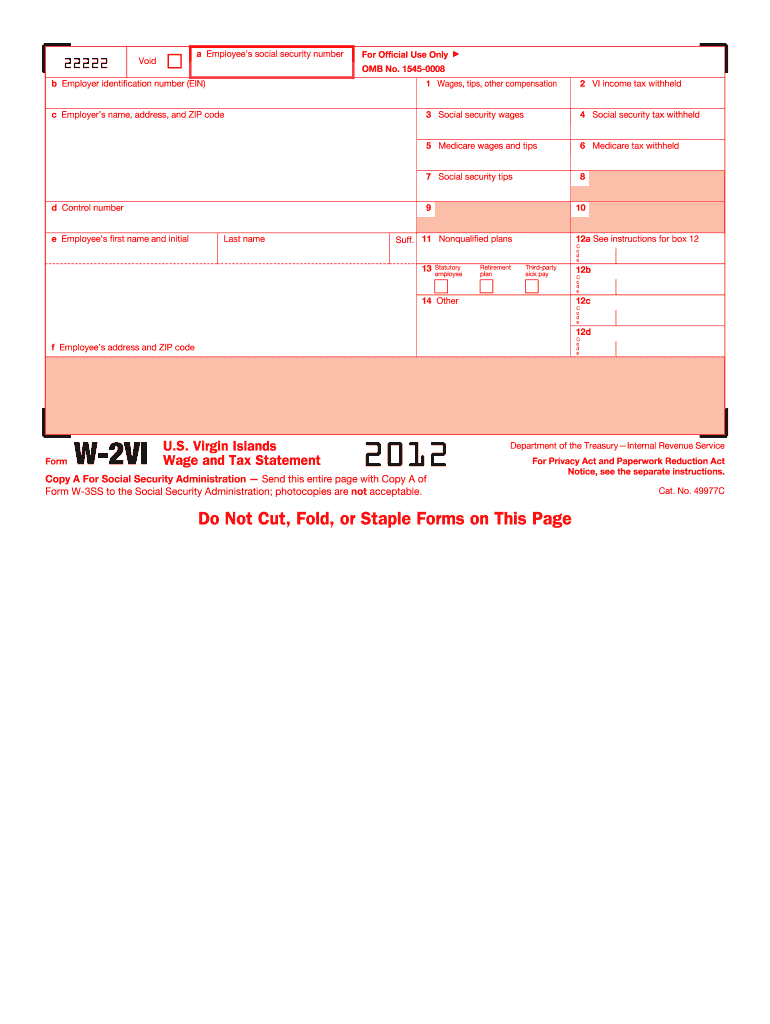

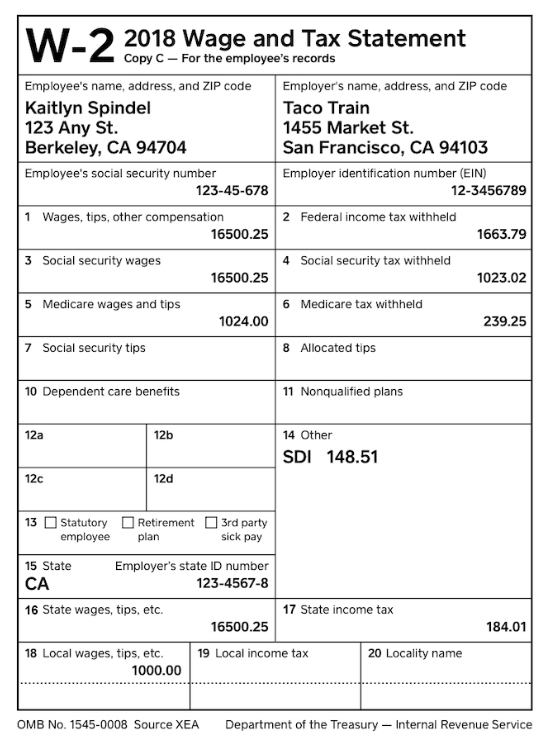

Form W 2 is filed by employers to report wages tips and other compensation paid to employees as well as FICA and withheld income taxes Requirements for Forms W 2 Requirements for Forms W 2c New box 12 code II for Medicaid waiver payments excluded from gross income under Notice 2014 7 Form and publication changes for 2024 Publications 51 80 and 179 Form 941 SS MSRRA changes Forms W 2c and W 3c have been updated SECURE 2 0 Act changes

Employers must file the State copies of the federal Forms W 2 W 2C W 2G and 1099 R as part of the reconciliation required for Arizona Forms A1 APR and A1 R Follow these steps to view and print your e filed return Most individuals deduct the amount of income tax withheld as shown on Form W 2 plus any Arizona estimated tax payments IRS Form W 2 Wage and Tax Statement Updated December 15 2023 A W 2 form also known as a Wage and Tax Statement is an IRS document used by an employer to report an employee s annual wages in a calendar year and the amount of taxes withheld from their paycheck

More picture related to W2 Form For Az Printable

Understanding Your IRS Form W 2

https://www.taxdefensenetwork.com/wp-content/uploads/2022/02/form-w2-instructions.jpg

How To Fill Out A W 2 Form Everything Else Employers Need To Know

https://fitsmallbusiness.com/wp-content/uploads/2022/07/Screenshot_of_W2_Form_2022.jpg

What Is W 2 Form And How Does It Work TaxAct Blog

https://blog.taxact.com/wp-content/uploads/Form-W-2-Employee-Instructions-1.png

DES has mailed 1099 G tax forms to claimants who received Unemployment Insurance UI and Pandemic Unemployment Assistance PUA benefits in 2023 to the address that DES has on file for you Beginning February 1 2024 if you received UI benefits in the calendar year 2023 you can log in to the Weekly Claims portal and view and print your 1099 E File Form W 2 and Arizona Withholding Reconciliation Return Form A1 R directly to the State agency Arizona Form W 2 Form A1 R Filing Requirements February 15 is the deadline for Forms 1099 S 1099 B and 1099 MISC Box 8 Box 10

Laser Printed Forms Where to File Paper W 2 W 2cs Select the appropriate mailing address depending on the type of W 2 and the carrier you choose e g U S Postal Service or a private carrier such as FedEx or UPS PAPER W 2 W 3 U S Postal Service Social Security Administration Direct Operations Center Resources W 2 ASU must report taxable wages and related compensation income taxes and certain other information to employees the Internal Revenue Service the state of Arizona or other states for which the university withholds taxes W 2s are mailed to all ASU employees by Jan 31 of the following year unless the employee has

C mo Llenar El Formulario W 2 Gu a Completa 2022

https://www.creditosenusa.com/wp-content/uploads/como-llenar-el-formulario-w2.png

An Employer s Guide To Easily Completing A W 2 Form Gift CPAs Expert Small Business Advisors

https://giftcpas.com/wp-content/uploads/2017/12/2017_Form_W-2.png

https://azdor.gov/e-file-process/e-services-w-2-1099

Electronically submitting federal Forms W 2 W 2c W 2G and 1099 to the Department Through AZTaxes to use the Manual data input method or to upload the supported federal forms as a formatted txt file Through AZ Web File AZFSET to upload the supported federal forms as a txt file

https://azdor.gov/forms

Corporate Tax Forms 120A Arizona Corporation Income Tax Return Short Form Corporate Tax Forms 120S Arizona S Corporation Income Tax Return Corporate Tax Forms 120S Schedule K 1 Resident Shareholder s Information Schedule Form with Instructions

W2 Form 2019 Online Print And Download Stubcheck

C mo Llenar El Formulario W 2 Gu a Completa 2022

Printable W2 Forms

Printable W2 Forms

/w2-9ca13523f4d74e958b821aab63af2e60.png)

How Do I Get W2 From Old Job Job Drop

How To Download Employee W 2 Withholding Form Using Deskera People

How To Download Employee W 2 Withholding Form Using Deskera People

Form W2 Everything You Ever Wanted To Know

W2 Example Form Fill Out And Sign Printable PDF Template SignNow

W 2 Form Filing Deadline And FAQs Square

W2 Form For Az Printable - If you have not received your Form W 2 or Form 1099 please contact your employer to learn if and when the W 2 was delivered If it was mailed it may have been returned to your employer because of an incorrect or incomplete address If you do not receive your W 2 by February 15th you can call the IRS at 800 829 1040