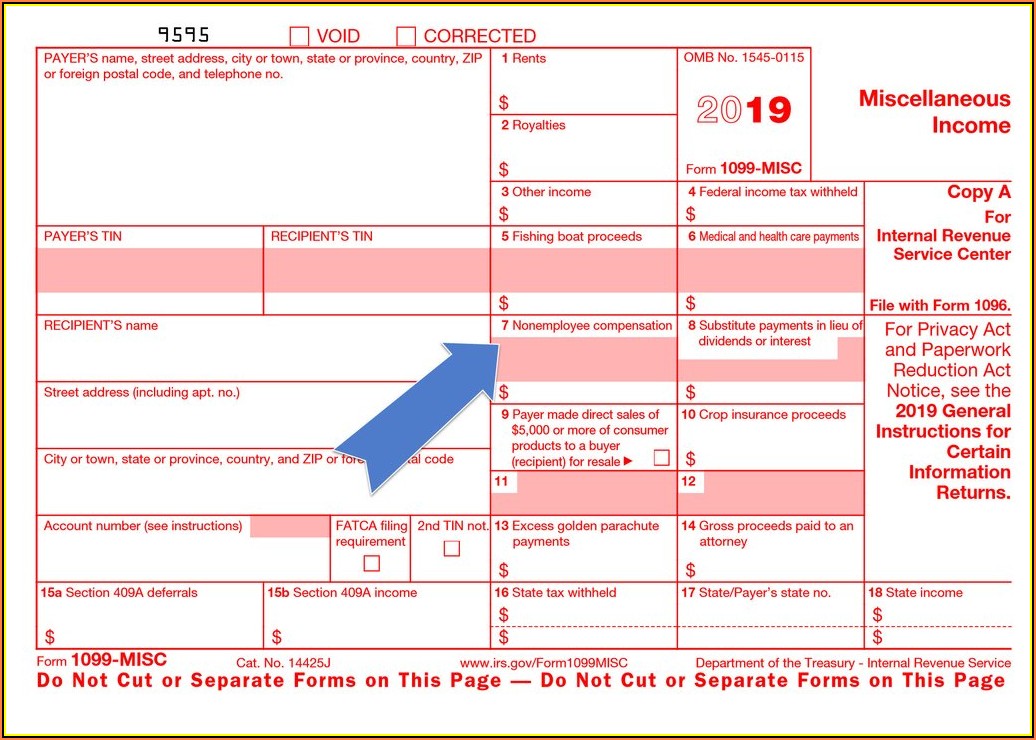

1099 Form Independent Contractor Printable Beginning with Tax Year 2020 you must use Form 1099 NEC Nonemployee Compensation to report payments of nonemployee compensation NEC previously reported in box 7 on Form 1099 MISC The separate instructions for filers issuers for Form 1099 NEC are available in the Instructions for Forms 1099 MISC and 1099 NEC PDF

An independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment Also known as a 1099 agreement due to the contractor not being an employee of the client A contractor is commonly hired on a short term or intermittent basis unlike an employee Paying Taxes 1099 NEC is the version of Form 1099 you use to tell the Internal Revenue Service whenever you ve paid an independent contractor or other self employed person 600 or more in compensation That s 600 or more over the course of the entire year

1099 Form Independent Contractor Printable

1099 Form Independent Contractor Printable

https://i2.wp.com/eforms.com/download/2018/06/1-Page-Independent-Contractor-Agreement.png?ssl=1

Printable Independent Contractor 1099 Form Printable Forms Free Online

https://i1.wp.com/eforms.com/images/2018/05/Independent-Contractor-Agreement.png?fit=1600%2C2070&ssl=1

Printable 1099 Form Independent Contractor TUTORE ORG Master Of Documents

https://www.viralcovert.com/wp-content/uploads/2018/12/irs-form-1099-misc-2012-download-free.jpg

As an independent contractor you may be required to file a 1099 form with the IRS The 1099 form is used to report income that is not subject to withholding tax This includes income from freelancing consulting or other self employment activities The first section of the form is devoted to establishing the necessity of the form 1099 Forms for Independent Contractors Jun 15 2023 Tax season often brings about a flurry of paperwork uncertainty and more than a few questions particularly for independent contractors One of the key tax forms independent contractors should be familiar with is the 1099 form

If you don t want to file your 1099s electronically through the IRS s Information Returns Intake System IRIS you ll need to print them out and mail them the old fashioned way But you can t just download the PDF form and hit Print to get a paper copy The IRS has very specific requirements about how to print 1099s Contents Form 1099 NEC Nonemployee compensation is a form businesses use to report payments made to independent contractors within a tax year The IRS uses it to determine the amount of taxable income acquired by independent contractors Form 1099 NEC was part of Form 1099 MISC but became a separate form in 2020

More picture related to 1099 Form Independent Contractor Printable

Printable 1099 Form Independent Contractor Printable Form Templates And Letter

https://s30311.pcdn.co/wp-content/uploads/2020/03/form-1099-misc-fold.png

Irs 1099 Forms For Independent Contractors Form Resume Examples

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2018/11/irs-1099-form-independent-contractor.jpg

Printable 1099 Form Independent Contractor Printable Form Templates And Letter

https://images.ctfassets.net/ifu905unnj2g/7AaGwx9GYM2YM9YyWJLFqv/b9806db0e4623117df61caf7b38e80e4/2022_1099_Form_Copy_B.png

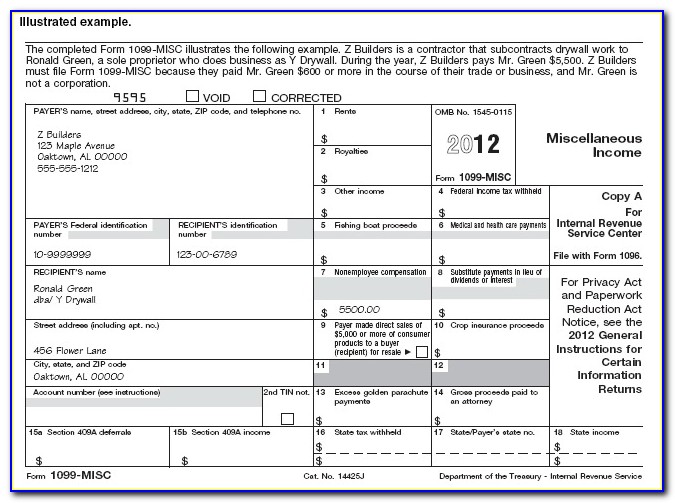

How contractors use Form 1099 NEC Most freelancers and independent contractors use Schedule C Profit or Loss From Business to report self employment income on their personal tax returns Here is the process for reporting income earned on a Form 1099 NEC Part 1 of Schedule C reports income earned by the contractor STEP 3 Prepare Your 1099 MISC Forms Start preparing 1099 MISC forms for independent contractors once you have bought the 1099 forms Fill in your Federal Tax ID number SSN or EIN and contractor s information SSN or EIN accurately Fill out Form 1099 MISC accurately using the information you ve gathered

A Form 1099 is typically filed by payers to report various types of income made to eligible entities or individuals other than employees Entities that must file a 1099 form include financial institutions various businesses and self employed individuals Independent contractors are among the recipients who should receive a 1099 form Form 1099 NEC Nonemployee Compensation applies to all payments made for work performed by independent contractors including freelancers and self employed individuals Some businesses mistakenly refer to independent contractors as 1099 employees but actual employees receive a W 2 not a 1099 NEC Determining whether a person performing work

Printable Independent Contractor 1099 Form Printable Forms Free Online

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2018/12/1099-form-independent-contractor-2018.jpg

Form 1099 For Independent Contractors A Guide For Recipients

https://mycountsolutions.com/wp-content/uploads/2019/07/Form-1099-for-Independent-Contractors-2048x1365.jpg

https://www.irs.gov/businesses/small-businesses-self-employed/forms-and-associated-taxes-for-independent-contractors

Beginning with Tax Year 2020 you must use Form 1099 NEC Nonemployee Compensation to report payments of nonemployee compensation NEC previously reported in box 7 on Form 1099 MISC The separate instructions for filers issuers for Form 1099 NEC are available in the Instructions for Forms 1099 MISC and 1099 NEC PDF

https://eforms.com/employment/independent-contractor/

An independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment Also known as a 1099 agreement due to the contractor not being an employee of the client A contractor is commonly hired on a short term or intermittent basis unlike an employee Paying Taxes

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

Printable Independent Contractor 1099 Form Printable Forms Free Online

1099 Form Independent Contractor Pdf Free Independent Contractor Agreement Templates Pdf Word

How To File A 1099 Form Independent Contractor Universal Network

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

Printable 1099 Forms For Independent Contractors

Printable 1099 Forms For Independent Contractors

Printable 1099 Form Independent Contractor Form Resume Examples

1099 Form Independent Contractor Pdf 14 Printable 1099 Form Independent Contractor Templates

1099 Form Independent Contractor Pdf Fillable Independent Contractor Agreement Fill Online

1099 Form Independent Contractor Printable - Form 1099 NEC Nonemployee compensation is a form businesses use to report payments made to independent contractors within a tax year The IRS uses it to determine the amount of taxable income acquired by independent contractors Form 1099 NEC was part of Form 1099 MISC but became a separate form in 2020