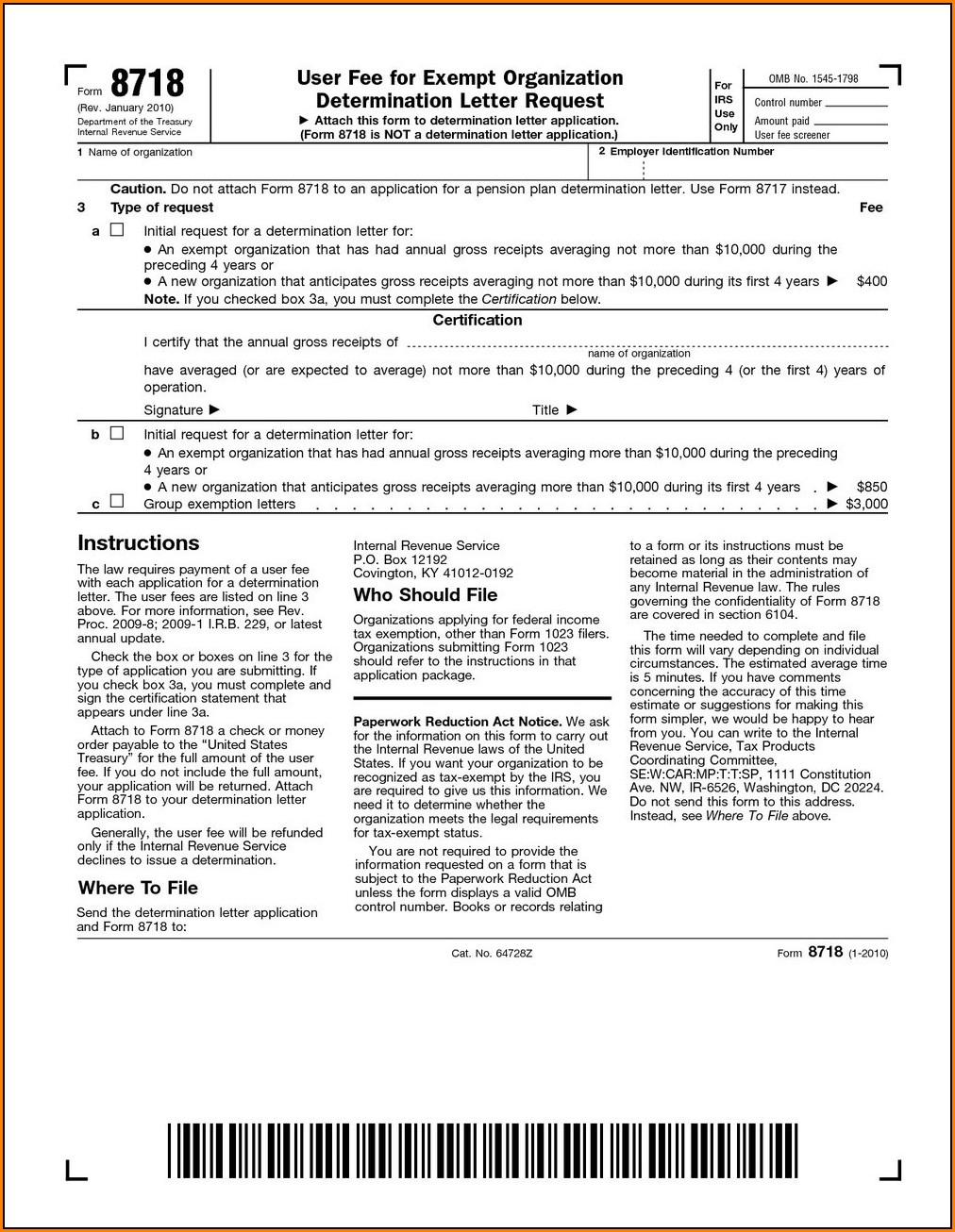

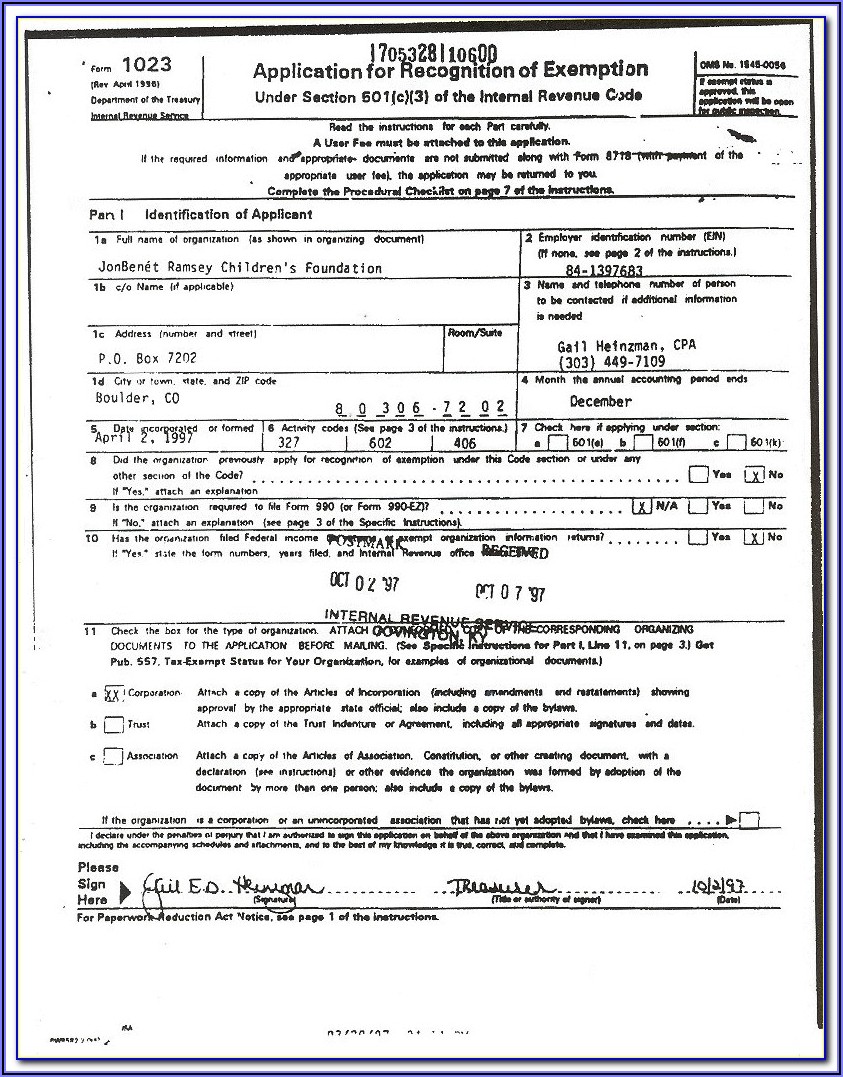

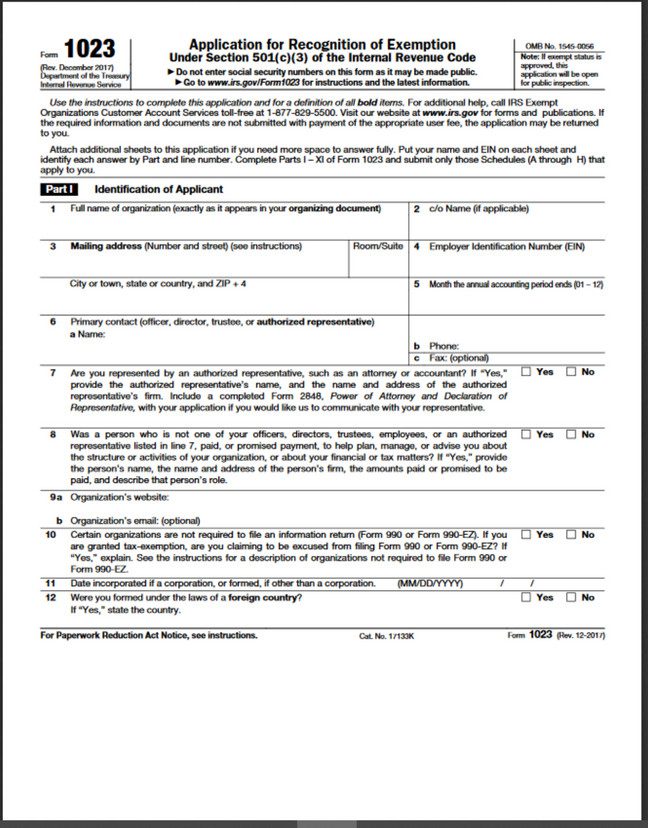

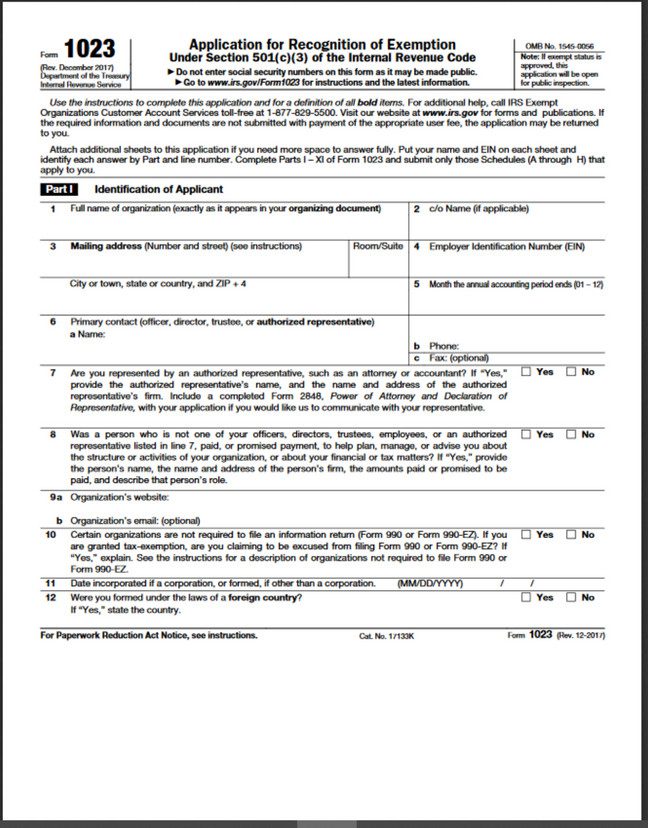

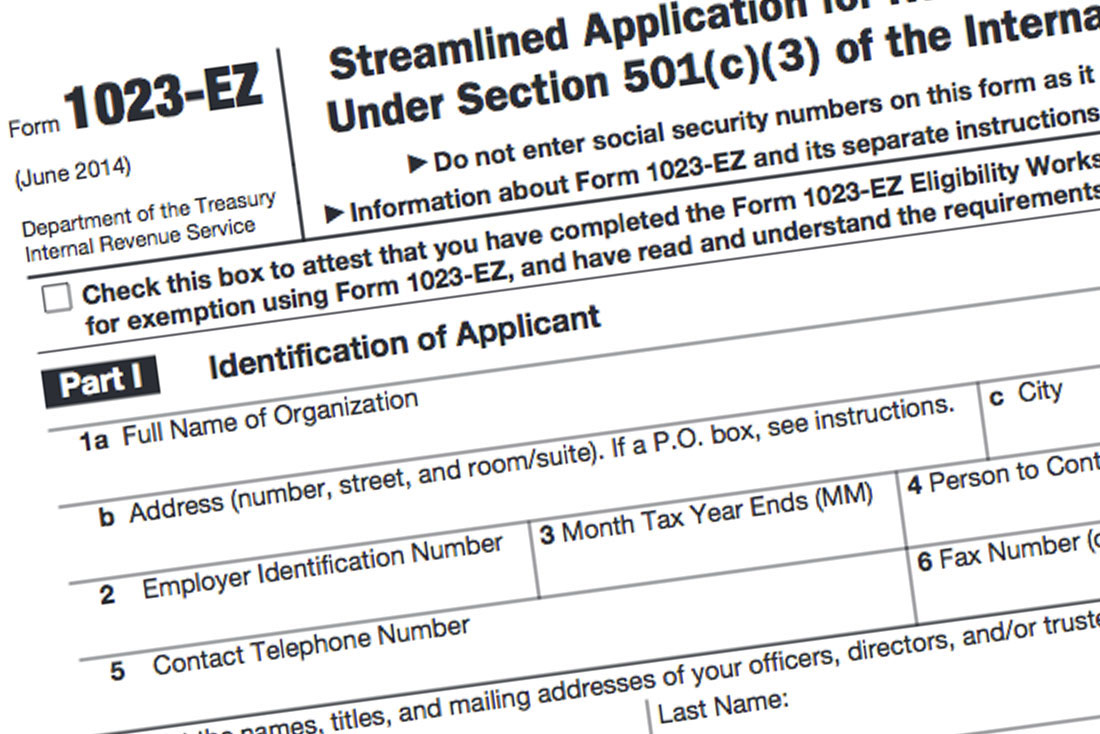

501 C 3 Printable Form Forms currently required by the IRS are Form 1023 Application for Recognition of Ex emption Under Section 501 c 3 of the Internal Revenue Code Form 1023 EZ Streamlined Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code Form 1024 Application for Recognition of Exemption Under Section 501 a o

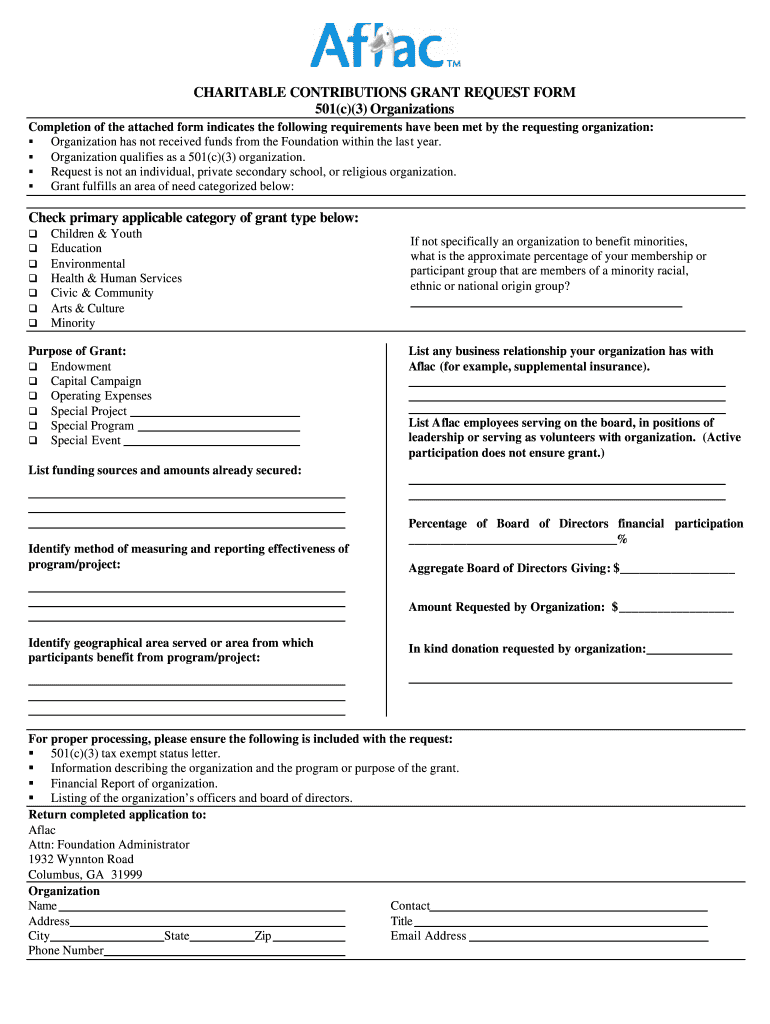

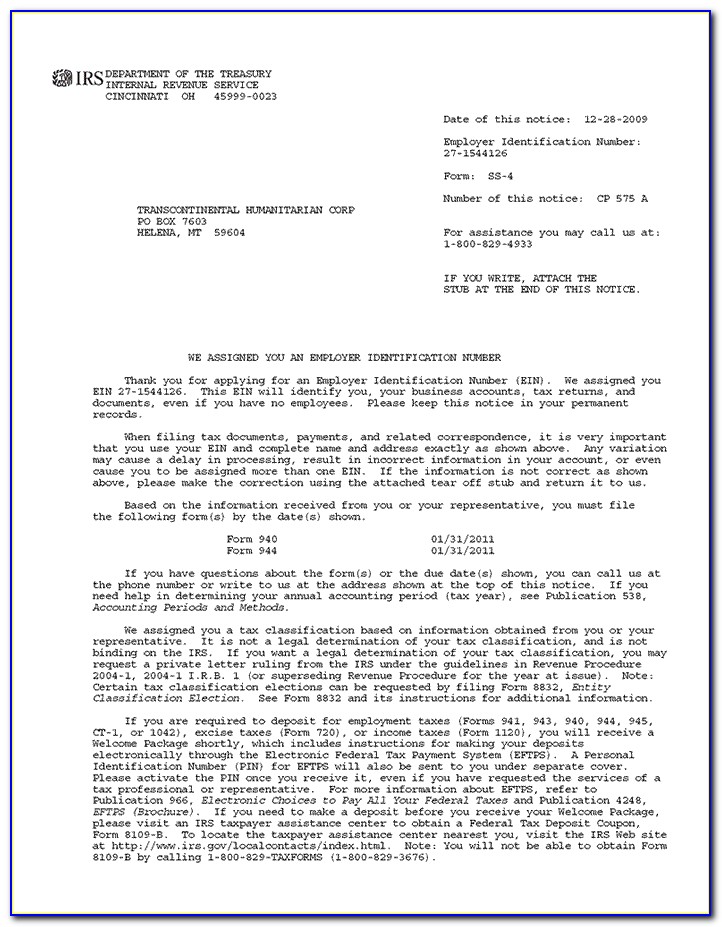

Organizations file this form to apply for recognition of exemption from federal income tax under Section 501 c 3 NOTICE You may experience issues with saving a form and accessing it later If this occurs you will need to complete the form again We apologize for this inconvenience A 501 c 3 is a corporation that receives tax exempt status from the IRS To get the 501 c 3 status a corporation must file for a Recognition of Exemption You must still file Form 990

501 C 3 Printable Form

501 C 3 Printable Form

https://www.certificatestemplatesfree.com/wp-content/uploads/2018/01/501c3-certificate-501-c-3-certificate-ybHqcU.jpg

501c3 Donation Receipt Template Printable Pdf Word

https://templatediy.com/wp-content/uploads/2022/03/501c3-Donation-Receipt-PDF.jpg

501c3 Form Sample Form Resume Examples wRYPBlP24a

https://www.contrapositionmagazine.com/wp-content/uploads/2018/11/501c3-form-download.jpg

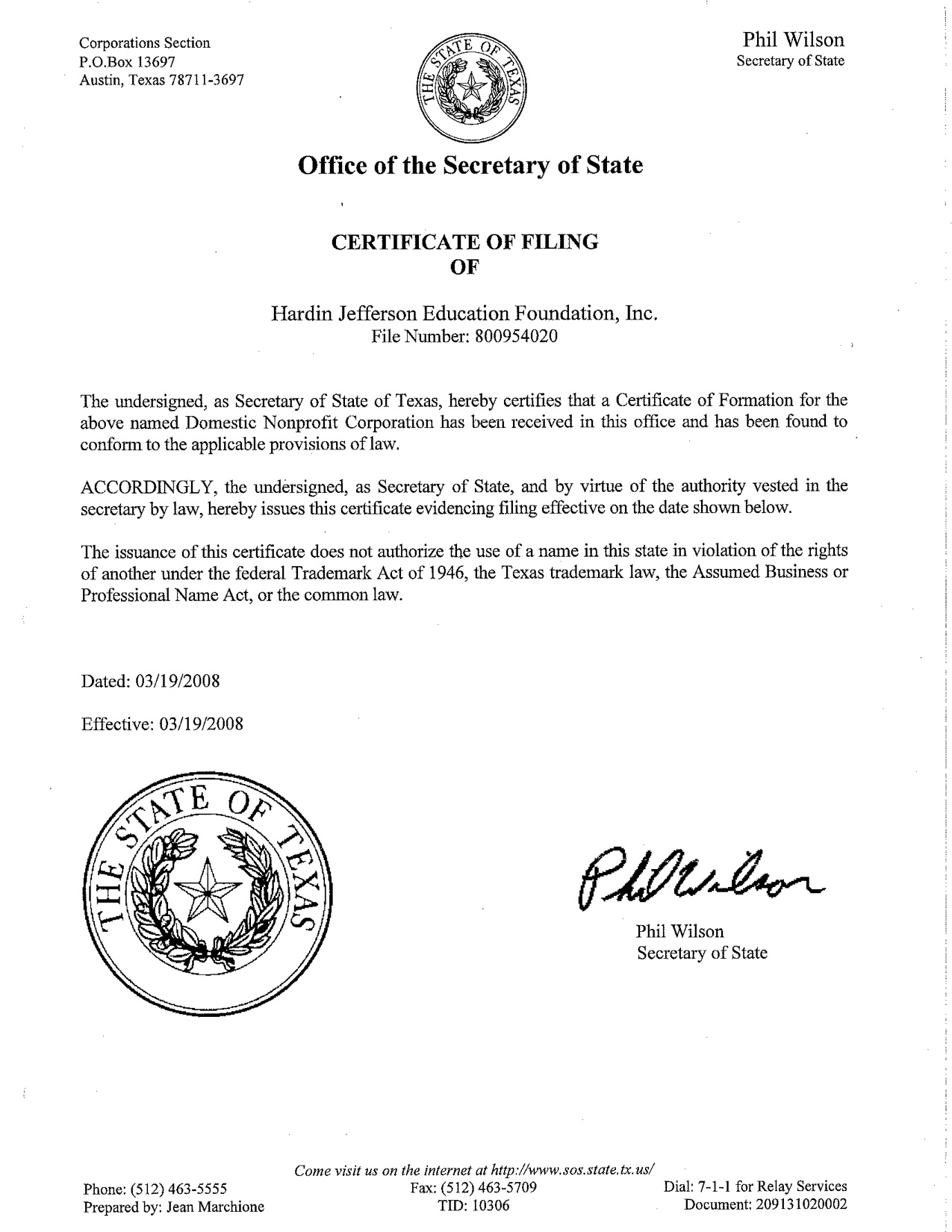

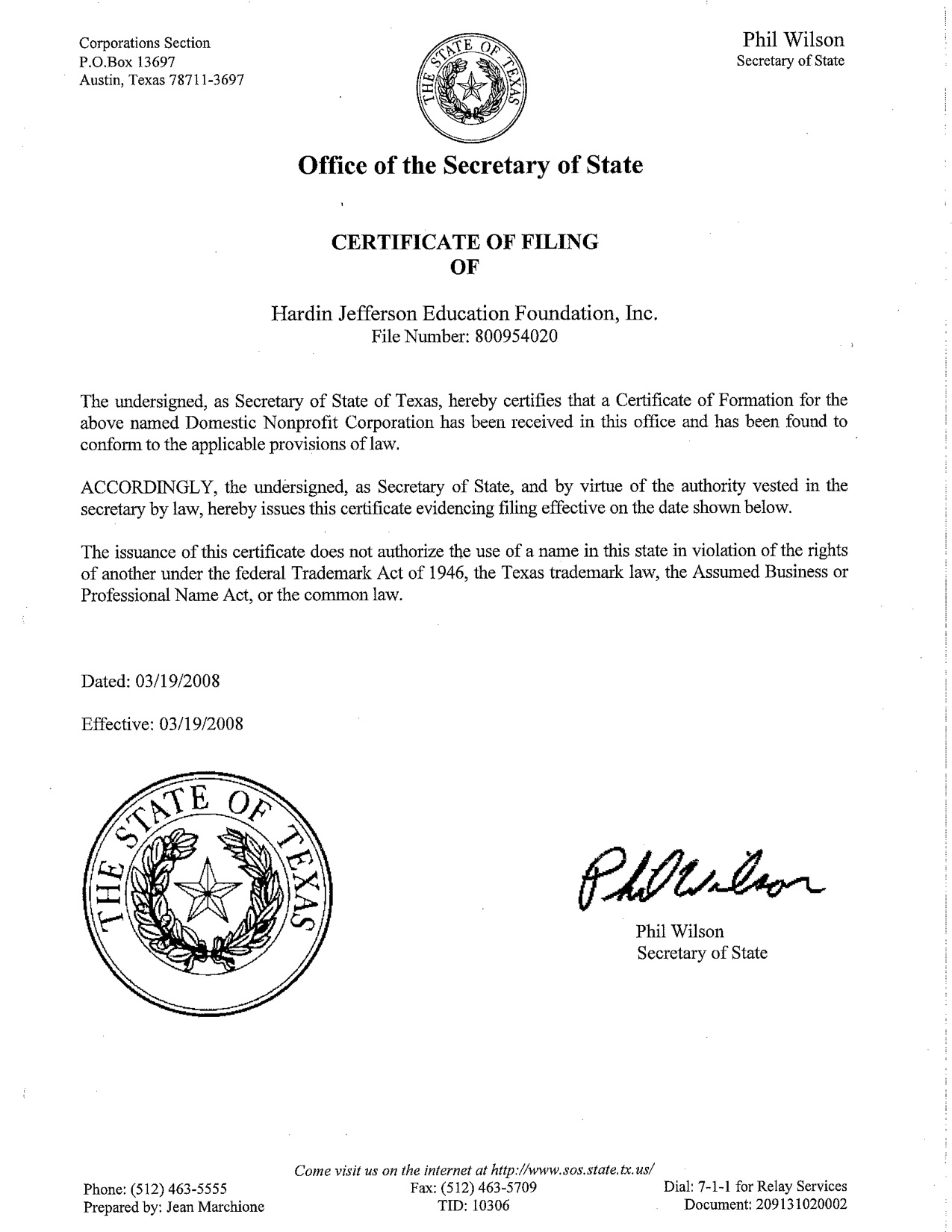

Applying for Section 501 c 3 Status Download PDF Version PDF Page Last Reviewed or Updated 07 Feb 2024 For 501 c 3 Tax Exempt Status and 557 Tax Exempt Status for Your Organization for additional information before beginning process 3 Register with the New York State Attorney General Charities Bureau by completing the Form CHAR410 Registration Statement for Charitable Organizations and attach related exhibits

A 501c 3 application is a document nonprofit organizations file with the Internal Revenue Service IRS to request tax exempt status as a charitable organization IRS Form 1023 is the document you must complete to apply for tax exempt status with the IRS as a 501c 3 Once granted tax exempt status your organization is exempt from paying Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code Form1023 Rev January 2020 Department of the Treasury Internal Revenue Service Do not enter social security numbers on this form as it may be made public Go to www irs gov Form1023 for instructions and the latest information

More picture related to 501 C 3 Printable Form

Irs 501c3 Form 1023 Form Resume Examples EvkBMrPO2d

https://www.viralcovert.com/wp-content/uploads/2018/10/irs-501c3-form-1023.jpg

501c3 Form Sample Form Resume Examples wRYPBlP24a

https://www.contrapositionmagazine.com/wp-content/uploads/2020/12/501c3-irs-form.jpg

501c3 Application PDF Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/10/15/10015521/large.png

Section 501 c 3 is the part of the U S Internal Revenue Code that allows for federal tax exemption of nonprofit organizations A 501 c 3 organization is a corporation trust unincorporated association or other type of organization exempt from federal income tax under section 501 c 3 of Title 26 of the United States Code The operational test requires that the nonprofit engages exclusively meaning primarily in IRS tax parlance in activities that accomplish one or more exempt purposes under Section 501 c 3 If just one substantial non exempt purpose exists then the applicant organization becomes ineligible for Section 501 c 3 recognition

About this form Eligible organizations file this form to apply for recognition of exemption from federal income tax under Section 501 c 3 Note You must complete the Form 1023 EZ Eligibility Worksheet in the Instructions for Form 1023 EZ to determine if you are eligible to file Form 1023 EZ If you are not eligible to file Form 1023 EZ In this presentation you ll learn who can use Form 1023 EZ to apply for tax exemption and how to submit an error free form You ll learn Common missing schedules and other incomplete items Consequences for filing incomplete incorrect returns and Useful filing tips Many charities are not aware of the tax implications of their

Non Profit With Full 501 c 3 Application In FL Patel Law

https://flpatellaw.com/wp-content/uploads/2019/08/8a12f68e00df5d238adc38707bb27749.jpg

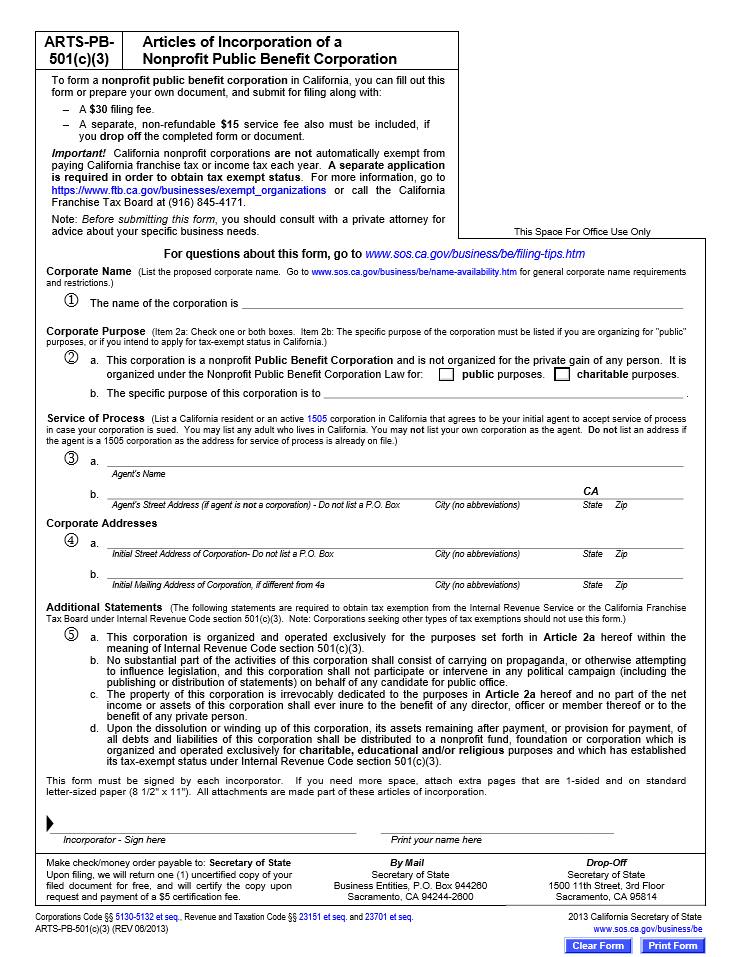

Free California Articles Of Incorporation Of A Nonprofit Public Benefit Corporation Form ARTS

https://articlesofincorporation.org/wp-content/uploads/CA-AoI-pb-nonprof-corp.png

https://www.irs.gov/charities-non-profits/other-non-profits/exempt-organizations-application-forms

Forms currently required by the IRS are Form 1023 Application for Recognition of Ex emption Under Section 501 c 3 of the Internal Revenue Code Form 1023 EZ Streamlined Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code Form 1024 Application for Recognition of Exemption Under Section 501 a o

https://www.pay.gov/public/form/start/704509645

Organizations file this form to apply for recognition of exemption from federal income tax under Section 501 c 3 NOTICE You may experience issues with saving a form and accessing it later If this occurs you will need to complete the form again We apologize for this inconvenience

Printable Form Section 501c3 Printable Forms Free Online

Non Profit With Full 501 c 3 Application In FL Patel Law

501 c 3 Letter Bright Horizons Foundation

Form 1023 EZ The Faster Easier 501 c 3 Application For Small Nonprofits Aspect Law Group

501c3 Non Profit Organization Form Form Resume Examples YL5zwjROzV

Printable 501c3 Application Printable Application

Printable 501c3 Application Printable Application

Printable 501C3 Form

Printable 501C3 Form

Irs 501 C 3 Application Form Universal Network

501 C 3 Printable Form - Applying for Section 501 c 3 Status Download PDF Version PDF Page Last Reviewed or Updated 07 Feb 2024