941x Schedule B Printable Form Correction to the Instructions for Form 941 Rev June 2021 19 OCT 2021 Rev Proc 2021 33 provides a safe harbor on figuring gross receipts solely for determining eligibility for the employee retention credit Notice 2021 49 provides guidance on the employee retention credit ERC under IRC 3134 and on other miscellaneous issues related

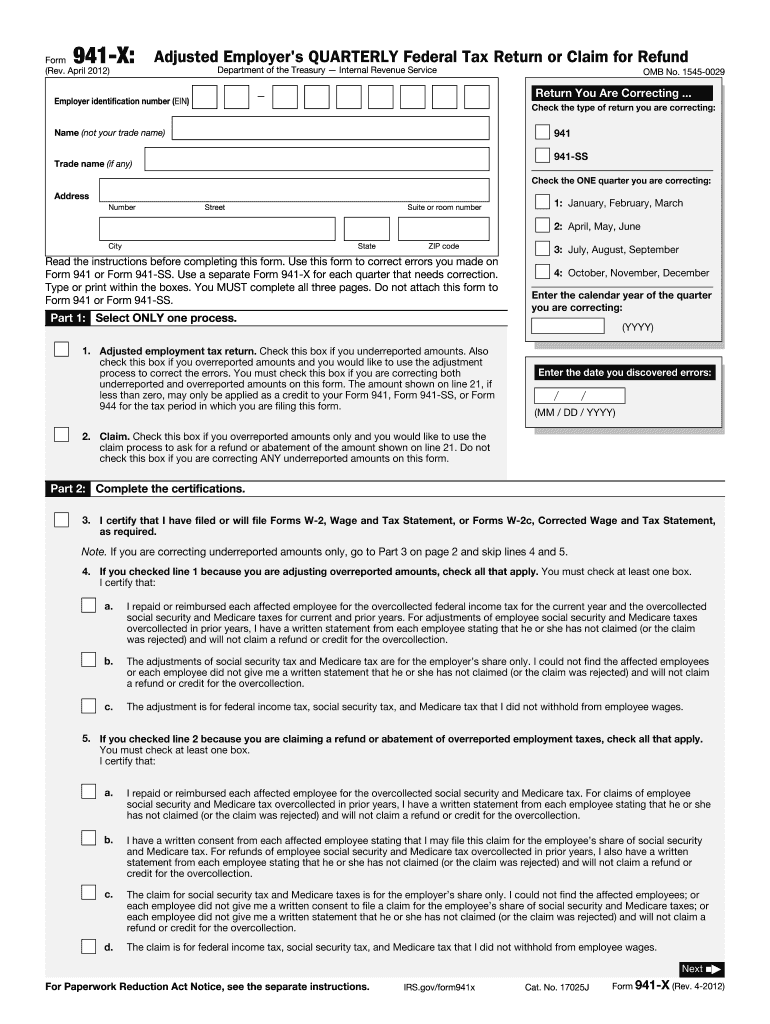

Pay the amount you owe from line 27 by the time you file Form 941 X For the claim process file a second Form 941 X to correct the overreported tax amounts Check the box on line 2 If you re filing Form 941 X You must use both the adjustment process and WITHIN 90 days of the the claim process Box 4 Name and address Enter your name and address as shown on Form 941 Enclose your check or money order made payable to United States Treasury Be sure to enter your EIN Form 941 and the tax period 1st Quarter 2021 2nd Quarter 2021 3rd Quarter 2021 or 4th Quarter 2021 on your check or money order

941x Schedule B Printable Form

941x Schedule B Printable Form

https://www.pdffiller.com/preview/400/414/400414967/big.png

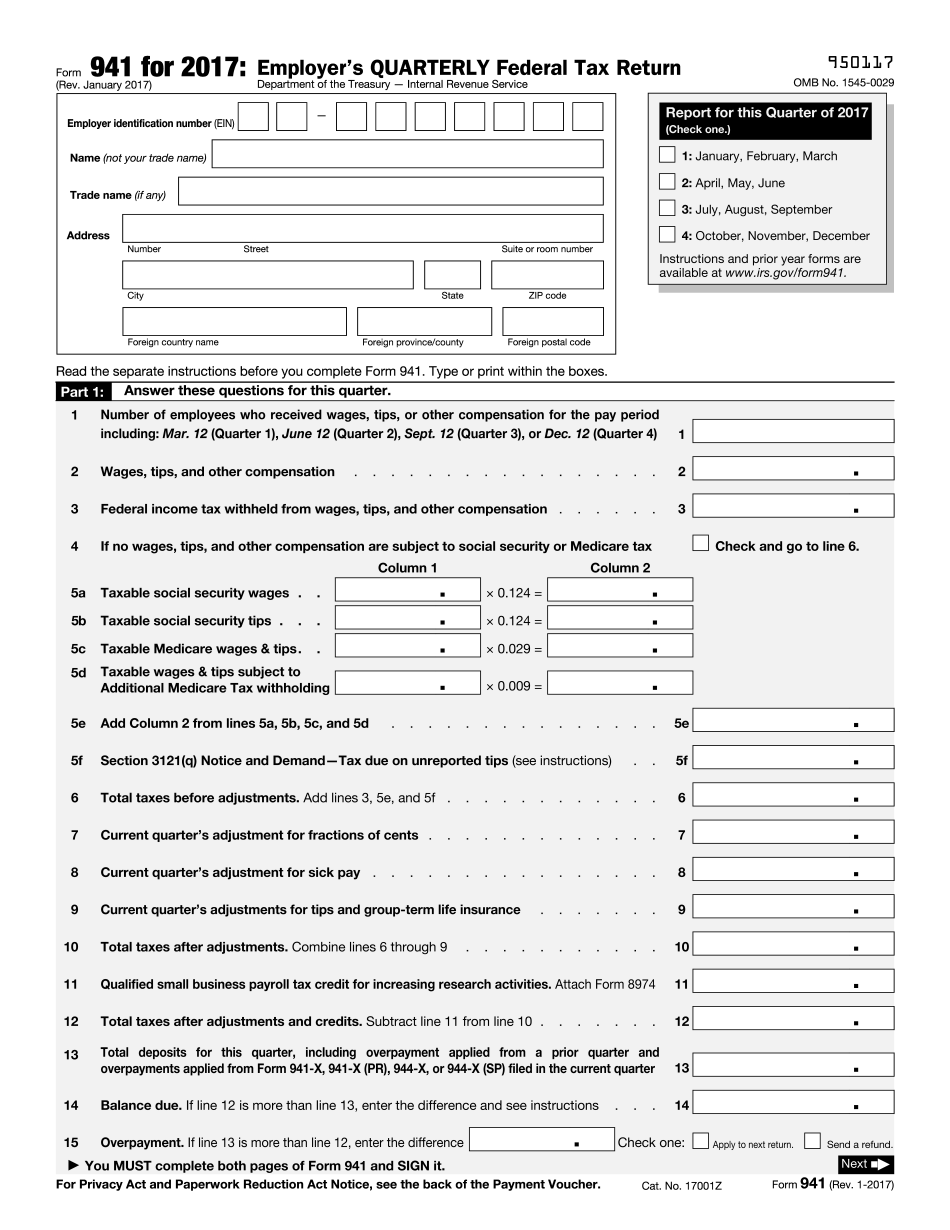

Form 941 Employers Quarterly Federal Tax Return Form 941 Employer 19 Printable 941 Schedule B

https://image.slidesharecdn.com/1272475/95/form-941-employers-quarterly-federal-tax-return-form-941-employers-quarterly-federal-tax-return-1-728.jpg?cb=1239356607

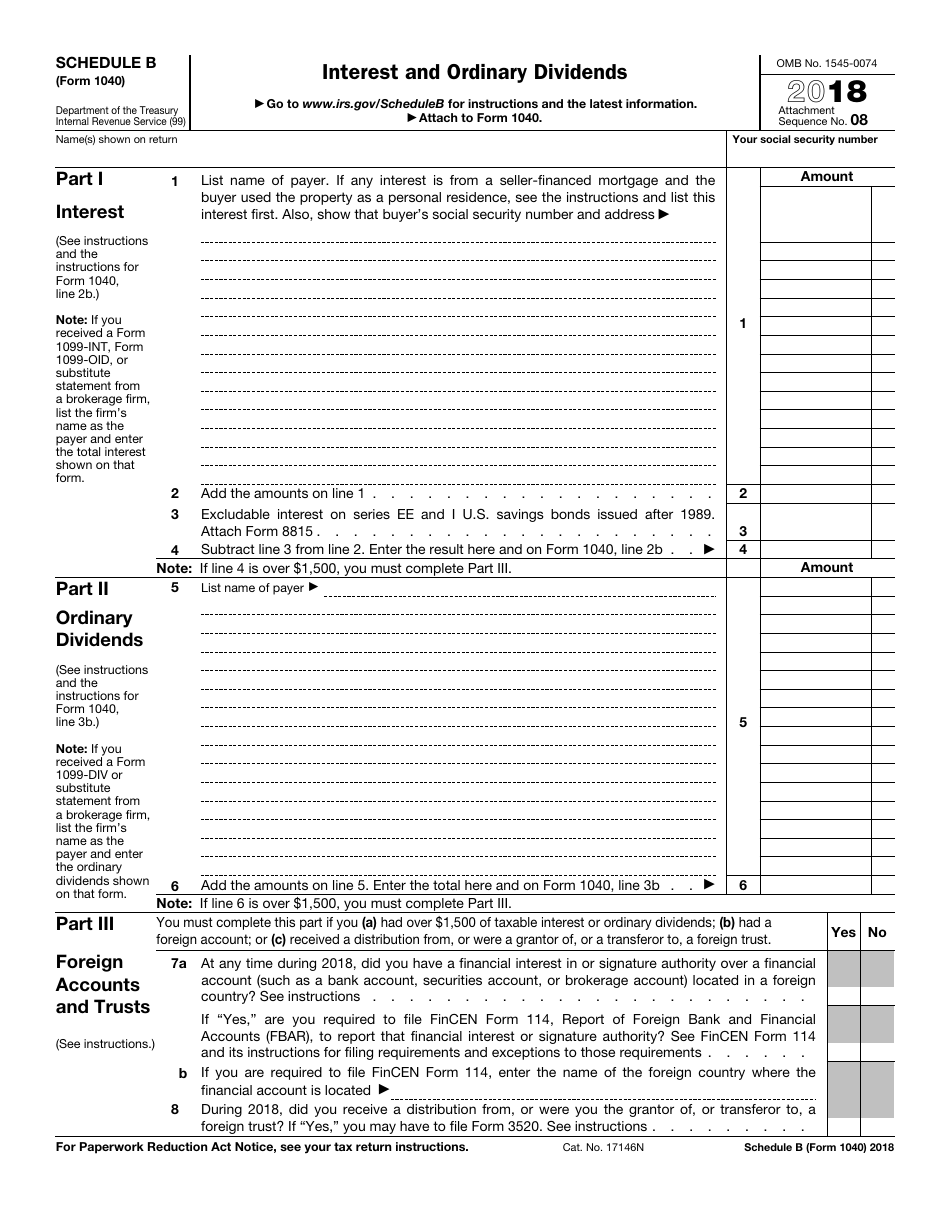

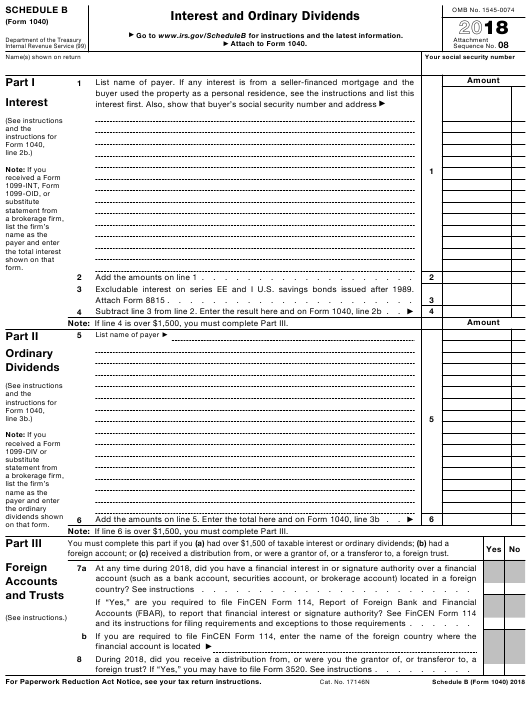

Schedule B Printable Form Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/1862/18621/1862172/irs-form-1040-2018-schedule-b-interest-and-ordinary-dividends_print_big.png

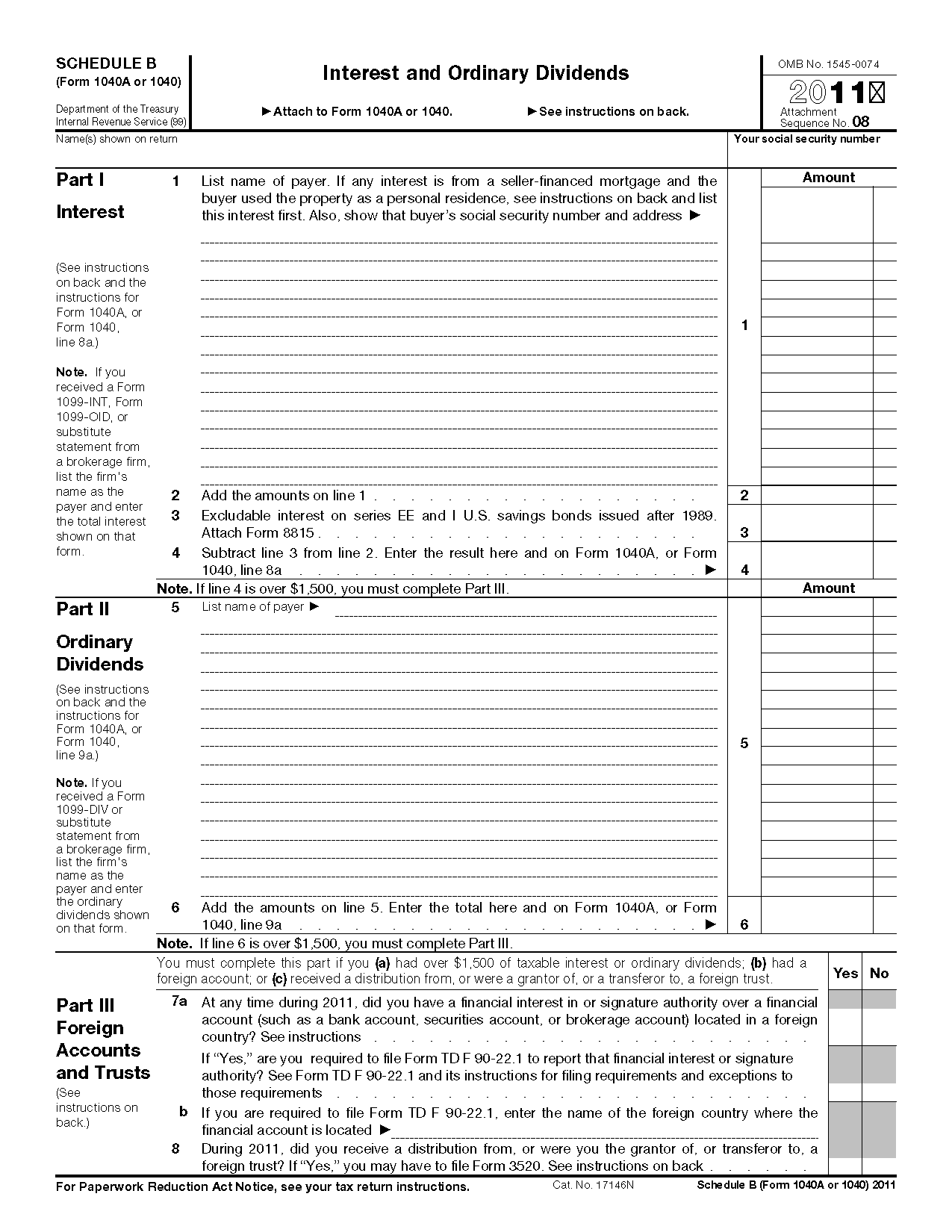

Form 941 X uses negative numbers to show reductions in tax credits and positive numbers to show additional tax amounts you owe When reporting a negative amount in columns 3 and 4 use a minus sign instead of parentheses For example enter 10 59 instead of 10 59 Most businesses must report and file tax returns quarterly using the IRS Form 941 This guide provides the basics of the 941 form instructions to help you fill it out and where you can get help meeting all your payroll tax obligations

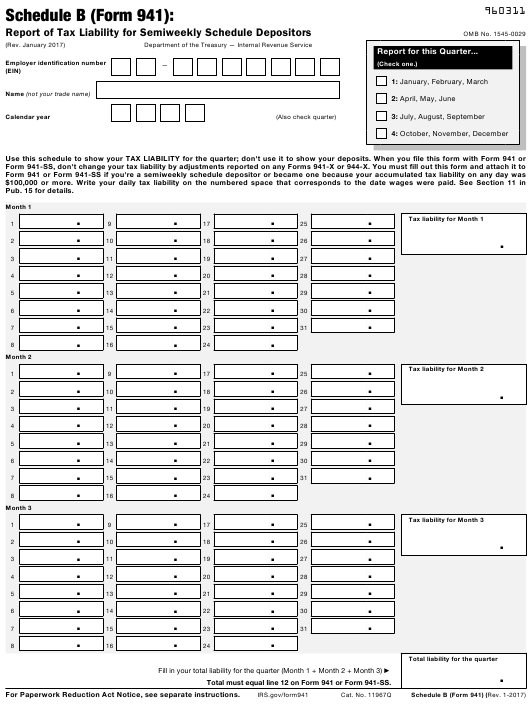

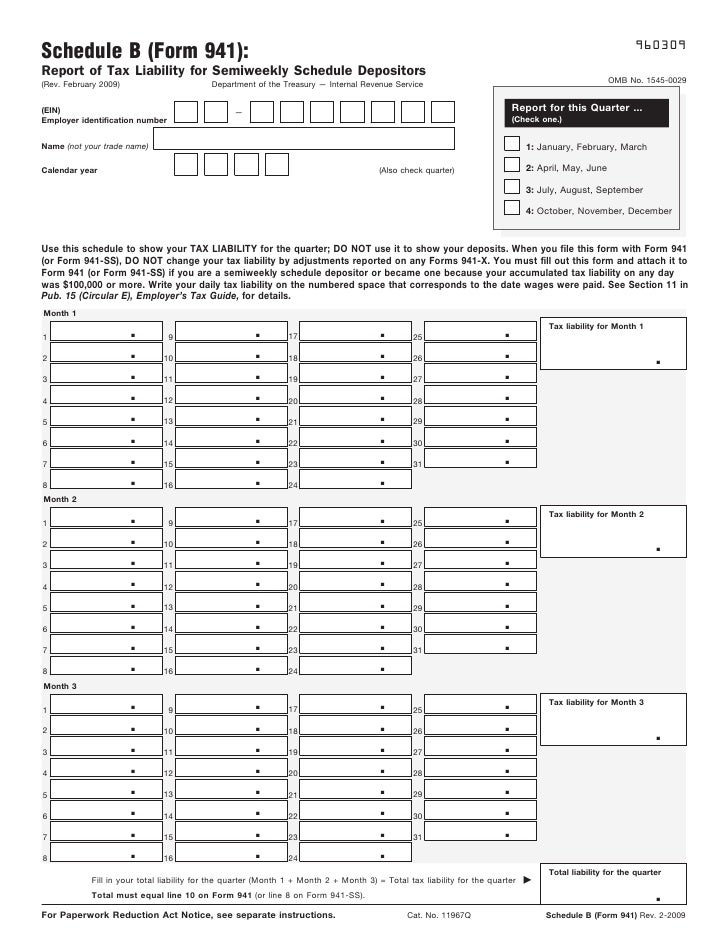

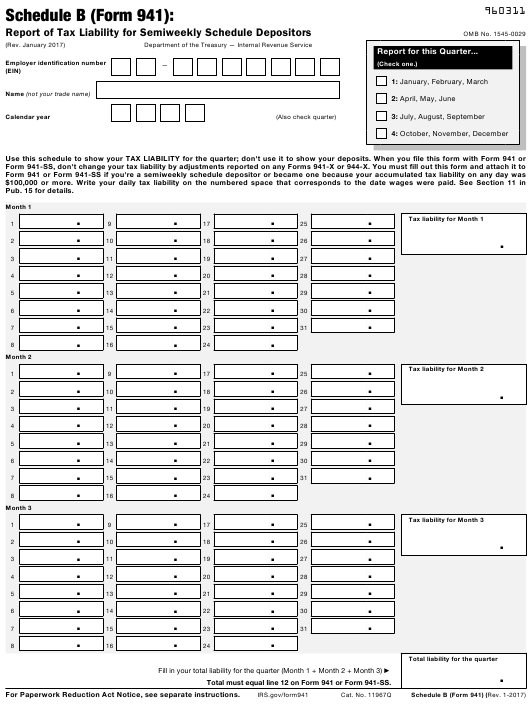

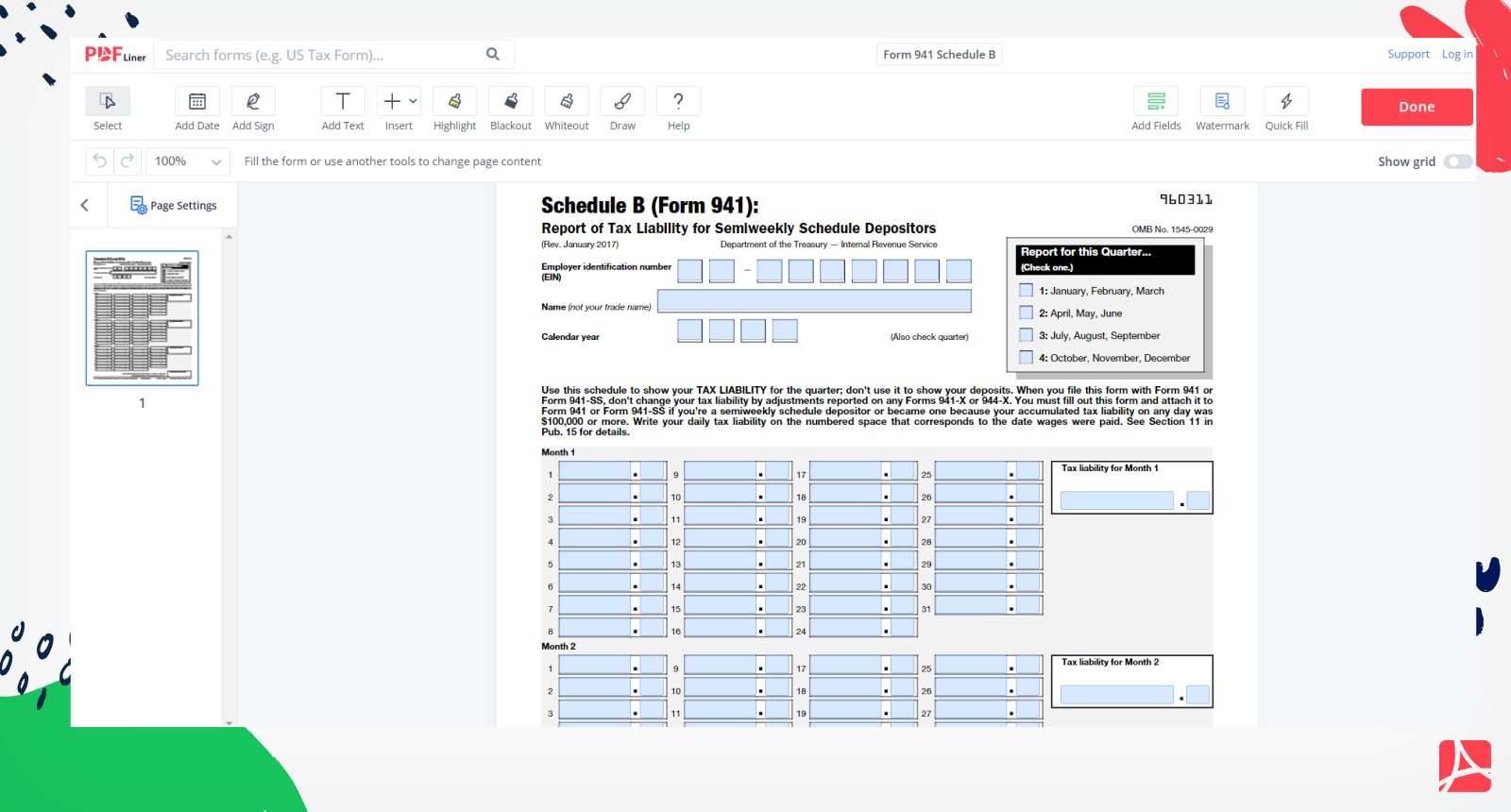

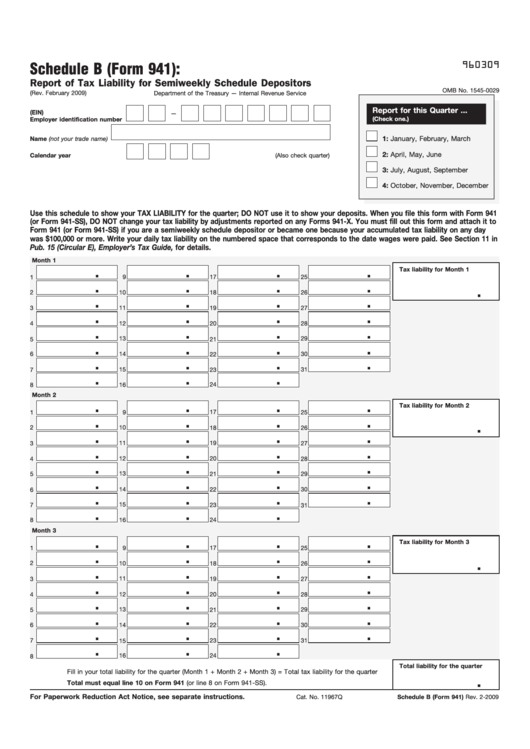

Schedule B is filed with Form 941 or Form 941 SS References to Form 941 Employer s QUARTERLY Federal Tax Return in these instructions also apply to Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of Feb 22 2023 the Northern Mariana Islands and the U S Virgin Islands unless otherwise noted How to fill out Form 941 X for 2023 Completing a correction Form 941 X consists of 5 parts You should use Form 941 X to correct any errors on a previously filed Form 941 or Form 941 SS You will need to use a separate Form 941 X for each quarter that requires corrections

More picture related to 941x Schedule B Printable Form

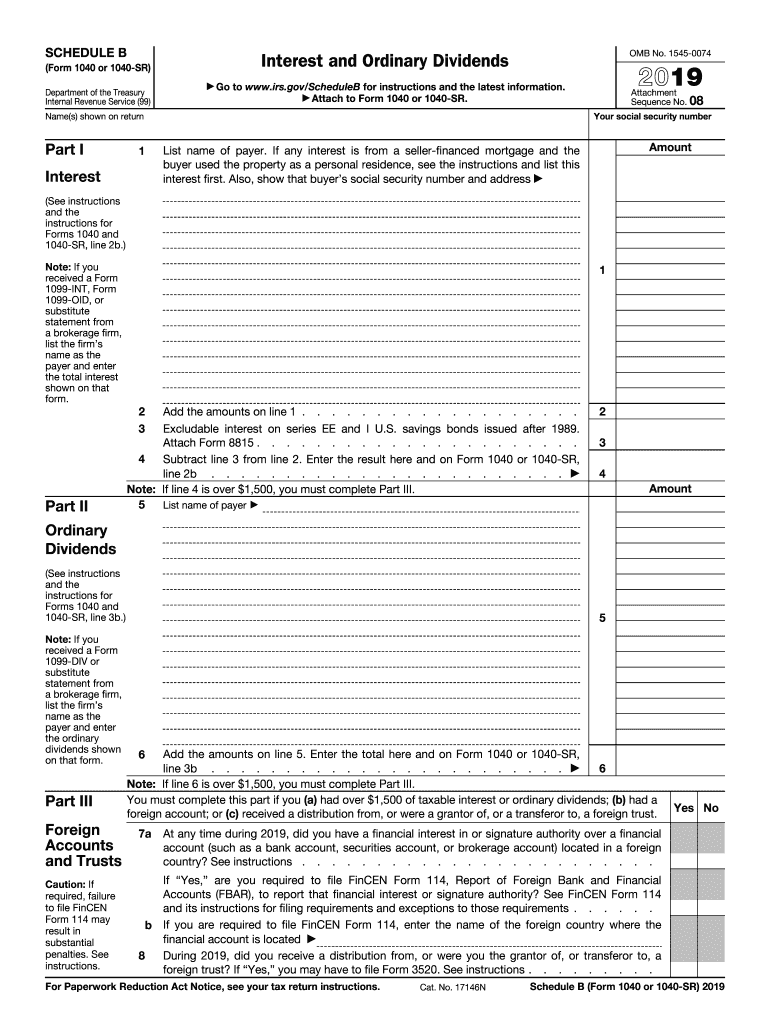

Irs Printable Form Schedule B Printable Forms Free Online

https://1044form.com/wp-content/uploads/2020/08/irs-form-1040-schedule-b-download-fillable-pdf-or-fill-2.png

941 X 2012 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/6/894/6894526/large.png

IRS Form 941 Schedule B 2023

https://www.zrivo.com/wp-content/uploads/2022/12/IRS-Form-941-Schedule-B-Zrivo-Cover-1-1536x864.jpg

2024 Poverty Guidelines 48 Contiguous States all states except Alaska and Hawaii Dollars Per Year Household Family Size 50 The Internal Revenue Service IRS has released the Schedule 3 tax form and instructions for the years 2023 and 2024 TRAVERSE CITY MI US January 13 2024 Form 941 Schedule B 2024 Printable they stumble upon a dark secret that two sadistic homeowners will do anything to keep from getting out The post Shudder January 2024 Schedule

Instructions for Form 941 X Rev July 2021 Internal Revenue Service 2020 You were assessed an FTD penalty File your amended Schedule B with Form 941 X The total liability for the quarter reported on your amended Schedule B must equal the corrected amount of tax reported on Form 941 X If your penalty is decreased the IRS will include the penalty decrease with your tax decrease

Printable Schedule B Form 941 Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/09/printable-schedule-b-form-941.png

Form 941 Schedule B 2022

https://blog.taxbandits.com/wp-content/uploads/2020/07/Screen-Shot-2020-07-16-at-9.36.55-AM-1024x531.png

https://www.irs.gov/forms-pubs/about-form-941

Correction to the Instructions for Form 941 Rev June 2021 19 OCT 2021 Rev Proc 2021 33 provides a safe harbor on figuring gross receipts solely for determining eligibility for the employee retention credit Notice 2021 49 provides guidance on the employee retention credit ERC under IRC 3134 and on other miscellaneous issues related

https://www.irs.gov/pub/irs-pdf/f941x.pdf

Pay the amount you owe from line 27 by the time you file Form 941 X For the claim process file a second Form 941 X to correct the overreported tax amounts Check the box on line 2 If you re filing Form 941 X You must use both the adjustment process and WITHIN 90 days of the the claim process

Irs Form 941 Schedule B 2024 Kore Shaine

Printable Schedule B Form 941 Fillable Form 2023

2023 Schedule B Form 941 Printable Forms Free Online

Irs Printable Form Schedule B Printable Forms Free Online

Fillable 941 Quarterly Form 2022 Printable Form Templates And Letter

Printable 941 Form For 2020 Printable World Holiday

Printable 941 Form For 2020 Printable World Holiday

Form 941 Schedule B Print And Sign Form Online PDFliner

Schedule B Form 941 Report Of Tax Liability For Semiweekly Schedule Depositors 2009

Irs Printable Form Schedule B Printable Forms Free Online

941x Schedule B Printable Form - Schedule B is filed with Form 941 or Form 941 SS References to Form 941 in these instructions also apply to Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of the Northern Mariana Islands and the U S Virgin Islands unless otherwise noted Reporting prior period adjustments