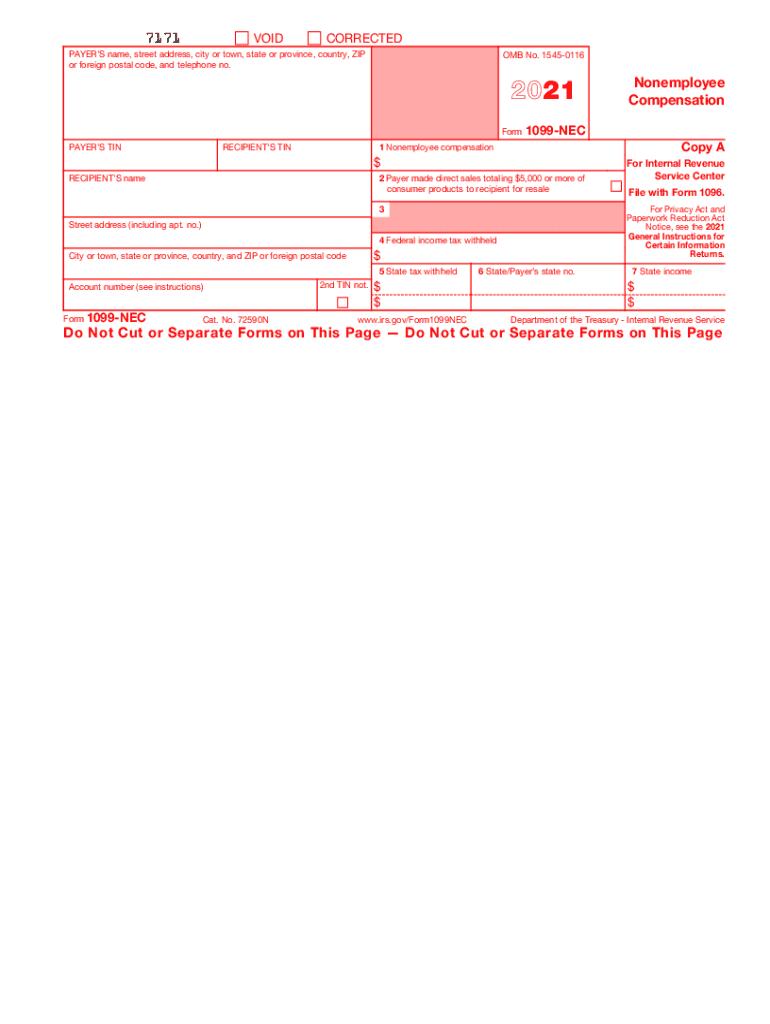

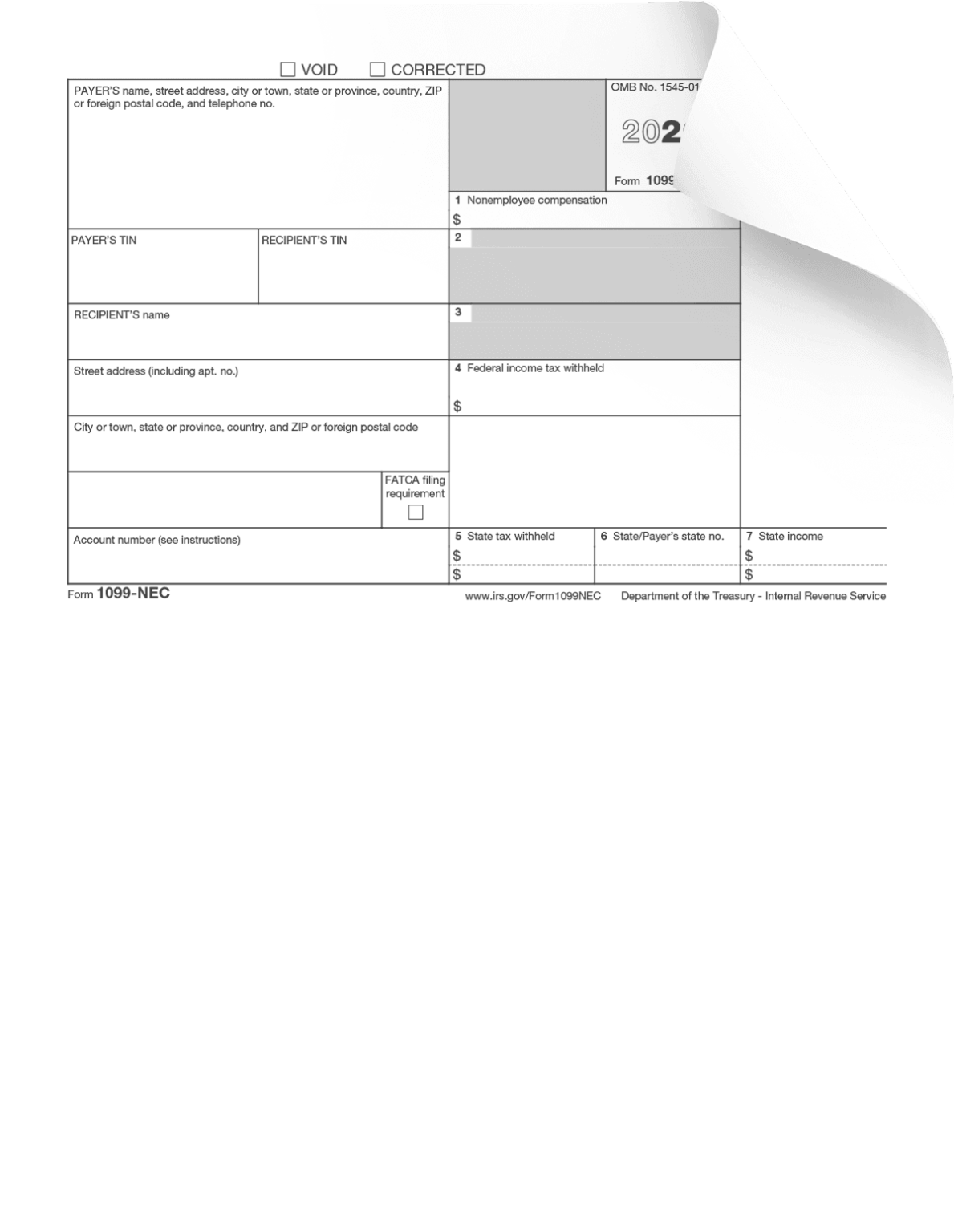

Blank 1099 Nec Form Printable A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes

Use Form 1099 NEC to report total payments to non employees if you paid them 600 or more during the year Give these forms to payees and report them to the IRS by January 31 of the year following the tax year being reported Tax withholding isn t usual for non employees but you may need to report backup withholding What is Form 1099 NEC This tax season millions of independent workers will receive Form 1099 NEC in the mail for the first time The 1099 NEC is the new form to report nonemployee compensation that is pay from independent contractor jobs also sometimes referred to as self employment income

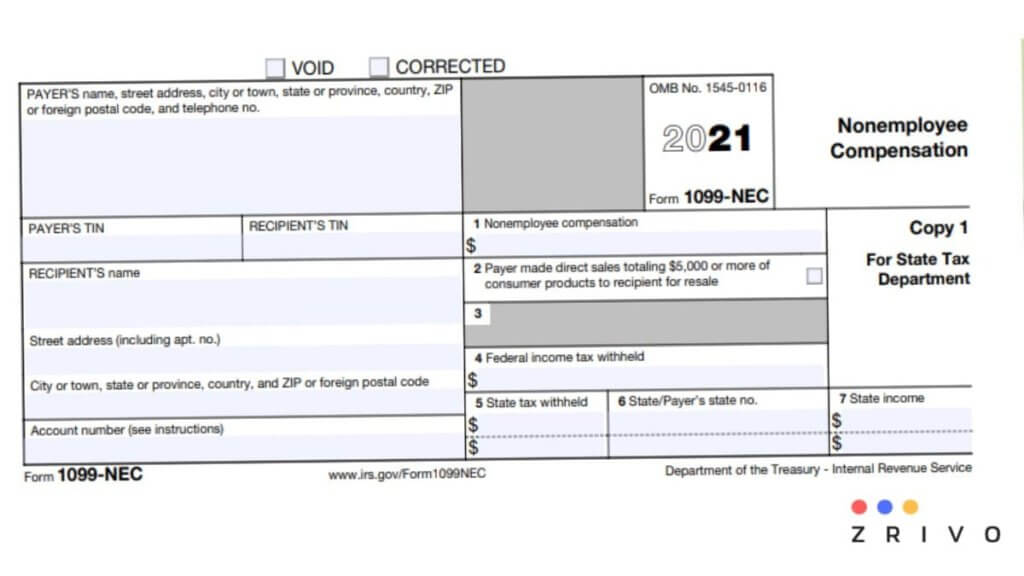

Blank 1099 Nec Form Printable

Blank 1099 Nec Form Printable

https://www.pdffiller.com/preview/533/156/533156765/large.png

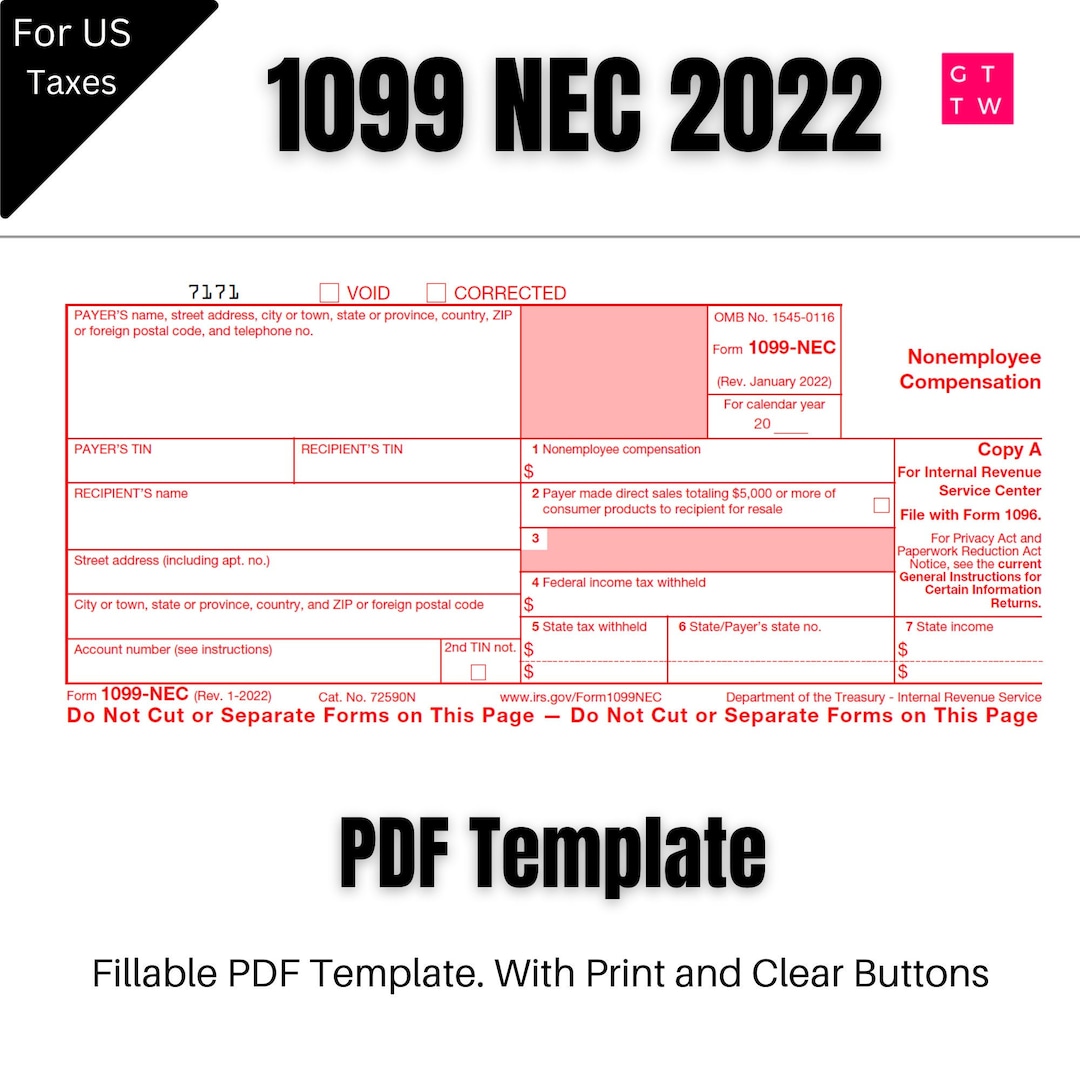

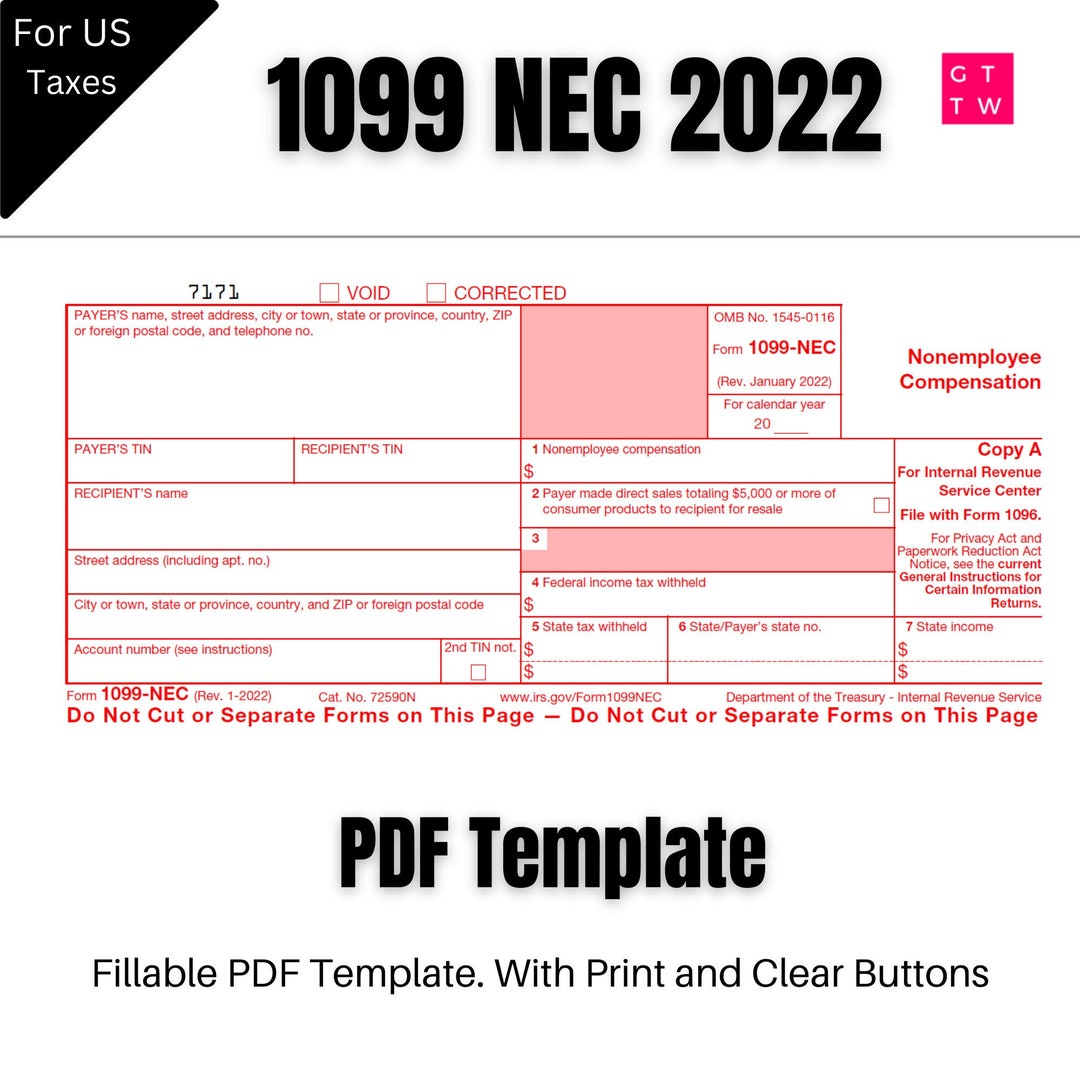

1099 NEC Editable PDF Fillable Template 2022 With Print And Clear Buttons Courier Font Etsy

https://i.etsystatic.com/25616924/r/il/53e8da/4486482592/il_1080xN.4486482592_n0gk.jpg

Printable Form 1099 Nec

https://www.chortek.com/wp-content/uploads/2019/08/1099-nec-2020-draft.png

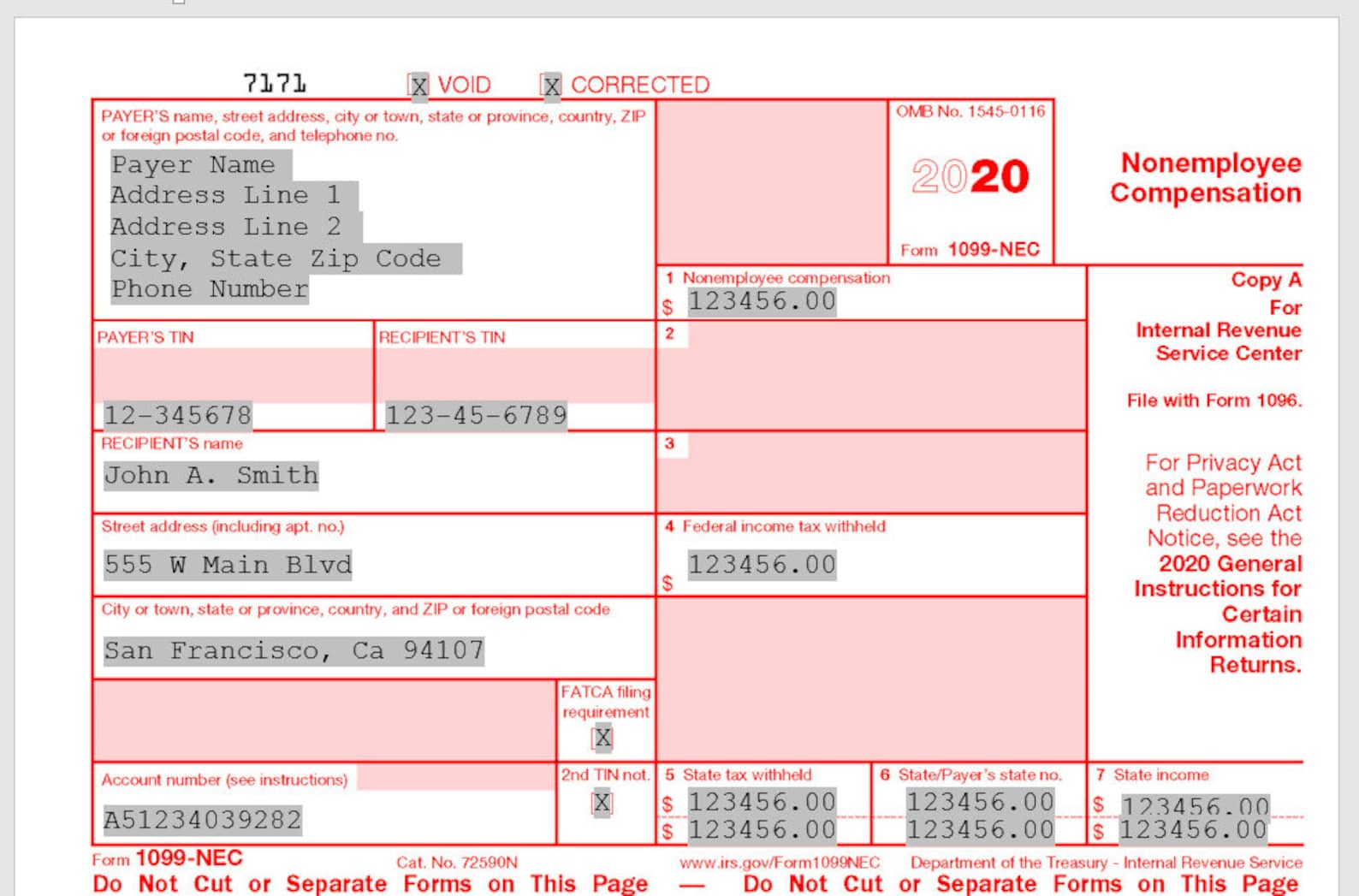

Size 8 1 2 x 11 Item numbers 321 718 633 Compatibility Pre printed 1099 NEC kits are compatible with QuickBooks Online QuickBooks Online Payroll QuickBooks Desktop 2020 or later and QuickBooks for Mac 2020 or later Printable from laser and inkjet printers Select state you re filing in The nonemployee compensation reported in Box 1 of Form 1099 NEC is generally reported as self employment income and is usually subject to self employment tax Payments from your trade or business to individuals that aren t reportable on the 1099 NEC form would typically be reported on Form 1099 MISC The IRS provides a more comprehensive list

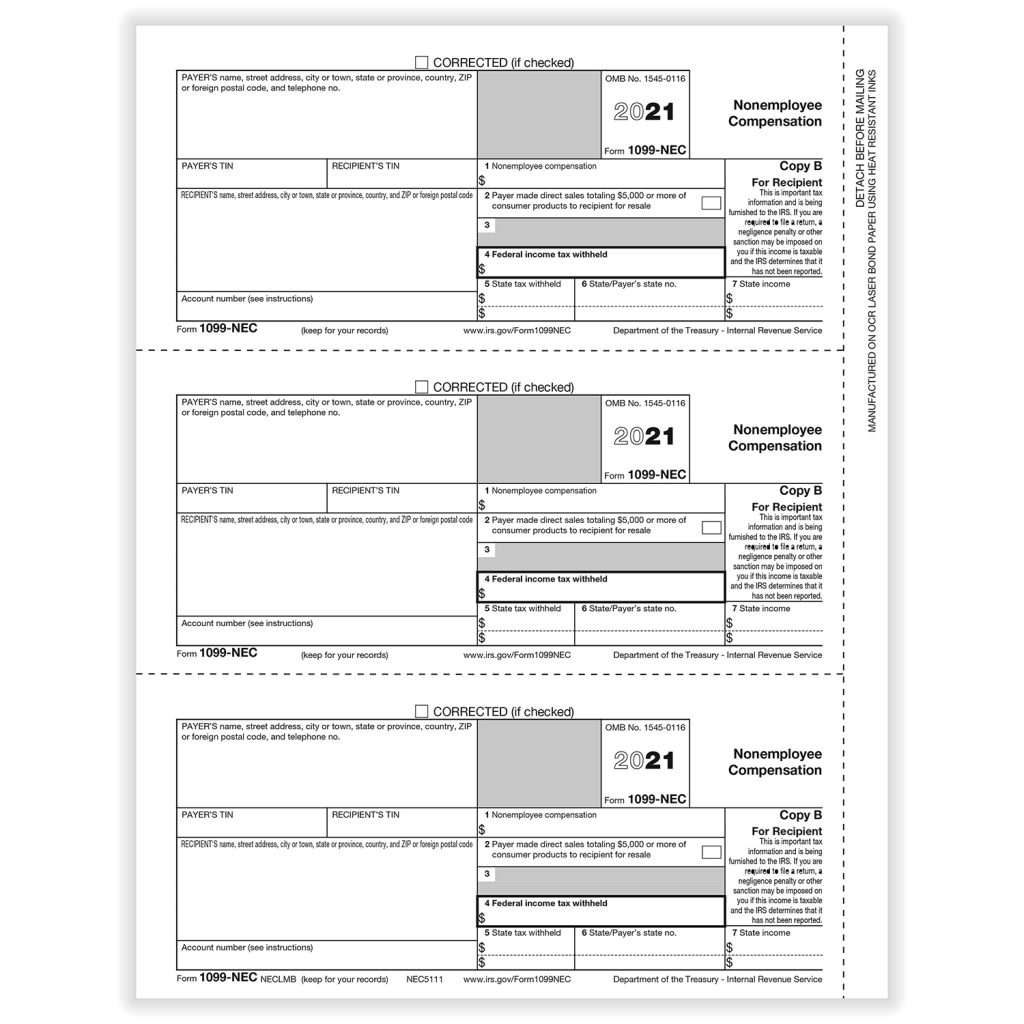

Use Form 1099 NEC solely to report nonemployee compensation payments of 600 or more you make in the course of your business to individuals who aren t employees Report payments for Services performed by a nonemployee including parts and materials Fish purchased in cash from someone engaged in the trade or business of catching fish Form 1099 NEC Form 1099 MISC You are required to furnish Form 1099 NEC to the payee and file with the IRS by January 31 2024 for payments made to contractors in the 2023 tax year For 2023 you are required to send Form 1099 MISC to the payee the contractor by January 31 2024 and file with the IRS by February 28 if filing by paper or by

More picture related to Blank 1099 Nec Form Printable

Fill Out A 1099 NEC

https://assets.website-files.com/5fbc22d336f673712db66095/5fbc25f076bd933980bbf983_progress-1099nec-img-2x-p-1080.png

Printable Blank 1099 Nec Form Printable World Holiday

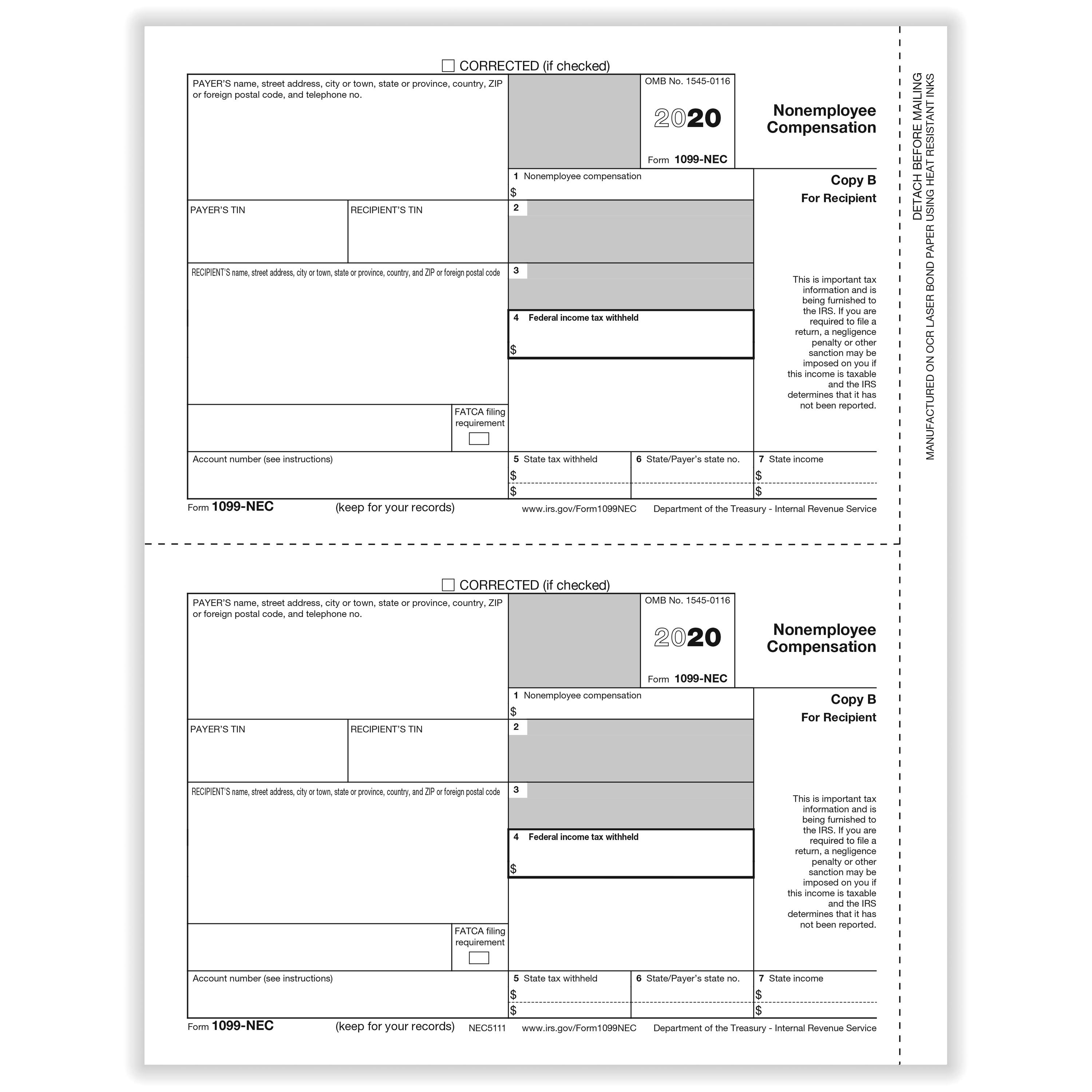

https://cdn.hrdirect.com/Images/Products/L0205-1099-NEC-rec-copy-b-sheet_xl.jpg

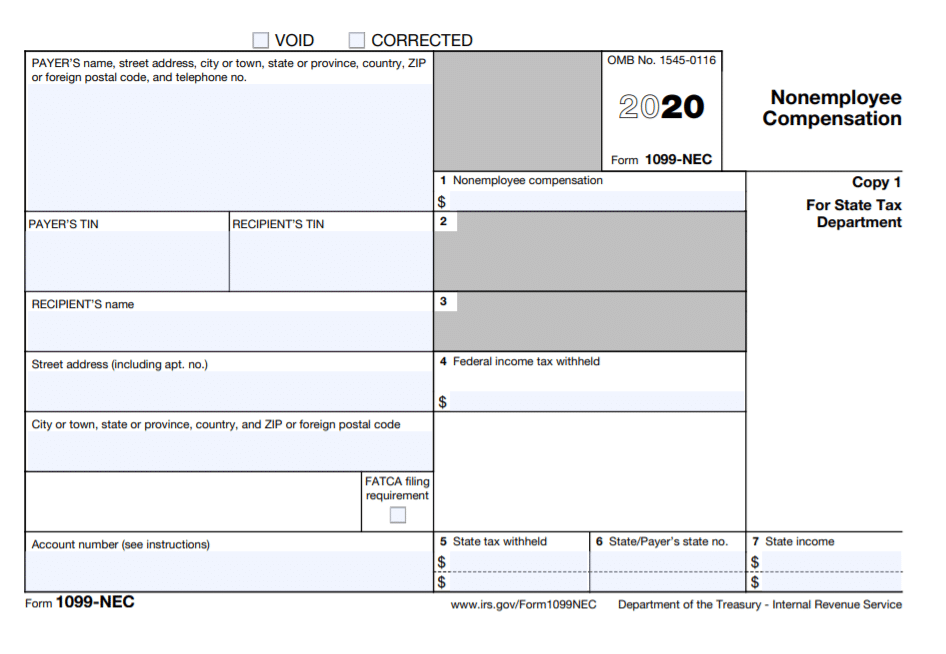

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/488/370/488370241/large.png

Form 1099 NEC nonemployee compensation is for businesses to report payments of at least 600 they ve issued to self employed individuals within a specific tax season Some self employed individuals that companies create 1099 NECs for include service providers consultants freelancers attorneys and independent contractors Businesses are required to send copies of Form 1099 NEC to the IRS and contractors if they pay 600 or more in compensation Search for Menu HR Form 1099 NEC is due Jan 31 2024 to report 2023 calendar year payments You can print blank 1099 NEC form copies from the web or fully completed forms from your payroll software many offer

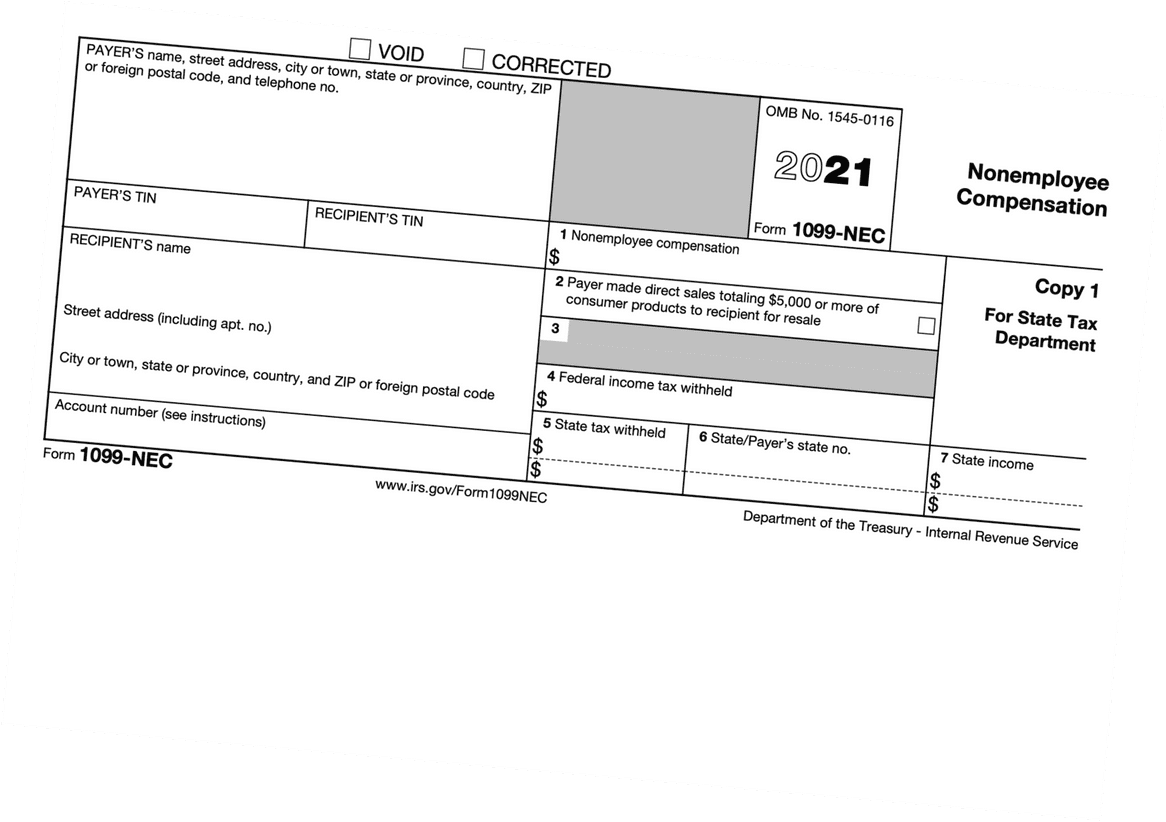

Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like Filing due dates for 1099 MISC forms have also been updated for the 2023 tax year The 1099 MISC must be sent To recipients by January 31 2024 To the IRS by February 28 2024 if filing by mail To the IRS by April 1 2024 if e filing The deadline for the 1099 MISC is different from the deadline for the 1099 NEC

How To File Your Taxes If You Received A Form 1099 NEC

https://forst.tax/wp-content/uploads/2020/01/1099-nec.jpg

Free Printable 1099 NEC File Online 1099FormTemplate

https://d9hhrg4mnvzow.cloudfront.net/www.1099formtemplate.com/1099-nec-printable/ecff6d62-1099-nec-long-5_10we0mu000000000000028.png

https://eforms.com/irs/form-1099/nec/

A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes

https://www.thebalancemoney.com/how-to-prepare-1099-misc-forms-step-by-step-397973

Use Form 1099 NEC to report total payments to non employees if you paid them 600 or more during the year Give these forms to payees and report them to the IRS by January 31 of the year following the tax year being reported Tax withholding isn t usual for non employees but you may need to report backup withholding

How To Fill Out And Print 1099 NEC Forms

How To File Your Taxes If You Received A Form 1099 NEC

Fillable 1099 nec Form 2023 Fillable Form 2023

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

Fillable 1099 nec Form 2023 Fillable Form 2023

1099 Nec Form 2021 Printable Get Your Hands On Amazing Free Printables

1099 Nec Form 2021 Printable Get Your Hands On Amazing Free Printables

Printable 1099 Nec Form

How To Fill Out A 1099 Nec Form By Hand Charles Leal s Template

1099 Nec Word Template

Blank 1099 Nec Form Printable - Size 8 1 2 x 11 Item numbers 321 718 633 Compatibility Pre printed 1099 NEC kits are compatible with QuickBooks Online QuickBooks Online Payroll QuickBooks Desktop 2020 or later and QuickBooks for Mac 2020 or later Printable from laser and inkjet printers Select state you re filing in