Printable Self Employment Tax Form Publication 15 Circular E Employer s Tax Guide Publication 15 A Employer s Supplemental Tax Guide PDF Publication 225 Farmer s Tax Guide Publication 334 Tax Guide for Small Business For Individuals Who Use Schedule C Publication 463 Travel Gift and Car Expenses Publication 505 Tax Withholding and Estimated Tax

Employment Tax Forms Form 940 Employer s Annual Federal Unemployment Tax Return Schedule A Form 940 Multi State Employer and Credit Reduction Information Schedule R Form 940 Allocation Schedule for Aggregate Form 940 Filers PDF Form 941 Employer s Quarterly Federal Tax Return Download This Form Print This Form More about the Federal 1040 Schedule SE Individual Income Tax TY 2023 Taxpayers who have received 400 or more in income from a Schedule C business or self employment must file Schedule SE to determine their self employment tax liability

Printable Self Employment Tax Form

Printable Self Employment Tax Form

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/61e9b9e5062816ec3f6caf30_schedule-se.png

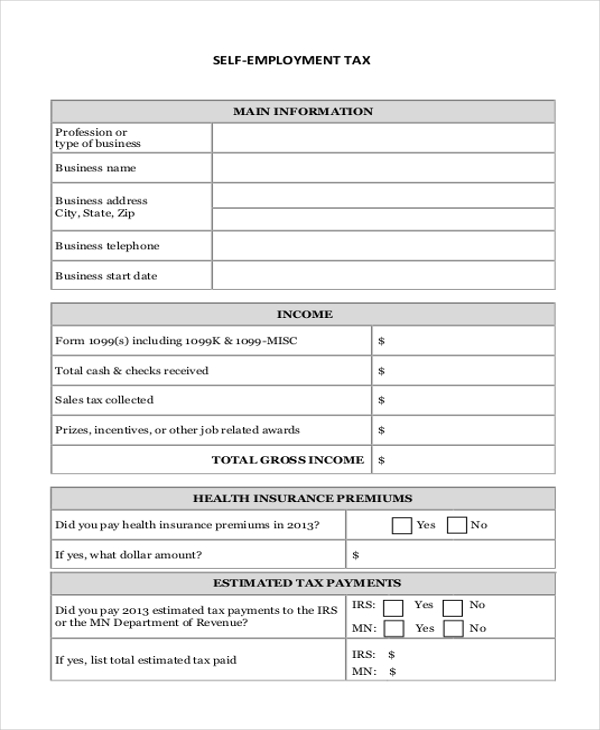

FREE 9 Sample Employee Tax Forms In MS Word PDF

https://images.sampletemplates.com/wp-content/uploads/2017/02/16004713/Self-Employee-Tax-Form-Example.jpg

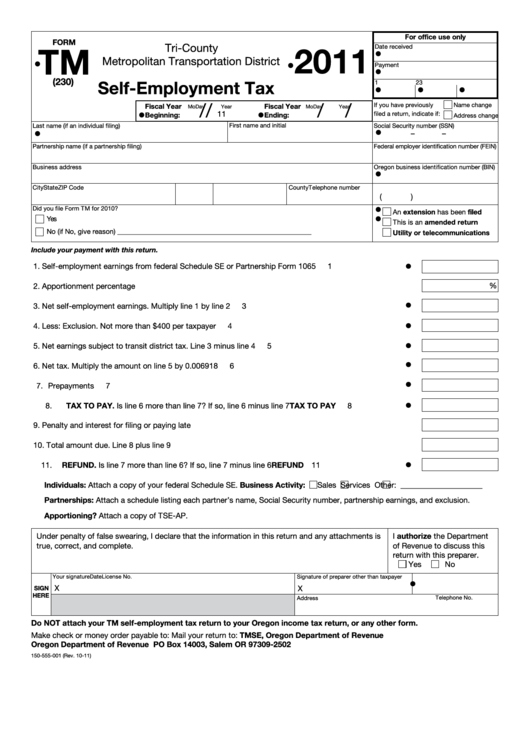

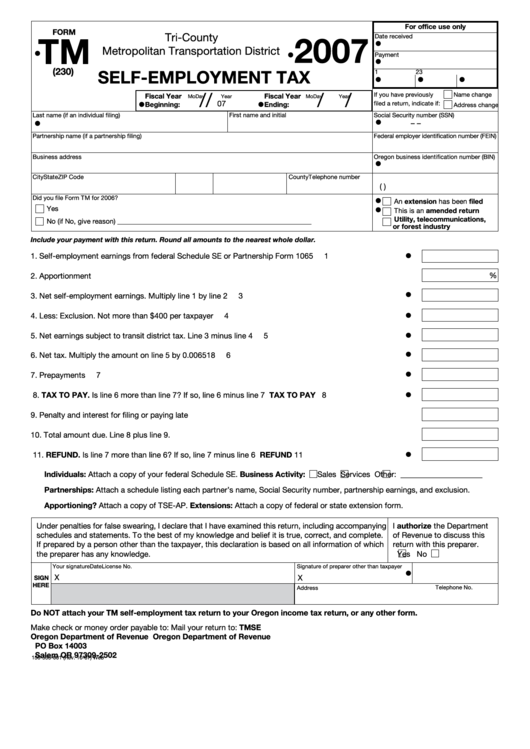

Fillable Form Tm Self Employment Tax 2011 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/199/1995/199557/page_1_thumb_big.png

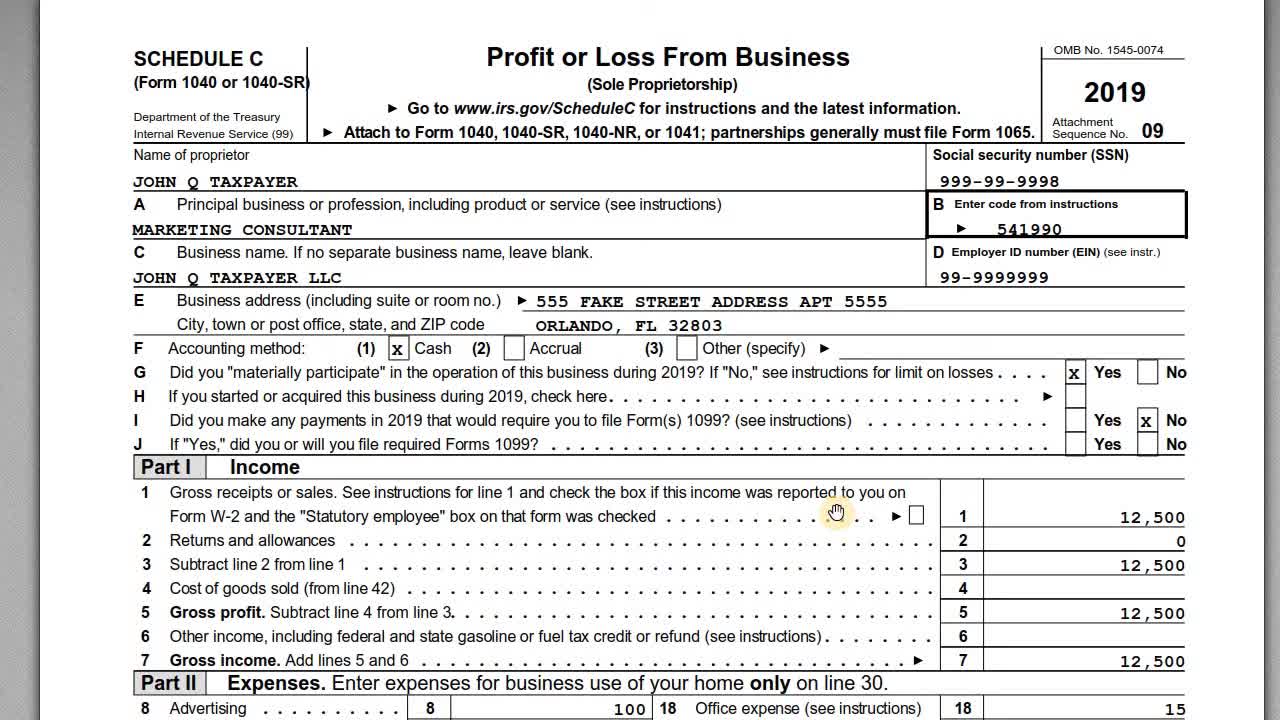

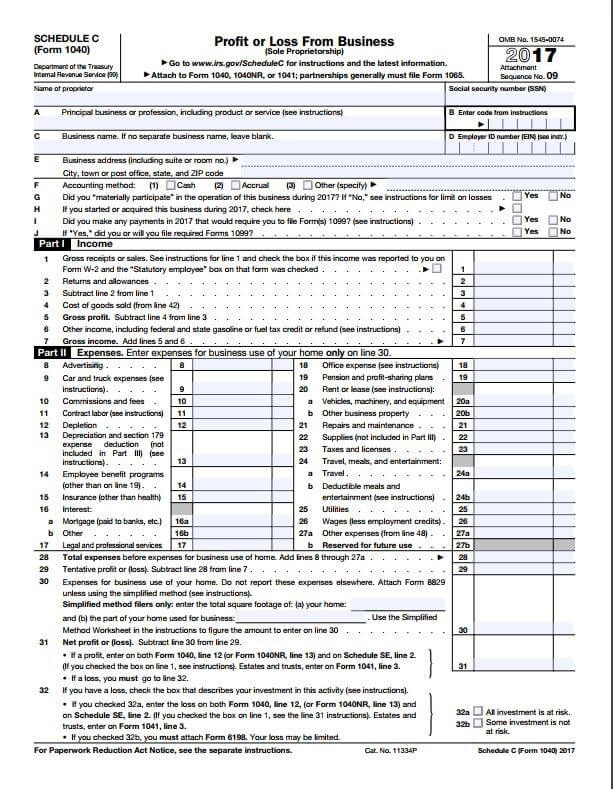

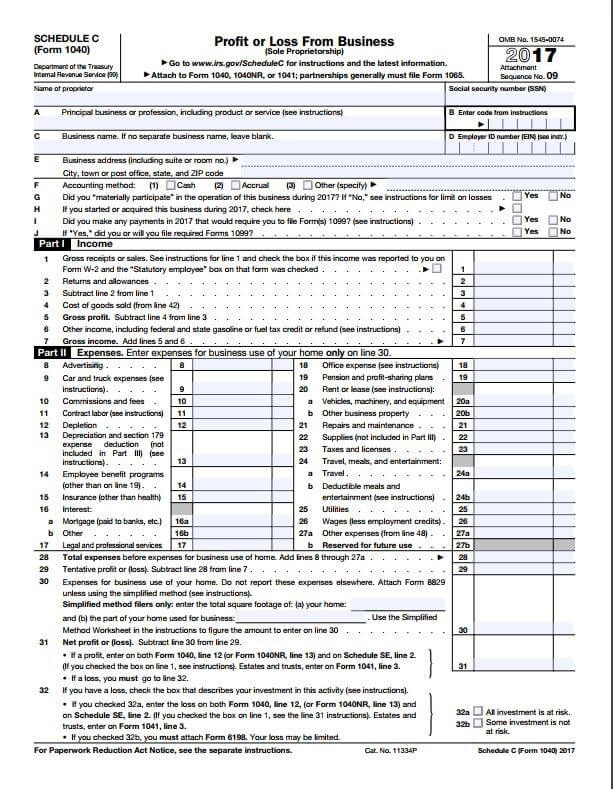

Form 1099 MISC Starting in tax year 2020 Form 1099 MISC was replaced by Form 1099 NEC non employee compensation for your freelance side gig or self employed income However you still may receive a 1099 MISC for any other miscellaneous income you earned such as Schedule SE is one of many schedules of Form 1040 the form you use to file your individual income tax return You use it to calculate your total self employment tax which you must report on another schedule of Form 1040 Schedule 2 Part II line 4 Self employment tax is a combination of your Social Security and Medicare tax similar to

5 Schedule SE Form 1040 Self Employment Tax In most cases self employed people who earned at least 400 in net self employment income in 2023 have to pay self employment tax SE tax You can do this by filing Schedule SE with your Form 1040 The SE tax is 15 3 of your net income and it covers your Social Security and Medicare taxes 4 Steps for Filing Self Employment Taxes Filing self employment taxes is fairly straightforward You basically tell the IRS how much you earn and subtract business expenses from that amount Then

More picture related to Printable Self Employment Tax Form

IRS Schedule C With Form 1040 Self Employment Taxes

https://sp.rmbl.ws/s8/6/j/f/l/X/jflXc.qR4e.1.jpg

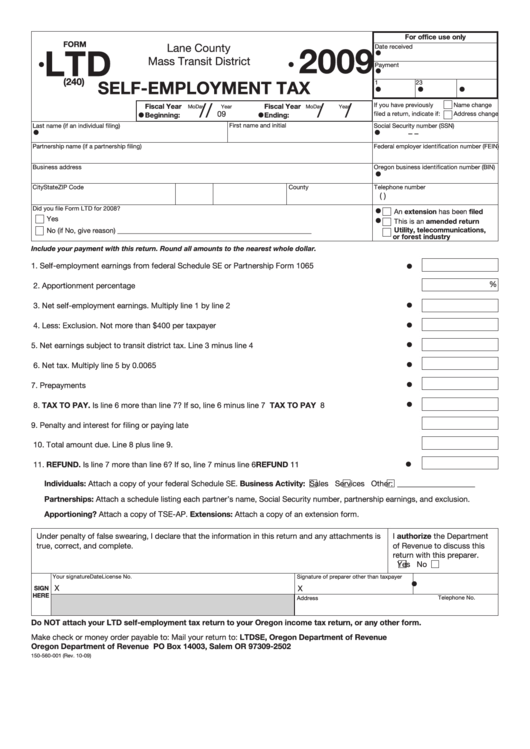

Fillable Form Ltd Self Employment Tax 2009 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/199/1995/199580/page_1_thumb_big.png

How To File Self Employment Taxes Step By Step Your Guide

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/61e9b88c2622fd37ddf5fcb8_schedule-c.png

What Is Form 1040 Schedule SE Schedule SE is used to calculate both your self employment tax due and your one half self employment tax deduction on IRS Form 1040 and Form 1040NR Schedule SE is generally required if you file Schedule C EZ Schedule C Schedule F or Schedule K 1 Form 1065 The Schedule SE Form 1040 is an IRS tax form used by self employed United States residents to determine their amount of due taxes which depends on their business profits or losses for the tax year If you re self employed our free Form 1040 SE Self Employment Tax Form is an easy way to file your taxes and save your information as a PDF

6 Common Law and Employment Agreements 7 Self employment Ledger Templates Create own personal self employment ledger template and self employment ledger forms in seconds with our fantastic templates Income Tax Forms 1040 Schedule SE Federal Self Employment Tax Download This Form Print This Form It appears you don t have a PDF plugin for this browser Please use the link below to download 2023 federal 1040 schedule se pdf and you can print it directly from your computer More about the Federal 1040 Schedule SE

Quarterly Tax Form For Self Employed Employment Form

https://i0.wp.com/www.employementform.com/wp-content/uploads/2022/10/quarterly-tax-form-for-self-employed.jpg?w=975&h=1320&ssl=1

FREE 6 Sample Self Employment Tax Forms In PDF

https://images.sampletemplates.com/wp-content/uploads/2016/01/18163109/Sample-Self-Employment-Tax.jpg

https://www.irs.gov/businesses/small-businesses-self-employed/publications-and-forms-for-the-self-employed

Publication 15 Circular E Employer s Tax Guide Publication 15 A Employer s Supplemental Tax Guide PDF Publication 225 Farmer s Tax Guide Publication 334 Tax Guide for Small Business For Individuals Who Use Schedule C Publication 463 Travel Gift and Car Expenses Publication 505 Tax Withholding and Estimated Tax

https://www.irs.gov/businesses/small-businesses-self-employed/employment-tax-forms

Employment Tax Forms Form 940 Employer s Annual Federal Unemployment Tax Return Schedule A Form 940 Multi State Employer and Credit Reduction Information Schedule R Form 940 Allocation Schedule for Aggregate Form 940 Filers PDF Form 941 Employer s Quarterly Federal Tax Return

FREE 22 Sample Tax Forms In PDF Excel MS Word

Quarterly Tax Form For Self Employed Employment Form

FREE 6 Sample Self Employment Tax Forms In PDF

Fillable Form Tm Self Employment Tax 2007 Printable Pdf Download

Self Employment Tax Form Line 18 Employment Form

Your Complete Guide To Self Employment Taxes In 2018 2021 Tax Forms 1040 Printable

Your Complete Guide To Self Employment Taxes In 2018 2021 Tax Forms 1040 Printable

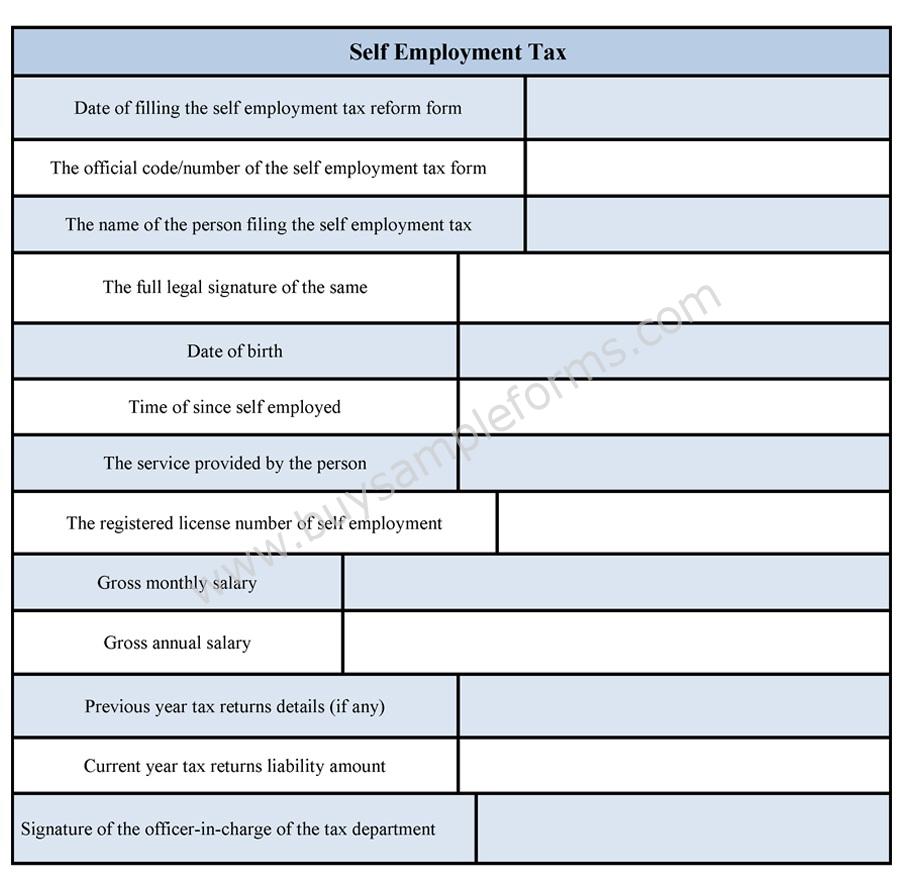

Self Employment Tax Form Editable Forms

FREE 6 Sample Self Employment Tax Forms In PDF

Self Employment Tax Form Sample Forms

Printable Self Employment Tax Form - Withholding Forms Local Tax Rate Changes There are no local tax rates increase for calendar year 2023 however one county Cecil s has decreased their local tax rate for calendar year 2024 For calendar year 2024 Federick and Anne Arundel counties tax rates were adjusted by adding new local tax brackets based on filing statuses and taxable income