Cra Mileage Log Requirements Full logbook The best evidence to support the use of a vehicle is an accurate logbook of business travel maintained for the entire year showing for each business trip the destination the reason for the trip and the distance covered

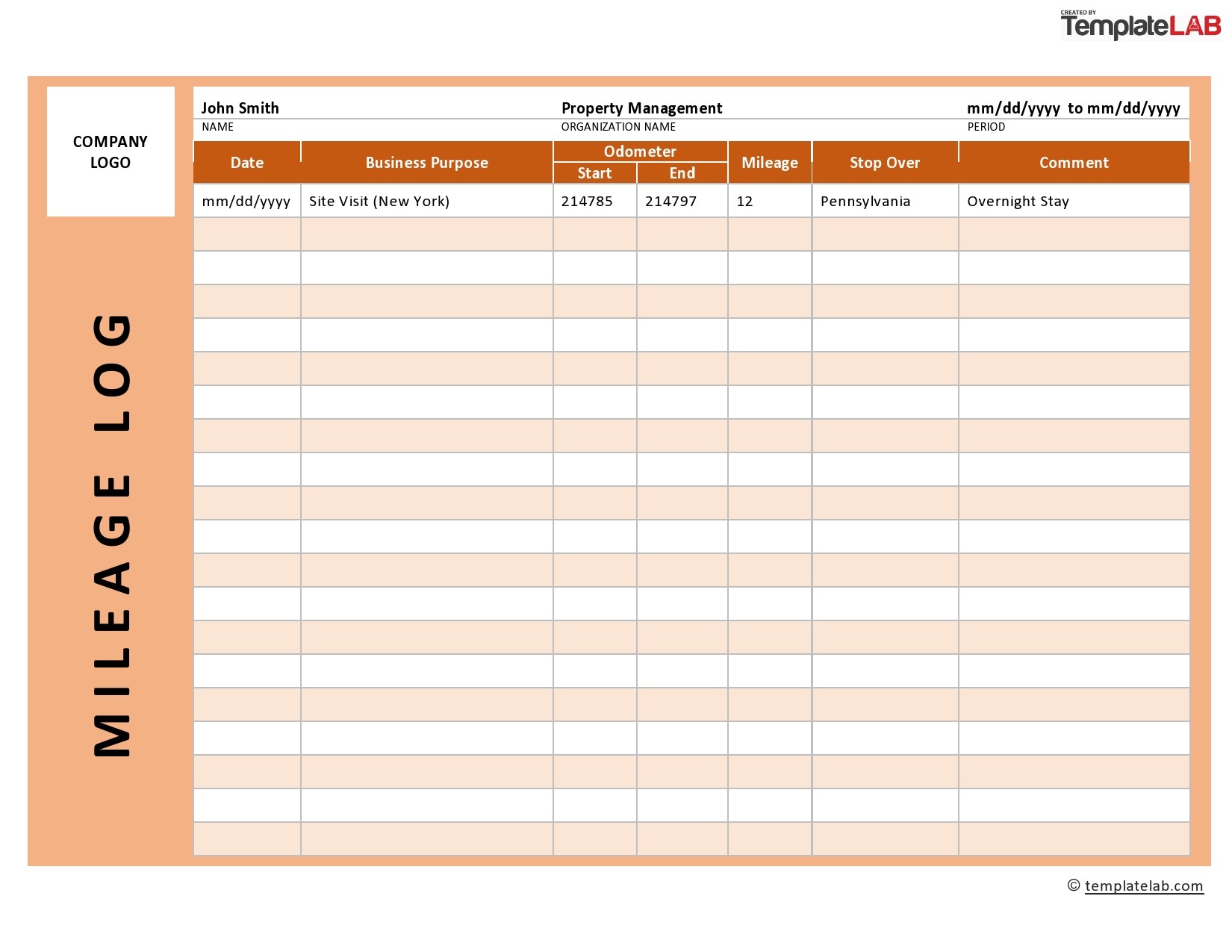

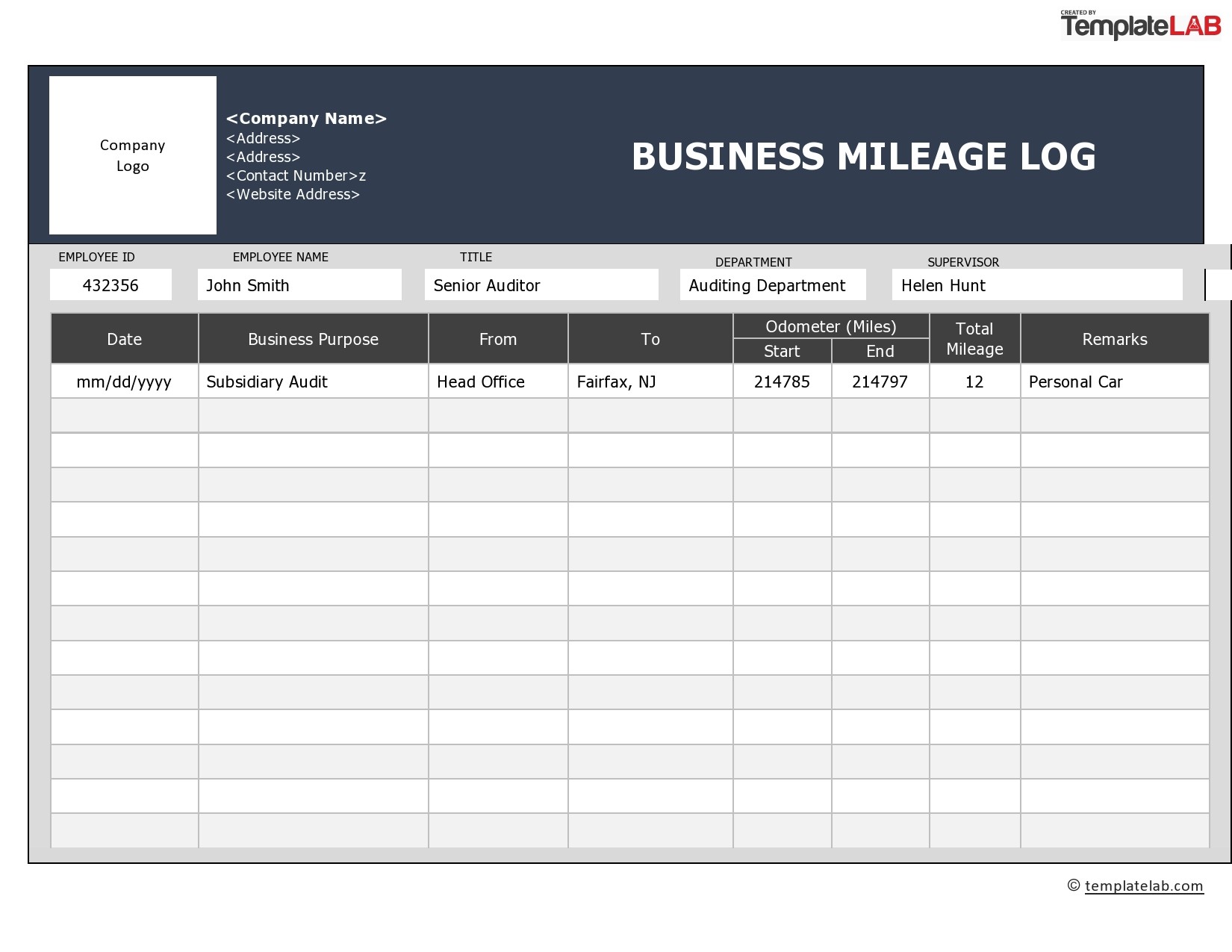

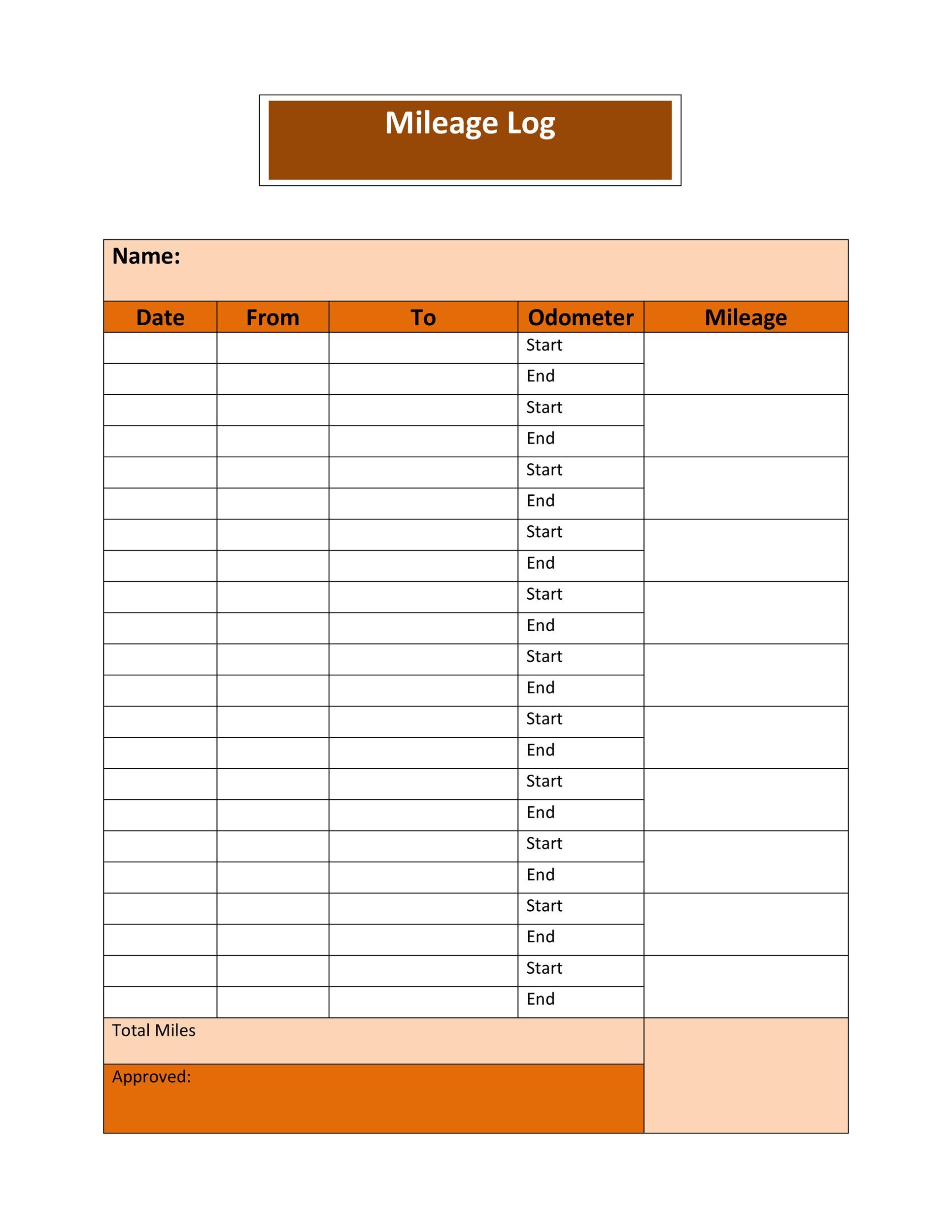

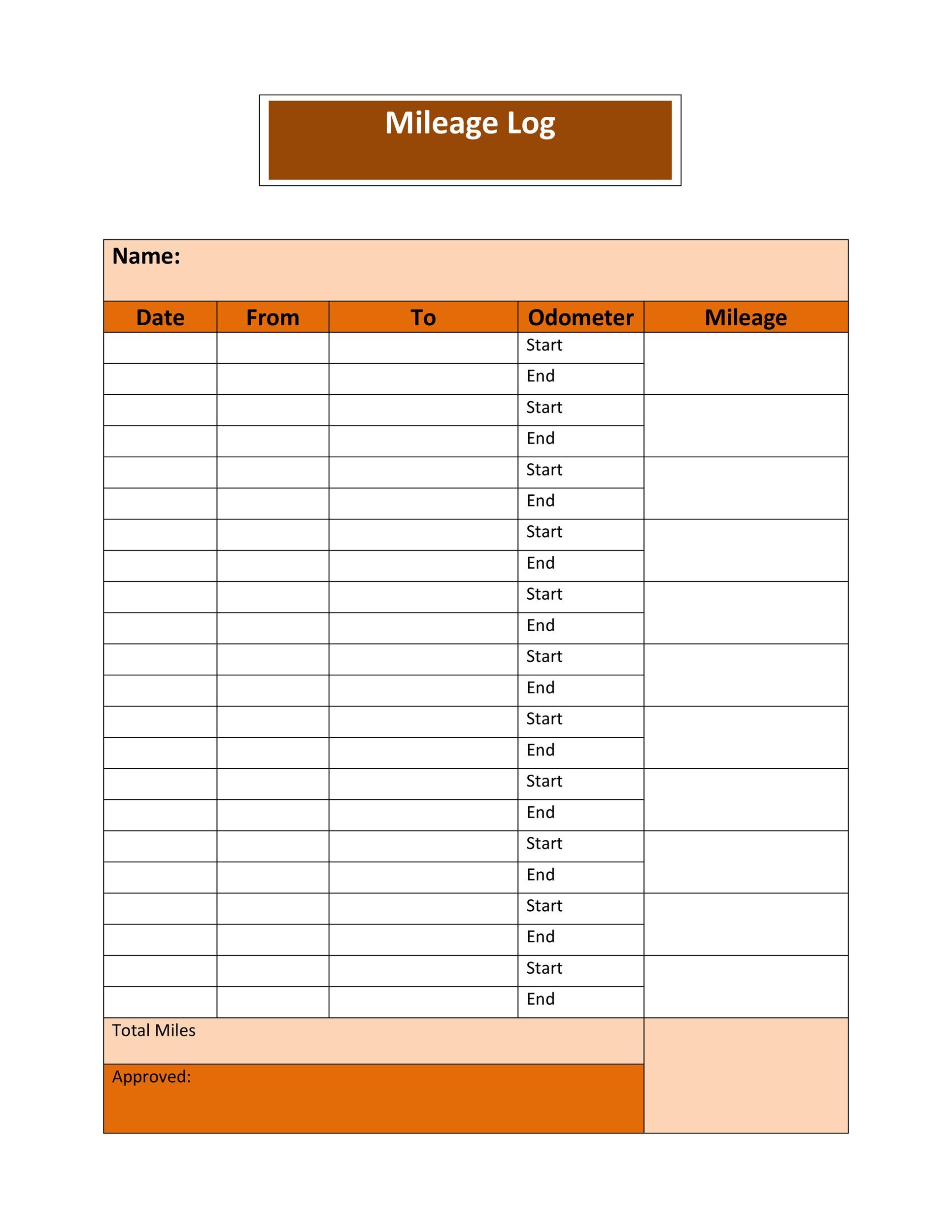

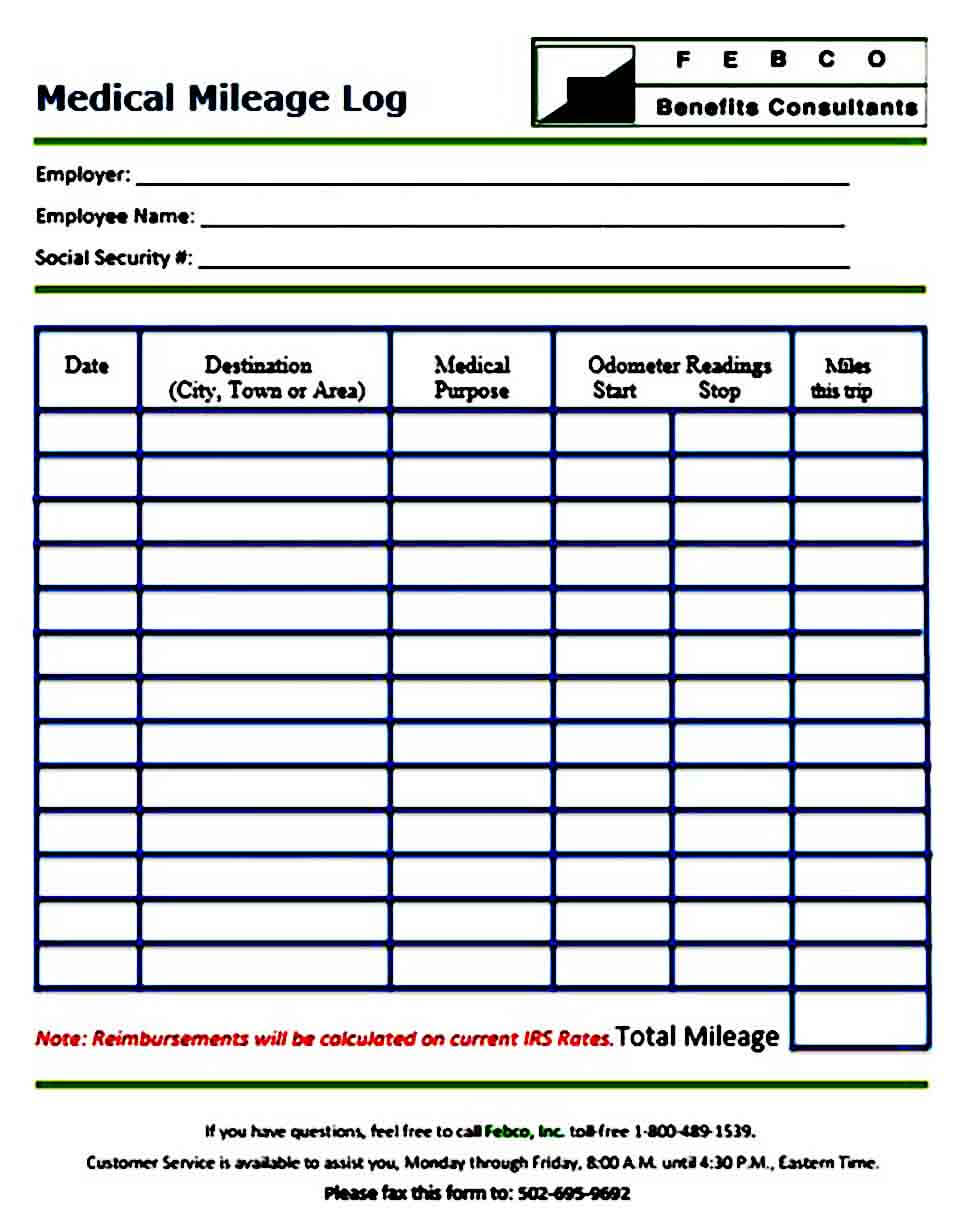

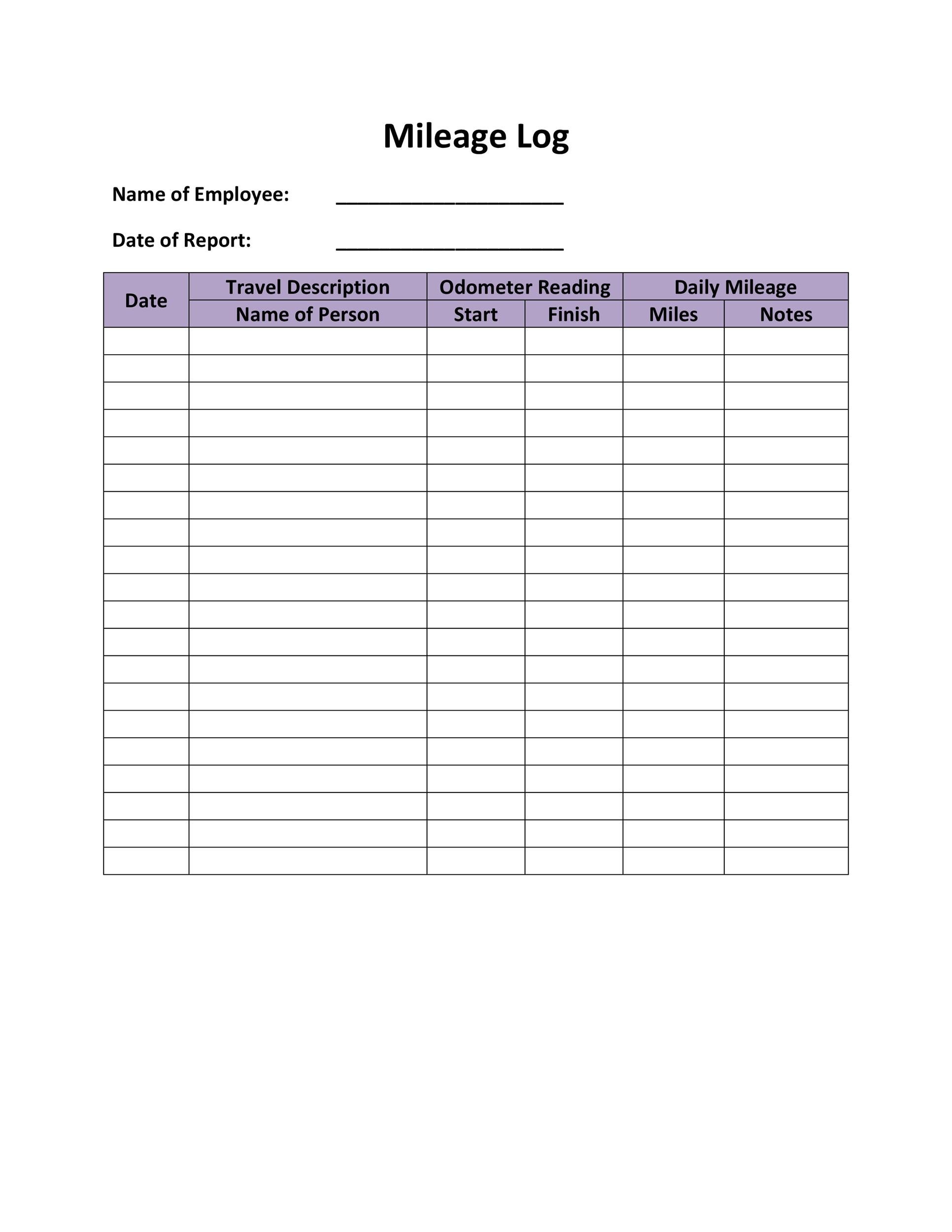

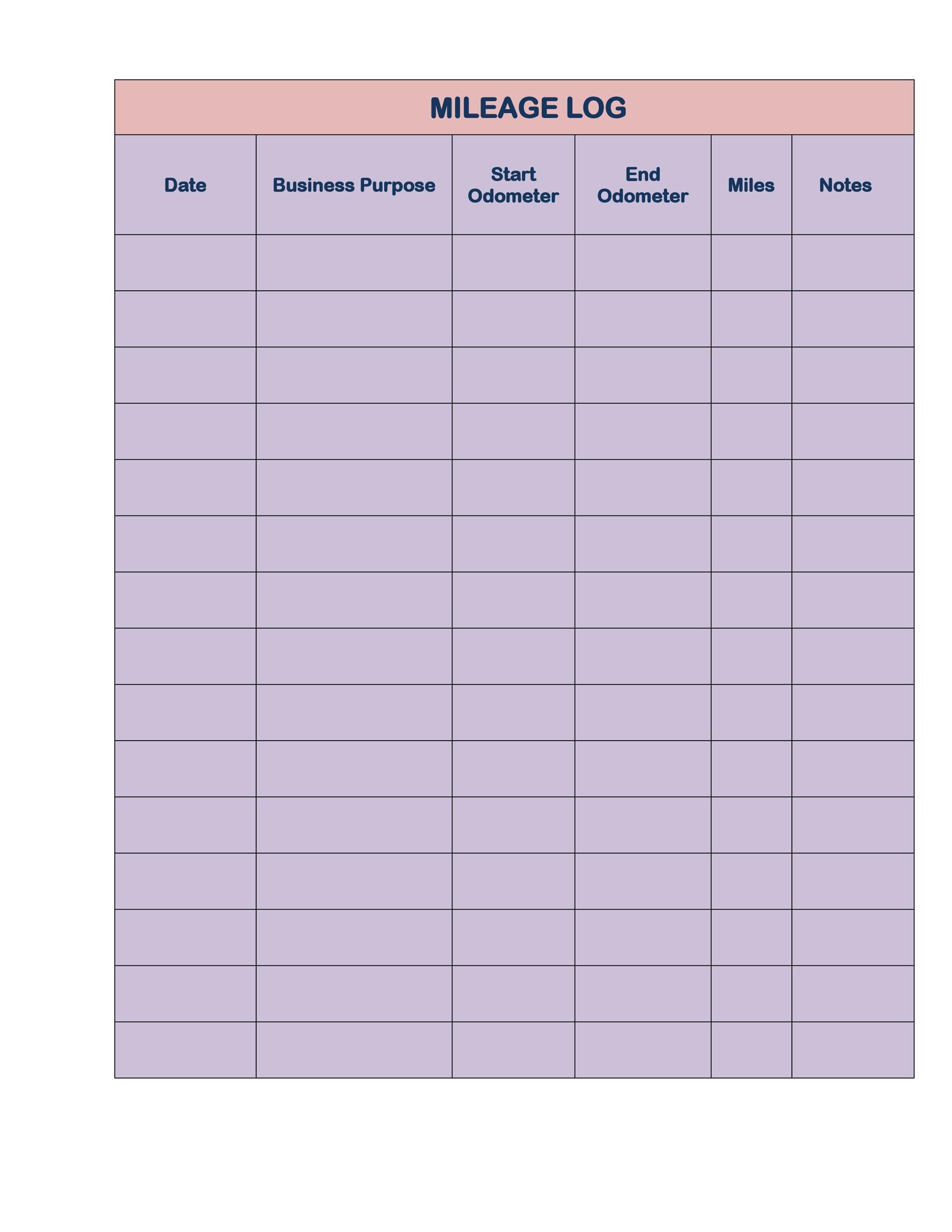

Here are seven key requirements Detailed Logbook The CRA typically requires a detailed logbook of motor vehicle operations for the entire year It should include the total distance driven and the distance driven to earn income during each business trip You will need to record the following details in your mileage log for each trip you take with your personal vehicle The date Destination Purpose Kilometres driven You are required to also include your vehicle s odometer readings at the start and end of the year in your CRA mileage log

Cra Mileage Log Requirements

Cra Mileage Log Requirements

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111caaee31b8741228fa11c_60d8c673f09a515eadb97f99_Canada-CRA-Mileage-log.jpeg

![]()

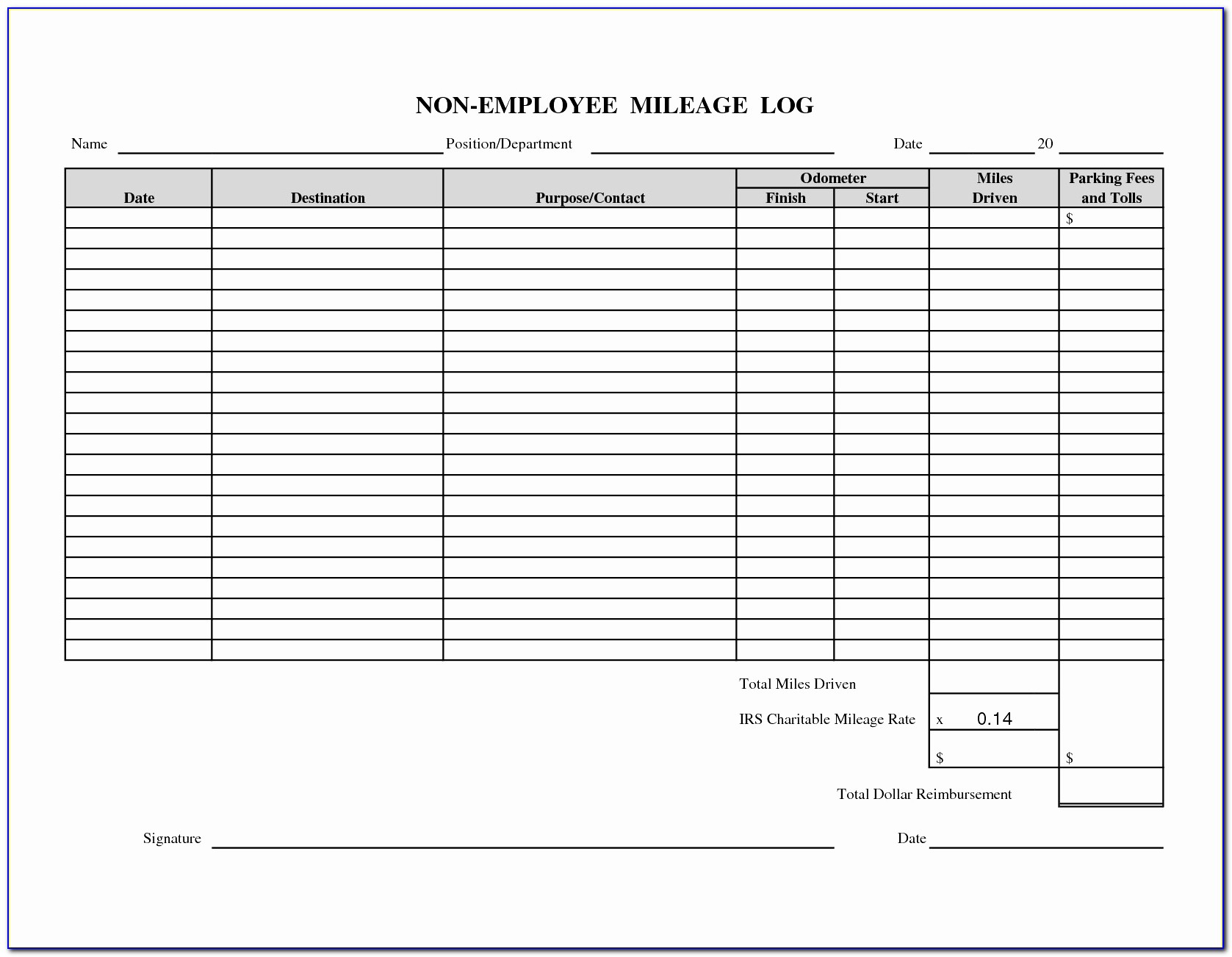

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log

https://wssufoundation.org/wp-content/uploads/2020/11/editable-25-printable-irs-mileage-tracking-templates-gofar-mileage-log-for-taxes-template-word-scaled-2048x1449.jpg

Breaking Down The IRS Mileage Log Requirements CompanyMileage

https://companymileage.com/wp-content/uploads/2020/10/irs-mileage-log-requirements.jpeg

Keep reading to find out more about CRA mileage log requirements along with how to claim them on next year s taxes What s required when tracking mileage for taxes The Canada Revenue Agency lets taxpayers claim the expenses associated with using their vehicle for work including business mileage Personal driving personal use Personal driving is any driving done for purposes not related to employment An employee may use one of your owned or leased vehicles for purposes other than business or an employee may use their personal vehicle to carry out employment duties and get an allowance for the business use of that vehicle

Your records must be Be reliable and complete Contain information relevant to tax obligations and calculating benefits Have documentation Be in French or English or a combination of the two Download MileIQ to start tracking your drives Automatic accurate mileage reports Get Started Can I use electronic records for taxes Yes How to keep accurate mileage records Three Month Sample Logbook The CRA has updated their requirements to allow small business people to reduce their logbook record keeping and use a three month sample logbook to extrapolate business use for the entire year To use a simplified logbook

More picture related to Cra Mileage Log Requirements

MILEAGE LOG BOOK Mileage Owner Gifts Business

https://i.pinimg.com/originals/47/26/39/472639b0332dff8786af1827223eaa70.jpg

Mileage Log Book Excel Templates

https://lh5.googleusercontent.com/proxy/dxgOvnwbqh9NbbbWoHLLHFie_w7P8CAAixWRHa9R_z1Odc-JLZYDqCWtAGPNiw6C3X4pZNm-IyMxkxV4UwU7ARF4OYaRjXuNG1PyHvYSTta6ryUgjIVHdg=s0-d

Mileage Log Template Excel Excel Templates

https://db-excel.com/wp-content/uploads/2019/01/mileage-spreadsheet-template-in-irs-mileage-log-book-template-lovely-irs-mileage-log-form-awesome.jpg

CRA mileage log book requirements vs business reality Although it can be difficult to do sometimes a complete record for the entire year is the best way to protect your claims for vehicle expenses Especially when undertaking a new business venture or earning income from a new source keeping a full vehicle log book for the whole year is 21 Mar 2017 CRA Mileage Log Claim Motor Vehicle Expenses On Taxes Written by Advertorial Posted in Advertorial Now that MileIQ for Canada is live it s easier than ever to claim the mileage deduction you deserve Be sure you re aware of the CRA mileage log requirements before you claim motor vehicle expenses on your taxes

Date Destination Purpose Kilometres driven Also write down your car s odometer readings at the start and end of the year If you drive for both work and personal reasons record everything Plus keep all your car expense receipts Two Ways to Log for the CRA Full Logbook Method Write down all your driving details for the year There are two methods by which you can claim CRA mileage the full logbook and the simplified logbook methods Full logbook The full logbook method requires you to keep a record of your driving each year

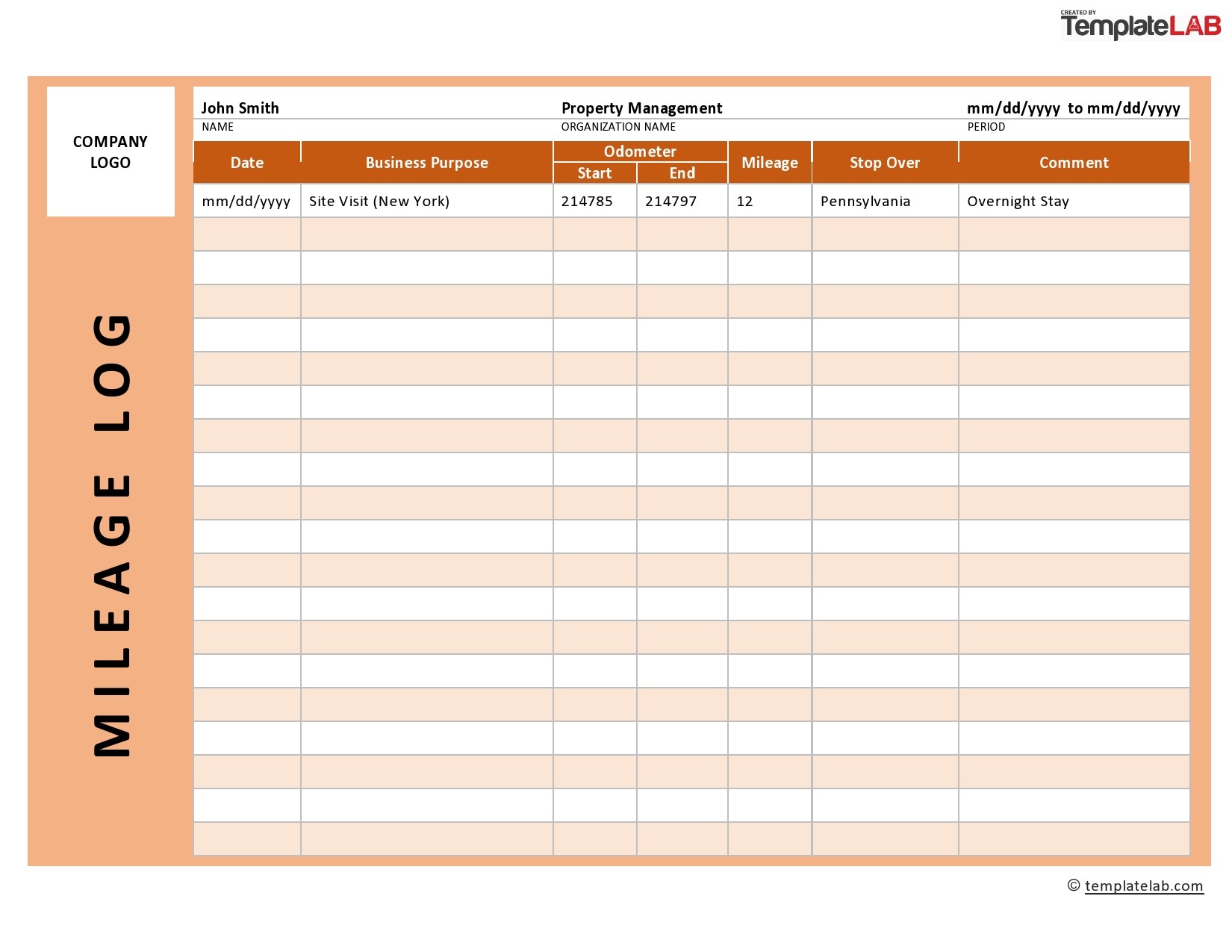

Uber Mileage Log Template

https://templatelab.com/wp-content/uploads/2020/02/Mileage-Log-TemplateLab.com_.jpg?w=395

Printable Mileage Log Template Templates Templates With Regard To

https://www.thegreenerleithsocial.org/wp-content/uploads/2019/11/printablemileagelogtemplate-templates-templates-with-regard-to-gas-mileage-expense-report-template.png

https://www.canada.ca/en/revenue-agency/services/...

Full logbook The best evidence to support the use of a vehicle is an accurate logbook of business travel maintained for the entire year showing for each business trip the destination the reason for the trip and the distance covered

https://www.bookkeeping-essentials.ca/CRA-mileage...

Here are seven key requirements Detailed Logbook The CRA typically requires a detailed logbook of motor vehicle operations for the entire year It should include the total distance driven and the distance driven to earn income during each business trip

Free Printable Vehicle Mileage Log High Resolution Printable

Uber Mileage Log Template

Cra Mileage Log Template HQ Template Documents

Free Mileage Tracker Printable Printable Templates

25 Printable Irs Mileage Tracking Templates Gofar In Mileage Report

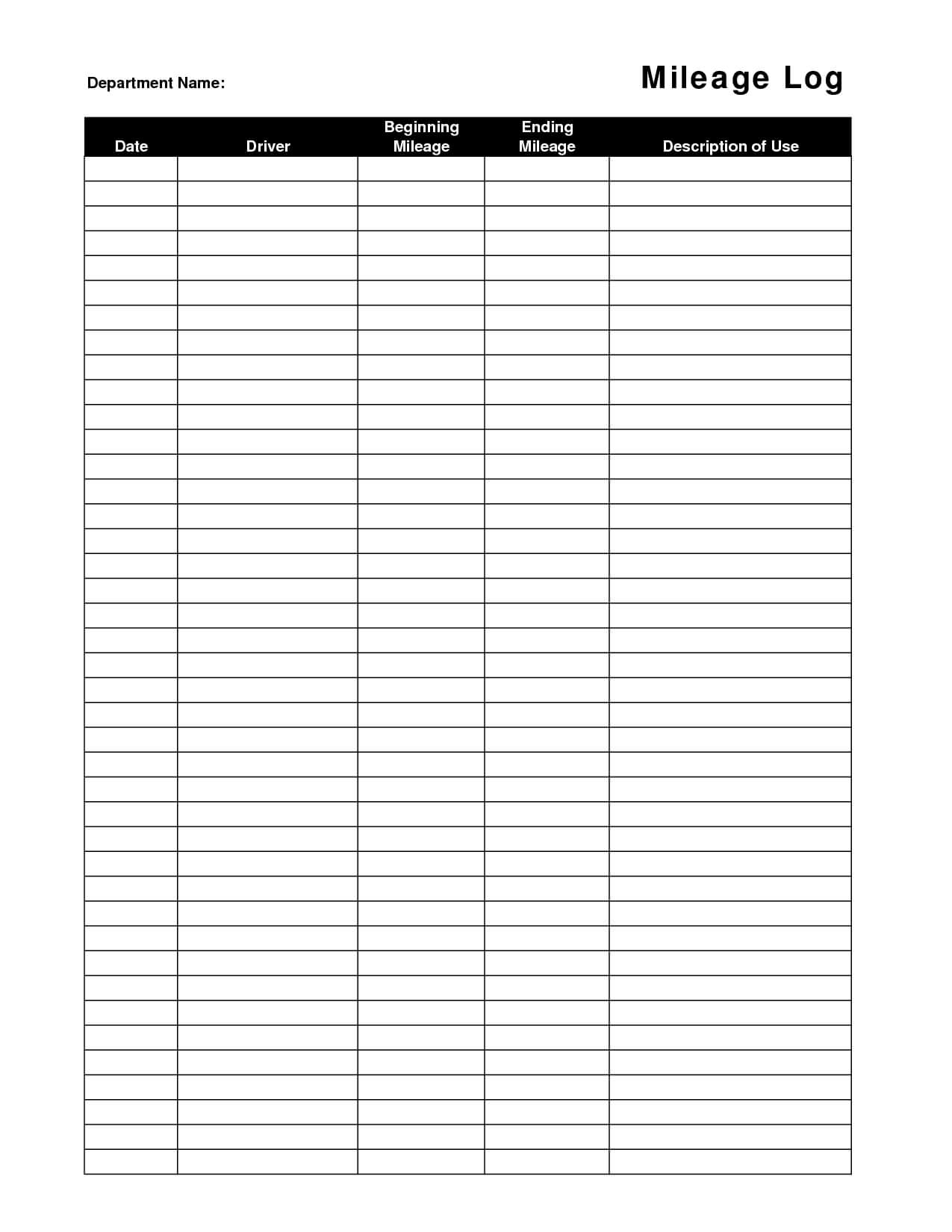

Mileage Log Templates 19 Free Printable Word Excel PDF Formats

Mileage Log Templates 19 Free Printable Word Excel PDF Formats

Mileage Template Excel Templates

Irs Approved Mileage Log Printable

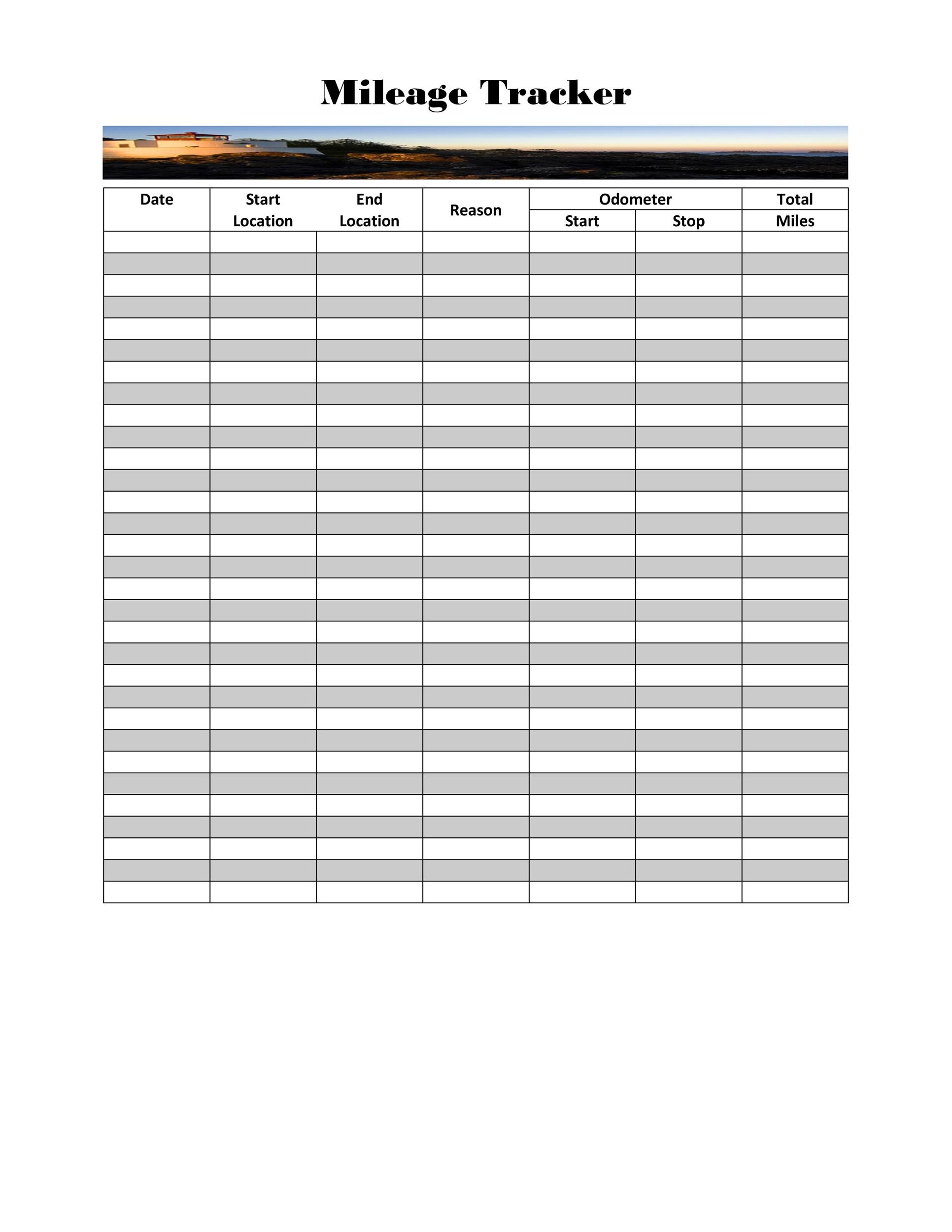

Free Printable Mileage Tracker

Cra Mileage Log Requirements - Personal driving personal use Personal driving is any driving done for purposes not related to employment An employee may use one of your owned or leased vehicles for purposes other than business or an employee may use their personal vehicle to carry out employment duties and get an allowance for the business use of that vehicle