Cra Payroll Remittance Form Printable Canada ca Taxes Payroll Remit pay payroll deductions and contributions Information on when and how to remit report a nil remittance confirm your remittance was received and correct remitting errors or misallocated payments Sections Types of remitters

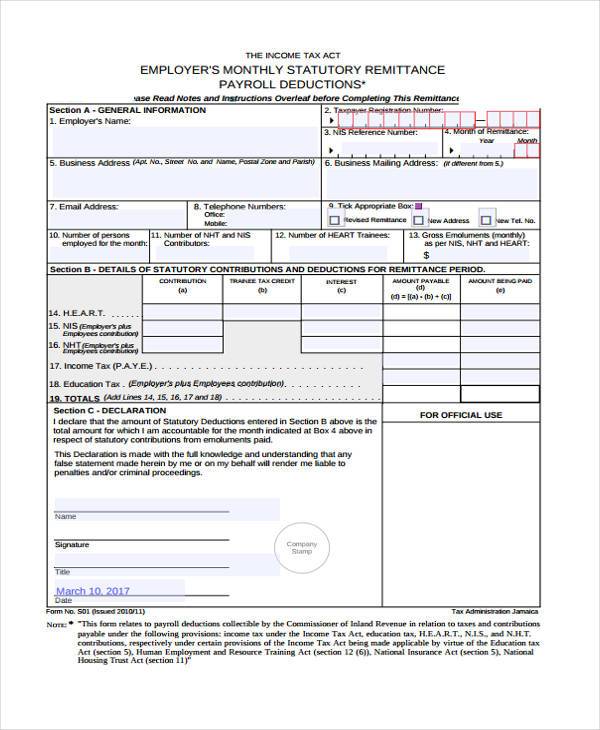

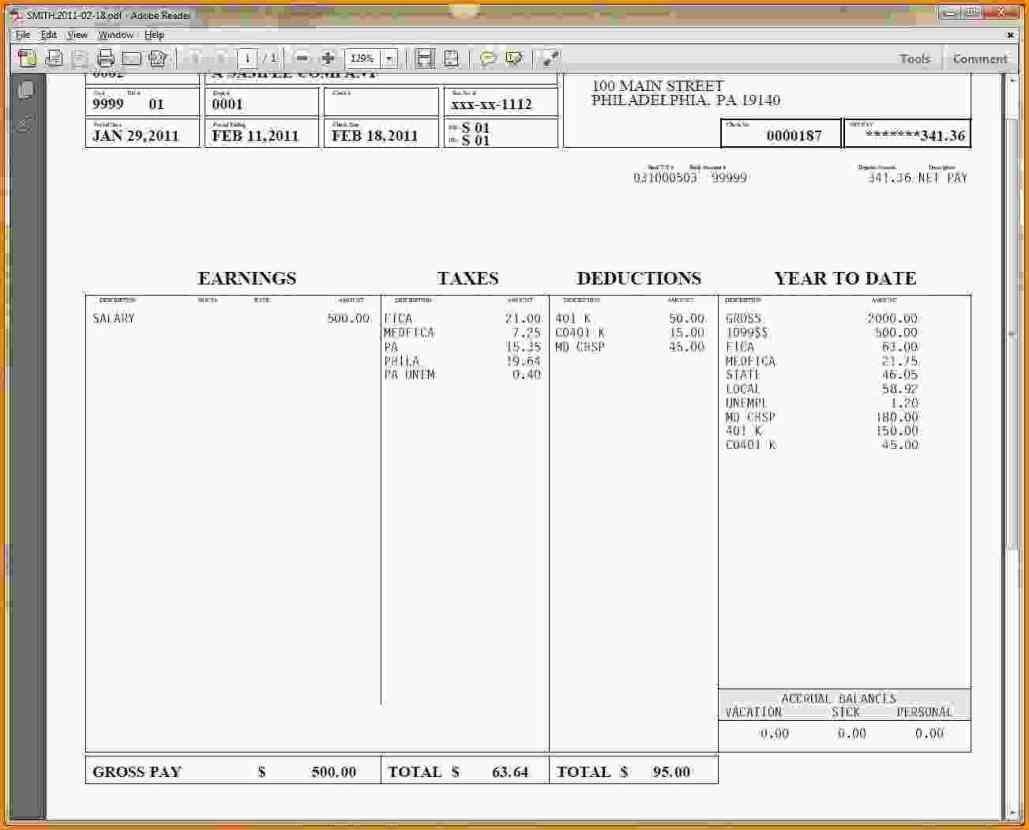

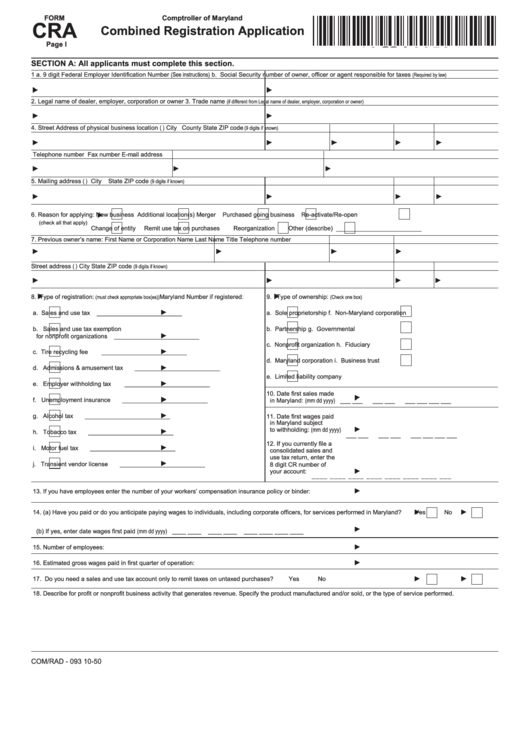

Chapter 1 General information Do you need to register for a payroll program account Contacts and authorized representatives Employment in Quebec Are you an employer Employment by a trustee Payer of other amounts What are your responsibilities Keeping records Social insurance number SIN beginning with the number 9 Payroll Deductions Tables The PD7A is a Canada Revenue Agency CRA payroll remittance form On it you report EI premiums CPP contributions and federal income tax withheld from your employee s pay Use the Sage 50 Accounting Remittance Summary Report to help you complete the PD7A Before you can perform this task To complete the electronic or paper version of the PD7A

Cra Payroll Remittance Form Printable

Cra Payroll Remittance Form Printable

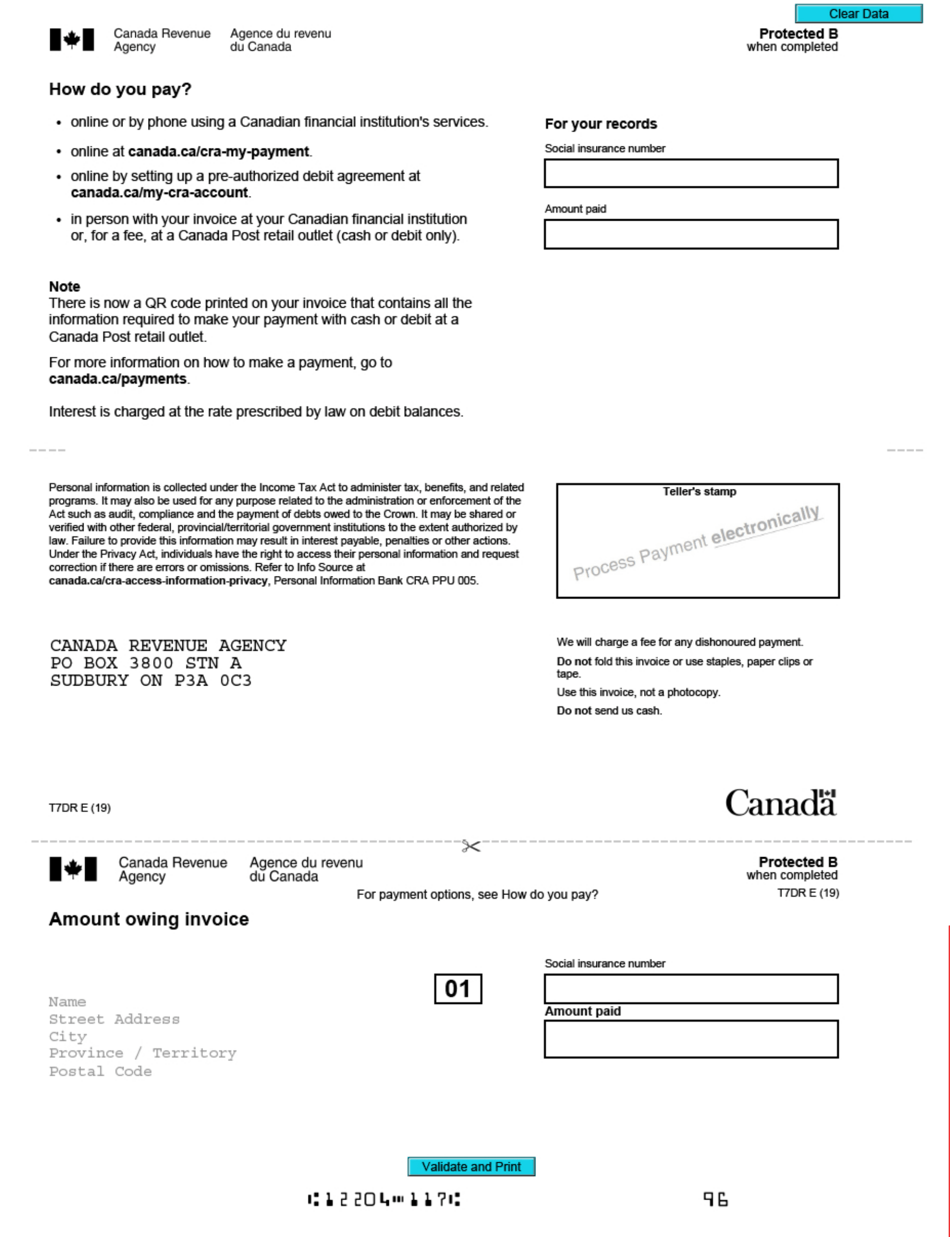

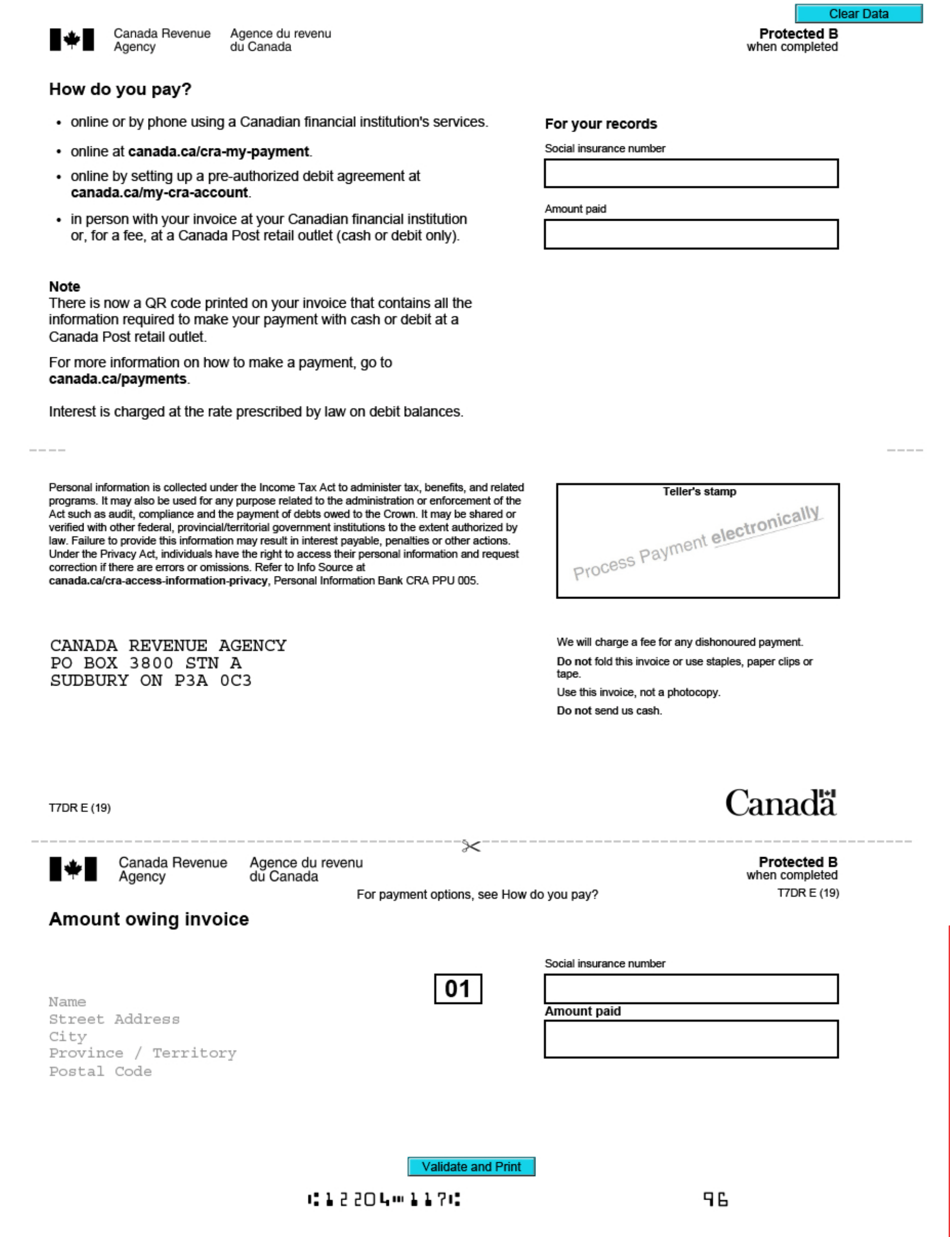

https://data.templateroller.com/pdf_docs_html/2031/20312/2031254/form-t7dr-amount-owing-remittance-voucher-canada_print_big.png

Cra Record Of Employment Fillable Form Printable Forms Free Online

https://www.pdffiller.com/preview/14/715/14715322/large.png

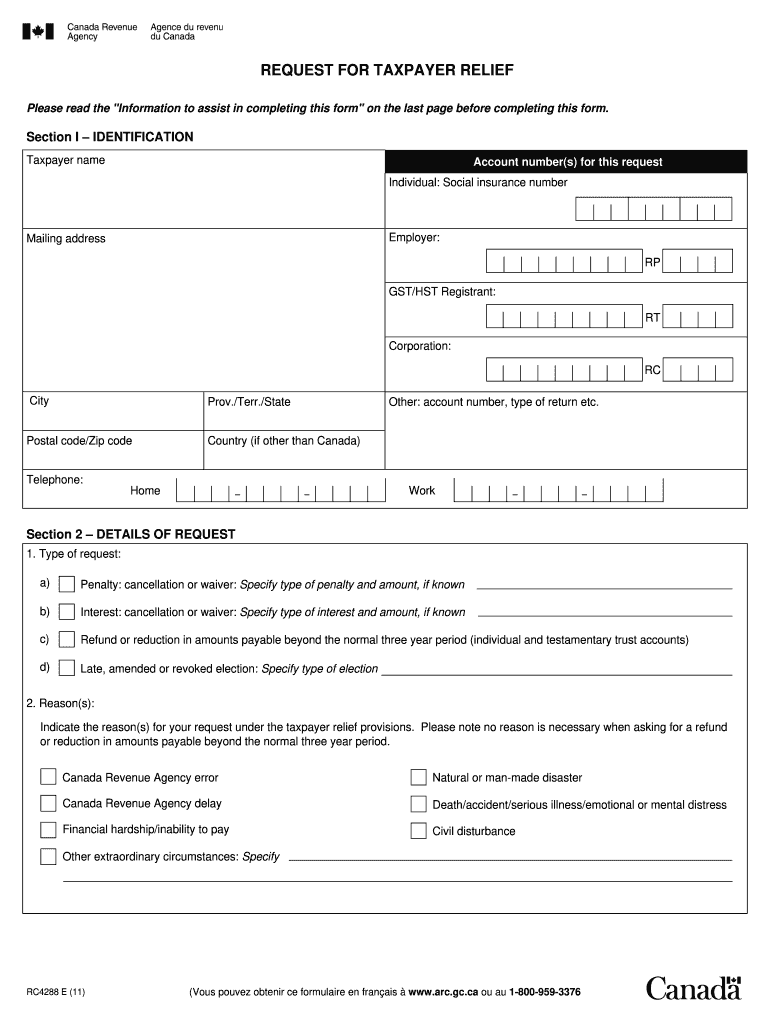

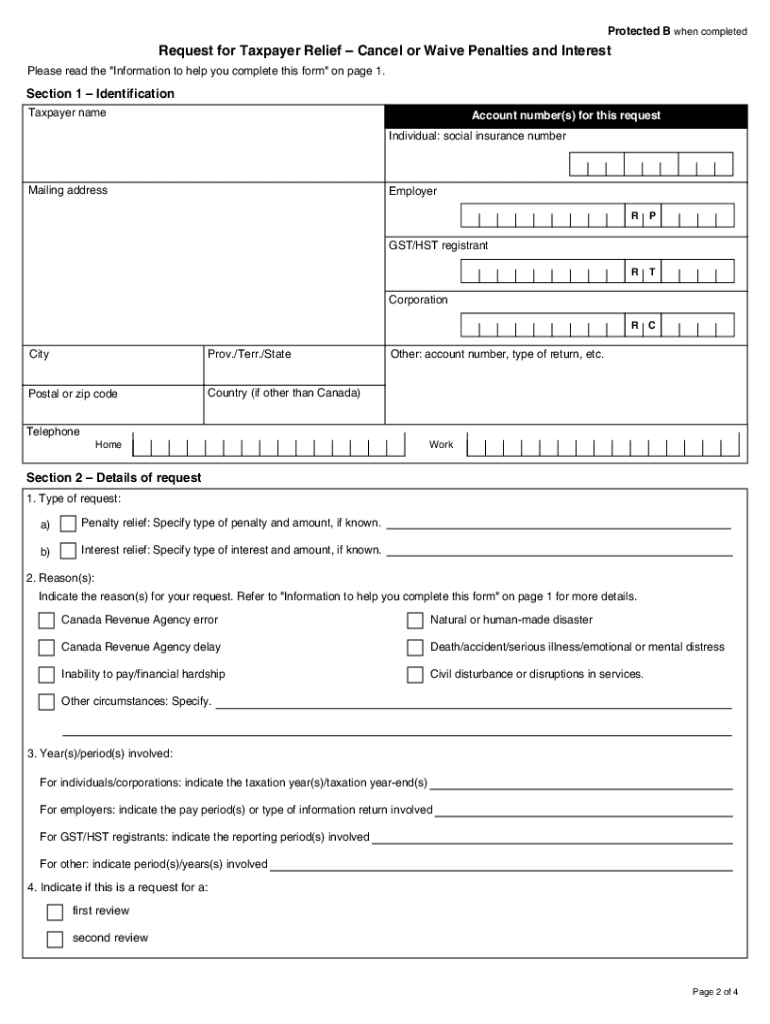

Rc4288 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/70/100070043/large.png

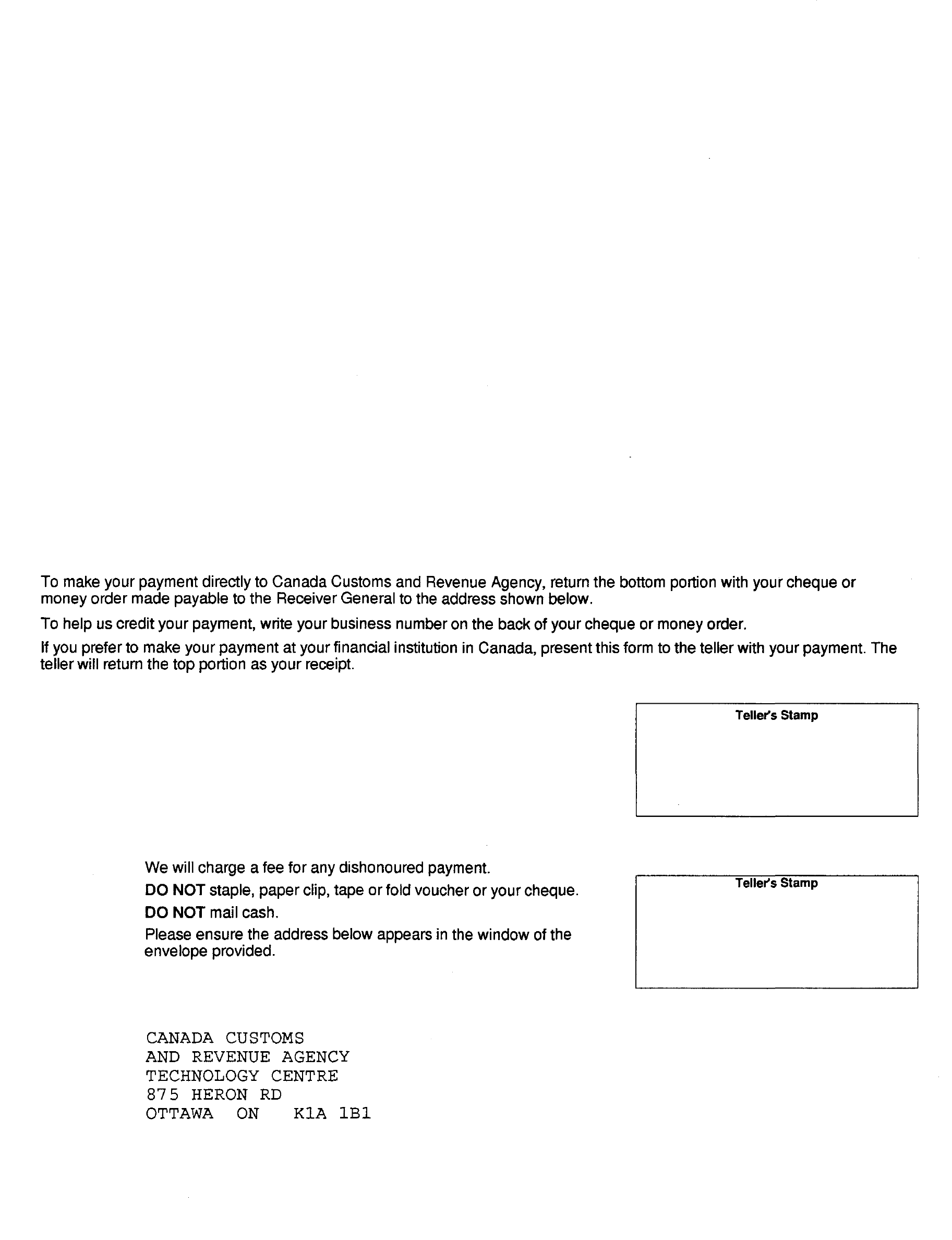

By mail You can mail a cheque or money order payable to the Receiver General to the address listed in your package or on the back of your remittance voucher Complete and include the bottom part of your remittance voucher with your payment Allow sufficient mailing time to ensure that we receive your payment by the due date Remit a payroll remittance payment to the Receiver General The PD7A is a Canada Revenue Agency CRA payroll remittance form On it you report EI premiums CPP contributions and federal income tax withheld from your employee s pay Use the Sage 50 Accounting Remittance Summary Report to help you complete the PD7A

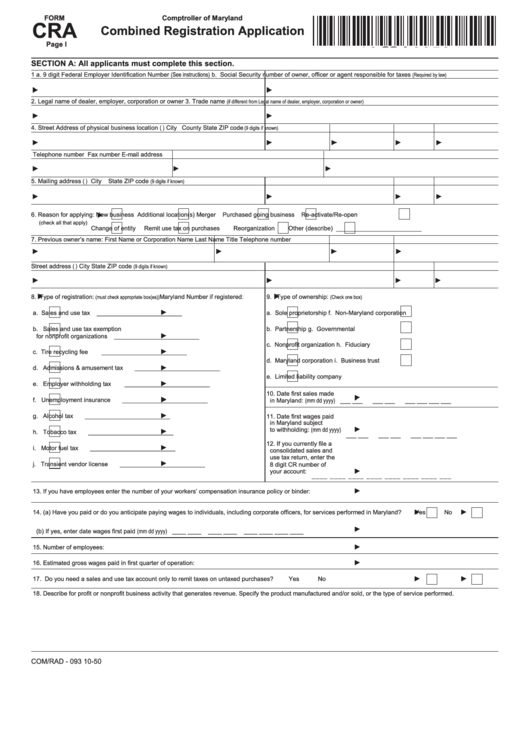

Register online with the business registration online service Call the CRA at 1 800 959 5525 Fax or mail a completed Form RC1 to the nearest tax centre or tax service office Once you get a business number you can register yourself for program accounts via the business registration online service This includes payroll deductions as well Instructions to complete the RC107 Remittance Voucher for Current Source Deductions can be found by on the CRA website at Businesses Payroll Remitting deductions Remittance forms PD7A Statement of Account for Current Source Deductions Bottom of Form PD7A You will notice the current payment is the total amount of source deductions you are

More picture related to Cra Payroll Remittance Form Printable

Uk Bank Remittance Form Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/27/119/27119214/large.png

T5013 A Simple Guide To Canadian Partnership Tax Forms

https://assets-global.website-files.com/645d153299ce00e5b32eb70b/64c2be145533b033e04cf827_CRA_Form_T5013SUM.png

FREE 34 Printable Payroll Forms In PDF Excel MS Word

https://images.sampleforms.com/wp-content/uploads/2017/03/Monthly-Payroll-Remittance-Form1.jpg?width=390

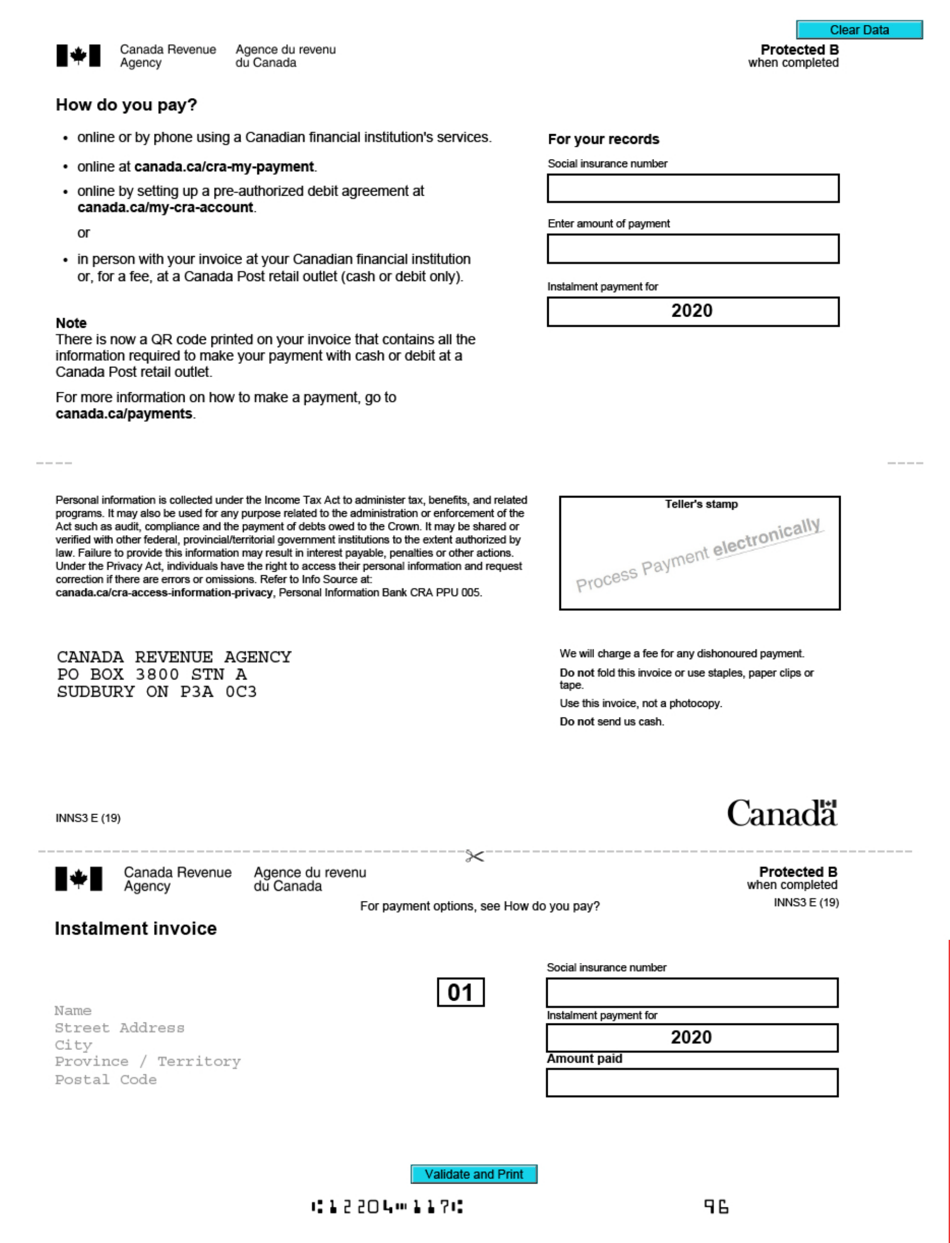

Updated 2022 04 26 The Canada Revenue Agency CRA has discontinued the T7DRA pre printed form In its place we have included the new printable T7DRA form in TaxCycle T1 so you can print it and give it to your clients to pay online at their financial institution or at a Canada Post retail outlet A few things to note Order a paper format Standard print versions of forms and publications Order an alternate format Digital audio etext braille and large print versions of forms and publications Order remittance vouchers and payment forms Vouchers and forms that provide information on applying and calculating payments Did you find what you were looking for

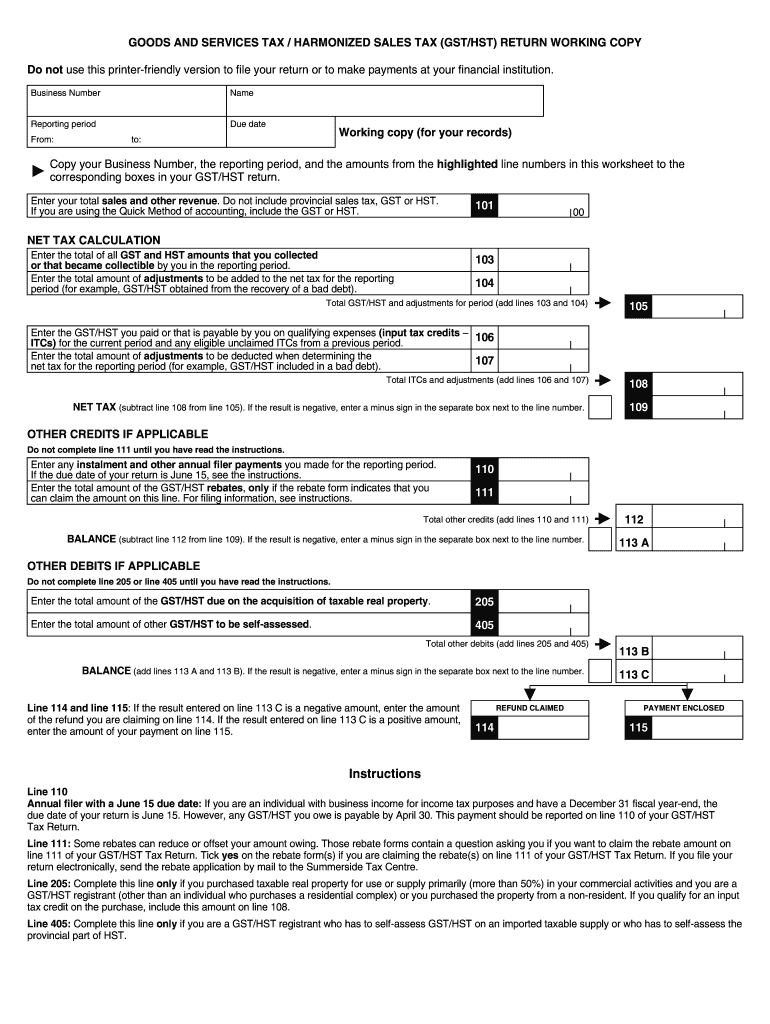

Types and due dates how to make a remittance and the forms to use When the due date falls on a Saturday a Sunday or a public holiday recognized by the Canada Revenue Agency we consider your payment to be on time if we receive it on the next business day For a list of public holidays go to cra gc ca duedates View remitting requirements 6 www cra gc ca Do you need to register for a payroll program account You need to register for a payroll program account if you pay salaries or wages pay tips or gratuities pay bonuses or vacation pay provide benefits or allowances to employees or need to report deduct and remit amounts from other types of remuneration such as pension or

T2202a Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/463/696/463696470/large.png

Payroll Remittance Form Ottawa Free Download

https://www.formsbirds.com/formhtml/a48b0ecbc6a9c3da67eb/payrol755c33cf0e2facef53c5/bg1.png

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/remitting-source-deductions.html

Canada ca Taxes Payroll Remit pay payroll deductions and contributions Information on when and how to remit report a nil remittance confirm your remittance was received and correct remitting errors or misallocated payments Sections Types of remitters

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4001/employers-guide-payroll-deductions-remittances.html

Chapter 1 General information Do you need to register for a payroll program account Contacts and authorized representatives Employment in Quebec Are you an employer Employment by a trustee Payer of other amounts What are your responsibilities Keeping records Social insurance number SIN beginning with the number 9 Payroll Deductions Tables

Form INNS3 2020 Fill Out Sign Online And Download Fillable PDF Canada Templateroller

T2202a Fill Out Sign Online DocHub

Google Sheets Pay Stub Template Free

Cra Business Income Tax Remittance Form Charles Leal s Template

Pta Remittance Form Fill Online Printable Fillable Blank PdfFiller

Cra Record Of Employment Fillable Form Printable Forms Free Online

Cra Record Of Employment Fillable Form Printable Forms Free Online

Invoice With Remittance Slip Template

Payroll Remittance Form Ottawa Edit Fill Sign Online Handypdf

Rc4288 Printable Form Printable Forms Free Online

Cra Payroll Remittance Form Printable - Register online with the business registration online service Call the CRA at 1 800 959 5525 Fax or mail a completed Form RC1 to the nearest tax centre or tax service office Once you get a business number you can register yourself for program accounts via the business registration online service This includes payroll deductions as well