Dave Ramsey Debt Snowball Printable Forms To get things rolling you can easily use Dave Ramsey s Debt Snowball Form to create and track your debt payoff progress These worksheets ensure that it s easy to clear off your debt promptly and visibly see the progress you re making To use the Debt Snowball form all you need is to download and print it

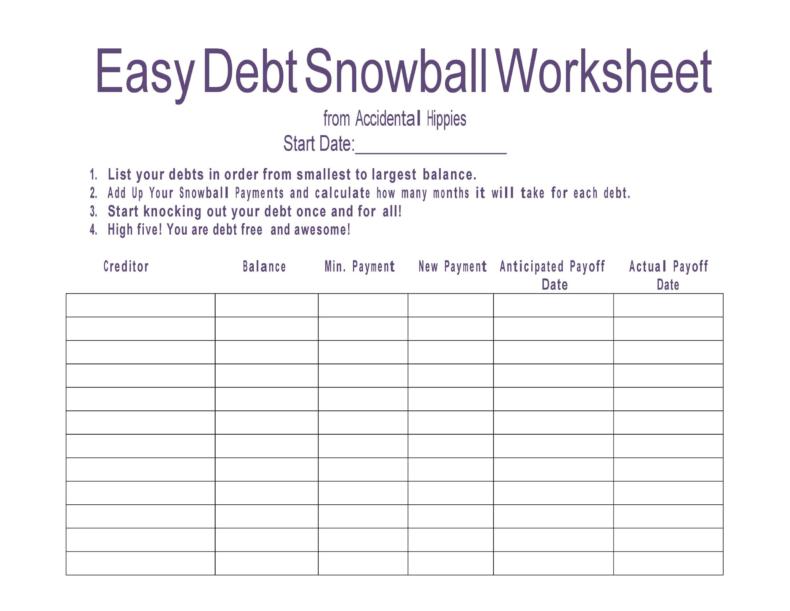

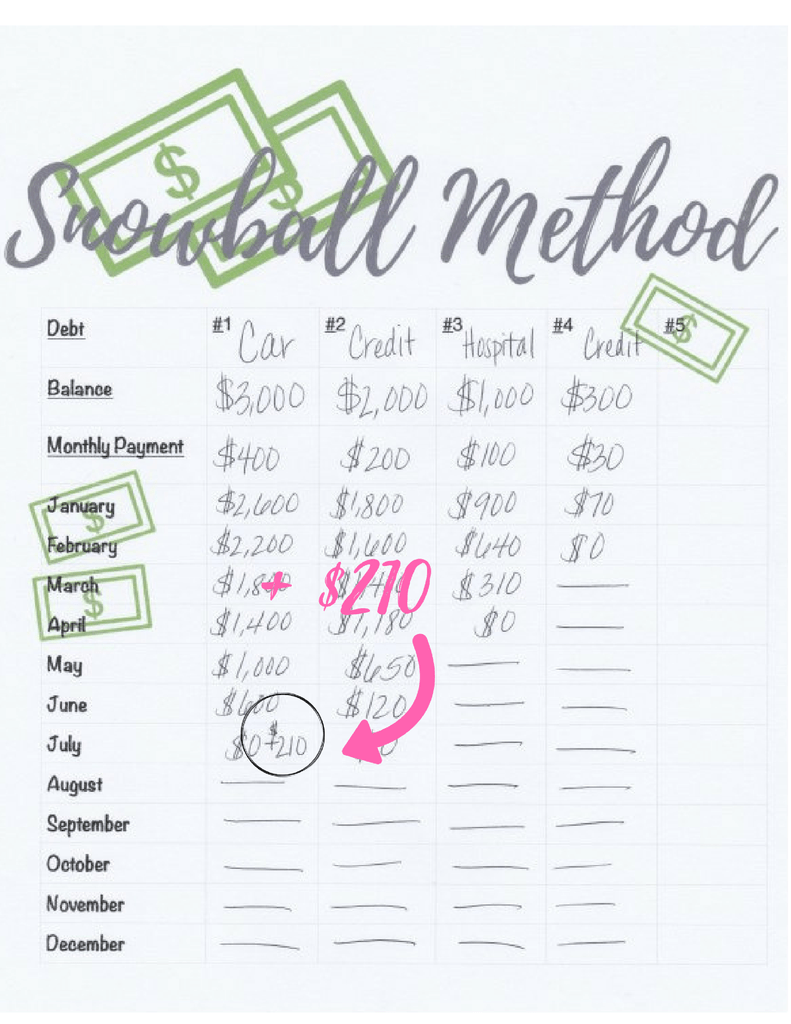

What Is the Debt Snowball The debt snowball is a debt payoff method where you pay your debts from smallest to largest regardless of interest rate Knock out the smallest debt first Then take what you were paying on that debt and add it to the payment of your next smallest debt Why a snowball Step 1 List your debts from smallest to largest regardless of interest rate Step 2 Make minimum payments on all your debts except the smallest debt Step 3 Throw as much extra money as you can on your smallest debt until it s gone

Dave Ramsey Debt Snowball Printable Forms

Dave Ramsey Debt Snowball Printable Forms

https://i.etsystatic.com/22538687/r/il/ad8096/2882225831/il_fullxfull.2882225831_cm17.jpg

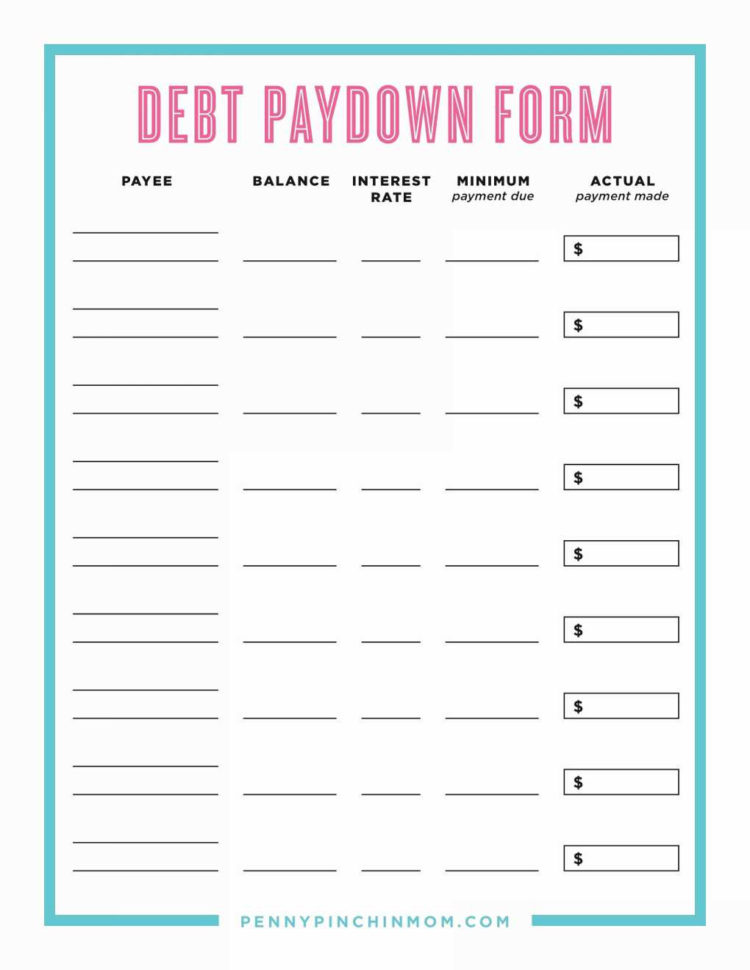

Debt Snowball Printable Dave Ramsey Debt Snowball Tracking Etsy In 2020 Dave Ramsey Debt

https://i.pinimg.com/736x/fa/56/9c/fa569c93ac0e15a4b87e76fb7eb8d9e1.jpg

Get Out Of Debt With The Debt Snowball Method A Dave Ramsey Method To Get Out Of Debt Debt

https://i.pinimg.com/originals/6f/83/55/6f8355b9a338bb6355c45dcf490219bf.jpg

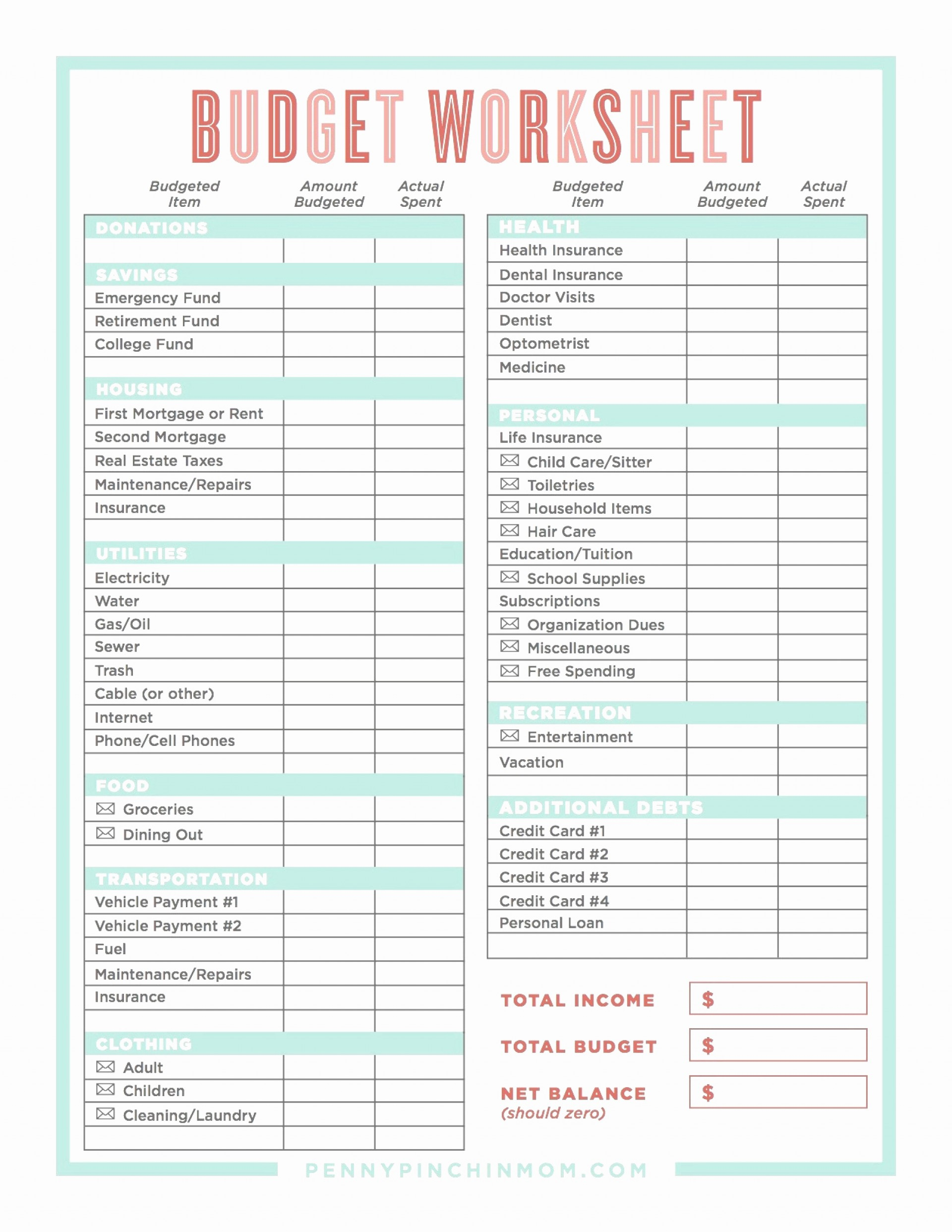

What Is the Debt Snowball Method The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest regardless of the interest rates Not only does the debt snowball help you get rid of debt fast it s also designed to help you change your behavior with money so you never go into debt again The free printable budget planner includes A monthly budget worksheet so you can give every dollar an assignment in your budget A debt snowball tracker to keep you motivated on your debt pay off journey A payment due date calendar and bill checklist to make sure you never pay another late fee A spending log to keep track of your payments

The debt snowball is Baby Step 2 of Dave Ramsey s 7 Baby Steps If you re on this step it means you already have 1 000 saved for your starter emergency fund so you are ready to tackle your debt While we ve set up guardrails to clarify how the debt snowball works we know that everyone s journey to financial peace is unique Dave Ramsey s 7 Baby Steps Ramsey Find Out Which Step You re On Step 1 Save 1 000 for your starter emergency fund Step 2 Pay off all debt except the house using the debt snowball Learn More Step 3 Save 3 6 months of expenses in a fully funded emergency fund Learn More Step 4 Invest 15 of your household income in retirement Learn More

More picture related to Dave Ramsey Debt Snowball Printable Forms

Dave Ramsey Budget Spreadsheet Example Of Snowball Best Debt Sheet Db excel

https://db-excel.com/wp-content/uploads/2019/09/dave-ramsey-budget-spreadsheet-example-of-snowball-best-debt-sheet-750x970.jpg

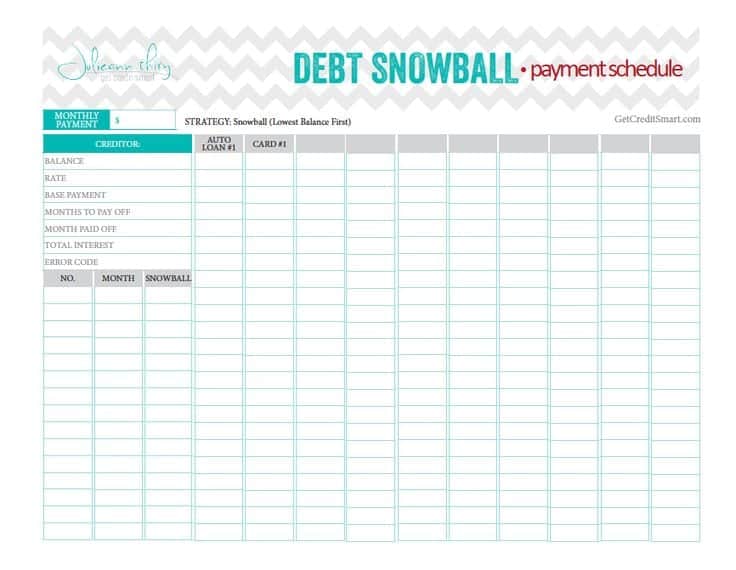

Ramsey Snowball Spreadsheet In Dave Ramsey Budget Form Pdf New Spreadsheet Debt Snowball Excel

https://db-excel.com/wp-content/uploads/2019/01/ramsey-snowball-spreadsheet-in-dave-ramsey-budget-form-pdf-new-spreadsheet-debt-snowball-excel.jpg

9 Debt Snowball Excel Templates Excel Templates

http://www.getexceltemplates.com/wp-content/uploads/2016/03/debt-snow-ball-648574.jpg

7 months ago Updated The debt snowball method is the best way to get out of debt Here s how it works List all your non mortgage debts from smallest to largest don t worry about interest rates and pay minimum payments on everything but the smallest The Debt Snowball made famous for being part of Dave Ramsey s Baby Steps helped me and my wife pay off over 52 000 in debt in 18 months This is the exact debt snowball form that we used to get out debt in that short period of time There are tons of ways to pay off debt but I would argue that this method is the most successful

Dave Ramsey s Debt Snowball Method is a way to quickly pay off your debt You begin by listing your debts from smallest to largest in terms of the balance You then make minimum payments on all your debts except for the smallest debt With that one you throw everything extra at it until it s paid off SNOWBALL 1 List all your debts below starting from the smallest to the largest balance 2 Pay the minimum amount into 3 Do the same 4 Keep using DEBT J F M A M J J A S O N D Monthly payment New balance Monthly payment New balance Monthly payment New balance

![]()

Free Debt Snowball Tracker Printable Simply Unscripted Db excel

https://db-excel.com/wp-content/uploads/2019/09/free-debt-snowball-tracker-printable-simply-unscripted.jpg

![]()

10 Free Debt Snowball Worksheet Printables To Help You Get Out Of Debt

https://www.moneymindedmom.com/wp-content/uploads/2019/12/Debt-Snowball-Tracker-1.jpg

https://savedbythecents.com/dave-ramsey-snowball-debt-templates-in-printable-excel-and-pdf/

To get things rolling you can easily use Dave Ramsey s Debt Snowball Form to create and track your debt payoff progress These worksheets ensure that it s easy to clear off your debt promptly and visibly see the progress you re making To use the Debt Snowball form all you need is to download and print it

https://www.ramseysolutions.com/debt/debt-calculator

What Is the Debt Snowball The debt snowball is a debt payoff method where you pay your debts from smallest to largest regardless of interest rate Knock out the smallest debt first Then take what you were paying on that debt and add it to the payment of your next smallest debt Why a snowball

Free Debt Snowball Printable Worksheet Track Your Debt Payoff Appetizers Debt Snowball

Free Debt Snowball Tracker Printable Simply Unscripted Db excel

Pay Off Debt Dave Ramsey Debt Snowball Concept Hassle Free Savings

This Is The Ultimate Guide To Dave Ramsey s Debt Snowball Method Use These Free Debt Snowball

38 Debt Snowball Spreadsheets Forms Calculators

Debt Snowball Printable Sheet Dave Ramsey Inspired Debt Snowball Sheet With Payments Balance

Debt Snowball Printable Sheet Dave Ramsey Inspired Debt Snowball Sheet With Payments Balance

Dave Ramsey Snowball Sheet Printable Room Surf

Free Debt Snowball Printable Worksheets Simplistically Living

Payoff Debt Snowball Method Dave Ramsey Debt Sheet Printable Snowball Method Worksheet

Dave Ramsey Debt Snowball Printable Forms - The debt snowball is Baby Step 2 of Dave Ramsey s 7 Baby Steps If you re on this step it means you already have 1 000 saved for your starter emergency fund so you are ready to tackle your debt While we ve set up guardrails to clarify how the debt snowball works we know that everyone s journey to financial peace is unique