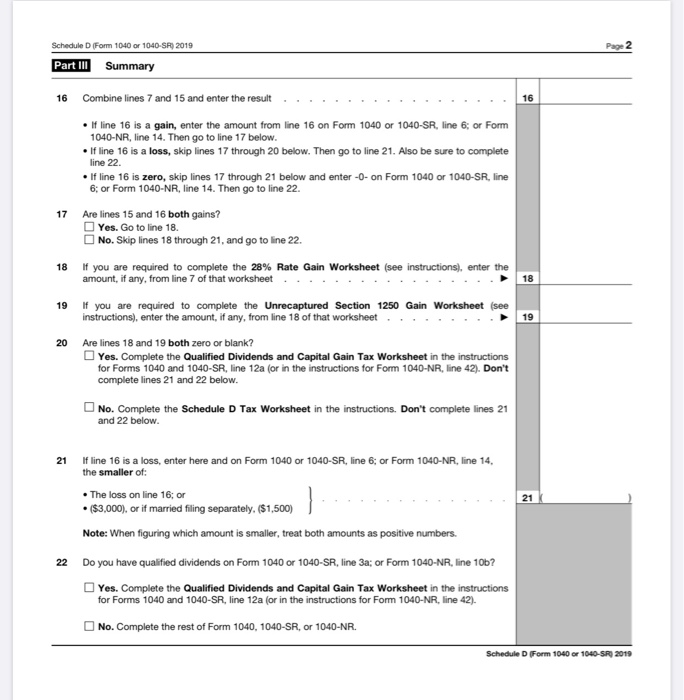

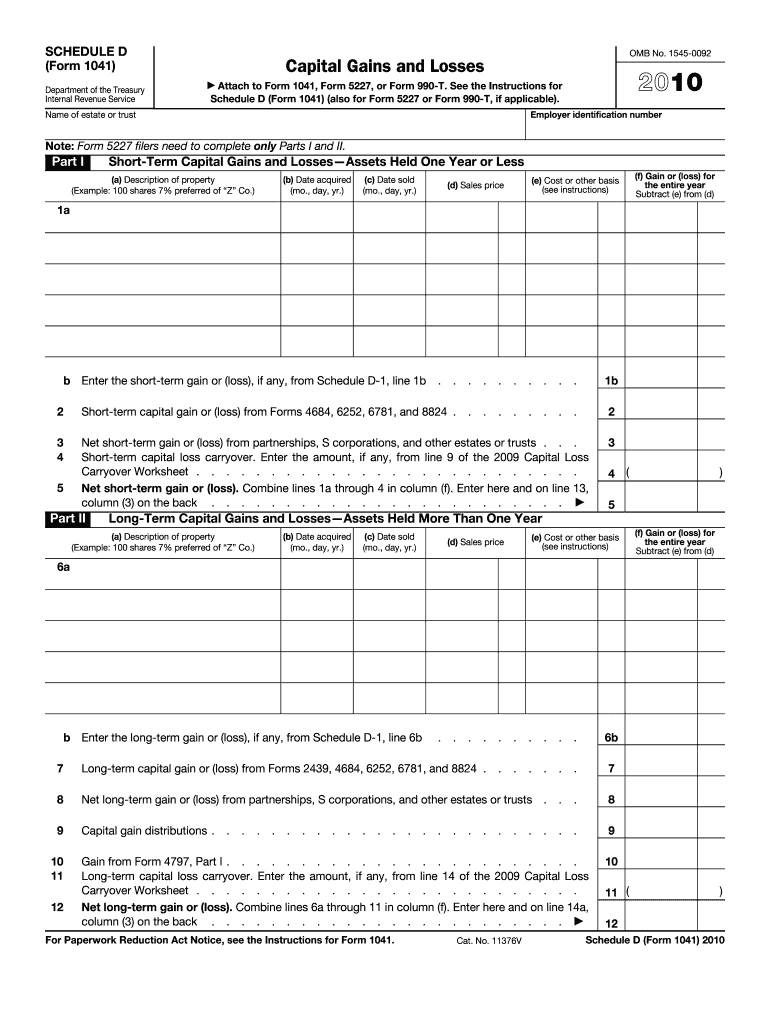

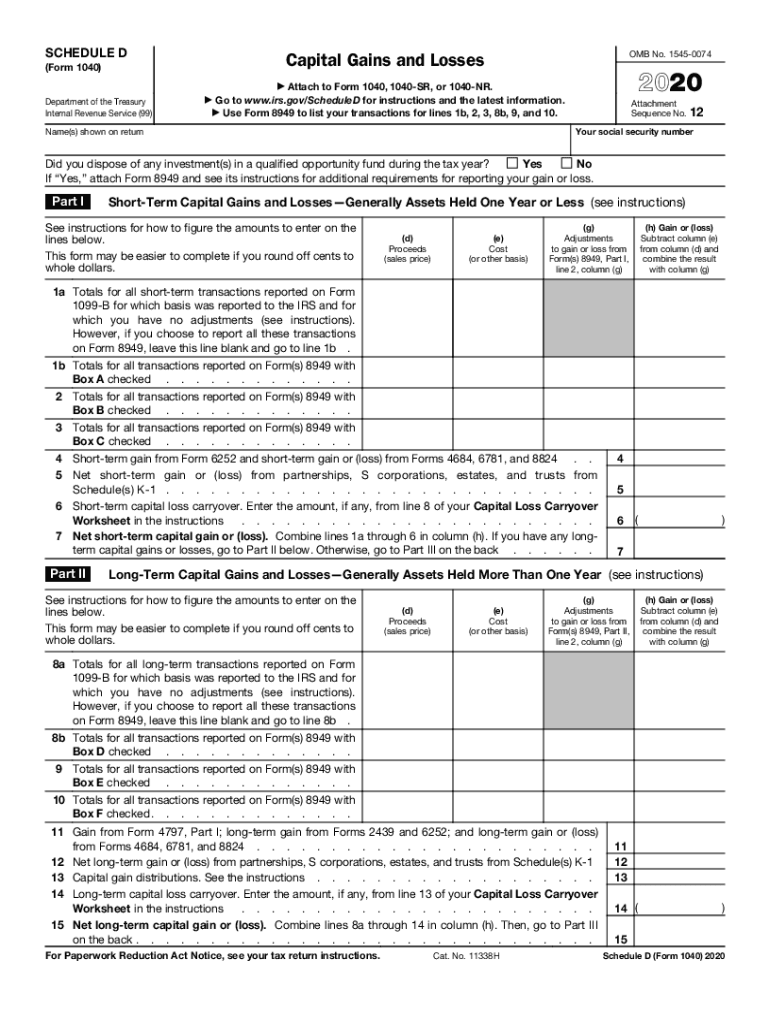

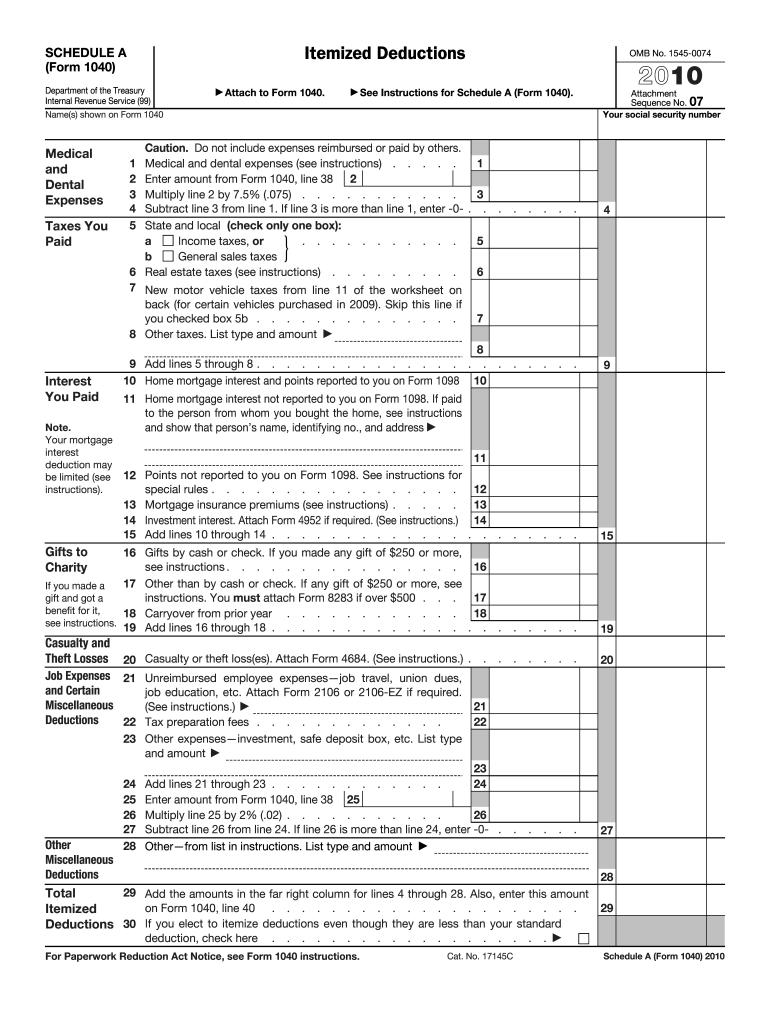

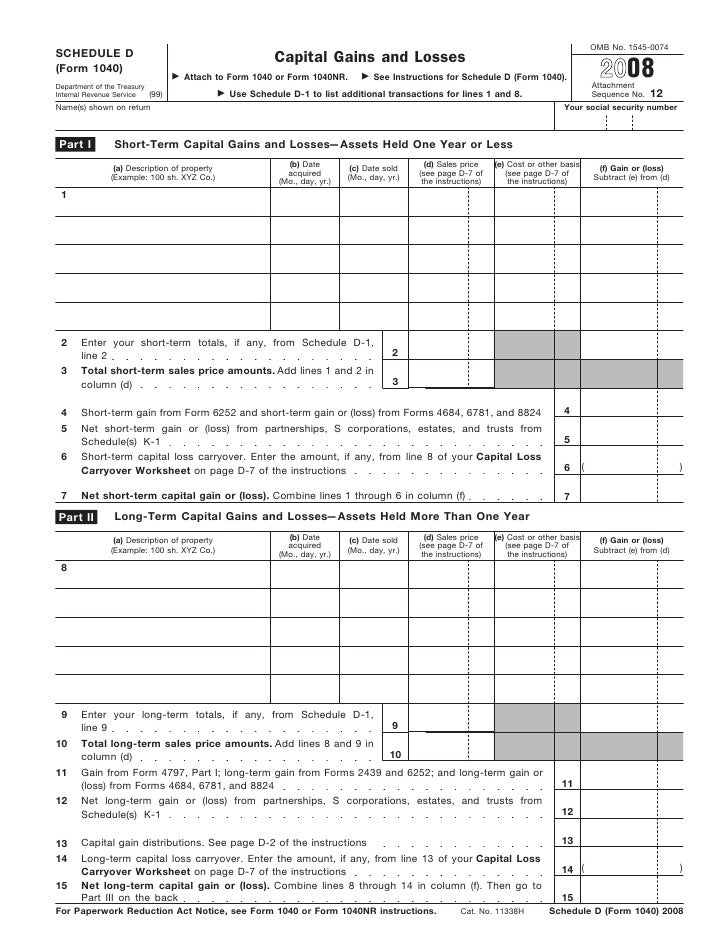

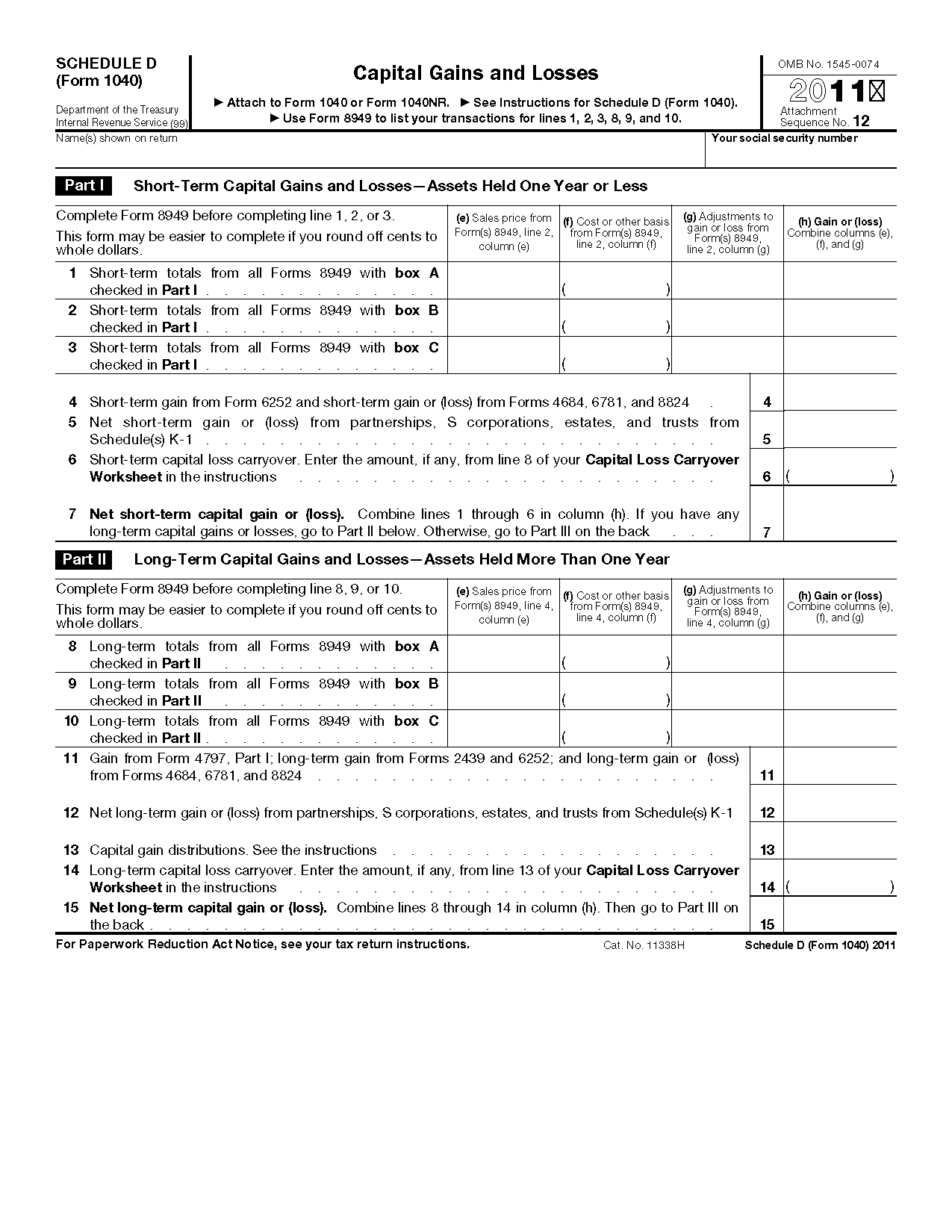

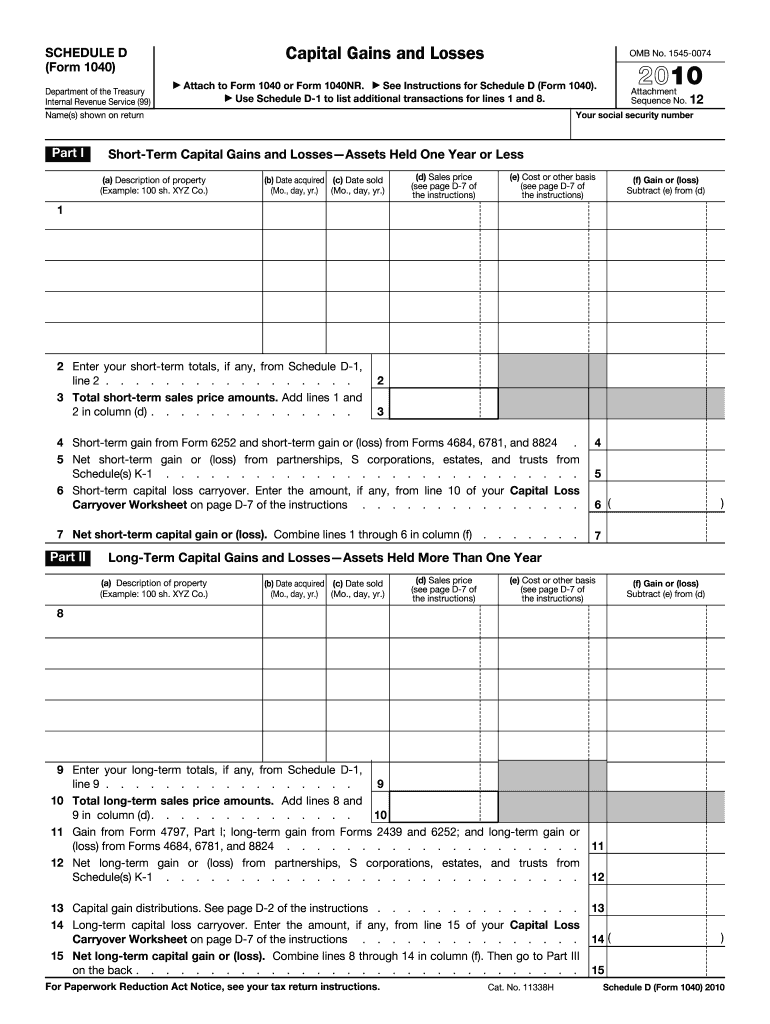

Form 1040 Schedule D Printable These instructions explain how to complete Schedule D Form 1040 Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D Use Schedule D To figure the overall gain or loss from transactions reported on Form 8949 To report certain transactions you don t have to report on Form 8949

File Now with TurboTax We last updated Federal 1040 Schedule D in December 2022 from the Federal Internal Revenue Service This form is for income earned in tax year 2022 with tax returns due in April 2023 We will update this page with a new version of the form for 2024 as soon as it is made available by the Federal government You can download or print current or past year PDFs of 1040 Schedule D directly from TaxFormFinder You can print other Federal tax forms here eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes

Form 1040 Schedule D Printable

Form 1040 Schedule D Printable

https://1044form.com/wp-content/uploads/2020/08/irs-schedule-d-1.gif

2022 Form IRS 1040 Schedule D Instructions Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/624/918/624918937/large.png

Solved Complete A 1040 Schedule D For This Assignment You Chegg

https://media.cheggcdn.com/study/455/455edda2-e6bd-4509-b550-f20e83fa78ac/image.png

Guide to Schedule D Capital Gains and Losses Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 October 19 2023 8 47 AM OVERVIEW The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year TABLE OF CONTENTS Schedule D 2020 Schedule D Form 1040 or 1040 SR Form 8949 2021 Name s shown on return Name and SSN or taxpayer identification no not required if shown on other side Attachment Sequence No 12A Page 2 Social security number or taxpayer identification number

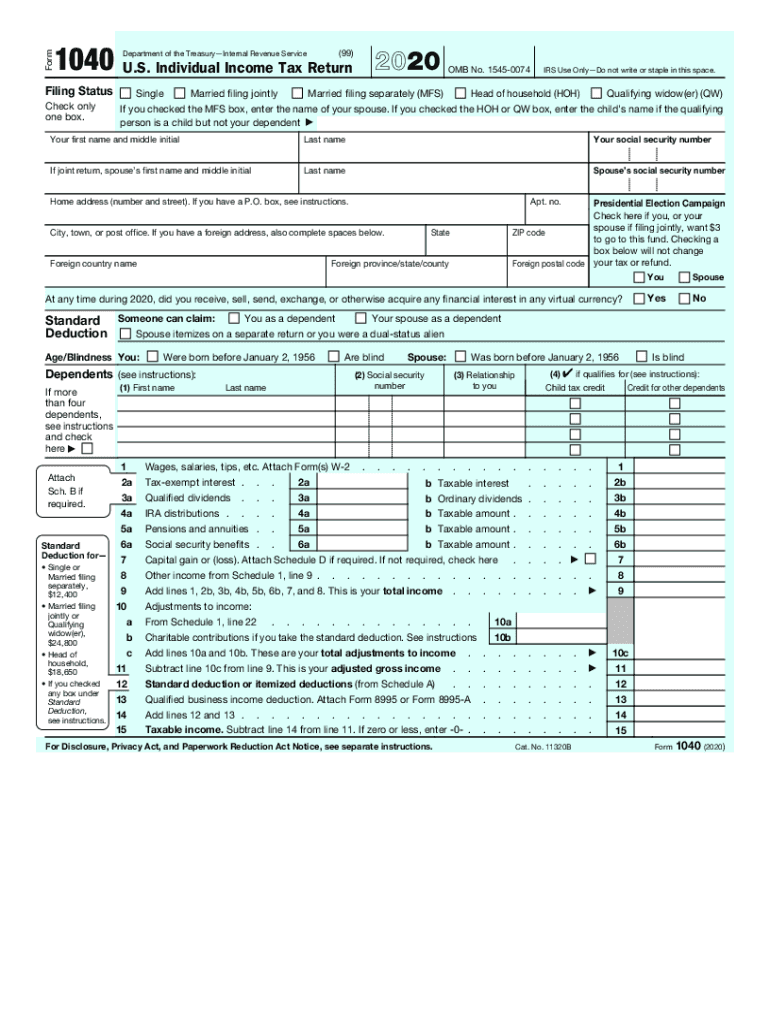

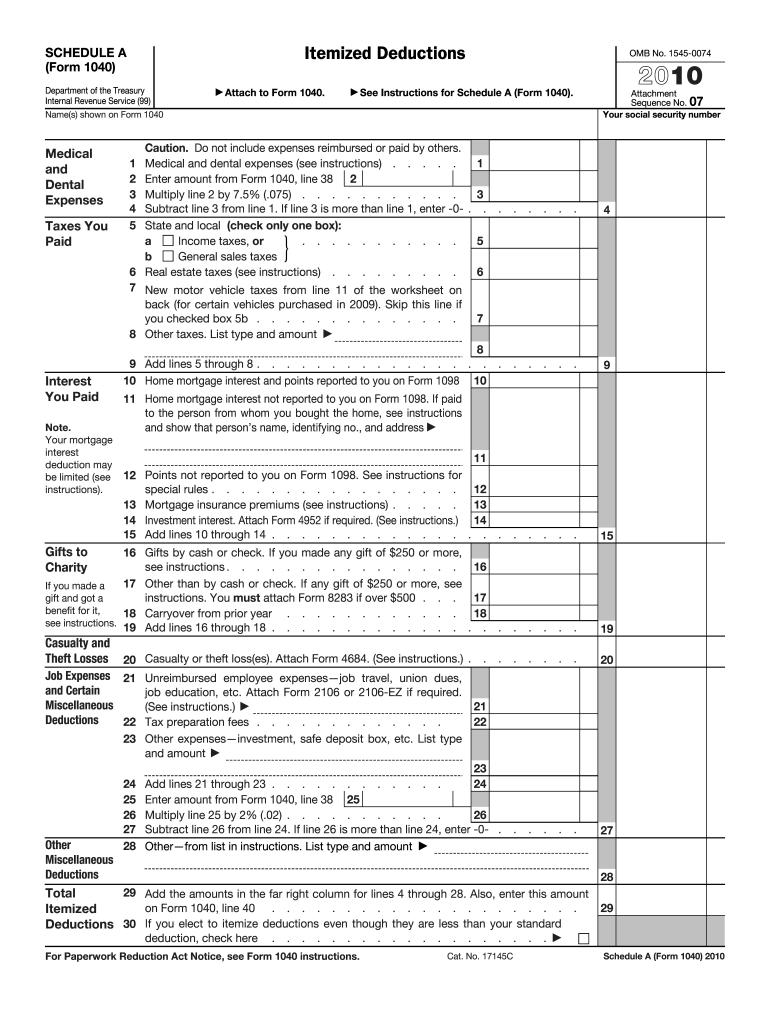

What Is Form 1040 Schedule D Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule D to report a capital gain or loss of income if required You can not file Schedule D with one of the shorter IRS forms such as Form 1040A or Form 1040EZ Schedule D Form 1040 is a tax schedule from the IRS that attaches to the Form 1040 U S Individual Income Tax Return Form 1040 SR or Form 1040NR It is used to help you calculate their capital gains or losses and the amount of taxes owed Computations from Schedule D are reported on the Form 1040 affecting your adjusted gross income

More picture related to Form 1040 Schedule D Printable

Printable IRS Form 1040 For Tax Year 2021 CPA Practice Advisor

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/01/Form_1040_2021.61dc944778e68.png

IRS 1041 Schedule D 2010 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/1/651/1651701/large.png

2020 Form IRS 1040 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/535/781/535781055/large.png

Schedule D is an IRS tax form that reports your realized gains and losses from capital assets that is investments and other business interests It includes relevant information such as the total Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if applicable is less than zero

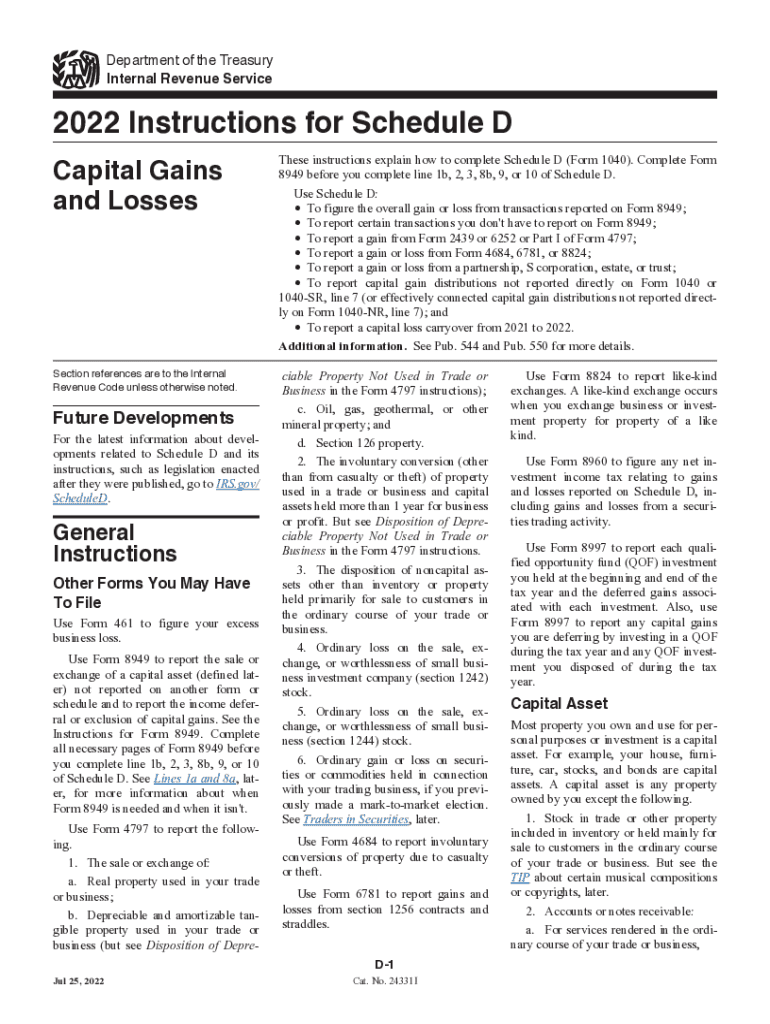

Although the newly consolidated 1040 form combines three current tax forms IRS Forms 1040 1040 A and 1040 EZ you ll still attach your Schedule D to the new 1040 When to Use Schedule D Part III Summary In Part III of Schedule D you ll do a little math check a couple boxes and wrap up the form Line 16 Here you ll add the values from Lines 7 and 15 which are your short term and long term totals If the sum is a gain or a positive number you ll enter the amount on Line 7 of Form 1040

Form 2010 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/24/100024174/large.png

2020 Form IRS 1040 Schedule D Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/538/824/538824044/large.png

https://www.irs.gov/instructions/i1040sd

These instructions explain how to complete Schedule D Form 1040 Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D Use Schedule D To figure the overall gain or loss from transactions reported on Form 8949 To report certain transactions you don t have to report on Form 8949

https://www.tax-brackets.org/federaltaxforms/1040-schedule-d

File Now with TurboTax We last updated Federal 1040 Schedule D in December 2022 from the Federal Internal Revenue Service This form is for income earned in tax year 2022 with tax returns due in April 2023 We will update this page with a new version of the form for 2024 as soon as it is made available by the Federal government

Schedule D Form 1040 Fillable Form PDF Sample FormSwift

Form 2010 Fill Out Sign Online DocHub

Form 1040 Schedule D Capital Gains And Losses

2023 Federal Tax Form 1040 Printable Forms Free Online

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

Printable Irs Form 1040 Printable Form 2023

Printable Irs Form 1040 Printable Form 2023

Irs Fillable Form 1040 Irs Fillable Form 1040 Irs Launches Tool For Nonfilers To Receive

Form 1040 Schedule D Capital Gains And Losses 2021 Tax Forms 1040 Printable

2010 Form IRS 1040 Schedule D Fill Online Printable Fillable Blank PdfFiller

Form 1040 Schedule D Printable - Internal Revenue Service IRS Form 8949 and Schedule D are the Capital Gains and Losses section of the Form 1040 Schedule D is used to calculate and report the sale or exchange of a capital asset To start you will need to fill out Form 8949 Print Thanks to all authors for creating a page that has been read 59 141 times Reader