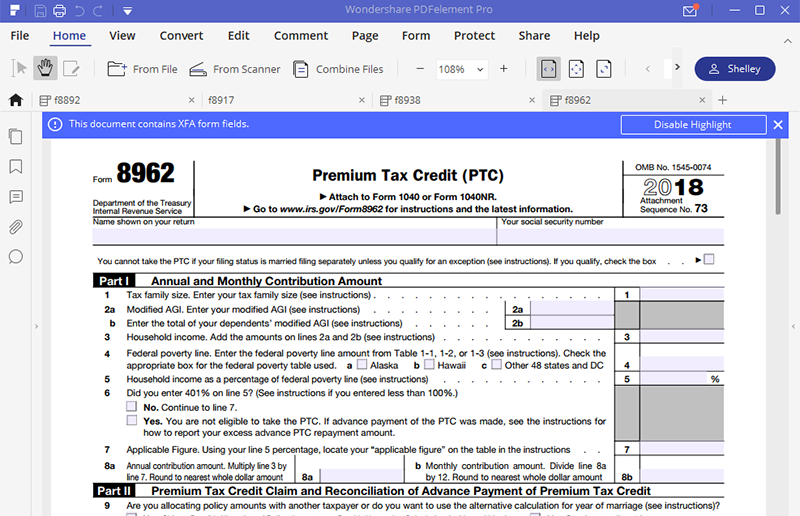

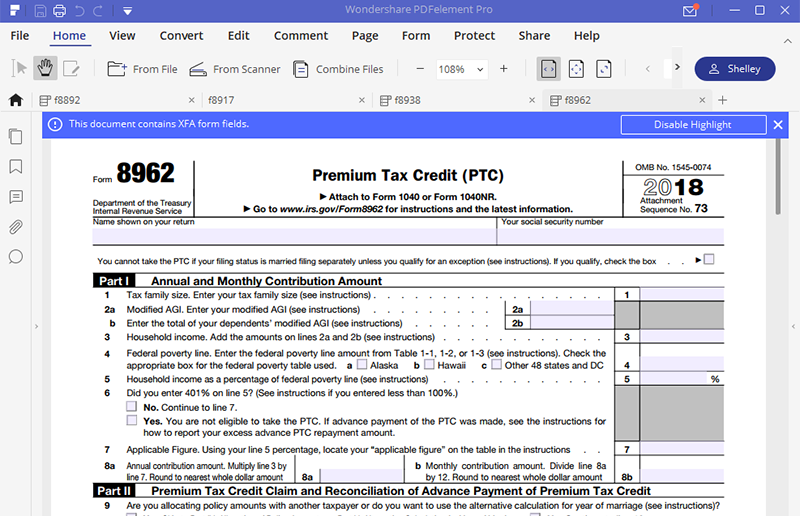

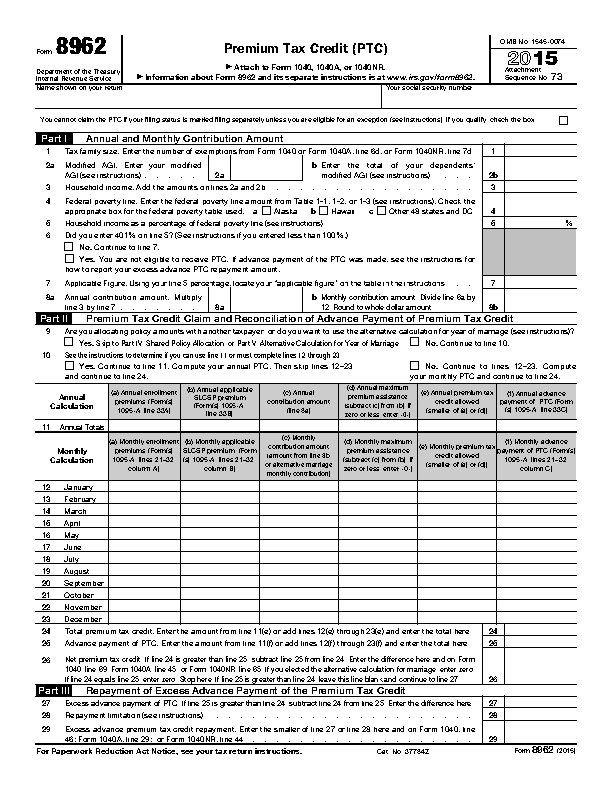

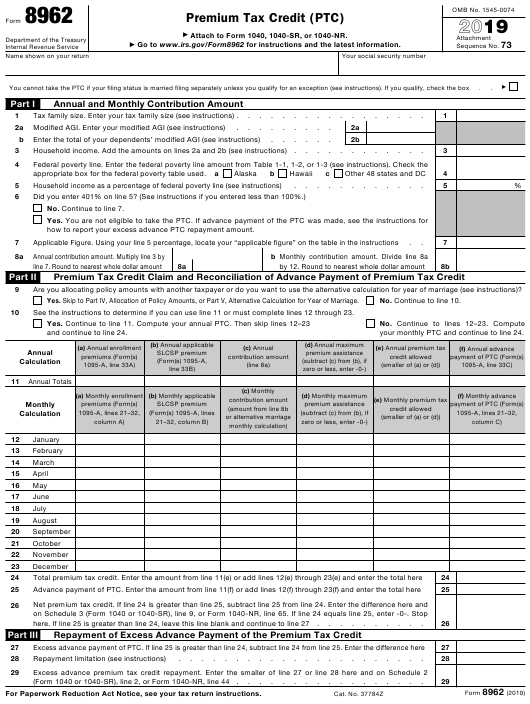

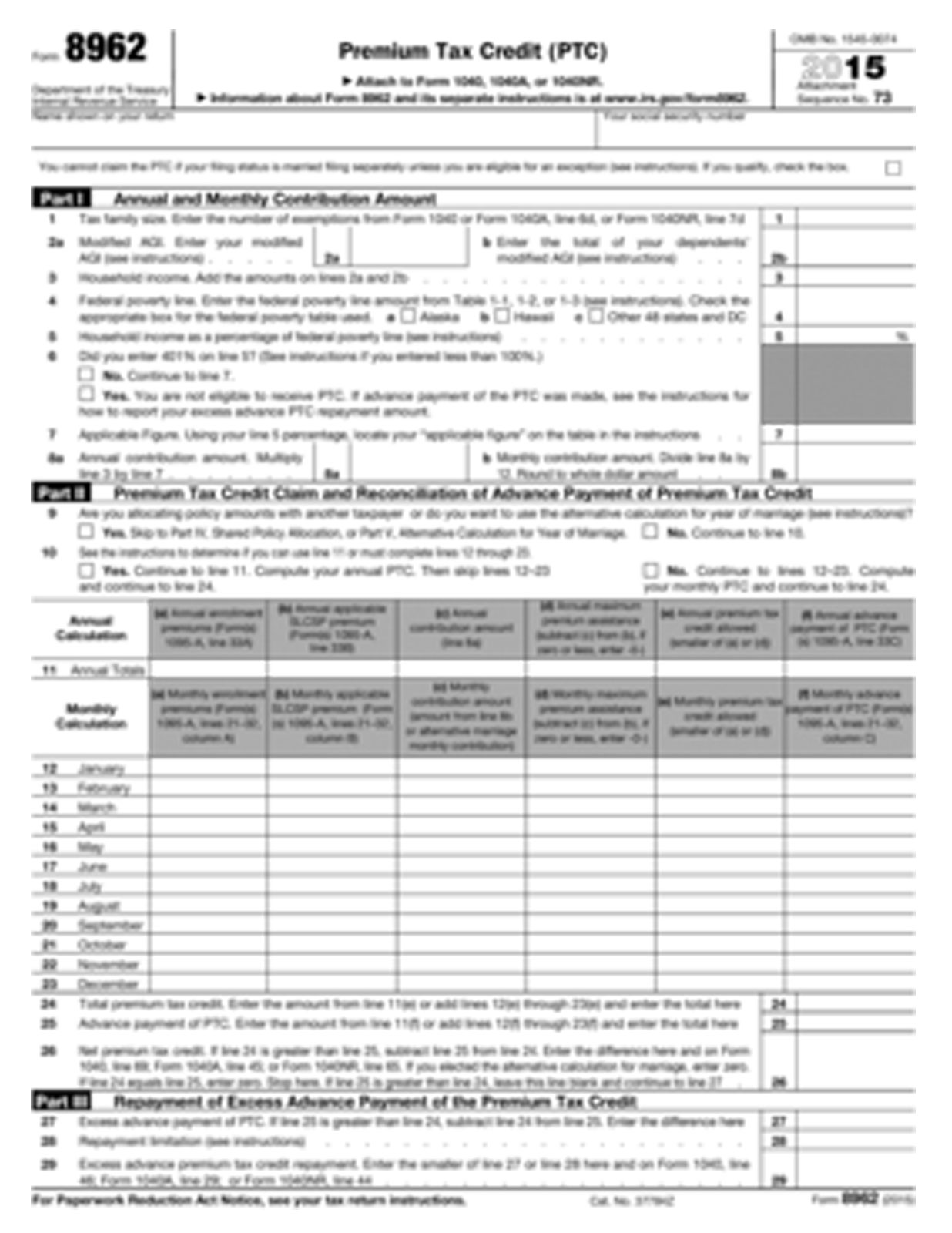

Free Printable Tax Form 8962 Form 8962 is used to calculate the amount of premium tax credit you re eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace Claiming

Print This Form More about the Federal Form 8962 Other TY 2023 We last updated the Premium Tax Credit in January 2024 so this is the latest version of Form 8962 fully updated for tax year 2023 You can download or print current or past year PDFs of Form 8962 directly from TaxFormFinder You can print other Federal tax forms here Go to the health coverage tax tool Get help filing your 2023 federal tax return Get free volunteer help filing your return through IRS programs Check if you re eligible for free tax filing software through the IRS See how to complete 2022 tax return Overview of tax form 1095 A health coverage tool penalties for not having coverage more

Free Printable Tax Form 8962

Free Printable Tax Form 8962

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-8962.png

How To Fill Out Form 8962 Monthly Premium Taxes Instructions PDFliner

https://blog.pdfliner.com/howTo/img/tild6663-3132-4061-b130-613137396433__w9-form.png

Tax Form 8962 Printable

https://lh6.googleusercontent.com/proxy/4yXZvveKCaUaJ96ObCep_Nm2AhTLZBDXpmWXbHEJYamMdqbQsIXzV5SjjnUhKET1I-QAH5zUO2lITqKkiDnelyatLlF5d_g_hgoFsQiVQzXYrg=s0-d

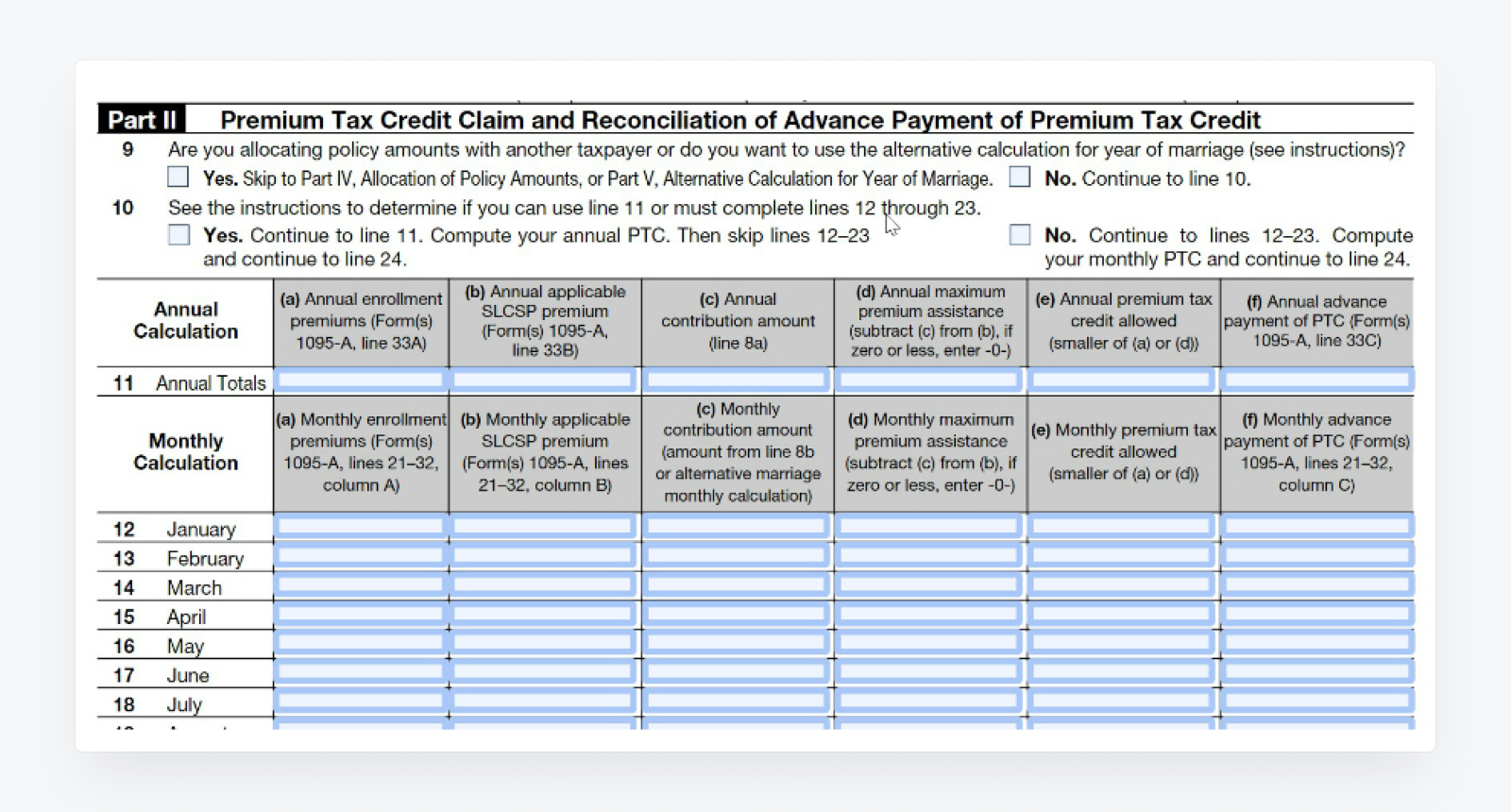

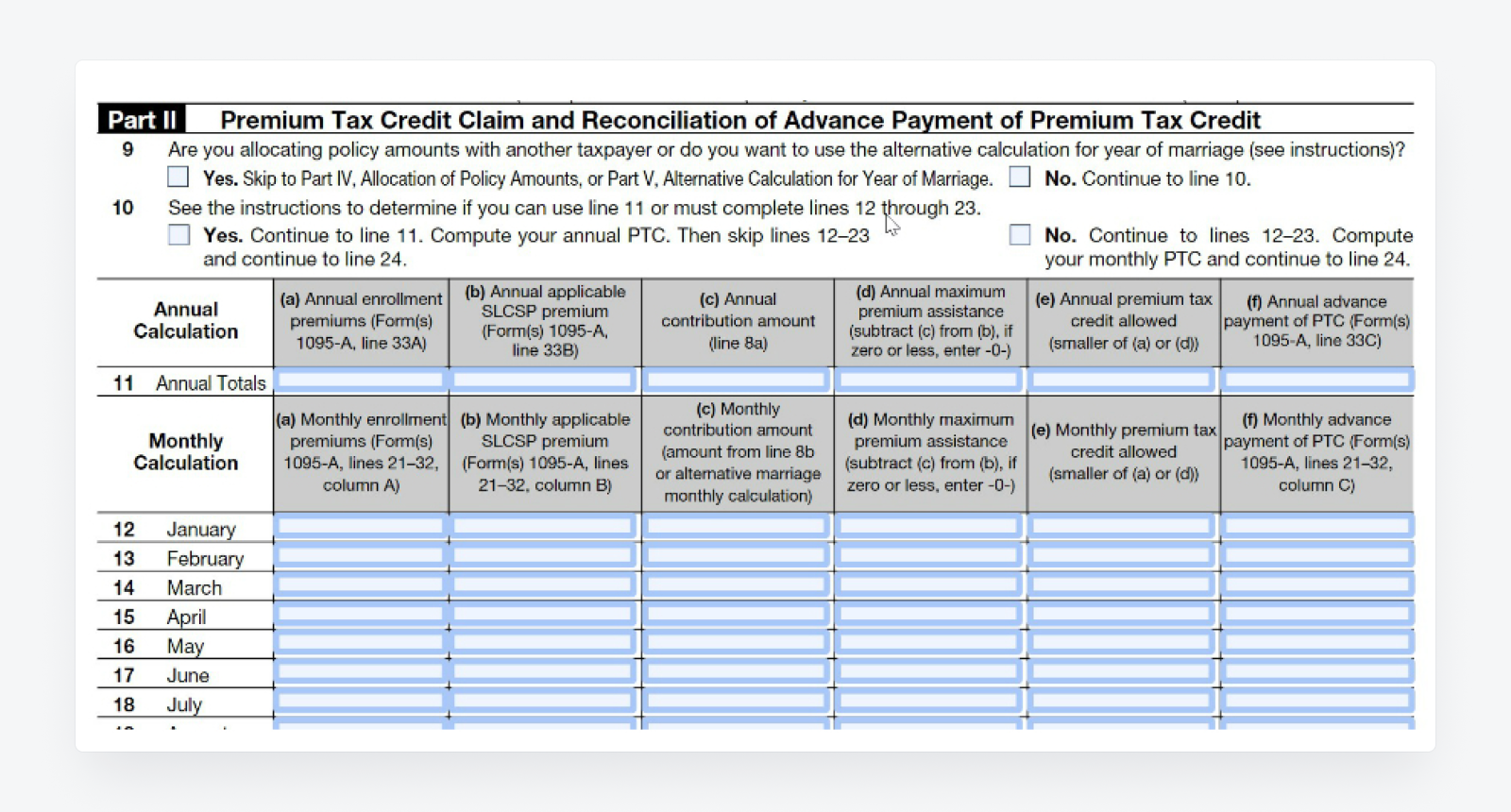

The purpose of Form 8962 is to allow filers to calculate their Premium Tax Credit amount with their federal return With that amount they re then able to reconcile that amount with any advance payments of the Advance Premium Tax Credit APTC that have been made for the filer throughout the year Complete all sections of Form 8962 On Line 26 you ll find out if you used more or less premium tax credit than you qualify for based on your final 2023 income This will affect the amount of your refund or tax due Include your completed Form 8962 with your 2023 federal tax return What happens if you don t reconcile your taxes

Claiming the premium tax credit Form 8962 is also used to reconcile the premium tax credit you might be eligible for with any advanced premium tax credit payments you ve already received The first part of the form determines your annual and monthly contribution amount based on your family income and tax family size Form 8962 also known as the Premium Tax Credit PTC form is used to reconcile and calculate the premium tax credit for those who have health insurance through the Health Insurance Marketplace Form 8962 must be completed if you received advance payments of the premium tax credit APTC or if you want to claim the credit on your tax return

More picture related to Free Printable Tax Form 8962

3 Easy Ways To Fill Out Form 8962 WikiHow

https://www.wikihow.com/images/thumb/8/89/Fill-Out-Form-8962-Step-5.jpg/aid11185289-v4-728px-Fill-Out-Form-8962-Step-5.jpg

IRS Form 8962 2016 Irs Forms Irs Household Income

https://i.pinimg.com/originals/8e/07/3b/8e073b2720723cbc763f552f532137f2.jpg

Health Insurance Tax Form 8962 Free Nude Porn Photos

https://i.pinimg.com/originals/96/bc/b1/96bcb162242f768bbc7590a90b1177df.jpg

For tax years 2023 through 2025 taxpayers with household income that exceeds 400 of the federal poverty line for their family size may be allowed a Premium Tax Credit Repayment The American Rescue Plan Act of 2021 enacted on March 11 2021 suspended the requirement to repay excess advance payments of the premium tax credit excess APTC Multiply the difference by 100 then drop any numbers after the decimal point For example if the difference was 1 8545565 you would enter 185 on line 5 of Form 8962 Tip There are 3 different federal poverty lines used 1 for the 48 contiguous states and the District of Columbia 1 for Hawaii and 1 for Alaska

TurboTax will automatically fill out Form 8962 once you enter your Form 1095 A You have to include Form 8962 with your tax return if You qualified for the Premium Tax Credit in 2023 You or someone on your tax return received advance payments of the Premium Tax Credit A member of your family received advance payments of the Premium Tax Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC

Form 8962 Edit Fill Sign Online Handypdf

https://handypdf.com/resources/formfile/images/10000/form-8962-page1.png

Free Free Irs 8962 Printable Forms Printable Forms Free Online

https://www.universalnetworkcable.com/wp-content/uploads/2018/12/printable-tax-forms-8962.jpg

https://www.investopedia.com/irs-form-8962-understanding-your-form-8962-4845835

Form 8962 is used to calculate the amount of premium tax credit you re eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace Claiming

https://www.taxformfinder.org/federal/form-8962

Print This Form More about the Federal Form 8962 Other TY 2023 We last updated the Premium Tax Credit in January 2024 so this is the latest version of Form 8962 fully updated for tax year 2023 You can download or print current or past year PDFs of Form 8962 directly from TaxFormFinder You can print other Federal tax forms here

Tax Form 8962 Printable

Form 8962 Edit Fill Sign Online Handypdf

Irs Form 8962 Printable 2021 Printable Form 2023

Tax Form 8962 Printable

8962 2015 Edit Forms Online PDFFormPro

Free Printable Tax Form 8962 Printable Forms Free Online

Free Printable Tax Form 8962 Printable Forms Free Online

Example Of Form 8962 Filled Out Fill Online Printable Fillable Blank

8962 Instructions 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

Tax Form 8962 Printable

Free Printable Tax Form 8962 - Complete all sections of Form 8962 On Line 26 you ll find out if you used more or less premium tax credit than you qualify for based on your final 2023 income This will affect the amount of your refund or tax due Include your completed Form 8962 with your 2023 federal tax return What happens if you don t reconcile your taxes