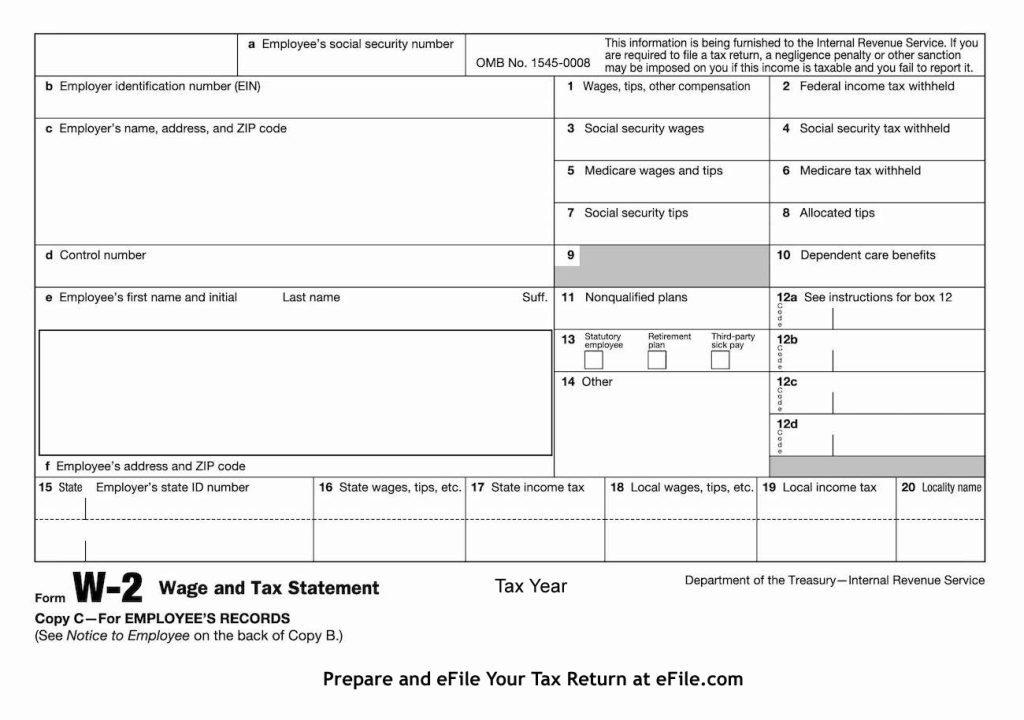

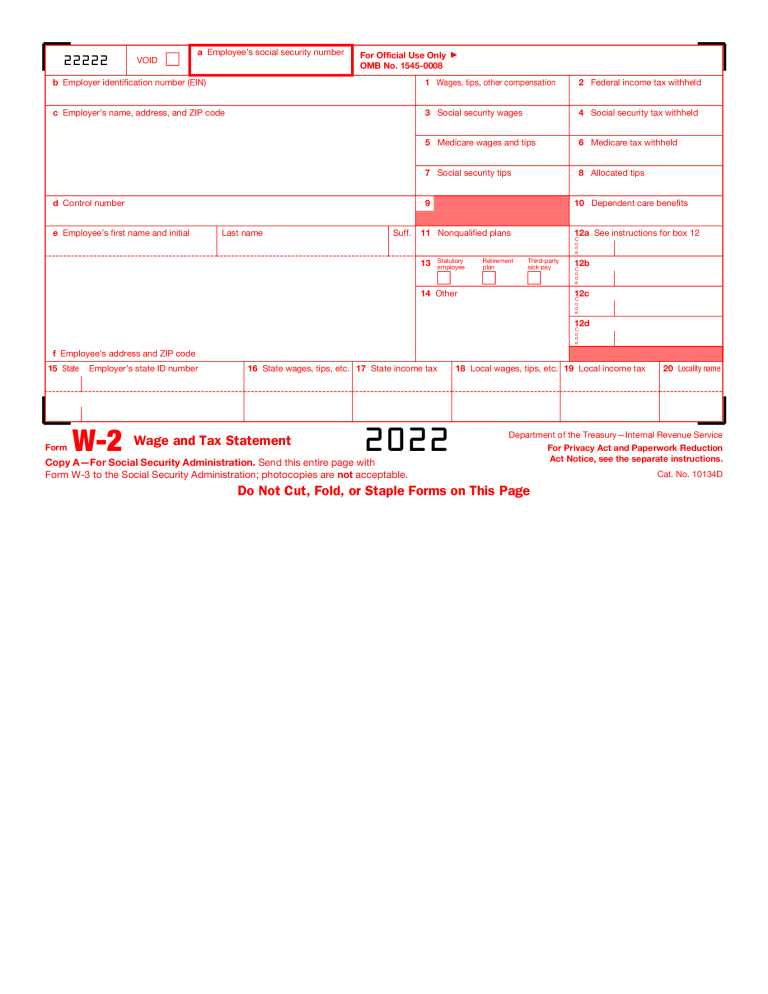

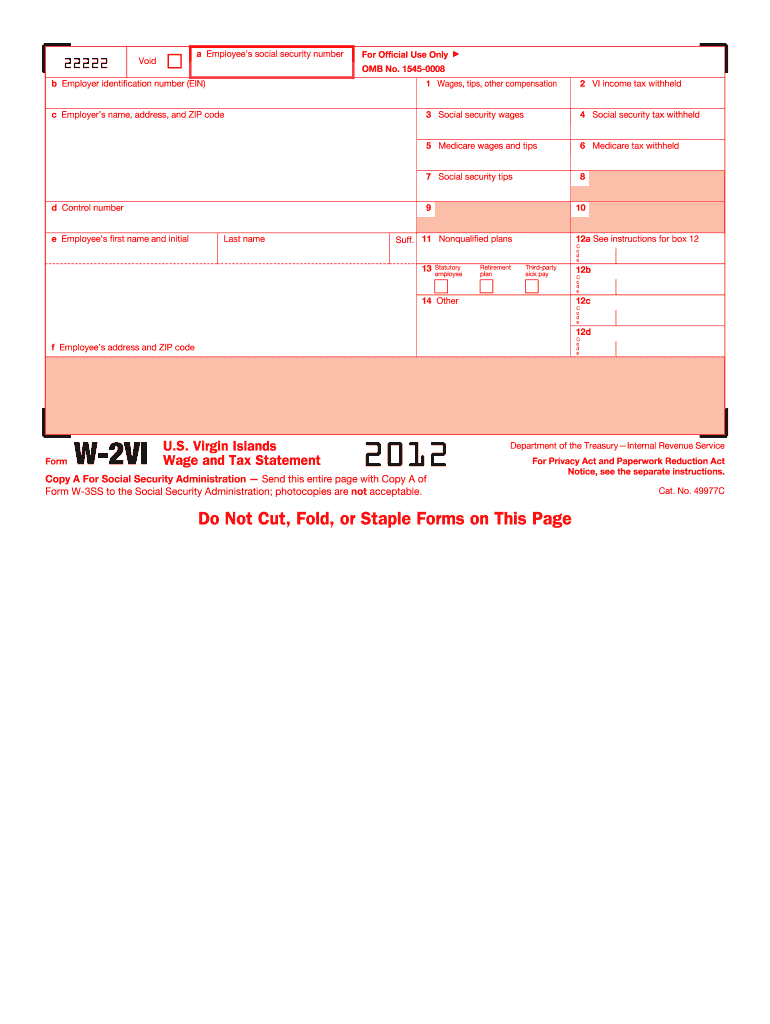

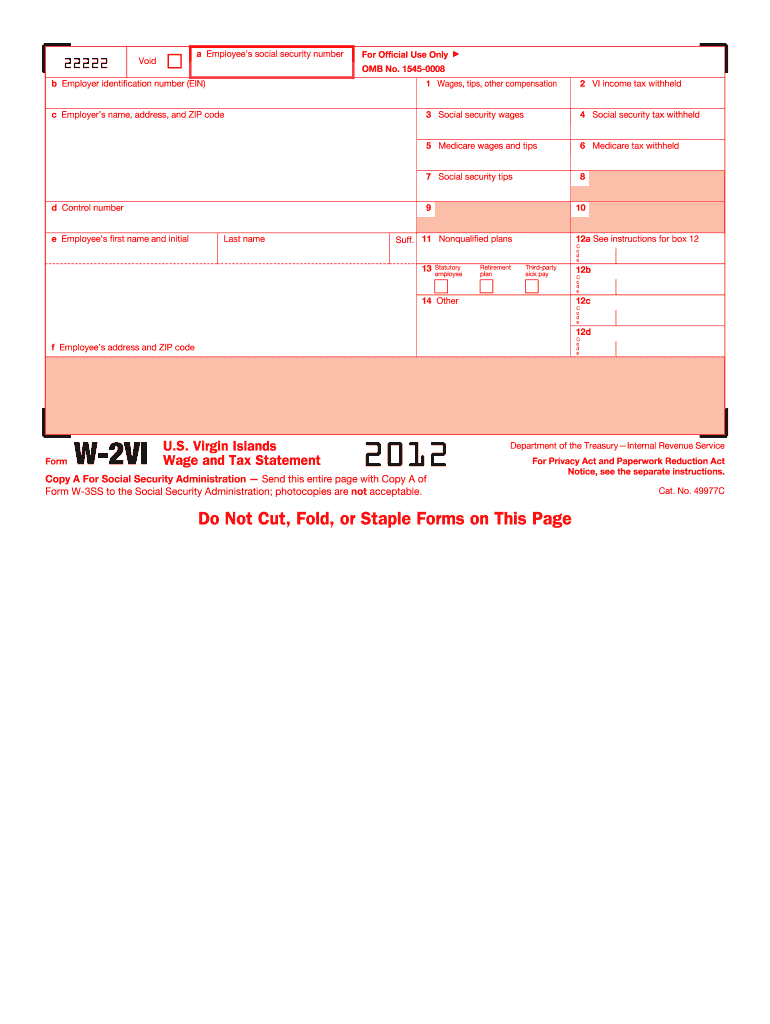

Free Printable W2 Form For Employees You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA

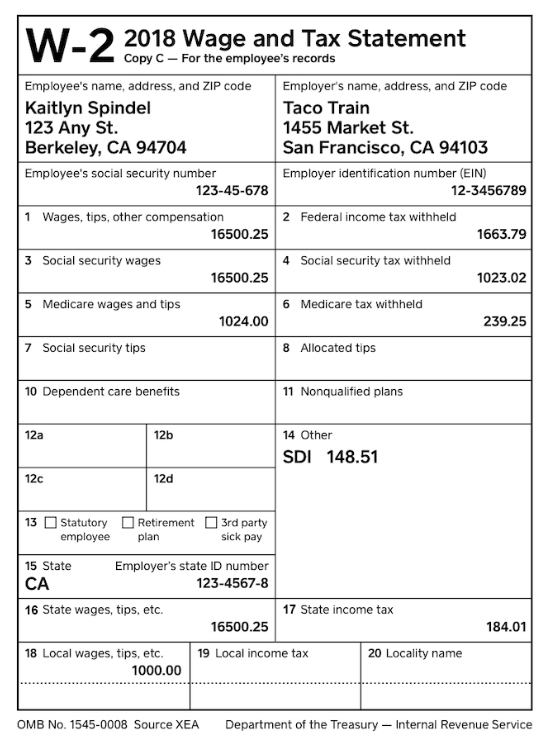

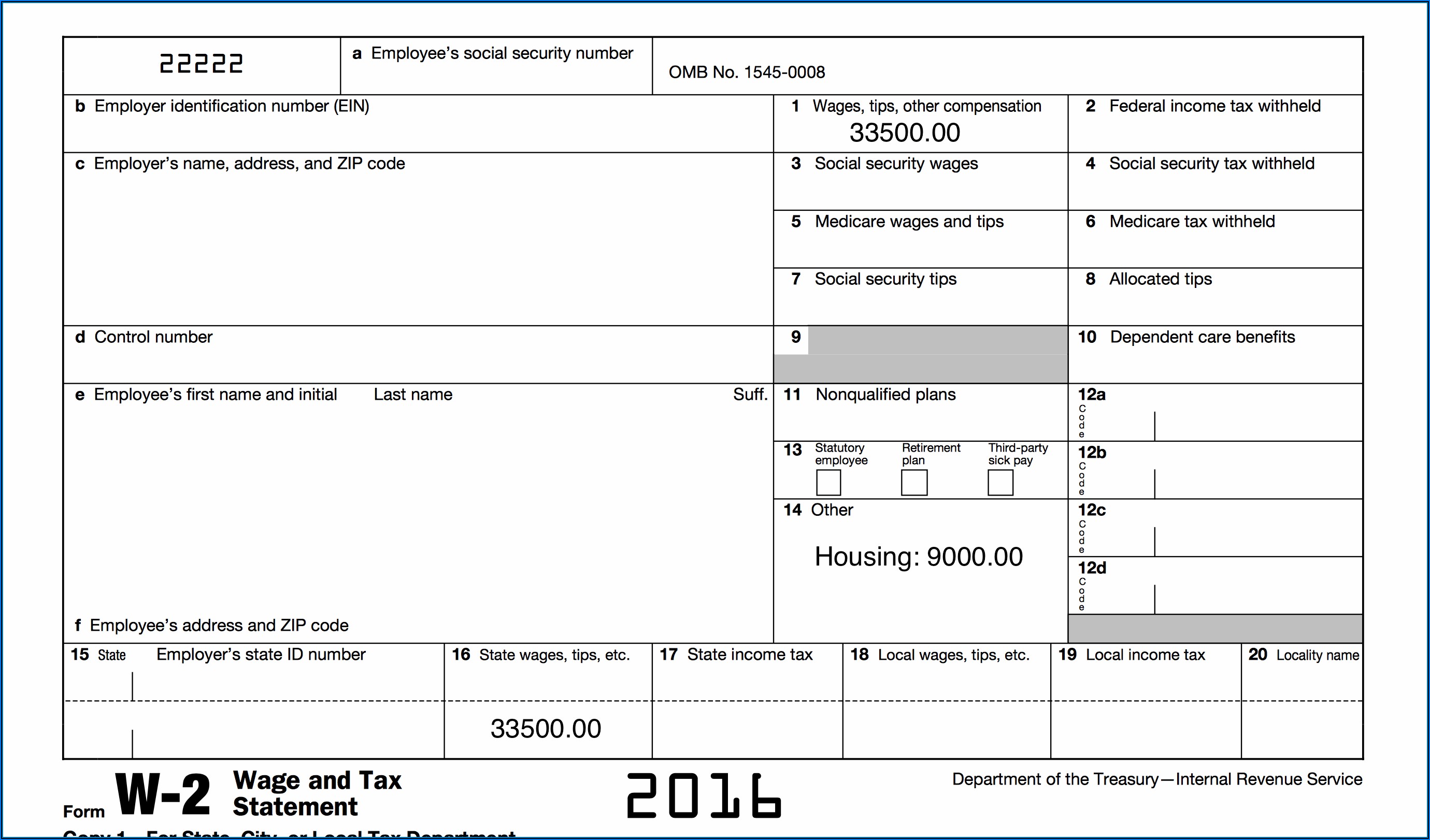

Income tax would have been withheld if the employee had claimed no more than one withholding allowance or had not claimed exemption from withholding on Form W 4 Employee s Withholding Allowance Certificate Current Revision Form W 2 PDF Instructions for Forms W 2 and W 3 Print Version PDF 1 Answer a few simple questions 2 Create an account 3 Print and download Sample W 2 Form Create Your Form 2020 2021 2022 2023 What is a W 2 Form A W 2 Form also known as a Wage and Tax Statement is a form that an employer completes and provides to the employee to complete their tax return

Free Printable W2 Form For Employees

Free Printable W2 Form For Employees

https://gusto.com/wp-content/uploads/2019/12/Form-W-2-Box-14.jpg

Understanding 2018 W 2 Forms

https://jumbotron-production-f.squarecdn.com/assets/1041514e5e807e8ee1ec7.png

W2 Form Template Create And Fill Online

https://www.pandadoc.com/app/uploads/form-w-2.png

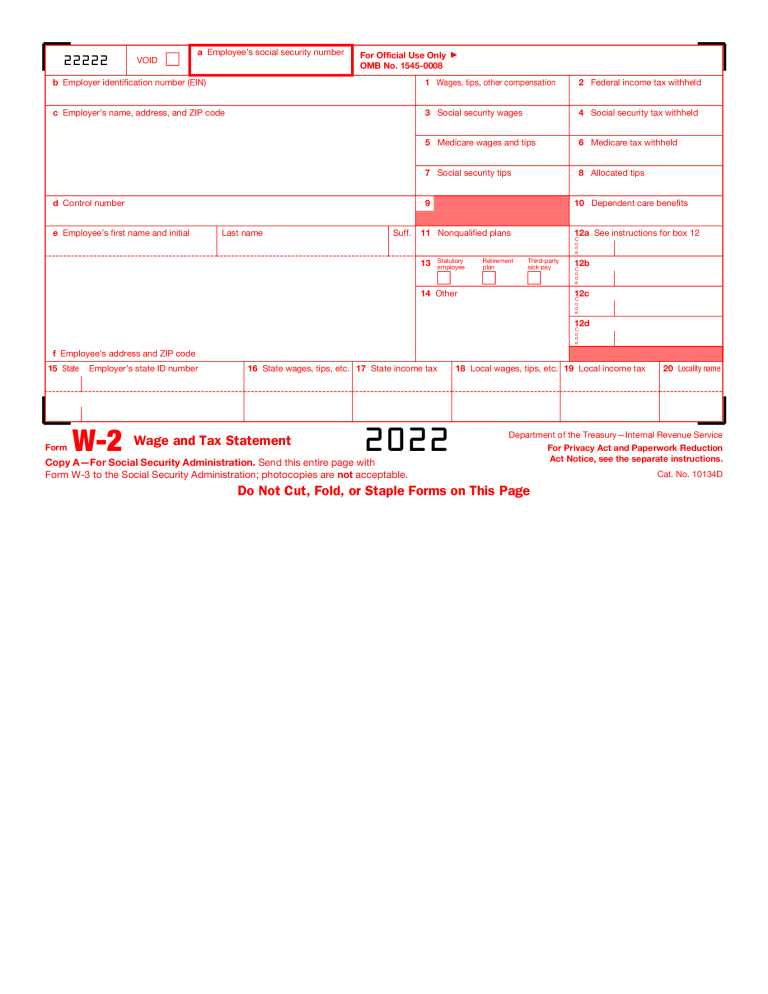

2021 Form W 2 Attention You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA Download the 2022 version of Form W 2 If you ve paid an employee more than 600 00 in a calendar year you are required by law to send them a W 2 to help them get their taxes done and to help the government ensure they re reporting everything correctly

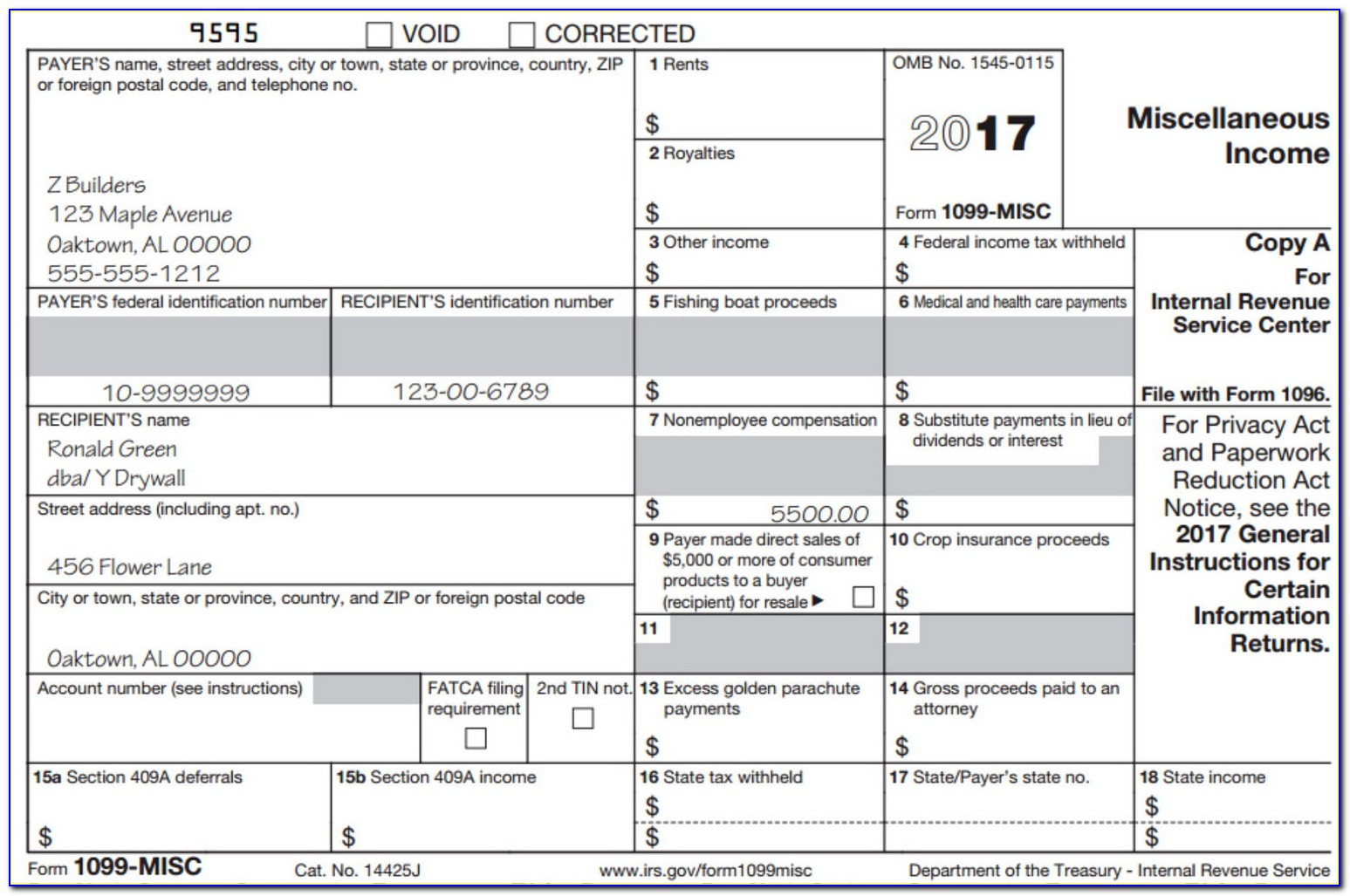

IRS Form W 2 Use our free 2023 W 2 form to provide your employees with a record of their earnings and withholdings over the course of a tax year Create Document Updated January 3 2024 Written by Josh Sainsbury Reviewed by Brooke Davis There s a reason why a W 2 is referred to as a wage and tax statement Put simply it s a form that shows how much money an employee has earned for the year and the amount of taxes that employers have already handed over to the IRS Not everyone needs a W 2 form Independent contractors and folks who are self employed need a 1099 form instead

More picture related to Free Printable W2 Form For Employees

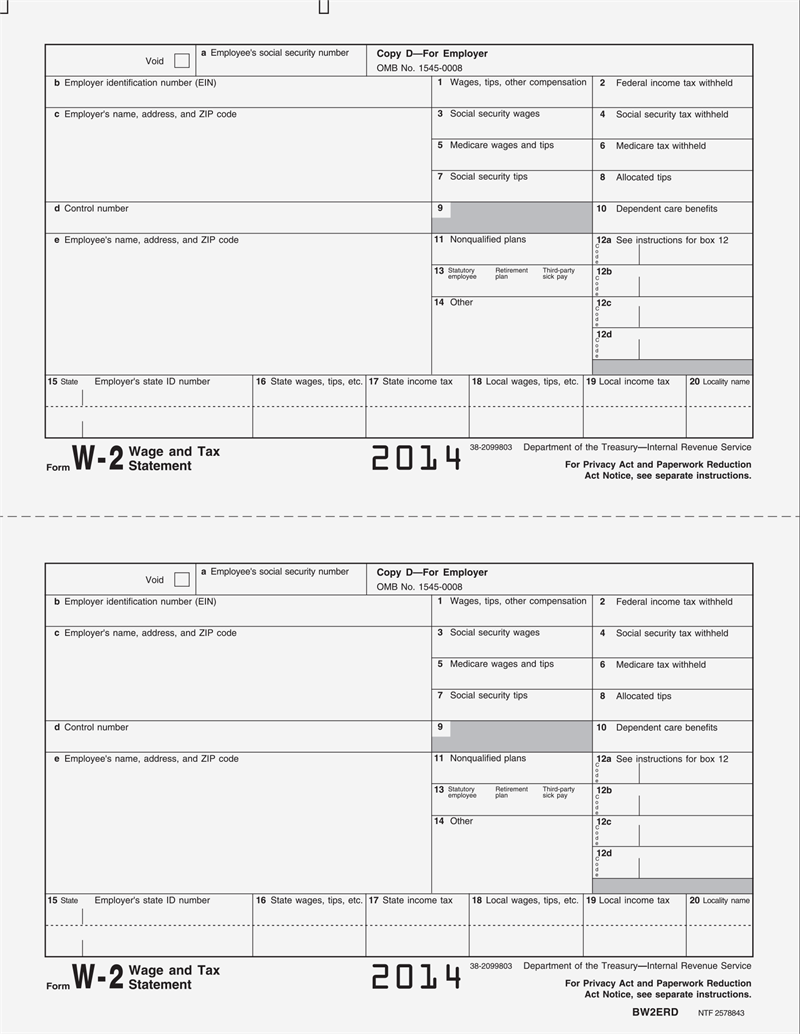

Printable W2 Form For New Employee Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/03/printable-w2-forms-for-employees-form-resume-examples.jpg

Printable W2 Form For New Employee

http://www.phoenixphive.com/images/products/detail/BW2ERD05.1.png

How To Fill Out And Print W2 Forms

https://www.halfpricesoft.com/w2-software/images/w2_form_ssa_substitute_m.jpg

Simply stated the IRS Form W 2 is a wage and tax statement that reports your taxable wages and the taxes withheld from your wages However if you ve ever looked at a W 2 form you ll notice that it has several lines of information and lots of boxes and codes on it other than the taxable wage information There s a lot to unpack where Step 1 Buy W 2 paper if applicable If your employee lost or didn t get their original W 2 or you need a copy for your records you can use plain paper Go to Step 2 Print your W 2s and W 3 Buy W 2 paper if you re printing from QuickBooks and mailing official copies to your employees

Employees will receive an Internal Revenue Service IRS Form W 2 Any employee that you ve paid during the previous calendar year from January 1 to December 31 should receive one of these forms The W 2 form is crucial because it s how you report the total wages and compensation for the year to both your employee and the IRS This service offers fast free and secure online W 2 filing options to CPAs accountants enrolled agents and individuals who process W 2s the Wage and Tax Statement and W 2Cs Statement of Corrected Income and Tax Amounts Verify Employees Social Security Numbers

2022 W2 Free Fillable Printable W 2 Form Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/09/2022-w2-free-fillable-printable-w-2-form-768x994.png

An Employer s Guide To Easily Completing A W 2 Form Gift CPAs Expert Small Business Advisors

https://giftcpas.com/wp-content/uploads/2017/12/2017_Form_W-2.png

https://www.irs.gov/pub/irs-access/fw2_accessible.pdf

You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA

https://www.irs.gov/forms-pubs/about-form-w-2

Income tax would have been withheld if the employee had claimed no more than one withholding allowance or had not claimed exemption from withholding on Form W 4 Employee s Withholding Allowance Certificate Current Revision Form W 2 PDF Instructions for Forms W 2 and W 3 Print Version PDF

W2 Form 2023 Fillable Form 2023

2022 W2 Free Fillable Printable W 2 Form Fillable Form 2023

Printable W2 Form For New Employee

Understanding 2015 W 2 Forms

How To Fill Out Form W 2 Detailed Guide For Employers 2023

W2 Example Form Fill Out And Sign Printable PDF Template SignNow

W2 Example Form Fill Out And Sign Printable PDF Template SignNow

W2 Form 2023

Understanding Your Tax Forms The W 2

Fillable W 2 Form 2019 Free Form Resume Examples WjYD17m6VK

Free Printable W2 Form For Employees - There s a reason why a W 2 is referred to as a wage and tax statement Put simply it s a form that shows how much money an employee has earned for the year and the amount of taxes that employers have already handed over to the IRS Not everyone needs a W 2 form Independent contractors and folks who are self employed need a 1099 form instead