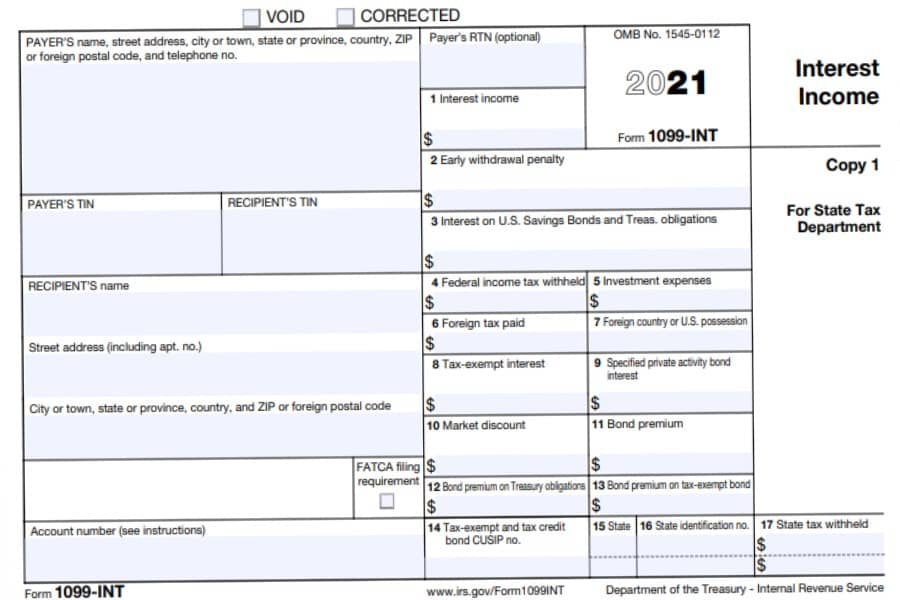

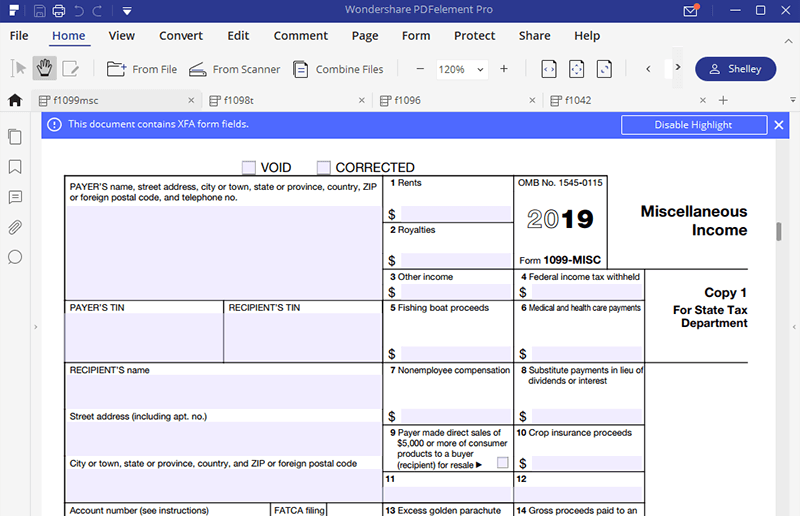

Irs 1099 Misc Form Printable You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use

What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like

Irs 1099 Misc Form Printable

Irs 1099 Misc Form Printable

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

How To File A 1099 Misc As An Employee Printable Form Templates And Letter

https://jumbotron-production-f.squarecdn.com/assets/11075493e5b6812373621.png

IRS instructions for Forms 1099 MISC and 1099 NEC Form 1096 and About Form 1096 Annual Summary and Transmittal of U S Information Returns File your state 1099 forms Step 1 Purchase 1099 paper Purchase your 1099 Kit by mid January so you can print Keep in mind the IRS filing and contractor delivery deadlines Step 2 Print your 1099s The due date for filing Form 1099 MISC with the IRS is February 28 2024 if you file on paper or March 31 2024 if you file electronically Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation forms used to prepare your return and forms or schedules included in your

So even if you don t receive a Form 1099 K or if the thresholds change you should keep diligent records and report all of your income to the IRS Form 1099 MISC While Form 1099 NEC reports nonemployee compensation Form 1099 MISC Miscellaneous Income captures income that doesn t fit in neat categories For gig workers this includes In tax year 2020 the IRS reintroduced Form 1099 NEC for reporting independent contractor income otherwise known as nonemployee compensation If you re self employed income you receive during the year might be reported on the 1099 NEC but Form 1099 MISC is still used to report certain payments of 600 or more you made to other businesses and people This article covers the 1099 MISC

More picture related to Irs 1099 Misc Form Printable

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

https://i.pinimg.com/originals/84/39/25/8439251aed2f493ff6de85d44058d911.gif

How To Fill Out And Print 1099 MISC Forms

https://www.halfpricesoft.com/1099-misc-software/images/1099-copyA.jpg

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1099-misc-tax-basics.png

A 1099 MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest 1 Form 1099 Misc is a tax form that reports the year end summary of all non employee compensation The 1099 Misc form covers rent royalties self employment and independent contractor income crop

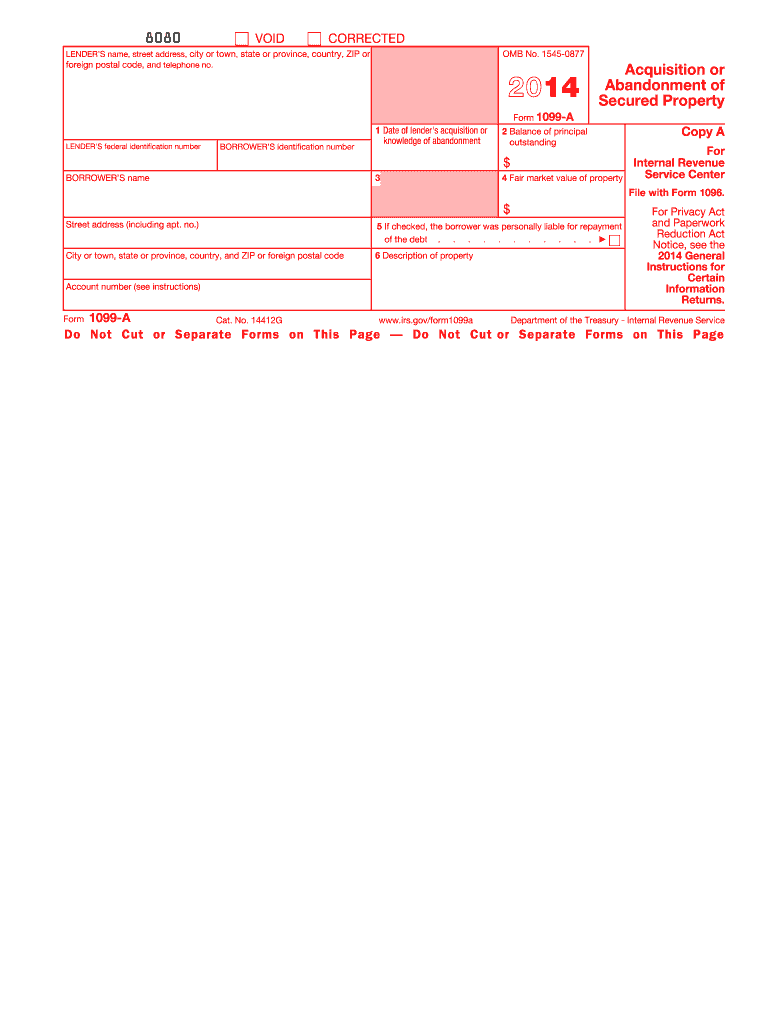

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more What is a 1099 MISC Form The 1099 MISC is used to report certain types of non employee income As of the 2020 tax year the 1099 MISC is now only used to report the following types of income worth at least 600 Rents Prizes and awards Other income payments

How To Fill Out And Print 1099 MISC Forms

https://www.halfpricesoft.com/images/1099_edit.jpg

Free Printable 1099 Misc Forms Free Printable

https://4freeprintable.com/wp-content/uploads/2019/06/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-misc-forms.png

https://www.irs.gov/instructions/i1099mec

You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use

https://eforms.com/irs/form-1099/misc/

What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

How To Fill Out And Print 1099 MISC Forms

Printable IRS Form 1099 MISC For Tax Year 2017 For 2018 Income Tax Season

2022 1099 MISC IRS Forms Print Template PDF Fillable With Etsy

Printable Form 1099 Misc For 2021 Printable Form 2023

1099 MISC Form Rellenable Imprimible Descargar Gratis Instrucciones 2020 Mark s Trackside

1099 MISC Form Rellenable Imprimible Descargar Gratis Instrucciones 2020 Mark s Trackside

1099 Misc Form Printable Instructions

IRS Form 1099 MISC How To Fill It Right

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

Irs 1099 Misc Form Printable - IRS instructions for Forms 1099 MISC and 1099 NEC Form 1096 and About Form 1096 Annual Summary and Transmittal of U S Information Returns File your state 1099 forms Step 1 Purchase 1099 paper Purchase your 1099 Kit by mid January so you can print Keep in mind the IRS filing and contractor delivery deadlines Step 2 Print your 1099s