Is There A Printable 1099 Form Home About Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds

You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn t your employer The payer fills out the form with the appropriate details and sends copies to you and the IRS reporting payments made during the tax year

Is There A Printable 1099 Form

Is There A Printable 1099 Form

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

1099 Form Template Create A Free 1099 Form Form

https://legaldocfinder.com/images/jumbotron/1099-form-sample.png

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/7njQnBtOe3zLbzG3V4rWHE/de7ada497a46a667e012a996afc8b7d1/1099_Sample_IRS.gif

Nerdy takeaways A 1099 form also called an information return is a document sent to you by an entity that paid you certain types of income throughout the tax year Getting a 1099 doesn t 1099 NEC You ll receive a 1099 NEC nonemployee compensation for income you receive for contract labor or self employment of more than 600 Note Prior to tax year 2020 this information was reported on Form 1099 MISC If you work for more than one company you ll receive a 1099 NEC tax form from each company

You ll get a 1099 if an organization or business paid you more than a certain amount during the year generally 600 for freelance or self employed work and you ll also get 1099s from your No at least not copy that you send to the IRS If you send the IRS a 1099 that you ve printed on plain paper you ll be charged a penalty just as if you d failed to file the form at all 1099s get printed at least three times sometimes four These are called copies A B C and 1 and here s who gets them Copy A For the IRS

More picture related to Is There A Printable 1099 Form

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/_h1CHqdnjvV-4nCTHDingOUQvJ4=/1288x1288/smart/filters:no_upscale()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg

IRS Form 1099 Reporting For Small Business Owners

https://fitsmallbusiness.com/wp-content/uploads/2019/01/1099-form.png

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC 1099 MISC Form 1099 MISC documents miscellaneous income If you received a payout of over 600 in a given year from a business you should have received a 1099 MISC Types of income include prize

What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more Businesses must issue 1099s to any payee other than a corporation who receives at least 600 in non employment income during the year However there are exceptions to the 600 threshold rule

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

https://www.esigngenie.com/wp-content/uploads/2019/06/1099-Form_Page-1.jpg

1099 S Fillable Form Printable Forms Free Online

https://www.pdffiller.com/preview/456/257/456257951/large.png

https://www.irs.gov/forms-pubs/about-form-1099-misc

Home About Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds

https://www.irs.gov/instructions/i1099mec

You can get the general instructions from General Instructions for Certain Information Returns at IRS gov 1099GeneralInstructions or go to IRS gov Form1099MISC or IRS gov Form1099NEC Continuous use form and instructions Form 1099 MISC Form 1099 NEC and these instructions are continuous use

Printable 1099 Tax Forms Free Printable Form 2024

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

Form 1099 div 2019 2024 Fill Online Printable Fillable Blank

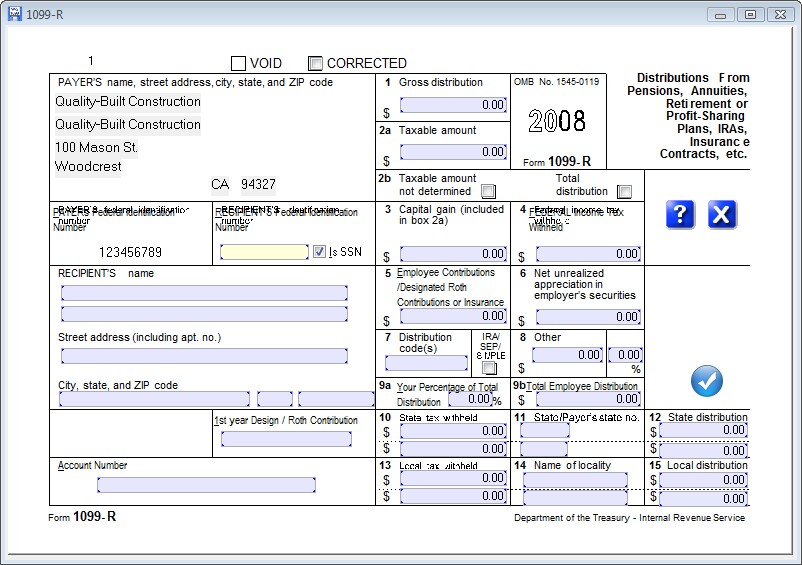

Free Printable 1099 R Form Printable Templates

Printable IRS Form 1099 MISC For Tax Year 2017 For 2018 Income Tax Season CPA Practice Advisor

Irs Printable 1099 Form Printable Form 2023

Irs Printable 1099 Form Printable Form 2023

1099 S Fillable Form Printable Forms Free Online

1099 Fillable Form Free Printable Form Templates And Letter

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

Is There A Printable 1099 Form - WASHINGTON The Internal Revenue Service announced today that businesses can now file Form 1099 series information returns using a new online portal available free from the IRS Known as the Information Returns Intake System IRIS this free electronic filing service is secure accurate and requires no special software