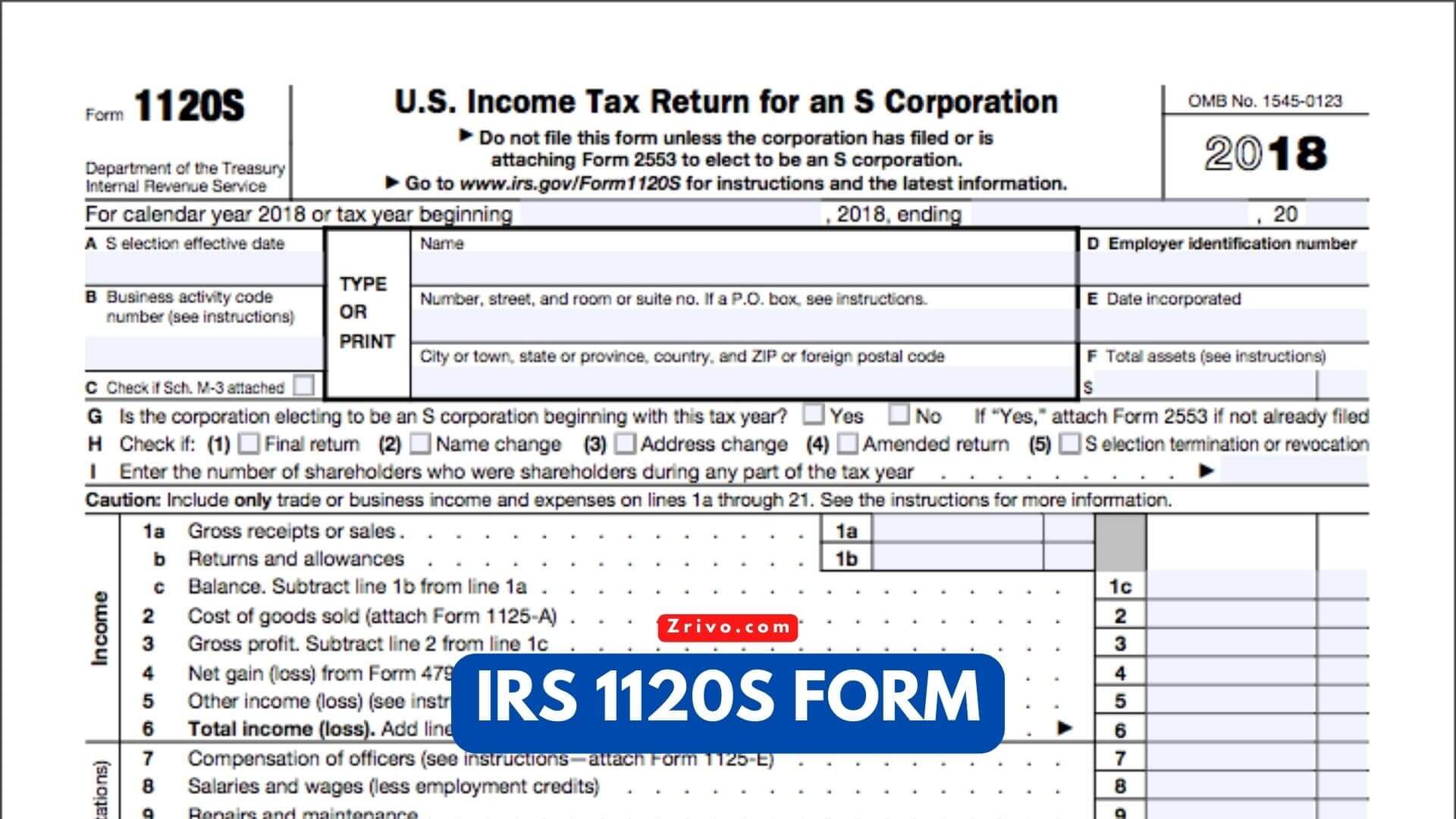

Irs 1120s Printable Tax Form Use Form 1120 S to report the income gains losses deductions credits etc of a domestic corporation or other entity for any tax year covered by an election to be an S corporation Current Revision Form 1120 S PDF Instructions for Form 1120 S Print Version PDF Recent Developments

Form 1120 Department of the Treasury Internal Revenue Service U S Corporation Income Tax Return For calendar year 2023 or tax year beginning 2023 ending 20 Go to www irs gov Form1120 for instructions and the latest information OMB No 1545 0123 2023 TYPE OR PRINT Name Number street and room or suite no If a P O box see instructions Form 1120 PDF Instructions for Form 1120 Print Version PDF Recent Developments Relief from additions to tax for underpayments applicable to the new corporate alternative minimum tax 21 DEC 2023 Guidance on Determining a Corporation s Estimated Tax Payment 20 JUN 2023

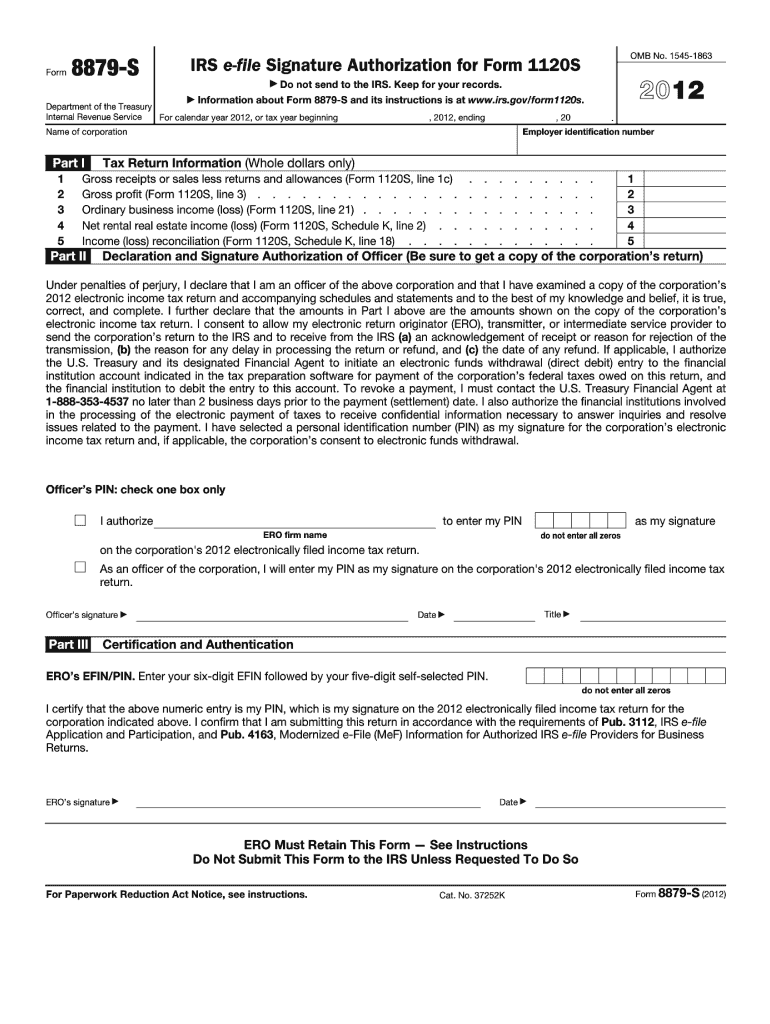

Irs 1120s Printable Tax Form

Irs 1120s Printable Tax Form

https://www.signnow.com/preview/6/954/6954580/large.png

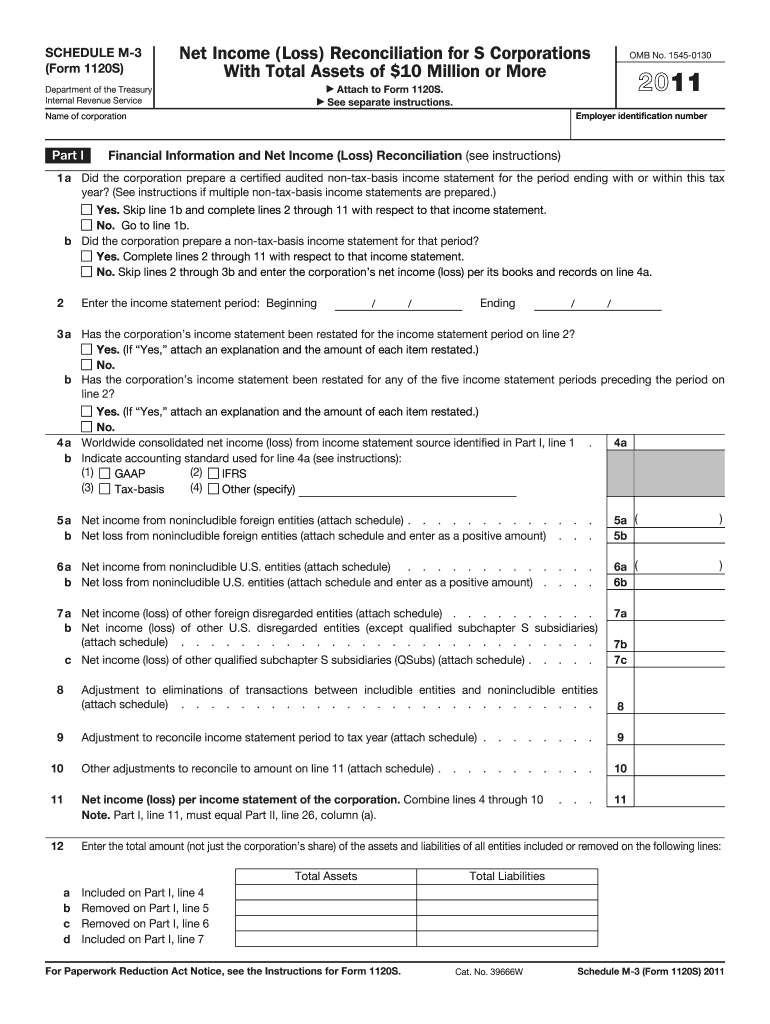

2011 Form IRS 1120S Schedule M 3 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/100/93/100093756/large.png

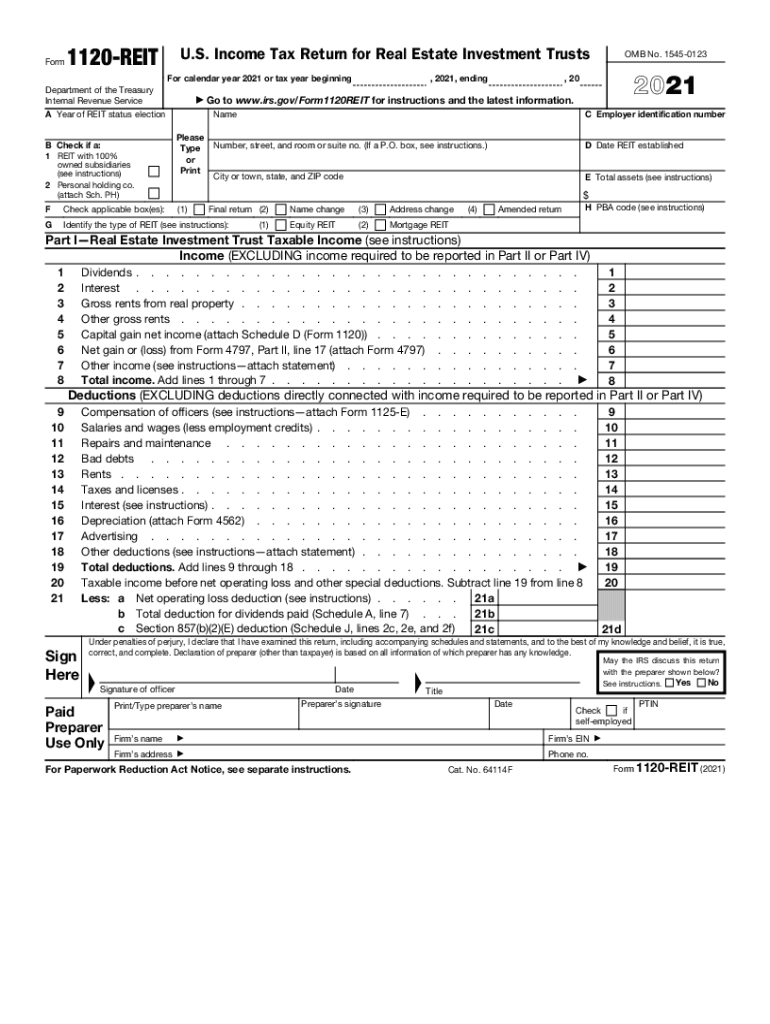

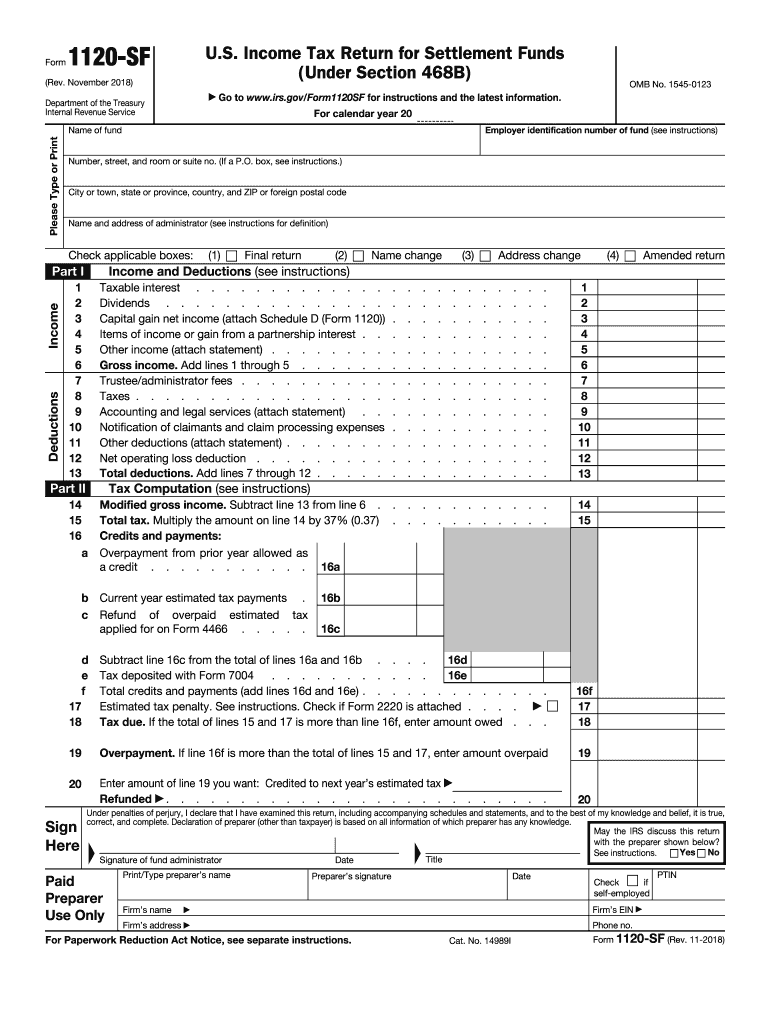

2021 Form IRS 1120 REIT Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/578/929/578929624/large.png

Introduction IRS Form 1120 S officially called the U S Income Tax Return for S Corporation may sound like a mouthful but it is an essential income tax form for many S corporation entrepreneurs This form is used to report annual income losses deductions credits and other transactions S Corps business entities elected to be treated differently for tax purposes are exempt from FILE TO DOWNLOAD OR INTEGRATE Download our Form 1120S Checklist Download as PDF Sample Financial Statements Step 1 Gather the Necessary Information for Form 1120S Whether you hire a tax professional to prepare your taxes or use tax software you ll need information and documentation to complete 1120S

Department of the Treasury Internal Revenue Service 2011 Instructions for Form 1120S U S Income Tax Return for an S Corporation Section references are to the InternalContents Pagethese children home by looking at the Revenue Code unless otherwise noted Schedule M 1 35 photographs and calling Form 1120S can be downloaded straight from the IRS website It s also available through most tax filing software programs You need to have the following information on hand while filling out Form 1120S Date you became an S corp Date your business was incorporated Your business activity code

More picture related to Irs 1120s Printable Tax Form

IRS 1120 2008 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/1/653/1653913/large.png

IRS Form 1120 C Download Fillable PDF Or Fill Online U S Income Tax Return For Cooperative

https://data.templateroller.com/pdf_docs_html/2125/21255/2125516/irs-form-1120-c-u-s-income-tax-return-for-cooperative-associations_print_big.png

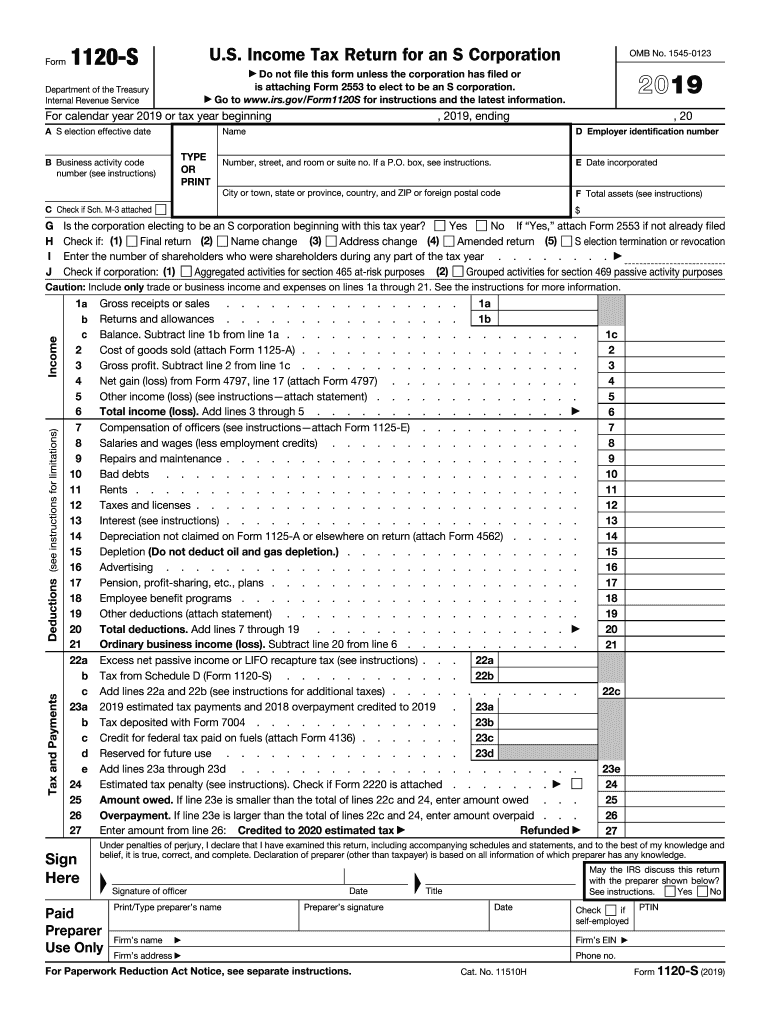

IRS 1120S 2019 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/490/783/490783239/large.png

Those source documents will give you everything you need but a tax pro will convert them into the type of information the IRS is looking for on Form 1120S Filing deadline The deadline for filing Form 1120S is March 15 2024 unless you ve applied for an extension You can apply for an extension up to March 15 2024 using Form 7004 An S corp files Form 1120 S itself and provides each shareholder with a copy of their Schedule K 1 to assist them in reporting their share of the S corp s income on their tax return For a corporation to be taxed as an S corp it must complete and file Form 2553 Election by a Small Business Corporation Form 2553 must be submitted to the IRS

See the instructions and enter the Business activity b Product or service At the end of the tax year did the corporation own directly or indirectly 50 or more of the voting stock of a domestic corporation For rules of attribution see section 267 c Download This Form Print This Form More about the Federal Form 1120 S Corporate Income Tax Tax Return TY 2023 We last updated the U S Income Tax Return for an S Corporation in January 2024 so this is the latest version of Form 1120 S fully updated for tax year 2023

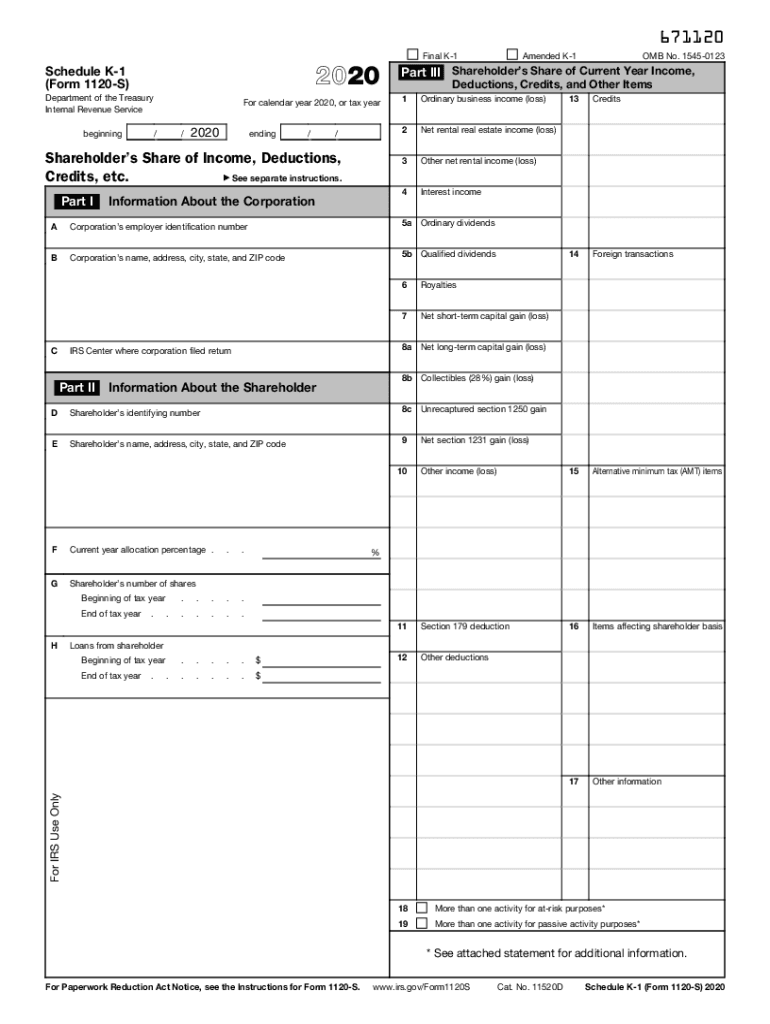

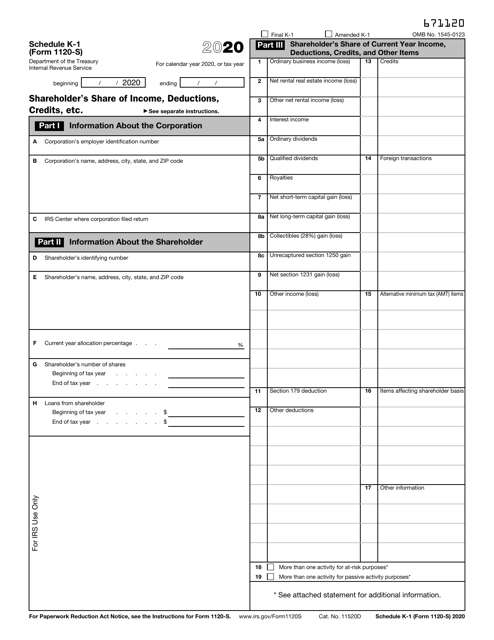

IRS 1120S Schedule K 1 2020 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/533/156/533156814/large.png

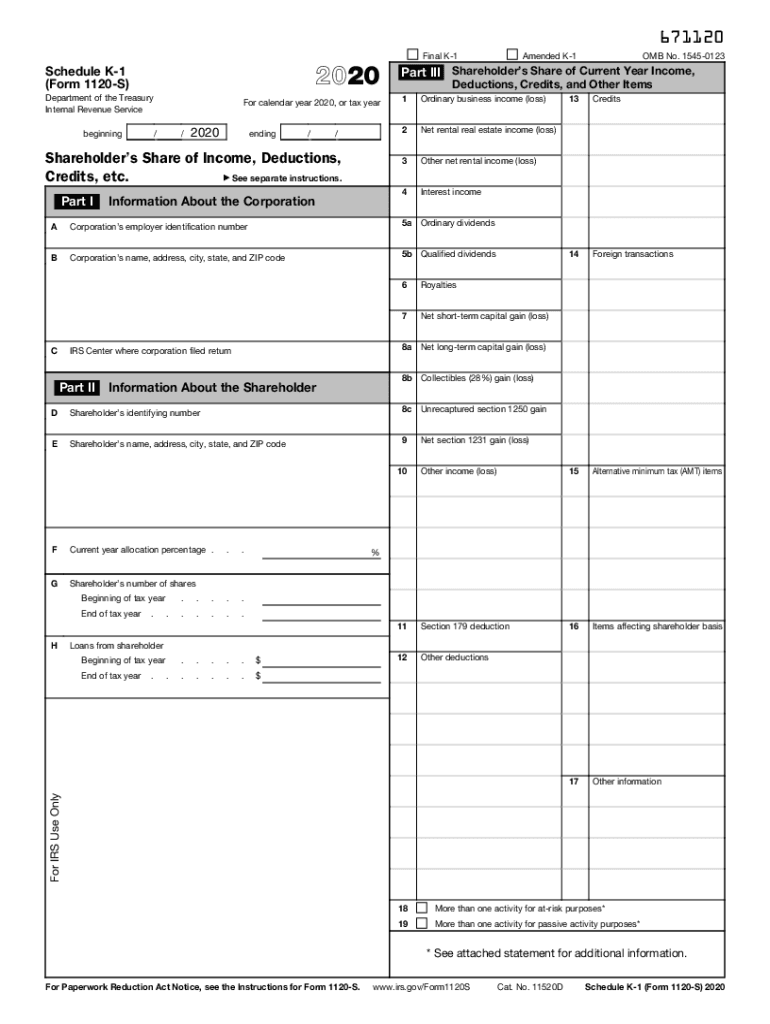

2011 Form IRS 1120S Schedule K 1 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/0/302/302396/large.png

https://www.irs.gov/forms-pubs/about-form-1120-s

Use Form 1120 S to report the income gains losses deductions credits etc of a domestic corporation or other entity for any tax year covered by an election to be an S corporation Current Revision Form 1120 S PDF Instructions for Form 1120 S Print Version PDF Recent Developments

https://www.irs.gov/pub/irs-pdf/f1120.pdf

Form 1120 Department of the Treasury Internal Revenue Service U S Corporation Income Tax Return For calendar year 2023 or tax year beginning 2023 ending 20 Go to www irs gov Form1120 for instructions and the latest information OMB No 1545 0123 2023 TYPE OR PRINT Name Number street and room or suite no If a P O box see instructions

1120s 2018 2024 Form Fill Out And Sign Printable PDF Template SignNow

IRS 1120S Schedule K 1 2020 Fill Out Tax Template Online US Legal Forms

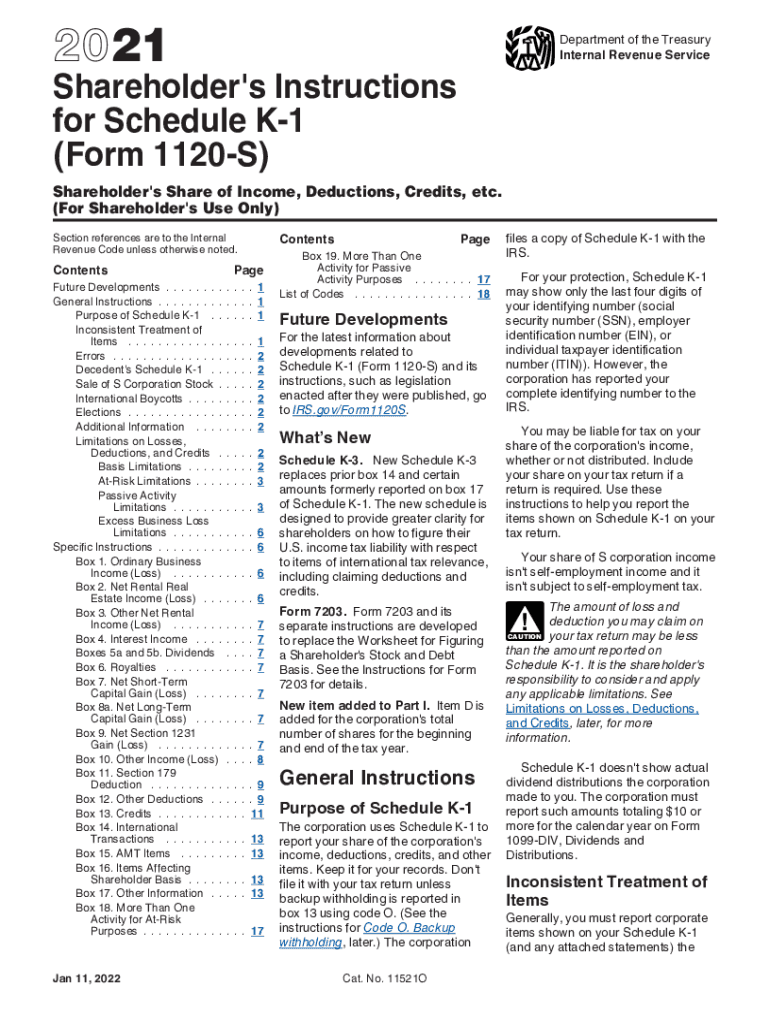

IRS Instruction 1120S Schedule K 1 2021 2022 Fill And Sign Printable Template Online US

2014 Form IRS 1120 H Fill Online Printable Fillable Blank PdfFiller

IRS 1120 F Schedule M 1 M 2 2019 Fill Out Tax Template Online US Legal Forms

How To Complete Form 1120s S Corporation Tax Return Heading

How To Complete Form 1120s S Corporation Tax Return Heading

IRS Form 1120S 2018 U S Income Tax Return For An S Corporation

IRS Form 1120 S Schedule K 1 Download Fillable PDF Or Fill Online Shareholder s Share Of Income

1120S Form 2023 2024

Irs 1120s Printable Tax Form - For more Form 1120 S tutorials see our playlist https www youtube playlist list PLTdpzKOWNutQW Aofody 1p5EyeaB9MkVIn this example we look at an S cor