Irs Form 433 D Printable In the e mail subject line enter DDIA for Input The revenue officer may also mail the Form 433 D to the address in d below Mail Forward the completed Form 433 D Installment Agreement with the bank account information or copy of a cancelled check on the ICS generated Form 3210 Document Transmittal for input

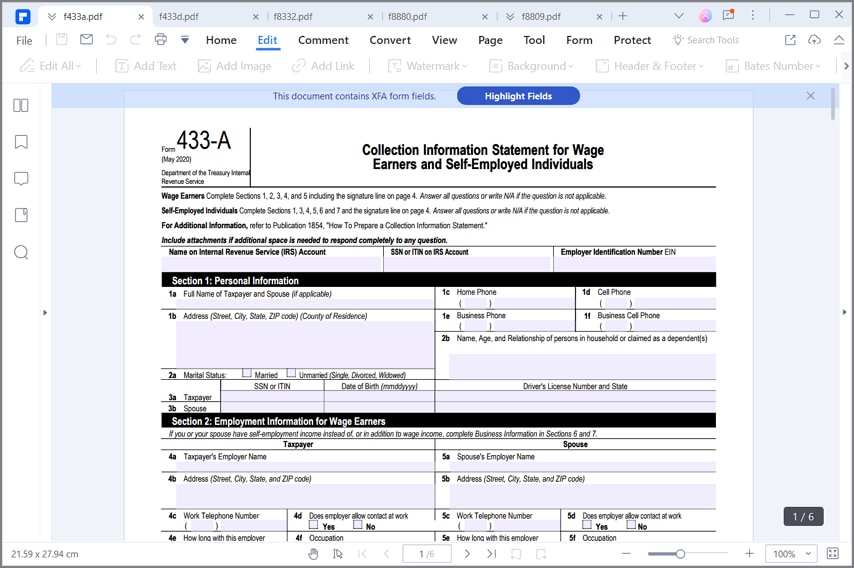

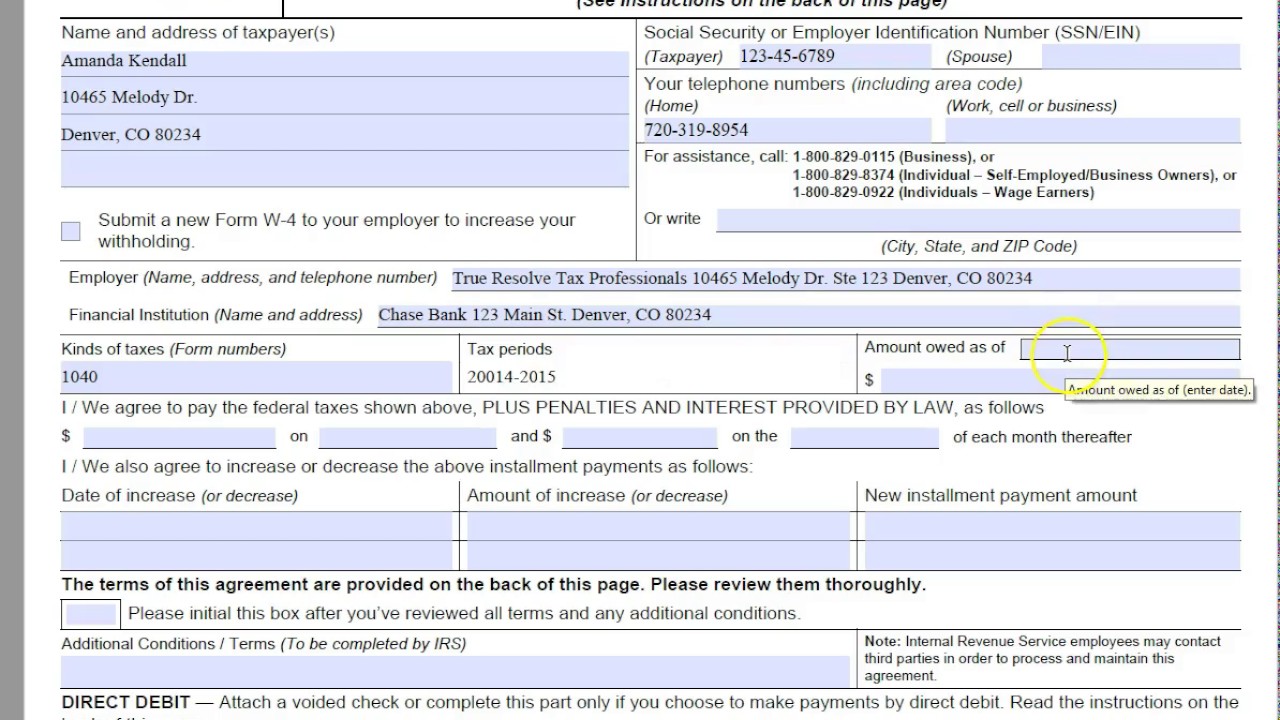

For assistance call 1 800 829 3903 Individual Self Employed Business Owners Businesses or 1 800 829 7650 Individuals Wage Earners Or write City State and ZIP Code Submit a new Form W 4 to your employer to increase your withholding Submit a new Form W 4 to your employer to increase your withholding Example 972 45 x 2 17 2 110 22 If paid semimonthly twice each month multiply semimonthly gross wages by 2 Example 856 23 x 2 1 712 46 Net Income from Business Enter monthly net business income This is the amount earned after ordinary and necessary monthly business expenses are paid

Irs Form 433 D Printable

Irs Form 433 D Printable

https://www.pdffiller.com/preview/455/559/455559610/large.png

IRS Form 433 D Walkthrough Setting Up An Installment Agreement YouTube

https://i.ytimg.com/vi/2yB021DUkys/maxresdefault.jpg

Irs Form 433 D Printable Printable World Holiday

https://pdfformpro.com/assets/images/form_thumb/11253-screenshot.png

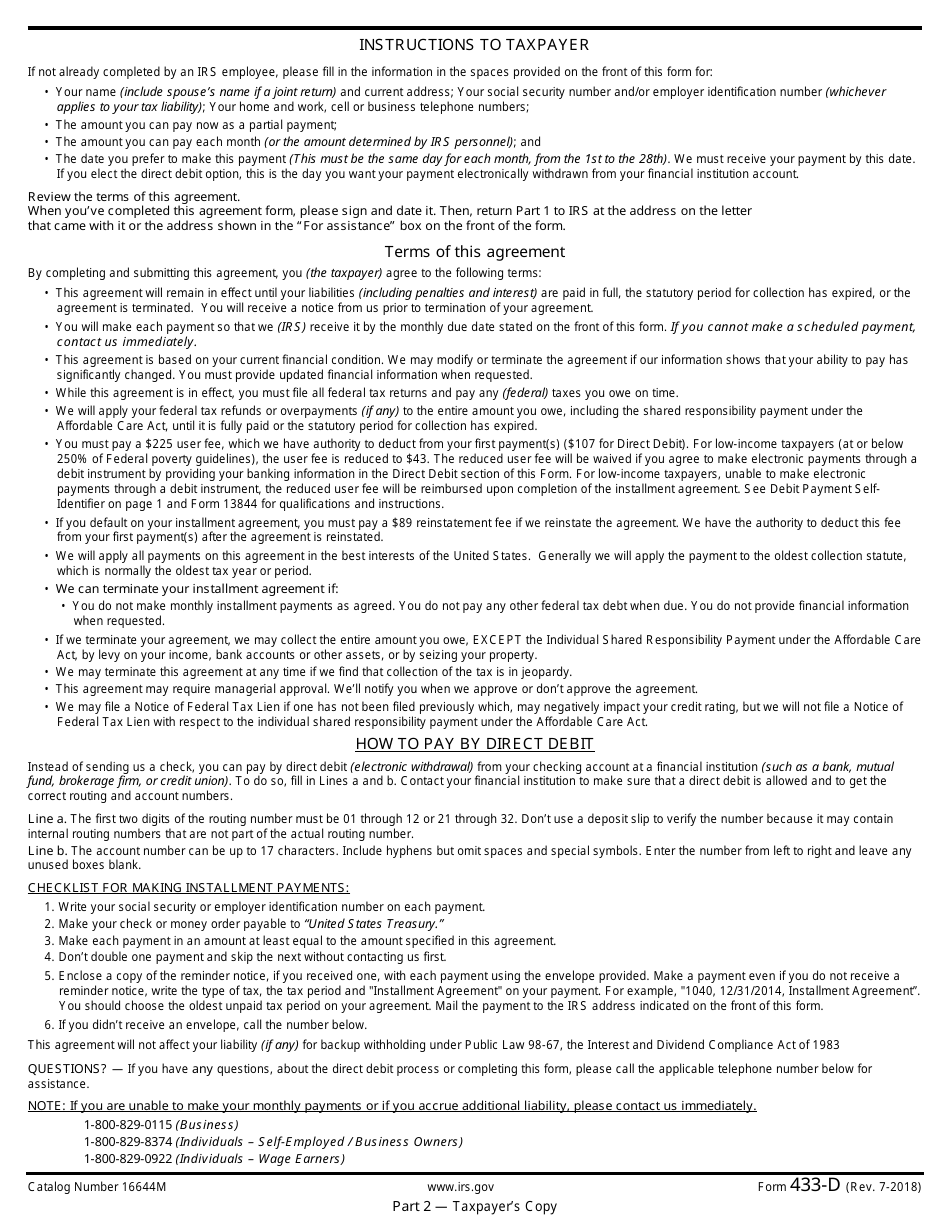

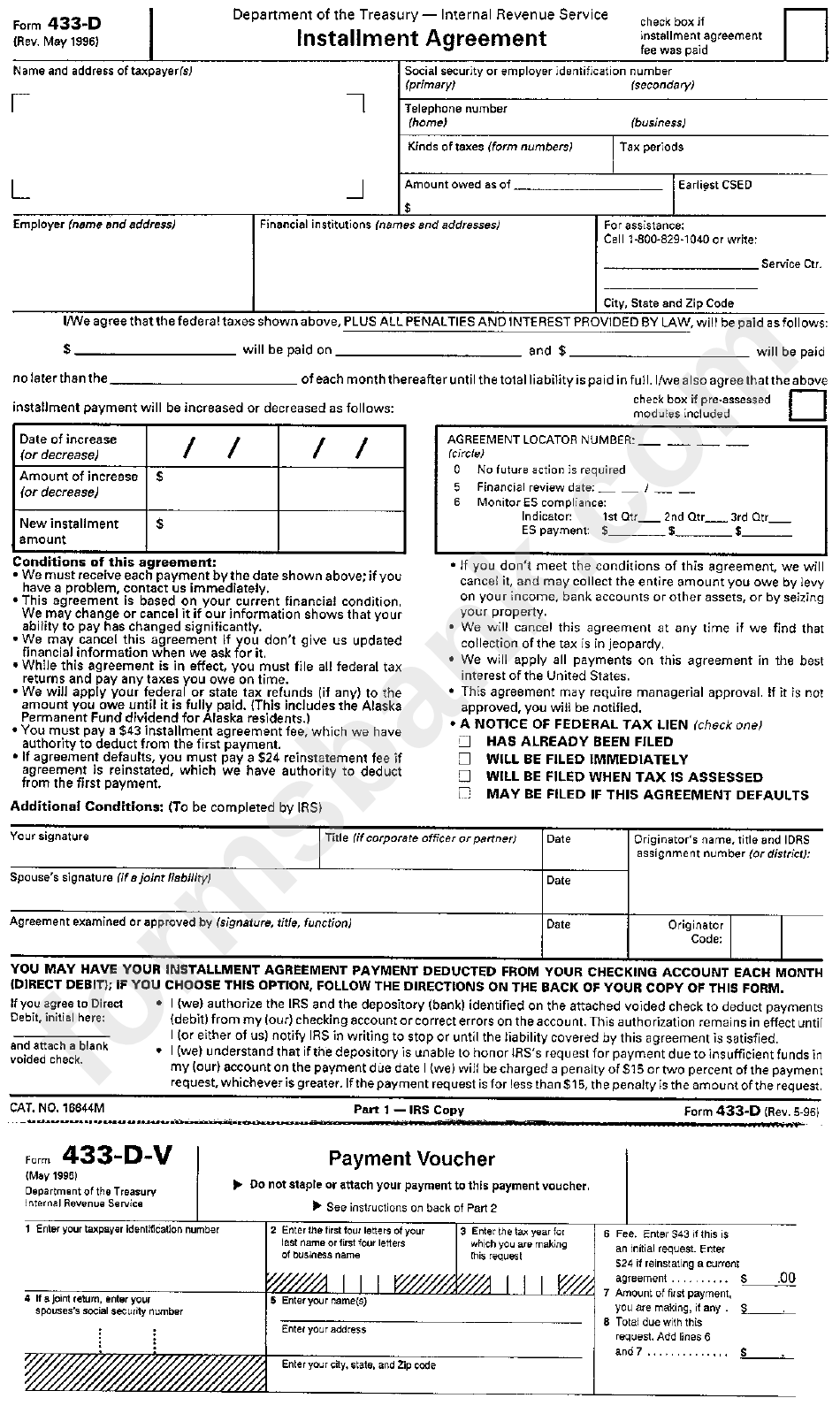

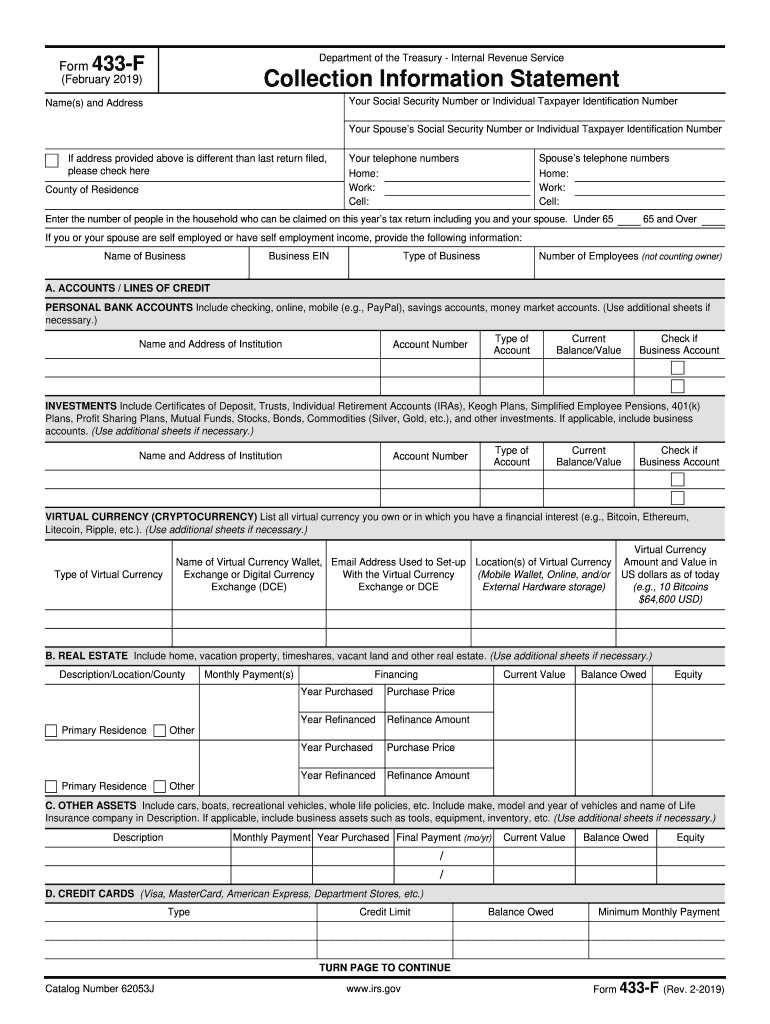

Currently the IRS will deduct a 225 user fee from your first installment payment unless you qualify as low income Low income is defined as at or below 250 percent of the Federal poverty guidelines If you qualify your user fees are reduced to 43 Direct debit users pay 107 An IRS form 433 D or installment agreement is a form that taxpayers fill to authorize automatic direct debit as a means to resolve overdue taxes The document finalizes the agreement between an individual or a business and the IRS However you need a form 9465 from the IRS to initiate the tax resolution

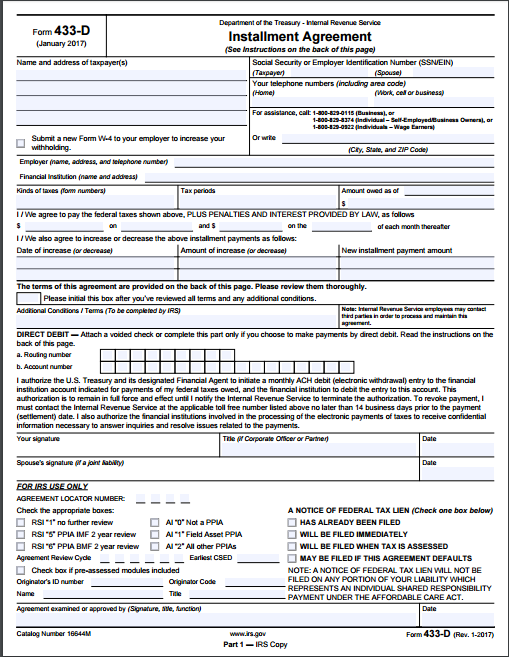

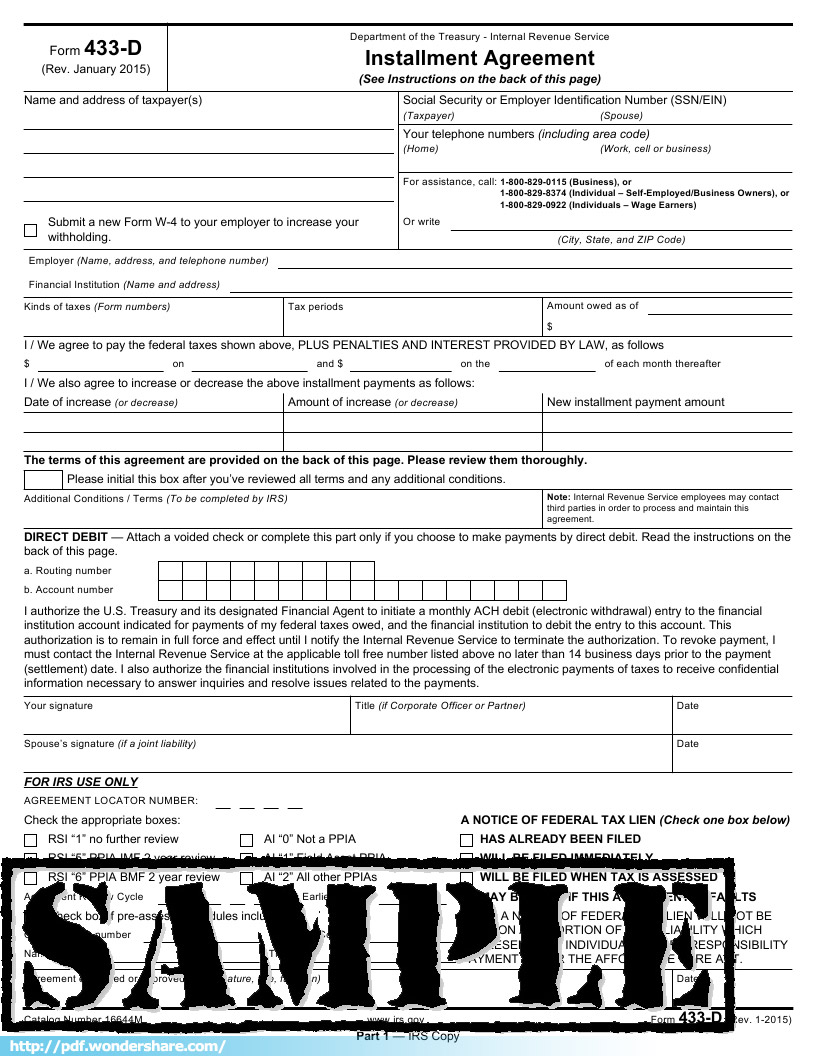

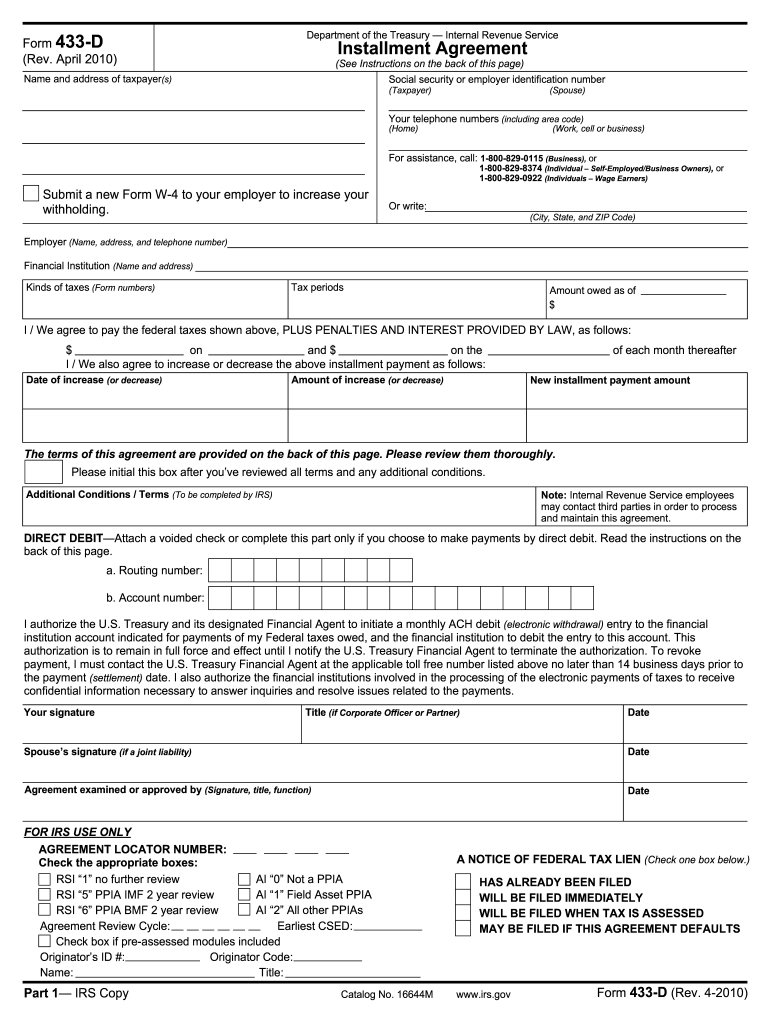

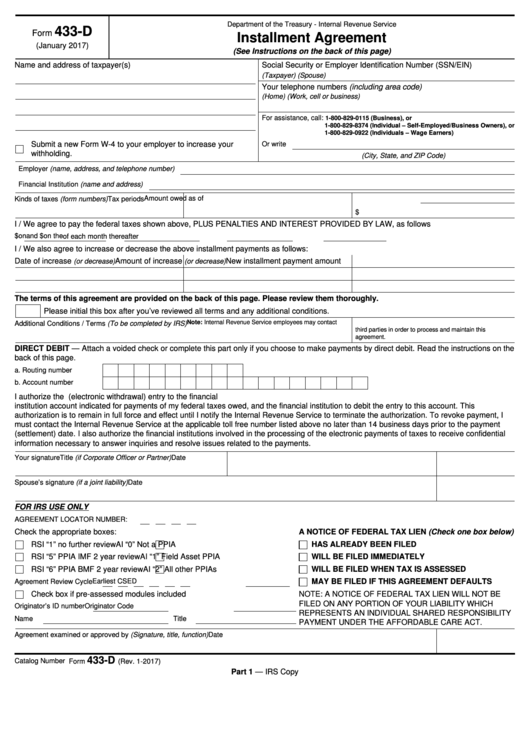

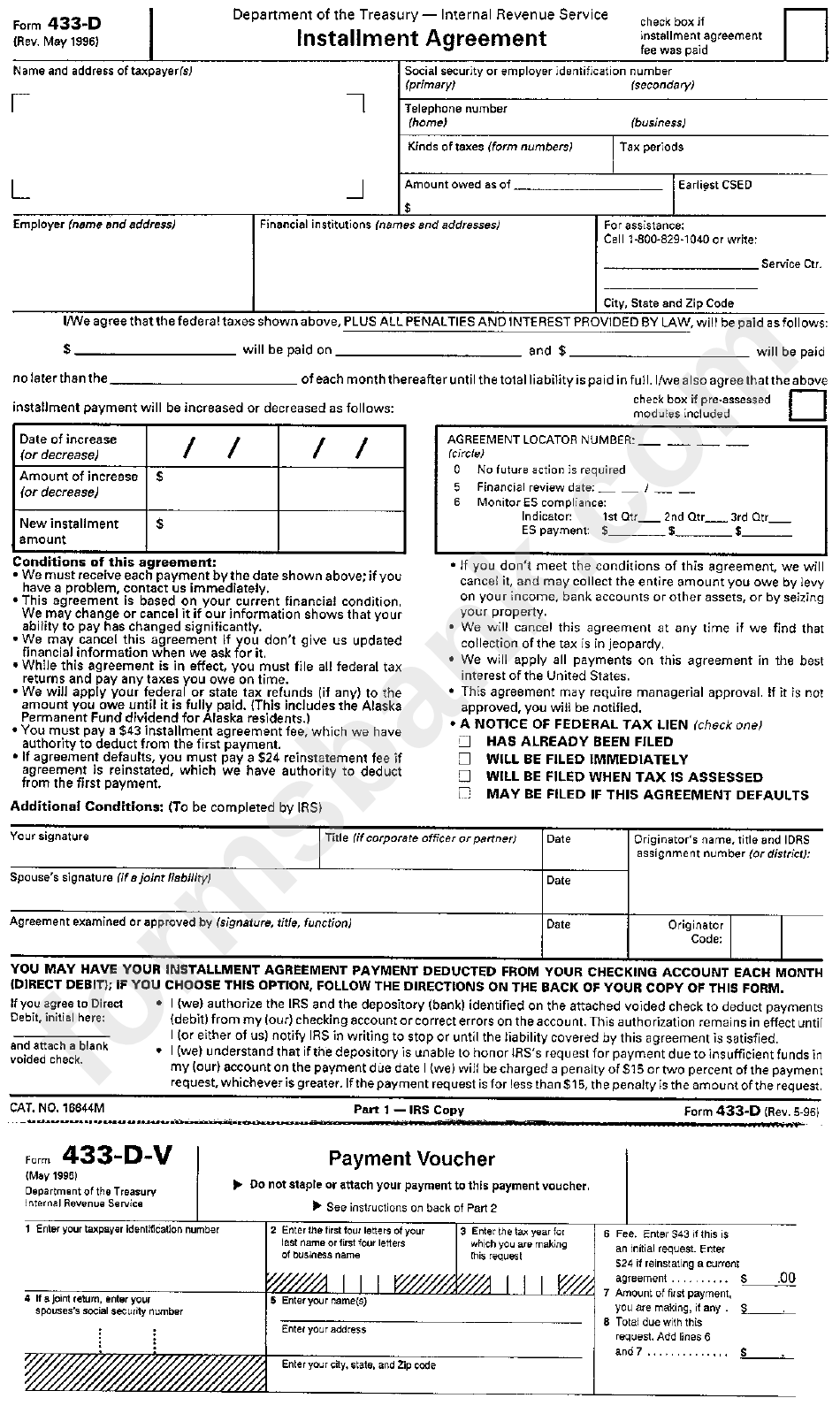

An IRS installment agreement is an option to manage federal tax debt and Form 433 D serves as the finalizing document for direct debit payments from your bank account This is where Form 433 D also known as the Installment Agreement form comes into play This IRS form serves a key purpose it finalizes your payment plan by collecting all IRS Form 433 D is one of the set of forms used to set taxpayers up with a tax resolution This particular form is used to apply for an Installment Agreement which breaks up an overdue tax balance into smaller monthly payments Filing Form 433 D carefully and accurately is very important as it can impact whether an individual s settlement

More picture related to Irs Form 433 D Printable

Fill Free Fillable Form 433 D Installment Agreement 2018 PDF Form

https://var.fill.io/uploads/pdfs/html/5b5b97a7-f20a-4a68-a2ce-cbeb3f031f9a/bg3.png

IRS Form 433 A How To Fill It Right

https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-433a-part1.png

IRS Form 433 D Free Download Create Edit Fill And Print

https://pdfimages.wondershare.com/images/templates/241-form-433-d-f433d.jpg

A Form 433 D is known as an Installment Agreement and it is used for taxpaying purposes This form will be used to help formulate and finalize payment plans and installments for people who owe taxes This is typically for people who owe a large amount of debt to the IRS or who are in a tough financial situation and can t afford to make a Form 433 D Installment Agreement is a single page form that outlines the main terms of your installment agreement including the total due and monthly payment amounts The back of the form lists the requirements for your payment plan and the reasons the IRS may put your plan into default By signing this form you agree to abide by the IRS

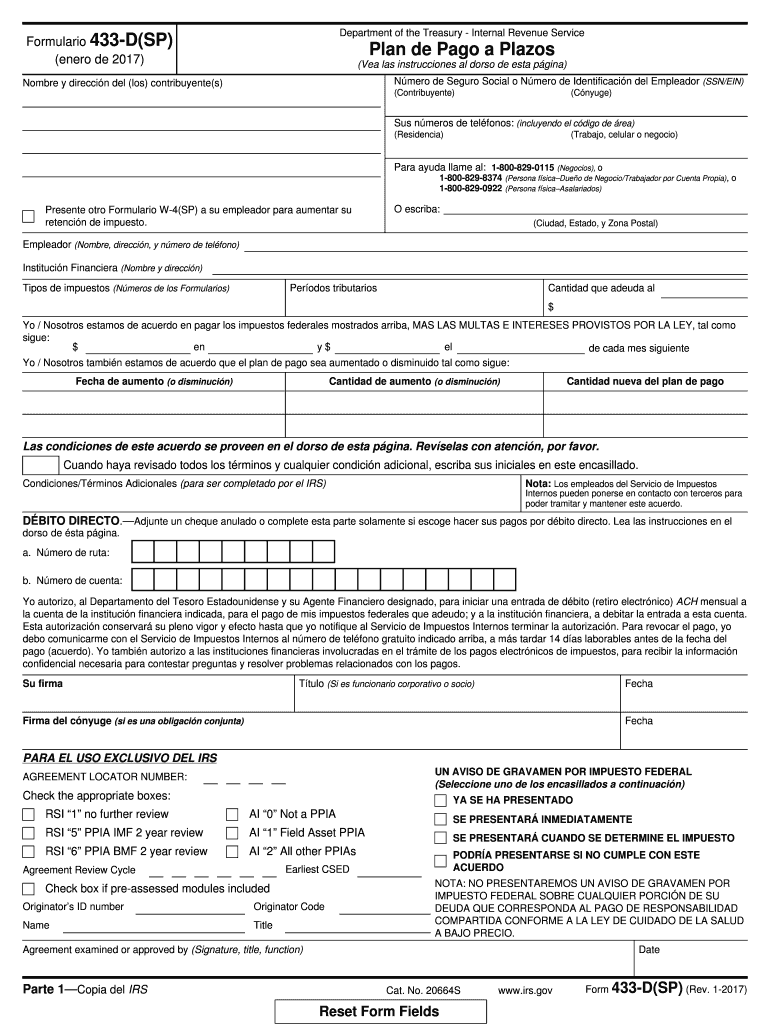

File Now with TurboTax We last updated Federal Form 433 D in January 2024 from the Federal Internal Revenue Service This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Federal government Www irs gov Form 433 D sp Rev 8 2022 Formulario 433 D agosto de 2022 Plan de Pago a Plazos Vea las instrucciones al dorso de esta p gina Department of the Treasury Internal Revenue Service Nombre y direcci n del los contribuyente s Presente un nuevo Formulario W 4 SP a su empleador para aumentar su retenci n de impuestos

IRS Form 433 D Installment Agreement DocFormats

https://www.docformats.com/wp-content/uploads/2022/07/Form-IRS-433-D-PDF.jpg

2010 Form IRS 433 D Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/1/652/1652323/large.png

https://www.irs.gov/irm/part5/irm_05-014-010

In the e mail subject line enter DDIA for Input The revenue officer may also mail the Form 433 D to the address in d below Mail Forward the completed Form 433 D Installment Agreement with the bank account information or copy of a cancelled check on the ICS generated Form 3210 Document Transmittal for input

https://www.zillionforms.com/2022/F2255007870.PDF

For assistance call 1 800 829 3903 Individual Self Employed Business Owners Businesses or 1 800 829 7650 Individuals Wage Earners Or write City State and ZIP Code Submit a new Form W 4 to your employer to increase your withholding Submit a new Form W 4 to your employer to increase your withholding

IRS Form 433 d Fill Out Sign Online And Download Fillable PDF Templateroller

IRS Form 433 D Installment Agreement DocFormats

A Simple Guide To The IRS Form 433 D Installment Agreement Silver Tax Group

Irs Form 433 D Printable

Fillable Form 433 D Installment Agreement Printable Pdf Download

Irs Form 433 D Printable

Irs Form 433 D Printable

Irs Form 433 D Printable TUTORE ORG Master Of Documents

Irs Form 433 D Printable

Form 433 D Installment Agreement Community Tax

Irs Form 433 D Printable - Notice of federal tax lien This indicates whether there is a federal tax lien in place or whether such a tax lien is expected to be filed Approval signature When you receive the final copy back from the IRS it should be marked as approved by an IRS representative authorized to do so What is IRS Form 433 D IRS Form 433 D Installment Agreement is the IRS form that a taxpayer may submit