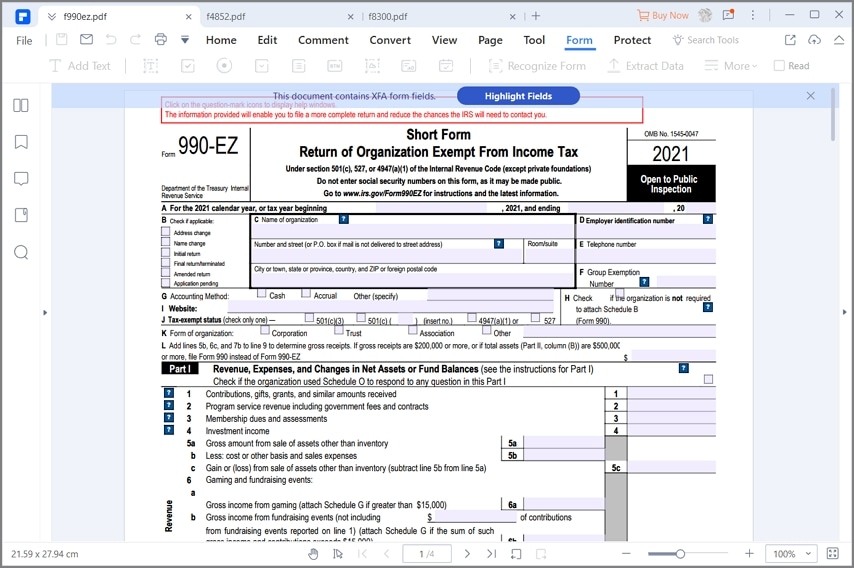

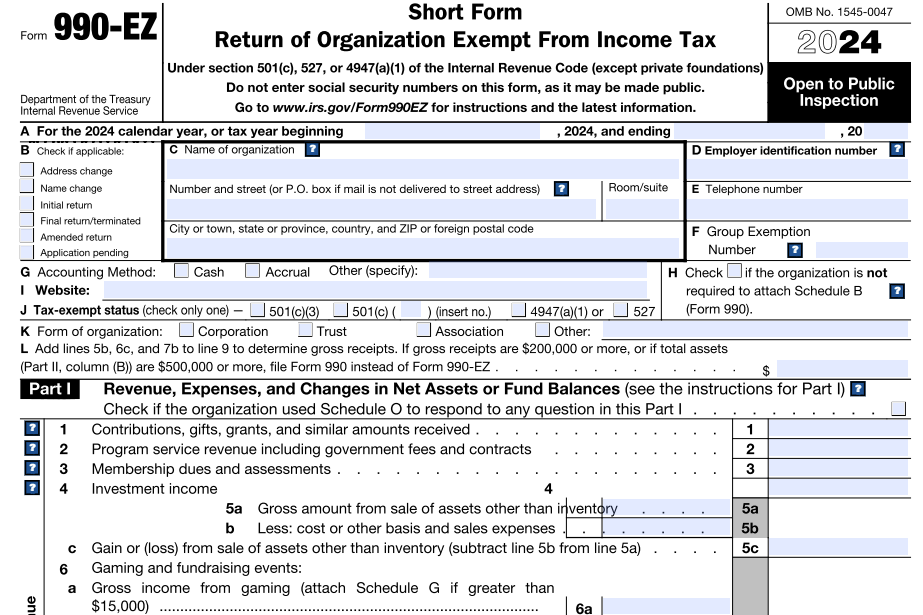

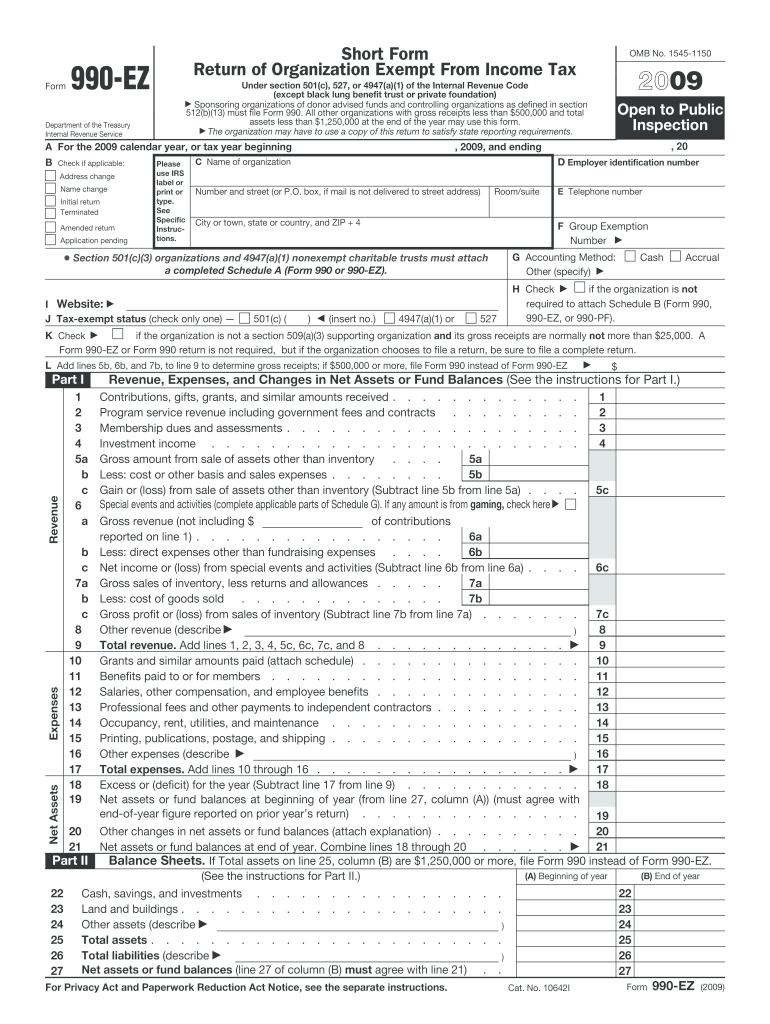

Irs Form 990 Ez Printable Information about Form 990 EZ Short Form Return of Organization Exempt from Income Tax including recent updates related forms and instructions on how to file Certain organizations file Form 990 EZ to provide the IRS with the information required by section 6033

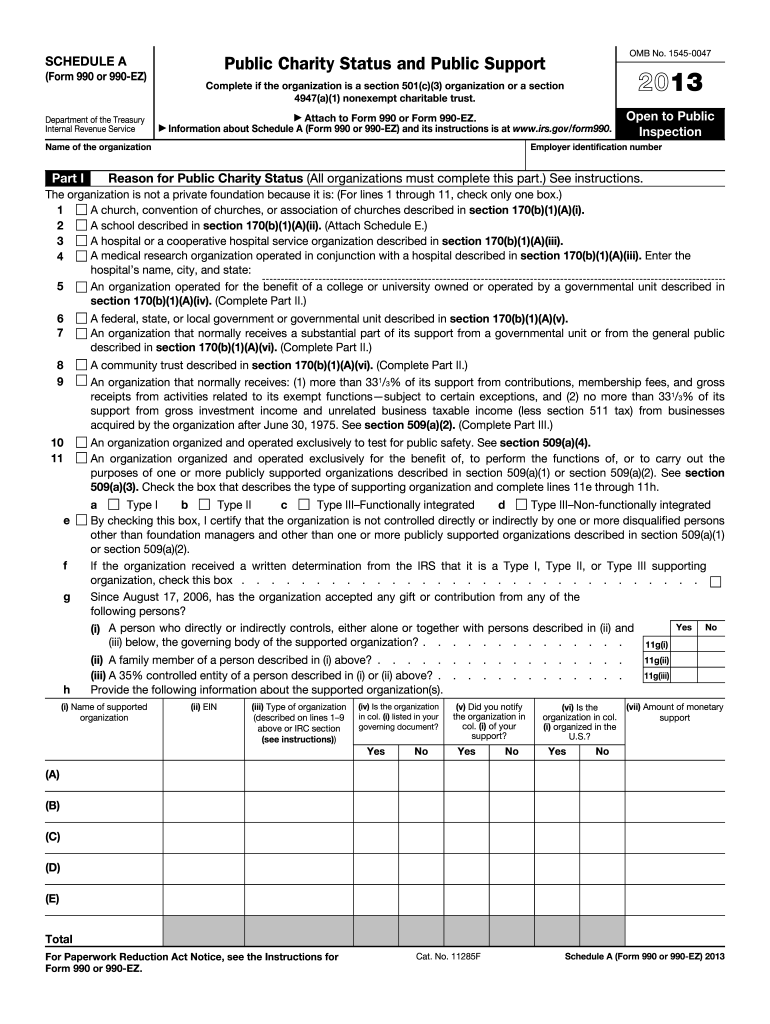

A supporting organization described in section 509 a 3 is required to file Form 990 or 990 EZ if applicable but cannot file Form 990 N even if its gross receipts are normally 50 000 or less it is within the class of organizations affiliated with a church or convention or association of churches and exempt from federal income tax An organization that is required to file an annual information return Form 990 or 990 EZ or submit an annual electronic notice Form 990 N for a given tax year see General Instructions A earlier must do so even if it hasn t filed a Form 1023 1023 EZ 1024 or 1024 A with the IRS if it claims tax exempt status

Irs Form 990 Ez Printable

Irs Form 990 Ez Printable

https://www.signnow.com/preview/6/954/6954826/large.png

Instructions De Remplissage Du Formulaire 990 EZ De L IRS

https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-990-part1.jpg

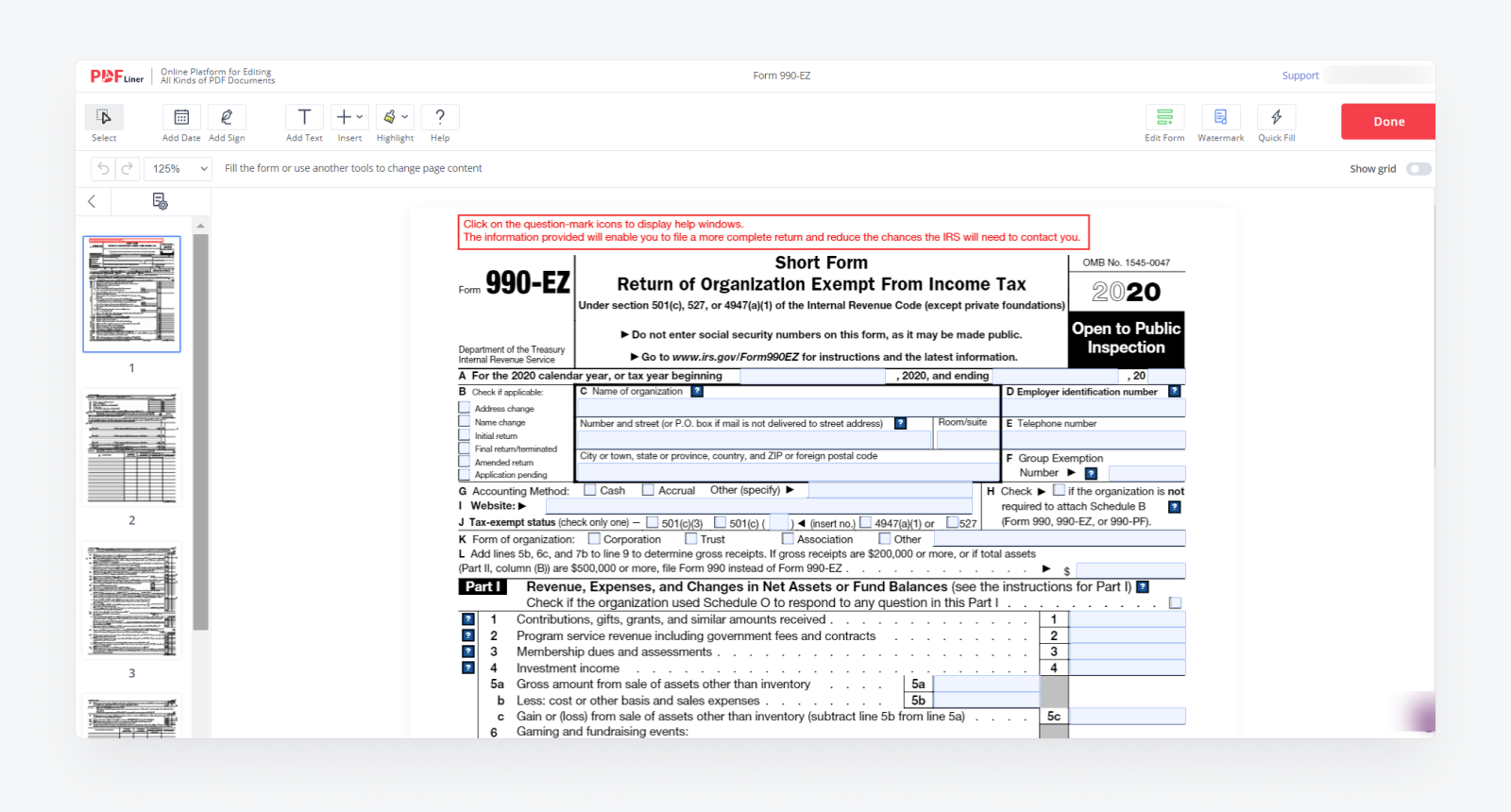

Form 990 EZ Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/1/649/1649102/large.png

Internal Revenue Service Form 990 EZ 2021 C OMB No 1545 0047 Form Department of the Treasury Internal Revenue Service Check if applicable Name of organization Address change Name change Number and street or P O box if mail is not delivered to street address Room suite Initial return Final return terminated

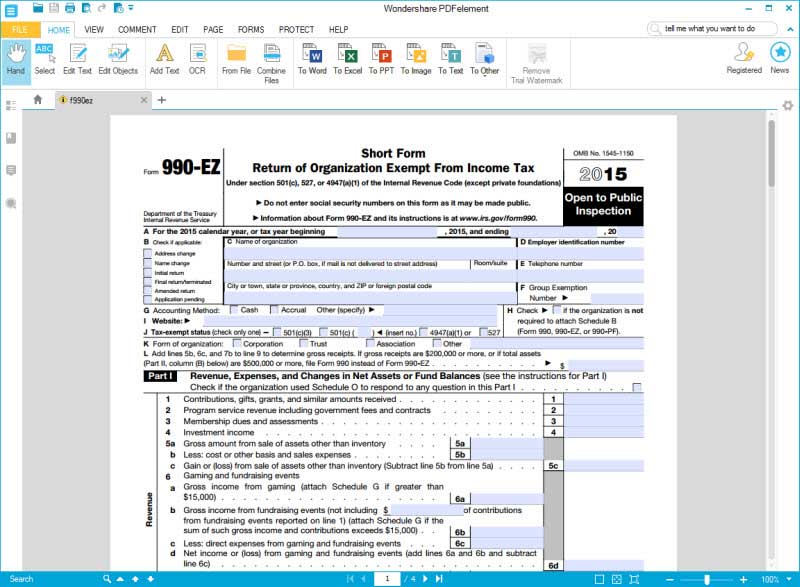

Cat No 10642I Form 990 EZ 2021 Form 990 EZ Department of the Treasury Internal Revenue Service Short Form Return of Organization Exempt From Income Tax Under section 501 c 527 or 4947 a 1 of the Internal Revenue Code except private foundations Do not enter social security numbers on this form as it may be made public Go to www irs I Tax exemptstatus check only one 501 c 3 LI 501 c I insert no LI 4947 a 1 or LI527 Form 990 990 EZ or 990 PF K Form of organization ICorporation LI Trust LI Association LI Other C Add lines 5b 6c and 7b to line 9 to determine gross receipts If gross receipts are 200 000 or more or if total assets Part II column B

More picture related to Irs Form 990 Ez Printable

2017 Form IRS 990 Or 990 EZ Schedule E Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/418/28/418028884/large.png

990 Ez Form Fill Online Printable Fillable Blank Irs 990 form

https://www.pdffiller.com/preview/539/26/539026036/big.png

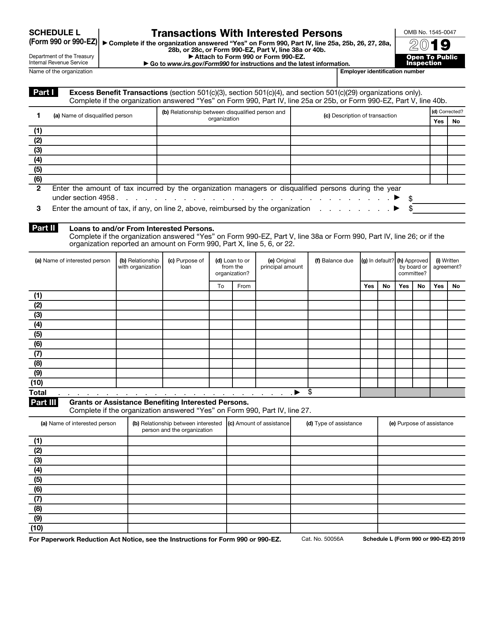

IRS Form 990 990 EZ Schedule L 2019 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2017/20173/2017313/irs-form-990-990-ez-schedule-l-transactions-with-interested-persons_big.png

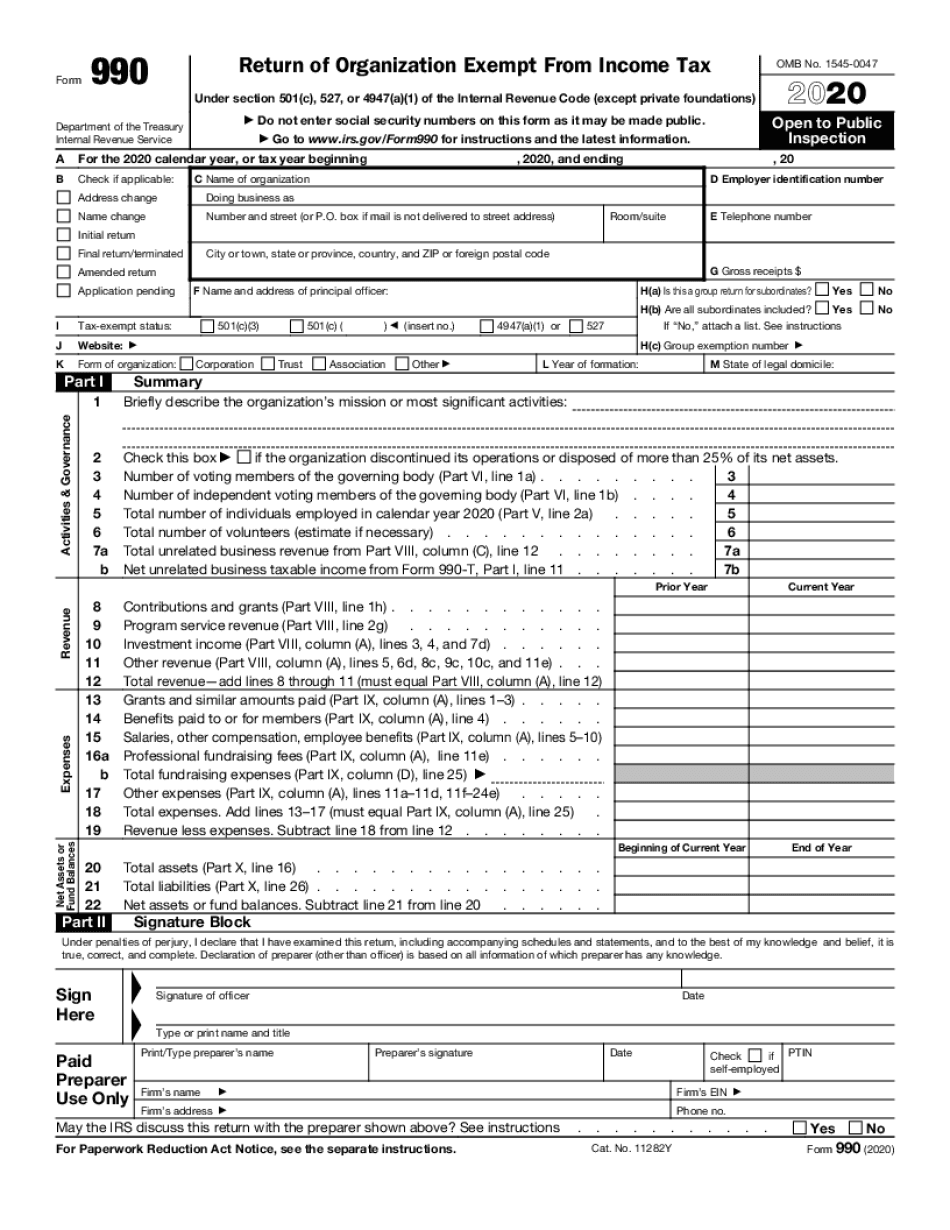

Form 990 EZ Department of the Treasury Internal Revenue Service Short Form Return of Organization Exempt From Income Tax OMB No 1545 0047 Under section 501 c 527 or 4947 a 1 of the Internal Revenue Code except private foundations Do not enter social security numbers on this form as it may be made public The 990 EZ is an annual tax information filing completed by many organizations that fall under the 501 c series of statuses of the tax code exempting them from the duty of paying taxes The 990EZ is just one type of 990 offered for small to mid sized nonprofit organizations For nonprofits like yours all of your funds will be reinvested in

This checklist is a comprehensive tool to use when preparing Form 990 EZ Short Form Return of Organization Exempt From Income Tax Under Sec 501 c 527 or 4947 a 1 of the Internal Revenue Code except private foundations The AICPA Tax Section s Annual Tax Compliance Kit provides a variety of resources to help you comply with tax laws and effectively serve your clients Form 990 Form 990 officially the Return of Organization Exempt From Income Tax 1 is a United States Internal Revenue Service IRS form that provides the public with information about a nonprofit organization 2 It is also used by government agencies to prevent organizations from abusing their tax exempt status 3

2020 Form IRS 990 EZ Instructions Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/543/439/543439730/large.png

2020 Form IRS Instructions Schedule A 990 Or 990 EZ Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/538/649/538649464/large.png

https://www.irs.gov/forms-pubs/about-form-990-ez

Information about Form 990 EZ Short Form Return of Organization Exempt from Income Tax including recent updates related forms and instructions on how to file Certain organizations file Form 990 EZ to provide the IRS with the information required by section 6033

https://www.irs.gov/charities-non-profits/charitable-organizations/forms-990-990-ez-and-990-n-509a3-supporting-organizations

A supporting organization described in section 509 a 3 is required to file Form 990 or 990 EZ if applicable but cannot file Form 990 N even if its gross receipts are normally 50 000 or less it is within the class of organizations affiliated with a church or convention or association of churches and exempt from federal income tax

How To Fill Out Form 990 EZ Instructions And Tips

2020 Form IRS 990 EZ Instructions Fill Online Printable Fillable Blank PdfFiller

IRS Form 990 EZ Filling Instructions Before Working On It

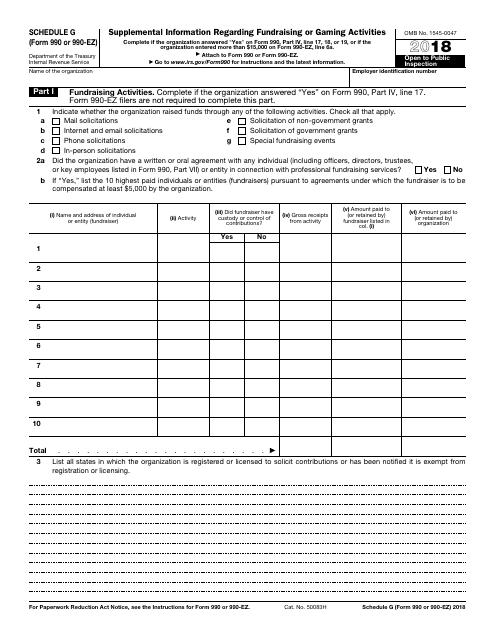

IRS Form 990 990 EZ Schedule G 2018 Fill Out Sign Online And Download Fillable PDF

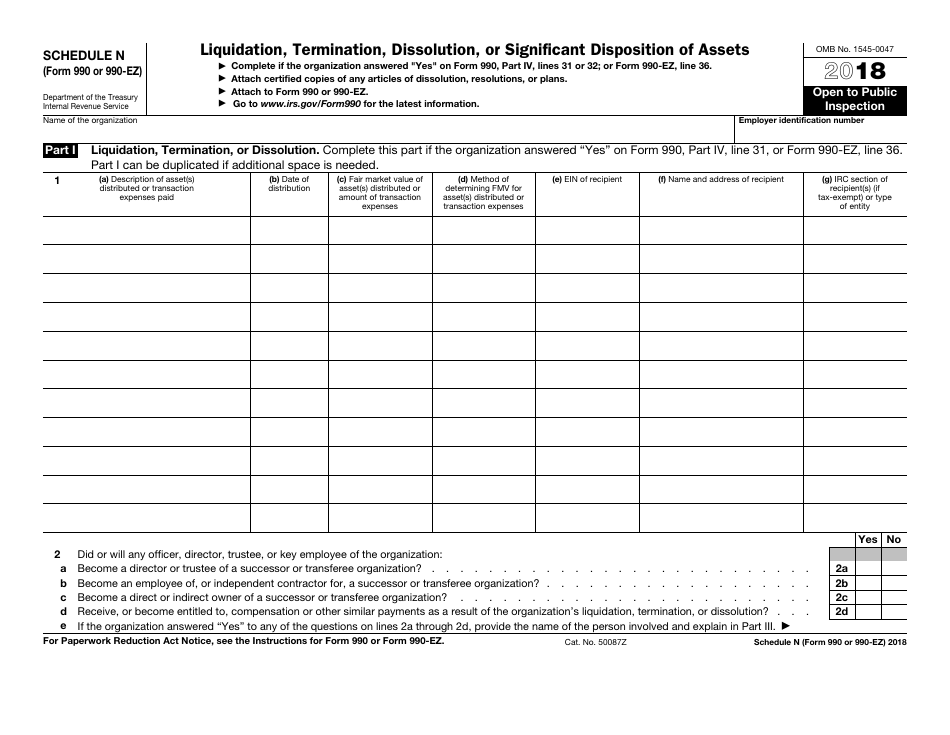

IRS Form 990 990 EZ Schedule N 2018 Fill Out Sign Online And Download Fillable PDF

990 Ez Fill Online Printable Fillable Blank Form 990 or 990 ez schedule n

990 Ez Fill Online Printable Fillable Blank Form 990 or 990 ez schedule n

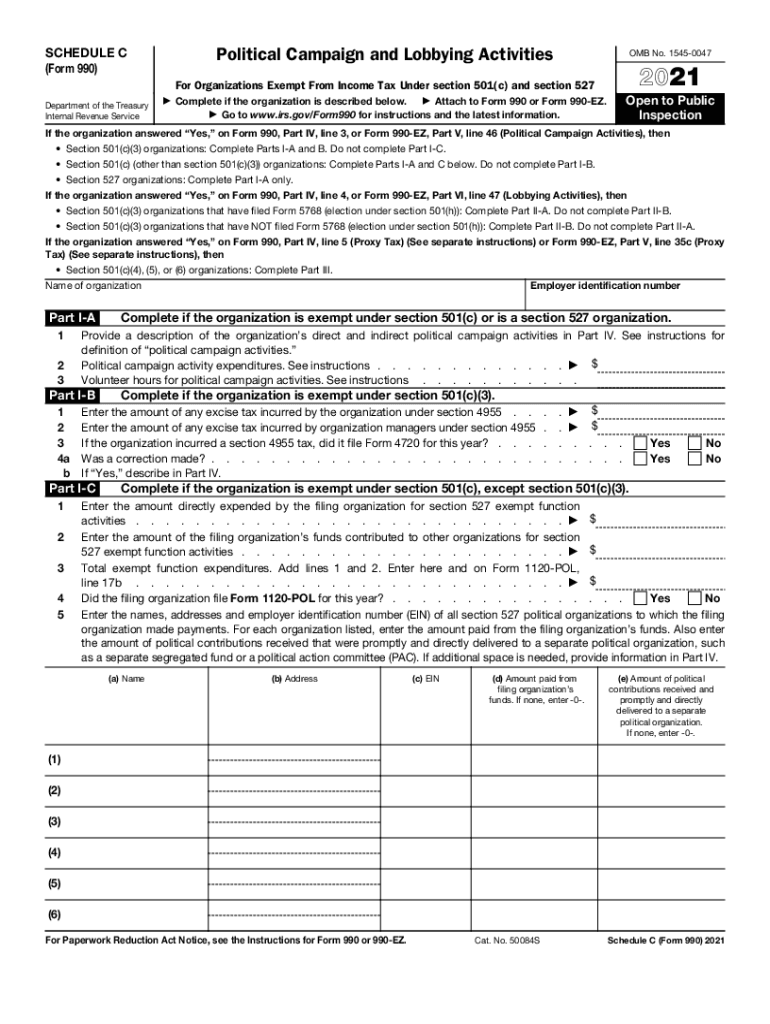

IRS 990 Or 990 EZ Schedule C 2021 2022 Fill And Sign Printable Template Online US Legal Forms

2022 IRS Form 990 EZ Instructions How To Fill Out Form 990 EZ

2009 Form IRS 990 EZ Fill Online Printable Fillable Blank PdfFiller

Irs Form 990 Ez Printable - I Tax exemptstatus check only one 501 c 3 LI 501 c I insert no LI 4947 a 1 or LI527 Form 990 990 EZ or 990 PF K Form of organization ICorporation LI Trust LI Association LI Other C Add lines 5b 6c and 7b to line 9 to determine gross receipts If gross receipts are 200 000 or more or if total assets Part II column B