Irs Gov Printable Form 8962 You must reconcile your premium tax credit when you file your tax return if you were enrolled in Health Insurance Marketplace plan

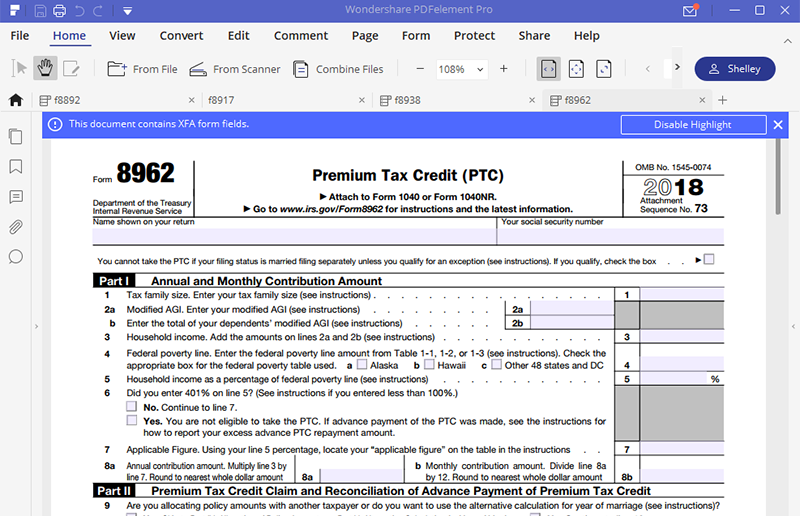

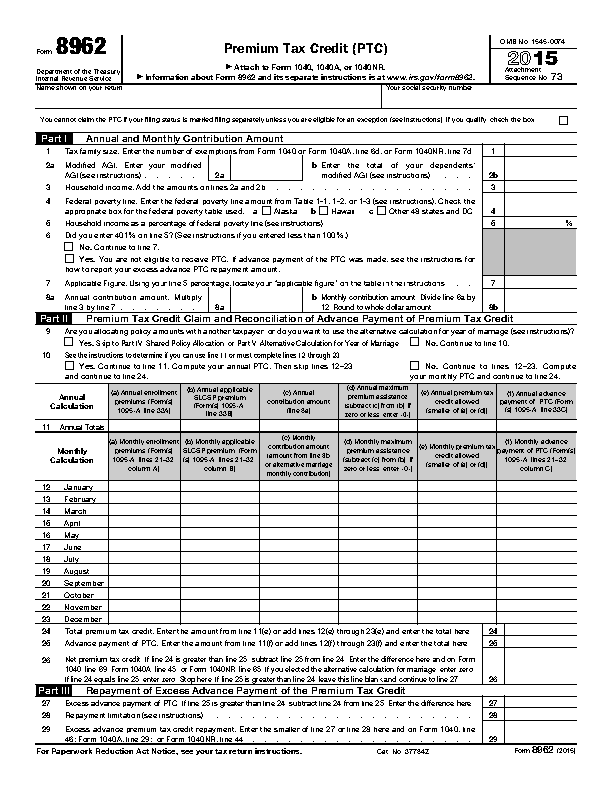

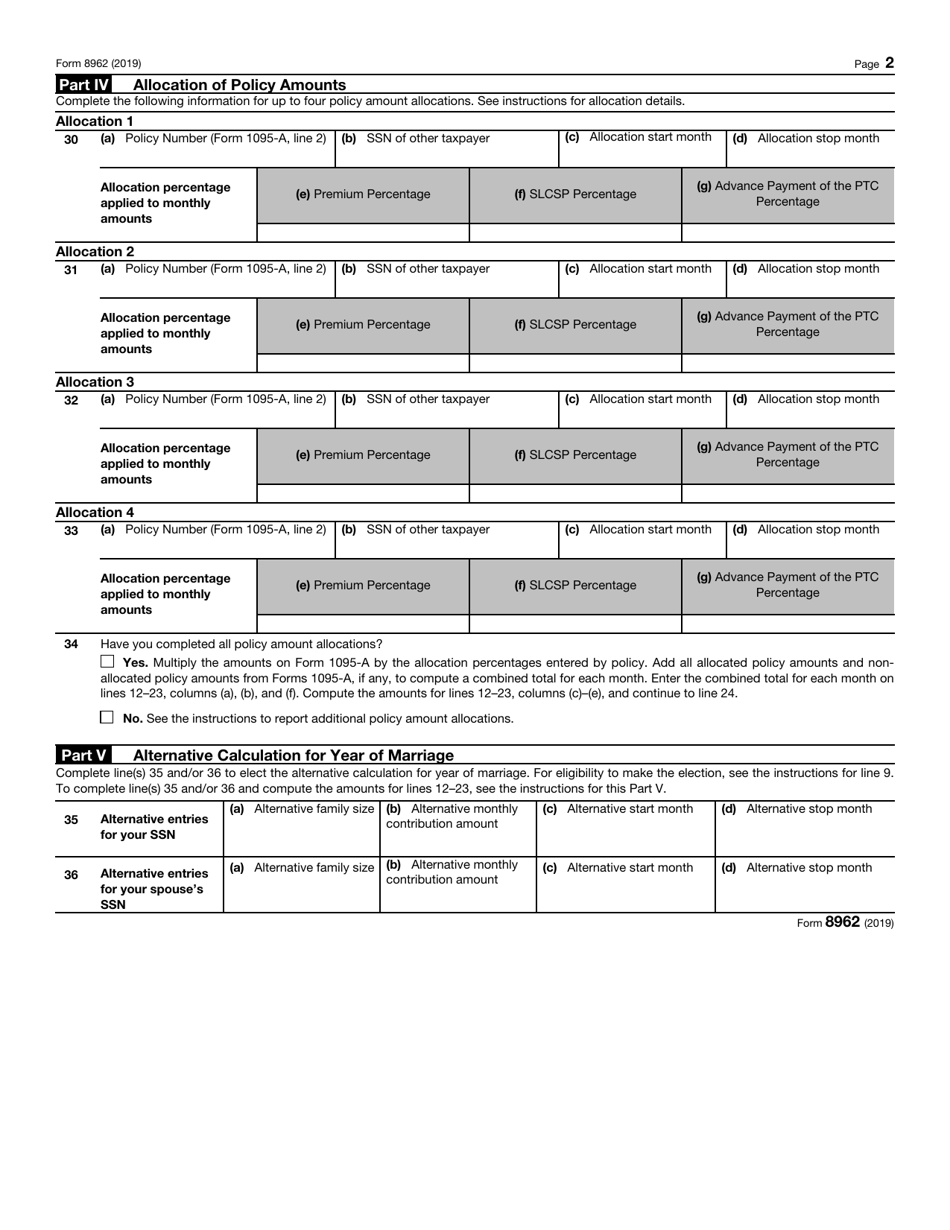

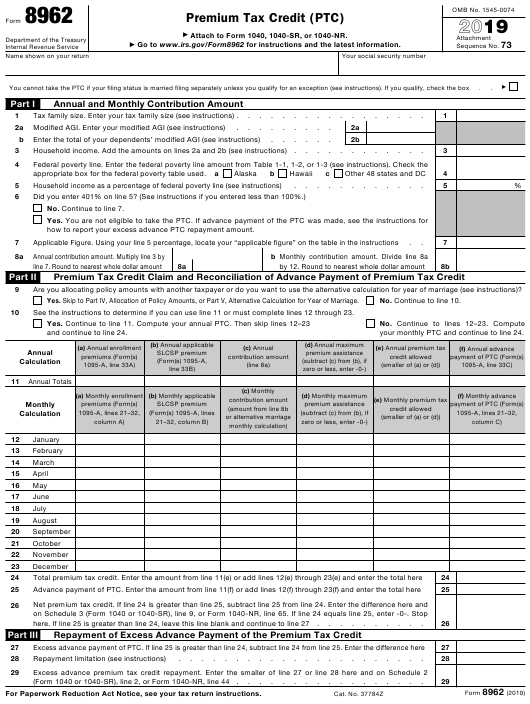

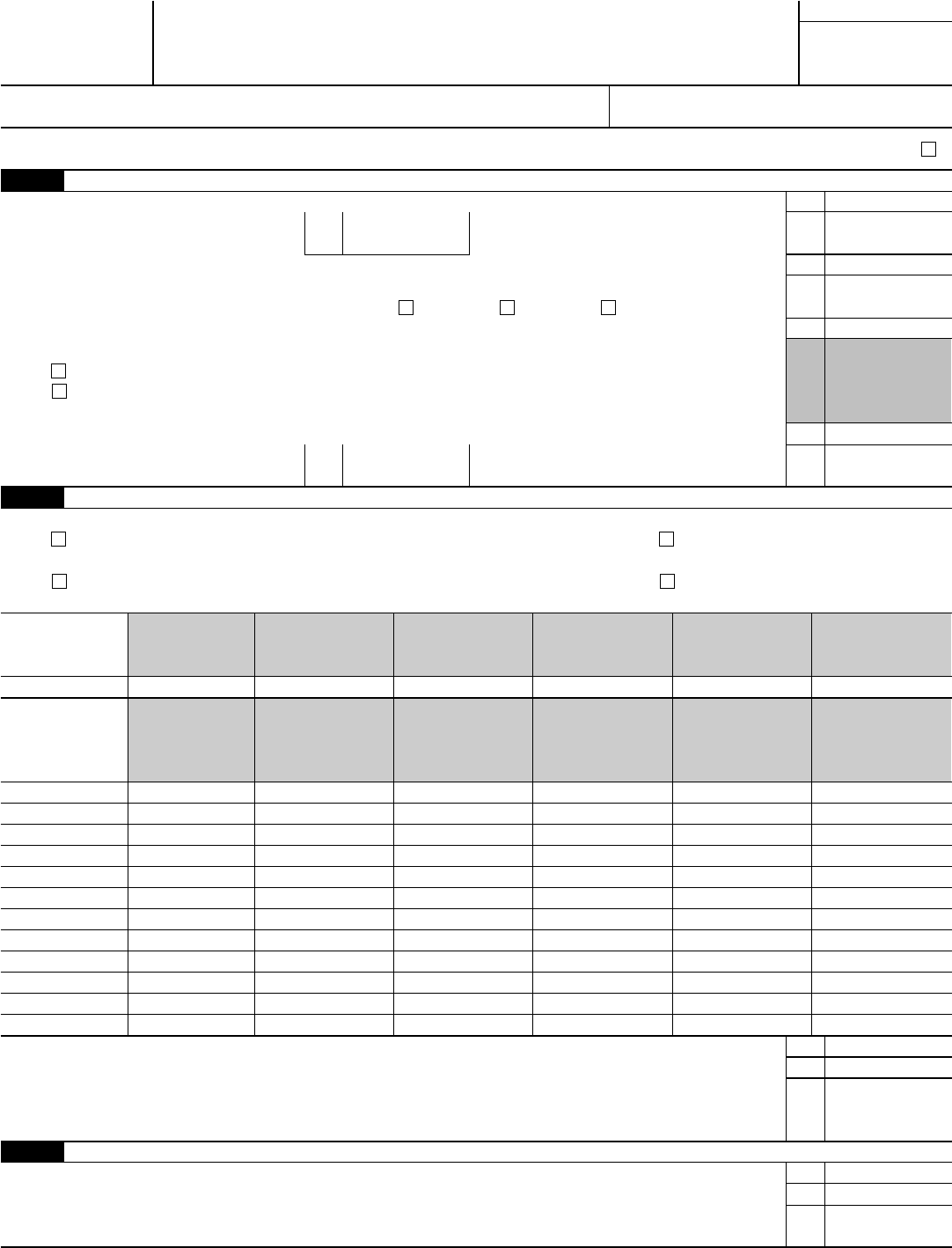

Form 8962 is used to estimate the amount of premium tax credit for which you re eligible if you re insured through the Health Insurance Marketplace You need to complete Form 8962 if you The purpose of Form 8962 is to allow filers to calculate their Premium Tax Credit amount with their federal return With that amount they re then able to reconcile that amount with any advance payments of the Advance Premium Tax Credit APTC that have been made for the filer throughout the year

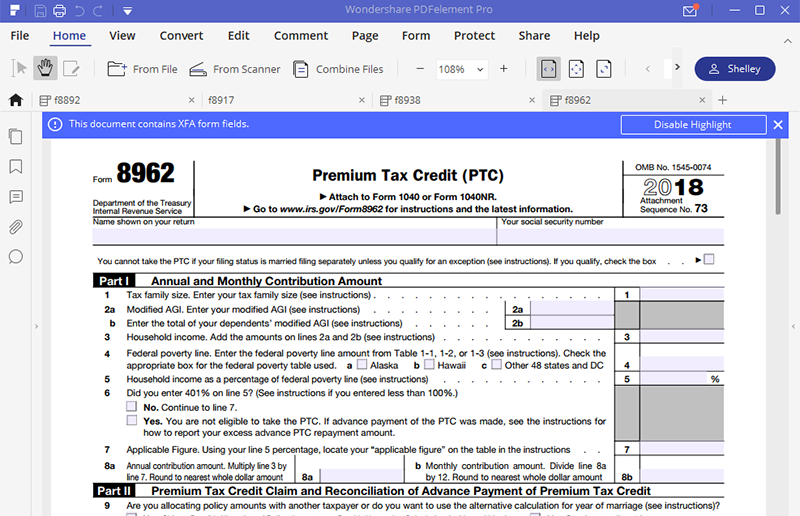

Irs Gov Printable Form 8962

Irs Gov Printable Form 8962

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-8962.png

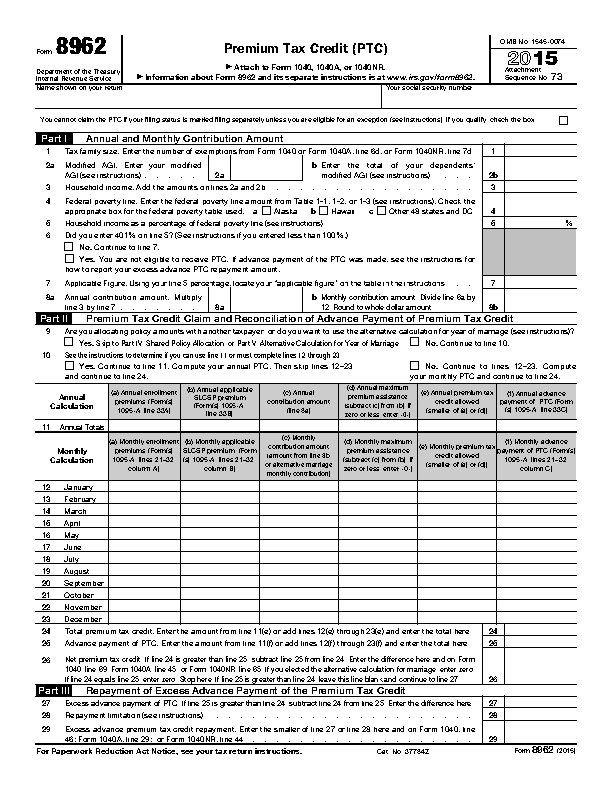

Free Free Irs 8962 Printable Forms Printable Forms Free Online

https://staticformsprocdn.azureedge.net/irs-form-8962-for-2015/irs-form-8962-for-2015-thumbnail.png

2018 Form IRS Instructions 8962 Fill Online Printable Fillable Blank PDFfiller

https://www.pdffiller.com/preview/459/416/459416023/large.png

Include Premium Tax Credit Form 8962 Be aware that 2021 electronically filed tax returns that require taxpayers to reconcile advance Premium Tax Credit payments on Form 8962 will be rejected this year if the form is missing Taxpayers and practitioners can simply complete a new tax return including the required line amounts attach the Form Form 8962 Premium Tax Credit If you had Marketplace coverage and used the premium tax credit to lower your monthly plan premiums you must file this tax form with your federal income tax return You ll use this form to reconcile to find out if you used more or less of the premium tax credit than you qualify for

If you purchased health insurance from the Healthcare gov site or your state healthcare marketplace if you live in a state that maintains one you ll need to use Tax Form 8962 This form has two parts you ll need to fill out Determining your eligibility for the credit Claiming the premium tax credit Form 8962 is also used to reconcile Medicaid Unwinding Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the Marketplace during that year At

More picture related to Irs Gov Printable Form 8962

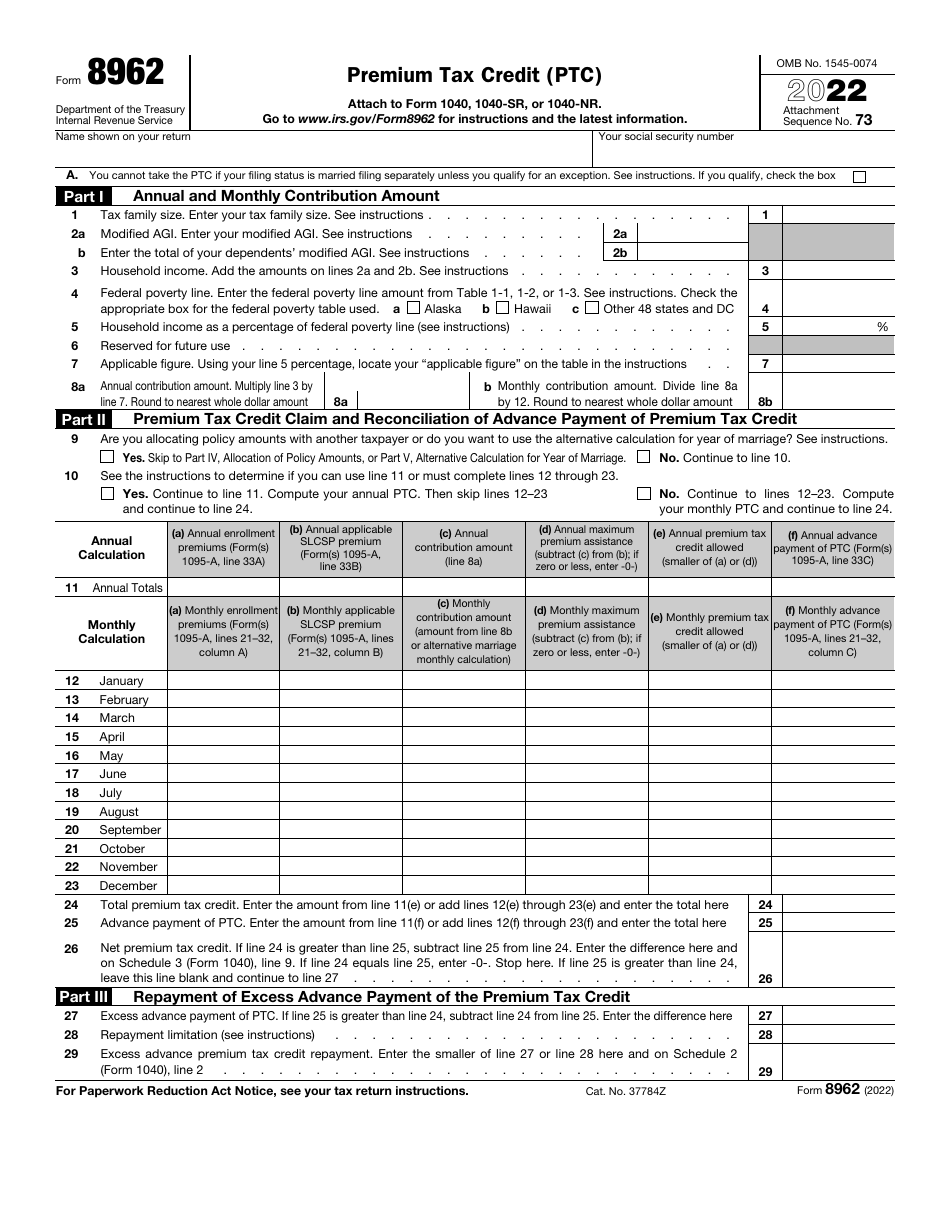

IRS Form 8962 Download Fillable PDF Or Fill Online Premium Tax Credit Ptc 2022 Templateroller

https://data.templateroller.com/pdf_docs_html/2550/25504/2550476/irs-form-8962-premium-tax-credit-ptc_print_big.png

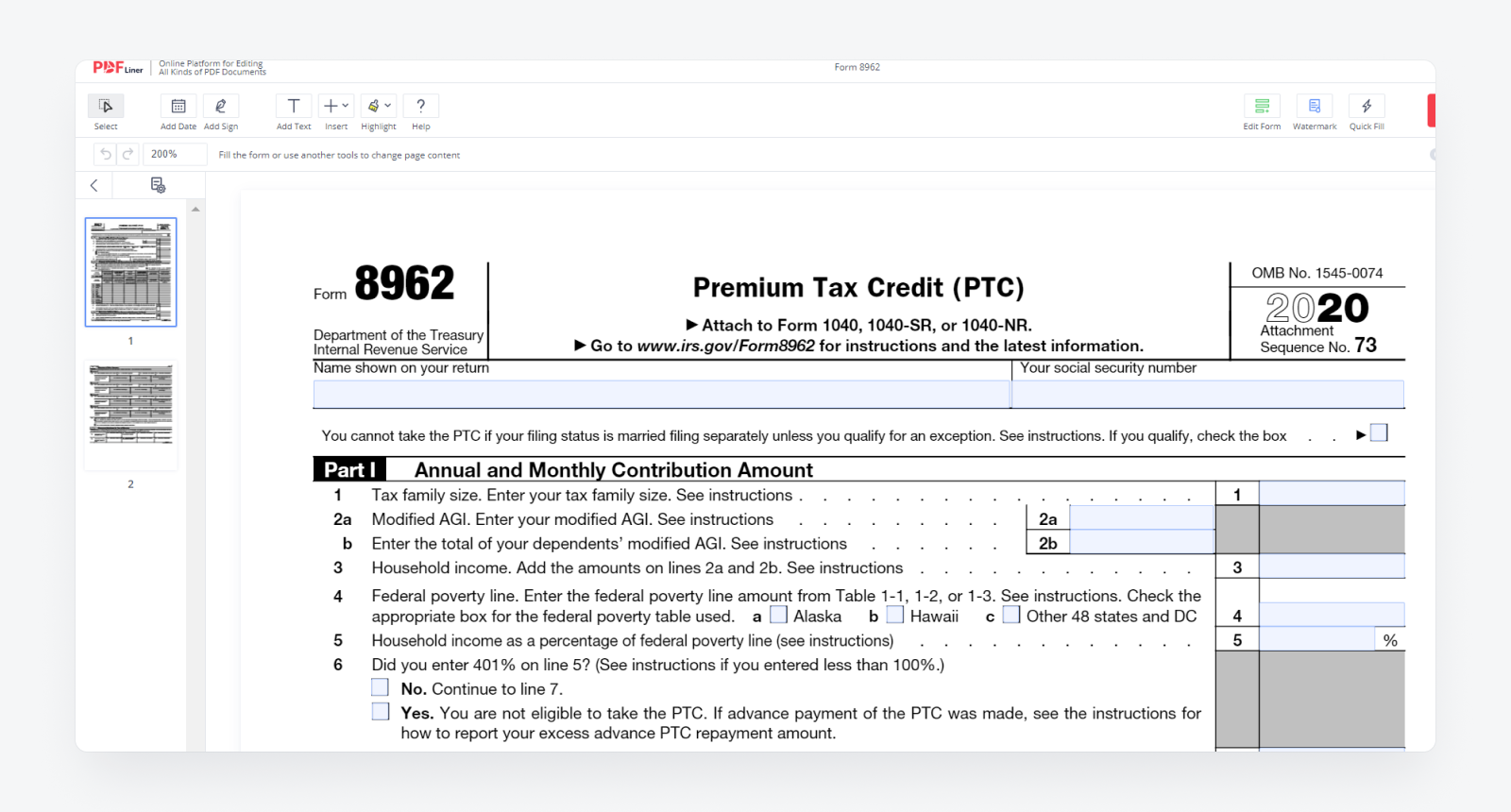

8962 Instructions 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/536/160/536160325/large.png

How To Get IRS Form 8962 Two Quick Ways

https://pdfliner.com/howTo/img/tild6563-6437-4932-b134-616132633030__8962.png

The net premium tax credit a taxpayer can claim the excess of the taxpayer s premium tax credit over APTC will appear on Form 1040 Schedule 3 This amount will increase taxpayer s refund or reduce the balance due Note If a taxpayer must repay APTC or gets additional PTC remember to adjust the insurance premium deduction on Schedule A Form 8962 is used to figure the amount of Premium Tax Credit and reconcile it with any advanced premium tax credit paid

At the top of Form 8962 enter your name and Social Security number Step 3 Calculate the Annual and Monthly Contribution Amounts in Part I of Form 8962 Line 1 Use your tax return to enter the size of your tax family on line 1 This number generally includes you your spouse if filing jointly and your dependents Form Sources The Internal Revenue Service usually releases income tax forms for the current tax year between October and January although changes to some forms can come even later We last updated Federal Form 8962 from the Internal Revenue Service in January 2024 Show Sources Historical Past Year Versions of Federal Form 8962

Instructions For IRS Form 8962 DocFormats

https://www.docformats.com/wp-content/uploads/2022/06/Instructions-for-IRS-Form-8962-PDF.jpg

Form 8962 Instructions Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/489/187/489187822/large.png

https://www.healthcare.gov/taxes-reconciling/

You must reconcile your premium tax credit when you file your tax return if you were enrolled in Health Insurance Marketplace plan

https://www.investopedia.com/irs-form-8962-understanding-your-form-8962-4845835

Form 8962 is used to estimate the amount of premium tax credit for which you re eligible if you re insured through the Health Insurance Marketplace You need to complete Form 8962 if you

How To File IRS Form 8962 For 2022 Premium Tax Credit YouTube

Instructions For IRS Form 8962 DocFormats

IRS Instructions 8962 2016 Fill Out Tax Template Online US Legal Forms

Fill Free Fillable Form 8962 Premium Tax Credit PDF Form

:max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)

IRS Form 8962 Understanding Your Form 8962

How To Fill Out IRS Form 8962 Correctly

How To Fill Out IRS Form 8962 Correctly

IRS Form 8962 2019 Fill Out Sign Online And Download Fillable PDF Templateroller

Irs Form 8962 Printable 2021 Printable Form 2023

Free Free Irs 8962 Printable Forms Printable Forms Free Online

Irs Gov Printable Form 8962 - 3 Fill out Form 8962 to reconcile Use the information from your 1095 A to fill out Form 8962 Premium Tax Credit Use Form 8962 to reconcile your premium tax credit compare the amount you used in 2021 to lower your monthly insurance payment with the actual premium tax credit you qualify for based on your final 2021 income