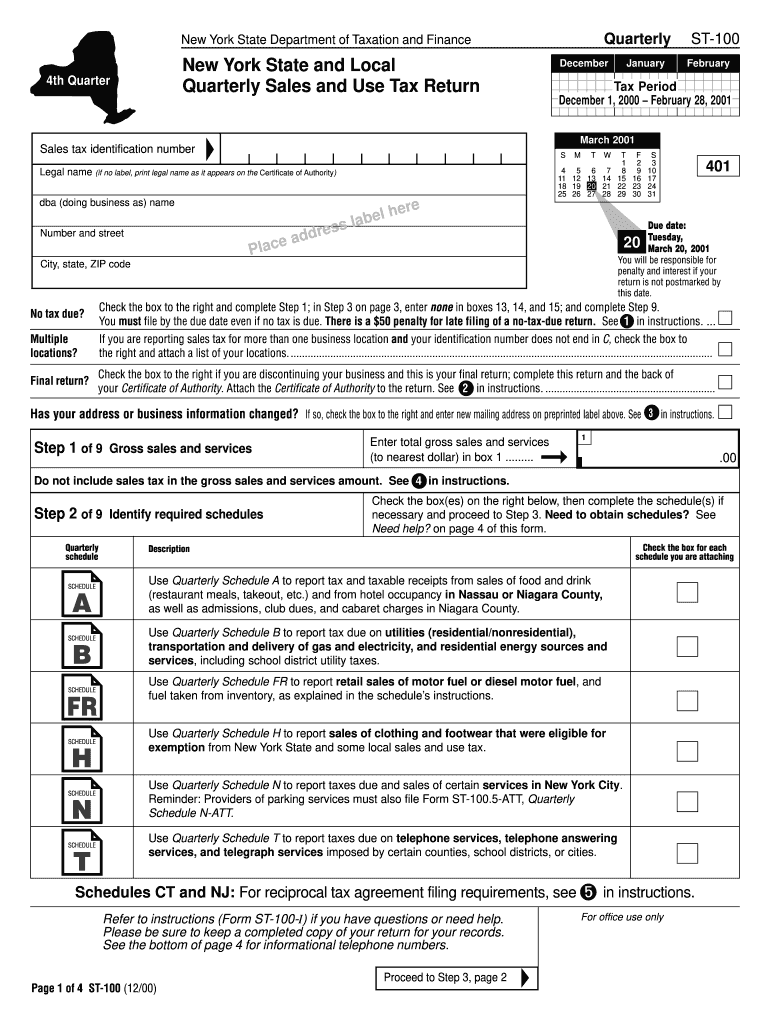

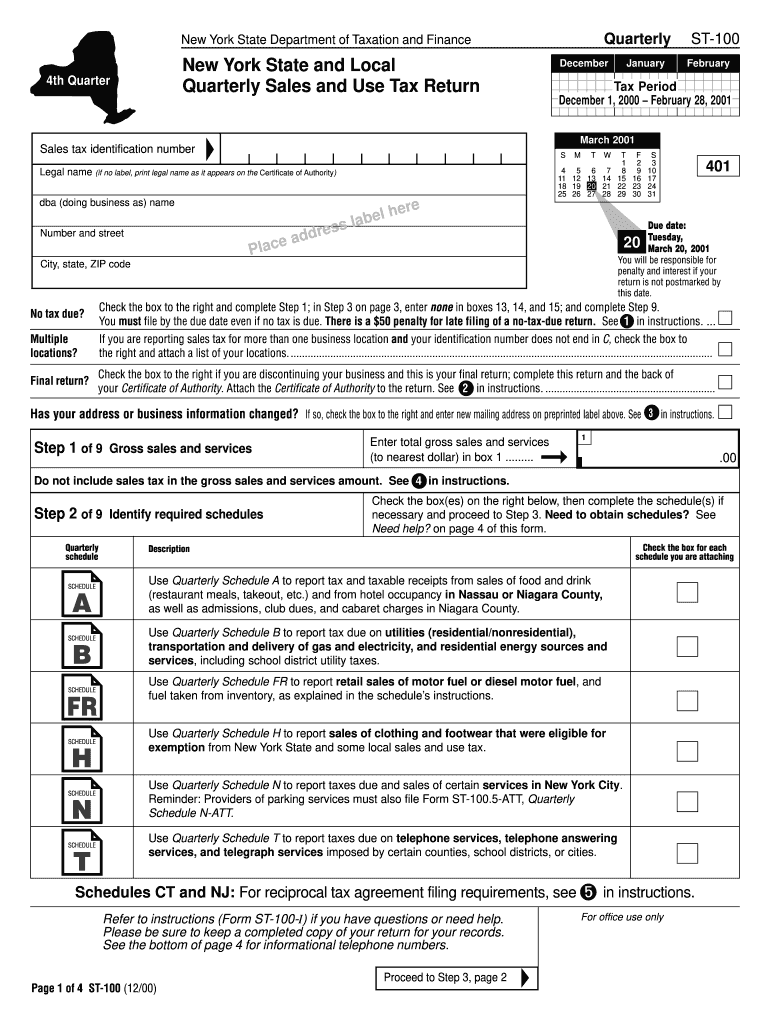

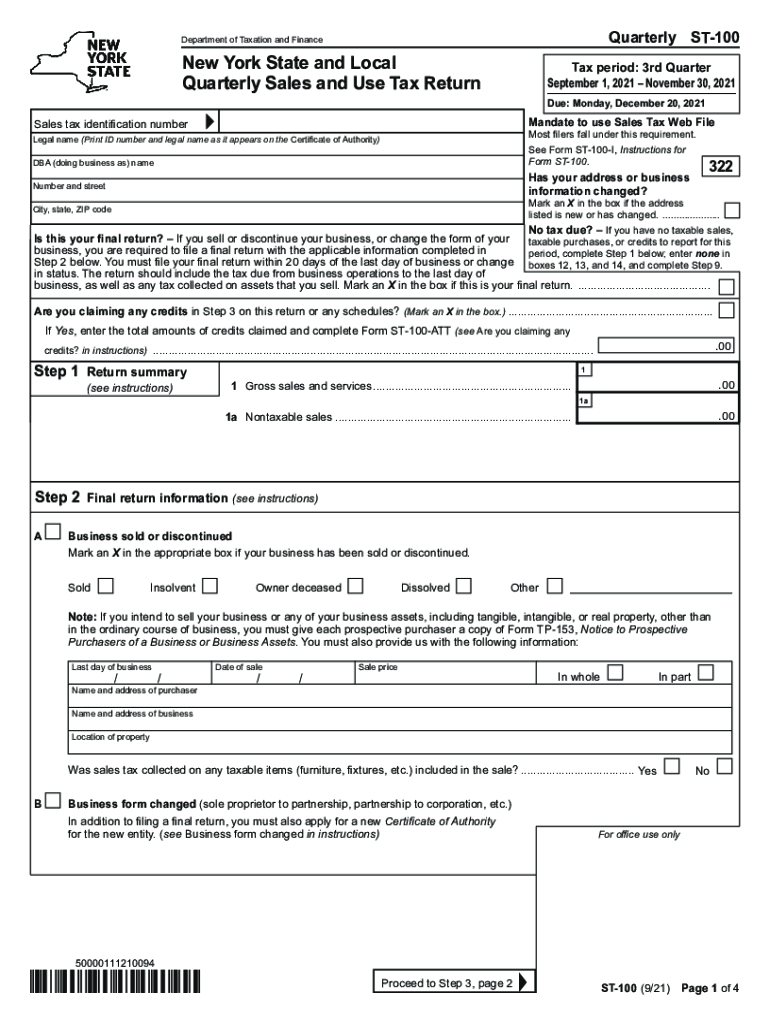

Printable Nys Sales Tax Form St 100 1 1a 00 00 New York State and Local Quarterly Sales and Use Tax Return Department of Taxation and FinanceQuarterly ST 100 Sales tax identification number Legal name Print ID number and legal name as it appears on the Certificate of Authority DBA doing business as name Number and street City state ZIP code Proceed to Step 3 page 2

Form ST 100 New York State and Local Quarterly Sales and Use Tax Return Web File is FREE No additional software needed Nearly 90 of businesses use Sales Tax Web File to file their quarterly returns Benefits include Automatic calculation of amounts due Up to date taxing jurisdiction information Scheduled payments up to the due date Form ST 100 New York State and Local Quarterly Sales and Use Tax Return is a formal document used by companies based in New York to notify the tax authorities about the total amount of sales of goods purchases and credits every quarter of the calendar year

Printable Nys Sales Tax Form St 100

Printable Nys Sales Tax Form St 100

https://data.formsbank.com/pdf_docs_html/333/3336/333681/page_1_thumb_big.png

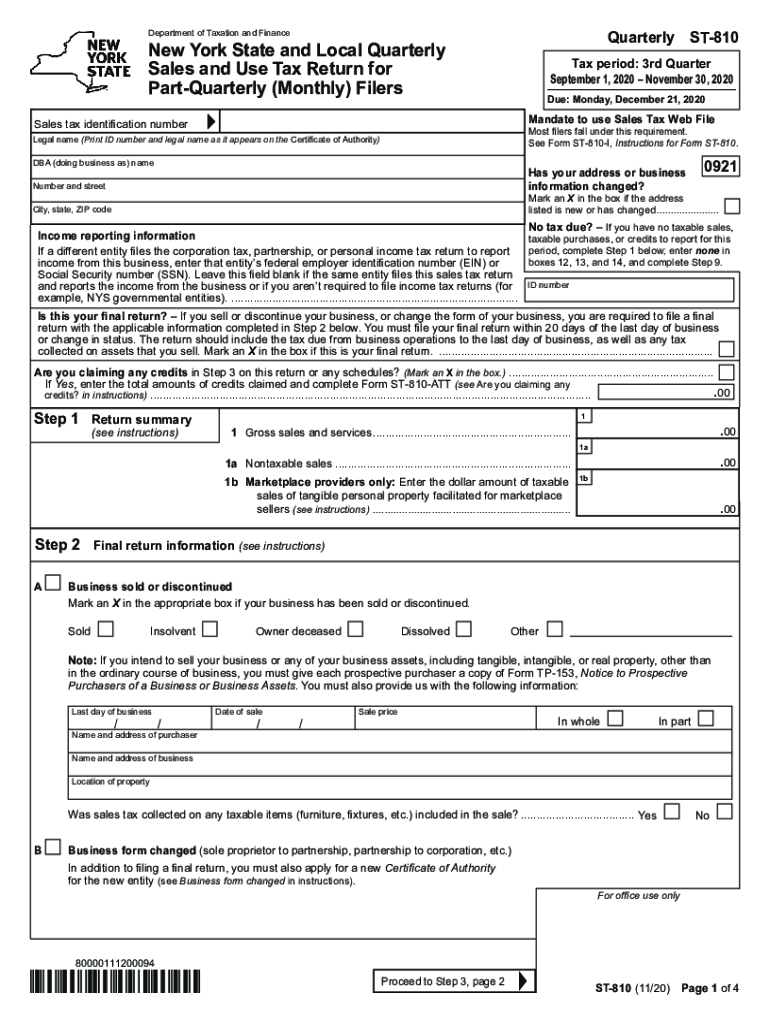

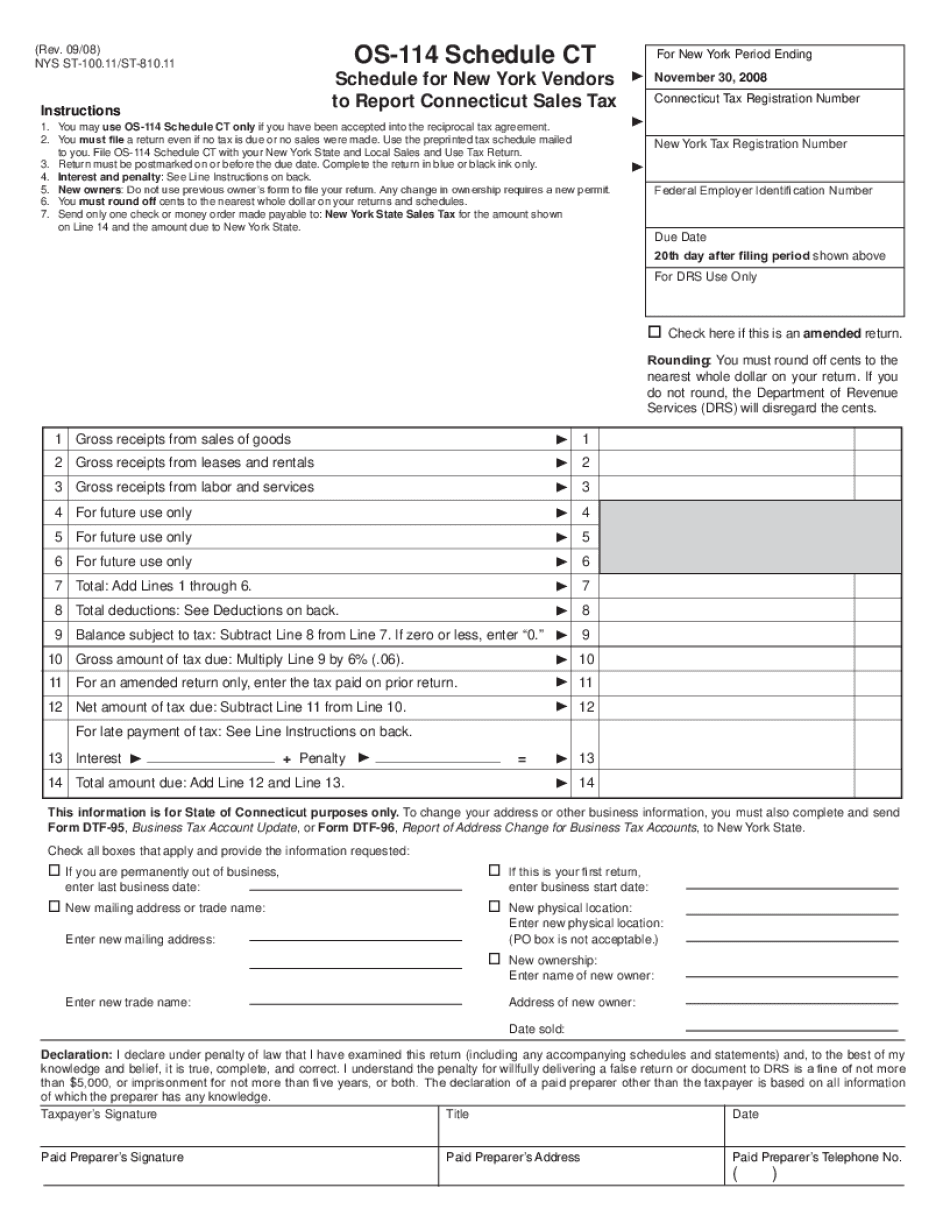

St810 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/533/497/533497880/large.png

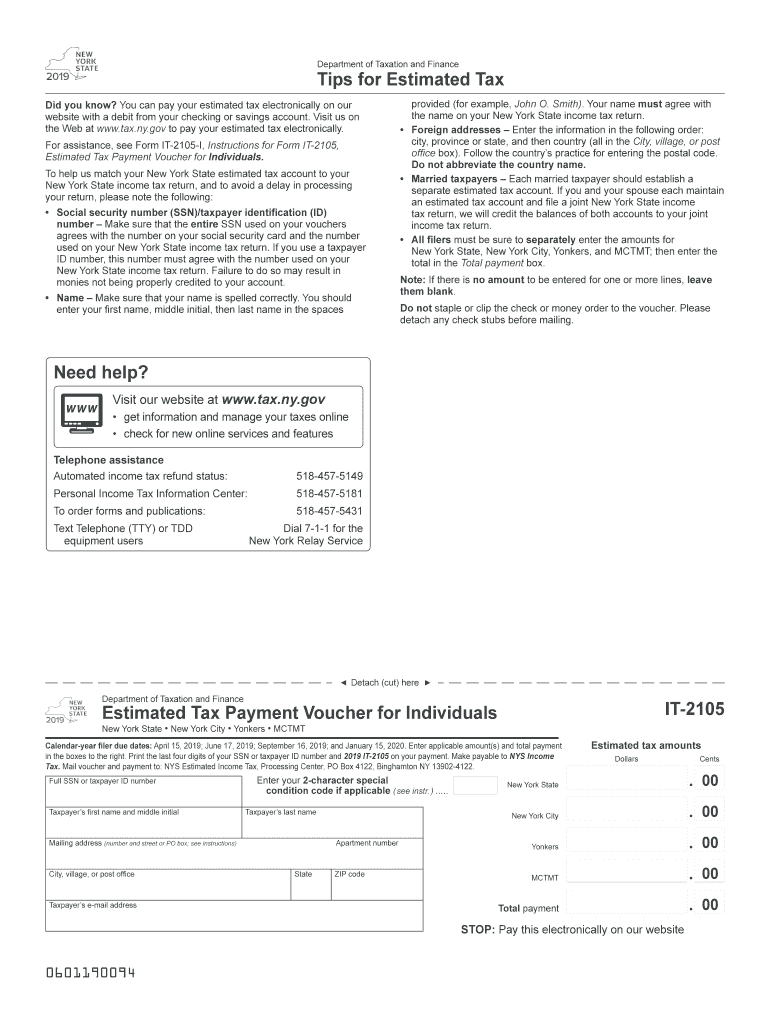

2019 Form NY IT 2105 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/468/972/468972300/large.png

Instructions for Form ST 100 New York State and Local Quarterly Sales and Use Tax Return For 1st quarter tax period March 1 2021 through May 31 2021 Highlights Albany County Beginning December 1 2020 Albany County is imposing the five cent paper carryout bag reduction fee ST 100 9 15 Page 1 of 4 Mandate to use Sales Tax Web File Most filers fall under this requirement see Form ST 100 I instructions B Business form changed sole proprietor to partnership partnership to corporation etc In addition to filing a final return you must also apply for a new Certificate of Authority for the new entity See in

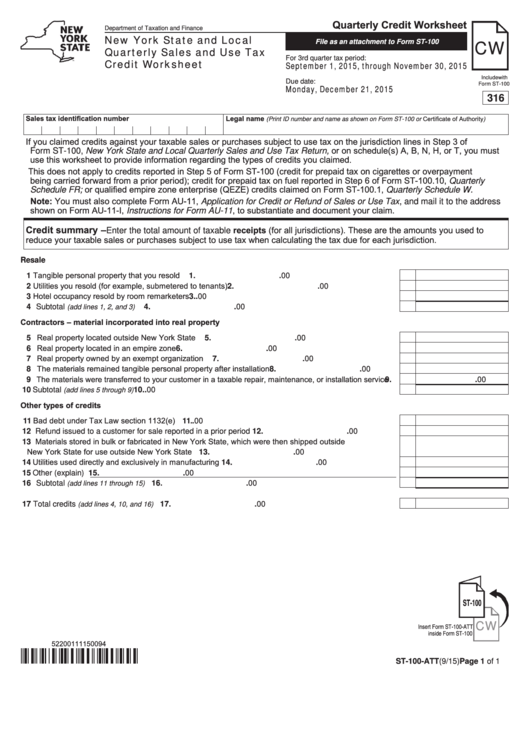

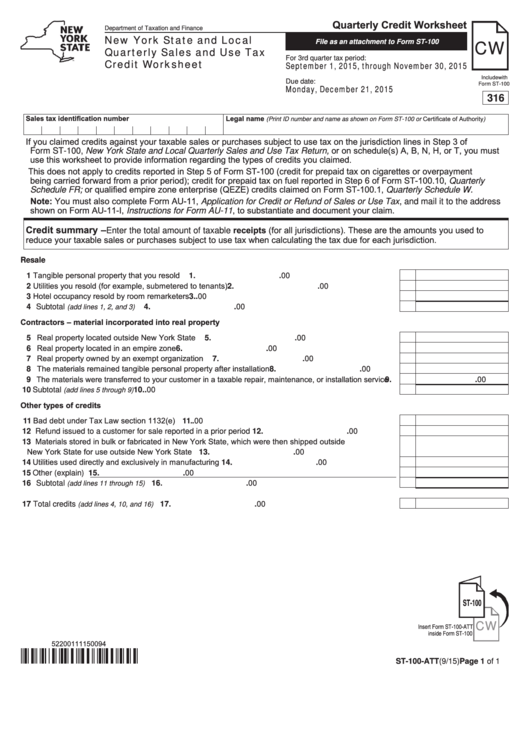

Information changed Mark an X in the box if the address listed is new or has changed see in instr No tax due If you have no taxable sales taxable purchases or credits to report for this period complete Step 1 below enter none in boxes 12 13 and 14 and complete Step 9 ID number Is this your inal return You must complete and submit this worksheet to provide information about the types of credits you claimed against your taxable sales or purchases subject to tax on the jurisdiction lines in Step 3 of Form ST 100 New York State and Local Quarterly Sales and Use Tax Return Schedule A B H N or T or

More picture related to Printable Nys Sales Tax Form St 100

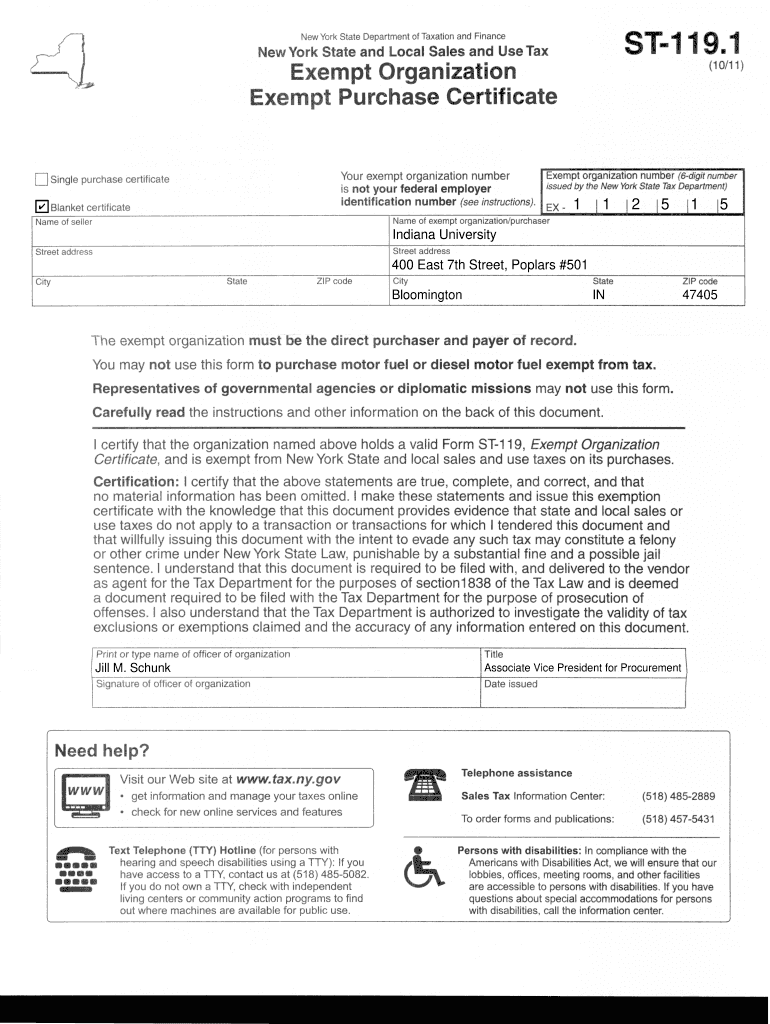

Nys Sales Tax Exempt Form 119 1 ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/nys-tax-exempt-form-st-119-1-fill-out-and-sign-printable-pdf-template-1.png

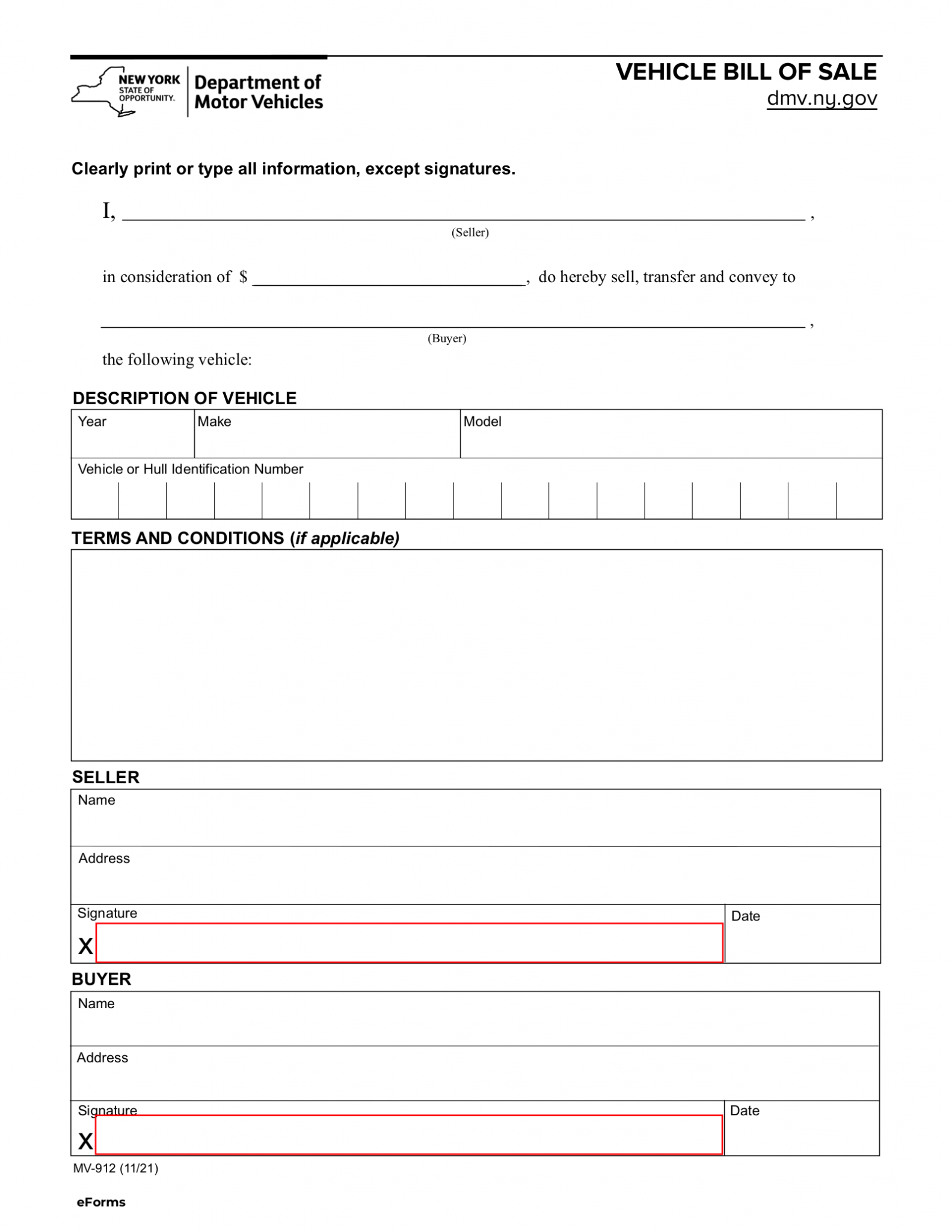

New York Gr tis Nota Fiscal De Venda Formul rios PDF EForms Share Me

https://eforms.com/images/2015/12/New-York-DMV-Bill-of-Sale-Form-mv-912-1583x2048.png

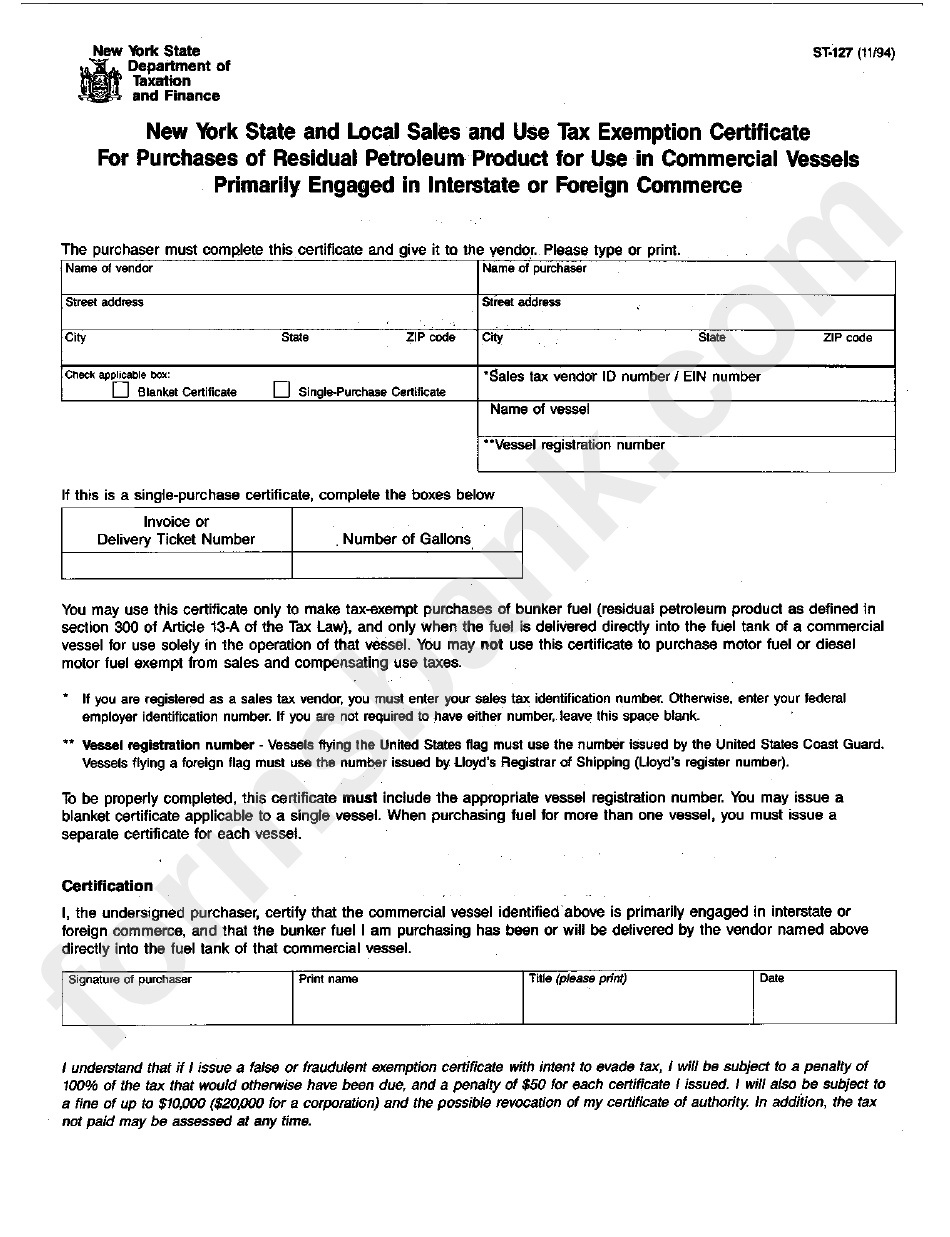

Form St 127 Nys And Local Sales And Use Tax Exemption Certificate Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/224/2242/224270/page_1_bg.png

ST 100 9 20 Page 1 of 4 Mandate to use Sales Tax Web File Most filers fall under this requirement See Form ST 100 I Instructions for Form ST 100 B Business form changed sole proprietor to partnership partnership to corporation etc In addition to filing a final return you must also apply for a new Certificate of Authority for the new Use Form ST 100 7 Quarterly Schedule H to report sales of clothing and footwear eligible for exemption from New York State and some local sales and use tax Use Form ST 100 5 Quarterly Schedule N to report taxes due and sales of certain services in New York City Reminder Providers of parking services must also file Form ST 100 5 ATT

NY Form ST 100 New York State and Local Quarterly Sales and Use Tax Return CFS Tax Software Inc NY Form ST 100 New York State and Local Quarterly Sales and Use Tax Return Click the link to get the form instructions from the New York website Current year forms and instructions Prior year forms and instructions How did we do Instructions for Form ST 100 New York State and Local Quarterly Sales and Use Tax Return For tax period June 1 2011 through August 31 2011 New

New York State Sales Tax Form St 100 Dec 12 Feb 13 Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/100/49/100049568/large.png

0908 NYS ST 100 Tax Ny Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/0/130/130308/big.png

https://www.tax.ny.gov/pdf/current_forms/st/st100.pdf

1 1a 00 00 New York State and Local Quarterly Sales and Use Tax Return Department of Taxation and FinanceQuarterly ST 100 Sales tax identification number Legal name Print ID number and legal name as it appears on the Certificate of Authority DBA doing business as name Number and street City state ZIP code Proceed to Step 3 page 2

https://www.tax.ny.gov/bus/ads/webst100.htm

Form ST 100 New York State and Local Quarterly Sales and Use Tax Return Web File is FREE No additional software needed Nearly 90 of businesses use Sales Tax Web File to file their quarterly returns Benefits include Automatic calculation of amounts due Up to date taxing jurisdiction information Scheduled payments up to the due date

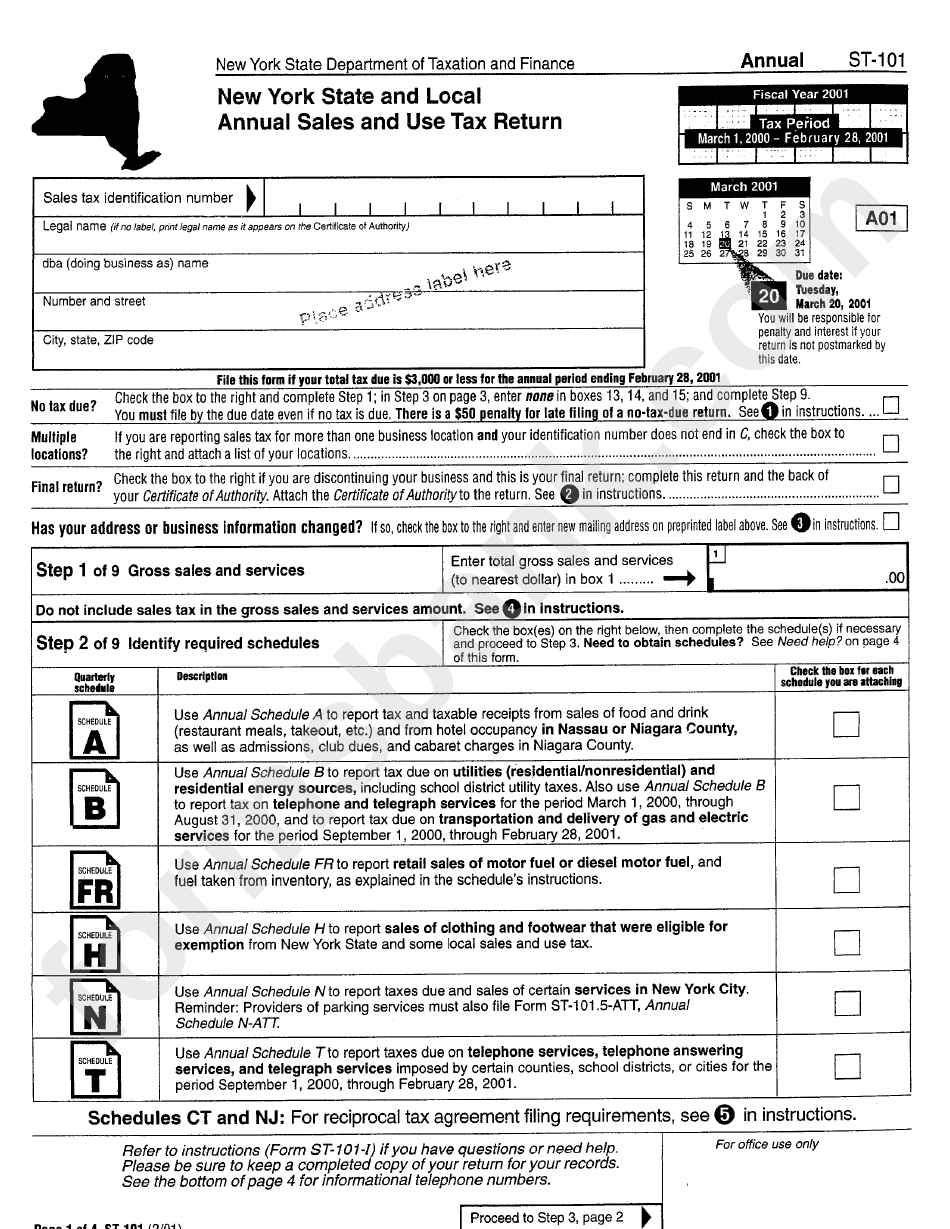

Form St 101 New York State And Local Annual Sales And Use Tax Return Printable Pdf Download

New York State Sales Tax Form St 100 Dec 12 Feb 13 Fill Out And Sign Printable PDF Template

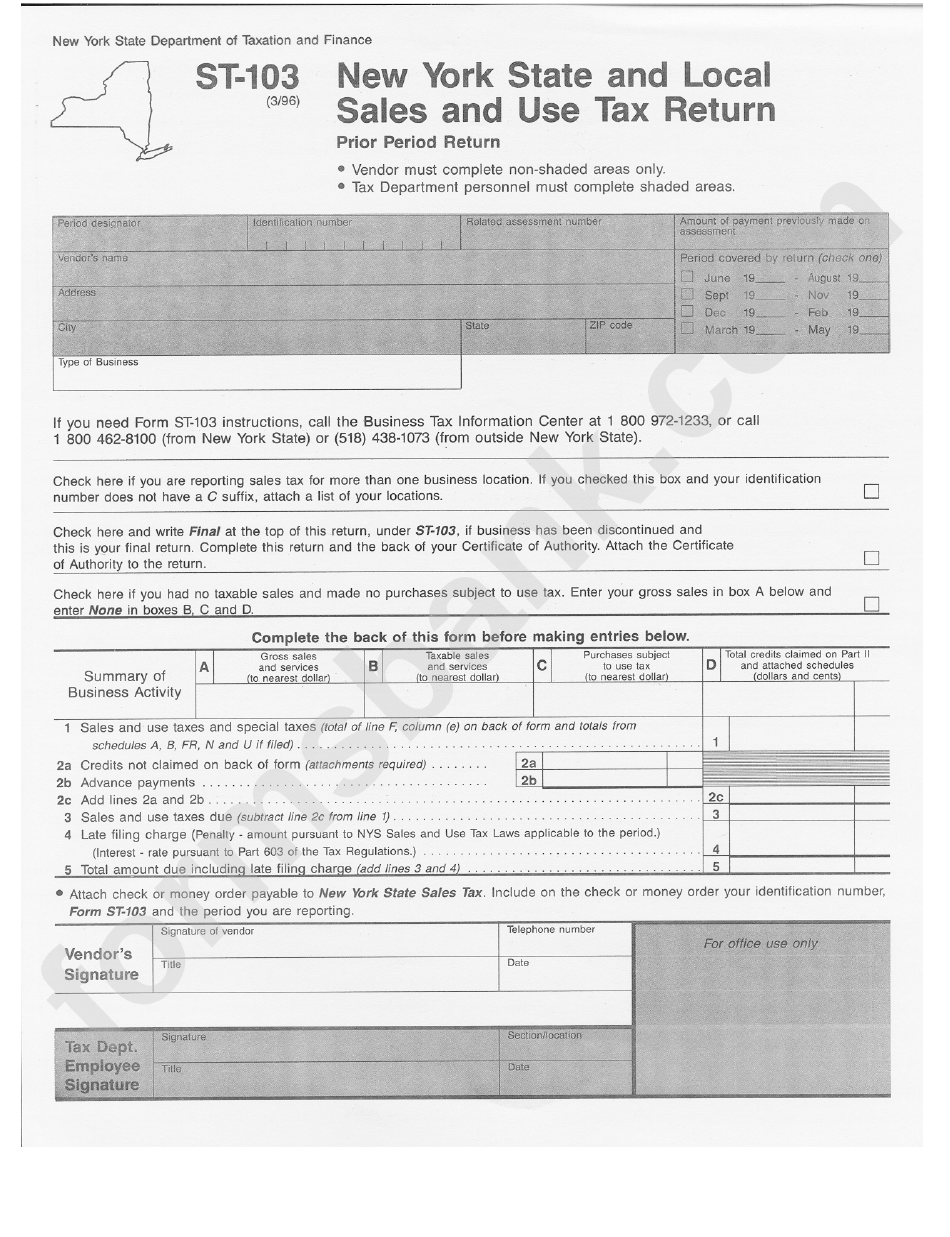

Form St 103 New York State And Local Sales And Use Tax Return Printable Pdf Download

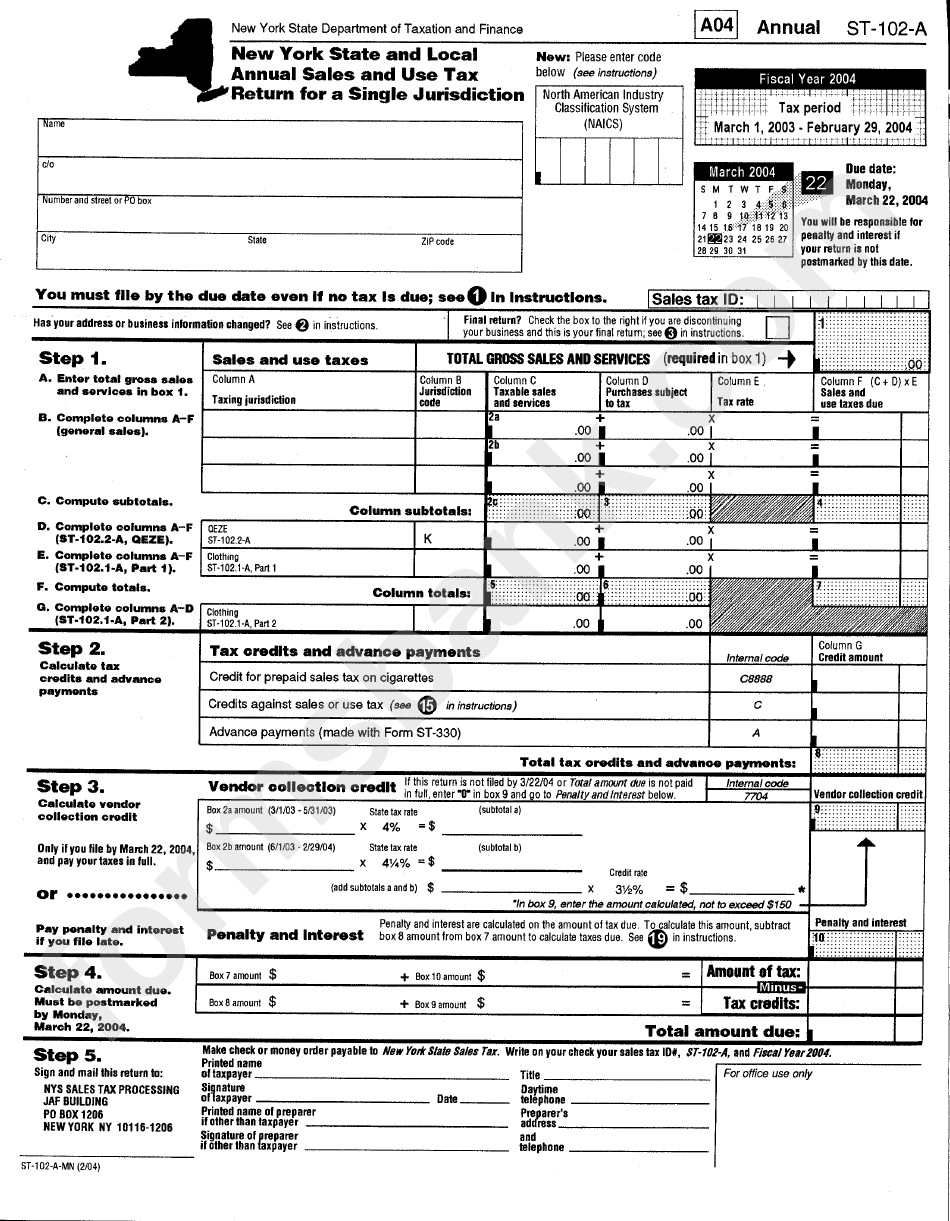

Form St 102 A New York State And Local Annual Sales And Use Tax Return For A Single

132 New York State Department Of Taxation And Finance Sales Tax Forms And Templates Free To

DMV Bill Of Sale Form New York Free Download

DMV Bill Of Sale Form New York Free Download

St 100 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

NY DTF ST 100 ATT 2020 2021 Fill Out Tax Template Online US Legal Forms

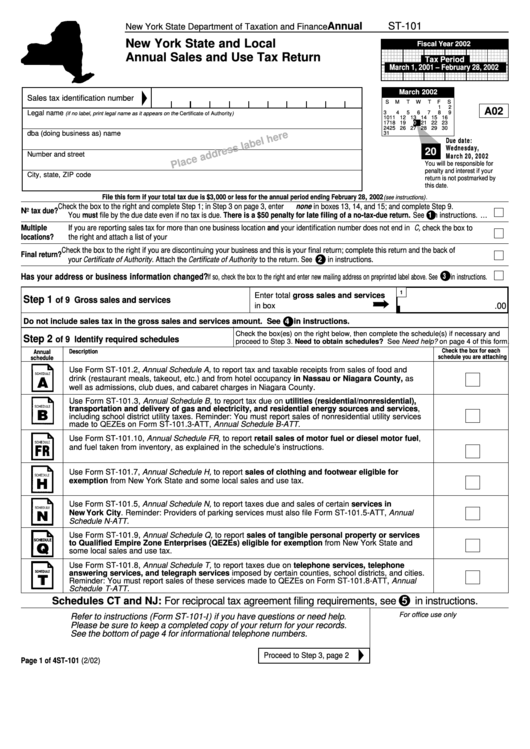

Form St 101 New York State And Local Annual Sales And Use Tax Return 2002 Printable Pdf Download

Printable Nys Sales Tax Form St 100 - INSTRUCTIONS NEW YORK STATE AND LOCAL QUARTERLY SALES AND USE TAX RETURN Form ST 100 New York businesses whose combined total of taxable receipts and other transactions subject state tax is 300 00 or more in a quarter must file a form ST 100 on a monthly basis