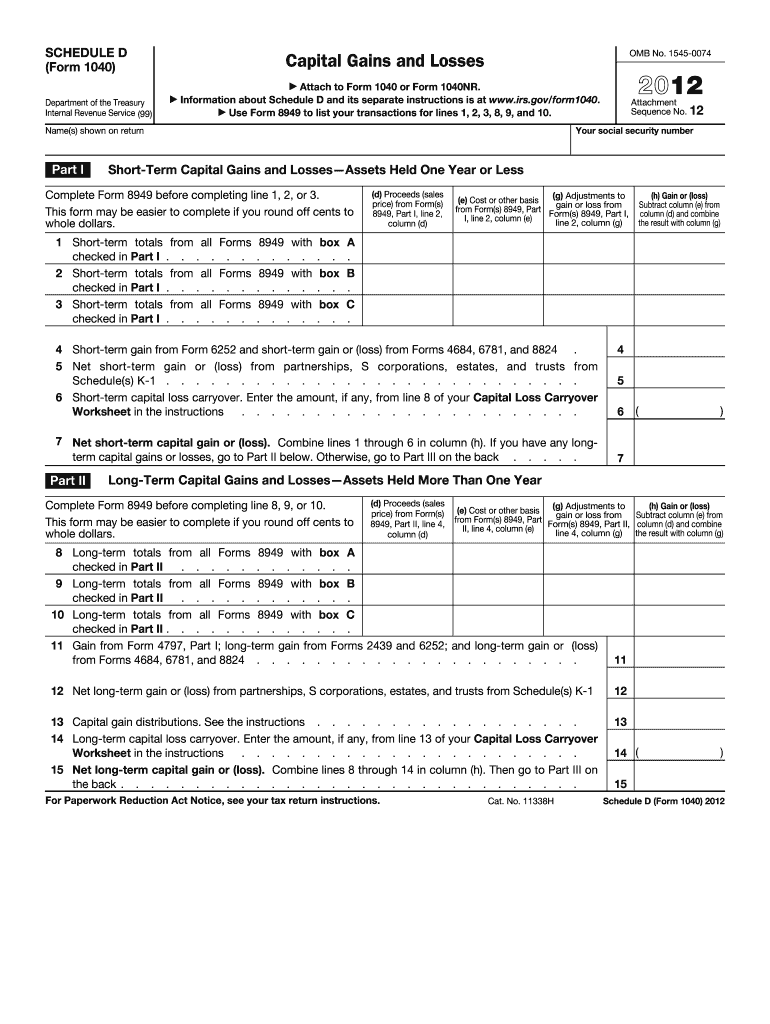

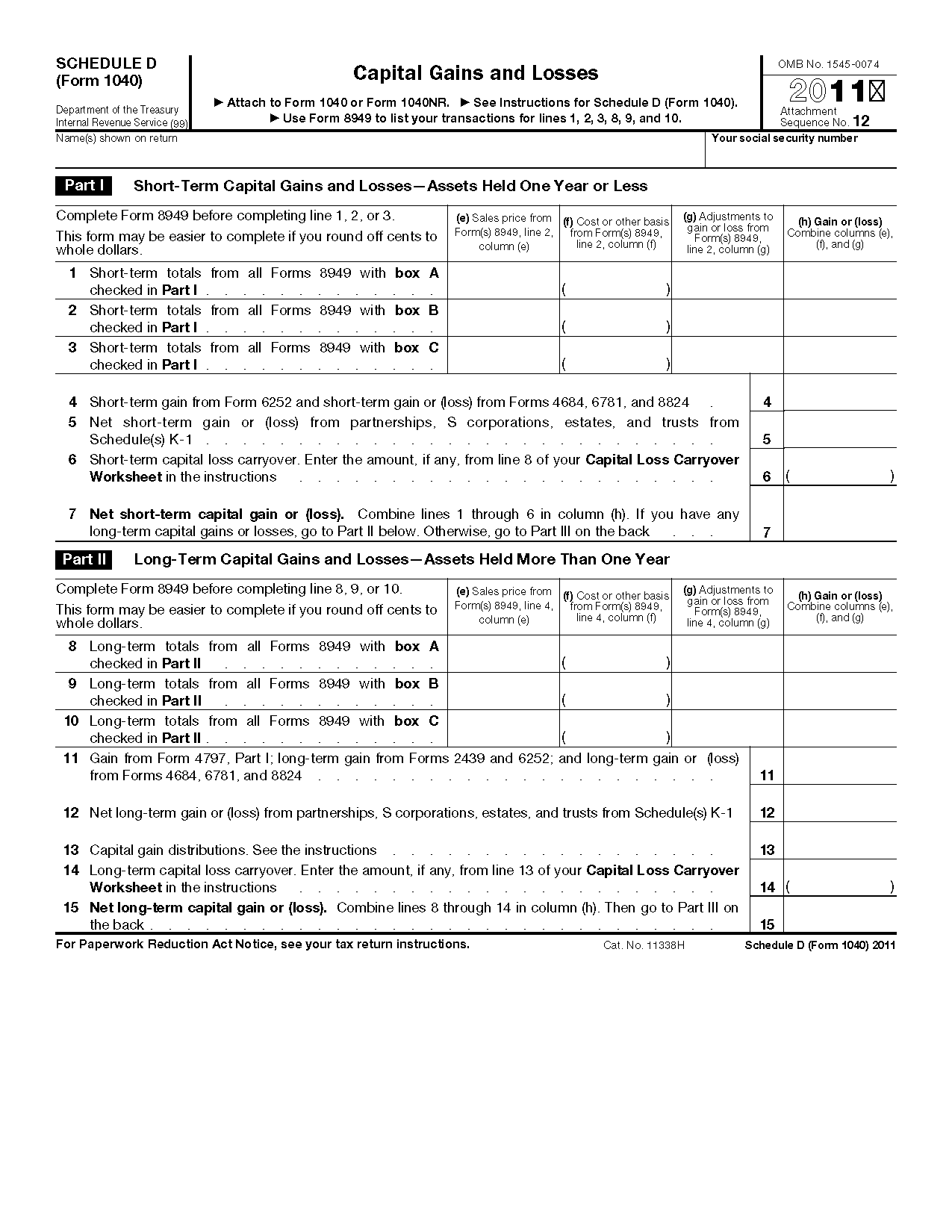

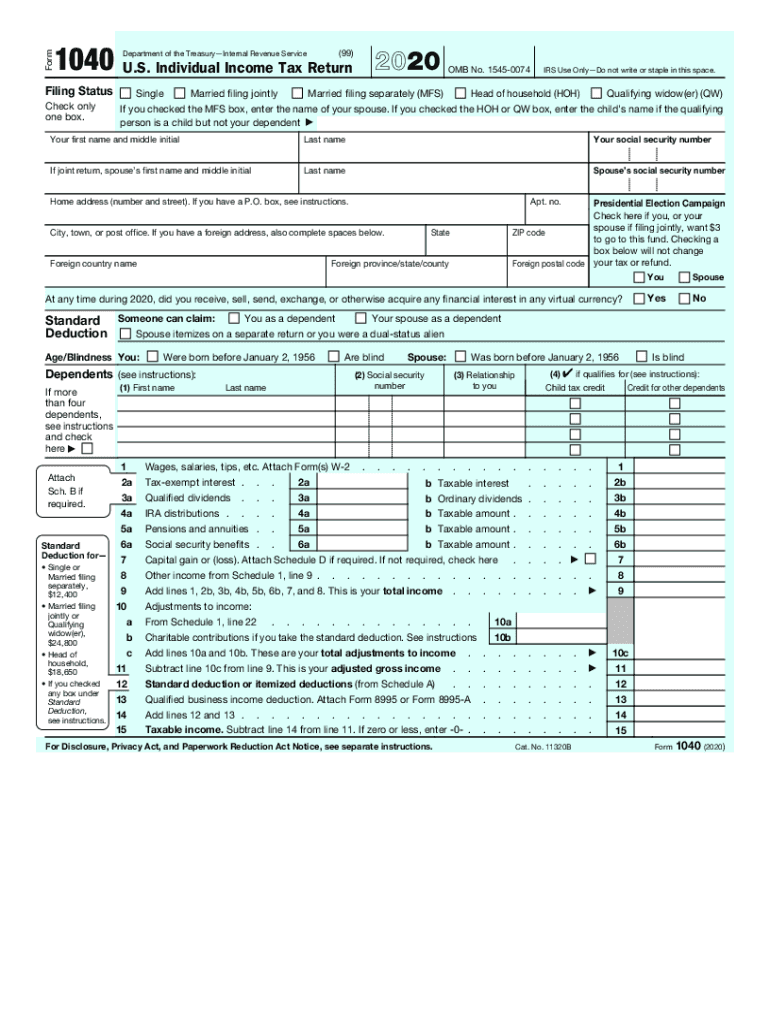

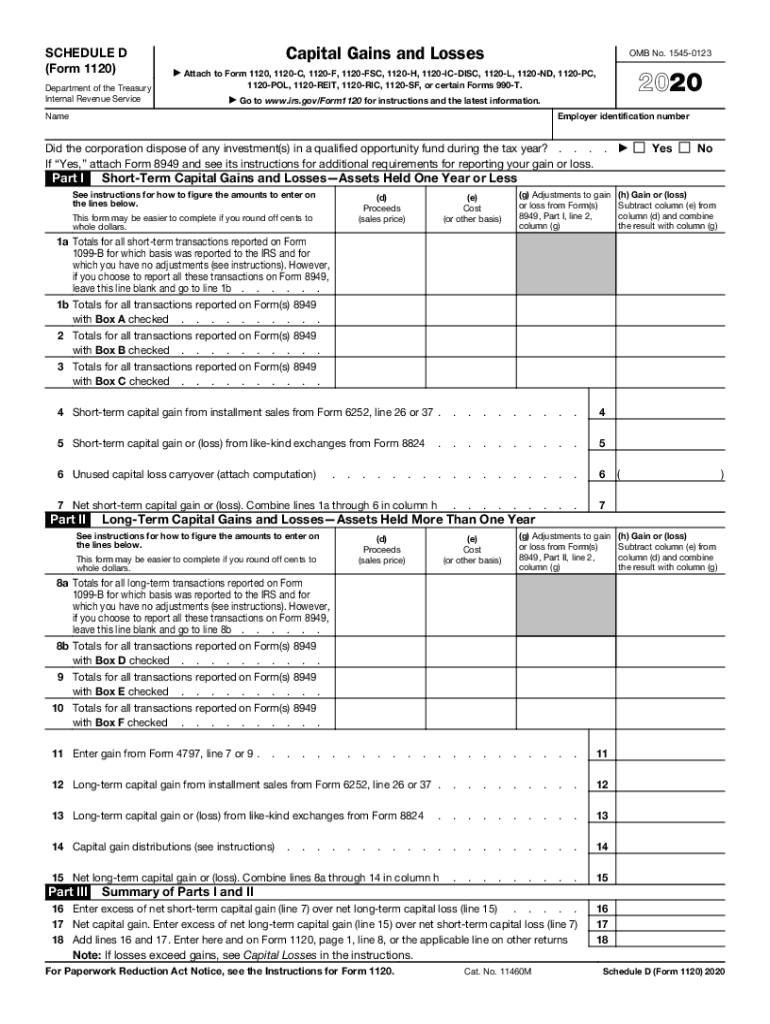

Irs Printable Form Schedule D What Is Form 1040 Schedule D Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule D to report a capital gain or loss of income if required You can not file Schedule D with one of the shorter IRS forms such as Form 1040A or Form 1040EZ

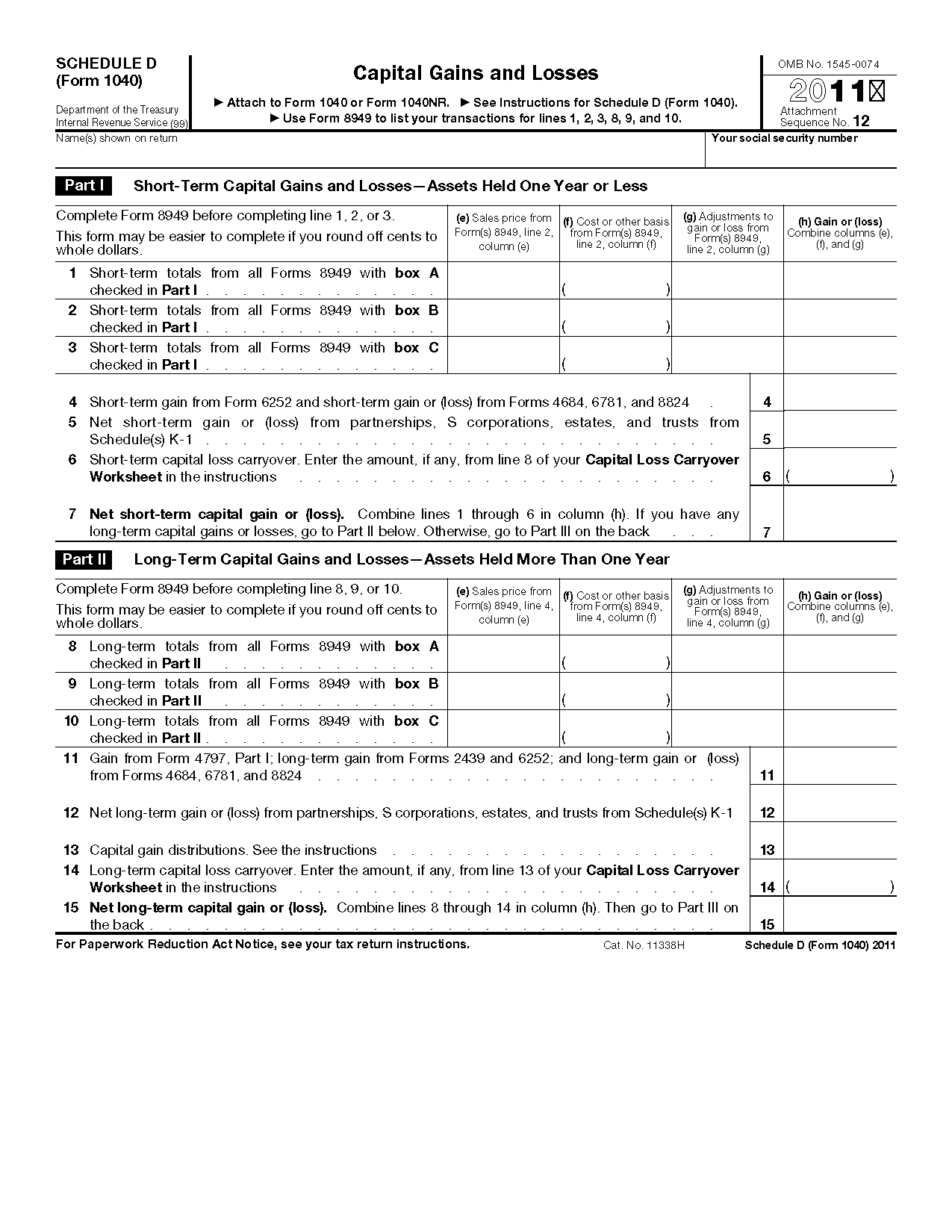

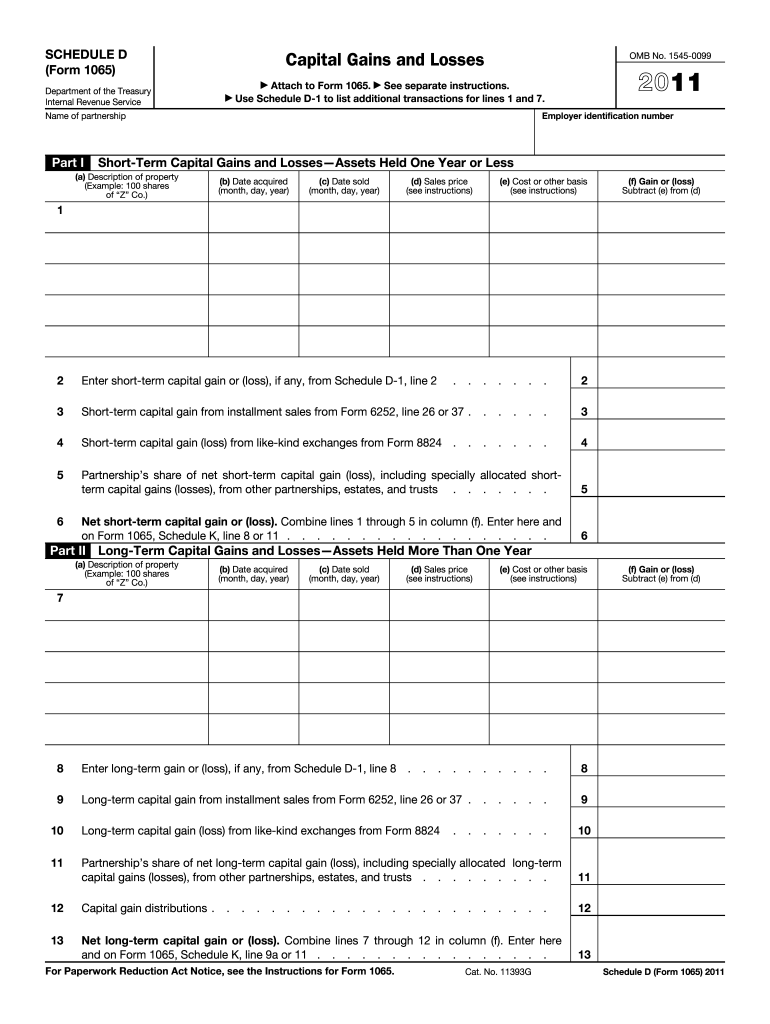

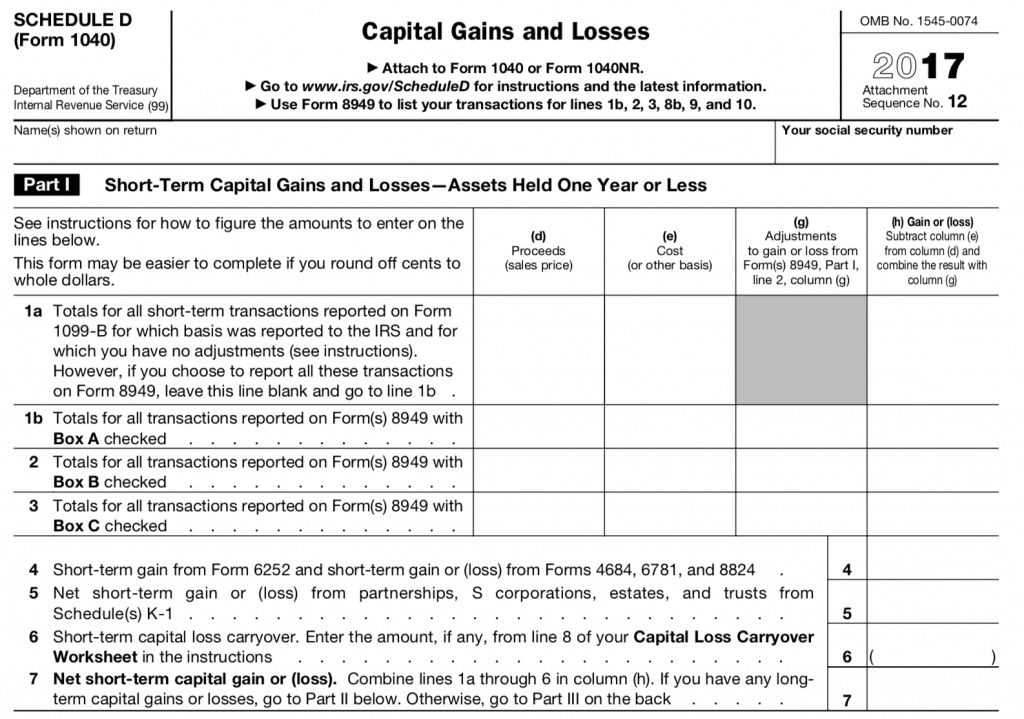

Schedule D Most people use the Schedule D form to report capital gains and losses that result from the sale or trade of certain property during the year In 2011 however the Internal Revenue Service created a new form Form 8949 that some taxpayers will have to file along with their Schedule D and 1040 forms Capital asset transactions You must check Box DRAFT D E or F below Check only one box If more than AS July 23 one box applies for your OF 2021 long term transactions complete a separate Form 8949 page 2 for each applicable box If you have more long term transactions than will fit on this page for one or

Irs Printable Form Schedule D

Irs Printable Form Schedule D

https://1044form.com/wp-content/uploads/2020/08/form-1040-schedule-d-capital-gains-and-losses-2.png

2011 Form IRS 1065 Schedule D Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/1/649/1649141/large.png

Schedule D For Cryptocurrency Gains The Cryptocurrency Forums

https://thecryptocurrencyforums.com/wp-content/uploads/2018/04/users-tc-desktop-irs-schedule-d-part-i-png-1024x719.png

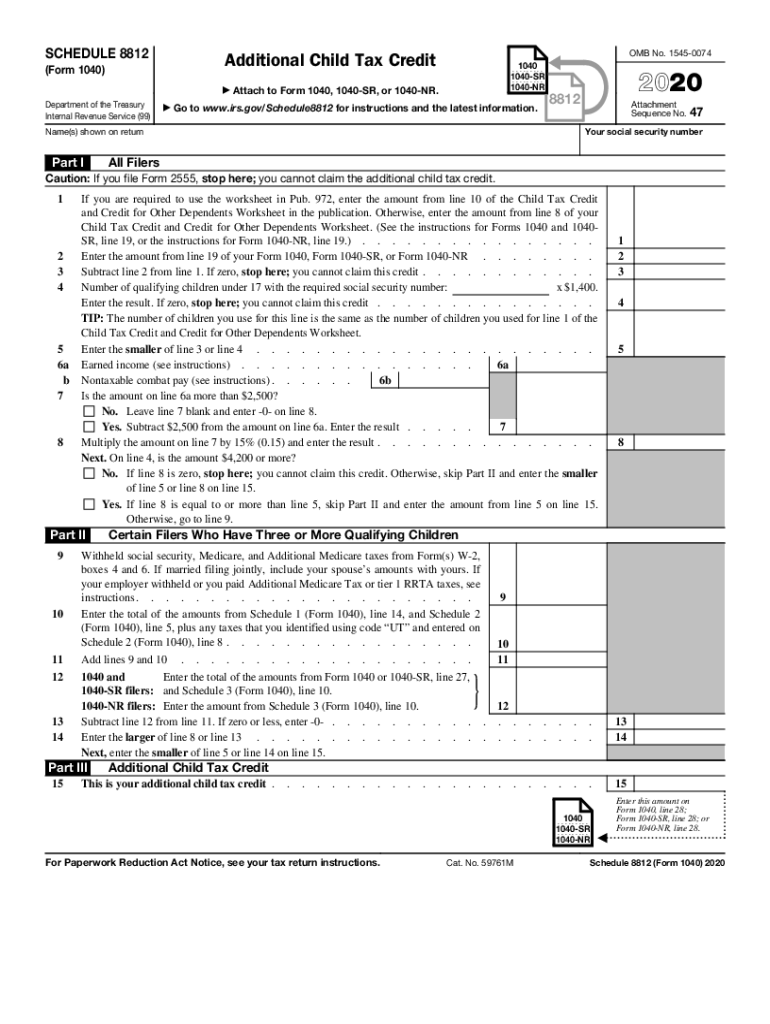

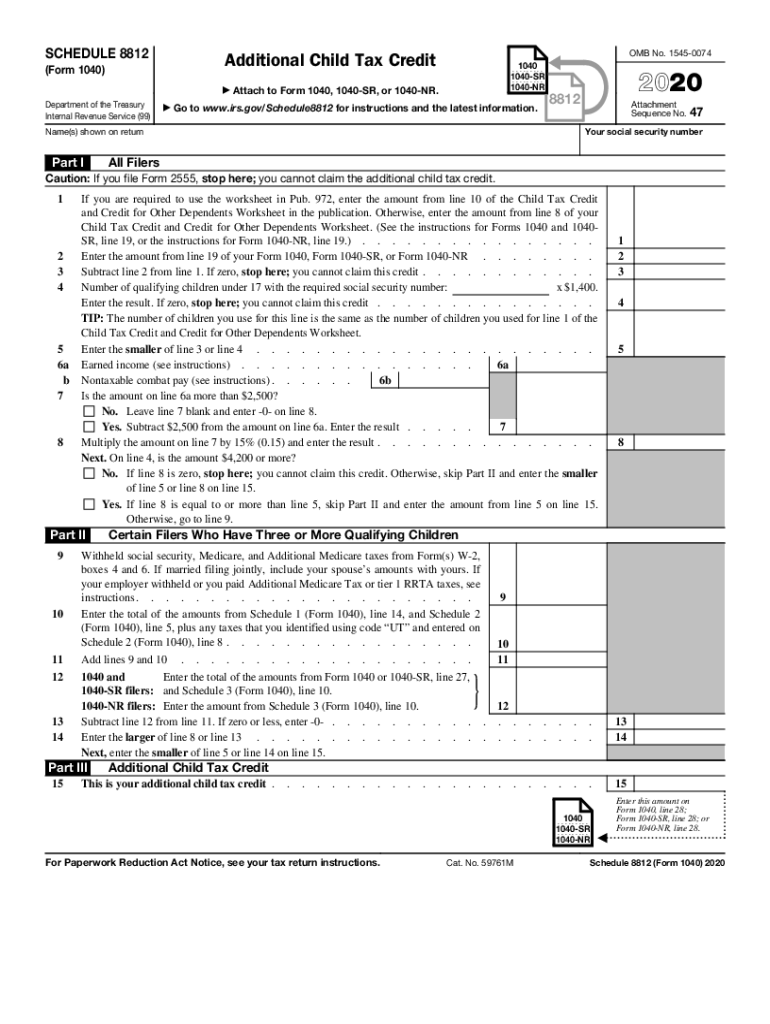

Schedule D is an IRS tax form that reports your realized gains and losses from capital assets that is investments and other business interests It includes relevant information such as the total Schedule D A U S income tax form used by taxpayers to report their realized capital gains or losses Investors are required to report their capital gains and losses from the sales of assets

Schedule D Form 1040 is a tax schedule from the IRS that attaches to the Form 1040 U S Individual Income Tax Return Form 1040 SR or Form 1040NR It is used to help you calculate their capital gains or losses and the amount of taxes owed Computations from Schedule D are reported on the Form 1040 affecting your adjusted gross income Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state s revenue department which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer s entire liability

More picture related to Irs Printable Form Schedule D

Free Printable Irs Tax Forms Printable Templates

https://allfreeprintable4u.com/wp-content/uploads/2019/03/free-fillable-1040-tax-form-free-file-fillable-formspng-forms-form-free-printable-irs-1040-forms.jpg

IRS 1040 Schedule 2 2021 2022 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/460/258/460258130/large.png

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)

Schedule D

https://www.investopedia.com/thmb/mS1dDZJEF2COzxNPk04fLYLAM_4=/2200x1700/filters:no_upscale():max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png

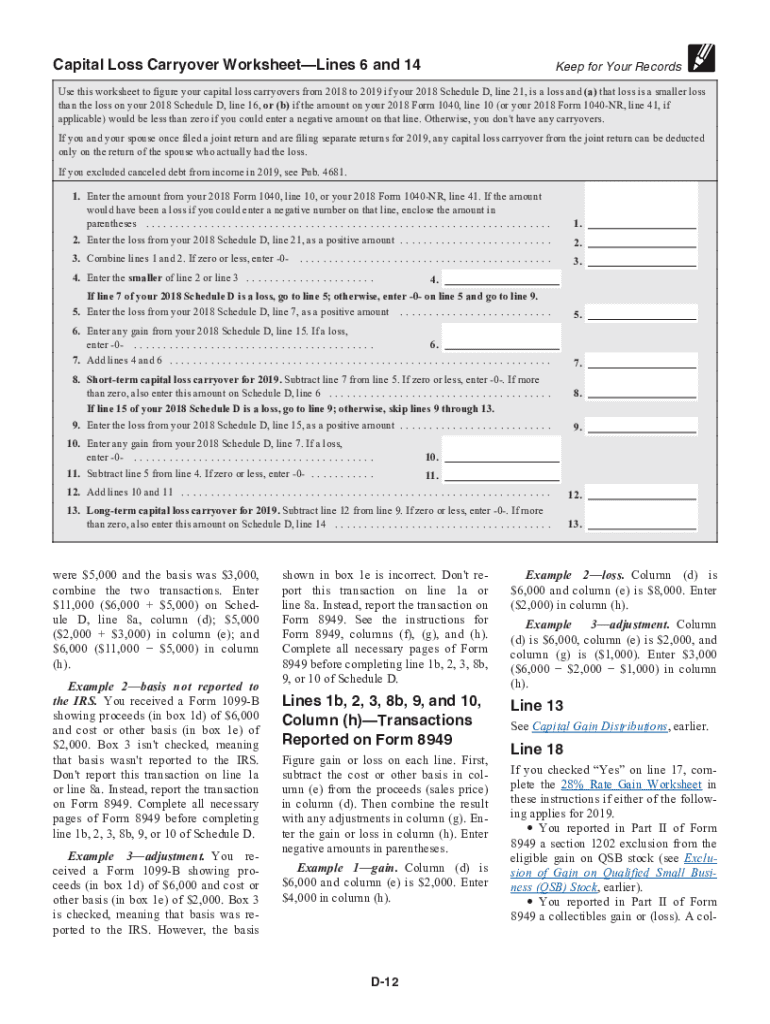

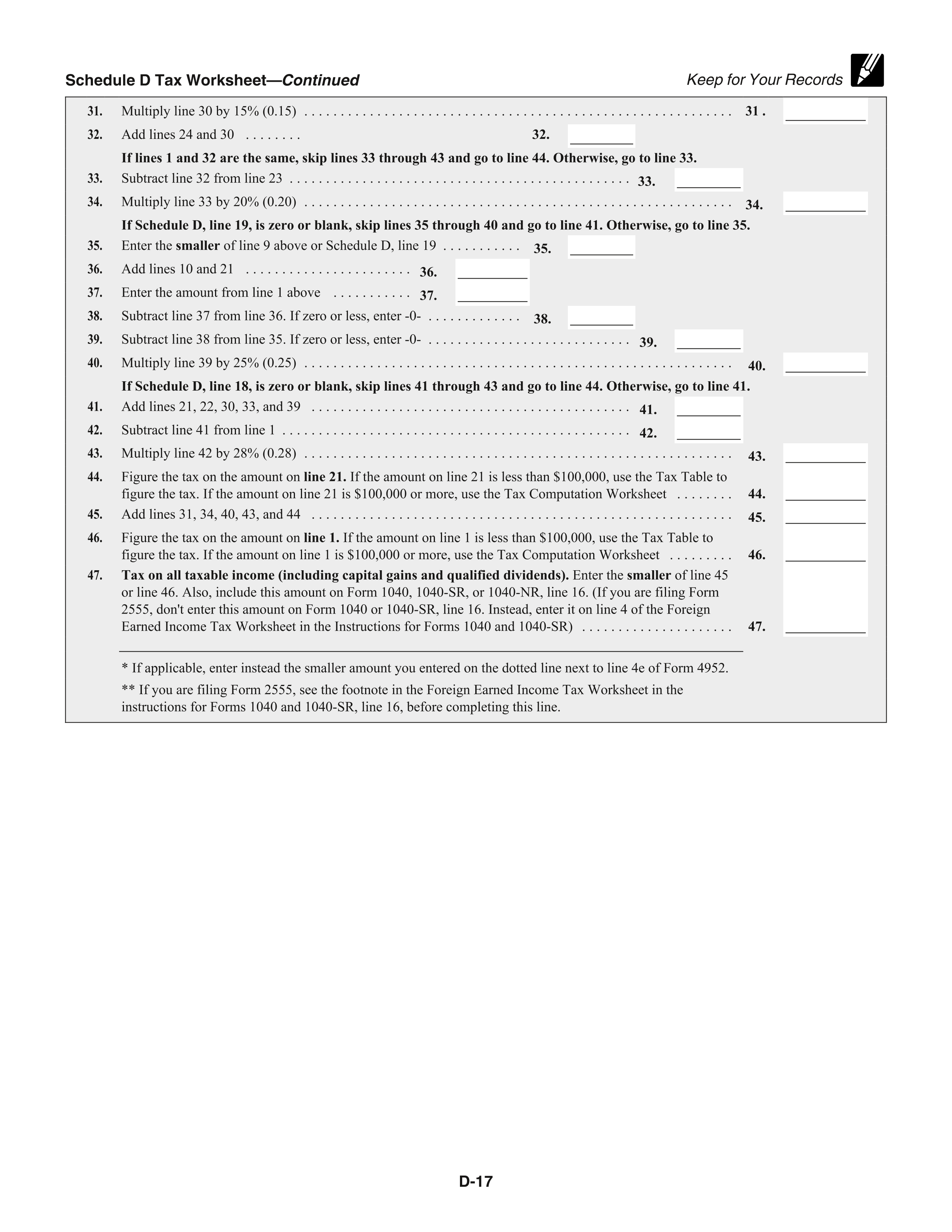

Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if applicable is less than zero Use this free informational booklet to help you fill out and file your Schedule C form for Profit or Loss from Business 11 0001 Capital Gains and Losses You should use Schedule D to report Sale or exchange of a capital asset not reported elsewhere Gains from involuntary conversions of capital assets not held for business or profit

EFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for Tax Brackets users File Now with TurboTax Access IRS forms instructions and publications in electronic and print media

Form 1040 Schedule D 1 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/irs-schedule-d-1.gif

Schedule D Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/948/6948283/large.png

https://www.incometaxpro.net/tax-form/schedule-d.htm

What Is Form 1040 Schedule D Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule D to report a capital gain or loss of income if required You can not file Schedule D with one of the shorter IRS forms such as Form 1040A or Form 1040EZ

https://turbotax.intuit.com/tax-tips/investments-and-taxes/guide-to-schedule-d-capital-gains-and-losses/L1bKWgPea

Schedule D Most people use the Schedule D form to report capital gains and losses that result from the sale or trade of certain property during the year In 2011 however the Internal Revenue Service created a new form Form 8949 that some taxpayers will have to file along with their Schedule D and 1040 forms Capital asset transactions

Irs 1040 Schedule Instructions 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

Form 1040 Schedule D 1 2021 Tax Forms 1040 Printable

Fill Out A 2017 IRS TAX Form 1040 Schedule D Based On Chegg

Printable Irs Form 1040 Printable Form 2023

2020 Form IRS 1040 Fill Online Printable Fillable Blank PdfFiller

IRS 1040 Schedule 8812 2020 Fill Out Tax Template Online US Legal Forms

IRS 1040 Schedule 8812 2020 Fill Out Tax Template Online US Legal Forms

2020 Schedule D 1040 Fill Online Printable Fillable Blank Form 1065 schedule d

Irs Schedule D For 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

IRS Schedule D Instructions

Irs Printable Form Schedule D - You can download or print current or past year PDFs of 1041 Schedule D directly from TaxFormFinder You can print other Federal tax forms here eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes