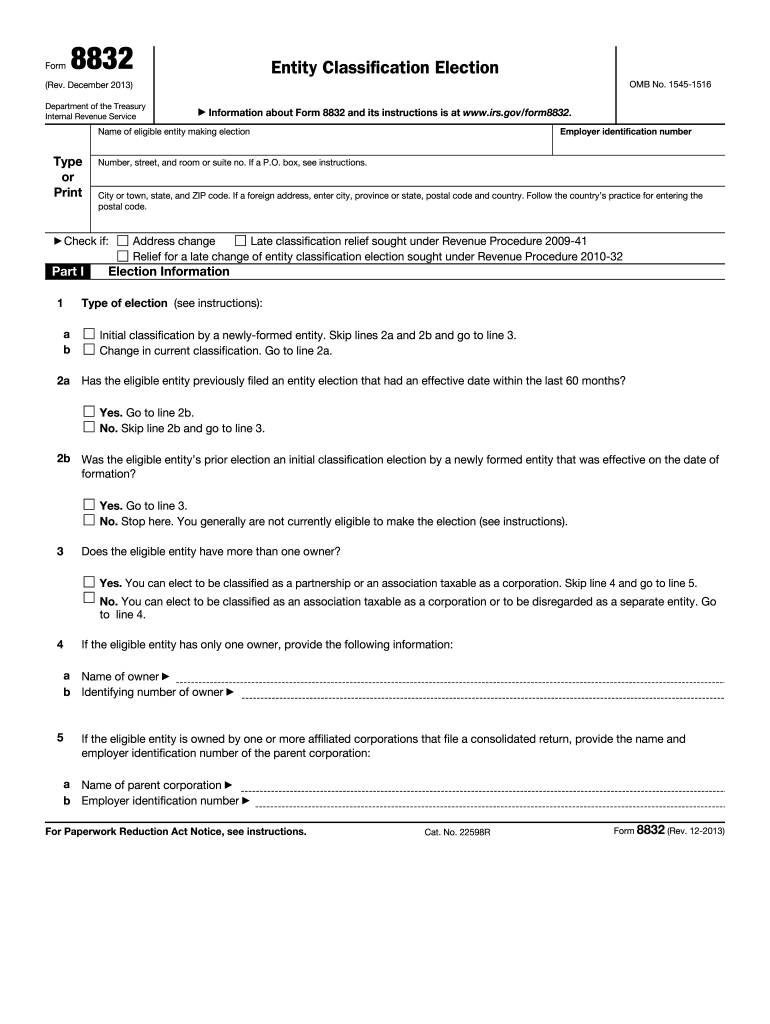

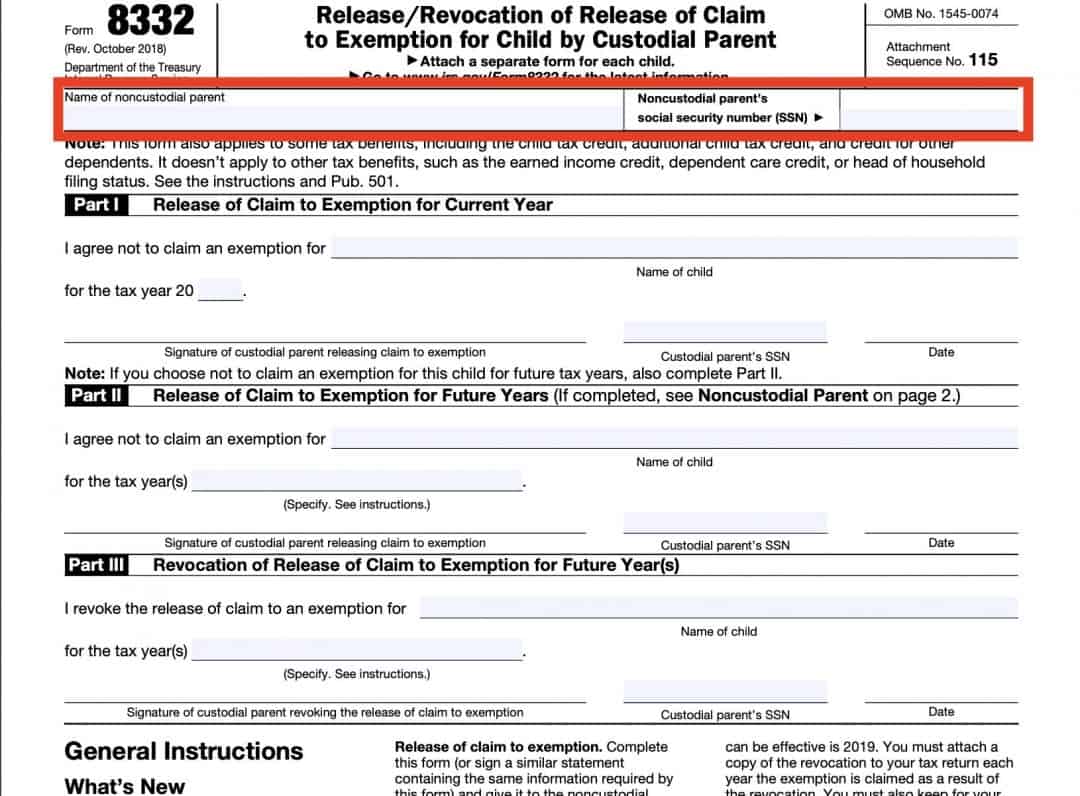

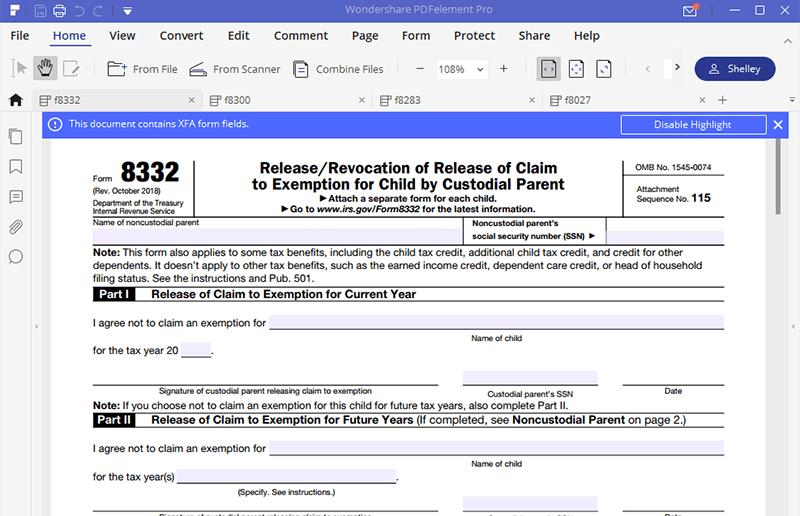

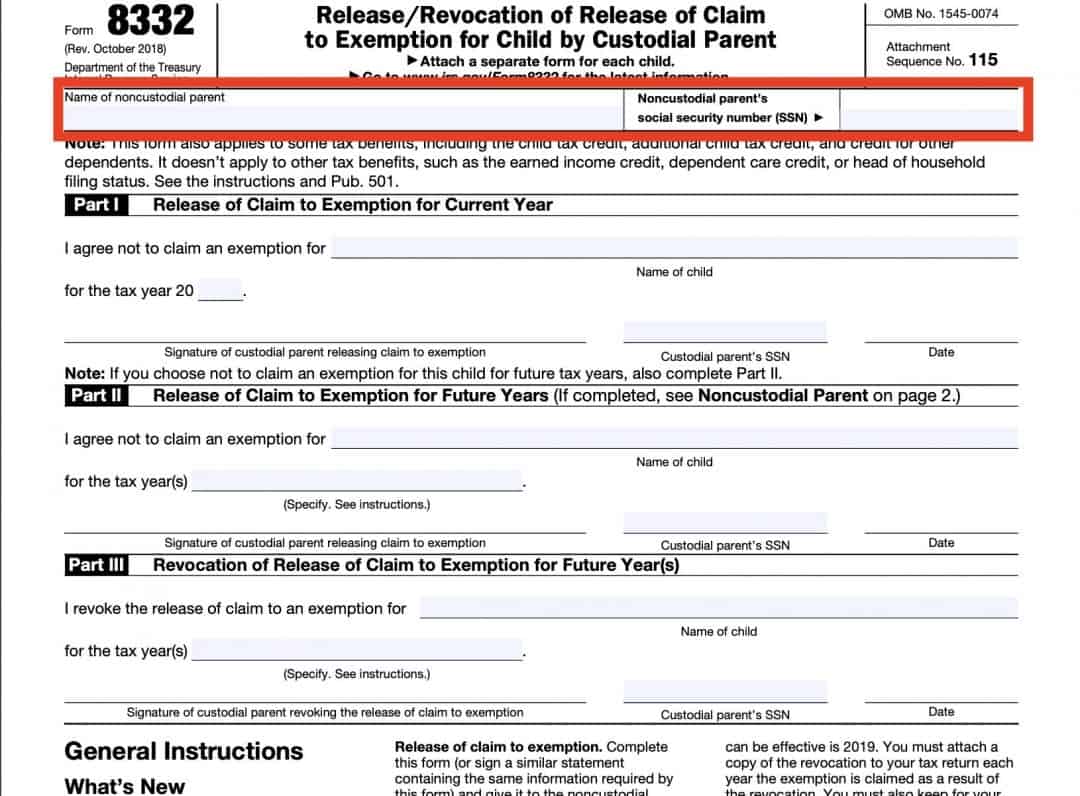

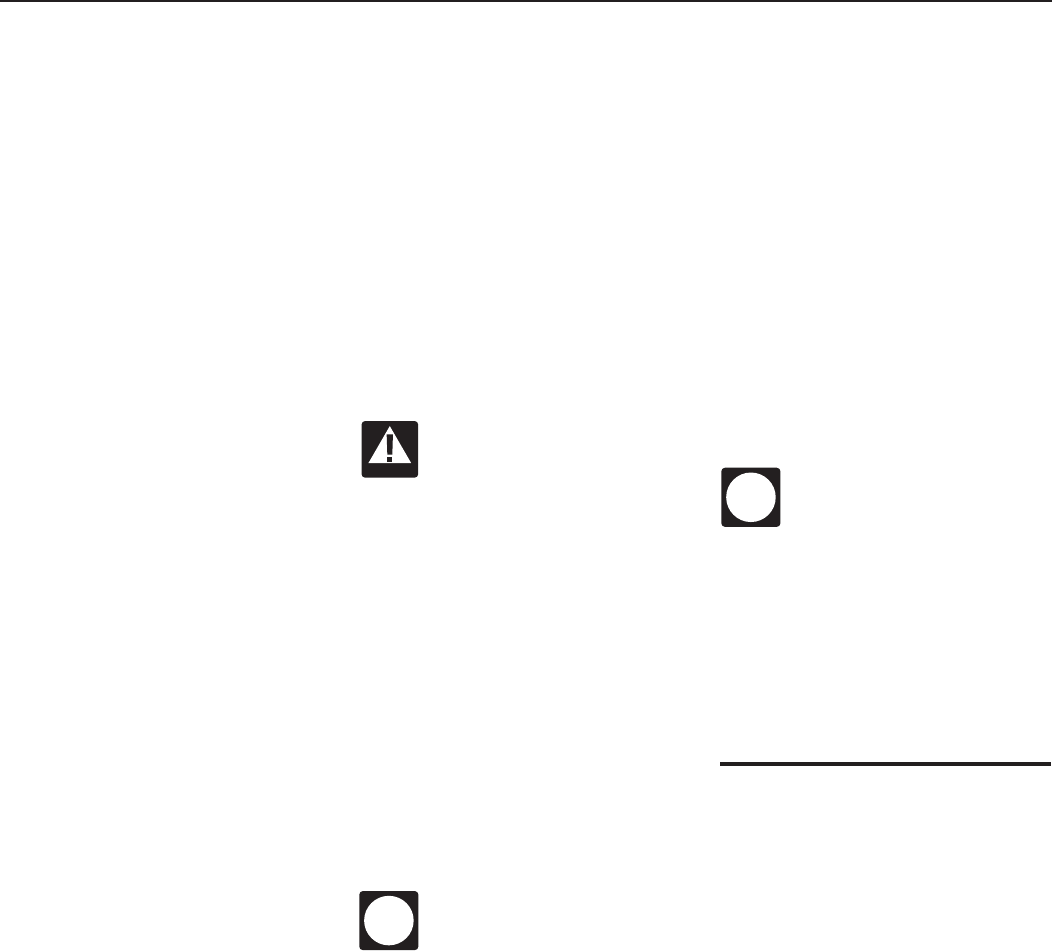

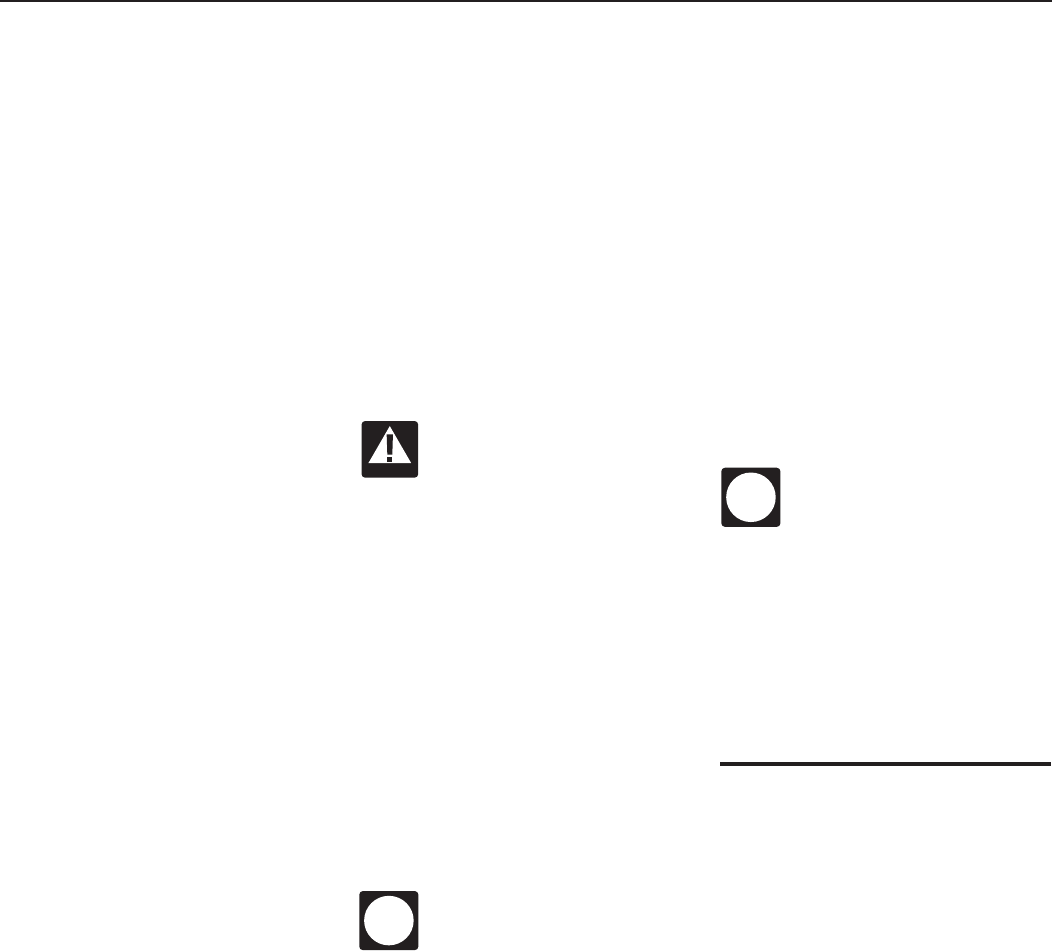

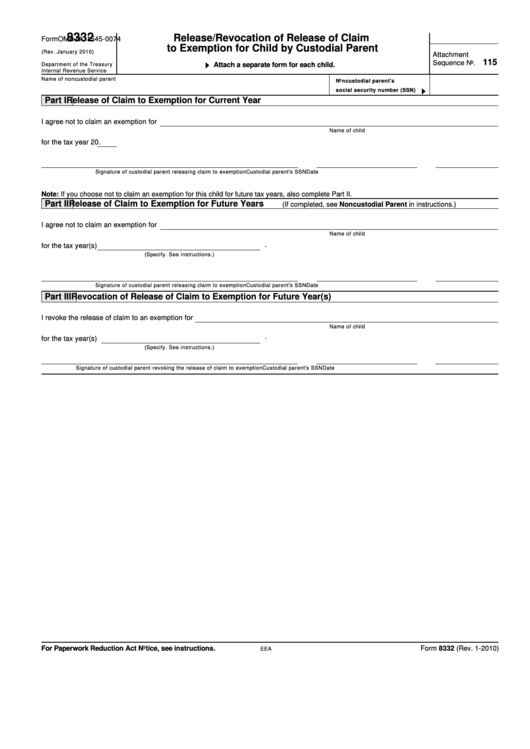

Irs Tax Form 8332 Printable Form 8332 Rev December 2000 I agree not to claim an exemption for Name s of child or children for the tax year 20 Signature of custodial parent releasing claim to exemption Custodial parent s SSN Date Note If you choose not to claim an exemption for this child or children for future tax years also complete Part II

What is Form 8332 Release Revocation of Release of Claim to Exemption for Child by Custodial Parent Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 October 19 2023 8 42 AM OVERVIEW Having custody of your child usually means you can claim that child as a dependent on your taxes The full name of Form 8332 is Release Revocation of Release of Claim to Exemption for Child by Custodial Parent While the tax benefit of exemptions is 0 until 2025 under tax reform there are other tax benefits a noncustodial can claim with a release from the custodial parent This form also applies to some tax benefits including the

Irs Tax Form 8332 Printable

Irs Tax Form 8332 Printable

https://www.pdffiller.com/preview/6/954/6954893/large.png

Tax Form 8332 Printable 2021 Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/09/tax-form-8332-printable-printable-form-2021.gif

Fillable Form 8332 Rev January 2006 Release Of Claim To Exemption For Child Of Divorced Or

https://data.formsbank.com/pdf_docs_html/114/1149/114975/page_1_thumb_big.png

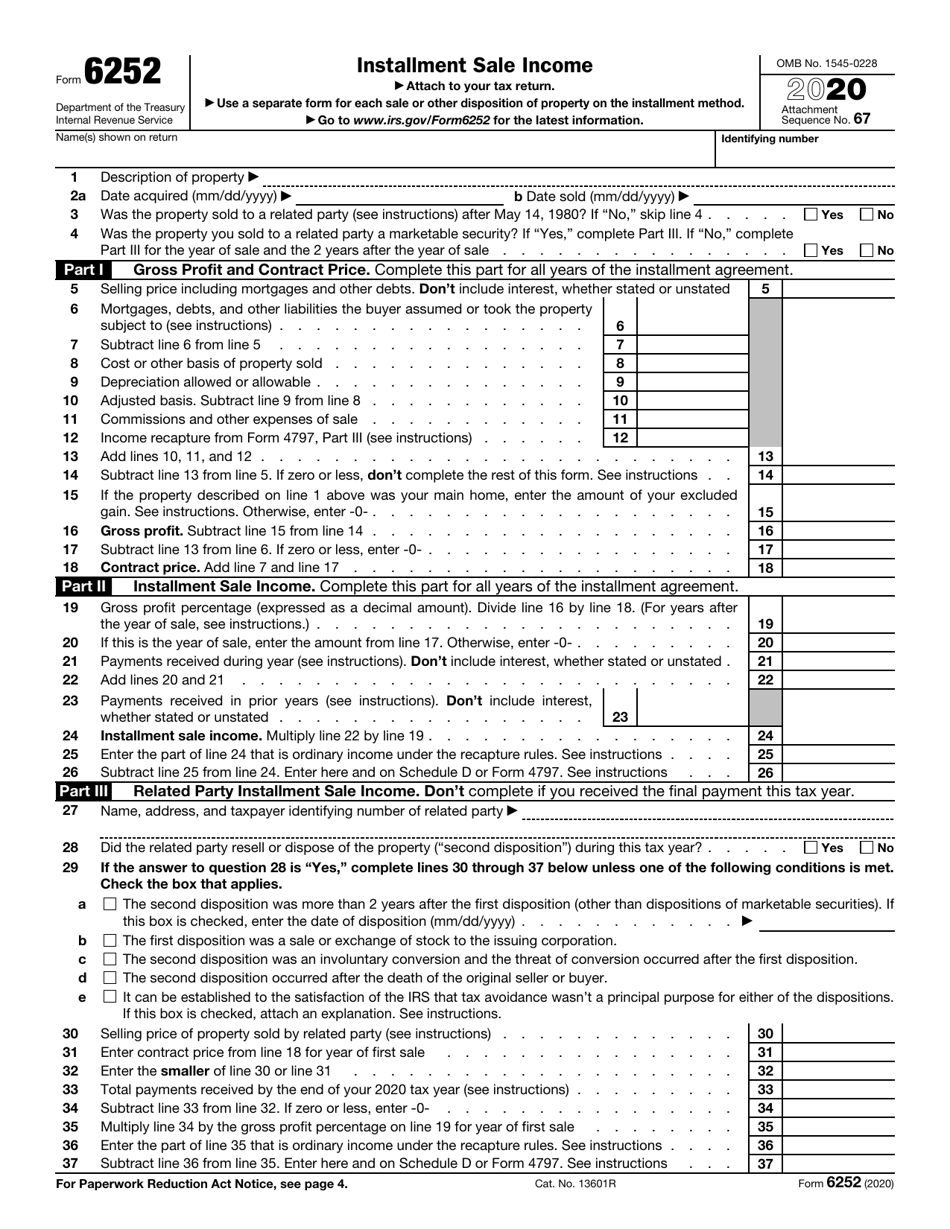

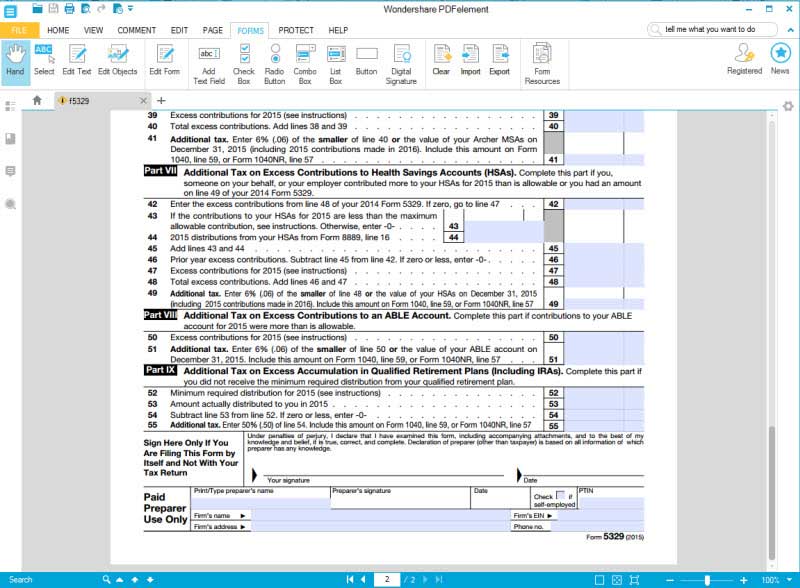

To complete Form 8332 in TaxAct From within your TaxAct return Online or Desktop click Federal On smaller devices click in the upper left hand corner then click Federal Click Miscellaneous Topics in the Federal Quick Q A Topics menu to expand then click Release Revocation of release of claim to an exemption Form 8332 is used when a divorce or separate maintenance agreement specifies a noncustodial parent can claim the dependent children Use it when you are separated from the noncustodial parent to allow them to claim the child s exemption Is Form 8332 still usable after the 2018 Tax Reform

Download Fillable Irs Form 8332 In Pdf The Latest Version Applicable For 2024 Fill Out The Release revocation Of Release Of Claim To Exemption For Child By Custodial Parent Online And Print It Out For Free Irs Form 8332 Is Often Used In Custodial Parent U s Department Of The Treasury Internal Revenue Service United States Federal Legal Forms And United States Legal Forms Them with Form 8332 Release Revocation of Release of Claim to Exemption for Child by Custodial Parent or a similar statement All noncustodial parents must attach Form 8332 or a similar statement to their return each year the custodial parent provides the release Review the Child Tax Credit charts in the Volunteer

More picture related to Irs Tax Form 8332 Printable

Form 8332 Release Revocation Of Release Of Claim To Exemption For Child By Custodial Parent

http://www.formsbirds.com/formimg/tax-support-document/8476/form-8332-releaserevocation-of-release-of-claim-to-exemption-for-child-by-custodial-parent-2010-l1.png

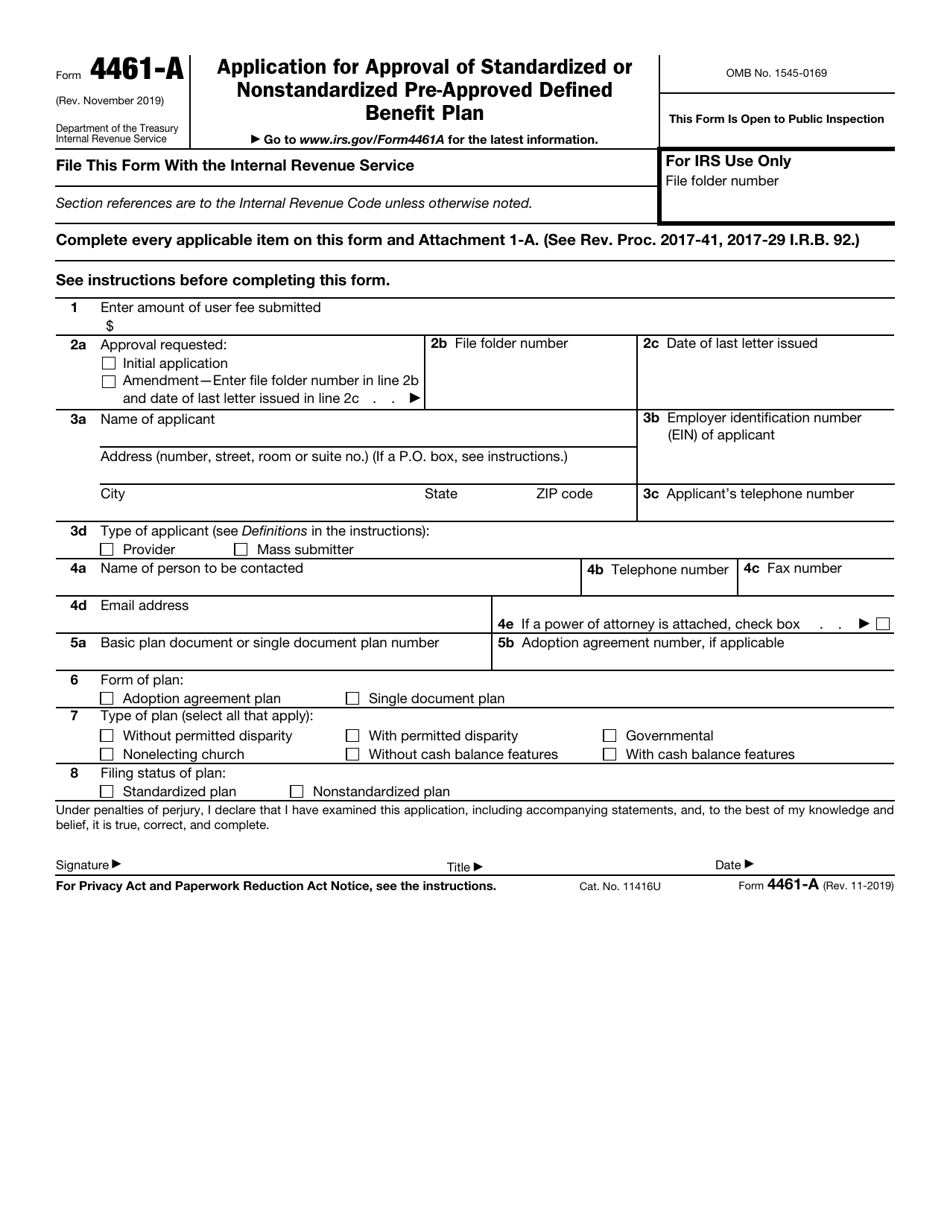

Tax Form 8332 Printable

https://data.templateroller.com/pdf_docs_html/2008/20082/2008212/irs-form-4461-a-application-for-approval-of-standardized-or-nonstandardized-pre-approved-defined-benefit-plan_print_big.png

Tax Form 8332 Printable Printable World Holiday

https://www.formsbirds.com/formimg/tax-support-document/8476/form-8332-releaserevocation-of-release-of-claim-to-exemption-for-child-by-custodial-parent-2010-l2.png

When the non custodial parent completes his her tax returns Form 8332 must accompany it You may complete the form for a single tax year or multiple years If you choose multiple years skip Part 1 on the form and complete Part 2 This gives the non custodial parent the right to claim the child ren for as many years as noted on the form The TCJA eliminated dependent exemptions until 2025 So noncustodial parents can only use Form 8332 to increase their tax refunds by 1 500 to 2 000 per child by claiming the additional child tax credit or the child tax credit The credit for other dependents is limited to 500 per qualifying dependent and it s only available to taxpayers

Form 8332 Rev January 2006 TLS have you transmitted all R text files for this cycle update Date 6 I R S SPECIFICATIONS TO BE REMOVED BEFORE PRINTING INSTRUCTIONS TO PRINTERS FORM 8332 PAGE 1 of 2 MARGINS TOP 1 2 CENTER SIDES PRINTS FACE ONLY PAPER WHITE WRITING SUB 20 INK BLACK FLAT SIZE 8 11 PERFORATE NONE The Role of Tax Form 8332 in Tax Reform The relevance of Form 8332 is particularly highlighted in the context of ongoing tax reforms Tax legislation changes can adjust the rules and benefits tied to claiming dependents making it vital for parents to stay informed about the latest tax laws

IRS Form 8332 A Guide For Custodial Parents

https://www.teachmepersonalfinance.com/wp-content/uploads/2022/05/IRS-Form-8332-ReleaseRevocation-of-Release-of-Claim-to-Exemption-for-Child-by-Custodial-Parent-1080x796.jpg

IRS Form 8332 Fill It With The Best PDF Form Filler

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-8332-part1.png

https://www.irs.gov/pub/irs-prior/f8332--2000.pdf

Form 8332 Rev December 2000 I agree not to claim an exemption for Name s of child or children for the tax year 20 Signature of custodial parent releasing claim to exemption Custodial parent s SSN Date Note If you choose not to claim an exemption for this child or children for future tax years also complete Part II

https://turbotax.intuit.com/tax-tips/family/what-is-form-8332-release-revocation-of-release-of-claim-to-exemption-for-child-by-custodial-parent/L25kdeRnR

What is Form 8332 Release Revocation of Release of Claim to Exemption for Child by Custodial Parent Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 October 19 2023 8 42 AM OVERVIEW Having custody of your child usually means you can claim that child as a dependent on your taxes

Irs Form 8332 Printable

IRS Form 8332 A Guide For Custodial Parents

Form 8332 Release Revocation Of Release Of Claim To Exemption For Ch

Irs Form 8332 Printable

Irs Form 8332 Printable

Tax Form 8332 Printable

Tax Form 8332 Printable

Tax Form 8332 Printable TUTORE ORG Master Of Documents

Printable 8332 Form Printable Forms Free Online

Irs Form 8332 Printable

Irs Tax Form 8332 Printable - Ines Zemelman EA 04 Jan 2024 Form 8332 is a tax form that allows a non custodial parent to claim a child as a dependent on their tax return This form is often used when the non custodial parent has been granted the right to claim the child as a dependent by a divorce or separation agreement or by a court order