Irs Tax Form 8962 Printable Form 8962 Premium Tax Credit If you had Marketplace coverage and used the premium tax credit to lower your monthly plan premiums you must file this tax form with your federal income tax return You ll use this form to reconcile to find out if you used more or less of the premium tax credit than you qualify for

Form 8962 is used to estimate the amount of premium tax credit for which you re eligible if you re insured through the Health Insurance Marketplace You need to complete Form 8962 if you Select a state By checking this box you consent to our data privacy policy You must reconcile your premium tax credit when you file your tax return if you were enrolled in Health Insurance Marketplace plan

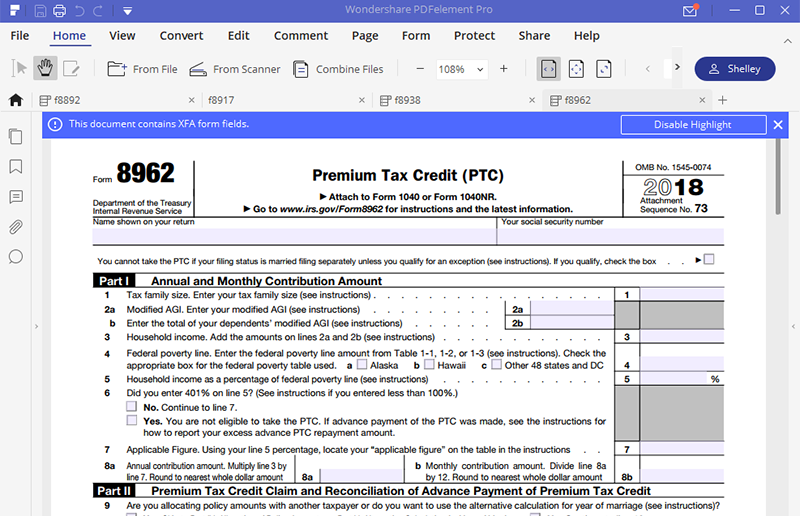

Irs Tax Form 8962 Printable

Irs Tax Form 8962 Printable

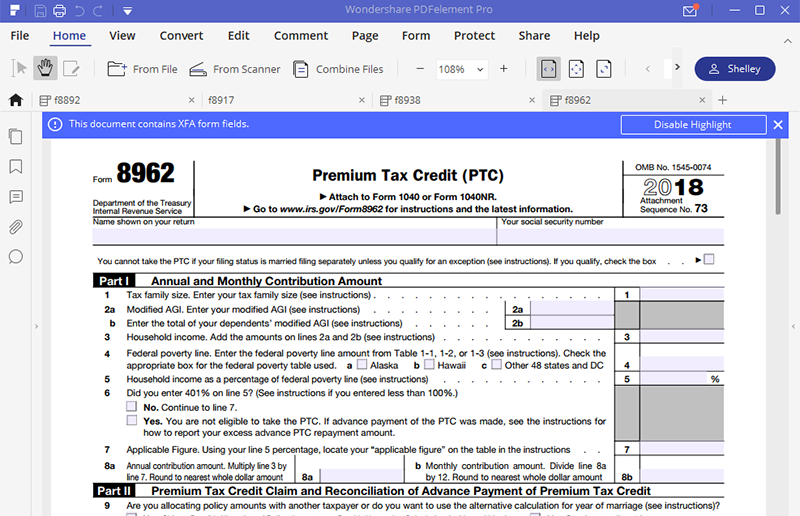

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-8962.png

8962

https://i.pinimg.com/originals/5a/ea/00/5aea00410784f7ab692813315d42f42f.jpg

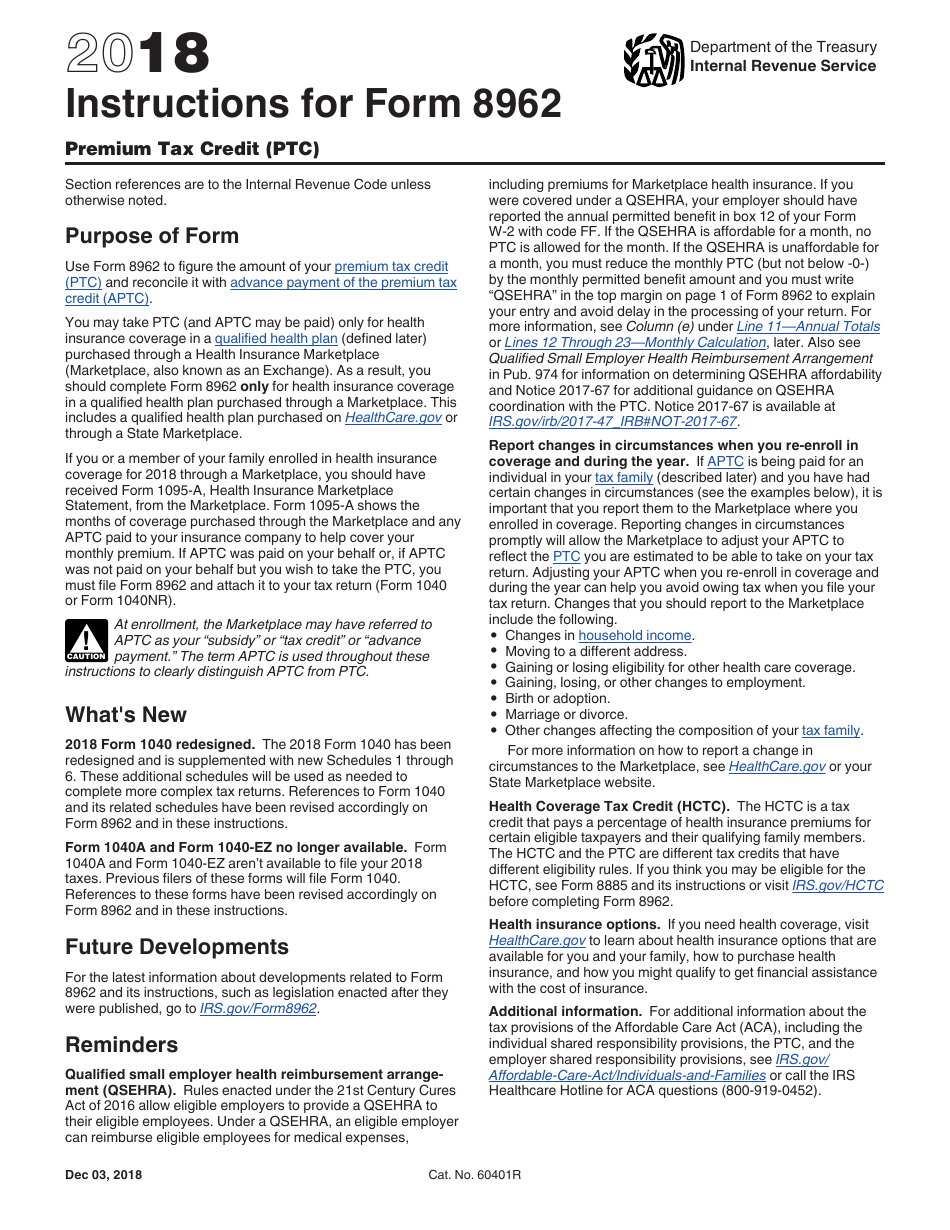

Download Instructions For IRS Form 8962 Premium Tax Credit Ptc PDF 2018 Templateroller

https://data.templateroller.com/pdf_docs_html/1862/18627/1862763/premium-tax-credit-ptc-2018_print_big.png

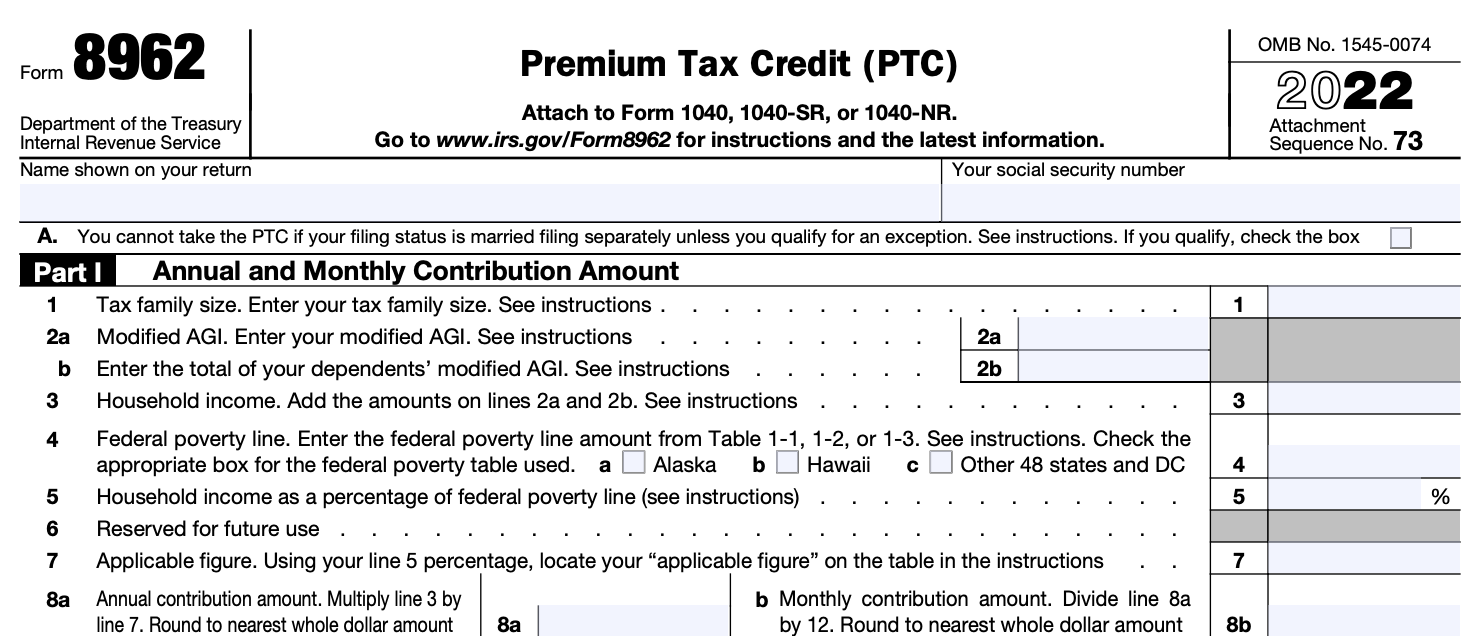

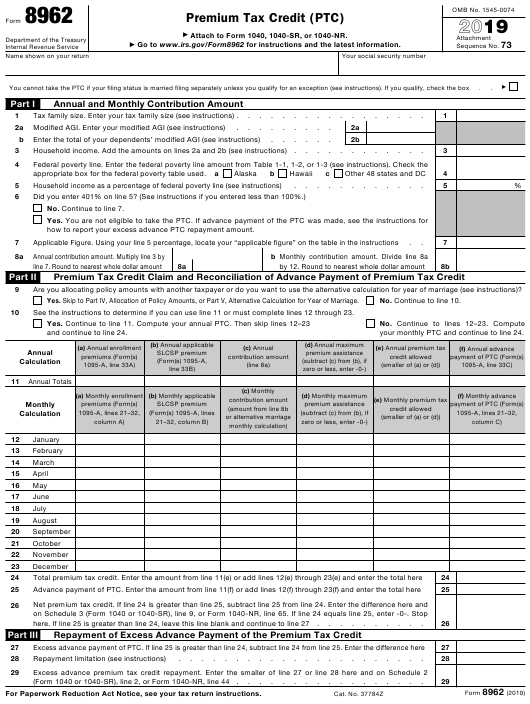

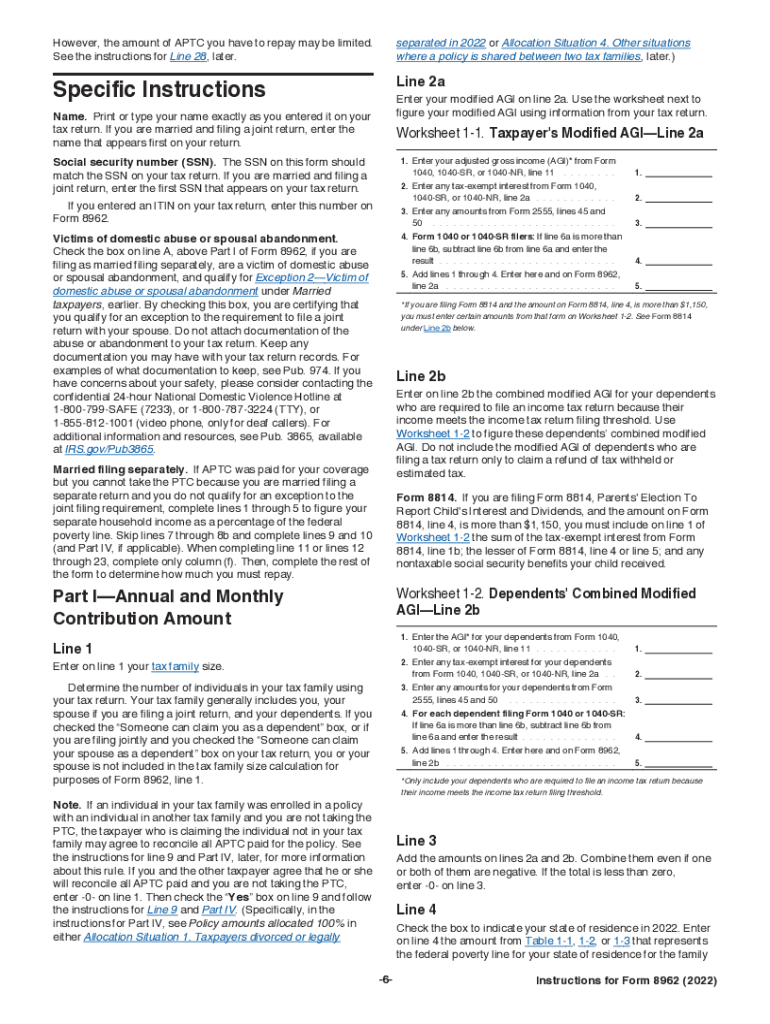

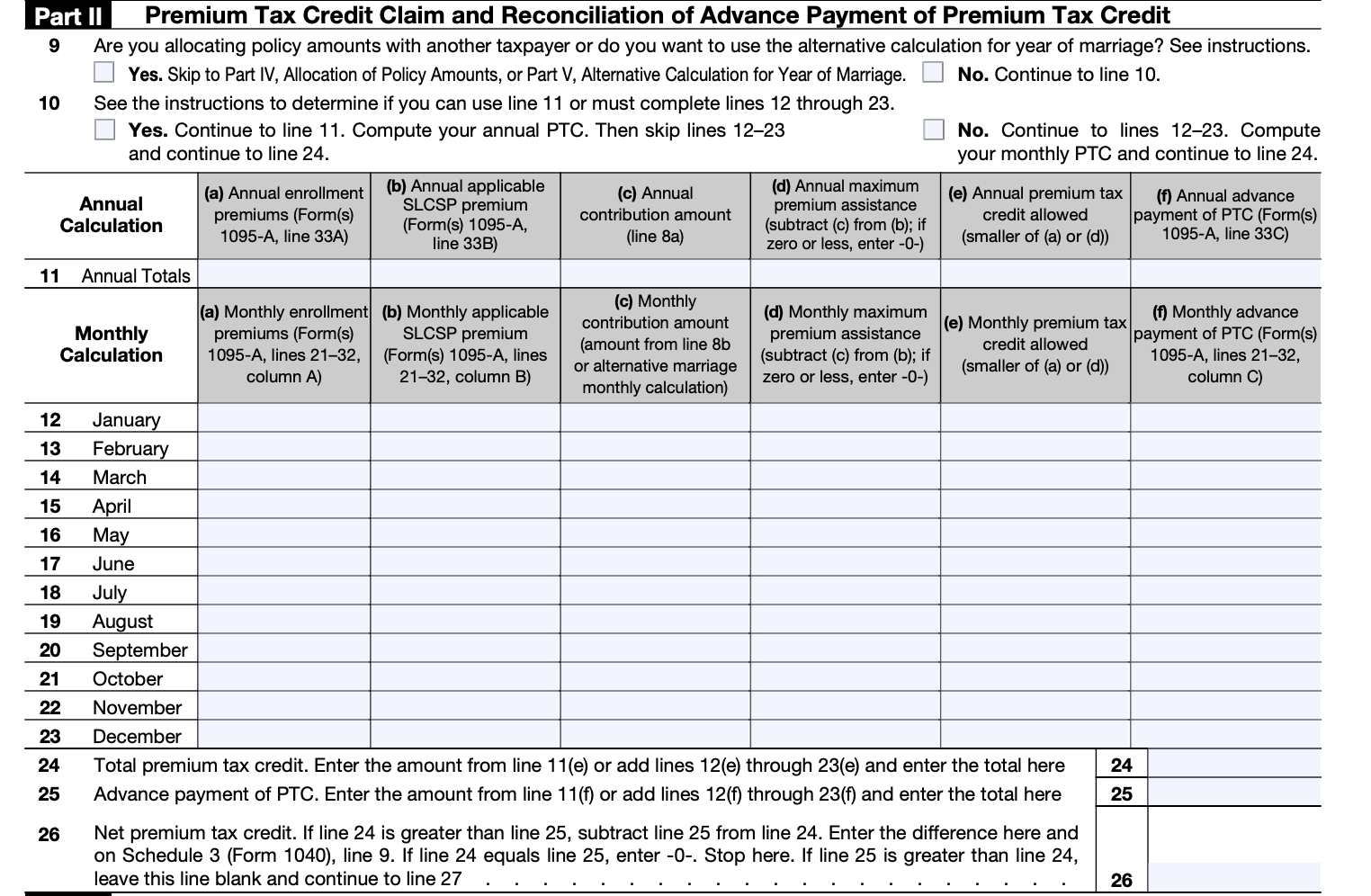

Follow the form instructions to enter the repayment limitation on line 28 Enter your excess advance premium tax credit repayment on line 29 Write the smaller of either line 27 or line 28 on line 29 and on your Form 1040 or 1040NR That s the amount you owe in repayment for getting more than your fair share in advance payment of the PTC Download This Form Print This Form More about the Federal Form 8962 Other TY 2023 We last updated the Premium Tax Credit in January 2024 so this is the latest version of Form 8962 fully updated for tax year 2023 You can download or print current or past year PDFs of Form 8962 directly from TaxFormFinder

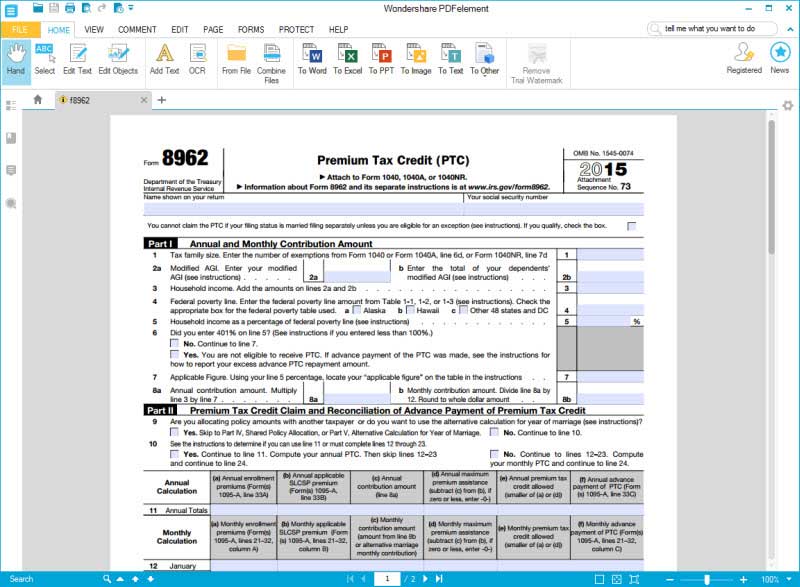

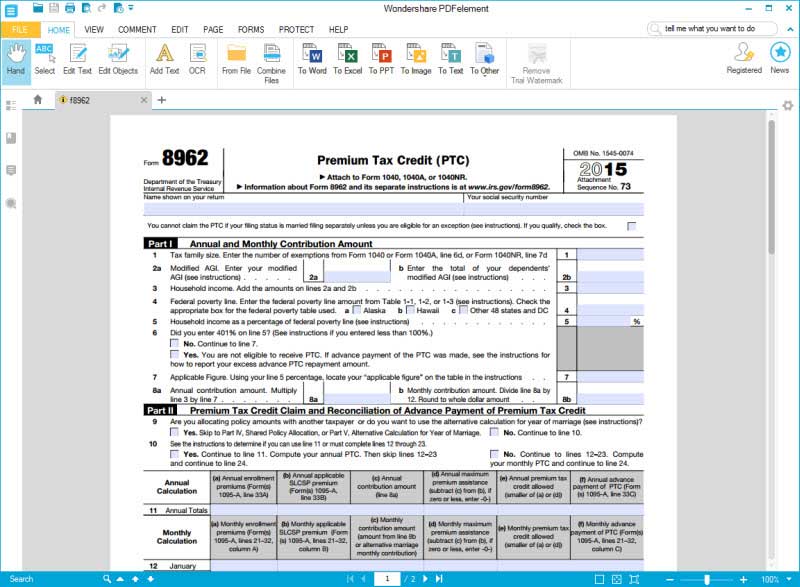

Use Form 1095 A to complete IRS tax Form 8962 and reconcile your 2023 premium tax credit when you file your 2023 taxes if you qualified for or used the premium tax credit Once you do you may Email Print FORMS How to find your Form 1095 A Form 8962 Premium Tax Credit PDF 110 KB 8962 Instructions PDF 348 KB Form 8962 must be completed if you received advance payments of the premium tax credit APTC or if you want to claim the credit on your tax return In today s post I m giving you step by step instructions to correctly complete and file Form 8962 What is the Premium Tax Credit

More picture related to Irs Tax Form 8962 Printable

All About IRS Form 8962 And Calculating Your Premium Tax Credit Nasdaq

https://dr5dymrsxhdzh.cloudfront.net/blog/images/a02a4c9c6/2016/03/Screen-Shot-2022-12-30-at-12.49.54-PM.png

Form 8962 Edit Fill Sign Online Handypdf

https://handypdf.com/resources/formfile/images/10000/form-8962-page1.png

8962 Instructions 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/536/160/536160325/large.png

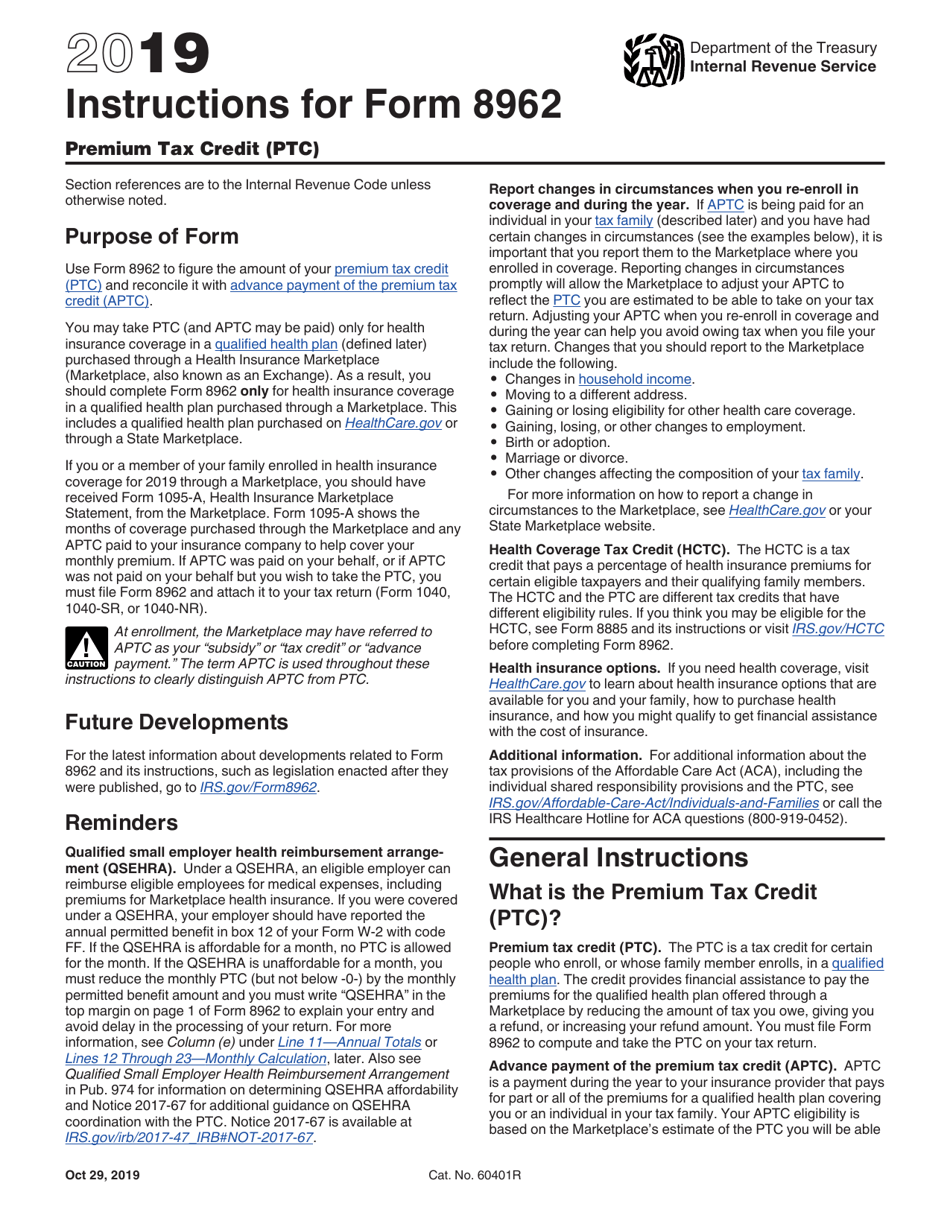

A 12C letter means the IRS needs more information to process your return Usually you need to provide Form 8962 Premium Tax Credit This form is required when someone on your tax return had health insurance in 2023 through healthcare gov or a state marketplace and took the Advance Premium Tax Credit to lower their monthly premium Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC

TurboTax will automatically fill out Form 8962 once you enter your Form 1095 A You have to include Form 8962 with your tax return if You qualified for the Premium Tax Credit in 2023 You or someone on your tax return received advance payments of the Premium Tax Credit A member of your family received advance payments of the Premium Tax Get Now 2023 IRS Form 8962 Ultimate Premium Tax Credit PTC Guide IRS Form 8962 a document to communicate with the Internal Revenue Service IRS is designed to aid taxpayers in calculating and reporting their Premium Tax Credit PTC

Free Free Irs 8962 Printable Forms Printable Forms Free Online

https://www.universalnetworkcable.com/wp-content/uploads/2018/12/printable-tax-forms-8962.jpg

Irs Form 8962 Printable 2021 Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/03/irs-form-8962-download-fillable-pdf-or-fill-online-premium.png

https://www.healthcare.gov/tax-forms-and-tools/

Form 8962 Premium Tax Credit If you had Marketplace coverage and used the premium tax credit to lower your monthly plan premiums you must file this tax form with your federal income tax return You ll use this form to reconcile to find out if you used more or less of the premium tax credit than you qualify for

https://www.investopedia.com/irs-form-8962-understanding-your-form-8962-4845835

Form 8962 is used to estimate the amount of premium tax credit for which you re eligible if you re insured through the Health Insurance Marketplace You need to complete Form 8962 if you

Download Instructions For IRS Form 8962 Premium Tax Credit Ptc PDF 2019 Templateroller

Free Free Irs 8962 Printable Forms Printable Forms Free Online

Publication 974 2021 Premium Tax Credit PTC Internal Revenue Service

IRS 8962 2014 Fill And Sign Printable Template Online US Legal Forms

Fa on Correcte De Remplir Le Formulaire 8962 De L IRS

IRS Form 8962 Instruction For How To Fill It Right

IRS Form 8962 Instruction For How To Fill It Right

Instructions 8962 2018 2019 Blank Sample To Fill Out Online In PDF

2022 2024 Form IRS Instructions 8962 Fill Online Printable Fillable Blank PdfFiller

All About IRS Form 8962 And Calculating Your Premium Tax Credit Nasdaq

Irs Tax Form 8962 Printable - Follow the form instructions to enter the repayment limitation on line 28 Enter your excess advance premium tax credit repayment on line 29 Write the smaller of either line 27 or line 28 on line 29 and on your Form 1040 or 1040NR That s the amount you owe in repayment for getting more than your fair share in advance payment of the PTC