Irs Tax Forms Printable 1040 Jointly Surviving Spouse IRS Tax Tip 2022 96 June 23 2022 When someone dies their surviving spouse or representative files the deceased person s final tax return On the final tax return the surviving spouse or representative will note that the person has died The IRS doesn t need any other notification of the death

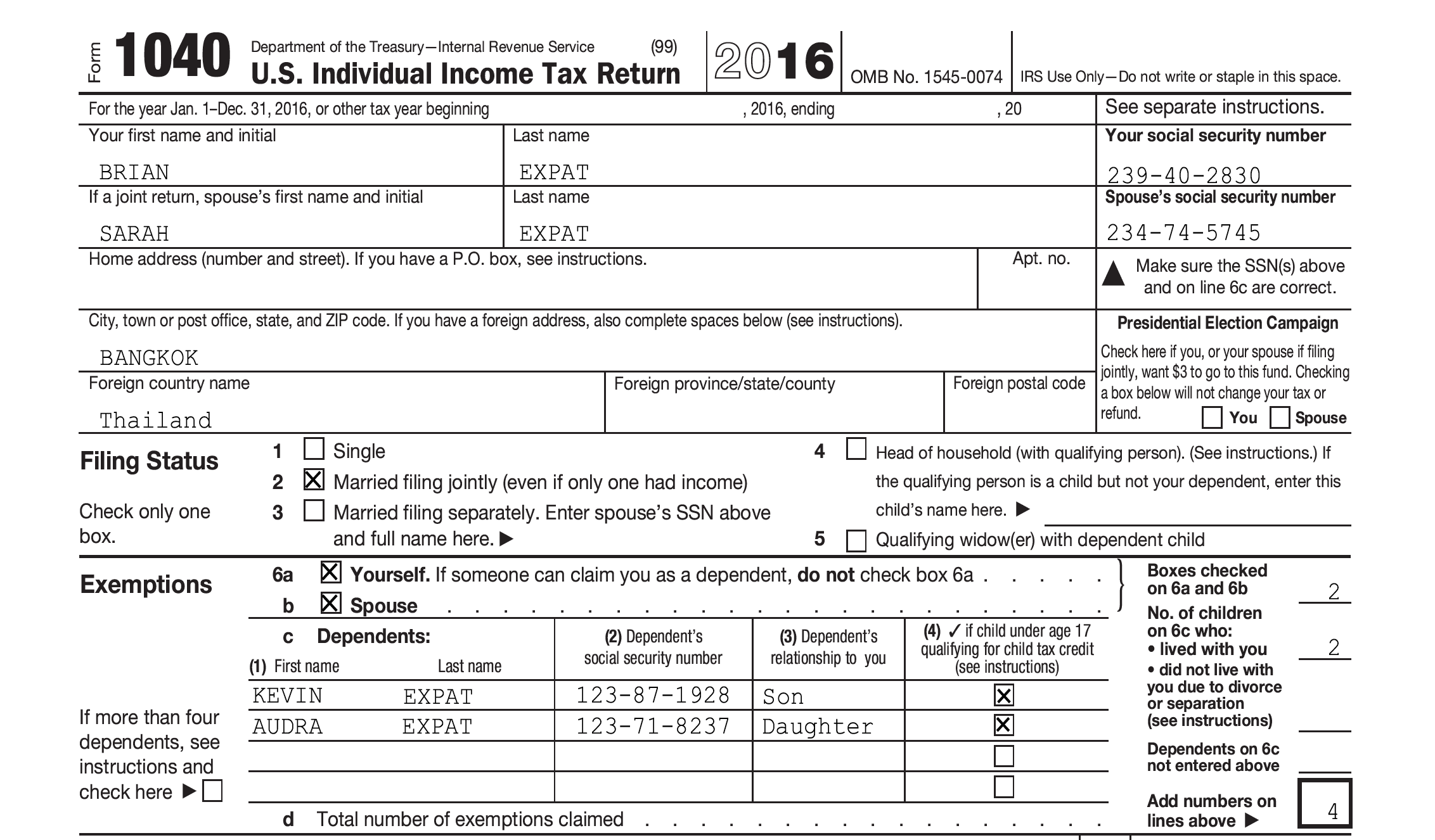

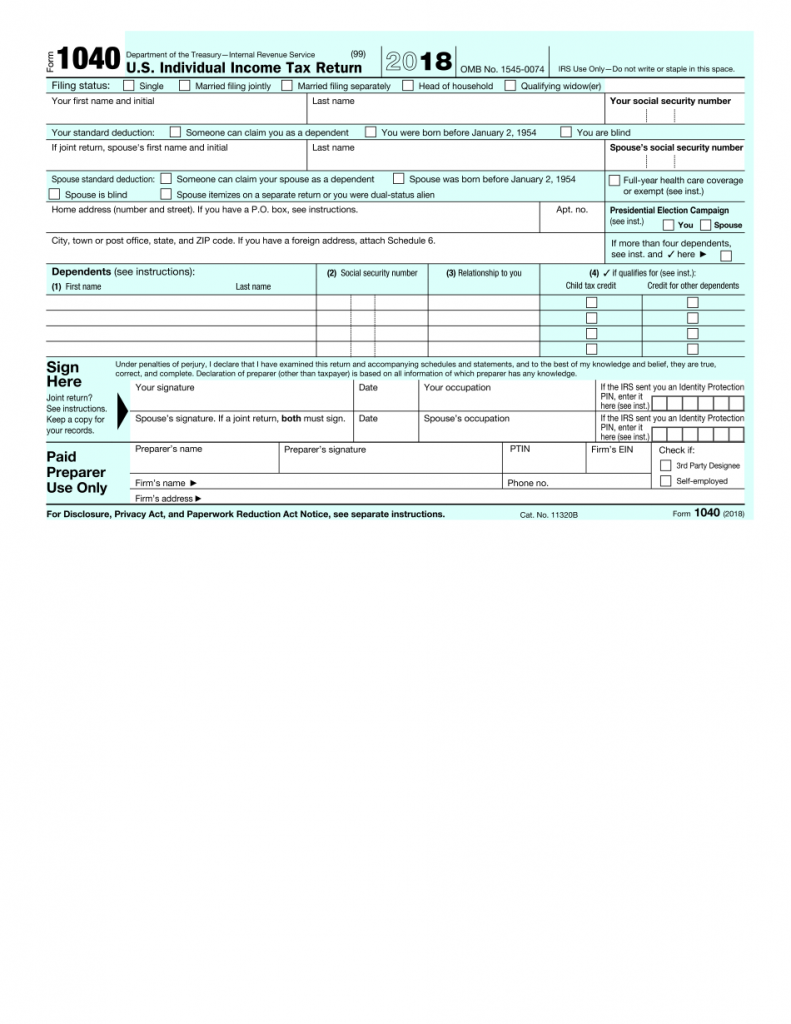

Form 1040 U S Individual Income Tax Return 2023 Department of the Treasury Internal Revenue Service OMB No 1545 0074 IRS Use Only Do not write or staple in this space Qualifying surviving spouse QSS If you checked the MFS box enter the name of your spouse If you checked the HOH or QSS box enter the child s name if the For tax years before 2018 and after 2025 a surviving spouse with no gross income can be claimed as an exemption on both of these Your deceased spouse s separate return Your new spouse s separate return However if you file jointly with your new spouse you can claim an exemption only on that joint return Qualifying widow er

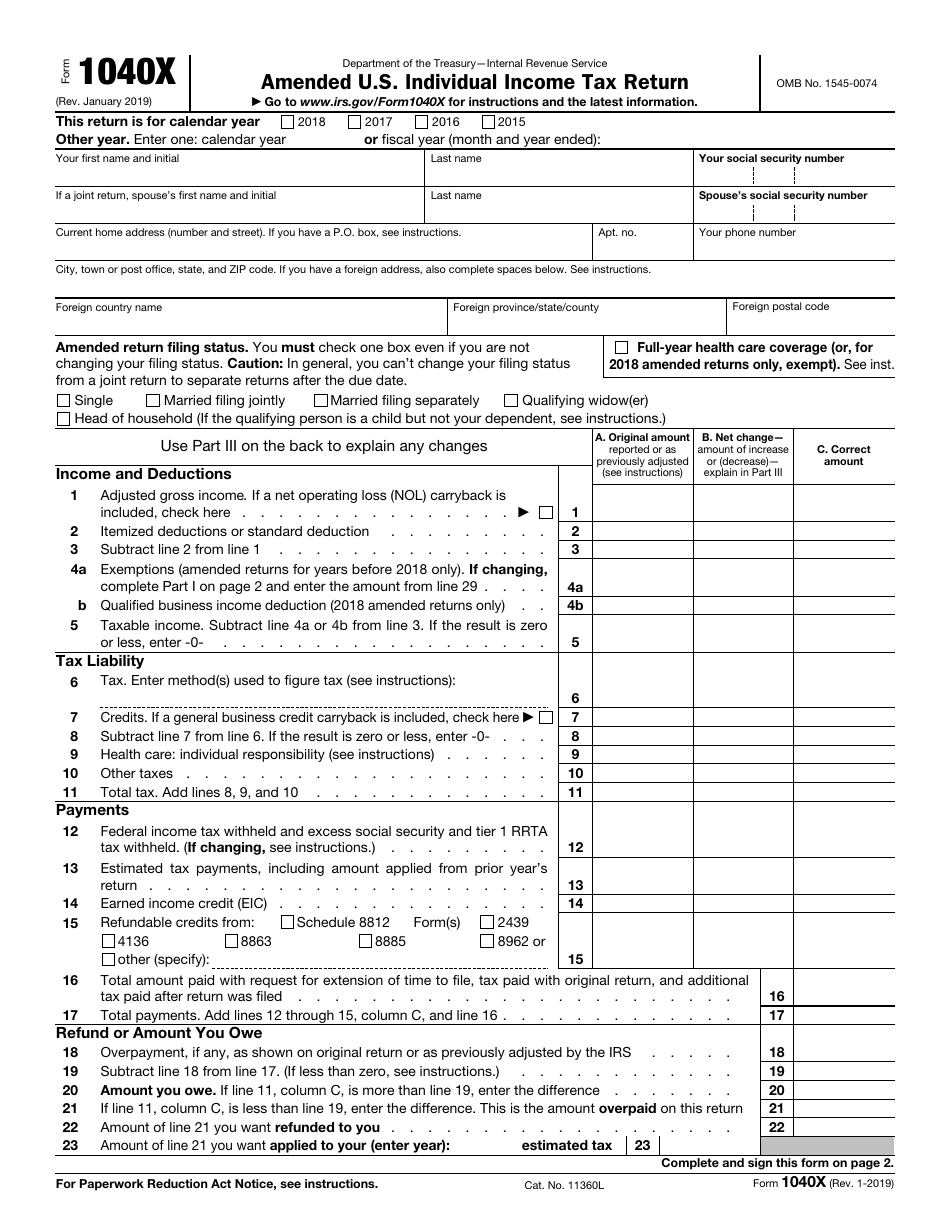

Irs Tax Forms Printable 1040 Jointly Surviving Spouse

Irs Tax Forms Printable 1040 Jointly Surviving Spouse

https://images.ctfassets.net/ifu905unnj2g/6WhnxDfD1Cy37oFnwl1y3A/cf0b773d3eabfd118e886dd452b6bff0/2021_Form_1040.png

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

https://d3pbdh1dmixop.cloudfront.net/pdfexpert/content_pages/mac_how-to-fill-1040-form/tax-forms-941-rs-tax-form-1040-20232x.png

Irs Form 1040 Married Filing Jointly Form Resume Examples

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2018/11/1040ez-tax-filing-form.jpg

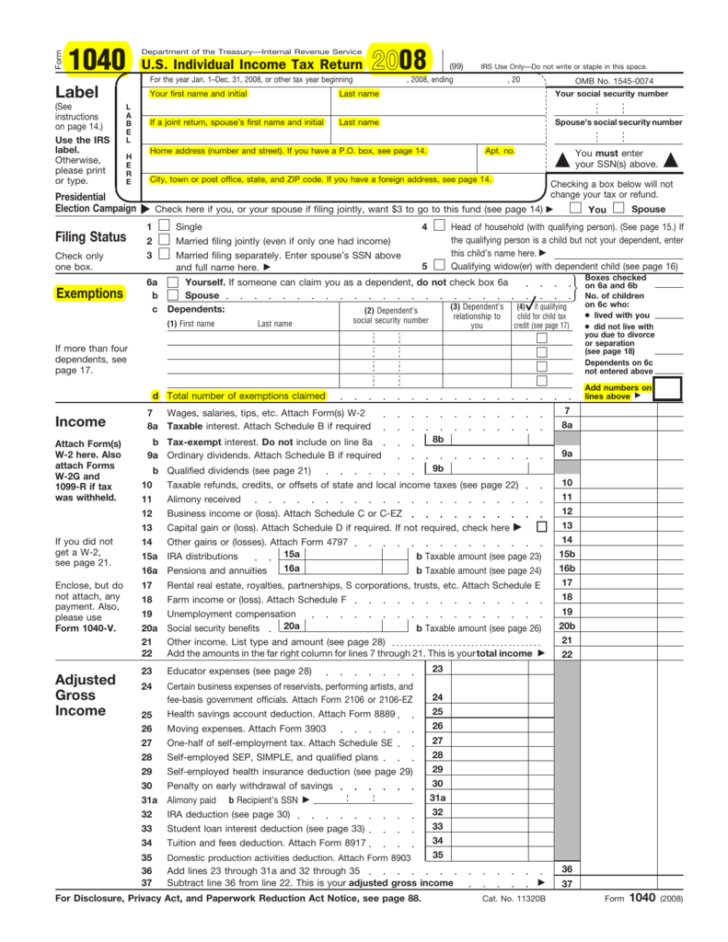

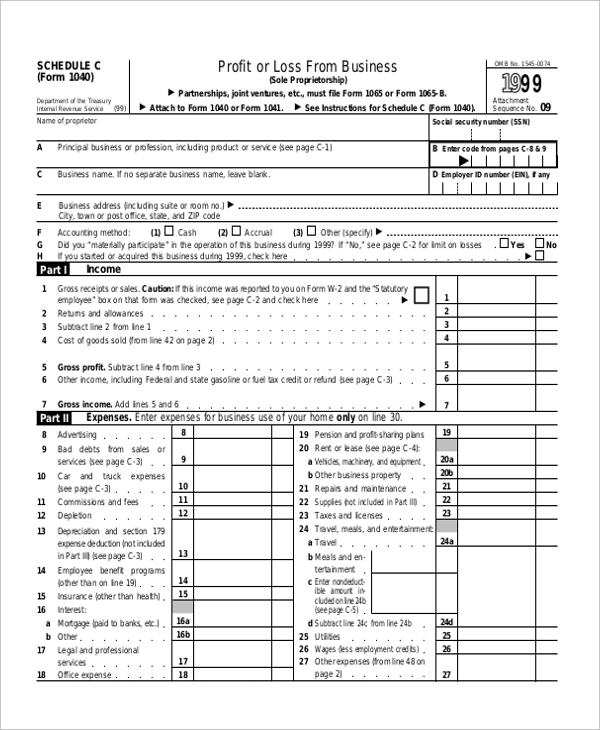

A final individual income tax return Form 1040 must be filed for the year of a decedent s death If a surviving spouse does not remarry during the year the spouse may file a joint return with the decedent for the year of death but is not required to do so Sec 6013 a 3 Internal Revenue Service Married filing jointly or Qualifying surviving spouse your total tax on line 24 on your 2023 Form 1040 or 1040 SR is zero or less than the sum of lines 27 28 and 29 or 2 you were not required to file a return because your income

Form 1040 ES Estimated Tax for Individuals Department of the Treasury Internal Revenue Service Purpose of This Package Use Form 1040 ES to figure and pay your estimated tax for 2024 Married filing jointly or Qualifying surviving spouse 29 200 Head of household 21 900 Single or Married filing separately 14 600 For unmarried decedent the initial step is to file the last tax return that covers the period from January 1 2020 through the date of death A surviving spouse can file a joint return for the year of death if the surviving spouse has not remarried during the same year The surviving spouse will file a joint Form 1040 with the deceased spouse

More picture related to Irs Tax Forms Printable 1040 Jointly Surviving Spouse

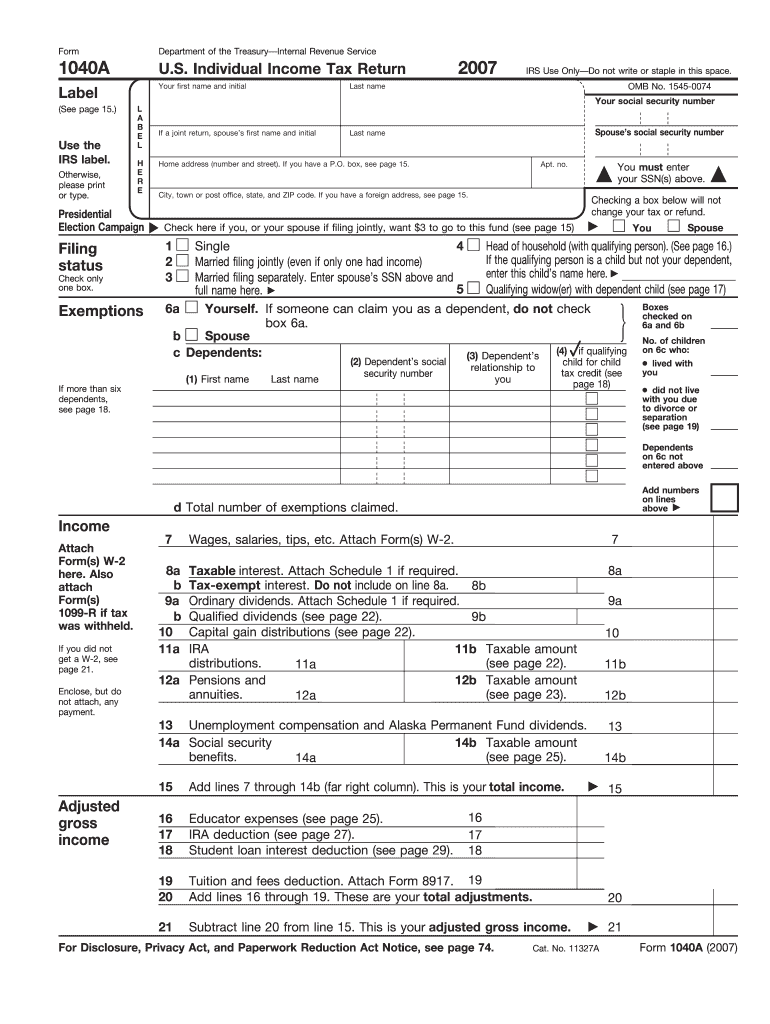

IRS 1040 A 2007 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/100/47/100047905/large.png

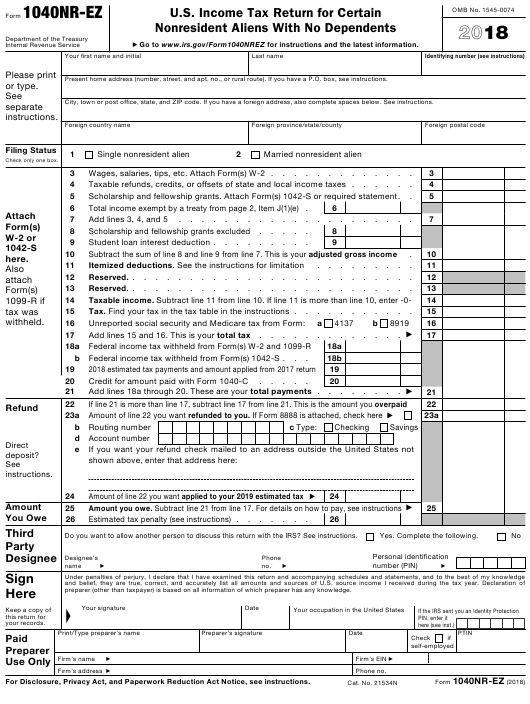

IRS Form 1040 NR EZ Download Fillable PDF Or Fill Online U 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/irs-form-1040-nr-ez-download-fillable-pdf-or-fill-online-u-5.png

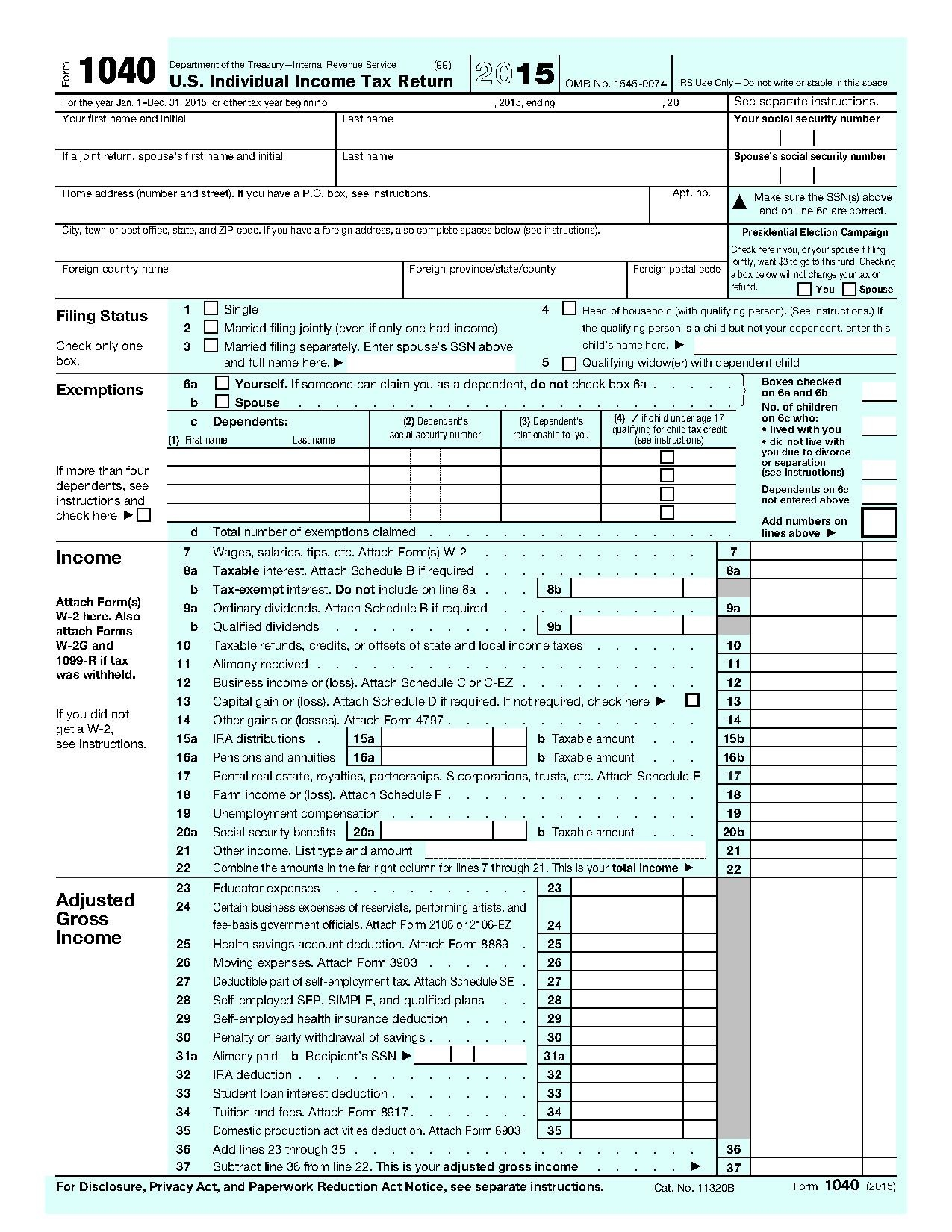

Irs Fillable Form 1040 Fillable Irs Forms 1040 Form Resume Examples GxKk5LY87A

https://1044form.com/wp-content/uploads/2020/08/irs-form-1040-the-ct-mirror-3.jpg

That said the IRS releases data periodically throughout tax season and so far the average tax refund is trending lower 1 395 versus 1 963 at this time last year the IRS said in a press Any armed forces federal reservist and National Guard personnel whose AGI is 79 000 or less are eligible for IRS Free File Veterans and retirees are not automatically eligible You or your spouse must have a 2023 Form W2 Wage and Tax Statement from a branch of the military services

Claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you file a paper return your deductions go on Form 1040 and may require extra forms 27 700 for married couples filing jointly or qualifying surviving spouse Filing a Final 2022 Form 1040 or 1040 SR for a Deceased Spouse If your spouse died during the year you are considered married for the entire year for federal income tax purposes

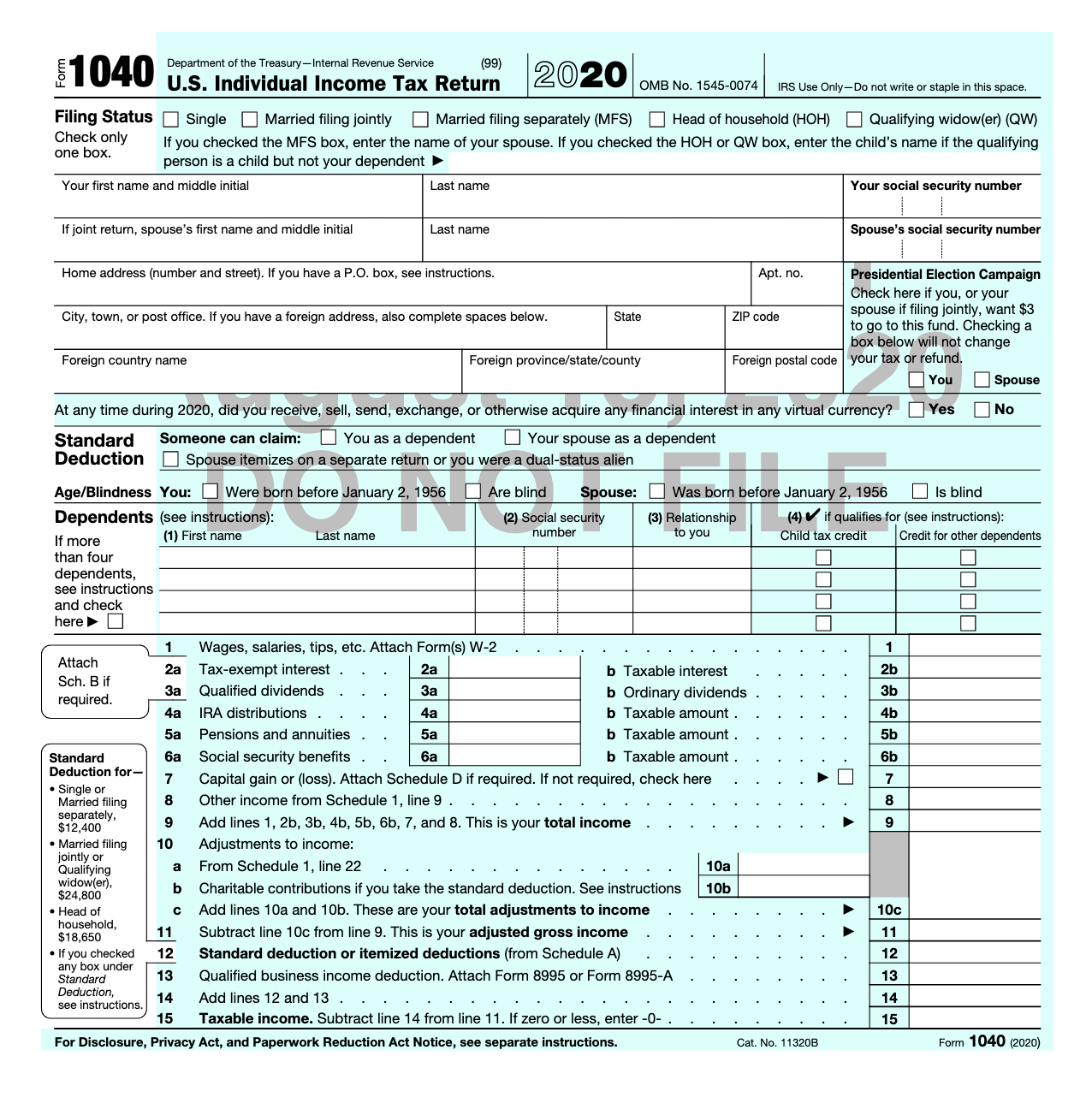

IRS Form 1040 Download Fillable PDF Or Fill Online U S Individual Income Tax Return 2020

https://data.templateroller.com/pdf_docs_html/2117/21172/2117242/irs-form-1040-u-s-individual-income-tax-return_print_big.png

What s New On Form 1040 For 2020 Taxgirl

https://www.taxgirl.com/wp-content/uploads/2020/11/Screen-Shot-2020-11-19-at-4.45.42-PM.png

https://www.irs.gov/newsroom/how-to-file-a-final-tax-return-for-someone-who-has-passed-away

IRS Tax Tip 2022 96 June 23 2022 When someone dies their surviving spouse or representative files the deceased person s final tax return On the final tax return the surviving spouse or representative will note that the person has died The IRS doesn t need any other notification of the death

https://www.irs.gov/pub/irs-pdf/f1040.pdf

Form 1040 U S Individual Income Tax Return 2023 Department of the Treasury Internal Revenue Service OMB No 1545 0074 IRS Use Only Do not write or staple in this space Qualifying surviving spouse QSS If you checked the MFS box enter the name of your spouse If you checked the HOH or QSS box enter the child s name if the

1040 Printable Tax Form

IRS Form 1040 Download Fillable PDF Or Fill Online U S Individual Income Tax Return 2020

1040 U S Individual Income Tax Return Filing Status 2021 Tax Forms 1040 Printable

Irs 1040 Form 2020 Pdf 1040ez Form Fill Out And Sign Printable Pdf Template Signnow

Irs 1040 Form Example IRS Offers New Look At Form 1040 SR U S Tax Return For It Helps

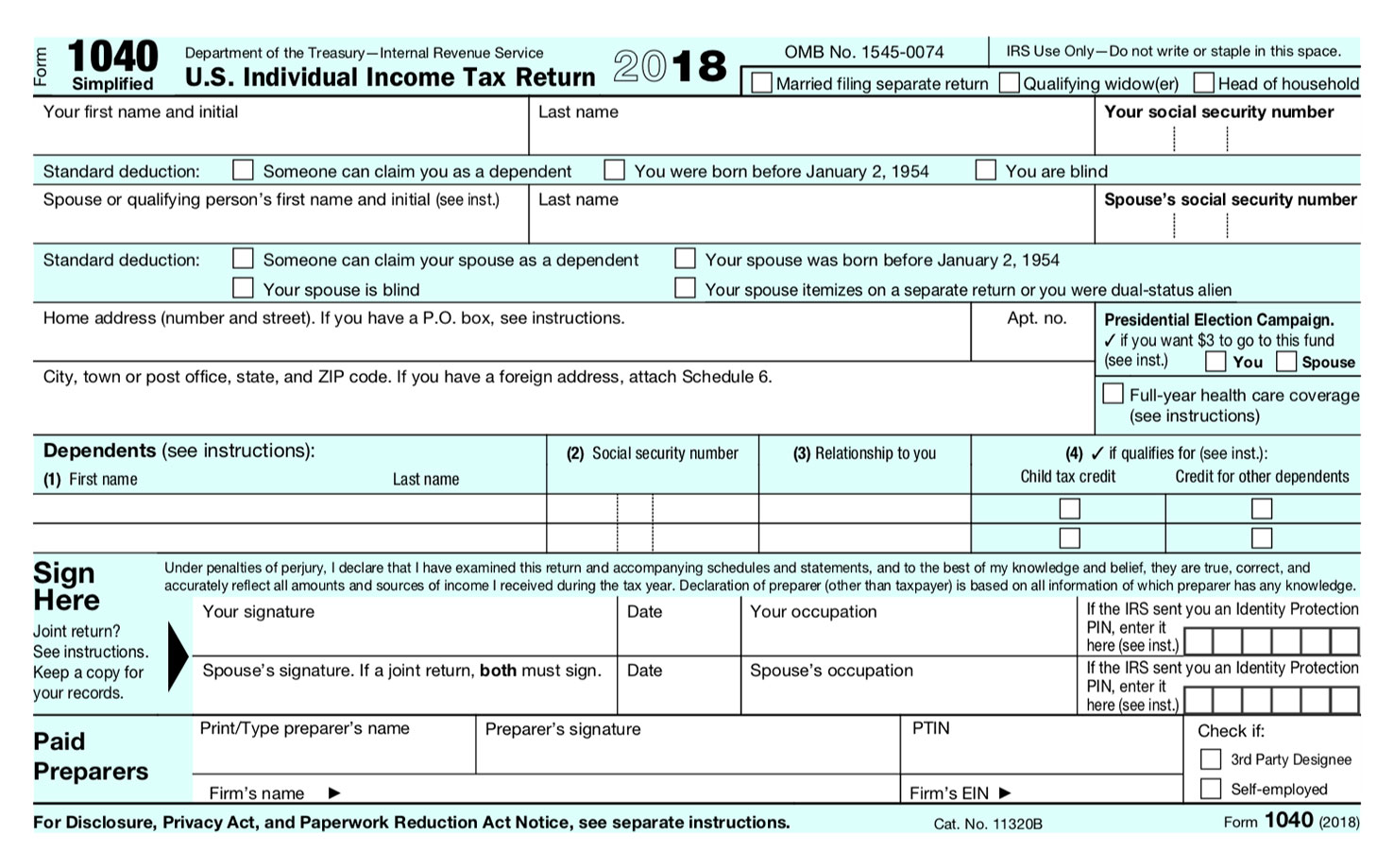

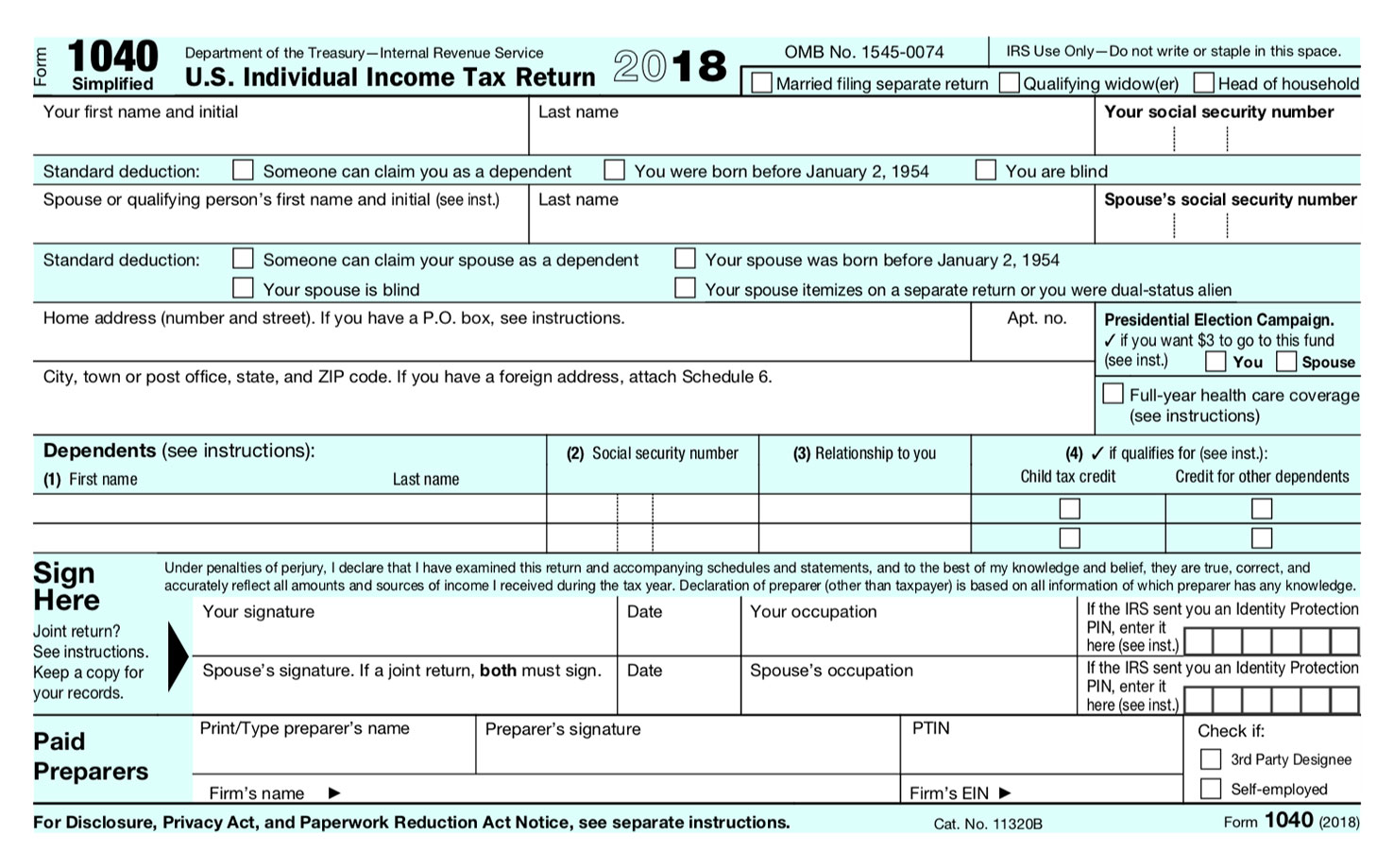

Simplified Tax Form NESA

Simplified Tax Form NESA

IRS 1040 Form Fillable Printable In PDF Printable Form 2021

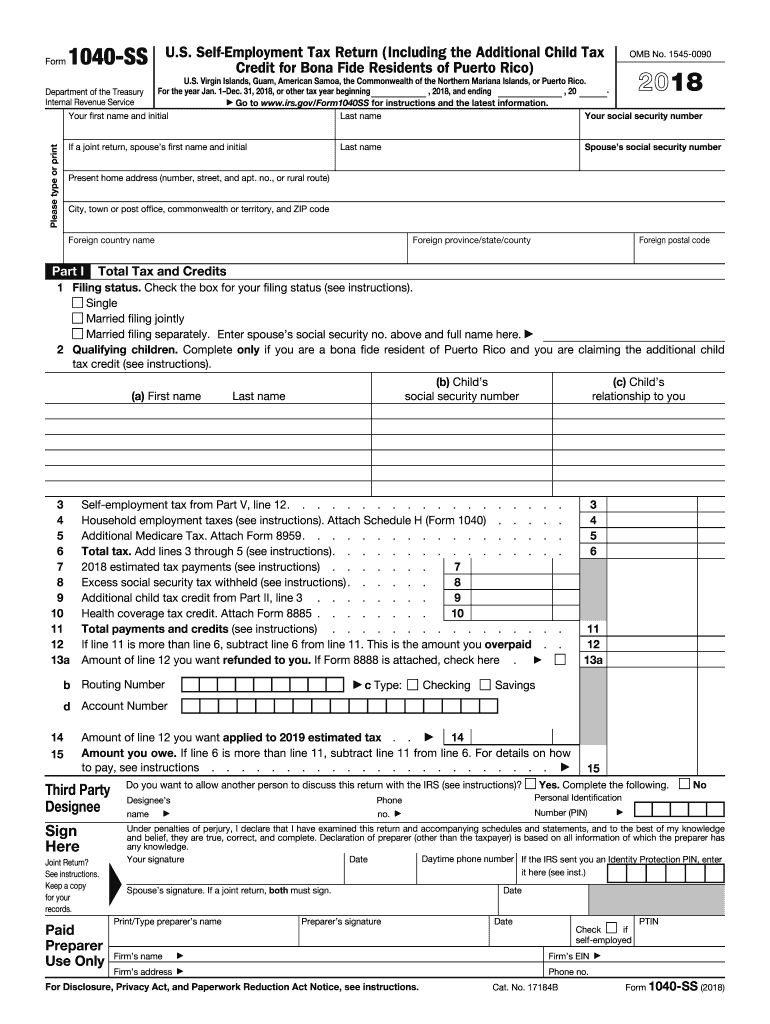

2018 Form IRS 1040 SS Fill Online Printable Fillable 2021 Tax Forms 1040 Printable

Irs Printable Form 1040

Irs Tax Forms Printable 1040 Jointly Surviving Spouse - Internal Revenue Service Married filing jointly or Qualifying surviving spouse your total tax on line 24 on your 2023 Form 1040 or 1040 SR is zero or less than the sum of lines 27 28 and 29 or 2 you were not required to file a return because your income