Kansas Income Ta Form Schedule S Printable Individual Income Tax Food Sales Refund Instructions Rev 8 05 Please allow 4 to 8 weeks from the date you mail your return to receive your refund Errors improperly completed forms photocopied forms or incomplete information will delay the processing of your return For a faster refund 7 days or less consider filing your return

2023 Forms Individual Income Tax K 40 Original and Amended 2023 Individual Income Tax Supplemental Schedule Schedule S 2023 Kansas Itemized Deduction Schedule Schedule A 2023 Kansas Payment Voucher K 40V 2023 Individual Underpayment of Estimated Tax Schedule and instructions K 210 2023 Historical Past Year Versions of Kansas Schedule S We have a total of twelve past year versions of Schedule S in the TaxFormFinder archives including for the previous tax year Download past year versions of this tax form as PDFs here 2023 Schedule S Sch S Supplemental Schedule Rev 7 23 2022 Schedule S Sch S Supplemental Schedule Rev 7 22

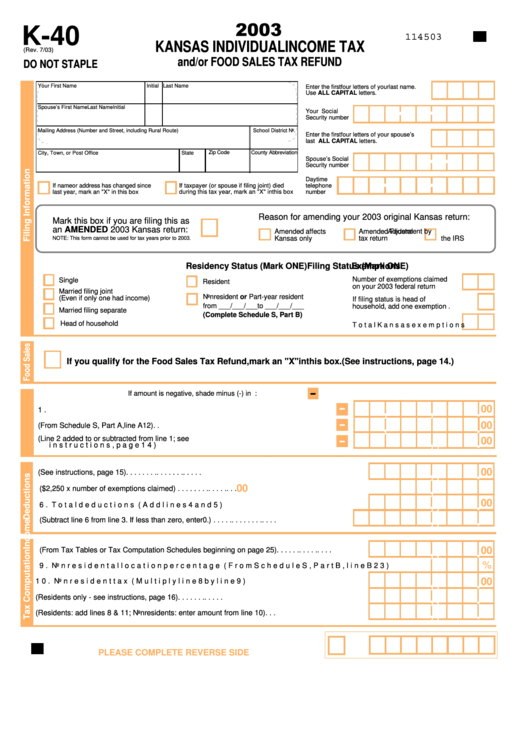

Kansas Income Ta Form Schedule S Printable

Kansas Income Ta Form Schedule S Printable

http://www.formsbirds.com/formimg/individual-income-tax/4013/individual-income-tax-kansas-l1.png

Kansas W2 Form Printable

https://data.formsbank.com/pdf_docs_html/289/2892/289204/page_1_thumb_big.png

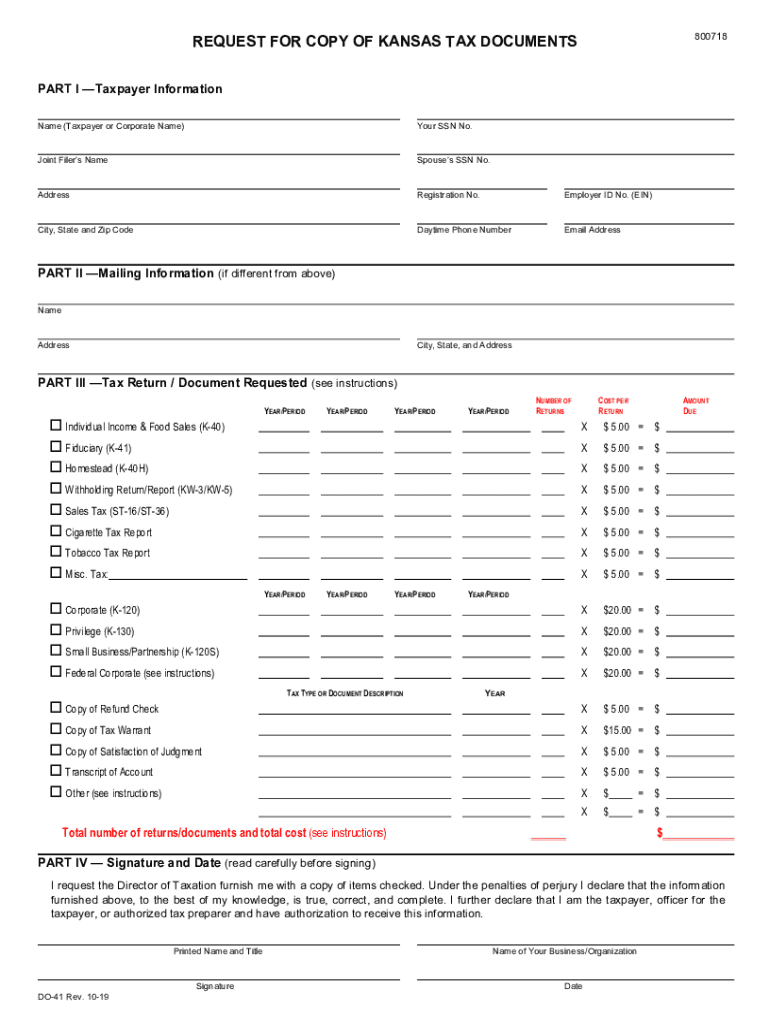

Kansas Form Copy Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/537/185/537185355/large.png

Printable Kansas Income Tax Schedule S Schedule S is a two page form that includes various modifications and additions for filing with your KS 40 including places for reporting income from sources including social security and various interest bearing investments Nonresidents or part time re For more information about the Kansas Income Tax File Now with TurboTax We last updated Kansas Schedule S in January 2024 from the Kansas Department of Revenue This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Kansas government

Schedule Period Dates Initiation Date Settlement Due Date Relevant Holidays No Schedules Found for this combination 2023 Kansas Printable Income Tax Forms 74 PDFS Kansas has a state income tax that ranges between 3 1 and 5 7 For your convenience Tax Brackets provides printable copies of 74 current personal income tax forms from the Kansas Department of Revenue The current tax year is 2023 with tax returns due in April 2024

More picture related to Kansas Income Ta Form Schedule S Printable

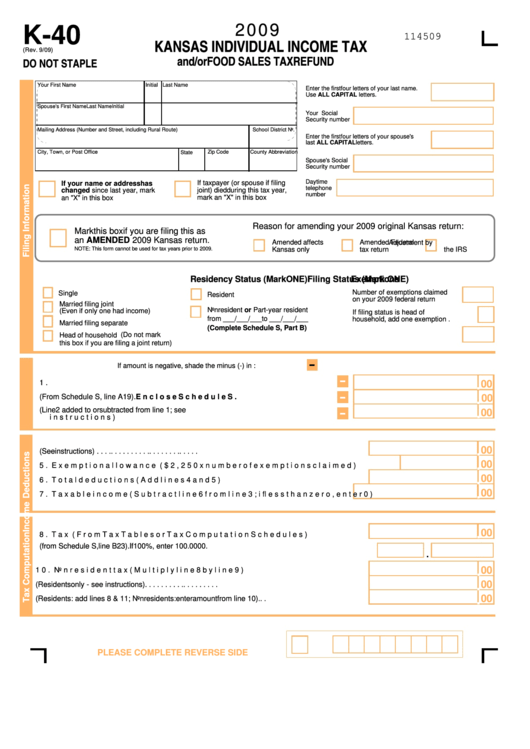

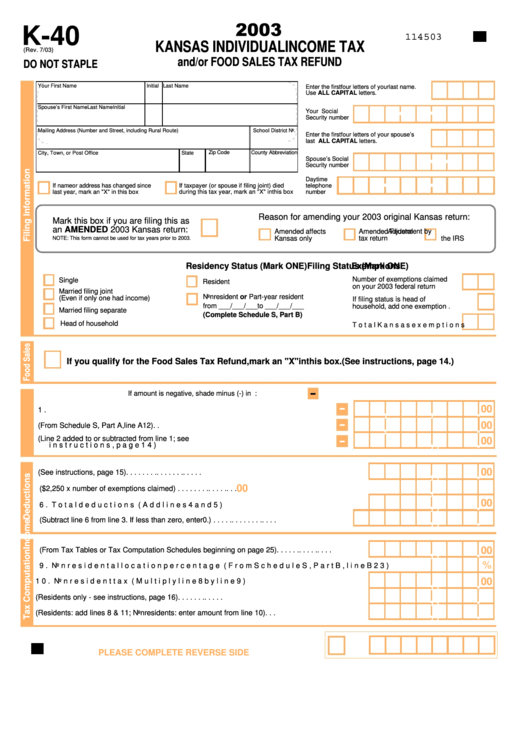

Fillable Form K 40 Kansas Individual Income Tax And or Food Sales Tax Refund 2009 Printable

https://data.formsbank.com/pdf_docs_html/171/1711/171164/page_1_thumb_big.png

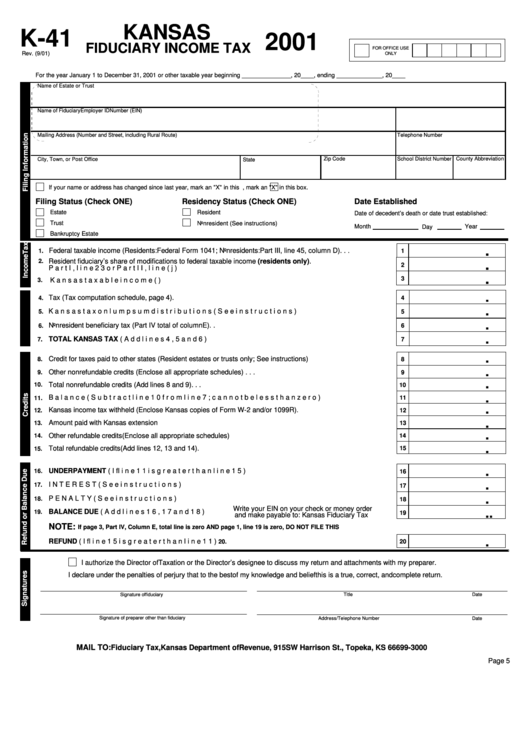

Form K 41 Kansas Fiduciary Income Tax 2001 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/194/1940/194094/page_1_thumb_big.png

1040x Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/392/726/392726019/large.png

Kansas has a state income tax that ranges between 3 1 and 5 7 which is administered by the Kansas Department of Revenue TaxFormFinder provides printable PDF copies of 74 current Kansas income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024 Individual Income Tax 21 Enter amounts withdrawn from a qualified retirement account Include any earnings thereon to the extent that the amounts withdrawn were 1 Originally received as a KPERS lump sum payment at retirement and rolled over into a qualified retirement account and 2 The amount is included in your Federal Adjusted Gross Income Line 1 of Form K 40 Do not make an entry if the amount withdrawn

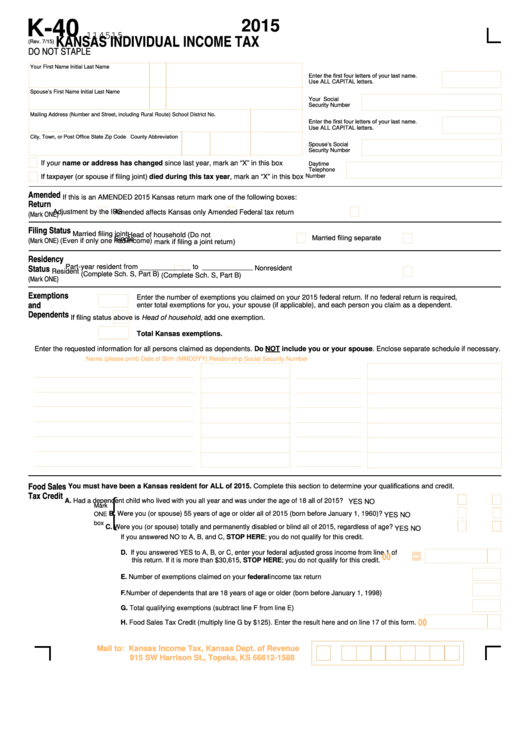

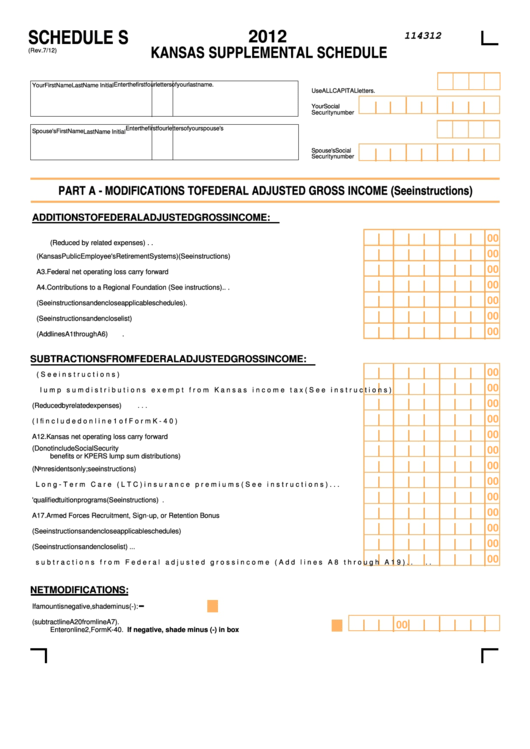

IMPORTANT Refer to the Schedule S instructions before completing Parts A B or C of this form You must enclose all supportive documentation where indicated in the instructions 114320 Enter the first four letters of your last name Use ALL CAPITAL letters Your Social Security number Enter the first four letters of your spouse s last name Individual Income Tax Return K 40 Individual Income Tax Return Rev 7 23 K 40 2023 KANSAS INDIVIDUAL INCOME TAX Rev 7 23 DO NOT STAPLE Your First Name K 40 Page 1 114523 Initial Last Name Enter the first four letters of your last name

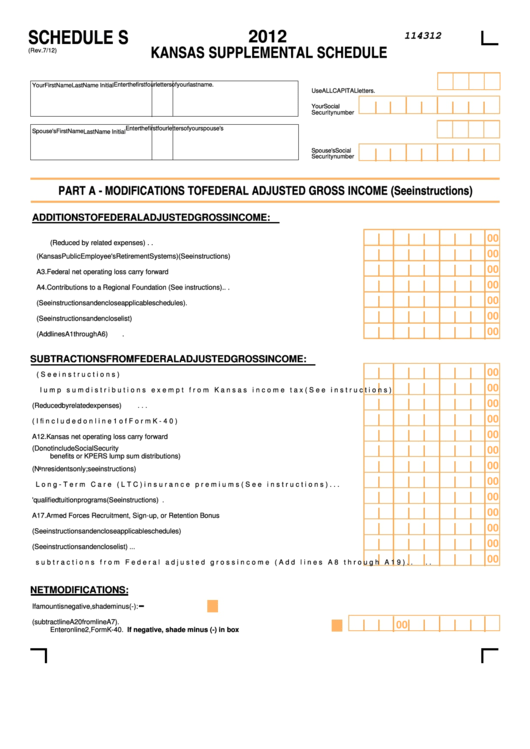

Fillable Form Schedule S Kansas Supplemental Schedule 2012 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/331/3315/331577/page_1_thumb_big.png

Free Printable Kansas Tax Forms Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/330/3305/330555/page_1_thumb_big.png

https://www.ksrevenue.gov/pdf/schsinst05.pdf

Individual Income Tax Food Sales Refund Instructions Rev 8 05 Please allow 4 to 8 weeks from the date you mail your return to receive your refund Errors improperly completed forms photocopied forms or incomplete information will delay the processing of your return For a faster refund 7 days or less consider filing your return

https://www.ksrevenue.gov/forms-ii.html

2023 Forms Individual Income Tax K 40 Original and Amended 2023 Individual Income Tax Supplemental Schedule Schedule S 2023 Kansas Itemized Deduction Schedule Schedule A 2023 Kansas Payment Voucher K 40V 2023 Individual Underpayment of Estimated Tax Schedule and instructions K 210 2023

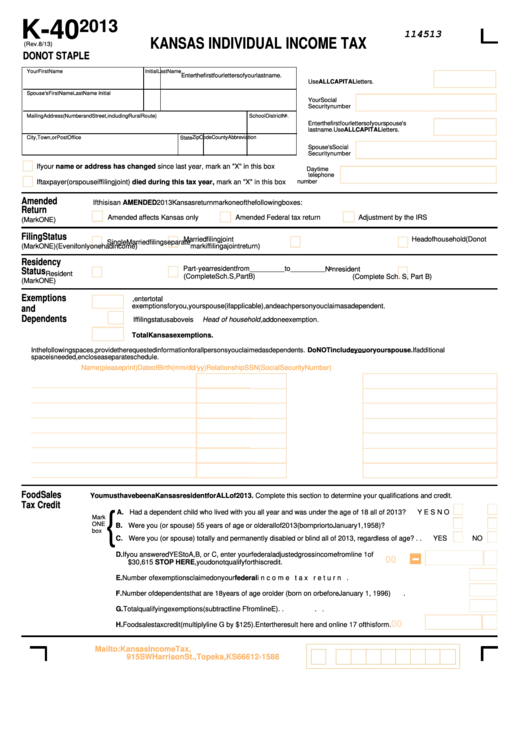

Fillable Form K 40 Kansas Individual Income Tax 2013 Printable Pdf Download

Fillable Form Schedule S Kansas Supplemental Schedule 2012 Printable Pdf Download

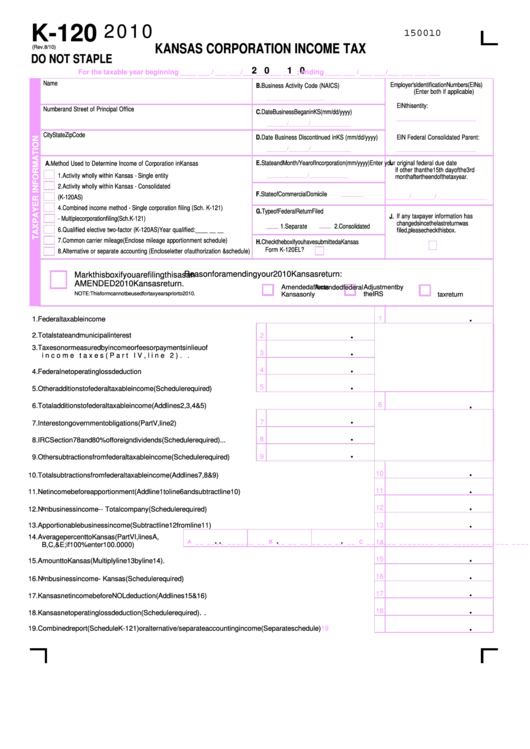

Form K 120 Kansas Corporation Income Tax 2010 Printable Pdf Download

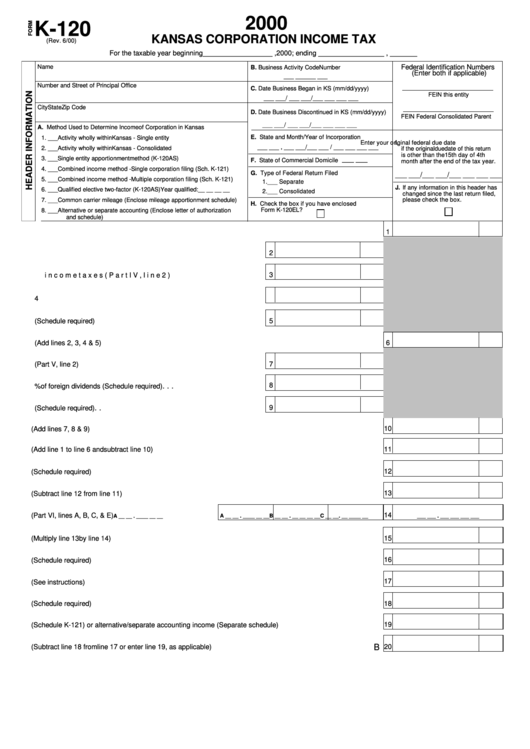

Form K 120 Kansas Corporation Income Tax 2000 Printable Pdf Download

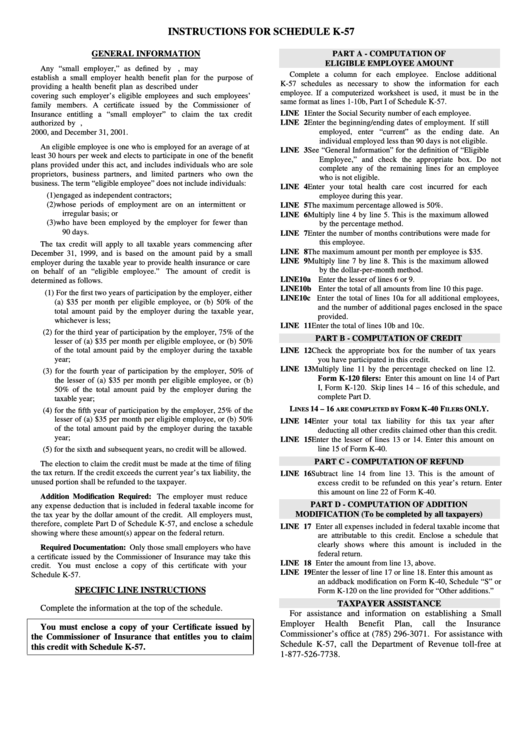

Instructions For Schedule K 57 Kansas Department Of Revenue Printable Pdf Download

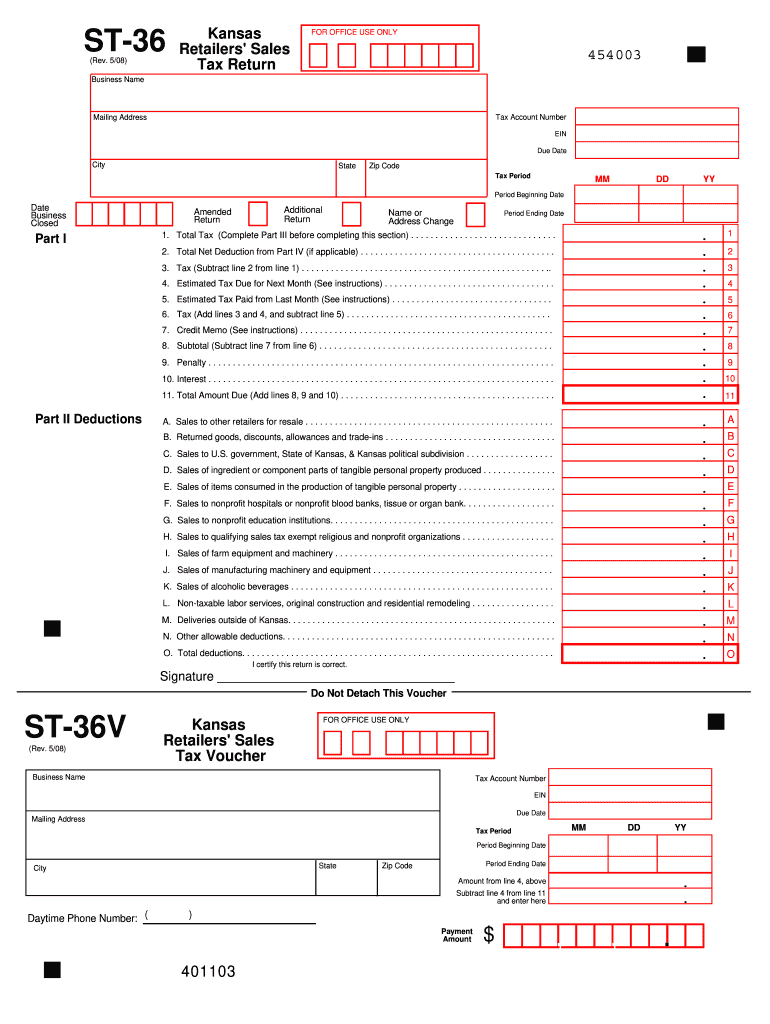

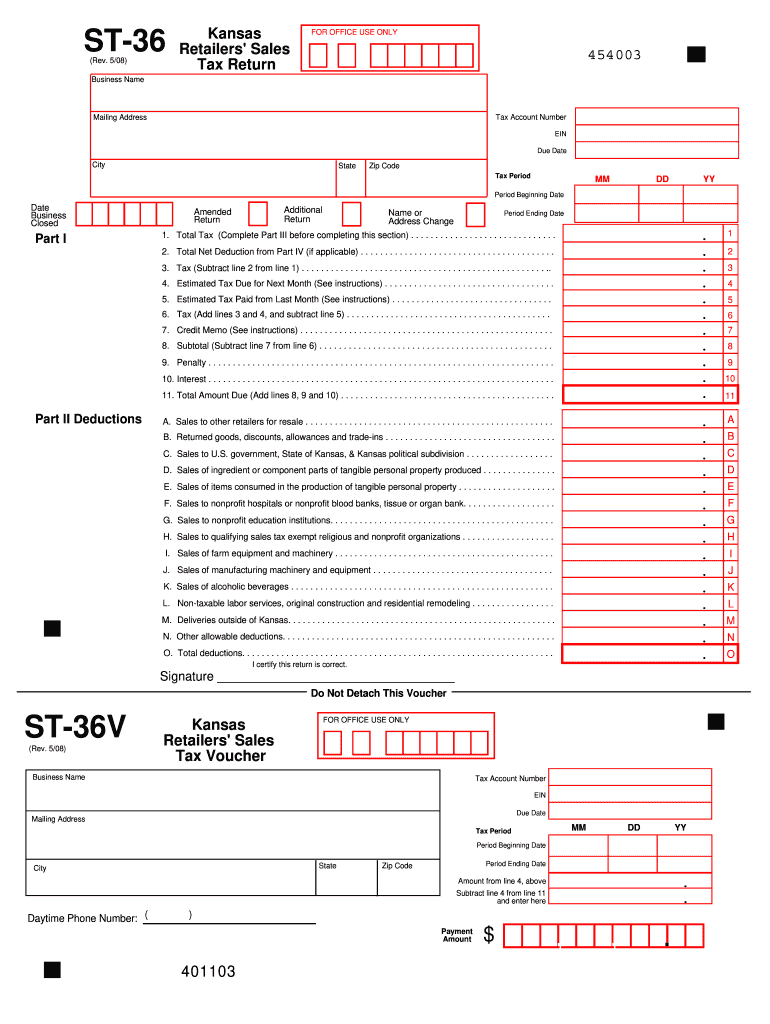

St 36 Kansas Retailers Sales Tax Return Online Fill Online Printable Fillable Blank PdfFiller

St 36 Kansas Retailers Sales Tax Return Online Fill Online Printable Fillable Blank PdfFiller

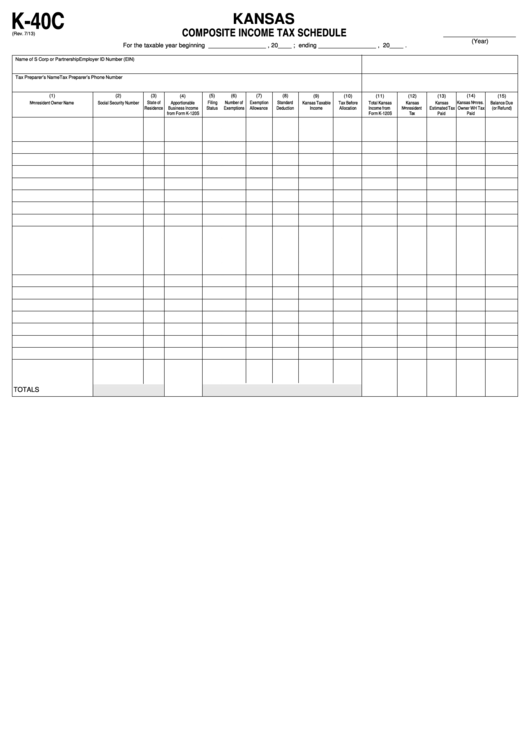

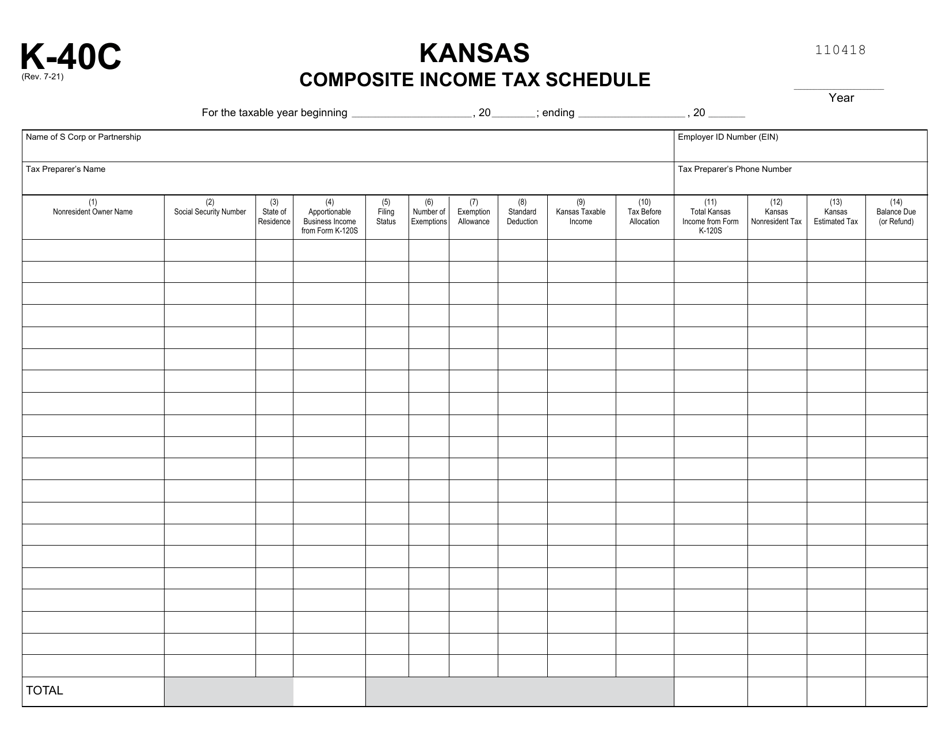

Fillable Form K 40c Kansas Composite Income Tax Schedule Printable Pdf Download

Schedule K 40C Download Fillable PDF Or Fill Online Kansas Composite Income Tax Schedule Kansas

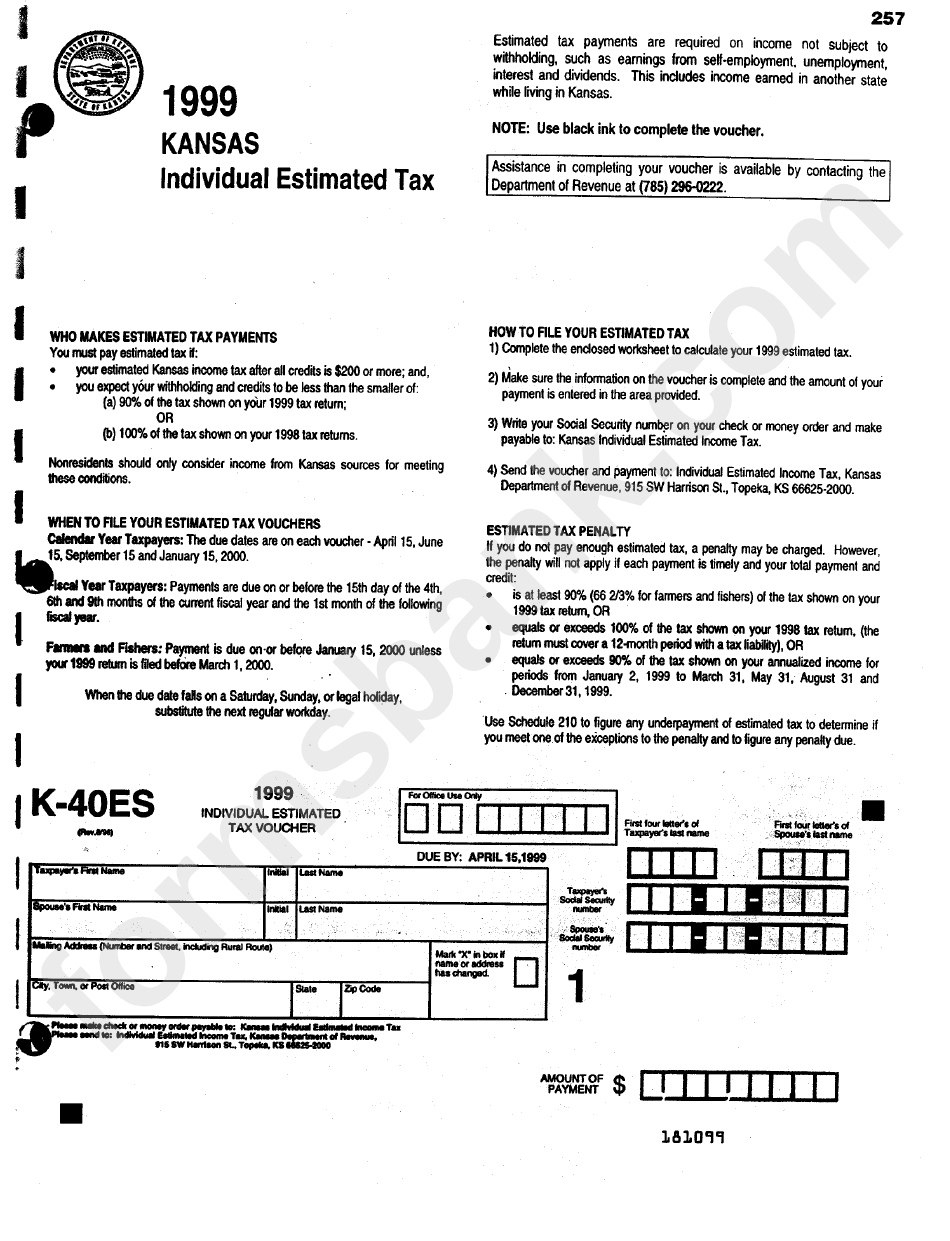

Fillable Form K 40es Individual Estimated Tax Kansas Department Of Revenue 1999 Printable

Kansas Income Ta Form Schedule S Printable - Standard deduction amounts The standard deduction for 2023 is 13 850 for single or married filing separately 27 700 for married couples filing jointly or qualifying surviving spouse 20 800 for head of household Find the standard deduction if you re Over 65 or blind A dependent on someone else s tax return