Printable Nc Tax Extension Form Contact Information File an extension Request an extension of time to file an Individual Income Tax Return D 400 Does not provide an extension of time to pay the tax due Must file the extension by the original due date of your return

Form D 410 is used to extend the time for filing a North Carolina Individual Income tax return Form D 400 This form is not required if you were granted an automatic extension to file your federal income tax return If you were granted an automatic federal extension and need to make a payment for taxes due use Form D 410 Extension for Filing Individual Income Tax Return Easily download view and print your forms online Download Tax Forms North Carolina Department of Revenue PO Box 25000 Raleigh NC 27640 0640 General information 1 877 252 3052 Individual income tax refund inquiries

Printable Nc Tax Extension Form

Printable Nc Tax Extension Form

https://www.pdffiller.com/preview/440/525/440525760/large.png

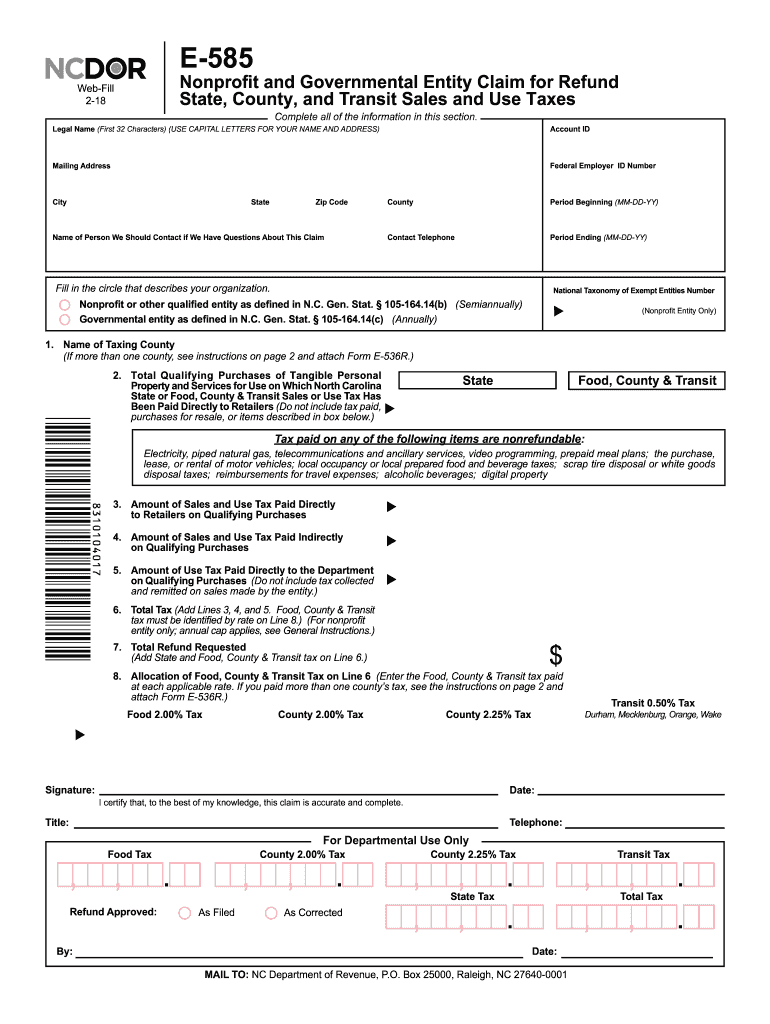

NC NC 3 2018 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/466/120/466120834/large.png

Free Printable Tax Extension Form Printable Forms Free Online

https://calendargraphicdesign.com/wp-content/uploads/2021/01/form-4868-fill-irs-extension-form-online-for-free-smallpdf.png

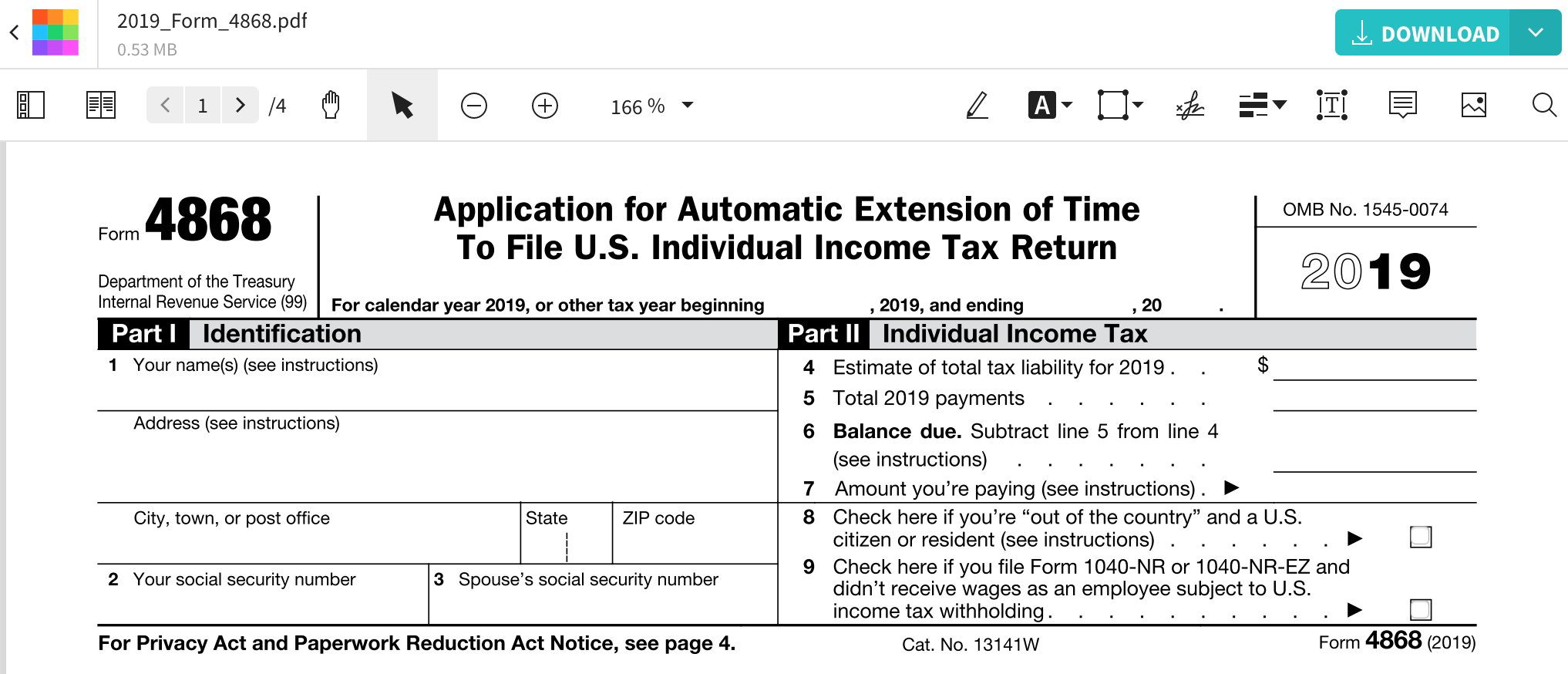

Download or print the 2023 North Carolina Form D 410 Application for Extension for Filing Individual Income Tax Return for FREE from the North Carolina Department of Revenue The IRS and most states will grant an automatic 6 month extension of time to file income tax and other types of tax returns which can be obtained by filing the To request an extension use North Carolina Form D 410 Application for Extension for Filing Individual Income Tax Return If you owe North Carolina tax remember to make an extension payment with your request and submit Form D 410 by the original due date of your return April 15

Purpose Use Form D 410 to ask for 6 more months to file the North Carolina Individual Income Tax Return Form D 400 If you were granted an automatic extension to file your federal income tax return federal Form 1040 you do not have to file Form D 410 to receive an extension of time to file Form D 400 Important Although Download or print the 2023 North Carolina Application for Extension for Filing Individual Income Tax Return 2023 and other income tax forms from the North Carolina Department of Revenue More about the North Carolina Form D 410 Extension eFile your North Carolina tax return now eFiling is easier faster and safer than filling out

More picture related to Printable Nc Tax Extension Form

:max_bytes(150000):strip_icc()/Screenshot2023-03-02at11.05.35AM-1f84898730d248759e61f6ad2e1cb4fe.png)

Income Tax Extension 2023 Form Printable Forms Free Online

https://www.investopedia.com/thmb/gQBvYiXclCkiIcOq2ojiOVZGtiU=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Screenshot2023-03-02at11.05.35AM-1f84898730d248759e61f6ad2e1cb4fe.png

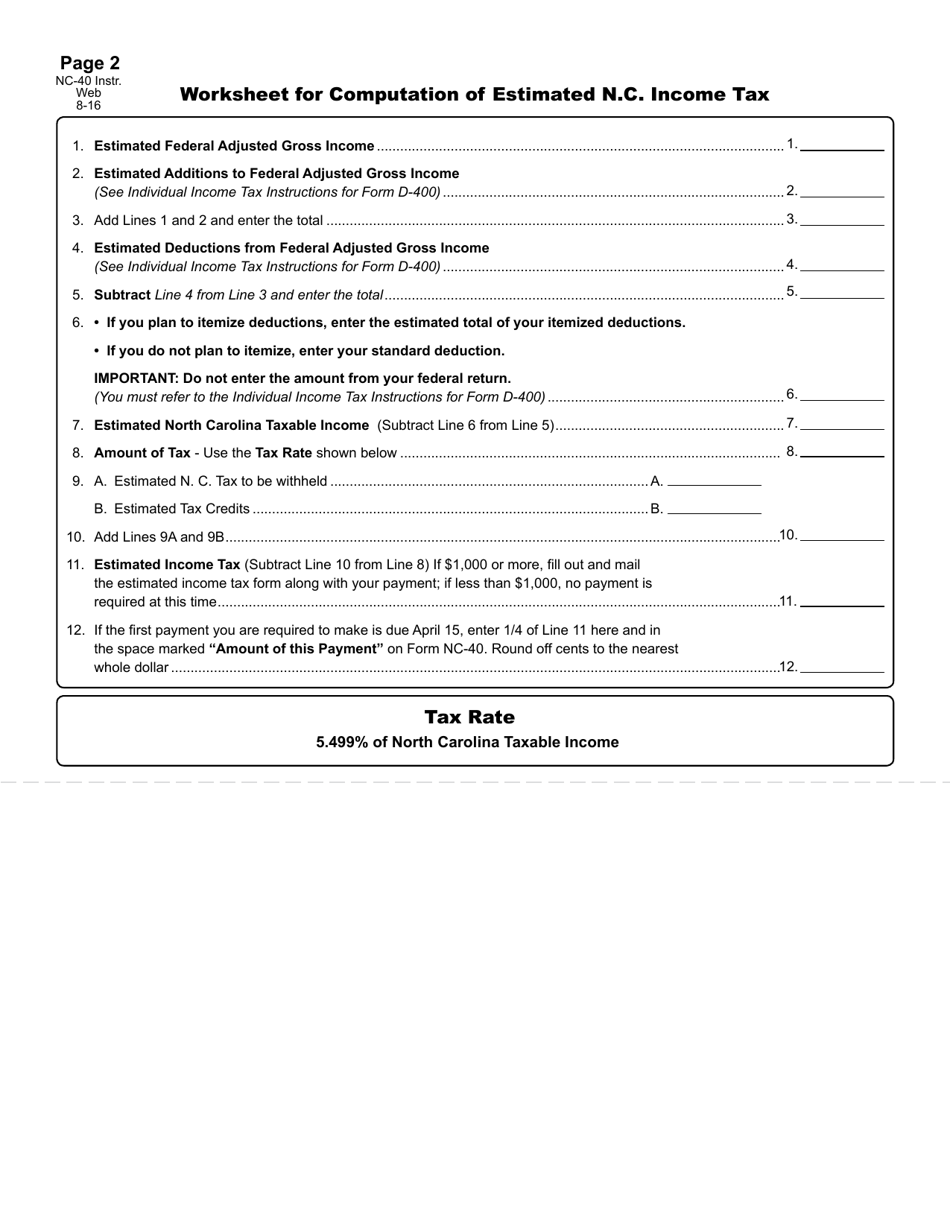

Form NC 40 Fill Out Sign Online And Download Printable PDF North Carolina Templateroller

https://data.templateroller.com/pdf_docs_html/1999/19996/1999655/page_2_thumb_950.png

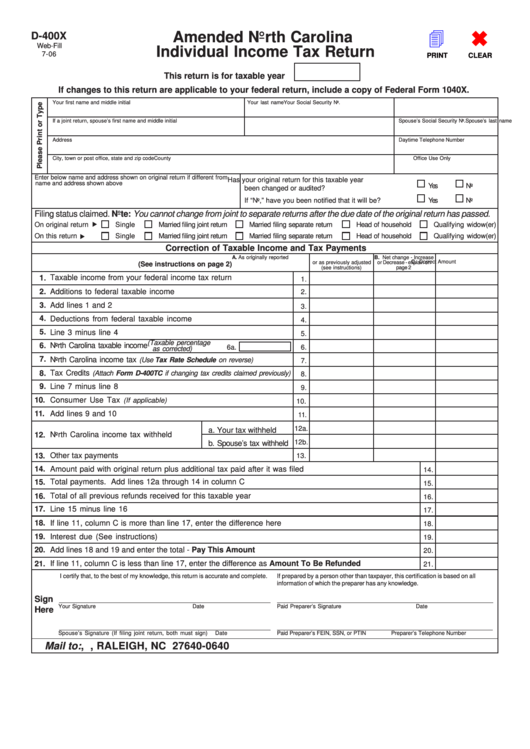

D 400x Amended North Carolina Individual Income Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/128/1287/128719/page_1_thumb_big.png

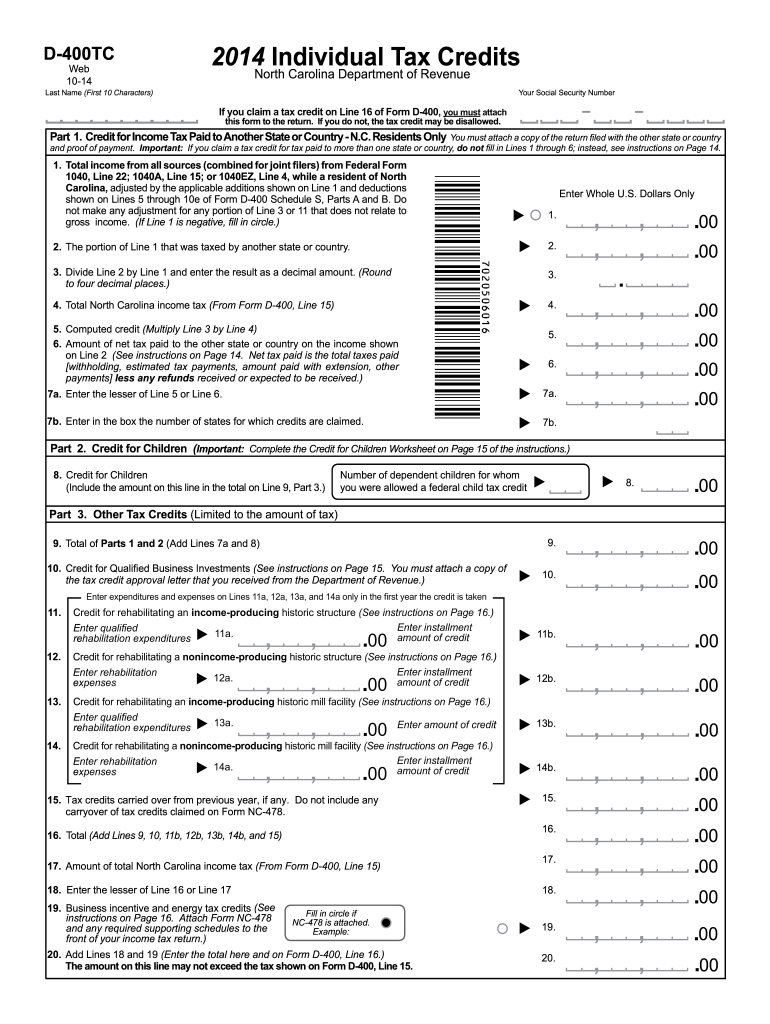

If tax is paid with this application include a check or money order in U S currency from a domestic bank Web 8 19 Application for Extension Franchise and Corporate Income Tax CD 419 GENERAL INSTRUCTIONS North Carolina law provides for an extension of time to file a North Carolina corporate tax return Form CD 405 CD 401S or CD 418 Federal Extension Were you granted an automatic extension to file your 2019 federal income tax return enclose Form NC EDU and your payment of To designate your overpayment to the Fund enter the amount of your designation on Page 2 Line 31 North Carolina Income Tax 15 Multiply Line 14 by 5 25 0 0525 If zero or less

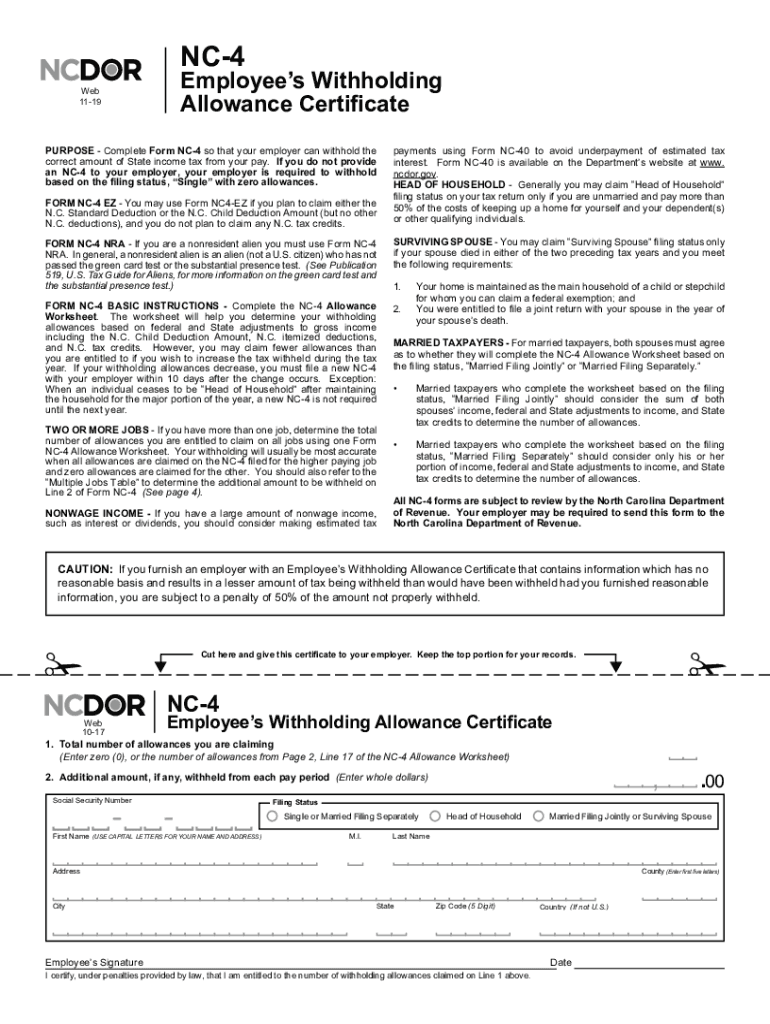

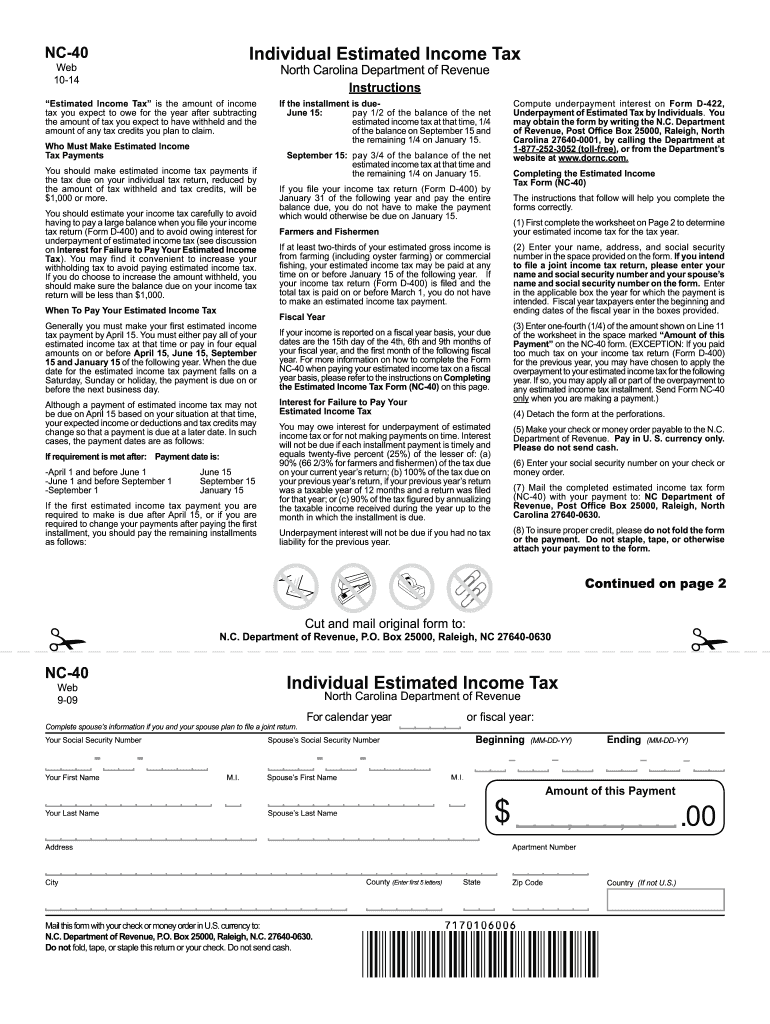

If you were granted an automatic federal extension and need to make a payment for taxes due use Form CD 419 Enter Your Information Below Then Click on Create Form to Create the Personalized Form CD 419 Application for Extension for Filing Corporate Income and Franchise Tax Return If you want to download a tax form use the navigation above search the site or choose a link below Find a Extension for Filing Individual Income Tax Return Individual Estimated Income Tax Form NC 40 North Carolina Department of Revenue PO Box 25000 Raleigh NC 27640 0640 General information 1 877 252 3052

NC DoR D 400 2015 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/6/964/6964331/large.png

Free Printable Tax Extension Form Printable Forms Free Online

https://www.pdffiller.com/preview/487/373/487373031/big.png

https://www.ncdor.gov/file-pay/extension-filing-individual-income-tax-return

Contact Information File an extension Request an extension of time to file an Individual Income Tax Return D 400 Does not provide an extension of time to pay the tax due Must file the extension by the original due date of your return

https://eservices.dor.nc.gov/vouchers/d410.jsp

Form D 410 is used to extend the time for filing a North Carolina Individual Income tax return Form D 400 This form is not required if you were granted an automatic extension to file your federal income tax return If you were granted an automatic federal extension and need to make a payment for taxes due use Form D 410

Nc State Tax Forms Printable

NC DoR D 400 2015 Fill Out Tax Template Online US Legal Forms

Nc State Tax Forms Printable

2019 Form NC DoR NC 4 Fill Online Printable Fillable Blank PdfFiller

Nc Department Of Revenue Estimated Tax Payment Form Fill Out And Sign Printable PDF Template

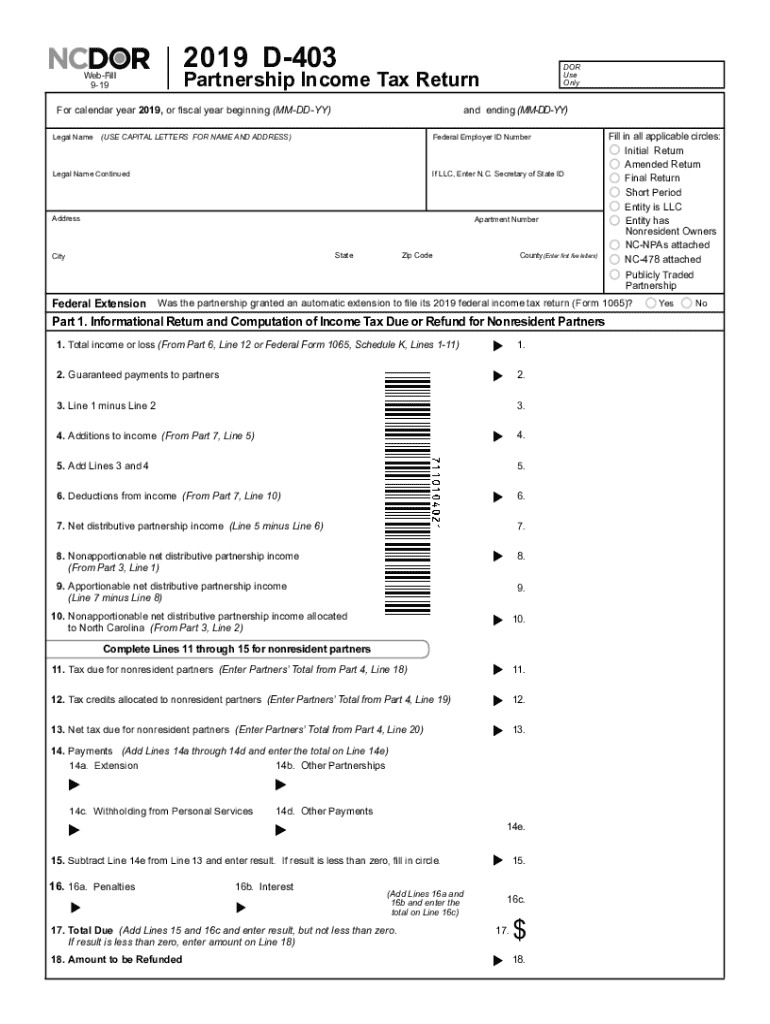

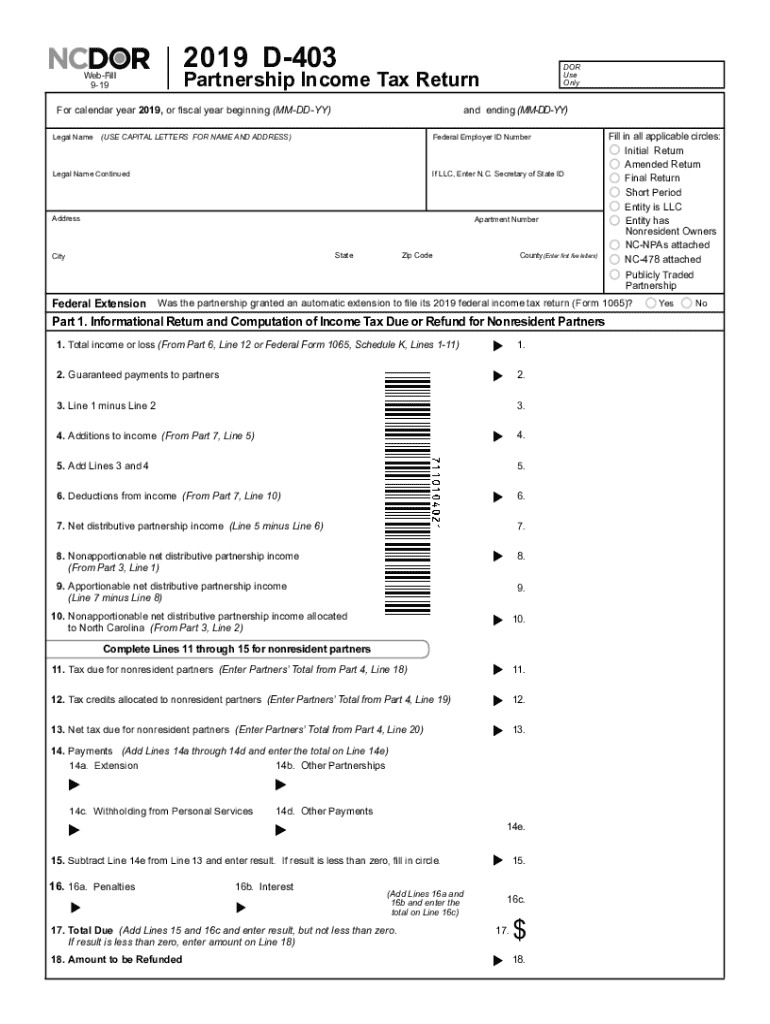

2019 Form NC DoR D 403 Fill Online Printable Fillable Blank PdfFiller

2019 Form NC DoR D 403 Fill Online Printable Fillable Blank PdfFiller

North Carolina Income Tax Withholding Form 2022 WithholdingForm

North Carolina 2016 Tax Extension Form Stpassl

2013 2022 Form NC DoR NC 5X Fill Online Printable Fillable Blank PdfFiller

Printable Nc Tax Extension Form - THIS BOOKLET CONTAINS INSTRUCTIONS FOR FORMS D 400 D 400 SCHEDULE S D 400 SCHEDULE PN D 400TC AND D 400 SCHEDULE AM FOR TAX YEAR 2019 eFile 3 Make it easy on yourself file electronically 3 Convenient faster more accurate 3 Pay by bank draft no convenience fee 3 Direct deposit for state tax refunds You may qualify to file for free