Louisiana State Tax Forms Printable Louisiana has a state income tax that ranges between 1 85 and 4 25 which is administered by the Louisiana Department of Revenue TaxFormFinder provides printable PDF copies of 35 current Louisiana income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024

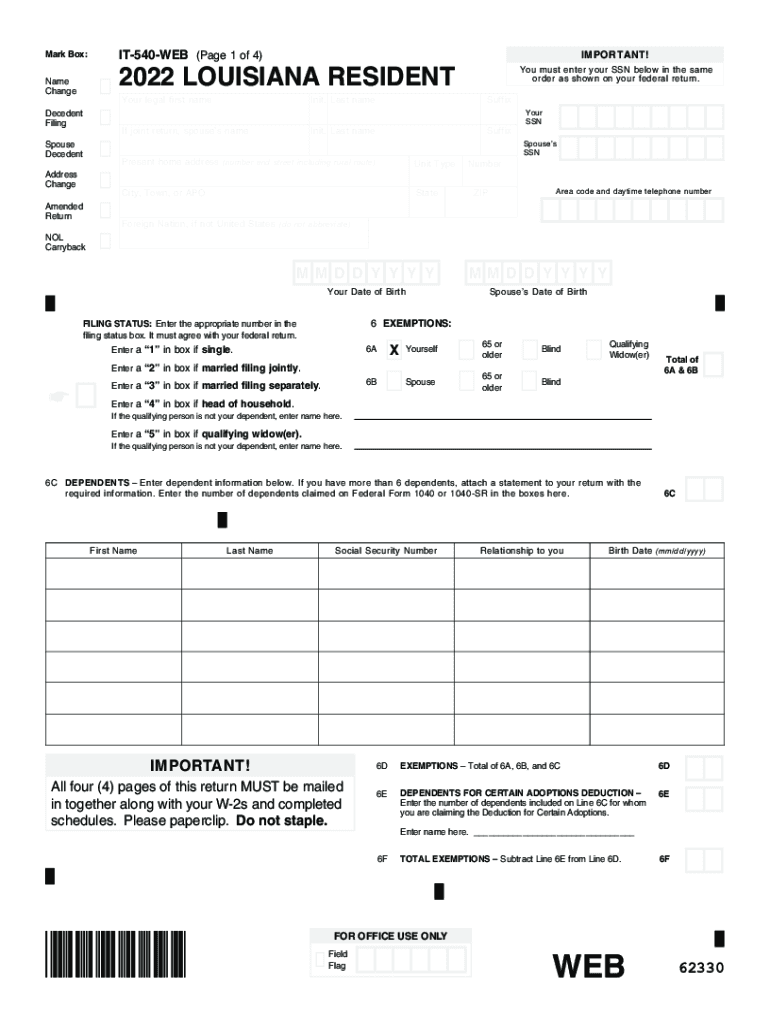

Fast Easy Absolutely Free revenue louisiana gov fileonline Are you due a refund If you file this paper return it will take up to 14 weeks to get your refund check With Louisiana File Online and direct deposit you can receive your refund within 45 days Your legal first name Init Last name Suffix If joint return spouse s name Init BATON ROUGE The Louisiana Department of Revenue LDR will begin accepting 2023 state individual income tax returns on Monday Jan 29 2024 On Jan 29 taxpayers can begin filing their state income tax returns electronically through Louisiana File Online the state s free web portal for individual tax filers

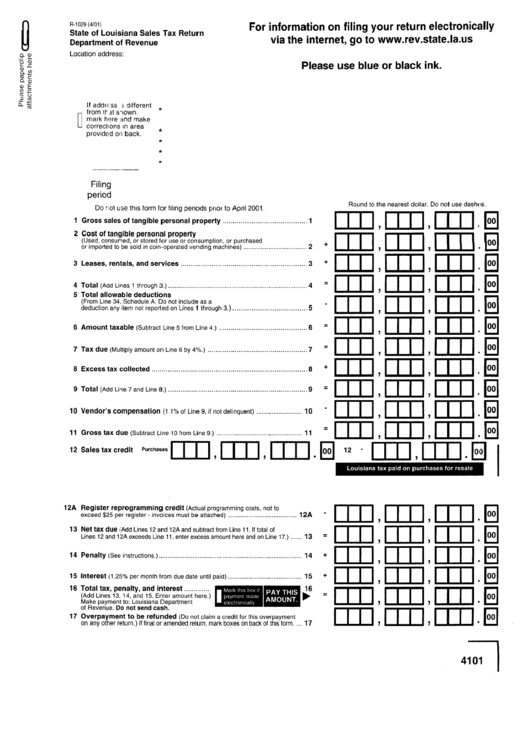

Louisiana State Tax Forms Printable

Louisiana State Tax Forms Printable

https://data.formsbank.com/pdf_docs_html/263/2636/263638/page_1_thumb_big.png

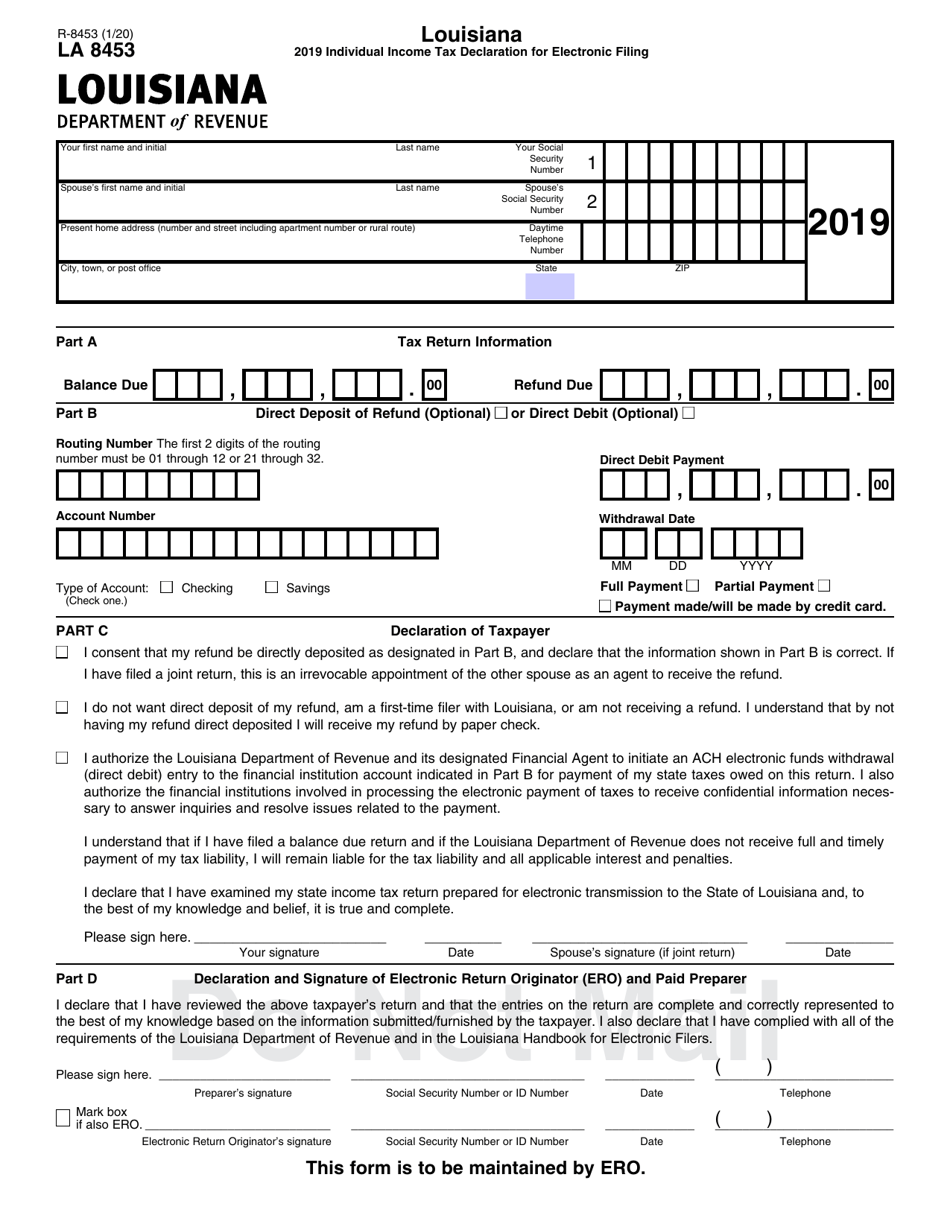

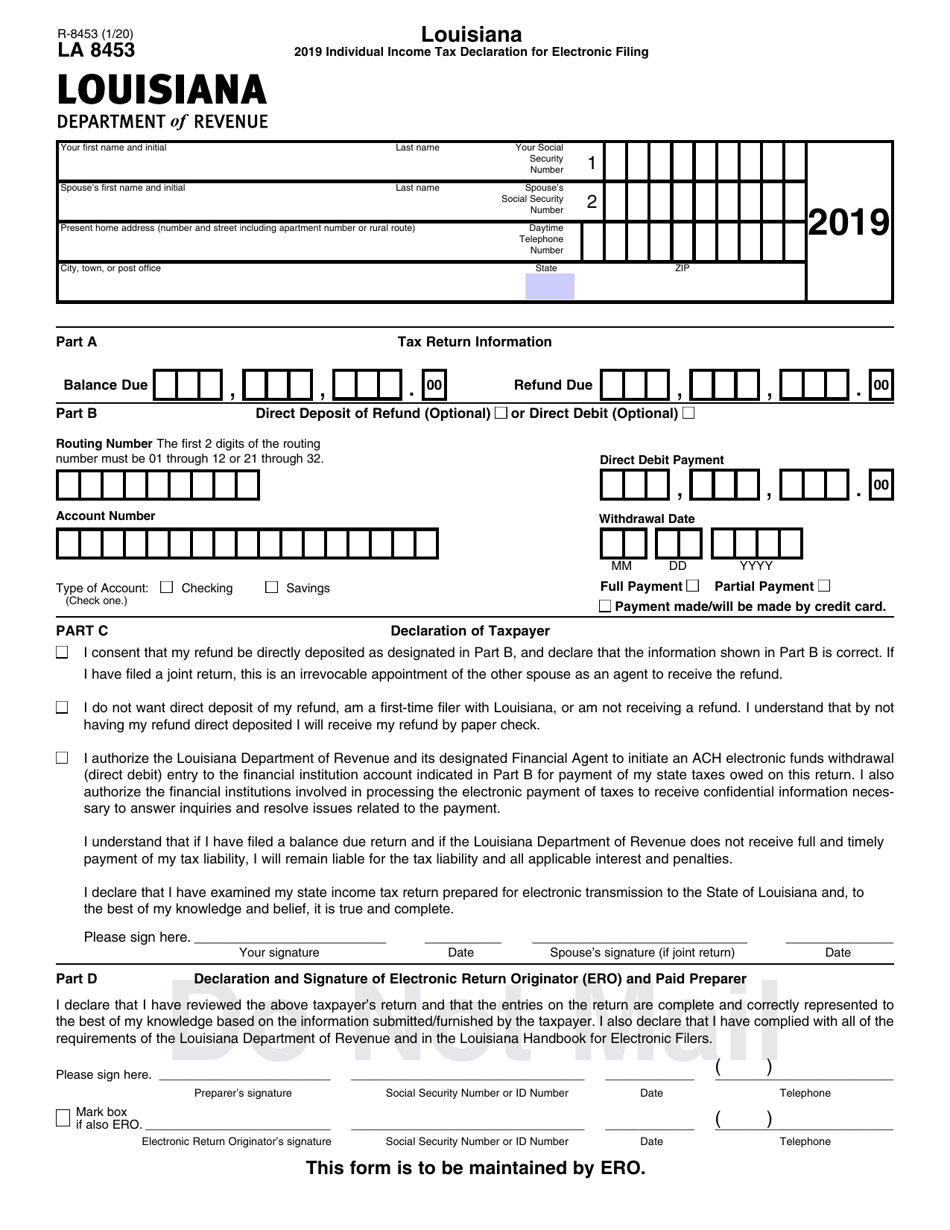

Form R 8453 2019 Fill Out Sign Online And Download Fillable PDF Louisiana Templateroller

https://data.templateroller.com/pdf_docs_html/2060/20606/2060680/form-r-8453-louisiana-individual-income-tax-declaration-for-electronic-filing-louisiana_print_big.png

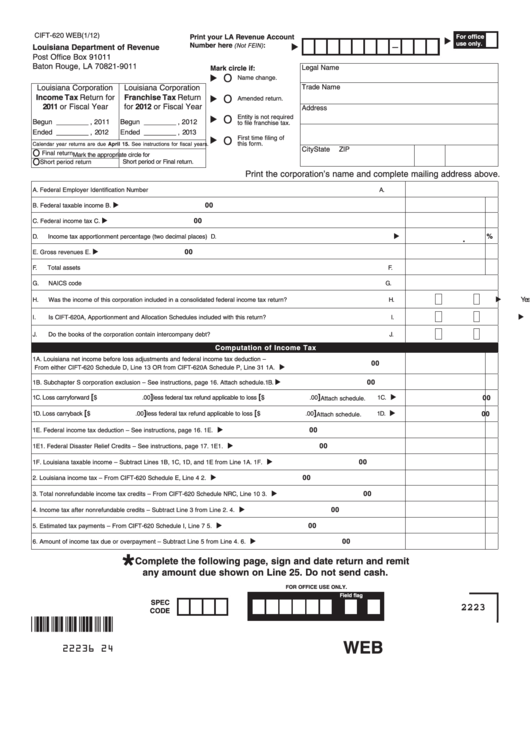

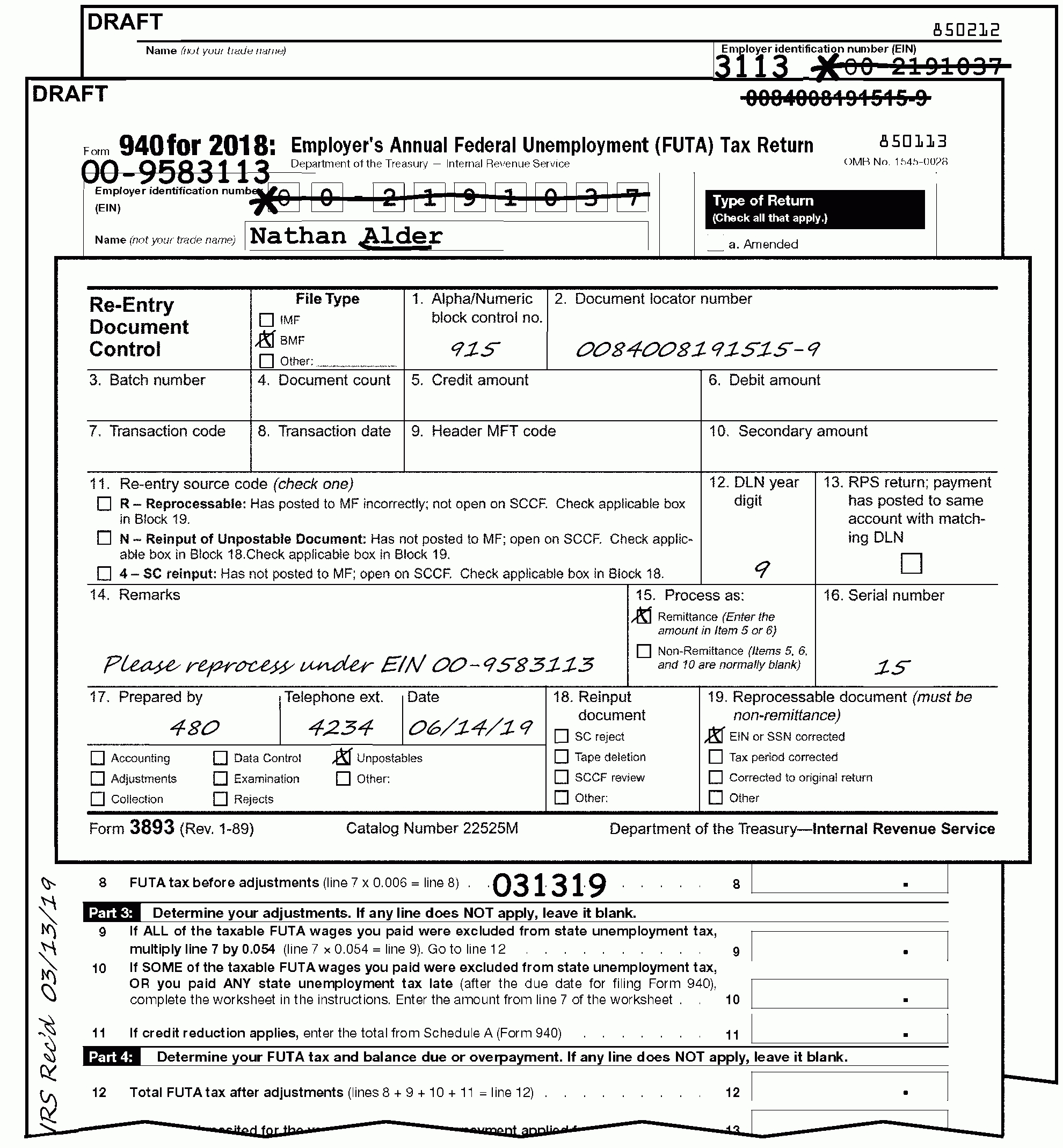

Fillable Form Cift 620 Louisiana Corporation Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/320/3204/320404/page_1_thumb_big.png

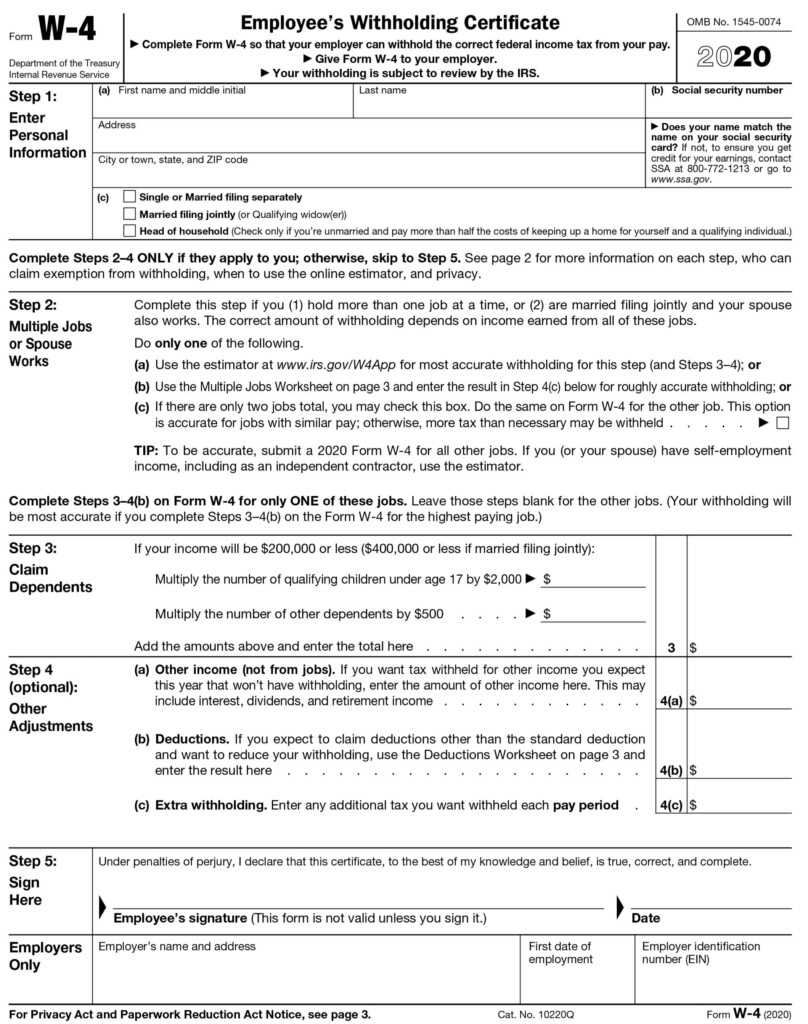

If you are single you should file Form IT 540 Louisiana Resident Individual Income Tax Return reporting all of your income to Louisiana If you are married and both you and your spouse are residents of Louisiana you should file Form IT 540 reporting all of your income to Louisiana Purpose Complete form L 4 so that your employer can withhold the correct amount of state income tax from your salary Instructions Employees who are subject to state withholding should complete the personal allowances worksheet indicating the number of withholding personal exemptions in Block A and the number of dependency credits in Block B

File your Louisiana and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for TaxFormFinder users File Now with TurboTax Related Louisiana Individual Income Tax Forms TaxFormFinder has an additional 34 Louisiana income tax forms that you may need plus all federal income tax forms How would you like to file your Individual Income Tax return Option 1 Louisiana File Online ABSOLUTELY FREE File online using the Department s e file application to reduce long delays and eliminate postage Using Louisiana File Online and direct deposit you can receive your refund within 30 days File Online Option 2 Download PDF

More picture related to Louisiana State Tax Forms Printable

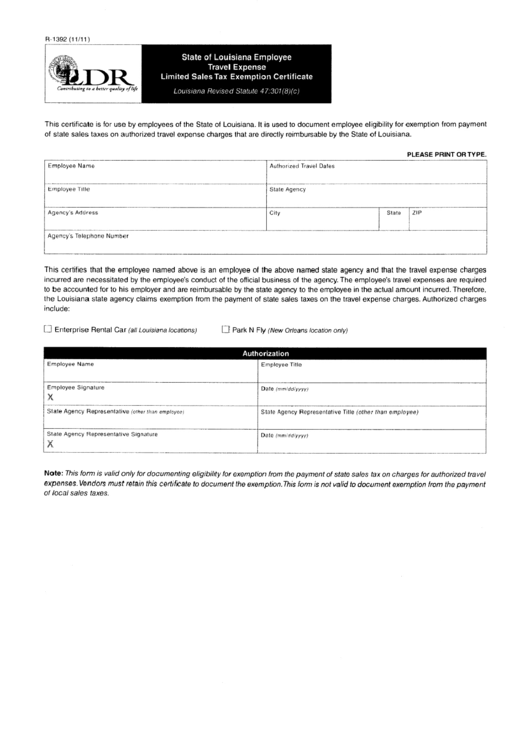

Louisiana Employee State Tax Form 2023 Employeeform

https://www.employeeform.net/wp-content/uploads/2022/07/fillable-state-of-louisiana-employee-travel-expense-limited-sales-tax.png

Louisiana State Tax Form 2022 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/627/301/627301619/large.png

Printable W 4 Form

https://w4formsprintable.com/wp-content/uploads/2020/09/w4-form-2018-printable-ezzy.jpg

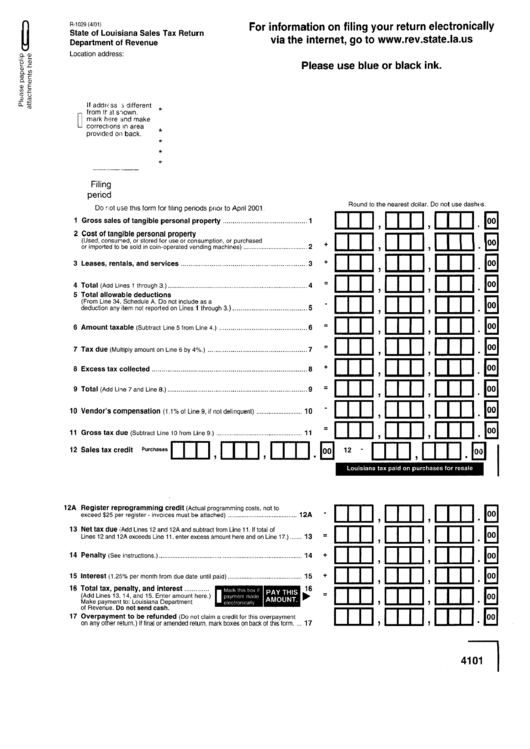

Request a Tax Return Please provide your name and address to where we will send your booklet s all fields are required unless otherwise indicated First Name Middle Initial optional Last Name Street Address Street Address 2 City State Zip Code Booklet Type Tax Period Download and print the PDF version instead Quantity Louisiana has a state income tax that ranges between 1 85 and 4 25 For your convenience Tax Brackets provides printable copies of 35 current personal income tax forms from the Louisiana Department of Revenue The current tax year is 2023 with tax returns due in April 2024

In order to use the Online Tax Filing application you must have already filed a return with the state of Louisiana for the 2004 tax year or later OR you must have a current Louisiana Driver s License or ID card issued by the LA Dept of Motor Vehicles You must create a user account to access the Online Filing application Only one user Tax Season is here and so are state tax forms The Louisiana Department of Revenue opens a new window LDR provides free digital copies opens a new window of tax forms You can also get tax forms mailed to you at no cost by ordering forms online opens a new window or calling the LDR at 888 829 3071 and selecting option 6 Tech savvy Louisiana residents can file their Louisiana tax forms

Louisiana Income Tax Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/495/857/495857113/large.png

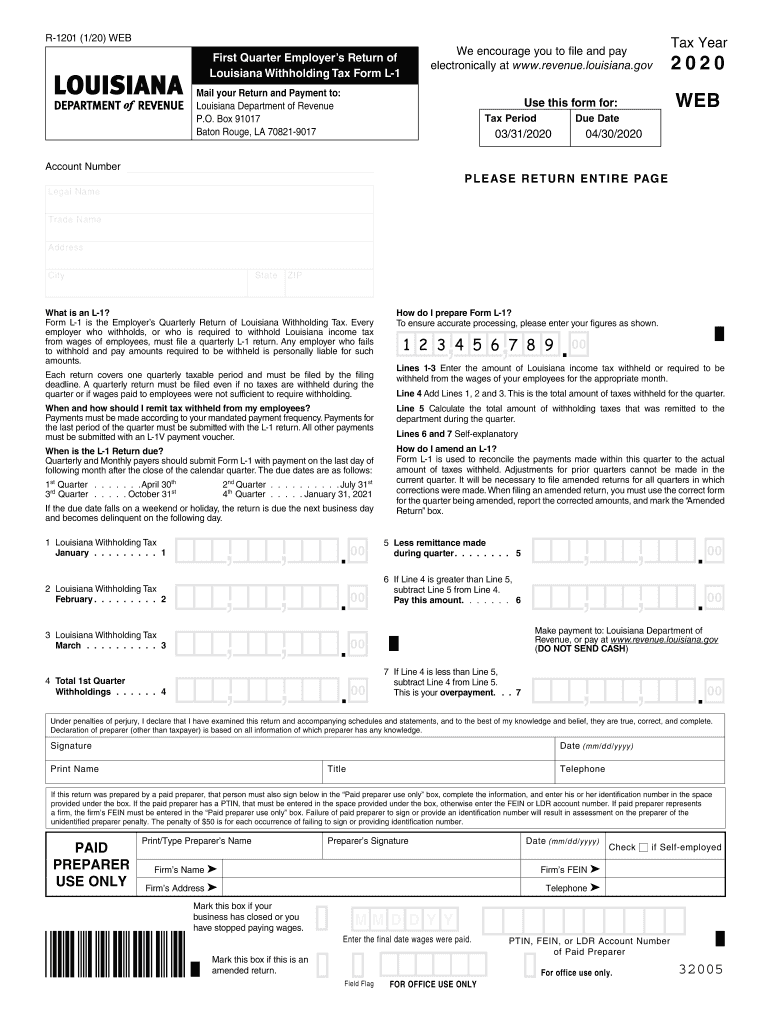

Louisiana L 1 4th Quarter 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/498/336/498336353/large.png

https://www.taxformfinder.org/louisiana

Louisiana has a state income tax that ranges between 1 85 and 4 25 which is administered by the Louisiana Department of Revenue TaxFormFinder provides printable PDF copies of 35 current Louisiana income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024

https://revenue.louisiana.gov/TaxForms/IT540-WEB(2020).pdf

Fast Easy Absolutely Free revenue louisiana gov fileonline Are you due a refund If you file this paper return it will take up to 14 weeks to get your refund check With Louisiana File Online and direct deposit you can receive your refund within 45 days Your legal first name Init Last name Suffix If joint return spouse s name Init

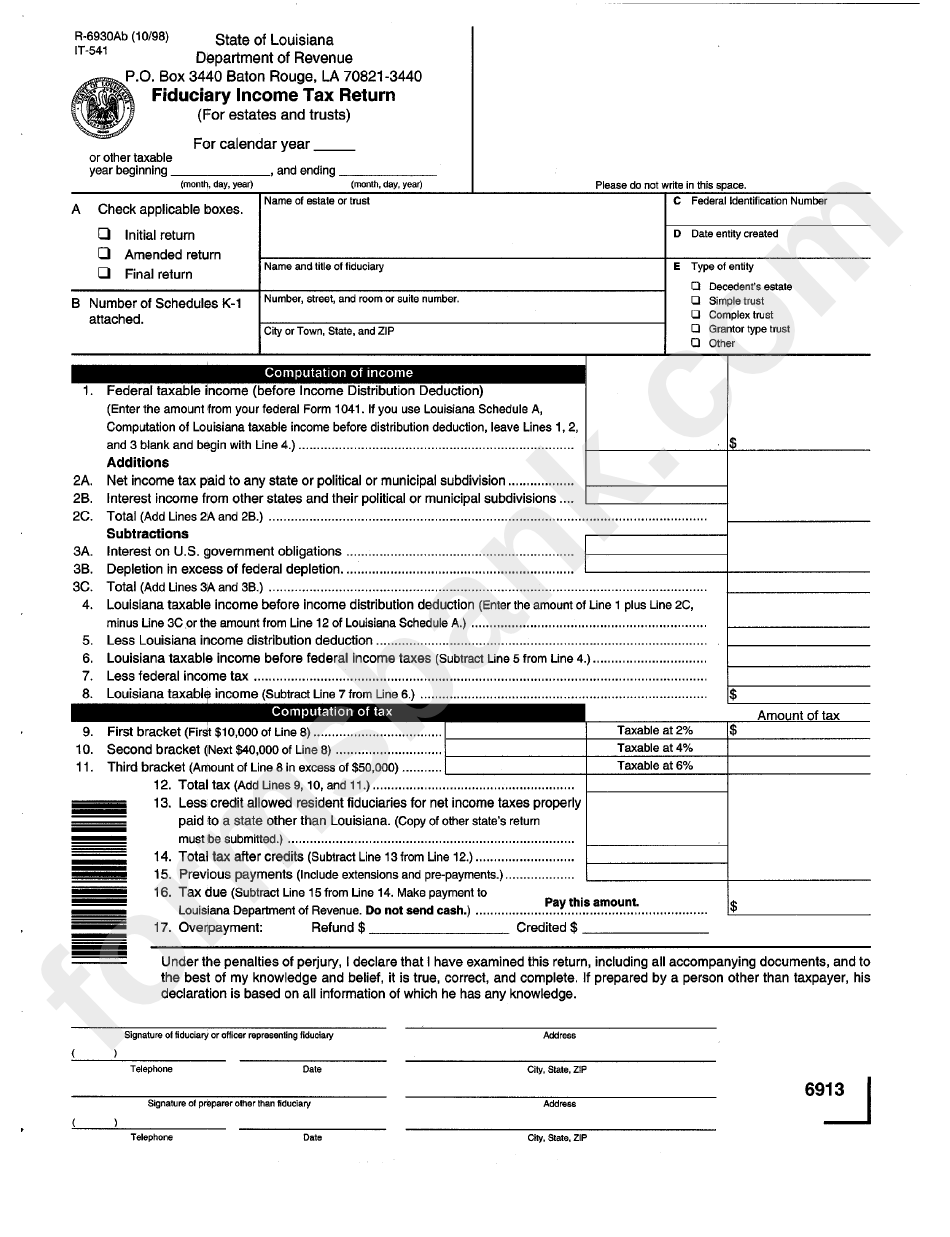

Fillable Form It 541 Louisiana Fiduciary Income Tax Return Printable Pdf Download

Louisiana Income Tax Fill Out Sign Online DocHub

Louisiana Withholding Tax Form L 1 2023 Withholdingform

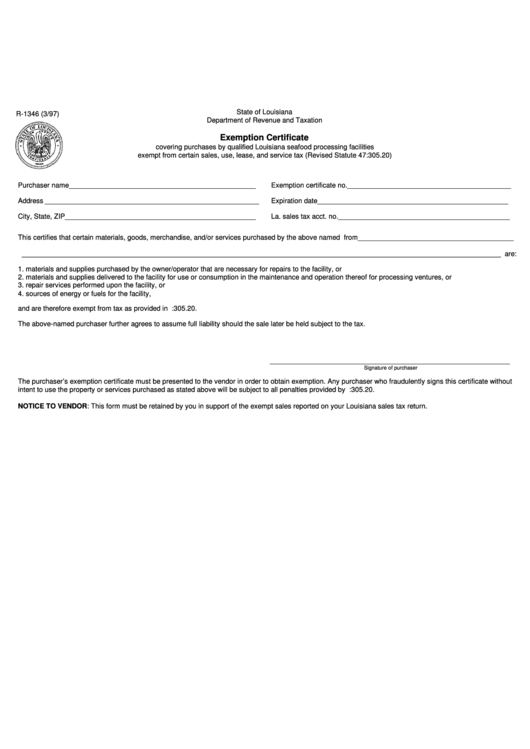

Fillable Form R 1346 Exemption Certificate State Of Louisiana Department Of Revenue And

Printable W9 Form Louisiana Printable Forms Free Online

Fillable And Printable Tax Forms Free Printable Forms Free Online

Fillable And Printable Tax Forms Free Printable Forms Free Online

Free Printable State Tax Forms Printable Templates

Top 54 Louisiana State Income Tax Forms And Templates Free To Download In PDF Format

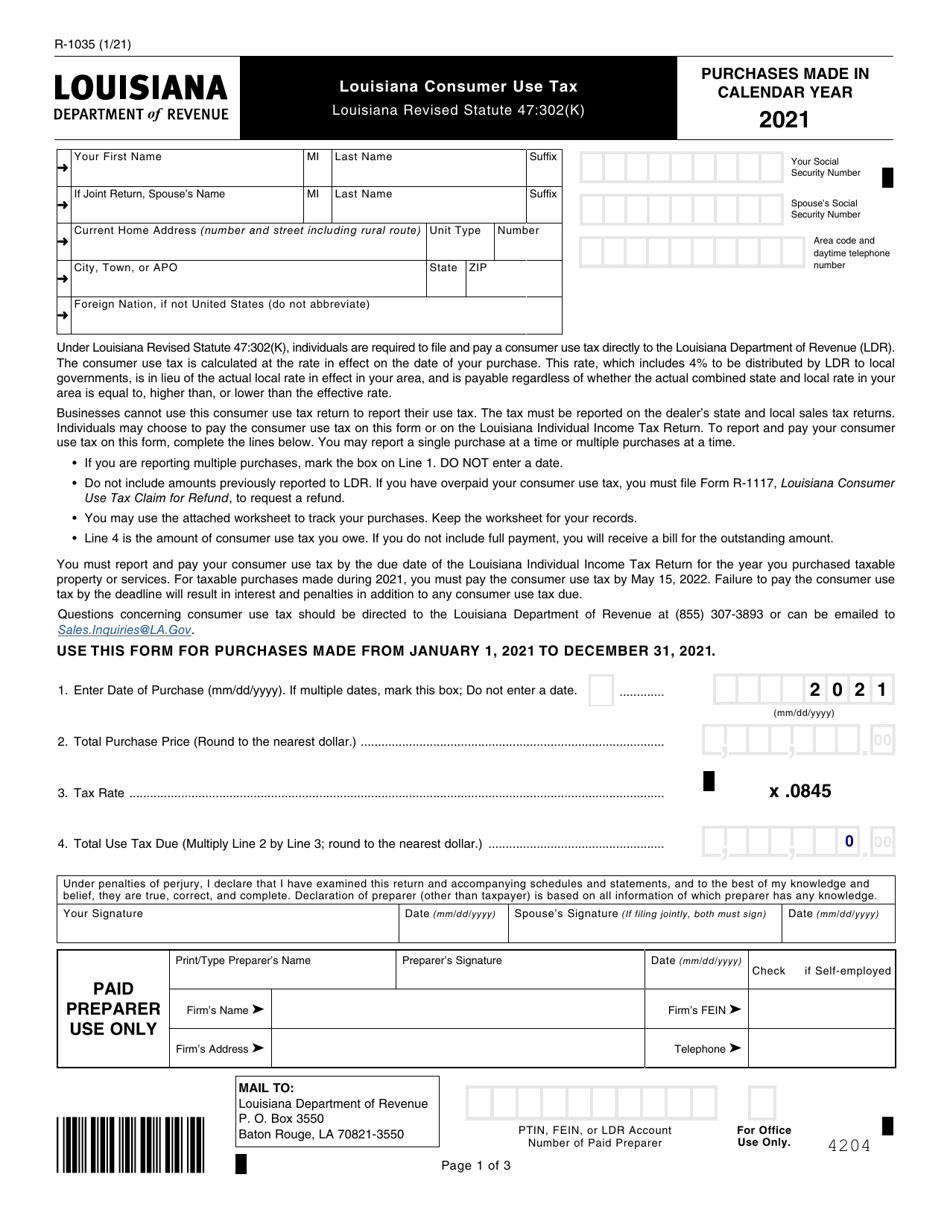

Form R 1035 Download Fillable PDF Or Fill Online Louisiana Consumer Use Tax 2021 Louisiana

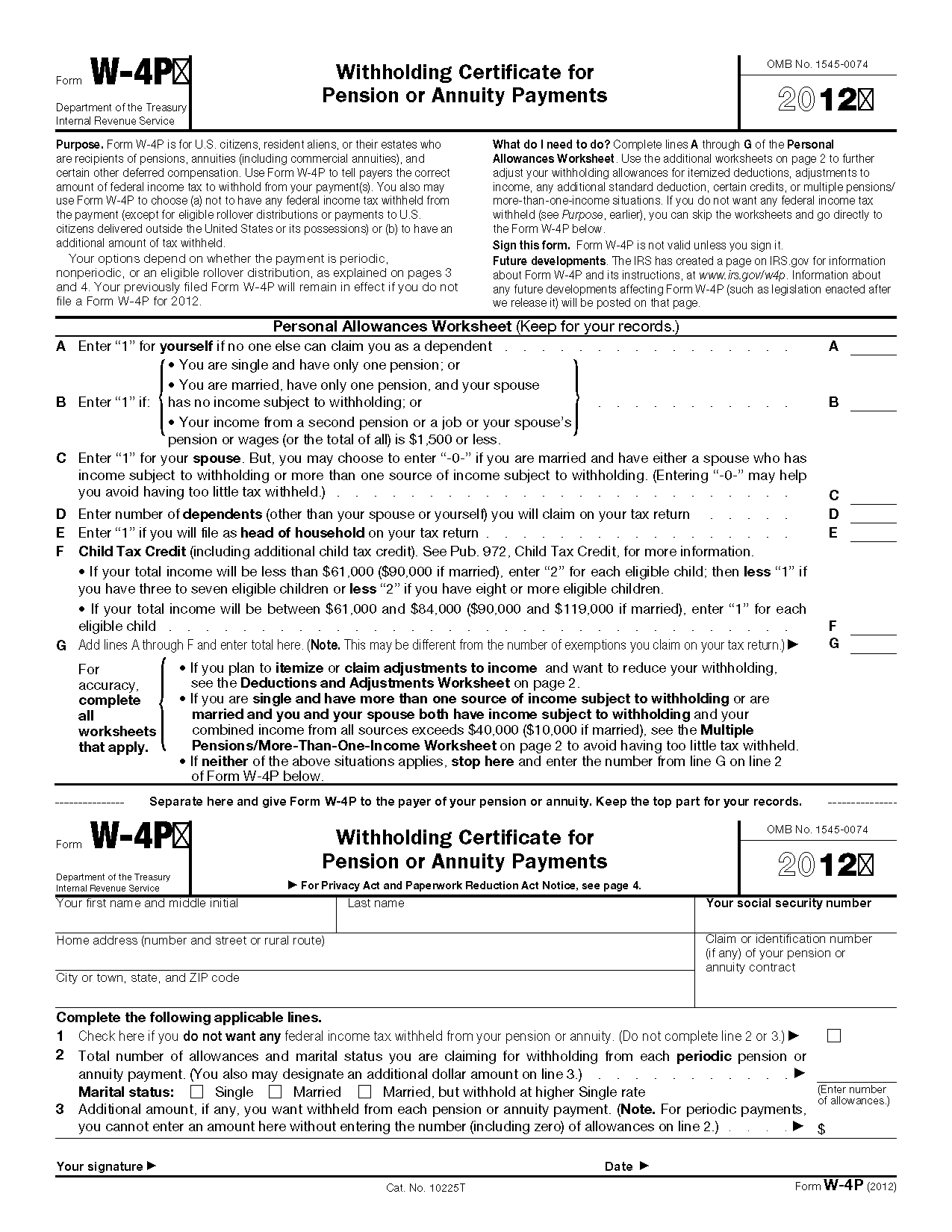

Louisiana State Tax Forms Printable - Purpose Complete form L 4 so that your employer can withhold the correct amount of state income tax from your salary Instructions Employees who are subject to state withholding should complete the personal allowances worksheet indicating the number of withholding personal exemptions in Block A and the number of dependency credits in Block B