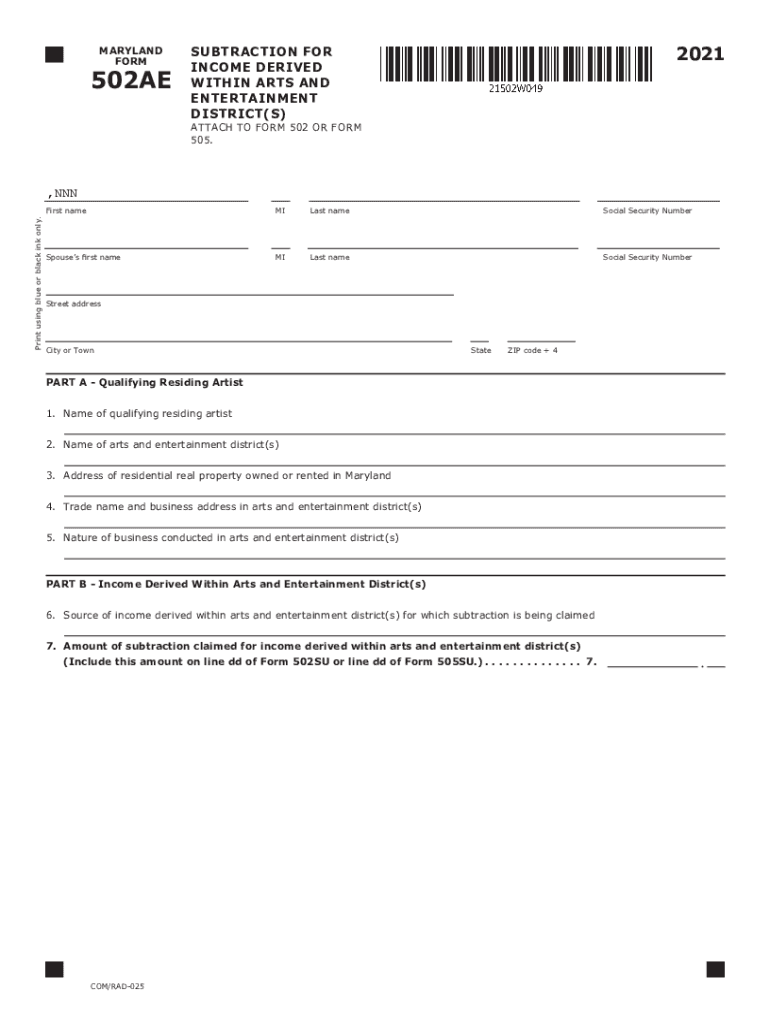

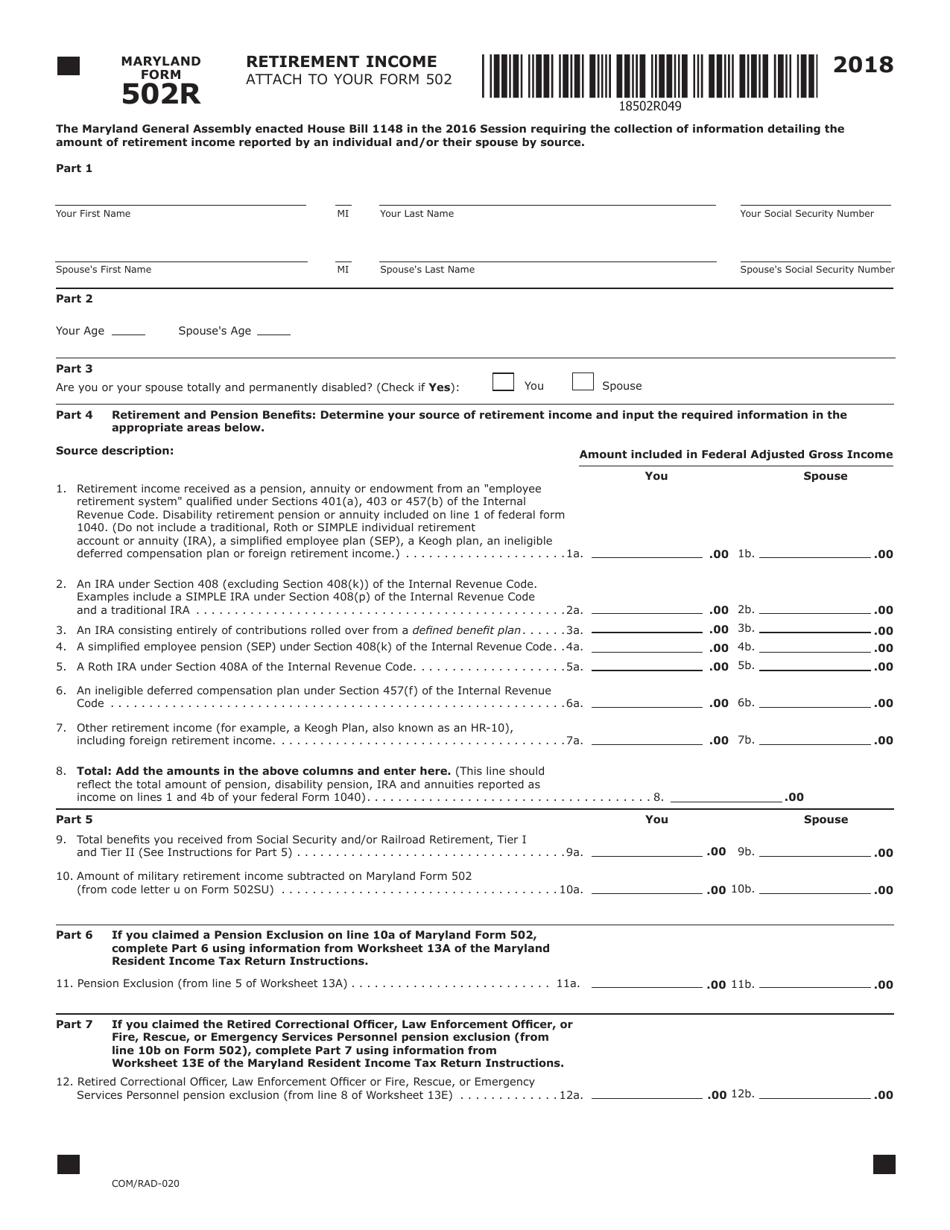

State Of Maryland Printable Tax Form 502 This form maybe used by taxpayers to report income modifications and credits applicable to tax year 2023 that are enacted after December 31 2023 502R Maryland Retirement Income Form Form for reporting retirement income as per enacted House Bill 1148 by the Maryland General Assembly during the 2016 Session

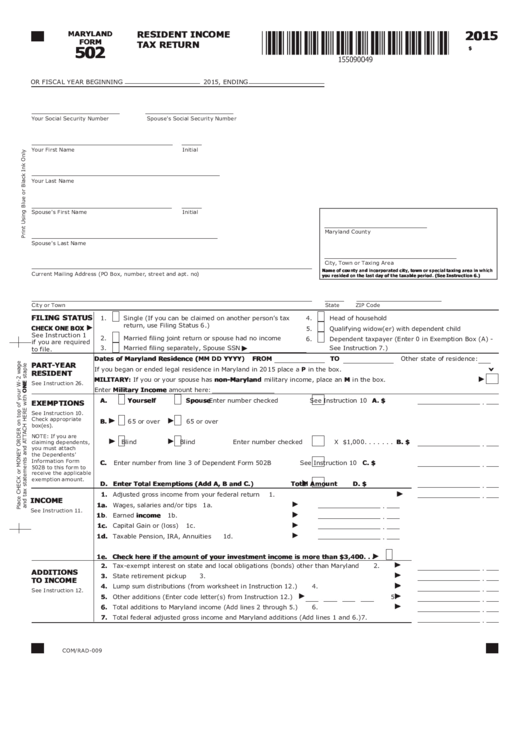

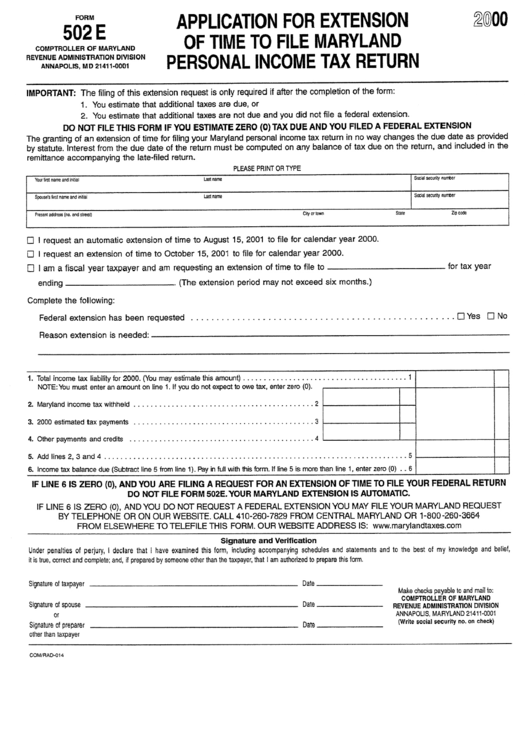

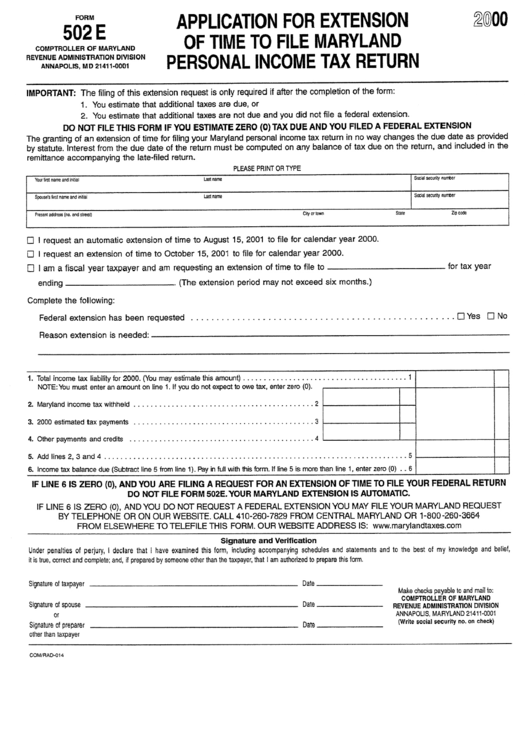

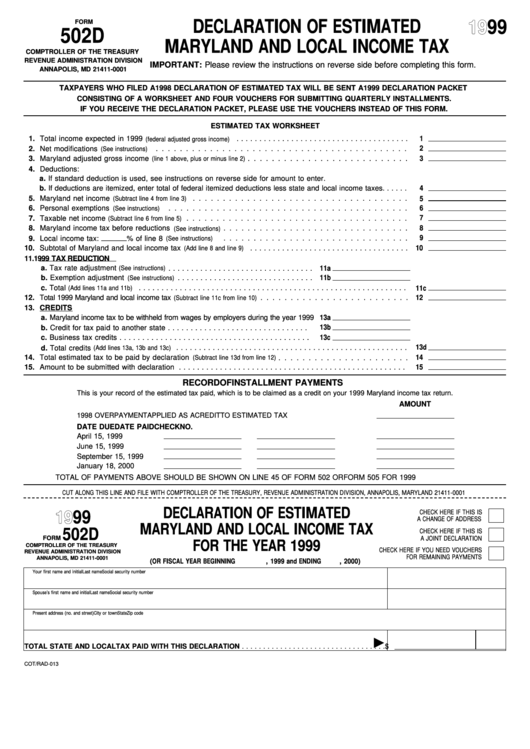

MD City State ZIP Code 4 Maryland County REQUIRED 99981231160000 08 00 Maryland Physical address of taxing area as of December 31 2021 or last day of the taxable year for fiscal year taxpayers See Instruction 6 Part year residents see Instruction 26 Form 502 and form 502B filed together are the individual income tax return forms for Maryland residents claiming any dependants You must file estimated individual income tax if you are self employed or do not pay sufficient tax withholding Form 502D is meant to be filed on a quarterly basis Use Form 502E to apply for an extension of time to

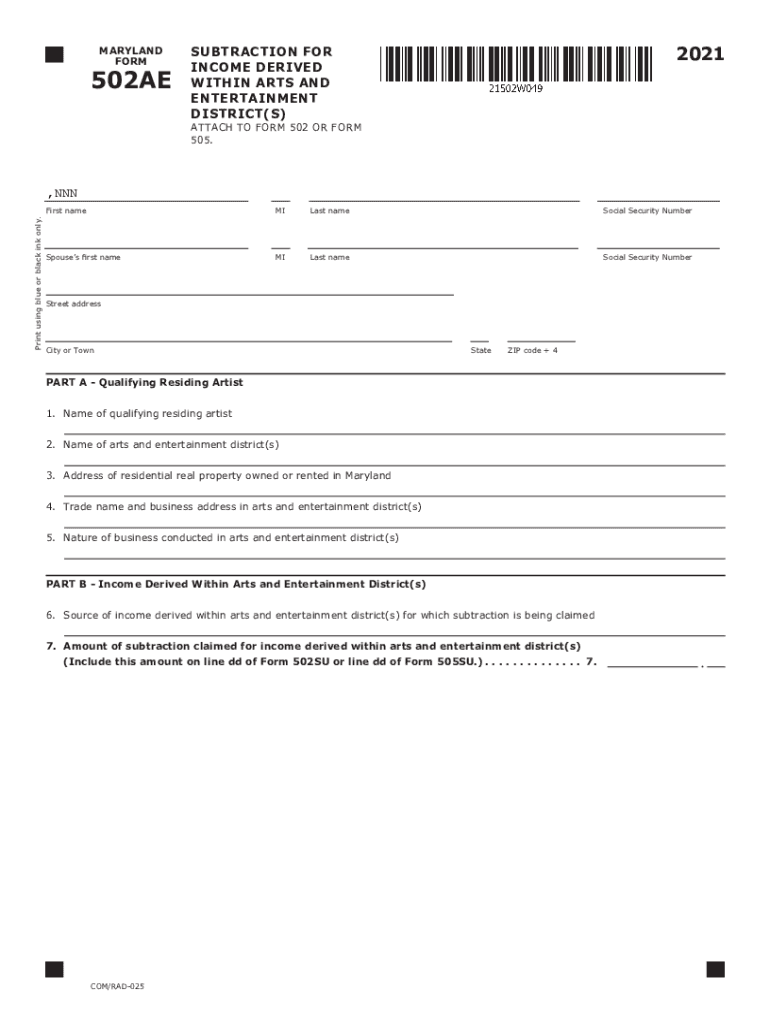

State Of Maryland Printable Tax Form 502

State Of Maryland Printable Tax Form 502

https://www.signnow.com/preview/586/99/586099941/large.png

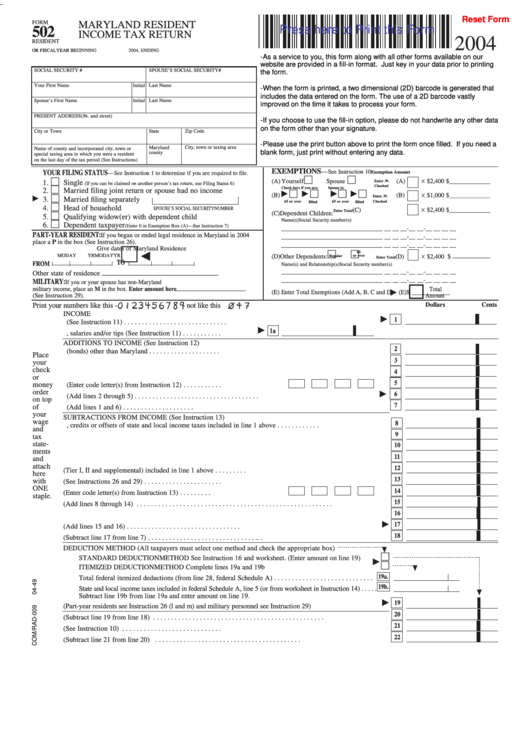

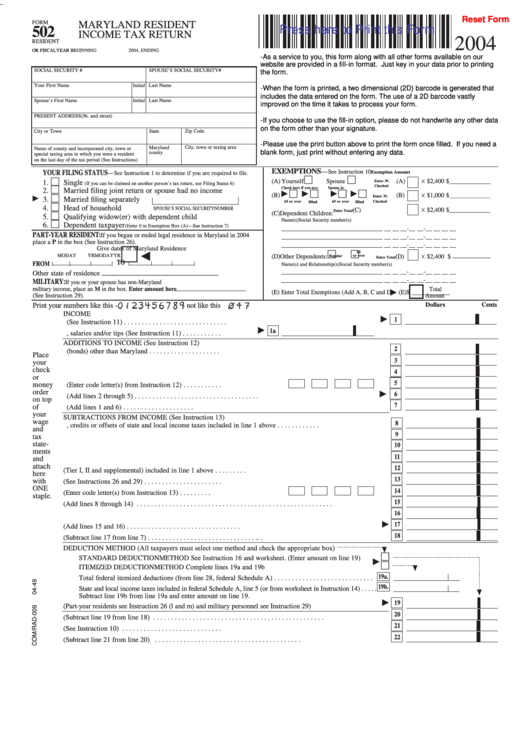

Fillable Form 502 Maryland Resident Income Tax Return 2004 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/262/2625/262518/page_1_thumb_big.png

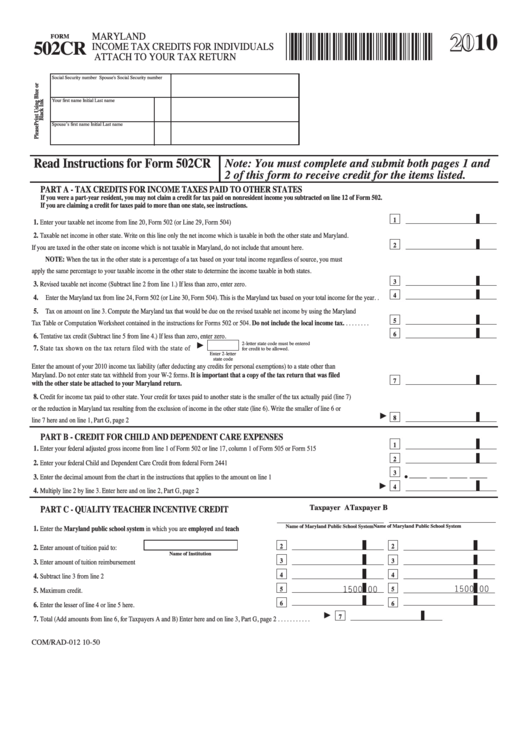

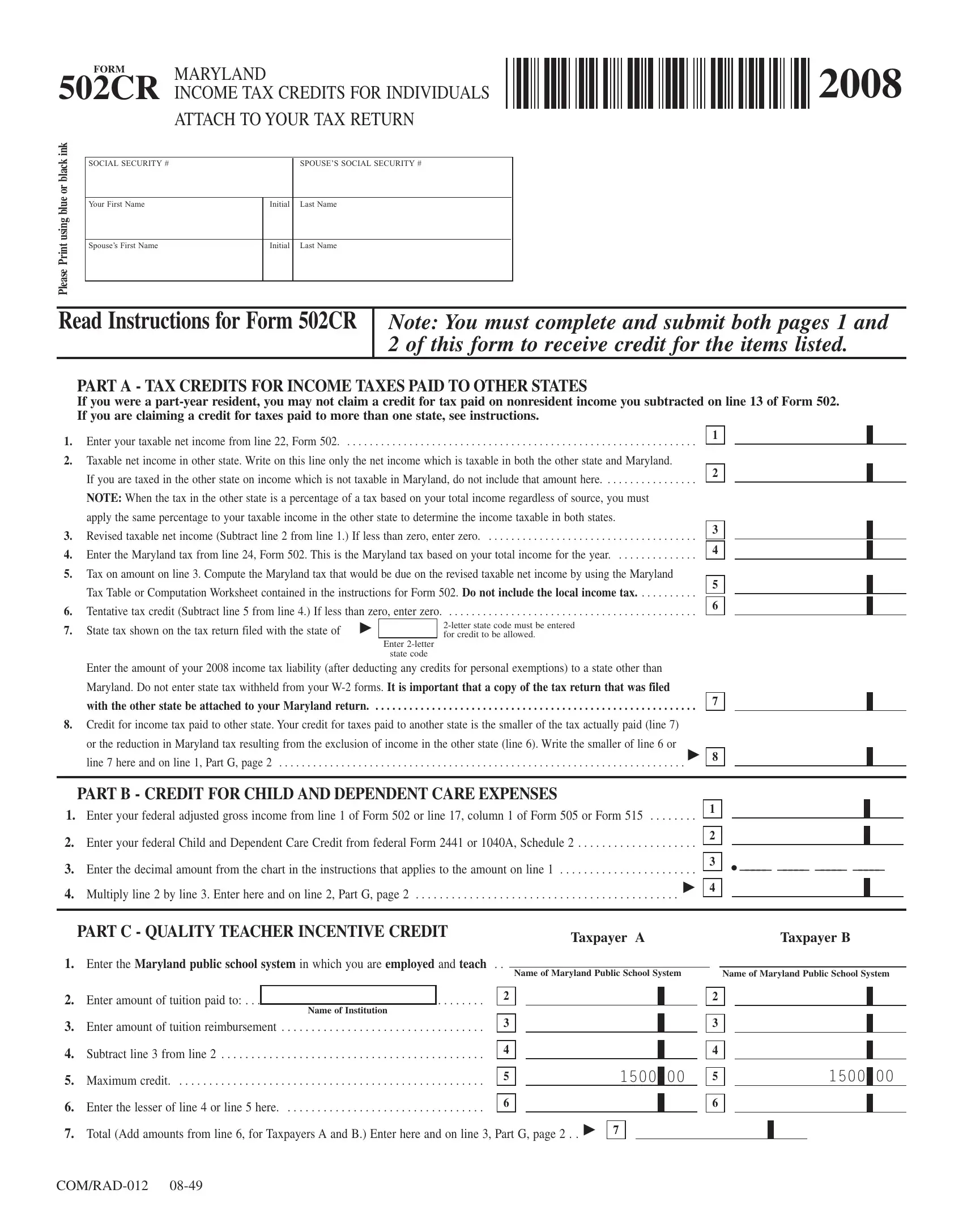

Fillable Form 502cr Maryland Income Tax Credits For Individuals 2010 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/274/2744/274454/page_1_thumb_big.png

Maryland Resident Income Tax Return Tax Year 2023 502 Resident Income Tax Return 502 OR FISCAL YEAR BEGINNING Print Using Blue or Black Ink Only Your Social Security Number Your First Name 2023 RESIDENT INCOME TAX RETURN MARYLAND FORM 2023 ENDING Spouse s Social Security Number MI Your Last Name Spouse s First Name MI Spouse s Last Name Does your name match the name on your social security Line 25 of Form 502 OTHER INCOME TAX CREDITS FOR INDIVIDUALS Enter the total of your income tax credits as listed below Complete and attach Form 502CR with Form 502 a CREDITS FOR INCOME TAXES PAID TO OTHER STATES If you have income subject to tax in both Maryland and another state you may be eligible for a tax credit

File Now with TurboTax We last updated Maryland Form 502 in January 2024 from the Maryland Comptroller of Maryland This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Maryland government City or Town State ZIP Code 4 PAYMENT AMOUNT Amount you are paying by check or money order of tax Form 502 or Form 505 Mail to Comptroller of Maryland PO Box 8888 Annapolis MD 21401 8888 COM RAD 006 MARYLAND FORM PV PERSONAL TAX PAYMENT VOUCHER FOR FORM 502 505 ESTIMATED TAX AND EXTENSIONS INSTRUCTIONS Title Maryland Form PV

More picture related to State Of Maryland Printable Tax Form 502

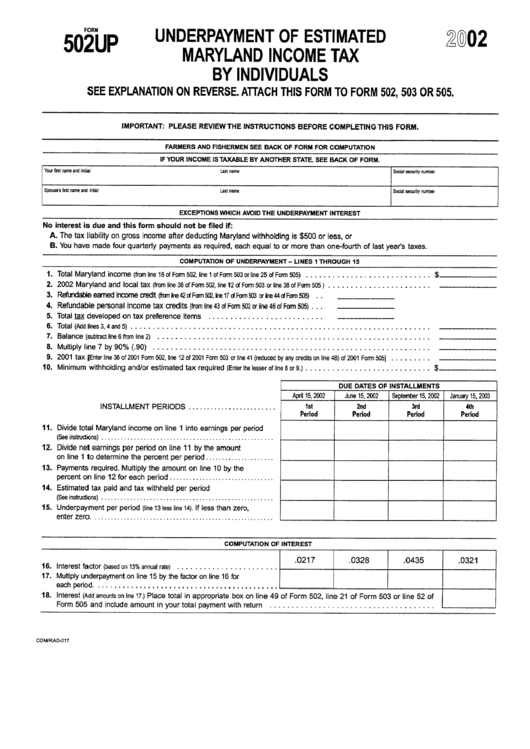

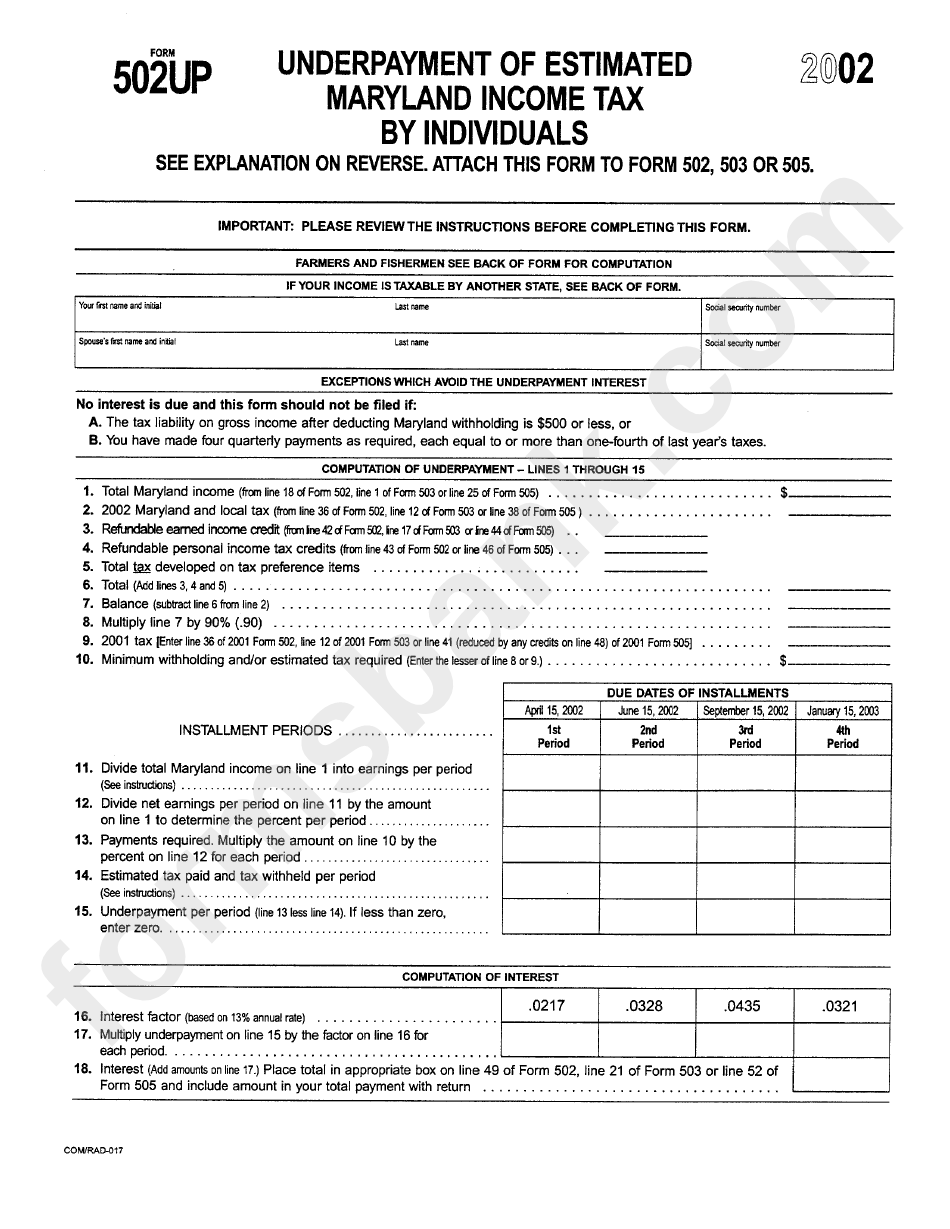

Form 502up Underpayment Of Estimated Maryland Income Tax By Individuals 2002 Printable Pdf

https://data.formsbank.com/pdf_docs_html/300/3003/300324/page_1_thumb_big.png

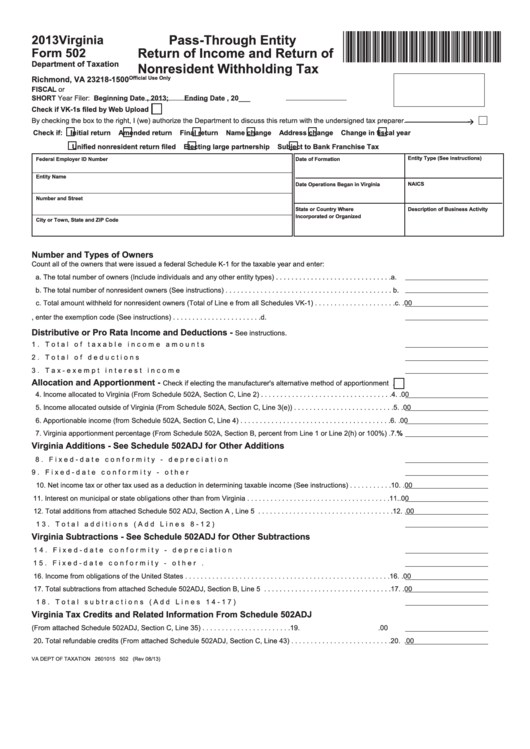

Fillable Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding

https://data.formsbank.com/pdf_docs_html/353/3535/353506/page_1_thumb_big.png

Maryland Form 502Cr Fill Out Printable PDF Forms Online

https://formspal.com/pdf-forms/other/maryland-form-502cr/maryland-form-502cr-preview.webp

For tax year 2021 Maryland s personal tax rates begin at 2 on the first 1000 of taxable income and increase up to a maximum of 5 75 on incomes exceeding 250 000 or 300 000 for taxpayers filing jointly heads of household or qualifying widow ers Nonresidents are subject to a special tax rate of 2 25 in addition to the state income Complete Form 502R if you or your spouse were required to file a 2023 Form 502 AND Reported income from a pension annuity or individual retirement account or annuity IRA on your federal income tax return lines 4b and 5b of federal Form 1040 Received any income during the tax year taxable or non taxable from Social Security or Railroad

Download or print the 2023 Maryland Form 502R Retirement Income Form for FREE from the Maryland Comptroller of Maryland also enter the age as of December 31 2023 of your spouse Deferred compensation plan of a state or local government or a tax exempt organization 457 b Part 2 Part 6 Complete Part 6 if you or your spouse claimed a If not to ensure you get credit for your personal exemptions contact SSA at 1 800 772 1213 or visit www ssa gov REQUIRED 99981231160000 08 00 Maryland Physical address of taxing area as of December 31 2022 or last day of the taxable year for fiscal year taxpayers

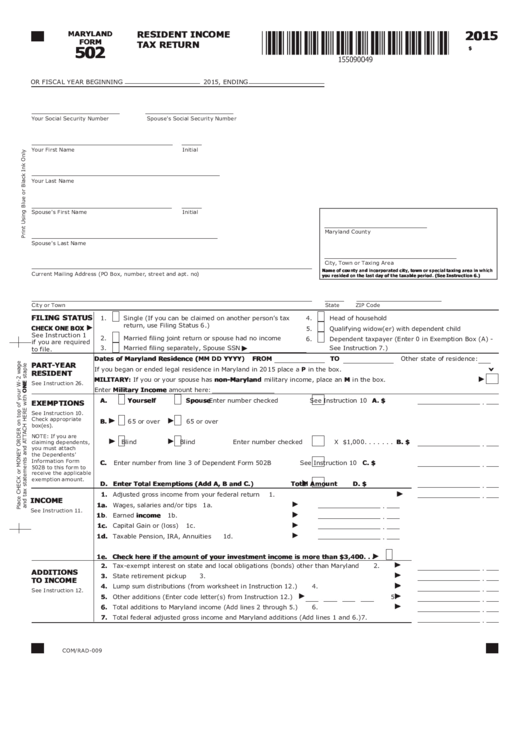

Fillable Maryland Form 502 Resident Income Tax Return 2015 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/7/72/7260/page_1_thumb_big.png

MD 502UP 2020 2021 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/544/907/544907640/large.png

https://www.marylandtaxes.gov/individual/income/forms/2023_Income_Tax_Forms.php

This form maybe used by taxpayers to report income modifications and credits applicable to tax year 2023 that are enacted after December 31 2023 502R Maryland Retirement Income Form Form for reporting retirement income as per enacted House Bill 1148 by the Maryland General Assembly during the 2016 Session

https://www.marylandtaxes.gov/forms/current_forms/502_502B.pdf

MD City State ZIP Code 4 Maryland County REQUIRED 99981231160000 08 00 Maryland Physical address of taxing area as of December 31 2021 or last day of the taxable year for fiscal year taxpayers See Instruction 6 Part year residents see Instruction 26

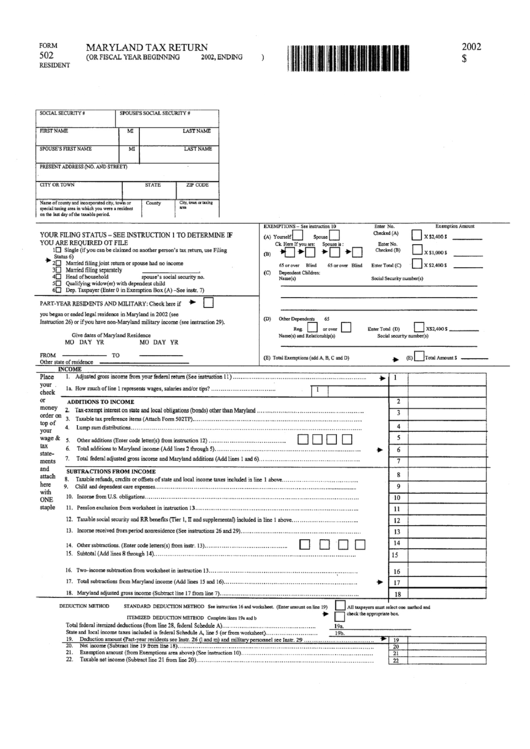

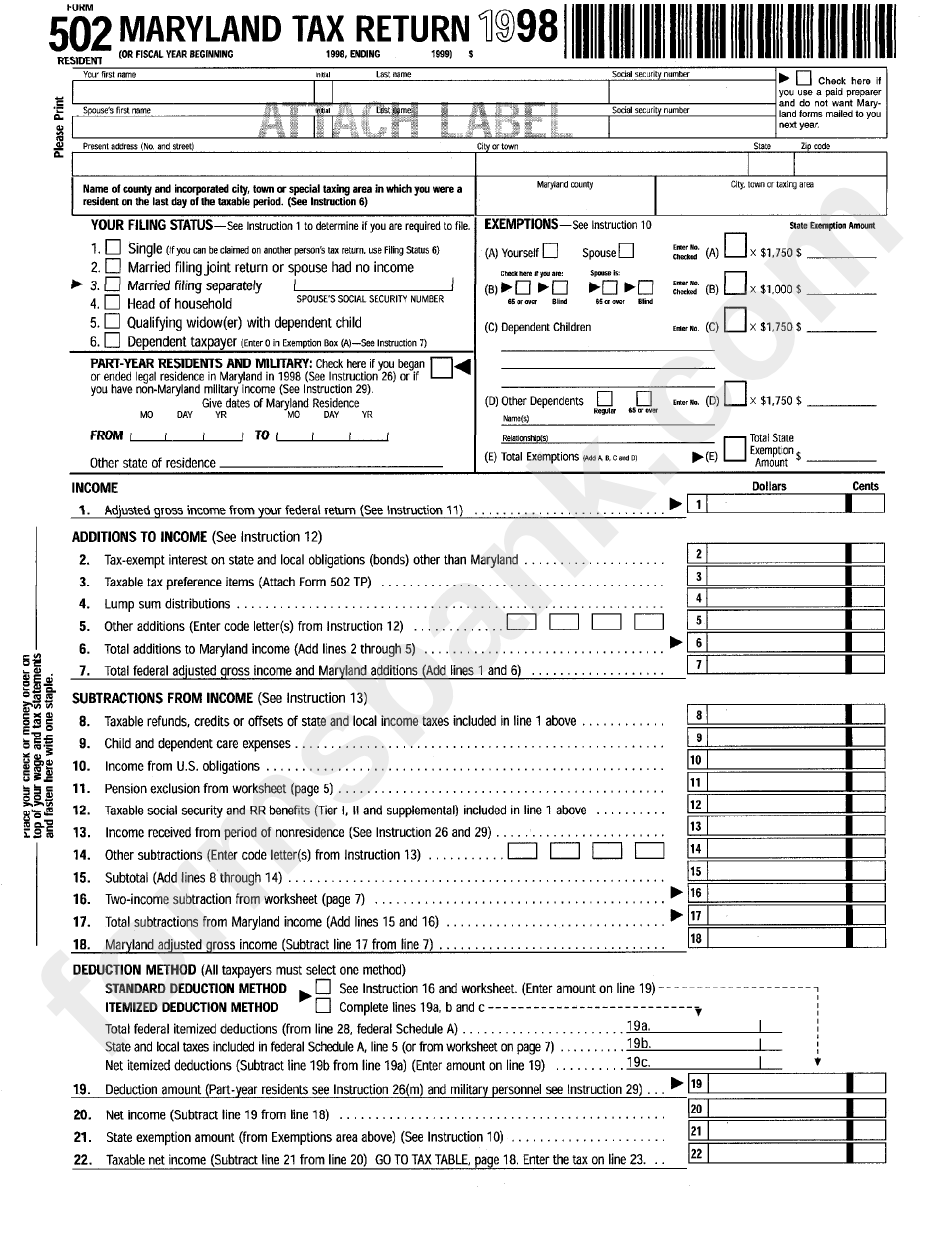

Form 502 Maryland Tax Return 2002 Printable Pdf Download

Fillable Maryland Form 502 Resident Income Tax Return 2015 Printable Pdf Download

Form 502up Underpayment Of Estimated Maryland Income Tax By Individuals 2002 Printable Pdf

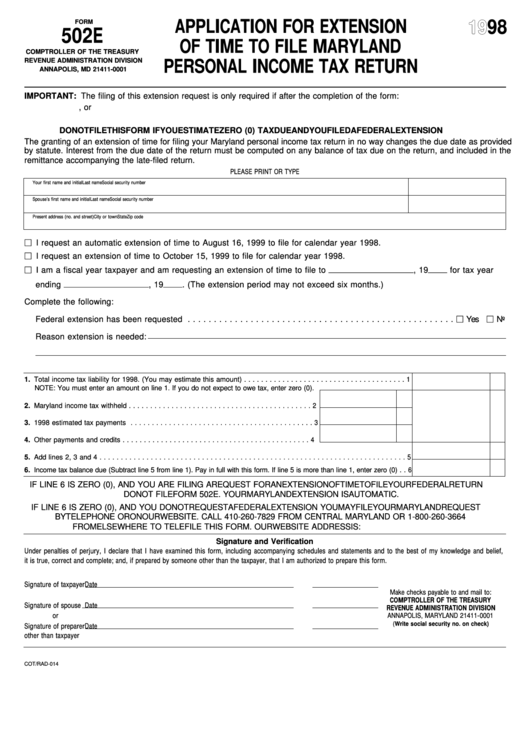

Fillable Form 502 E Application For Extension Of Time To File Maryland Personal Income Tax

Form COM RAD 020 Maryland Form 502R 2018 Fill Out Sign Online And Download Fillable PDF

Form 502e Application For Extension Of Time To File Maryland Personal Income Tax Return 2000

Form 502e Application For Extension Of Time To File Maryland Personal Income Tax Return 2000

Fillable Form 502 Maryland Tax Return 1998 Printable Pdf Download

2013 Form MD 502 Fill Online Printable Fillable Blank PdfFiller

Fillable Form 502 D Declaration Of Estimated Maryland And Local Income Tax 1999 Printable

State Of Maryland Printable Tax Form 502 - More about the Maryland Form 502B Individual Income Tax TY 2023 Form 502 and form 502B filed together are the individual income tax return forms for Maryland residents claiming any dependants We last updated the Maryland Dependents Information in January 2024 so this is the latest version of Form 502B fully updated for tax year 2023