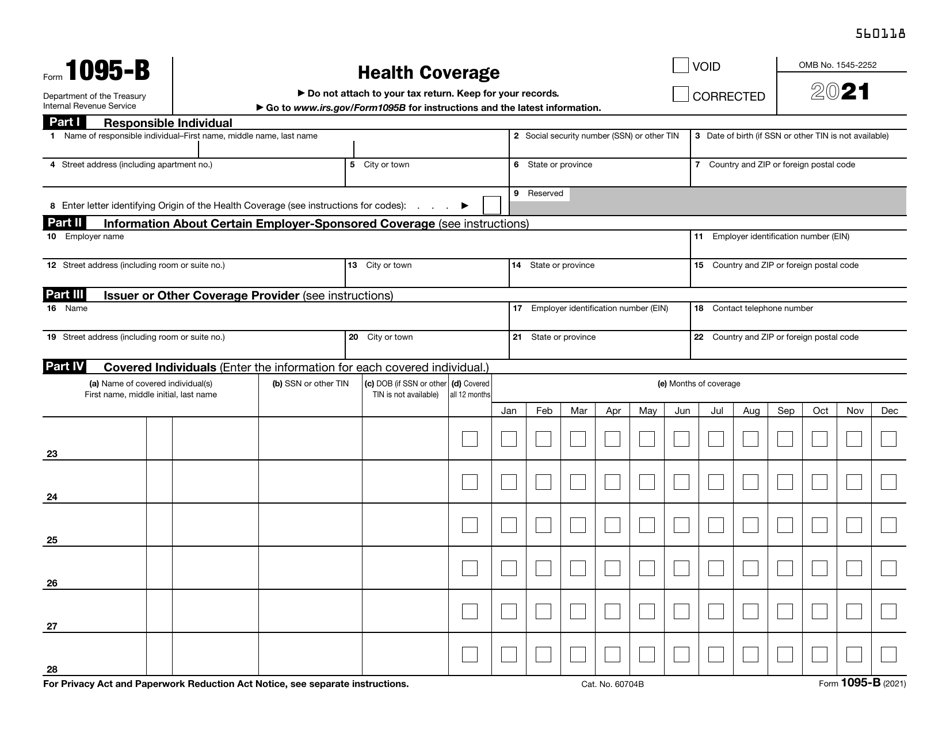

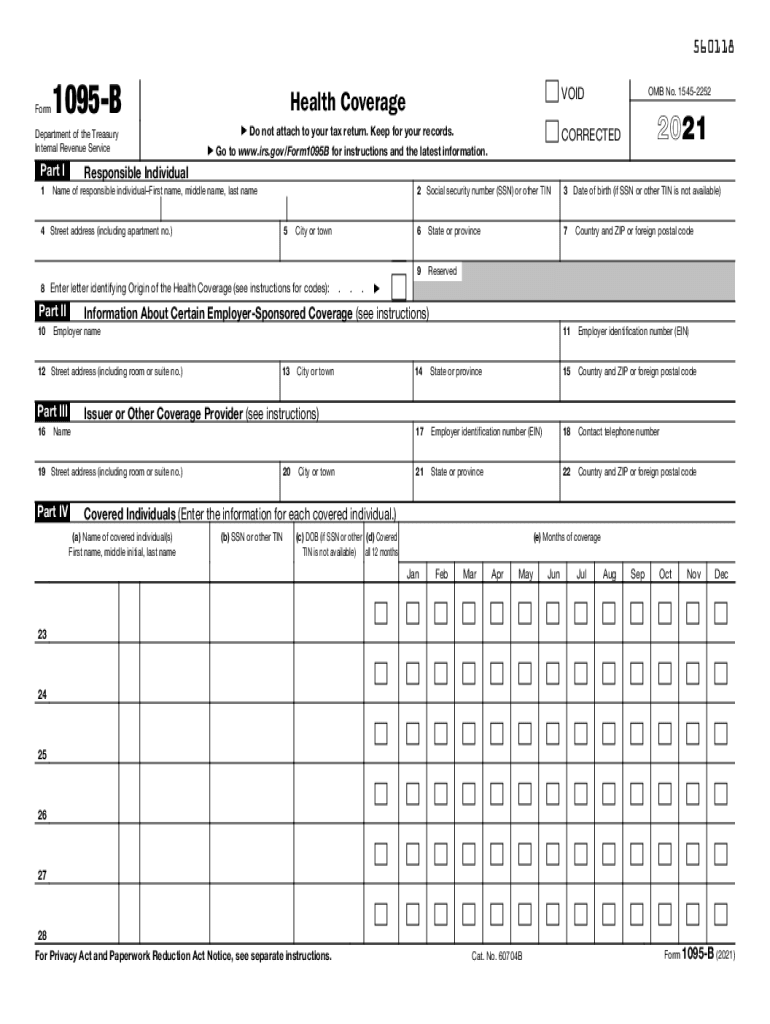

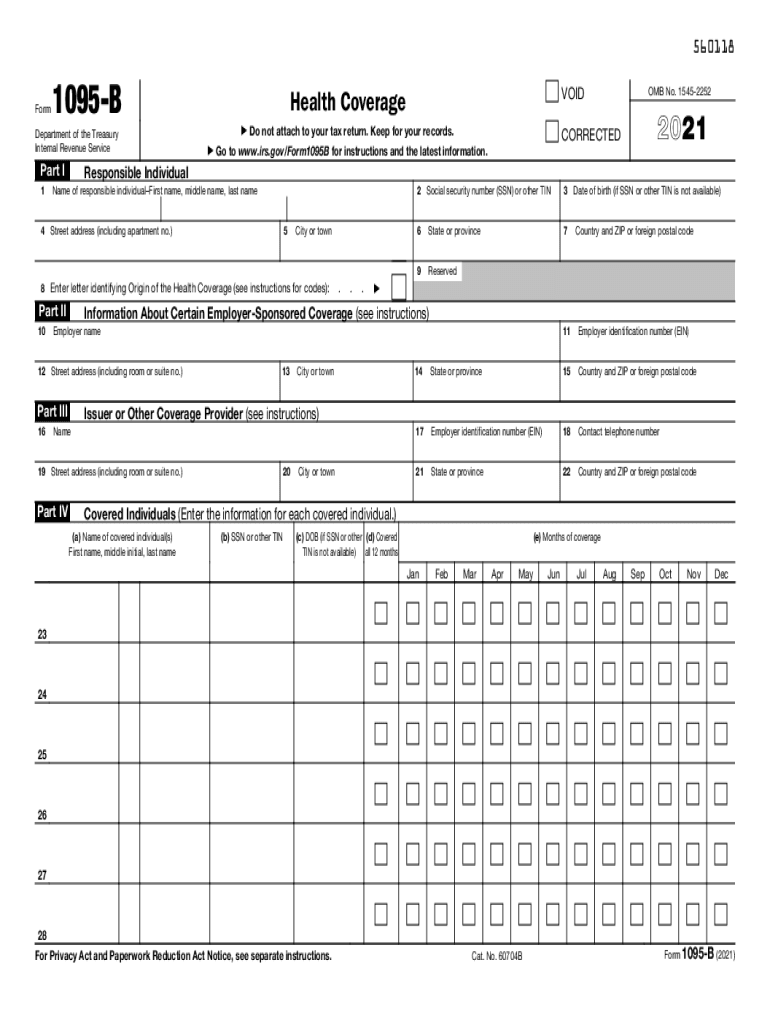

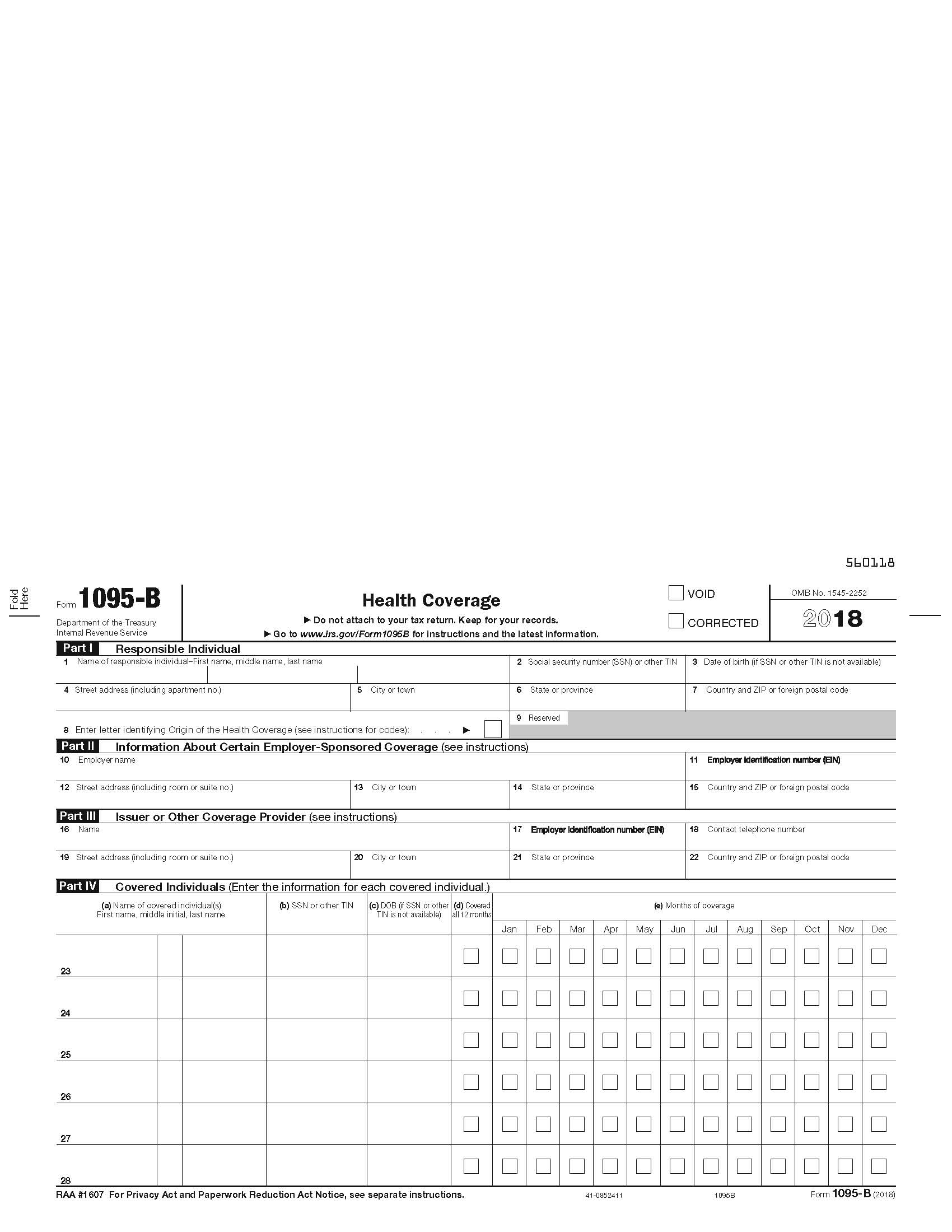

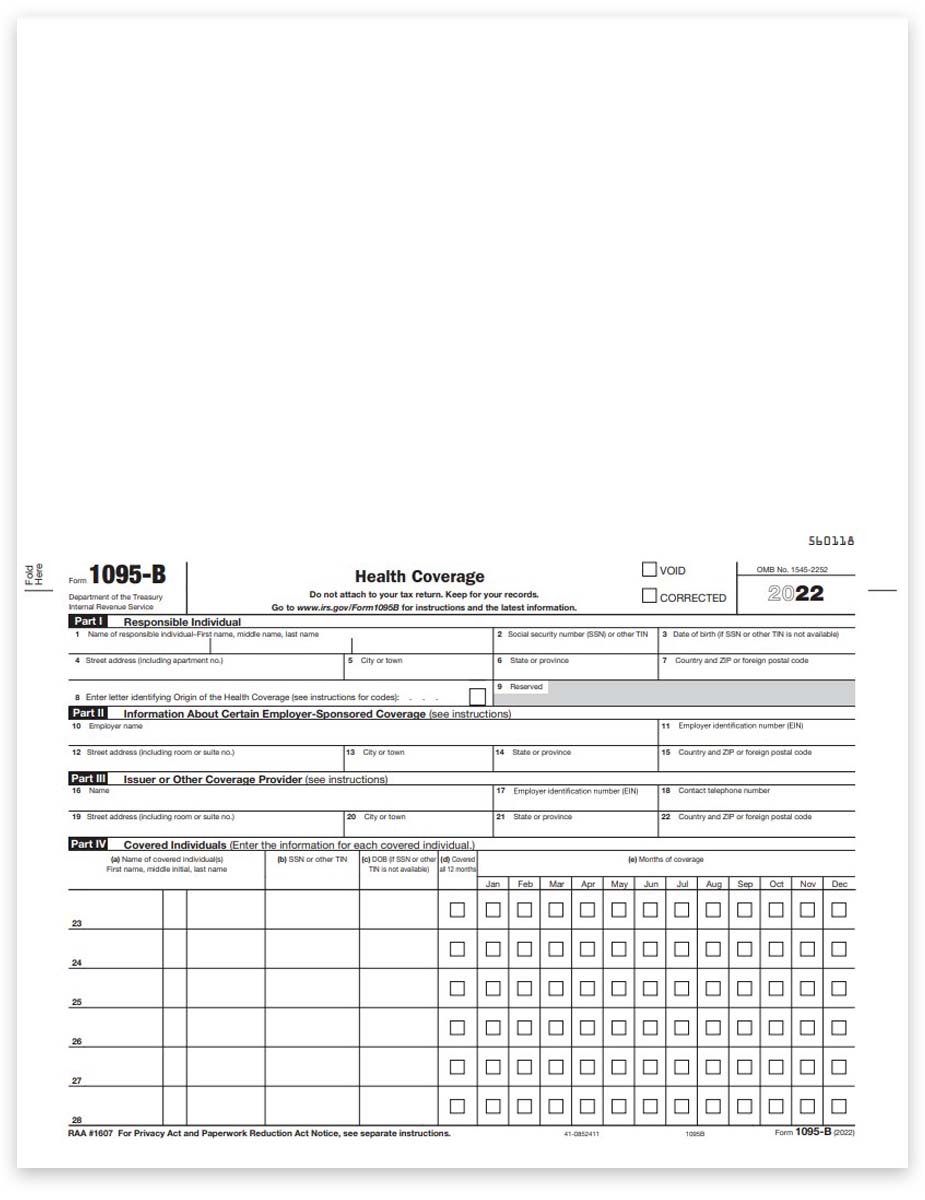

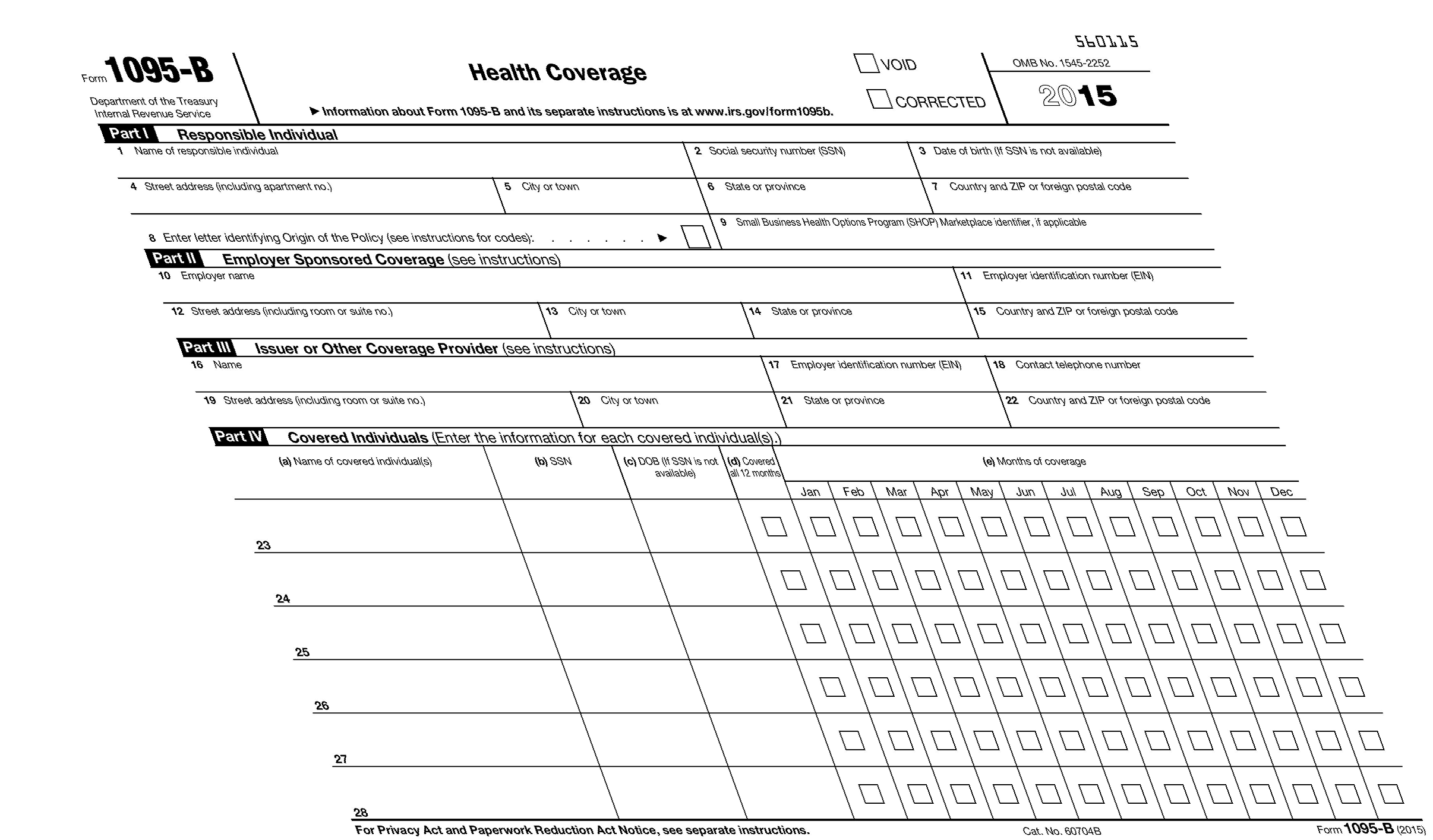

Medical Form 1095 B Printable Form 1095 B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment Current Revision Form 1095 B PDF Instructions for Forms 1094 B and 1095 B Print Version PDF Recent Developments

What is it The Qualifying Health Coverage QHC notice lets you know that your Medicare Part A Hospital Insurance coverage is considered to be qualifying health coverage under the Affordable Care Act If you have Part A you can ask Medicare to send you an IRS Form 1095 B In general you don t need this form to file your federal taxes Form 1095 B will report the months of MEC a Medi Cal beneficiary received during the calendar year DHCS will send your MEC information to the IRS and beneficiaries are not required to provide Form 1095 B to the IRS if they chose to file their taxes

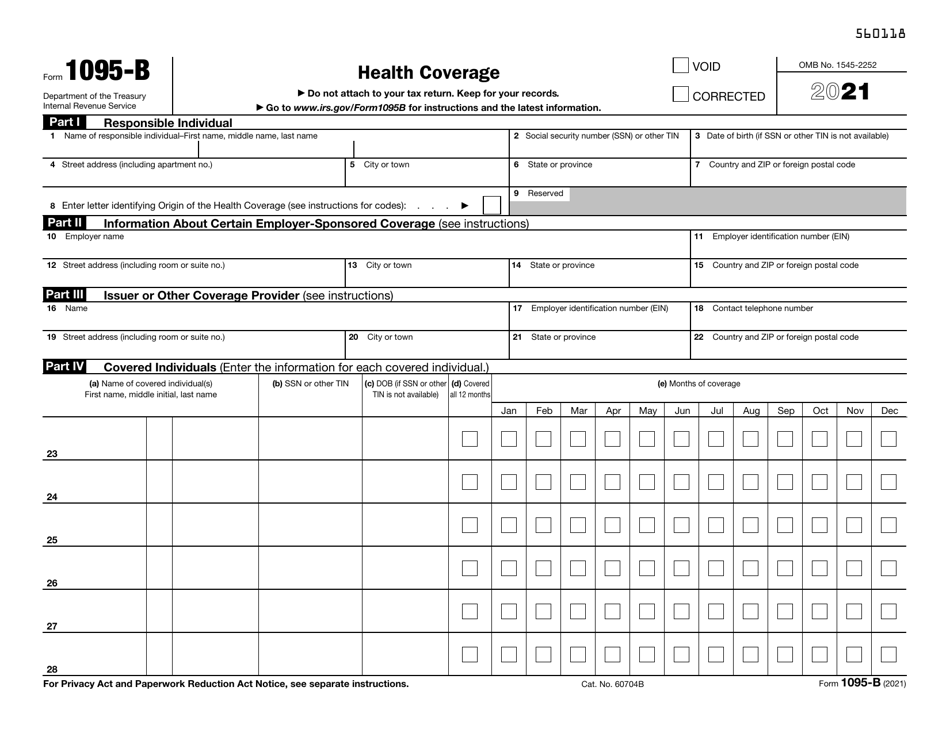

Medical Form 1095 B Printable

Medical Form 1095 B Printable

https://data.templateroller.com/pdf_docs_html/2251/22510/2251099/irs-form-1095-b-health-coverage_print_big.png

1095 B 2021 2023 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/575/719/575719686/large.png

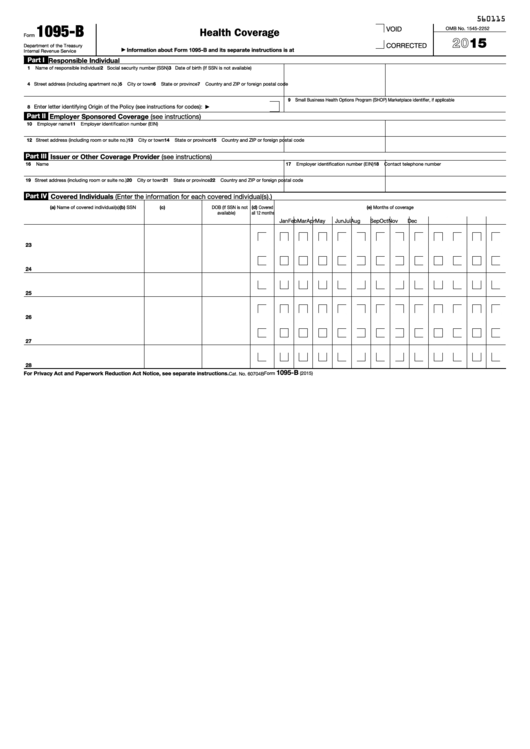

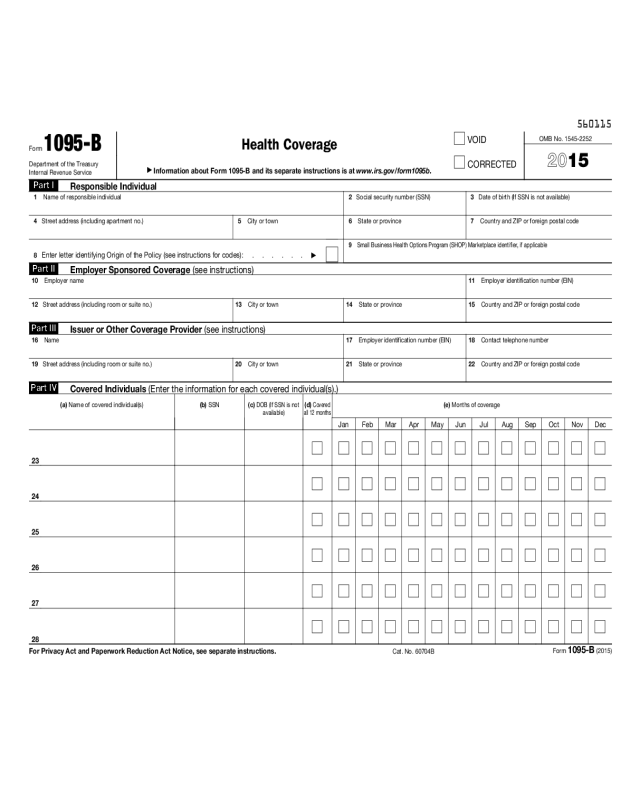

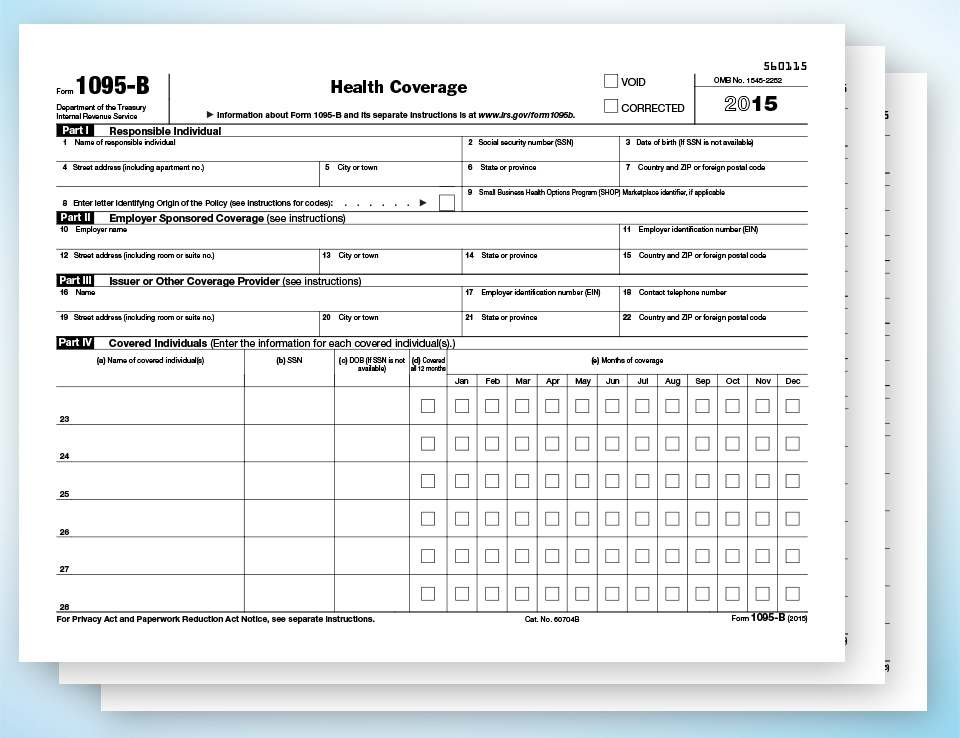

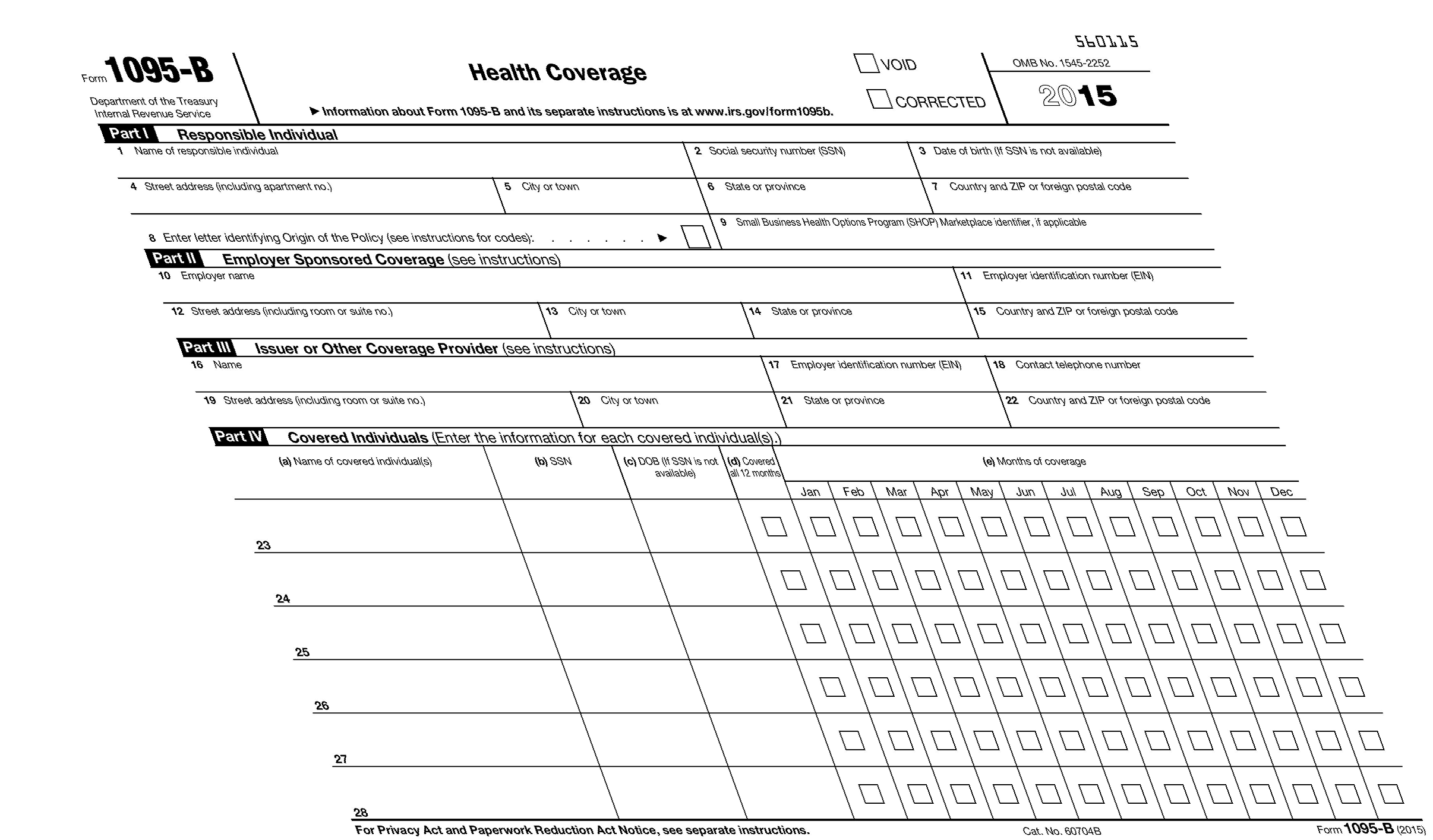

Fillable 2015 Form 1095 B Health Coverage Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/115/1152/115205/page_1_thumb_big.png

IRS Form 1095B UnitedHealthcare Members living in states with laws that require reporting of health coverage will continue to receive a paper copy of the Form 1095 B OVERVIEW Form 1095 B is a tax form that reports the type of health insurance coverage you have any dependents covered by your insurance policy and the period of coverage for the prior year This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage TABLE OF CONTENTS

This form includes details about the Marketplace insurance you and household members had in 2023 You ll need it to complete Form 8962 Premium Tax Credit Get a quick overview of health care tax Form 1095 A when you ll get it what to do if you don t how to know if it s right and how to use it Get a sample 1095 A PDF 132 KB DHCS will mail Form 1095 B to people who had Medi Cal that met the health coverage requirement by January 31 A cover letter explaining the purpose of the form will be included with Form 1095 B DHCS will also send an electronic copy of 1095 B to the IRS by March 30 IRS Resources Affordable Care Act and California Health Mandate

More picture related to Medical Form 1095 B Printable

Form 1095 B Health Coverage 2015 Edit Fill Sign Online Handypdf

https://handypdf.com/resources/formfile/images/10000/form-1095-b-health-coverage-2015-page1.png

Form 1095 B For Health Insurers Clarity Software Solutions

https://www9.clarityssi.com/images/solution-headerimages/lightbox-images/1095BForm.jpg

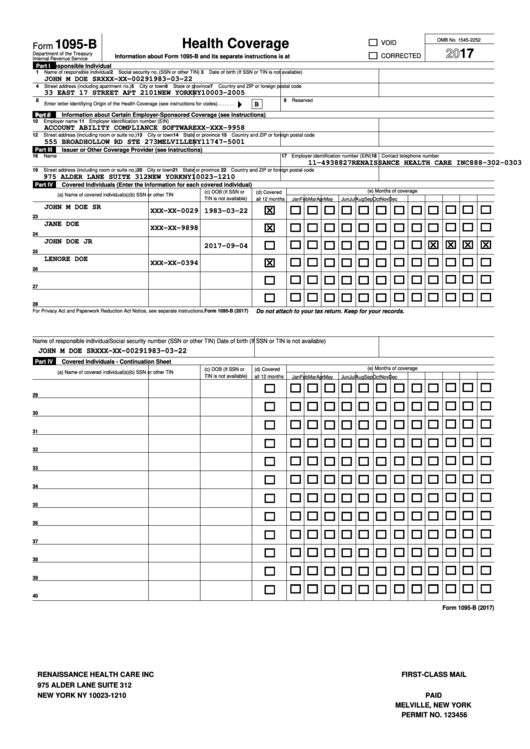

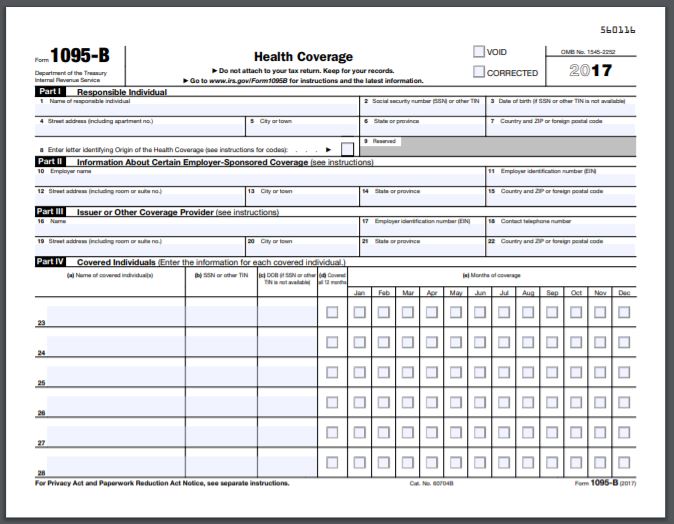

Form 1095 B Health Coverege 2017 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/365/3655/365512/page_1_thumb_big.png

The information on your Form 1095 B is incorrect please contact Kaiser Permanente at 844 477 0450 The hours of operation are from 8 a m to 6 p m Monday through Friday and 7 a m to 3 p m Saturday and Sunday Pacific Time lost or need another copy of your Form 1095 B the form is available through your personal documents page Important tax document information for 1095 B Kaiser Permanente is changing the annual tax mailing process for the 2023 tax year This means 1095 B forms for proof of minimal essential coverage will no longer be automatically mailed If you need a copy of your 1095 B form you may request one by calling Member Services at 1 844 477 0450

Upon request the Department of Human Services will mail 1095 B tax forms to households who have a member receiving Medical Assistance MA coverage If you need a copy of your 1095 B tax form you can Print the form or go to your myCOMPASS account to obtain the form You can also request the form by Calling 877 617 9906 Your Form 1095 B shows your Medi Cal coverage and can be used to verify that you had MEC during the previous calendar year You can use this information to complete your state and or federal income tax returns We have also sent this information to the IRS and the Franchise Tax Board FTB Keep this Form 1095 B for your records

1095 B Health Coverage Information 1095 B Forms Fulfillment

https://formquality.com/wp-content/uploads/2019/07/1095B50.jpg

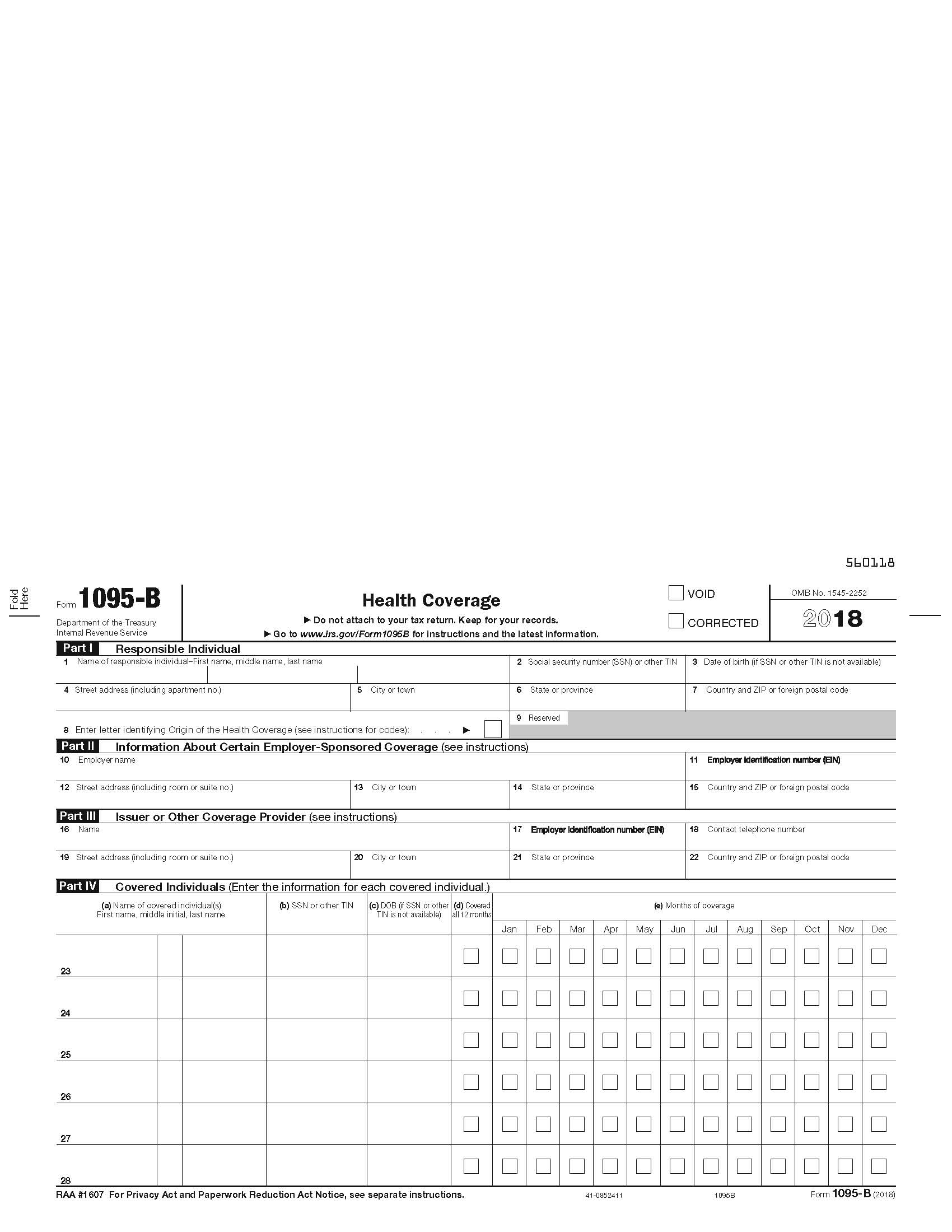

Fill Free Fillable Form 1095 B Health Coverage 2018 Pdf PDF Form

https://var.fill.io/uploads/pdfs/html/fb5a5513-a737-4ffc-aa3c-280763d7321b/bg1.png

https://www.irs.gov/forms-pubs/about-form-1095-b

Form 1095 B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment Current Revision Form 1095 B PDF Instructions for Forms 1094 B and 1095 B Print Version PDF Recent Developments

https://www.medicare.gov/basics/forms-publications-mailings/mailings/other-mailings/qualifying-health-coverage-notice

What is it The Qualifying Health Coverage QHC notice lets you know that your Medicare Part A Hospital Insurance coverage is considered to be qualifying health coverage under the Affordable Care Act If you have Part A you can ask Medicare to send you an IRS Form 1095 B In general you don t need this form to file your federal taxes

1095 B Health Coverage IRS Copy For 2018 92636 5095L TF5095L

1095 B Health Coverage Information 1095 B Forms Fulfillment

1095 B Forms ComplyRight Format Discount Tax Forms

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Understanding Form 1095 B The ACA Times

1095 B Submit Your 1095 B Form OnlineFileTaxes

1095 B Submit Your 1095 B Form OnlineFileTaxes

Ez1095 Software How To Print Form 1095 B And 1094 B

Formulario B Consejos

It s Tax Season What You Should Know About Form 1095 B Exact Insure

Medical Form 1095 B Printable - OVERVIEW Form 1095 B is a tax form that reports the type of health insurance coverage you have any dependents covered by your insurance policy and the period of coverage for the prior year This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage TABLE OF CONTENTS