Official Free Employer Quarterly Tax Forms Printably For State Taxes Correction to the Instructions for Form 941 Rev June 2021 19 OCT 2021 Rev Proc 2021 33 provides a safe harbor on figuring gross receipts solely for determining eligibility for the employee retention credit Notice 2021 49 provides guidance on the employee retention credit ERC under IRC 3134 and on other miscellaneous issues related

Form W 2 Wage and Tax Statement Form W 3C Transmittal of Corrected Wage and Tax Statements Form W 2C Corrected Wage and Tax Statement Form 1096 Annual Summary and Transmittal of U S Information Returns Form 1099 NEC Nonemployee Compensation Form 1099 MISC Miscellaneous Income Most businesses must report and file tax returns quarterly using the IRS Form 941 This guide provides the basics of the 941 form instructions to help you fill it out and where you can get help meeting all your payroll tax obligations

Official Free Employer Quarterly Tax Forms Printably For State Taxes

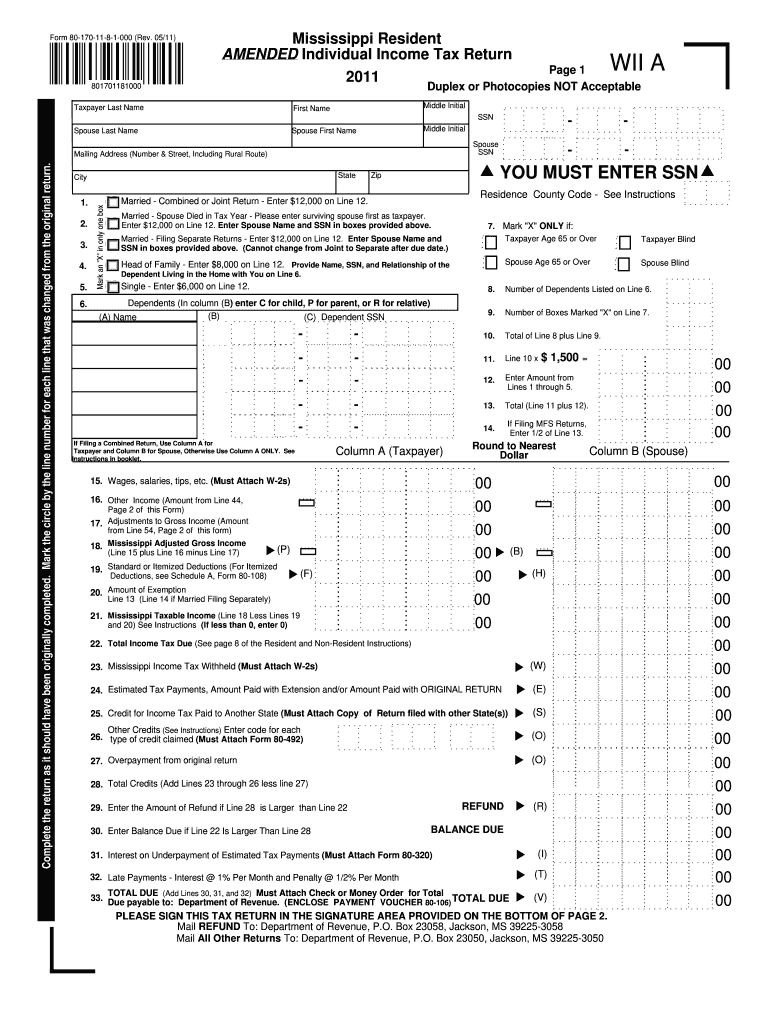

Official Free Employer Quarterly Tax Forms Printably For State Taxes

http://www.formsbirds.com/formimg/individual-income-tax/2719/form-941-ss-employers-quarterly-federal-tax-return-2015-l1.png

Printable State Tax Forms

https://www.pdffiller.com/preview/5/737/5737296/large.png

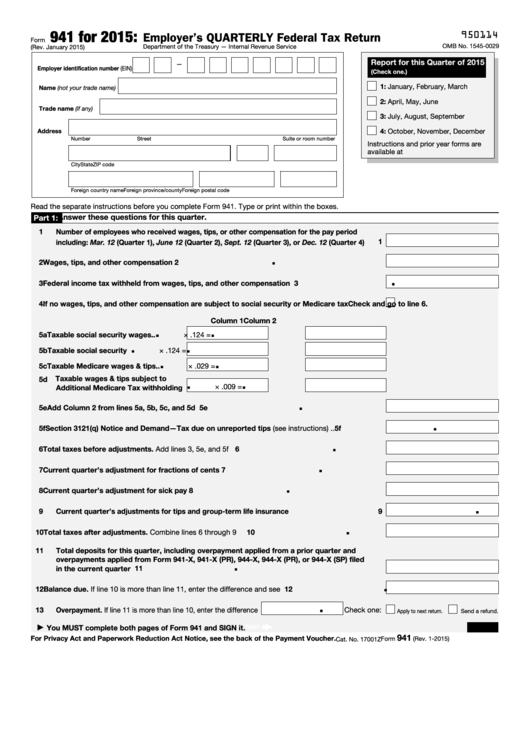

Fillable Form 941 Employer S Quarterly Federal Tax Return 2015 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/375/3750/375027/page_1_thumb_big.png

Publication Description Outline of the Hawaii Tax System as of July 1 2023 4 pages 172 KB 11 17 2023 A summary of state taxes including information on tax rates forms that must be filed and when taxes must be paid Booklet A Employer s Tax Guide Rev 2023 58 pages 518 KB 12 1 2023 An employer s guide on state income tax Download the Taxpayer Bill of Rights The Kentucky Department of Revenue conducts work under the authority of the Finance and Administration Cabinet

Check on the status of your individual income refund File your taxes online It s absolutely free Ensure we have your latest address on file Access your account online File returns and make payments Online applications to register a business Find out when all state tax returns are due The 941 Form also known as the Employer s Quarterly Federal Tax Return is used by employers to report their federal taxes This form must be filed four times a year and reports the employer s federal income tax withheld from employees paychecks and Social Security and Medicare taxes owed to the Internal Revenue Service IRS

More picture related to Official Free Employer Quarterly Tax Forms Printably For State Taxes

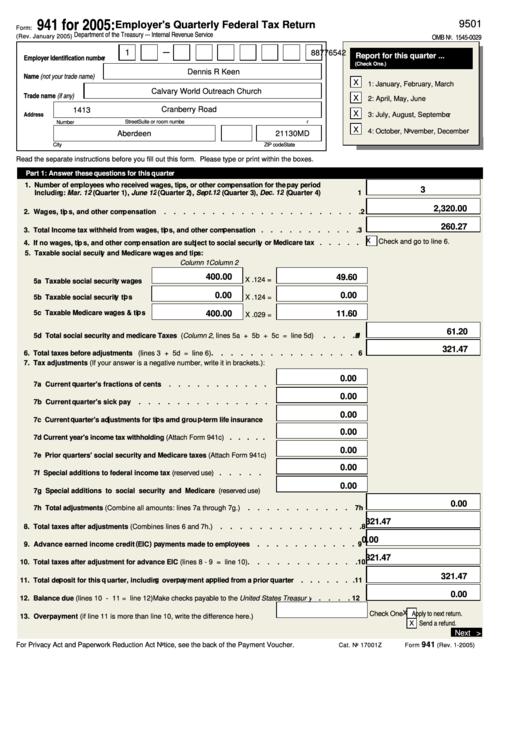

Employer S Quarterly Federal Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/45/451/45186/page_1_thumb_big.png

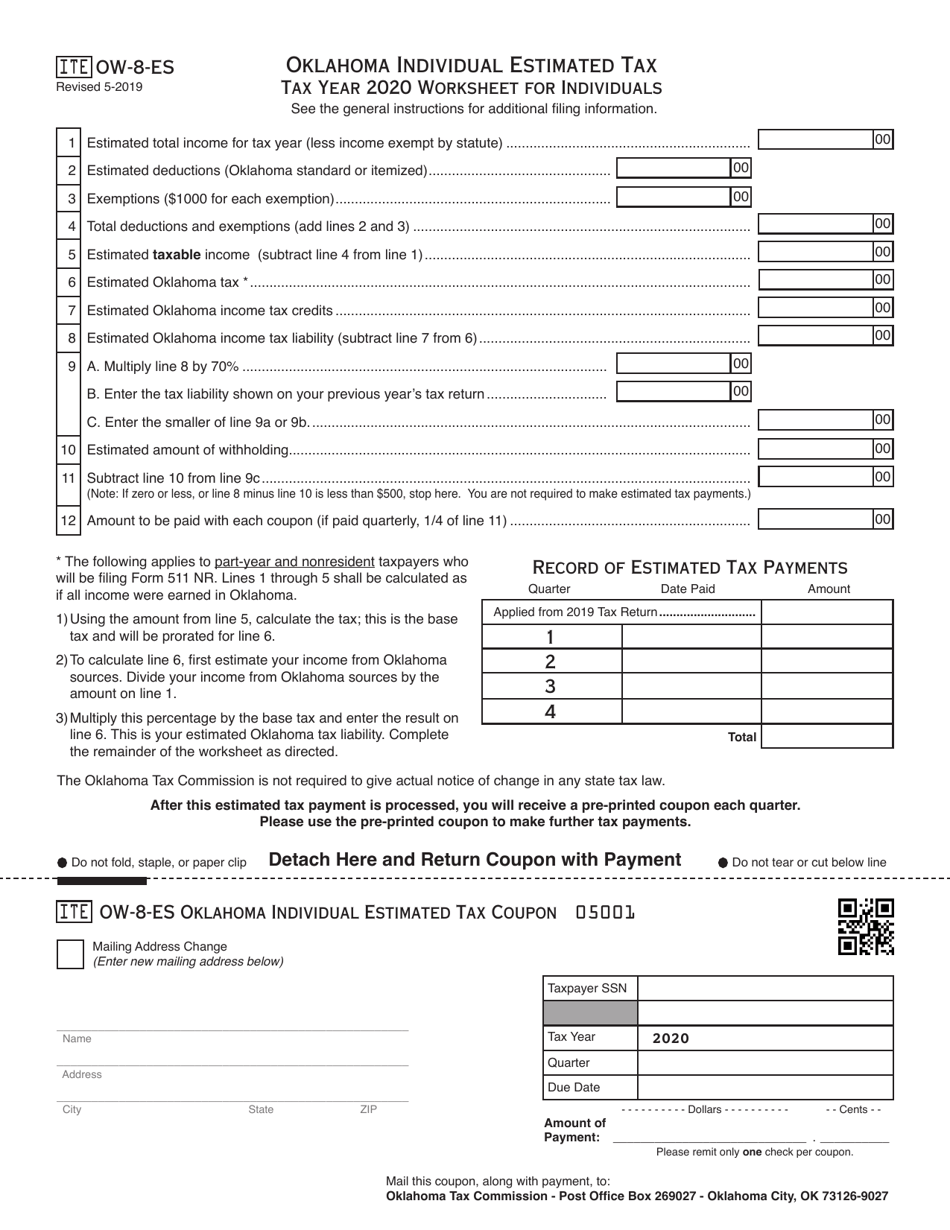

Form OW 8 ES Download Fillable PDF Or Fill Online Oklahoma Individual Estimated Tax Declaration

https://data.templateroller.com/pdf_docs_html/2060/20604/2060426/form-ow-8-es-oklahoma-individual-estimated-tax-declaration-oklahoma_print_big.png

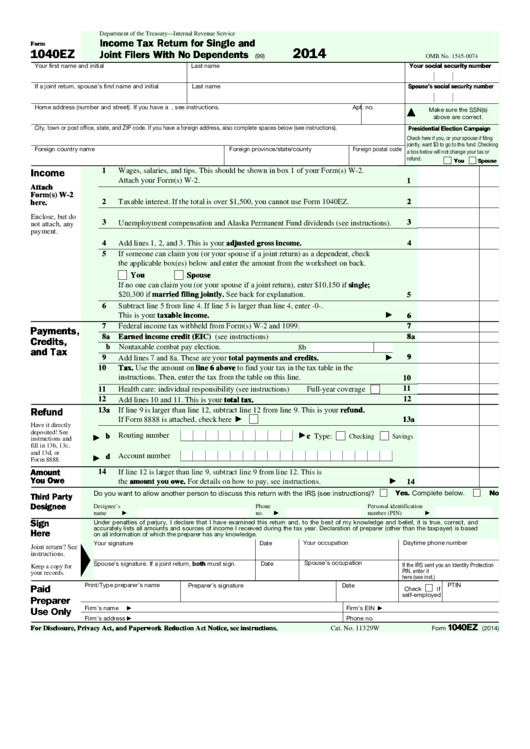

Free Printable Tax Forms 1040ez Printable Templates

https://data.formsbank.com/pdf_docs_html/7/72/7237/page_1_thumb_big.png

Pass Through Entity Taxes Withholding from Pass Through Entities on Non Resident Members 941P ME Composite Filing of Maine Income Tax for Nonresident Owners and Partnership Audit Return 1040C ME Step 4 Select a Mainline Range and or Section s The Thruway s 496 mile mainline connects New York City and Buffalo the State s two largest cities Other Thruway sections make direct connections with the Connecticut and Massachusetts Turnpikes New Jersey s Garden State Parkway and Interstate 287 and other major expressways that lead to New England Canada the Midwest and the South

36 43082 GNIS feature ID 0955783 Website lockportny gov Lockport is both a city and the town that surrounds it in Niagara County New York United States The city is the Niagara county seat with a population of 21 165 according to 2010 census figures and an estimated population of 20 305 as of 2019 2 The latest versions of IRS forms instructions and publications View more information about Using IRS Forms Instructions Publications and Other Item Files Click on a column heading to sort the list by the contents of that column Enter a term in the Find box Click the Search button

How To Fill Out 2020 Form 941 Employer s Quarterly Federal Tax Return Part 1 Line 1 To 5 Step

https://ninasoap.com/wp-content/uploads/2020/04/2020-Form-941-Emplyers-Quarterly-Tax-Return-Part-1-Line-to-5-Step5.jpg

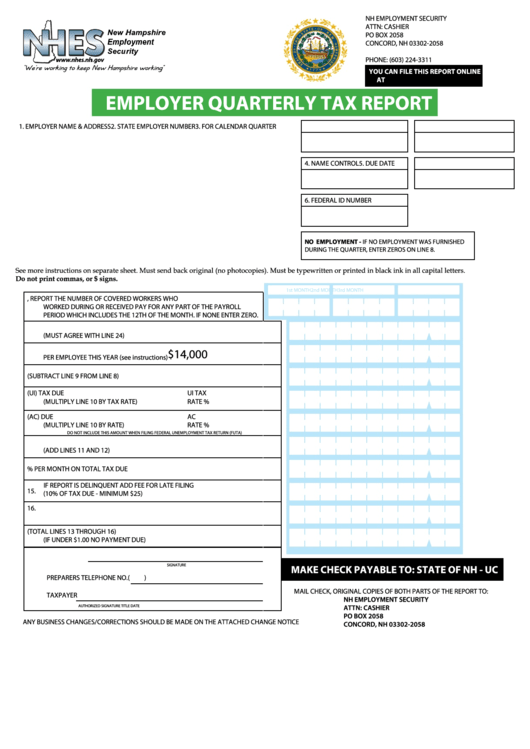

Fillable Employer Quarterly Tax Report Nhes Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/221/2219/221905/page_1_thumb_big.png

https://www.irs.gov/forms-pubs/about-form-941

Correction to the Instructions for Form 941 Rev June 2021 19 OCT 2021 Rev Proc 2021 33 provides a safe harbor on figuring gross receipts solely for determining eligibility for the employee retention credit Notice 2021 49 provides guidance on the employee retention credit ERC under IRC 3134 and on other miscellaneous issues related

https://www.irs.gov/businesses/small-businesses-self-employed/employment-tax-forms

Form W 2 Wage and Tax Statement Form W 3C Transmittal of Corrected Wage and Tax Statements Form W 2C Corrected Wage and Tax Statement Form 1096 Annual Summary and Transmittal of U S Information Returns Form 1099 NEC Nonemployee Compensation Form 1099 MISC Miscellaneous Income

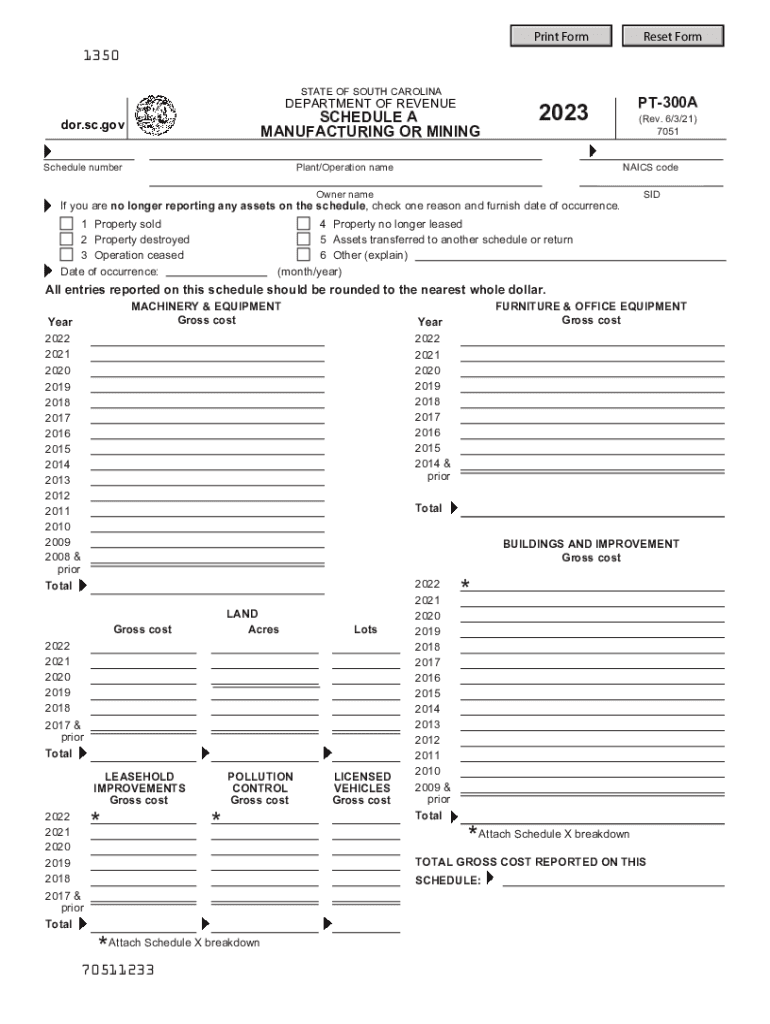

2023 Form SC PT 300A Fill Online Printable Fillable Blank PdfFiller

How To Fill Out 2020 Form 941 Employer s Quarterly Federal Tax Return Part 1 Line 1 To 5 Step

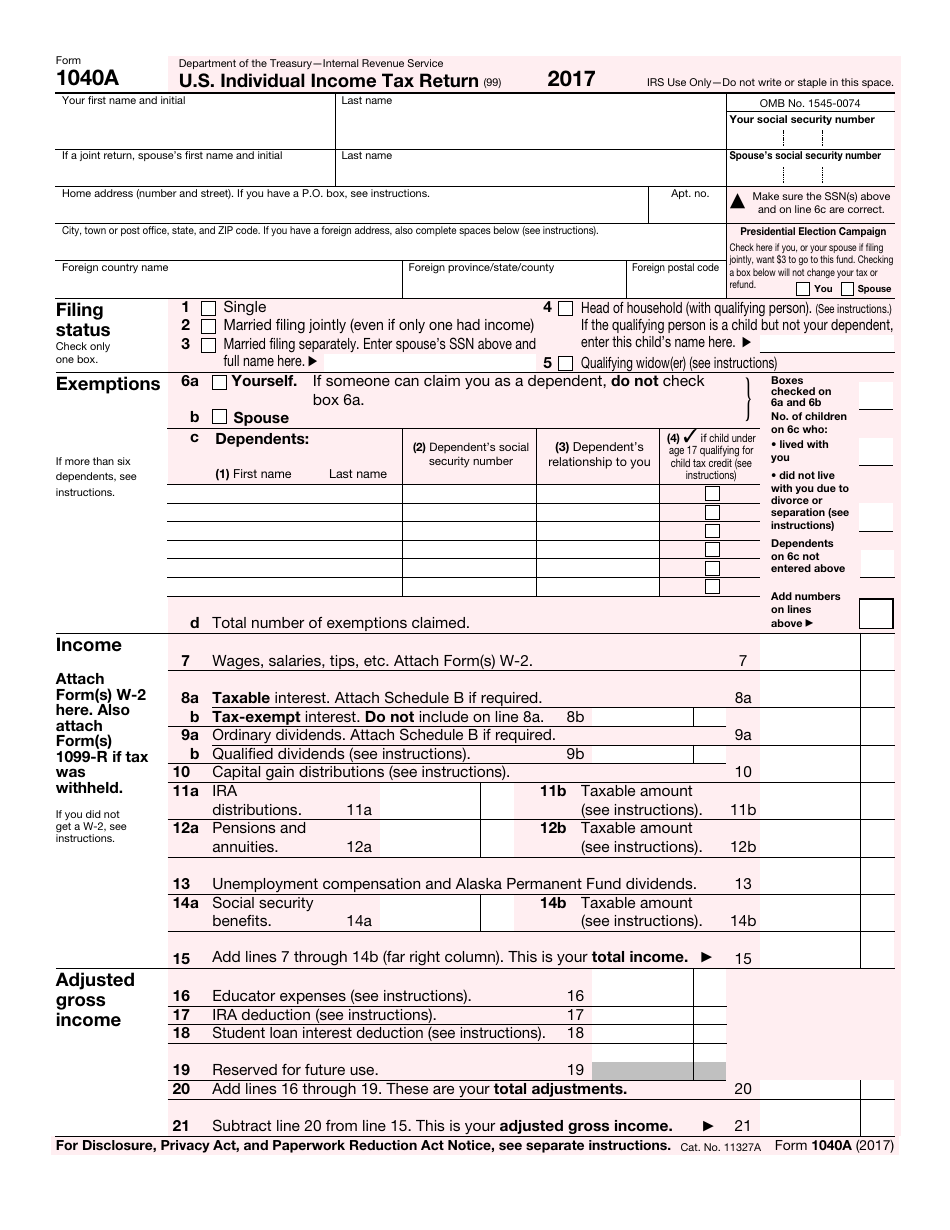

Printable Income Tax Forms

Form 941 Employer s Quarterly Federal Tax Return 2015 Free Download

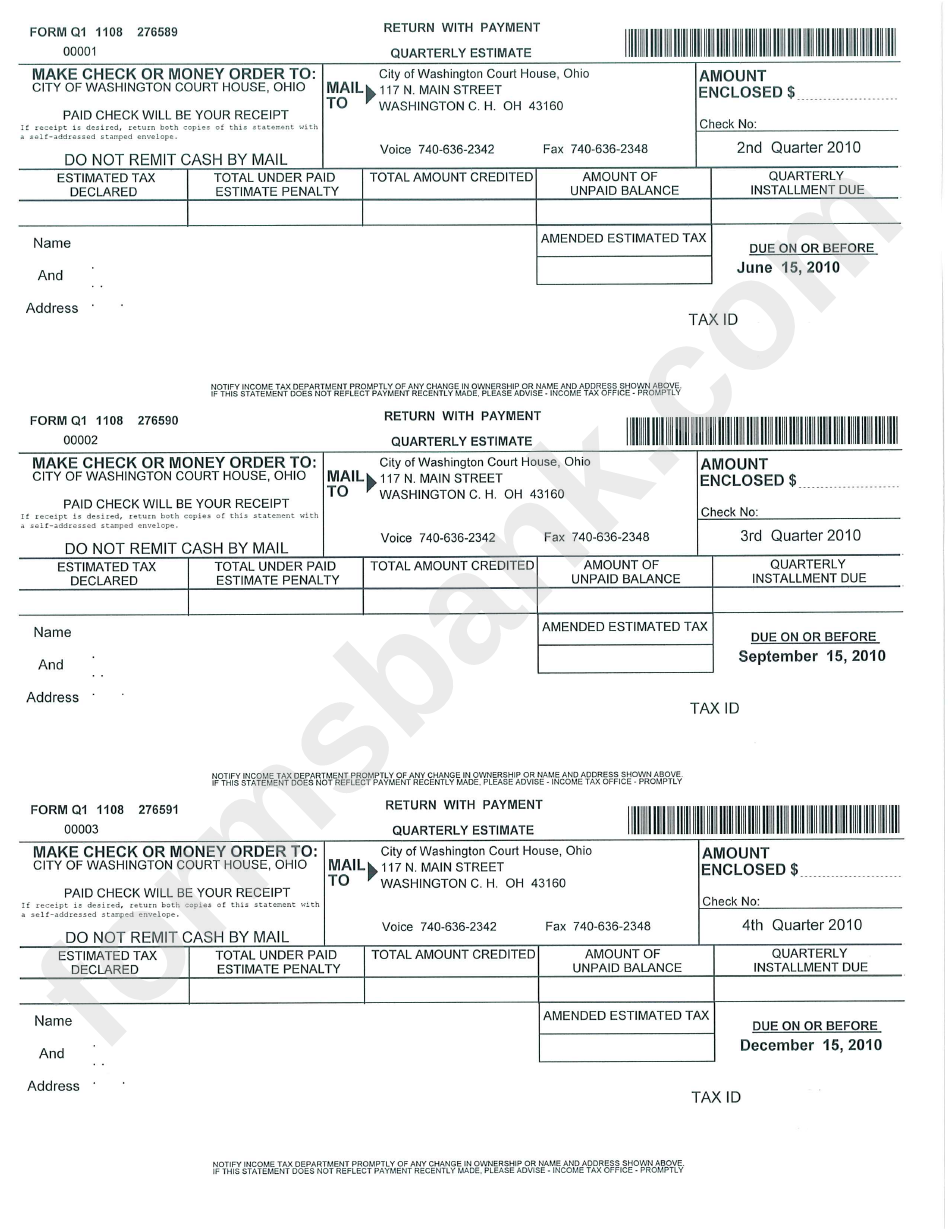

Form Q1 Individual Quarterly Estimate Tax Form Printable Pdf Download

Fillable 941 Quarterly Form 2022 Printable Form Templates And Letter

Fillable 941 Quarterly Form 2022 Printable Form Templates And Letter

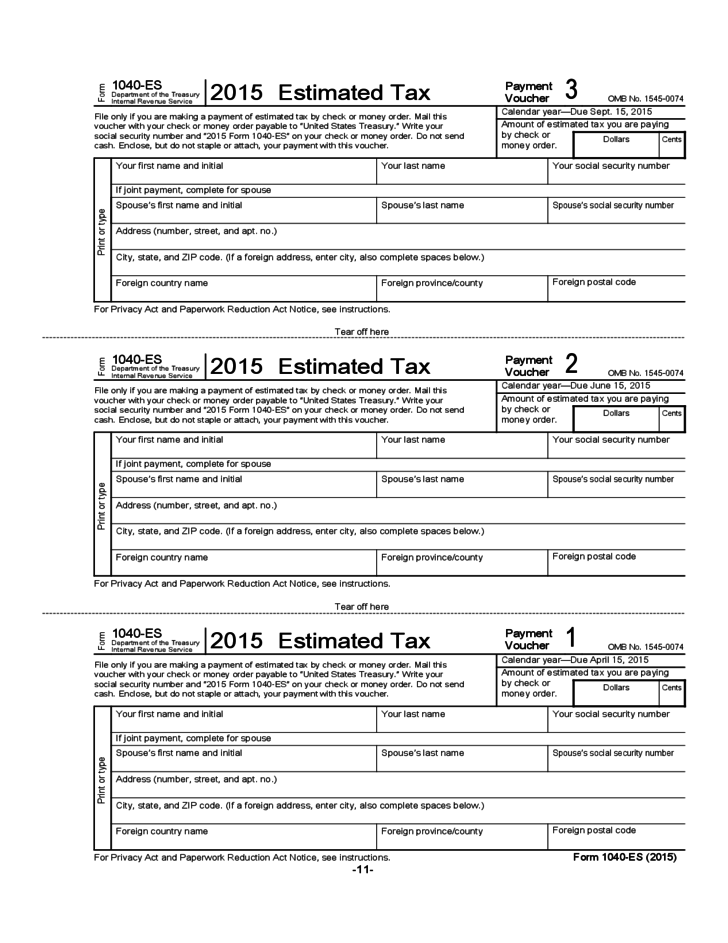

2015 Form 1040 ES Estimated Tax For Individual Free Download 1040 Form Printable

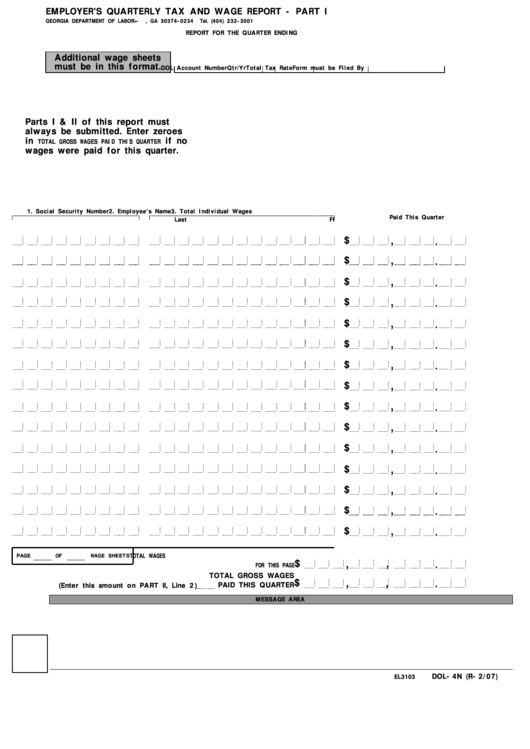

Printable Form Dol 4N

Free Printable State Tax Forms Printable Templates

Official Free Employer Quarterly Tax Forms Printably For State Taxes - Tax Bills Online If you choose to make partial payments the first MUST be made by 10 04 2017 Each partial payment may be any amount and must include current penalties 09 05 2017 to 10 04 2017 No penalty 10 05 2017 tp 10 31 2017 2 penalty Up to 3 partial payments may be made No delinquent taxes may be due on any property