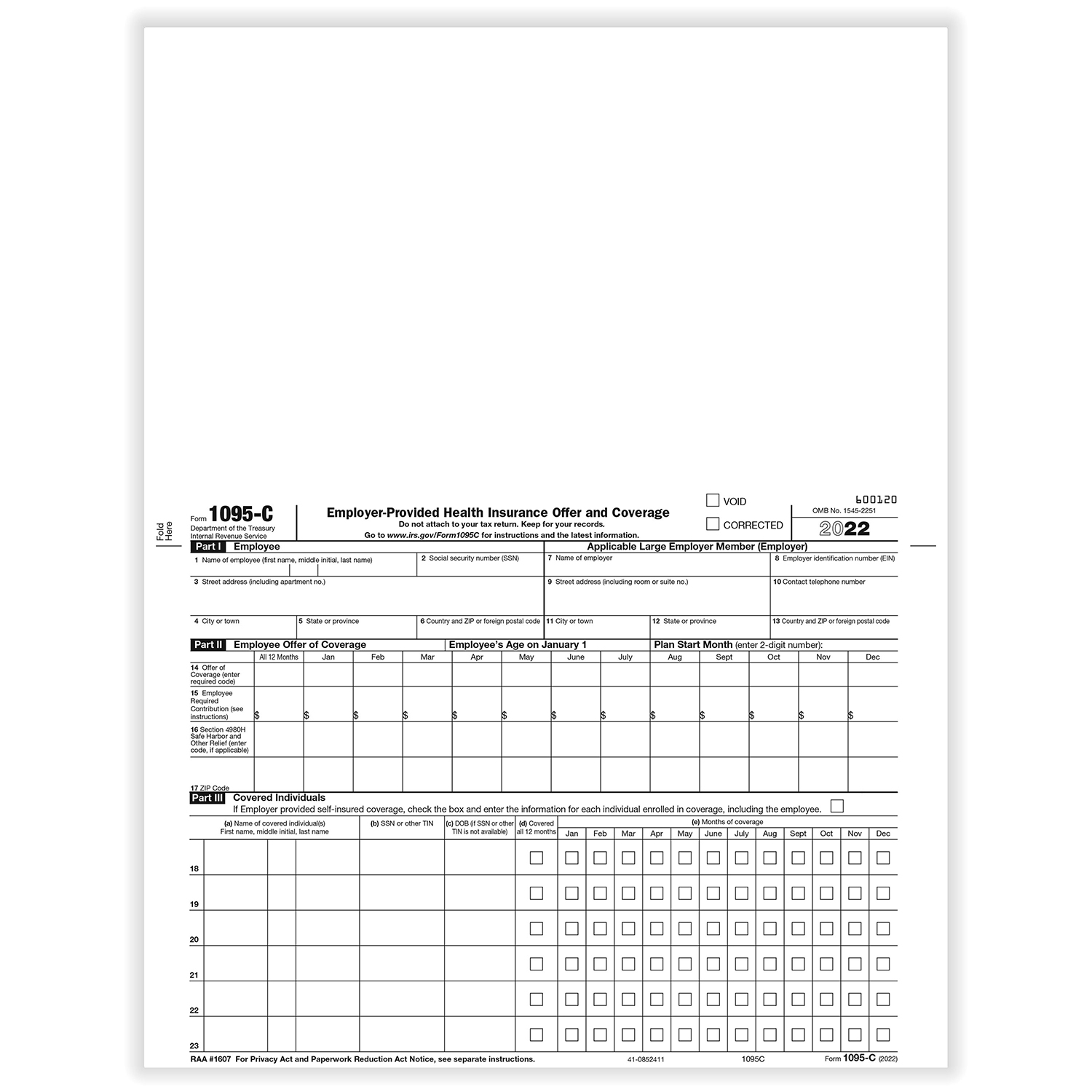

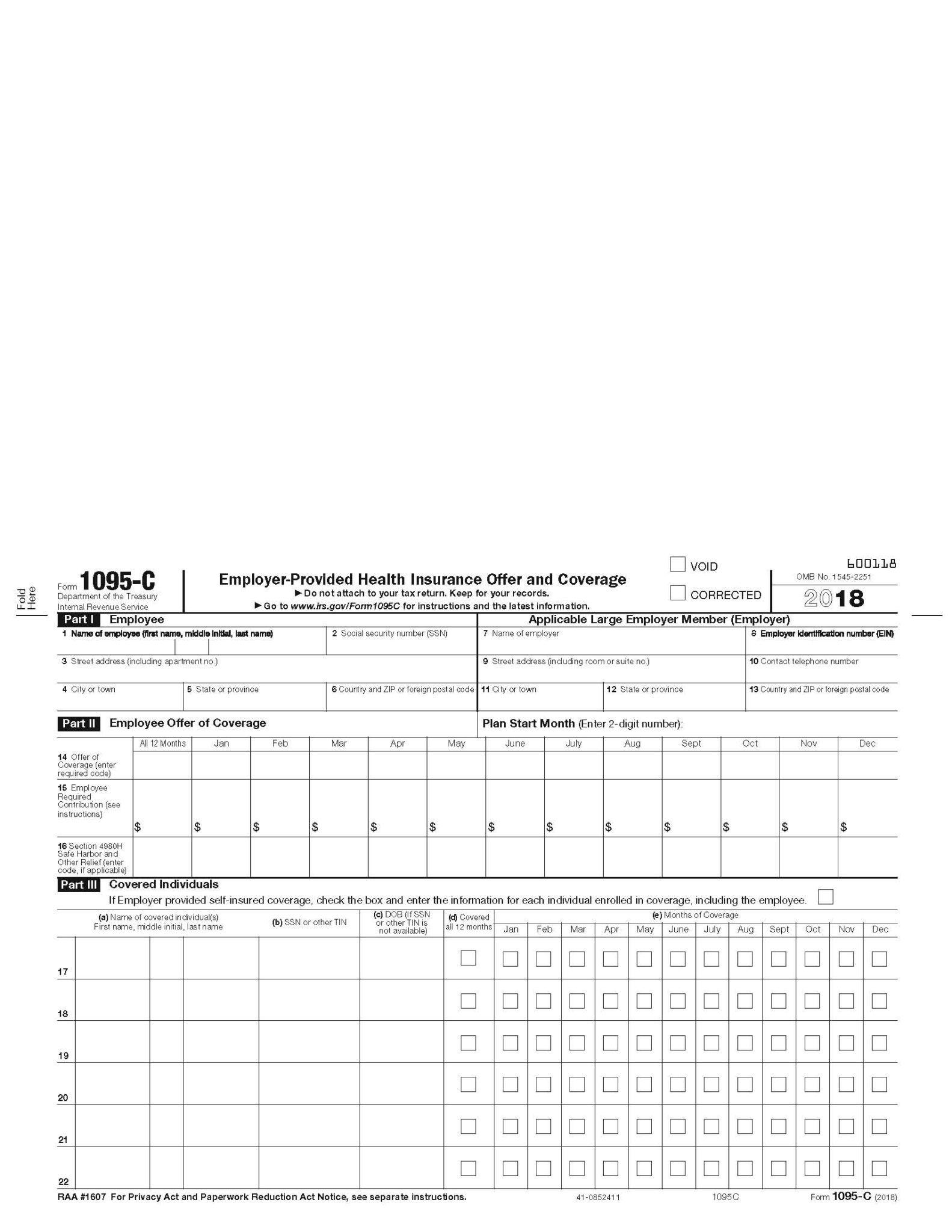

Printable 1095 C Form Landscape Style The federal tax form 1095 C is a document that must be filed by employers with over 50 full time employees to report information about health insurance coverage offered to their full time staff The IRS uses this form to determine whether an employer has met the Affordable Care Act s requirements for providing health coverage Consider a Case

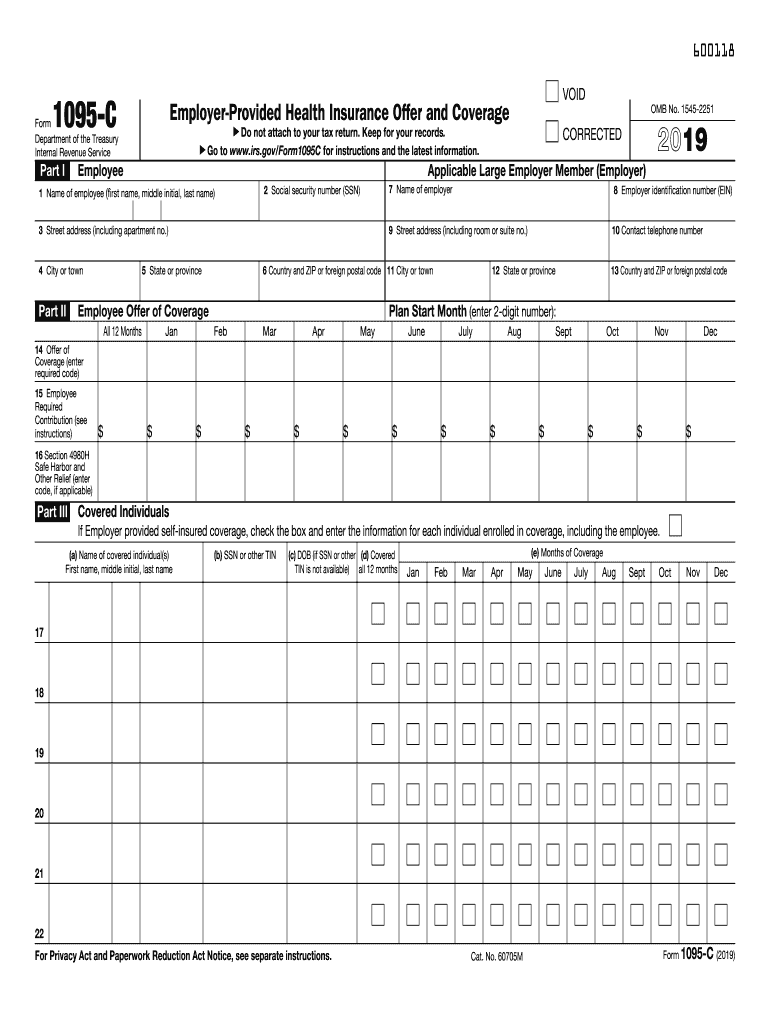

Form 1095 C is used to report information about each employee to the IRS and to the employee Forms 1094 C and 1095 C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095 C is also used in determining the eligibility of employees for the premium tax credit The electronic Standard 1095 C PDF file prints the front side only including lines and boxes on letter size 8 5 x 11 paper For 2020 and future reporting years the Foldable 7171 1 PDF prints on legal size 8 5 x 14 paper and the Pressure Sealed PDF prints on legal size 8 5 x 14 pressure sealed paper

Printable 1095 C Form Landscape Style

Printable 1095 C Form Landscape Style

https://blog.boomtax.com/wp-content/uploads/2022/06/Form-1095-C-Image-with-Border.png

Create Fillable 1095 C Form According To Your Needs

https://www.pdffiller.com/preview/527/848/527848229/big.png

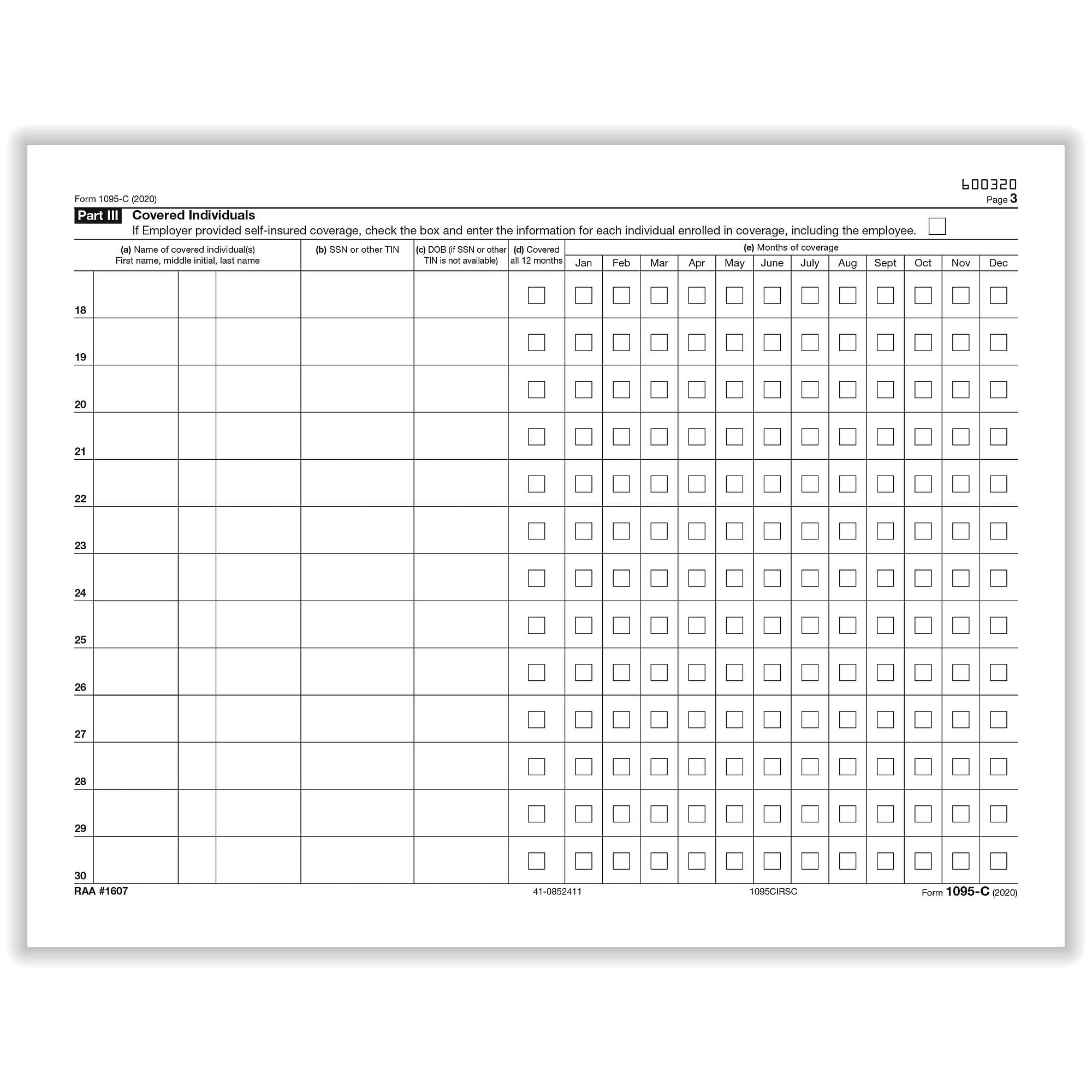

1095 C IRS Employer Provided Health Insurance Offer And Coverage Continuation Form Landscape

https://suppliesshops.gumlet.io/images/1095CIRSC-2020.jpg

Print in landscape format Use First Class Mail Do not fold paper clip or staple forms Use conveniently sized packaging On each package write your name and number the packages consecutively Place Form 1094 C in package number one 1095 form distributed to employees March 2 2022 Note Date change Previous due date January 31 Form 1095 C IRS Landscape format is now two pages If the employee has dependents who were enrolled in coverage you must purchase the 1095 Continuation form to maintain compliance THIS IS THE OFFICIAL IRS VERSION of the 1095 C It is a half page and does NOT have a compatible envelope Use Form 1094 C transmittal to summarize information on

What is Form 1095 C Form 1095 C is an information return filed by employers with at least 50 full time full time equivalent employees These employers are known as Applicable Large Employers or ALEs by the IRS No Tax Form 1095 C is a reference tax form and doesn t need to be completed by you the taxpayer Your employer will send a copy of Form 1095 C to the IRS Additionally it isn t filed or attached to your individual tax return that you file Keep it in your tax records as you could be audited for up to three tax years

More picture related to Printable 1095 C Form Landscape Style

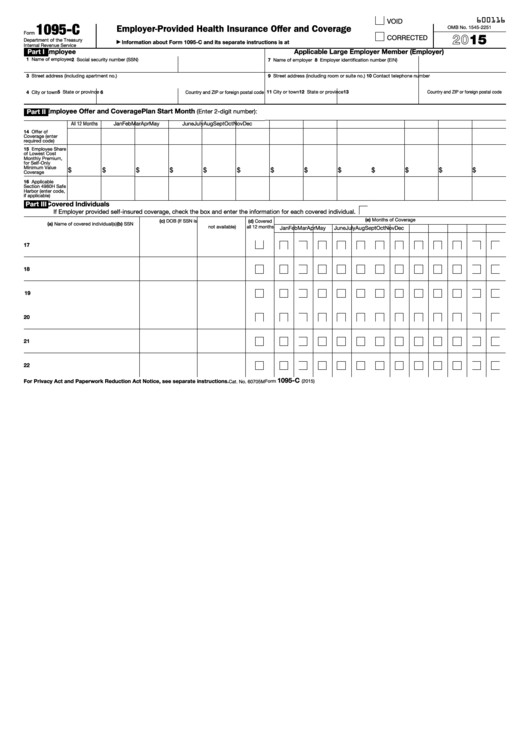

Fillable Form 1095 C Employer Provided Health Insurance Offer And Coverage 2015 Printable

https://data.formsbank.com/pdf_docs_html/339/3390/339051/page_1_thumb_big.png

Fill Free Fillable 2020 Form 1095 C PDF Form

https://var.fill.io/uploads/pdfs/html/a52570f5-d9ac-4fcd-ae57-bdaac817384d/bg1.png

1095 C Excel Template Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/51/47/51047313/large.png

Form 1095 C Guide for Employees On November 29 2018 the Internal Revenue Service IRS Notice 2018 94 announced the extension of the due date to furnish 2018 health coverage information forms to employees Applicable Large Employers ALEs now have until March 4 2019 to provide Forms 1095 C to individuals If you work for an organization Form 1095 C is a tax form sent from employers to employees that describes the health insurance that is available to them This annual statement is required by law under the Affordable Care

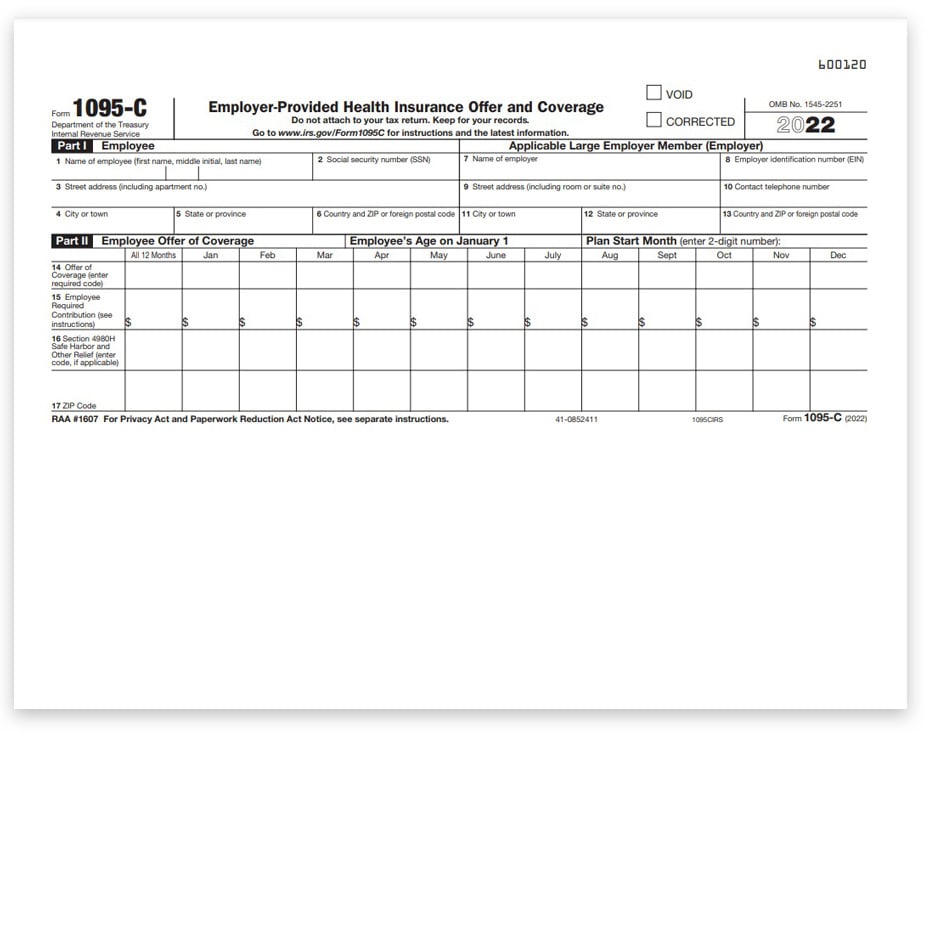

Form 1095 C www greenshades Used to show that employer offered healthcare complied with the Affordable Care Act Final version and instructions released on October 15 New fields on Form 1095 C are Employee s age on January 1 Part II Line 17 ZIP code for primary residence for codes 1L 1M or 1N on line 14 or Form 1095 B Health Coverage If you are enrolled in FEHB you may request IRS Form 1095 B from your FEHB carrier and receive this form within 30 days of your carrier receiving your request or your Carrier will furnish this form to you by March 2 2020 If you have questions about the information on your IRS Form 1095 B or about lost

Form 1095 C Instructions Office Of The Comptroller

https://www.macomptroller.org/wp-content/uploads/img_announcement_1095-c-2022.png

1095 C Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/489/187/489187928/large.png

https://1095c-form.com/

The federal tax form 1095 C is a document that must be filed by employers with over 50 full time employees to report information about health insurance coverage offered to their full time staff The IRS uses this form to determine whether an employer has met the Affordable Care Act s requirements for providing health coverage Consider a Case

https://www.irs.gov/instructions/i109495c

Form 1095 C is used to report information about each employee to the IRS and to the employee Forms 1094 C and 1095 C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095 C is also used in determining the eligibility of employees for the premium tax credit

1095 C Form IRS Half Sheet Format Discount Tax Forms

Form 1095 C Instructions Office Of The Comptroller

2020 Form 1095 C Mailed On March 1 2021 News Illinois State

2019 Form 1095 C ACA Reporting Service Obamacare Compliance Health Care Compliance Inc

Preprinted 1095 C Full Page Form W Instructions B95CFPREC05

IRS Form 1095 C Codes Explained Integrity Data

IRS Form 1095 C Codes Explained Integrity Data

1095 Form 1095 Employer Provided Health Insurance Formstax

Form 1095 C Instructions Office Of The Comptroller

1095 C Employer Provided Health Coverage Information 1095 C Forms Fulfillment

Printable 1095 C Form Landscape Style - What is Form 1095 C Form 1095 C is an information return filed by employers with at least 50 full time full time equivalent employees These employers are known as Applicable Large Employers or ALEs by the IRS