Printable Form For Stimulus Check IRS Statements and Announcements Page Last Reviewed or Updated 05 Dec 2023 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit

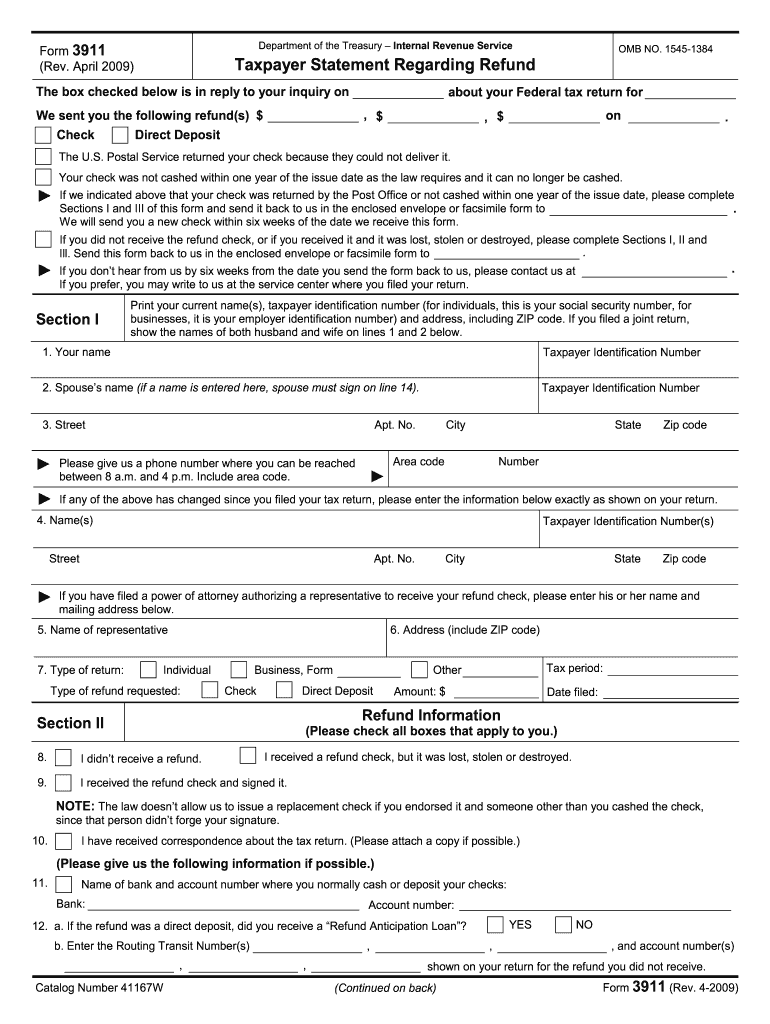

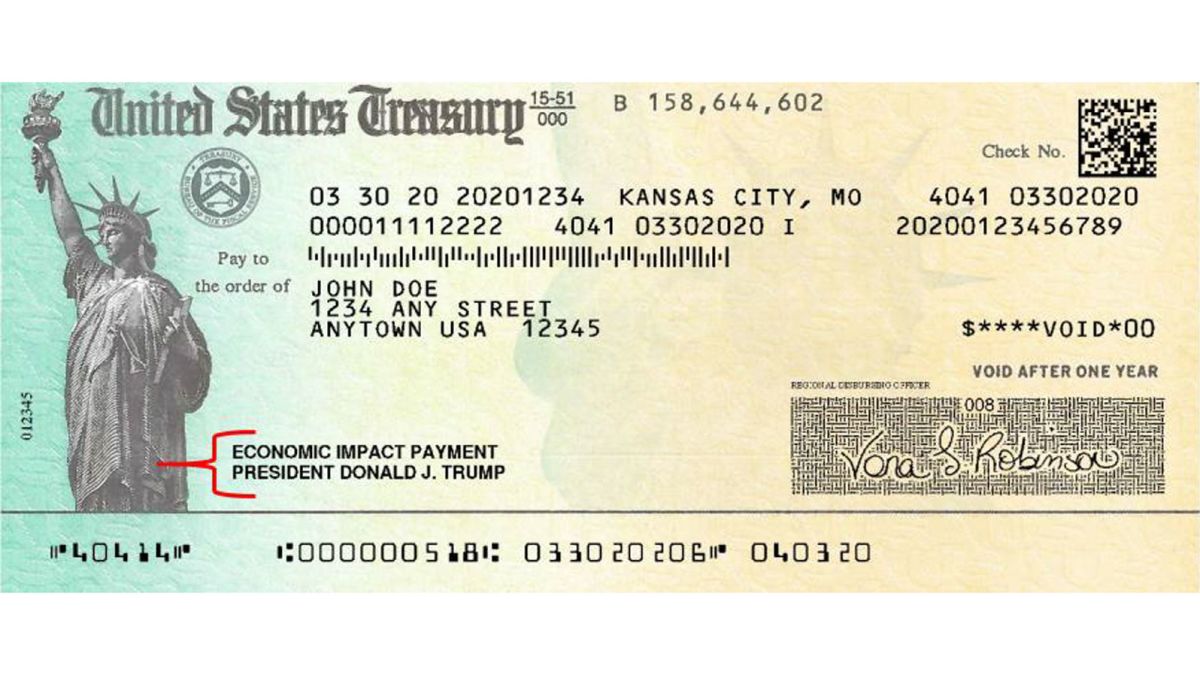

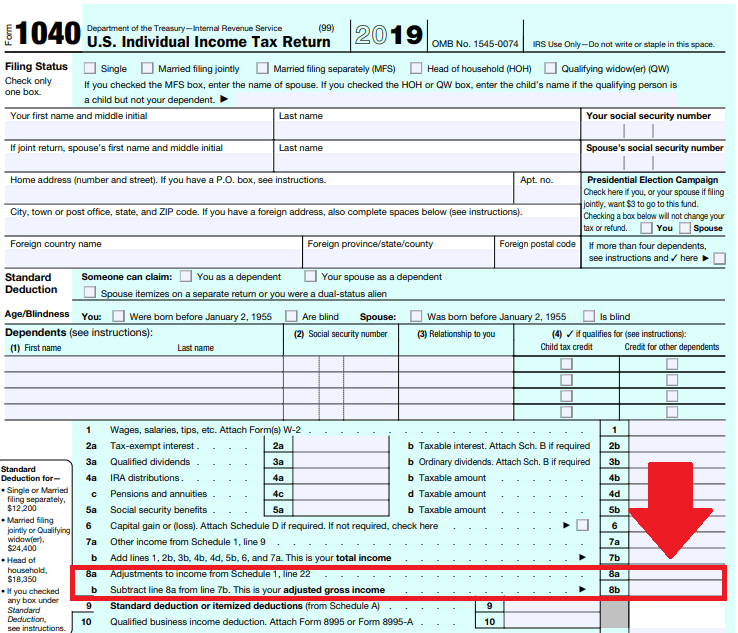

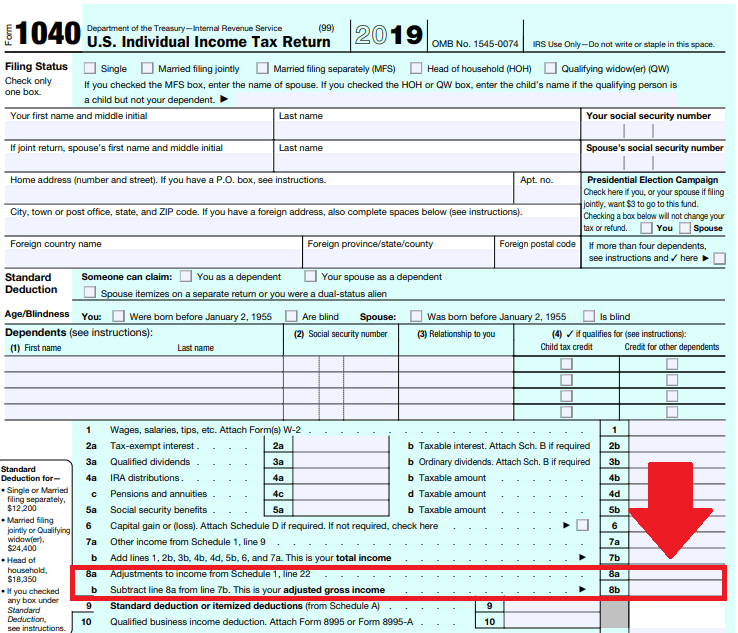

You ll need to file the standard 1040 federal tax return form or the 1040 SR tax return for people 65 or older to get your missing stimulus money in the form of a tax credit that will either lower the amount of tax you owe or increase the size of your refund AARP Membership To complete Form 3911 for your third stimulus check the IRS provides the following instructions 1 Write EIP3 on the top of the form EIP stands for Economic Impact Payment 2 Complete the

Printable Form For Stimulus Check

Printable Form For Stimulus Check

https://www.pdffiller.com/preview/65/908/65908534/large.png

IRS 3911 2009 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/0/316/316883/large.png

Irs Form 3911 Fillable Printable Forms Free Online

https://i.ytimg.com/vi/12wVxxlNnRY/maxresdefault.jpg

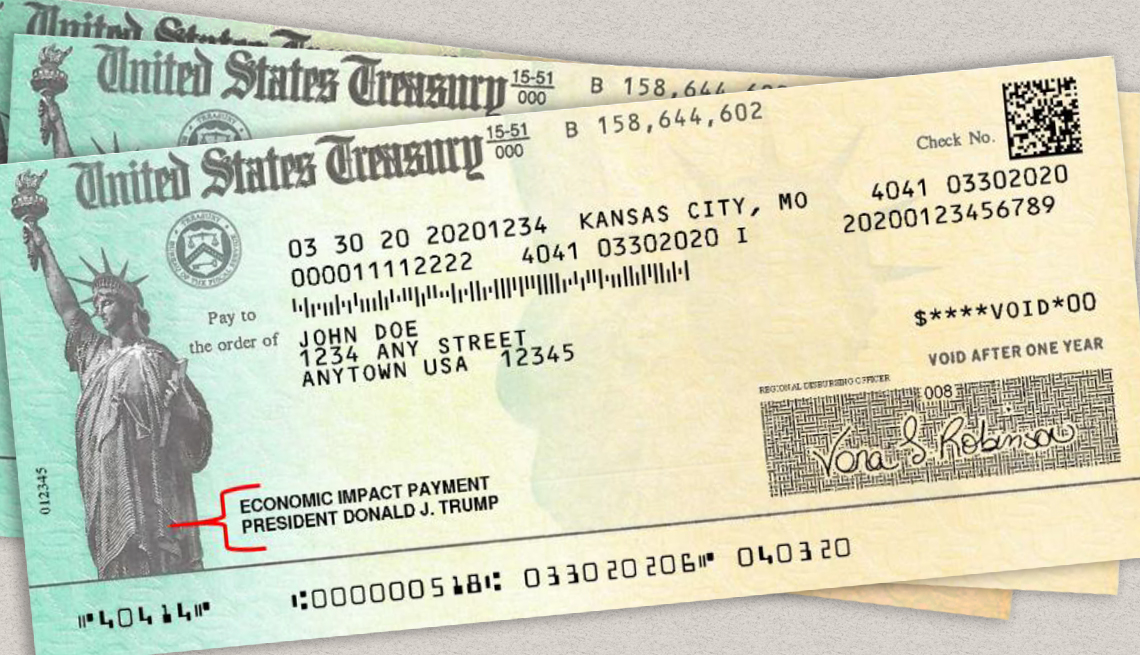

Form 3911 Department of the Treasury Internal Revenue Service OMB Number October 2022 Taxpayer Statement Regarding Refund 1545 1384 The information below is in reply to your inquiry on about your Federal tax refund for If you did not receive your refund or if the refund check you received was lost stolen or destroyed complete the entire form Get My Payment Find information about the Economic Impact Payments stimulus checks which were sent in three batches over 2020 and 2021 Assistance for American Families and Workers Find information about Economic Impact Payments Unemployment Compensation payments Child Tax Credit payments and Emergency Rental Assistance payments Where is My Refund Check the status of your Internal

How to Claim Your Rebate Credit To get your money you ll need to claim the 2021 Recovery Rebate Credit on your 2021 return Filing electronically can guide you through the form Don t claim any missing first or second stimulus payments on your 2021 return rather you ll need to file a 2020 return or an amended return to get these payments Starting in March 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act provided Economic Impact Payments of up to 1 200 per adult for eligible individuals and 500 per qualifying child under age 17 The payments were reduced for individuals with adjusted gross income AGI greater than 75 000 150 000 for married couples filing a joint return For a family of four

More picture related to Printable Form For Stimulus Check

Stimulus Update Is A 4th Stimulus Check Coming In 2021 Mlive

https://www.mlive.com/resizer/Eet8lMsoxoKCk_dVhLWT4401fAQ=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/65WBVNYYT5EE3KKQXJ5EYIELDI.jpg

Missing Stimulus Check Money How To Claim The Payment On Fill And Sign Printable Template

https://www.pdffiller.com/preview/548/464/548464234/large.png

How To Track Your Federal Stimulus Check Cleveland

https://www.cleveland.com/resizer/kmhGg7-lh9tGsSVaVINmrX-v-aQ=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/2XKIARVBDZA5NIY7JA6WTHLS6U.JPG

This document provides information for Social Security beneficiaries retirement survivors disability and Supplemental Security Income SSI recipients related to economic impact payments being issued to eligible individuals People who received no stimulus check or a partial stimulus check can apply for the credit by filing Form 1040 an individual tax return or 1040 SR a return for seniors The credit is

Step 1 Visit the IRS website to access the Non filer form Scroll to the bottom of this IRS portal https www irs gov credits deductions child tax credit non filer sign up tool Click the blue Use the Non filer Sign up Tool button You will be taken to this page https www freefilefillableforms fd childtaxcredit The stimulus bill based eligibility for the checks or direct deposits on federal tax returns sparking widespread confusion about how non tax filers would qualify and how the IRS would know where

How To Fill Out Form To Get Stimulus Check Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Stimulus Check Blank Template Imgflip

https://i.imgflip.com/4hxxsw.jpg

https://www.irs.gov/newsroom/recovery-rebate-credit

IRS Statements and Announcements Page Last Reviewed or Updated 05 Dec 2023 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit

https://www.aarp.org/money/taxes/info-2021/how-to-claim-stimulus-on-tax-return.html

You ll need to file the standard 1040 federal tax return form or the 1040 SR tax return for people 65 or older to get your missing stimulus money in the form of a tax credit that will either lower the amount of tax you owe or increase the size of your refund AARP Membership

View 20 Irs gov Non Filers Form For Stimulus Check

How To Fill Out Form To Get Stimulus Check Printable Rebate Form

/https://specials-images.forbesimg.com/imageserve/52182000/0x0.jpg)

Stimulus Check COVID 19 Stimulus Package Cruz Paul Question Spending We Share Daily

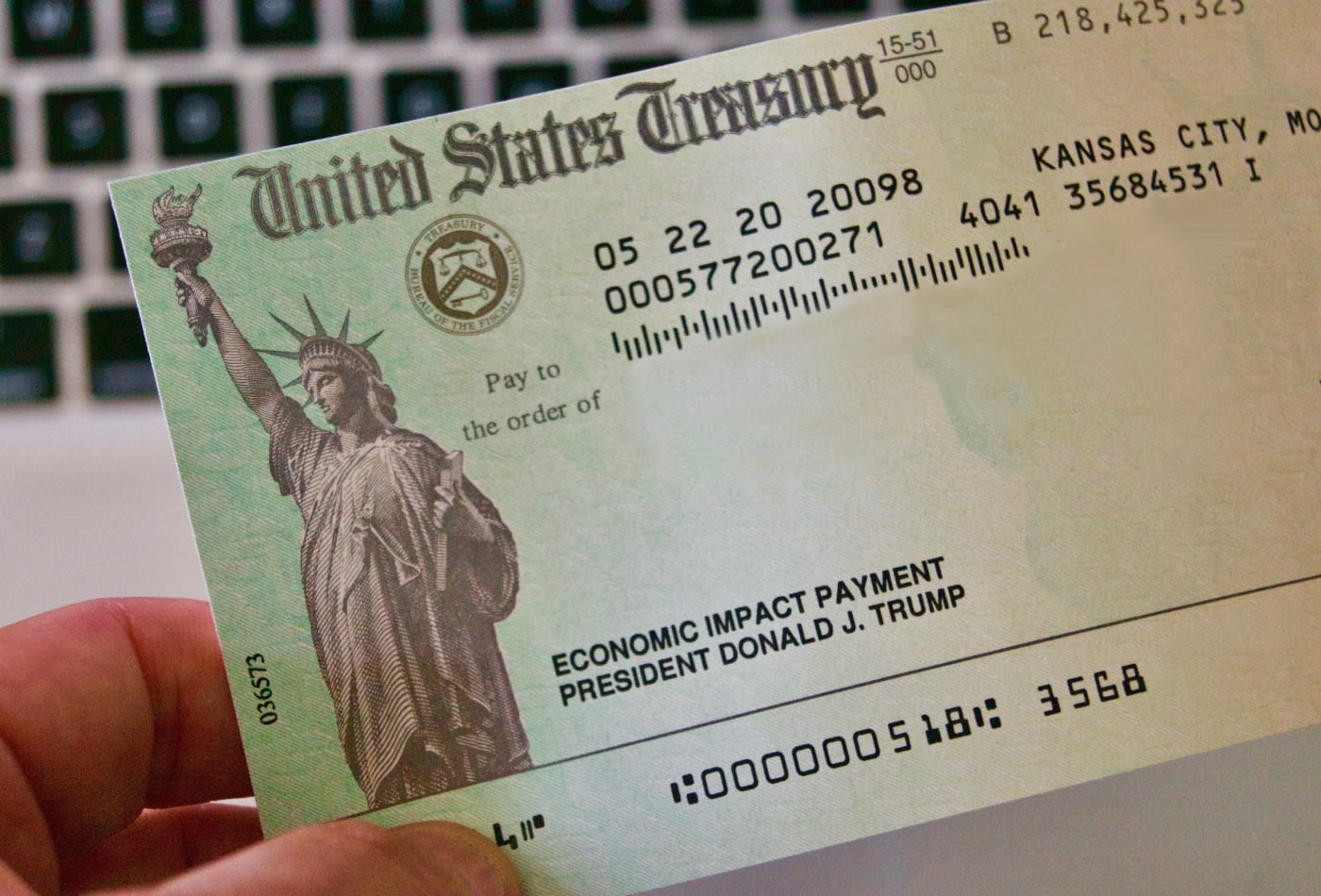

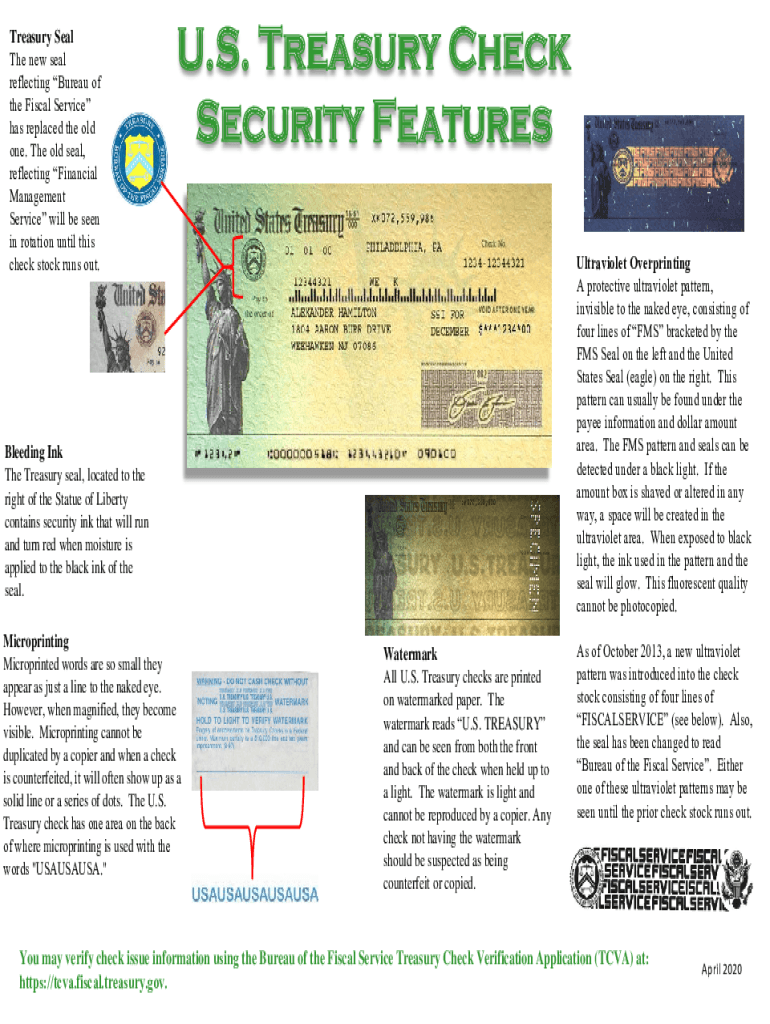

This Is What A Real Paper Stimulus Check Looks Like

Stimulus Checks And Dependent Payments Everything You Need To Know Latin Post Latin News

Stimulus Check 2021 Tracker Irs Irs Stimulus Check Schedule 2020 Chart Pdf Test Track

Stimulus Check 2021 Tracker Irs Irs Stimulus Check Schedule 2020 Chart Pdf Test Track

Stimulus Check Template PDF 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

How To Get Stimulus Checks On Tax Return Irs Stimulus Check How Can I Still Claim A Payment

Fourth Stimulus Check Update Some Americans Eligible For More Money

Printable Form For Stimulus Check - How to Claim Your Rebate Credit To get your money you ll need to claim the 2021 Recovery Rebate Credit on your 2021 return Filing electronically can guide you through the form Don t claim any missing first or second stimulus payments on your 2021 return rather you ll need to file a 2020 return or an amended return to get these payments