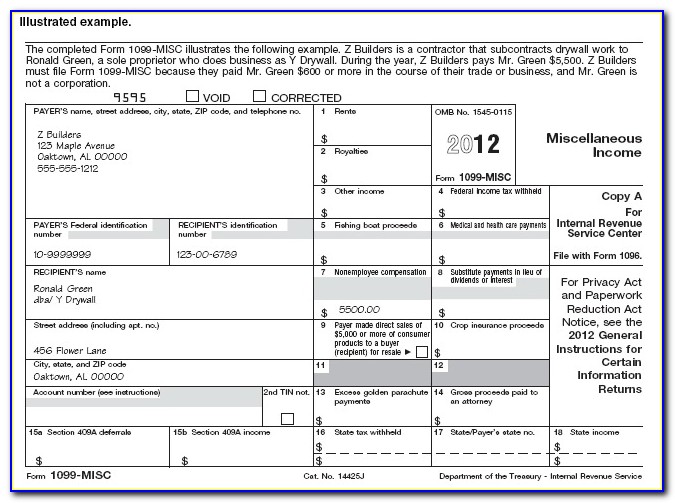

Printable 1099 Contractor Employment Form Form 1099 MISC Rev January 2024 Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

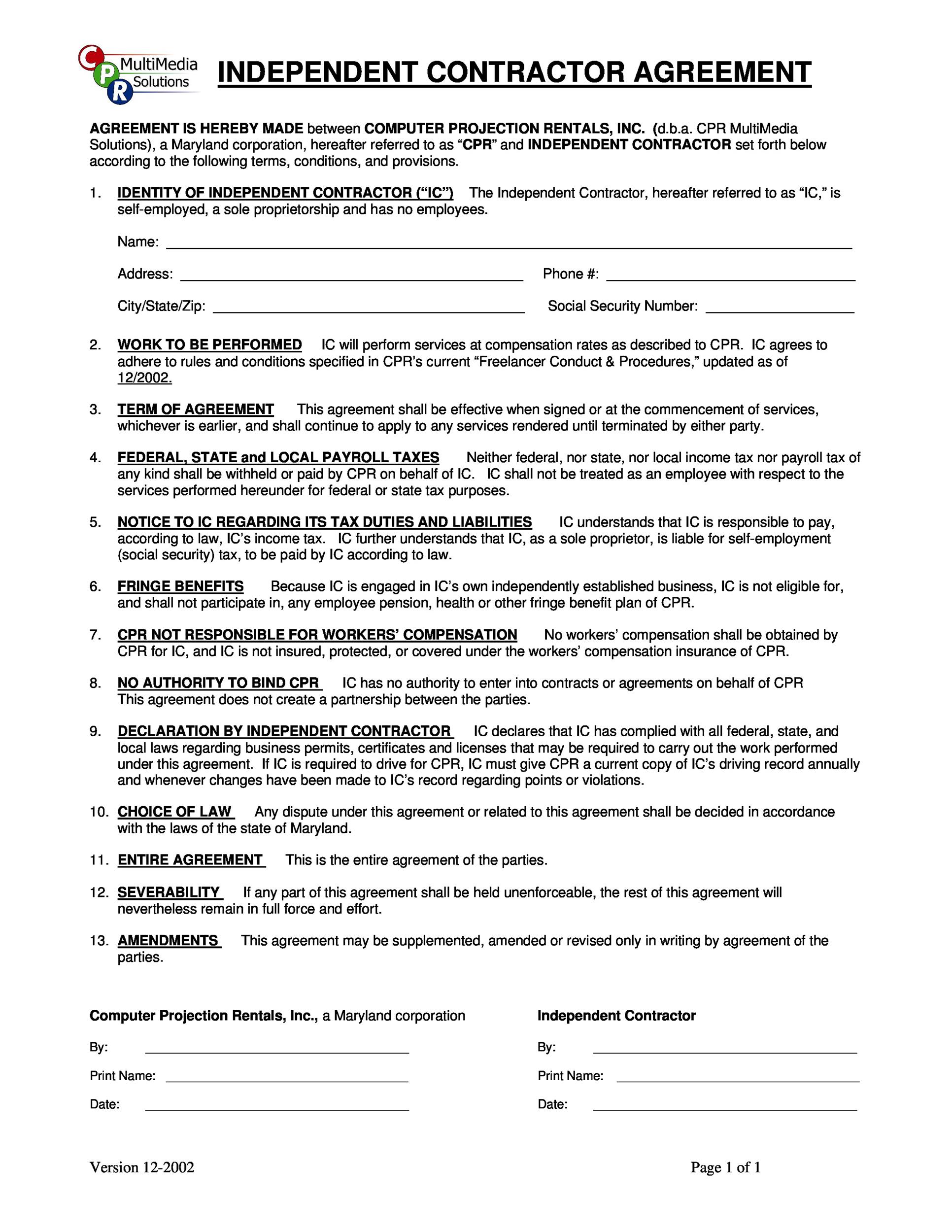

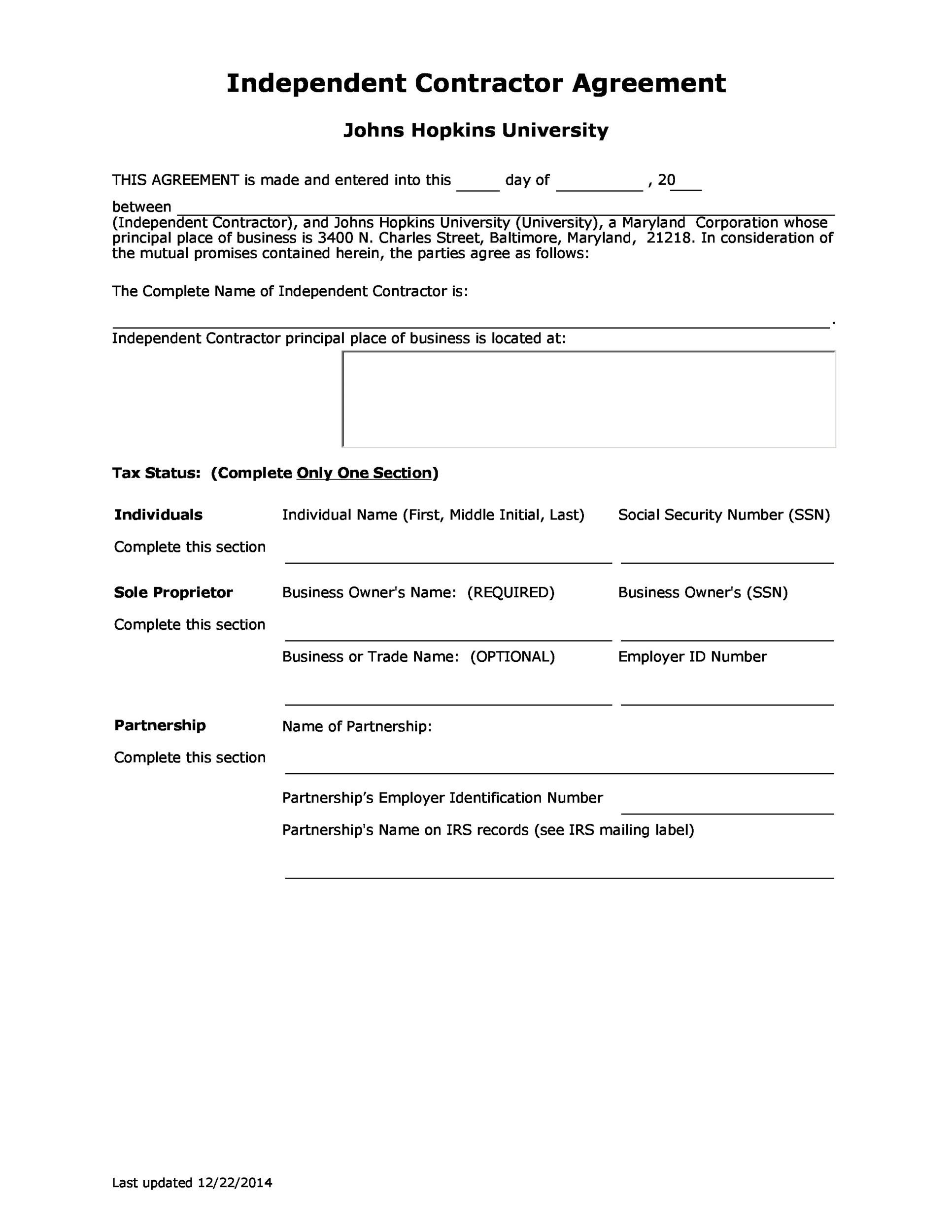

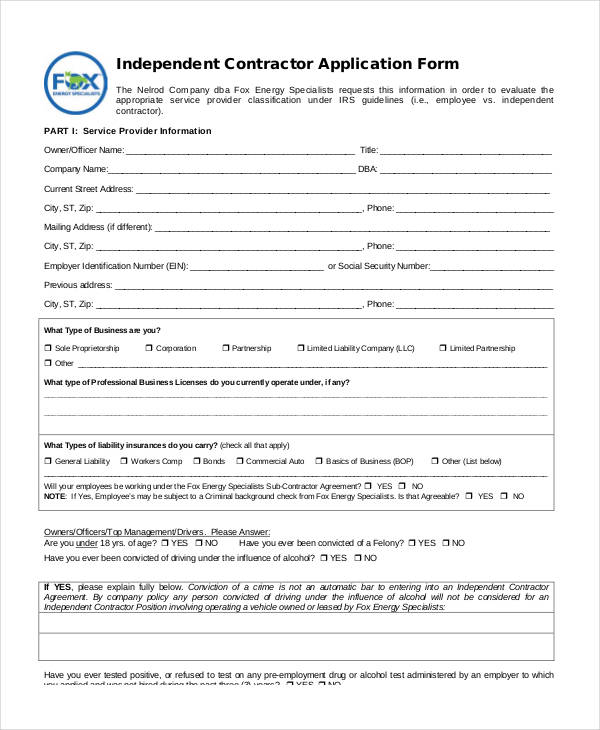

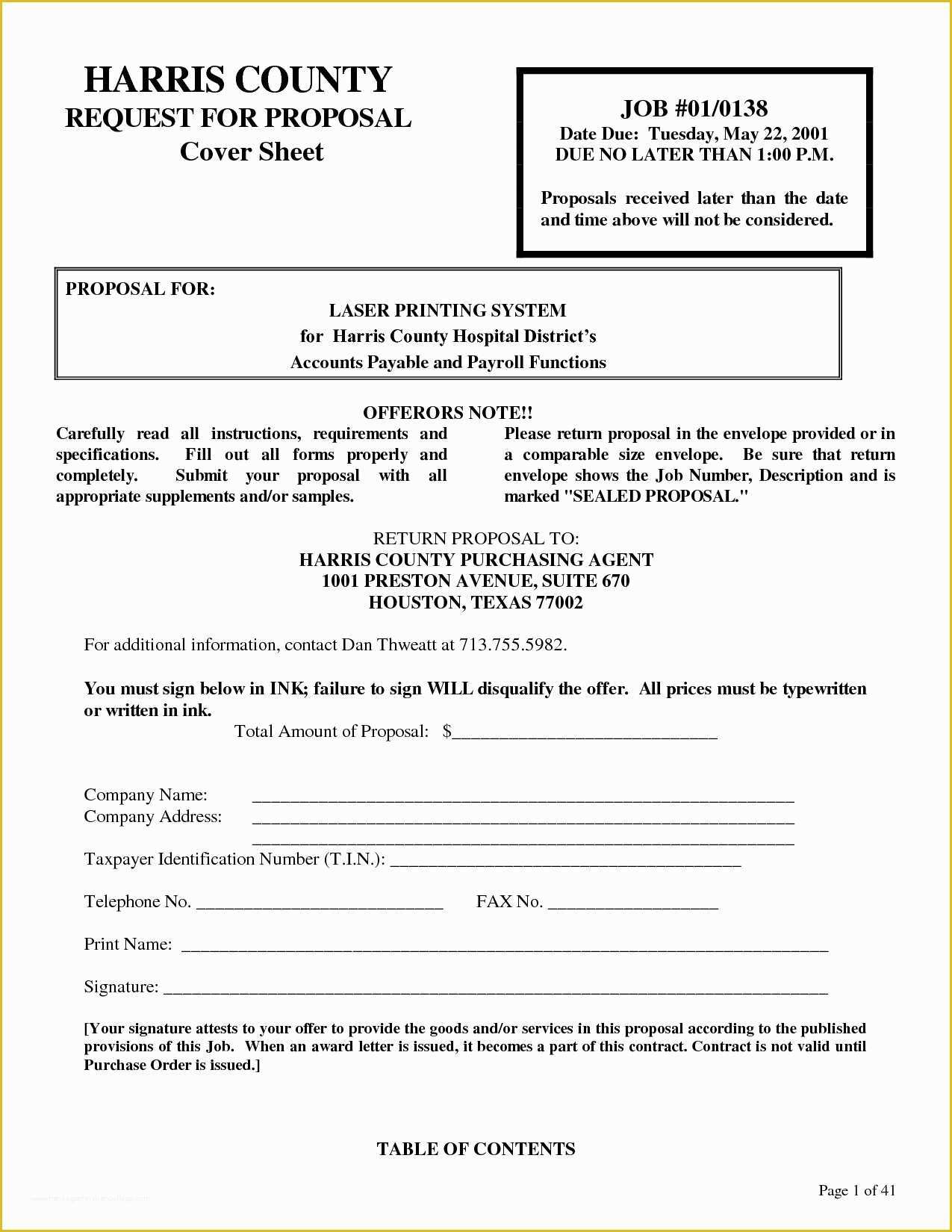

Help Frequently Asked Questions Form 1099 NEC Independent Contractors Form 1099 NEC Independent Contractors What s the difference between a Form W 2 and a Form 1099 MISC or Form 1099 NEC How do you determine if a worker is an employee or an independent contractor Back to Frequently Asked Questions Page Last Reviewed or Updated 15 Jun 2023 An independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment Also known as a 1099 agreement due to the contractor not being an employee of the client A contractor is commonly hired on a short term or intermittent basis unlike an employee Paying Taxes

Printable 1099 Contractor Employment Form

Printable 1099 Contractor Employment Form

https://i2.wp.com/eforms.com/download/2018/06/1-Page-Independent-Contractor-Agreement.png?ssl=1

Printable 1099 Form Independent Contractor TUTORE ORG Master Of Documents

https://www.viralcovert.com/wp-content/uploads/2018/12/irs-form-1099-misc-2012-download-free.jpg

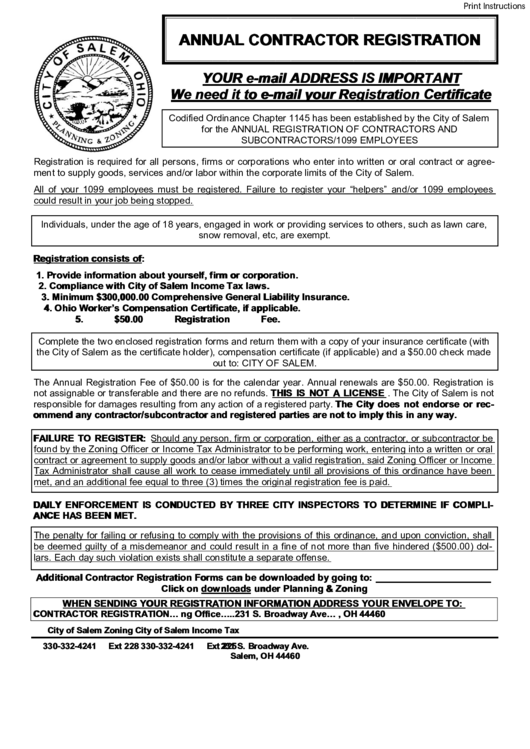

Fillable Contractor subcontractor 1099 Employee Registration Form Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/9/99/9973/page_1_thumb_big.png

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more Step 2 Fill out two 1099 NEC forms Copy A and B Mark your calendar because this information return comes with a filing deadline In January look at how much you ve paid the independent contractor over the past year If you ve paid them more than 600 nonemployee compensation within the past calendar year and their business entity is

If you re a business owner you may need to create W 2 and 1099 forms including 1099 NEC and 1099 MISC for your employees or contractors Select your product and follow the instructions to create W 2s and 1099s using Quick Employer Forms The distinction is critical since the wrong classification may result in huge penalties Here are the forms and documents you are going to need when hiring a 1099 contractor 1 Form W 9 It gathers tax information from independent contractors The first tax document required to recruit a 1099 contractor is IRS Form W 9

More picture related to Printable 1099 Contractor Employment Form

Free Independent Contractor Agreement Template 1099 Word PDF EForms

https://i1.wp.com/eforms.com/images/2018/05/Independent-Contractor-Agreement.png?fit=1600%2C2070&ssl=1

Irs 1099 Forms For Independent Contractors Form Resume Examples

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2018/11/irs-1099-form-independent-contractor.jpg

Free Form 1099 MISC PDF Word

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

Integrating employee payments with independent contractor transactions allows all payroll data to be saved in one place Automatically generate Forms 1099 NEC and 1099 MISC Payroll software provides easy access to all the forms necessary when paying freelancers Comprehensive reporting What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

Completing the Form 1 Obtain a 1099 MISC form from the IRS or another reputable source You can ask the IRS to send you the necessary form by calling 1 800 TAX FORM 1 800 829 3676 or navigating to their online ordering page 1 File your state 1099 forms by mid January so you can print Keep in mind the IRS filing and contractor delivery deadlines Step 2 Print your 1099s or 1096 Choose your product below to see the steps to print your 1099s About Form 1096 Annual Summary and Transmittal of U S Information Returns

Printable 1099 Form Independent Contractor Printable Form Templates And Letter

https://images.ctfassets.net/ifu905unnj2g/7AaGwx9GYM2YM9YyWJLFqv/b9806db0e4623117df61caf7b38e80e4/2022_1099_Form_Copy_B.png

1099 Printable Forms

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

Form 1099 MISC Rev January 2024 Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not

https://www.irs.gov/faqs/small-business-self-employed-other-business/form-1099-nec-independent-contractors

Help Frequently Asked Questions Form 1099 NEC Independent Contractors Form 1099 NEC Independent Contractors What s the difference between a Form W 2 and a Form 1099 MISC or Form 1099 NEC How do you determine if a worker is an employee or an independent contractor Back to Frequently Asked Questions Page Last Reviewed or Updated 15 Jun 2023

How To Fill Out And Print 1099 NEC Forms

Printable 1099 Form Independent Contractor Printable Form Templates And Letter

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

1099 Form Independent Contractor Pdf 1779 Independent Contractor Or Employee

1099 Employee Contract Template

1099 Form Independent Contractor Pdf 14 Printable 1099 Form Independent Contractor Templates

1099 Form Independent Contractor Pdf 14 Printable 1099 Form Independent Contractor Templates

1099 Form Independent Contractor Pdf 1099 Form Independent Contractor Pdf Free One 1 Page

1099 Form Independent Contractor Pdf 1779 Independent Contractor Or Employee

1099 Agreement Template Free Of 1099 Employee Contract Template Independent Contractor

Printable 1099 Contractor Employment Form - The distinction is critical since the wrong classification may result in huge penalties Here are the forms and documents you are going to need when hiring a 1099 contractor 1 Form W 9 It gathers tax information from independent contractors The first tax document required to recruit a 1099 contractor is IRS Form W 9