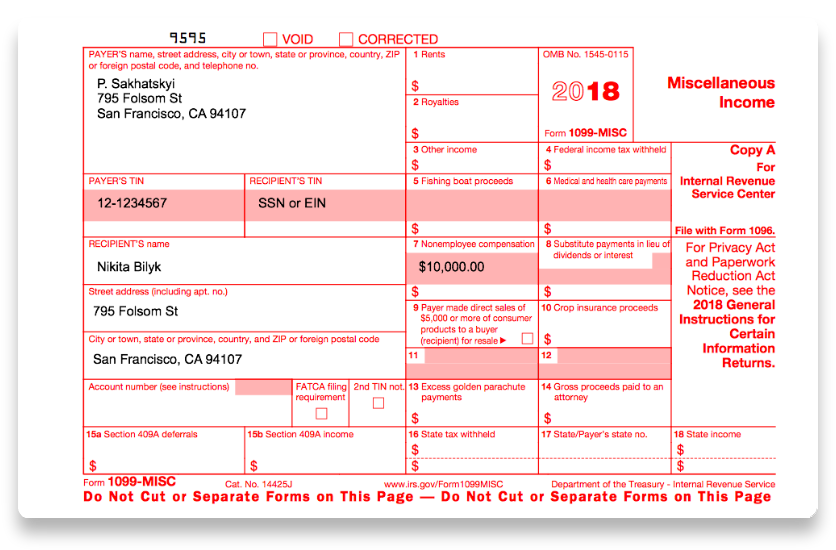

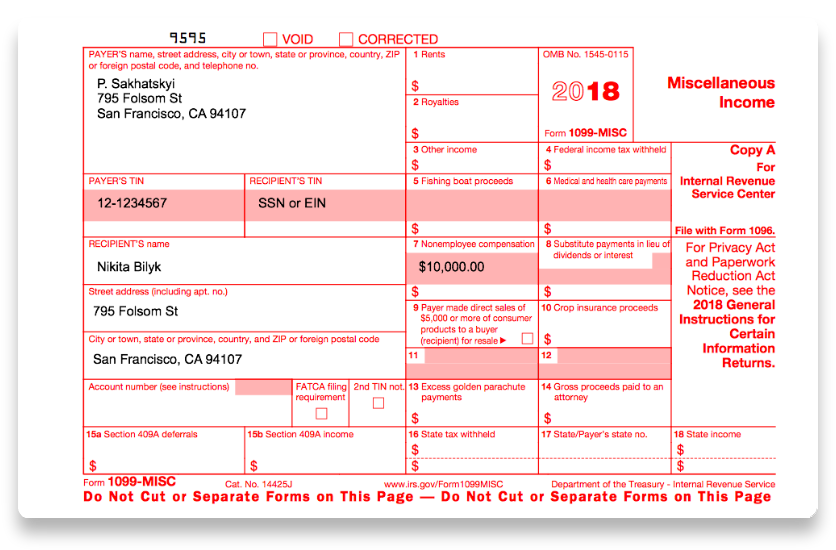

Printable 1099 Form A To Fill Out Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like

Instructions Instructions for Forms 1099 MISC and 1099 NEC 01 2024 Miscellaneous Information and Nonemployee Compensation Section references are to the Internal Revenue Code unless otherwise noted Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments Step 1 Understand the 1099 form Step 2 Fill out a 1099 form Step 3 Submit the 1099 form How to file a 1099 form online How contractors use Form 1099 NEC Who gets a 1099 form Individuals or independent contractors who earn 600 or more in nonemployment income within a calendar year must receive a Form 1099

Printable 1099 Form A To Fill Out

Printable 1099 Form A To Fill Out

https://images.ctfassets.net/ifu905unnj2g/7njQnBtOe3zLbzG3V4rWHE/de7ada497a46a667e012a996afc8b7d1/1099_Sample_IRS.gif

IRS Form 1099 Reporting For Small Business Owners

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

https://www.esigngenie.com/wp-content/uploads/2019/06/1099-Form_Page-1.jpg

You will meet your Form 1099 A filing requirement for the debtor by completing boxes 4 5 and 7 on Form 1099 C However you may file both Forms 1099 A and 1099 C if you do file both forms do not complete boxes 4 5 and 7 on Form 1099 C See the Specific Instructions for Form 1099 A earlier and Box 4 Debt Description Box 5 A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC

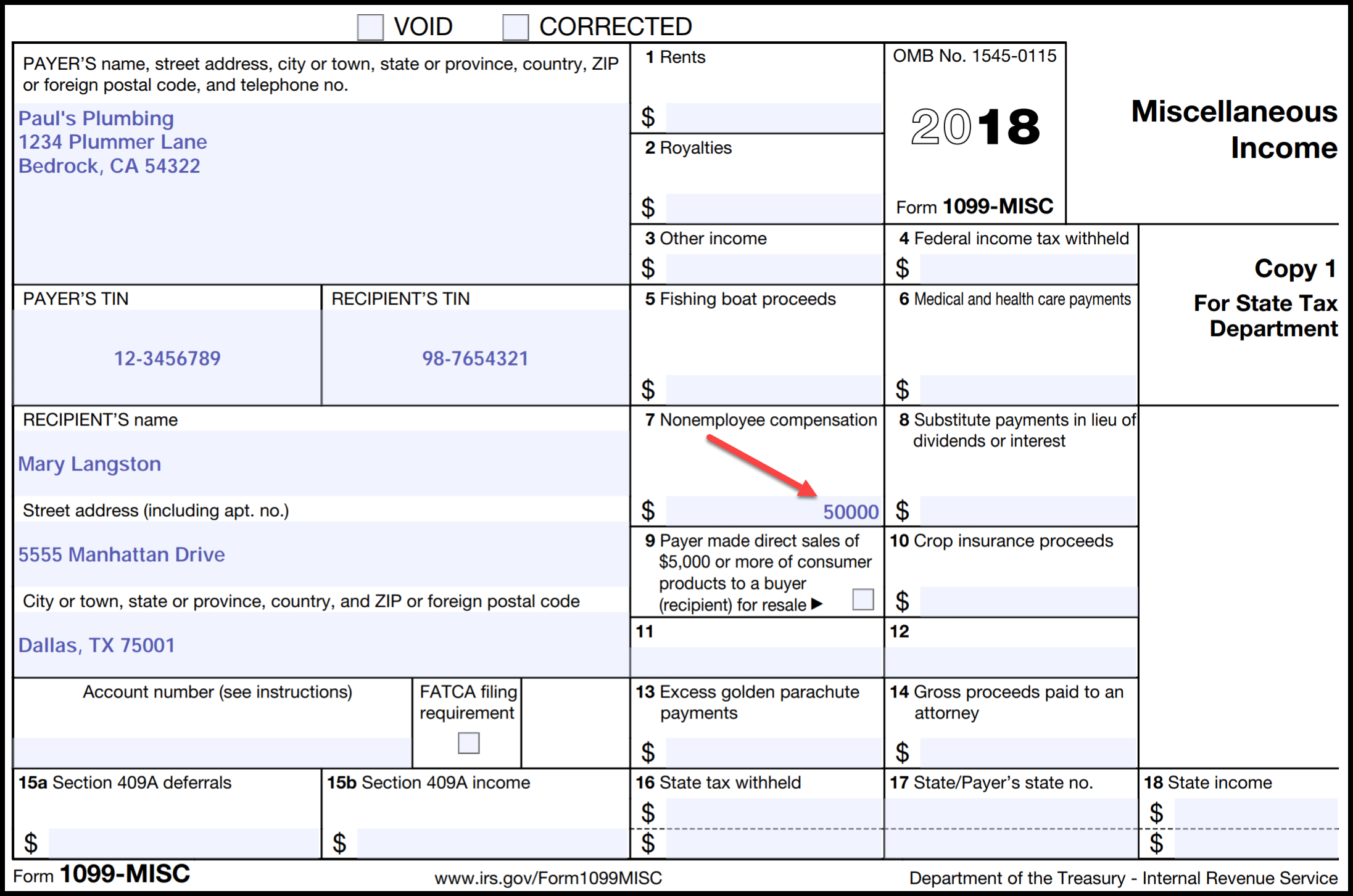

Form 1099 MISC Miscellaneous Information is an information return businesses use to report payments and miscellaneous payments File Form 1099 MISC for each person you have given the following types of payments in the course of your business during the tax year Fill Out 1099 MISC Form Create My Document Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below

More picture related to Printable 1099 Form A To Fill Out

1099 Form Template Create A Free 1099 Form Form

https://legaldocfinder.com/images/jumbotron/1099-form-sample.png

How To Fill Out IRS 1099 MISC Form PDF 2023 PDF Expert

https://d3pbdh1dmixop.cloudfront.net/pdfexpert/content_pages/mac_how-to-fill-1099-misc-form/new_2023-how-to-fill-1099-filledform2x.png

How To Fill Out 1099 MISC IRS Red Forms

http://www.halfpricesoft.com/1099-misc-software/images/1099-copyA.jpg

This form is sent to taxpayers who have earned more than 10 worth of interest during the tax year and is usually sent out by banks brokerage firms and other investment firms 1099 B This form is sent by a broker to a taxpayer listing all the different transactions related to the sale of stocks securities commodities and other similar items Recipient s TIN Enter the contractor s TIN EIN or Social Security number SSN If they re working as a self employed individual use their SSN If they ve incorporated they will provide a TIN or EIN Most of the time you ll find this information on the W 9 form you had the contractor fill out when you hired them

Use Form 1099 NEC to report total payments to non employees if you paid them 600 or more during the year Give these forms to payees and report them to the IRS by January 31 of the year following the tax year being reported Tax withholding isn t usual for non employees but you may need to report backup withholding 1099 INT reports interest income typically of 10 or more from your bank credit union or other financial institution The form reports the interest income you received any federal income taxes

How To Fill Out IRS 1099 MISC 2017 2018 Form PDF Expert

https://pdfexpert.com/img/howto/fill-1099-misc-form/how-to-fill-1099-filledform.png

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

https://www.keepertax.com/posts/how-do-i-print-a-1099

Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like

https://www.irs.gov/instructions/i1099mec

Instructions Instructions for Forms 1099 MISC and 1099 NEC 01 2024 Miscellaneous Information and Nonemployee Compensation Section references are to the Internal Revenue Code unless otherwise noted Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments

How To PDF Printing 1099 misc Forms

How To Fill Out IRS 1099 MISC 2017 2018 Form PDF Expert

Printable Blank 1099 Form

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

How To File A 1099 Misc As An Employee Printable Form Templates And Letter

1099 Printable Form

1099 Printable Form

1099 Template

1099 Nec Fill Out Sign Online DocHub

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg)

Types Of 1099 Form 2023 Printable Forms Free Online

Printable 1099 Form A To Fill Out - Form 1099 MISC Miscellaneous Information is an information return businesses use to report payments and miscellaneous payments File Form 1099 MISC for each person you have given the following types of payments in the course of your business during the tax year