Printable 1099 Form Charge Per Form Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New

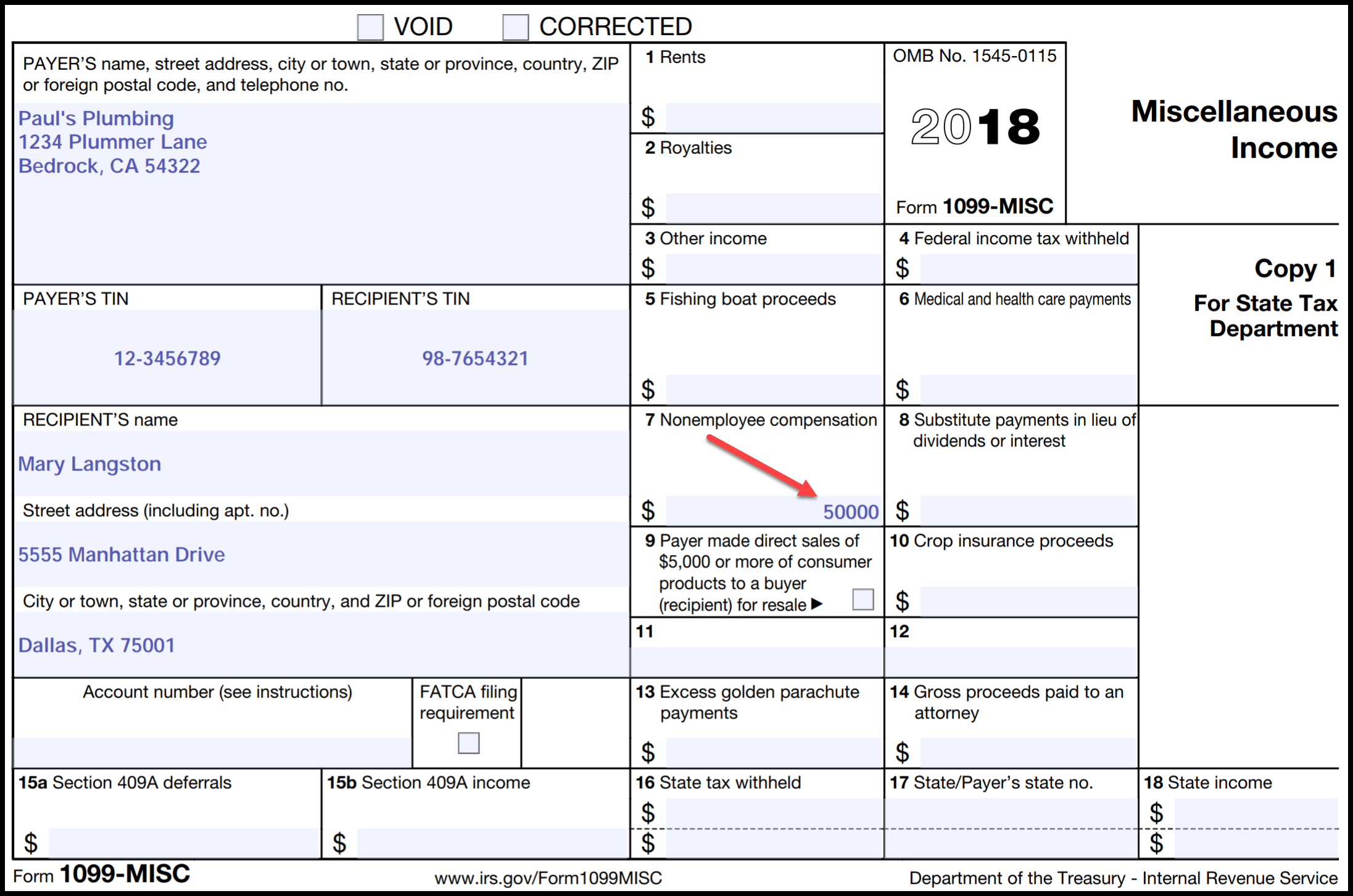

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below

Printable 1099 Form Charge Per Form

Printable 1099 Form Charge Per Form

https://legaldocfinder.com/images/jumbotron/1099-form-sample.png

1099 Form

https://www.signnow.com/preview/100/9/100009398/large.png

1099 Forms Printable Printable Forms Free Online

https://www.pdffiller.com/preview/421/116/421116584/big.png

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC Note that the 600 threshold that was enacted

You can print the following number of copies for these 1099 forms on 1 page 1098 2 copies 1098 C 1 copy 1098 E 3 copies 1098 T 3 copies 1099 A 3 copies 1099 B 2 copies 1099 C 3 copies 1099 DIV 2 copies 1099 G 3 copies 1099 INT 2 copies 1099 MISC 2 copies 1099 NEC 3 copies 1099 OID 2 copies 1099 PATR 3 copies 1099 R 2 copies File your state 1099 forms Purchase your 1099 Kit by mid January so you can print Keep in mind the IRS filing and contractor delivery deadlines Step 2 Print your 1099s or 1096 Choose your product below to see the steps to print your 1099s About Form 1096 Annual Summary and Transmittal of U S Information Returns

More picture related to Printable 1099 Form Charge Per Form

1099 S Fillable Form Printable Forms Free Online

https://www.pdffiller.com/preview/456/257/456257951/large.png

1099 S Fillable Form Printable Forms Free Online

http://www.contrapositionmagazine.com/wp-content/uploads/2019/01/1099-s-fillable-form.jpg

Printable 1099 Tax Forms Free Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/07/free-printable-1099-form-2019-1099-form-printable.png

Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like Starting at 58 99 Use federal 1099 MISC tax forms to report payments of 600 or more for rents royalties medical and health care payments and gross proceeds paid to attorneys These continuous use forms no longer include the tax year QuickBooks will print the year on the forms for you

For State Tax Department www irs gov Form1099NEC if checked For calendar year Federal income tax withheld Copy B For Recipient This is important tax information and is being furnished to the IRS If you re a business owner you may need to create W 2 and 1099 forms including 1099 NEC and 1099 MISC for your employees or contractors Select your product and follow the instructions to create W 2s and 1099s using Quick Employer Forms

Irs Printable 1099 Form Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/06/what-is-irs-form-1099-q-turbotax-tax-tips-videos.jpg

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/_h1CHqdnjvV-4nCTHDingOUQvJ4=/1288x1288/smart/filters:no_upscale()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg

https://www.irs.gov/instructions/i1099mec

Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New

https://eforms.com/irs/form-1099/

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

Irs Form 1099 Reporting For Small Business Owners Free Printable 1099 Form Free Printable

Irs Printable 1099 Form Printable Form 2023

1099 Fillable Form Free Printable Form Templates And Letter

How To Fill Out And Print 1099 NEC Forms

How To Fill Out And Print 1099 MISC Forms

1099 MISC 3 Part Continuous 1 Wide Formstax

1099 MISC 3 Part Continuous 1 Wide Formstax

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

Form 1099 div 2019 2024 Fill Online Printable Fillable Blank

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

Printable 1099 Form Charge Per Form - To change the settings close the filing process and go to your tax form settings Finally accept a standard IRS penalty of perjury statement Click the File tax forms button to queue your tax forms for automatic filing with the IRS If you aren t filing any 1099 tax form corrections you can disregard delivery preferences for form corrections