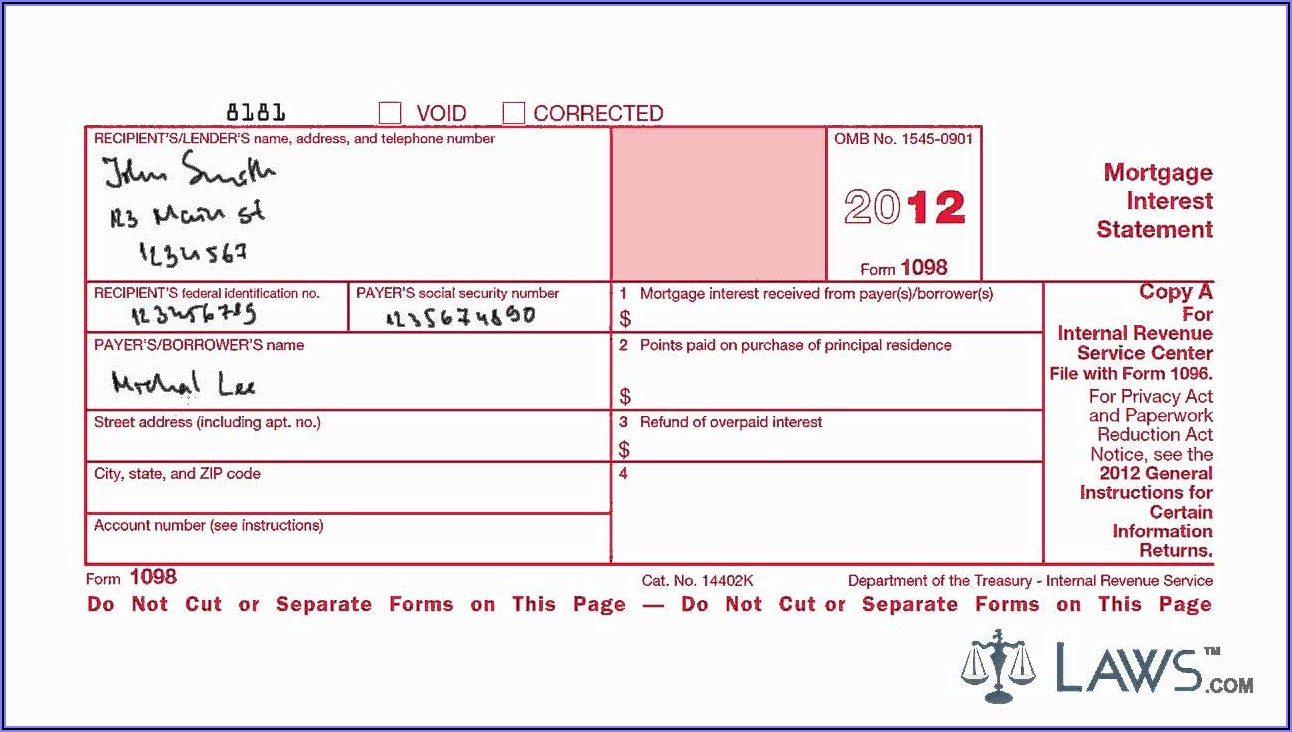

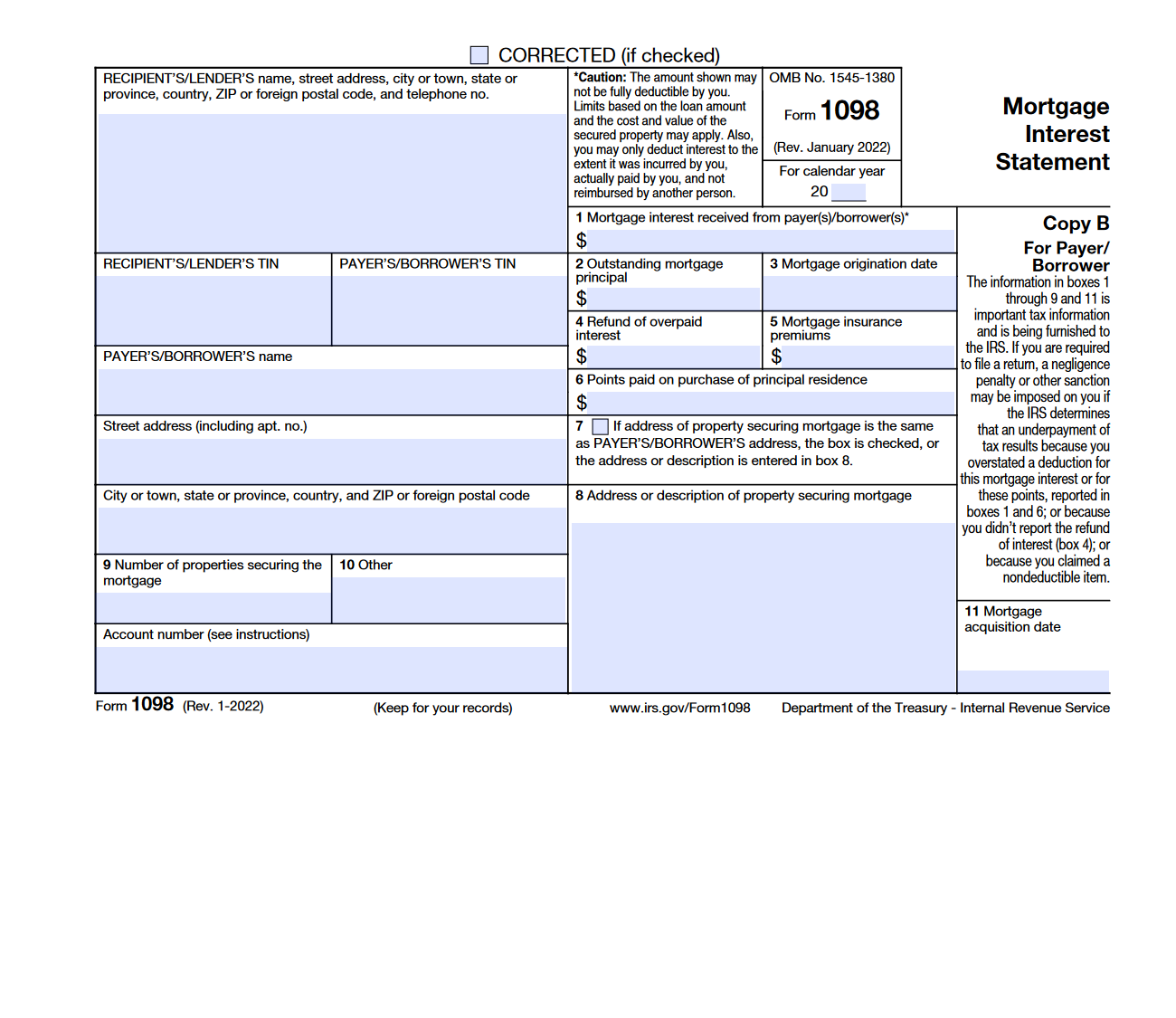

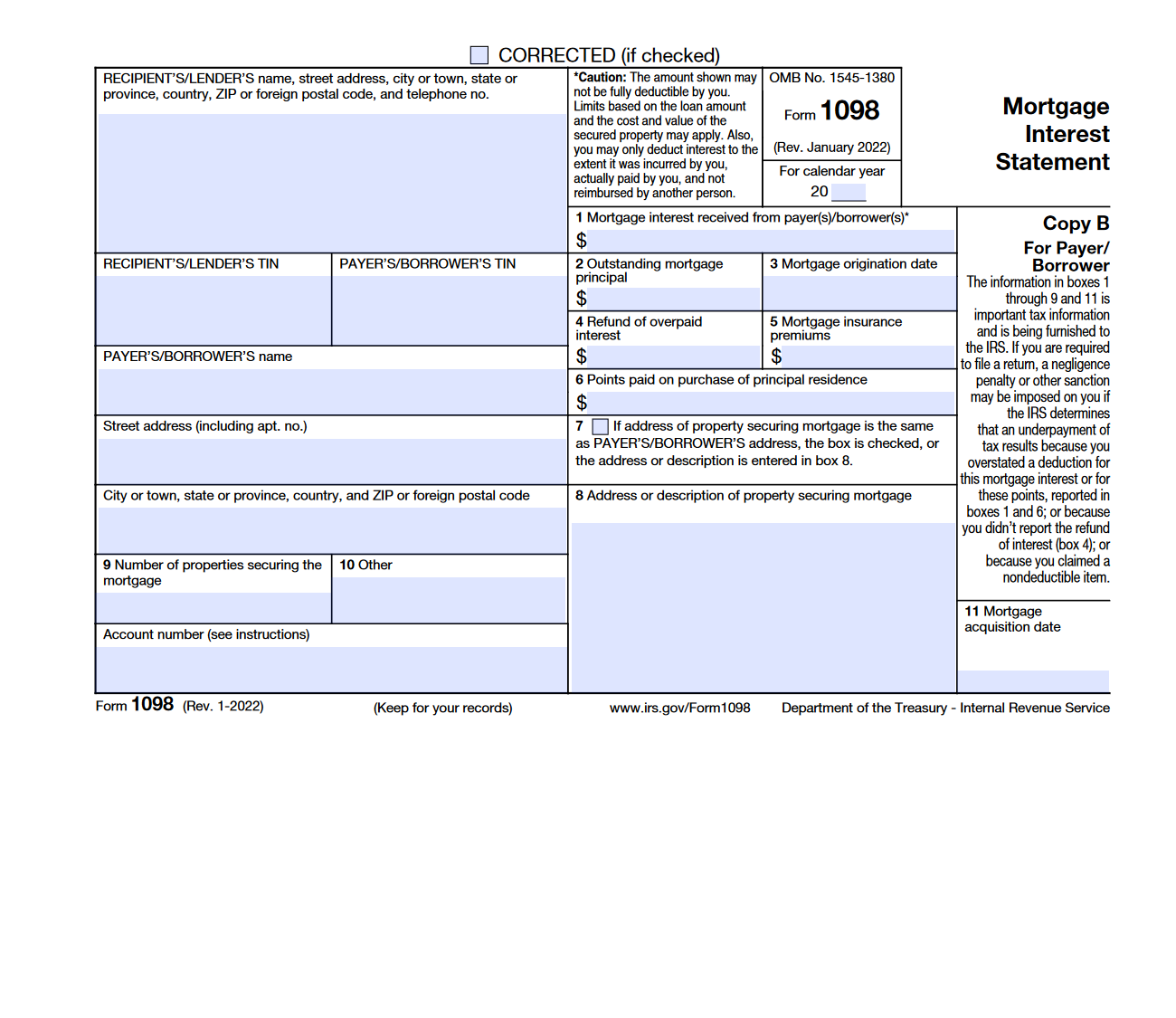

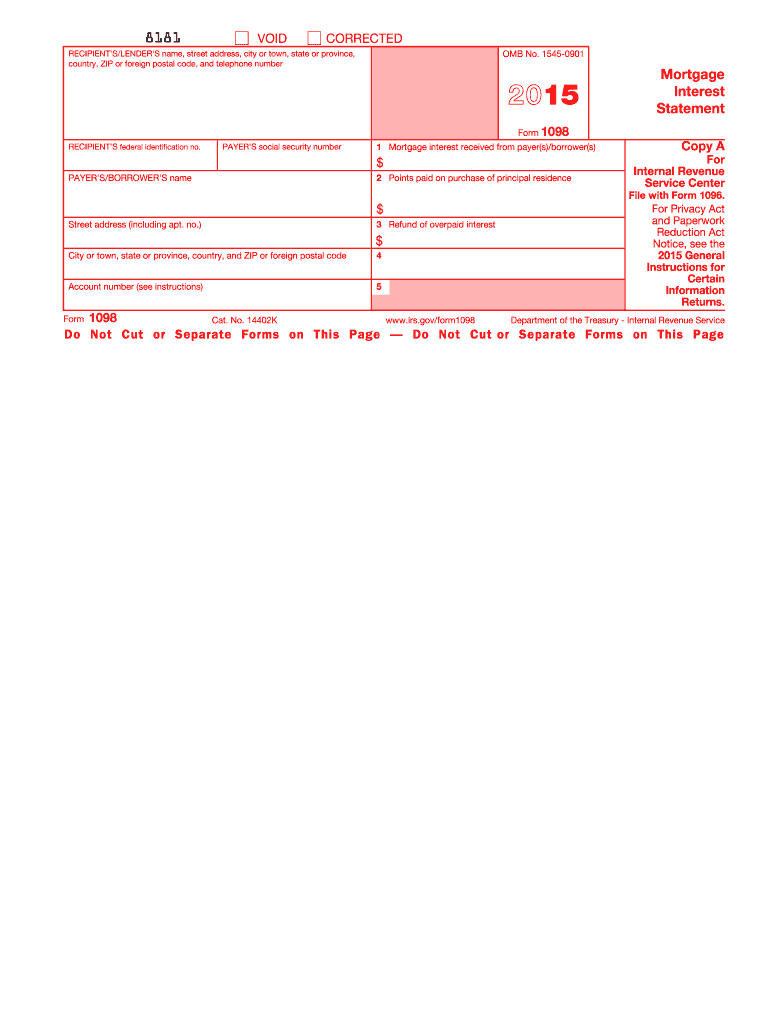

Free Printable Form 1098 Pdf IRS Form 1098 is a tax form used to report mortgage interest received in the course of a trade or business within a year Lenders file a copy with the IRS and send another copy to the payer of the interest A separate Form 1098 which is also known as a Mortgage Interest Statement should be filed for each mortgage on which interest was paid

A form 1098 Mortgage Interest Statement is used to report mortgage interest including points of 600 or more paid to a lender for a mortgage We last updated the Mortgage Interest Statement Info Copy Only in February 2023 and the latest form we have available is for tax year 2022 On your 1098 tax form is the following information Box 1 Interest paid not including points Box 2 Outstanding mortgage principal Box 3 Mortgage origination date Box 4 Refund of overpaid interest Box 5 Mortgage insurance premiums Box 6 Mortgage points you might be able to deduct

Free Printable Form 1098 Pdf

Free Printable Form 1098 Pdf

https://data.formsbank.com/pdf_docs_html/295/2950/295009/page_1_thumb_big.png

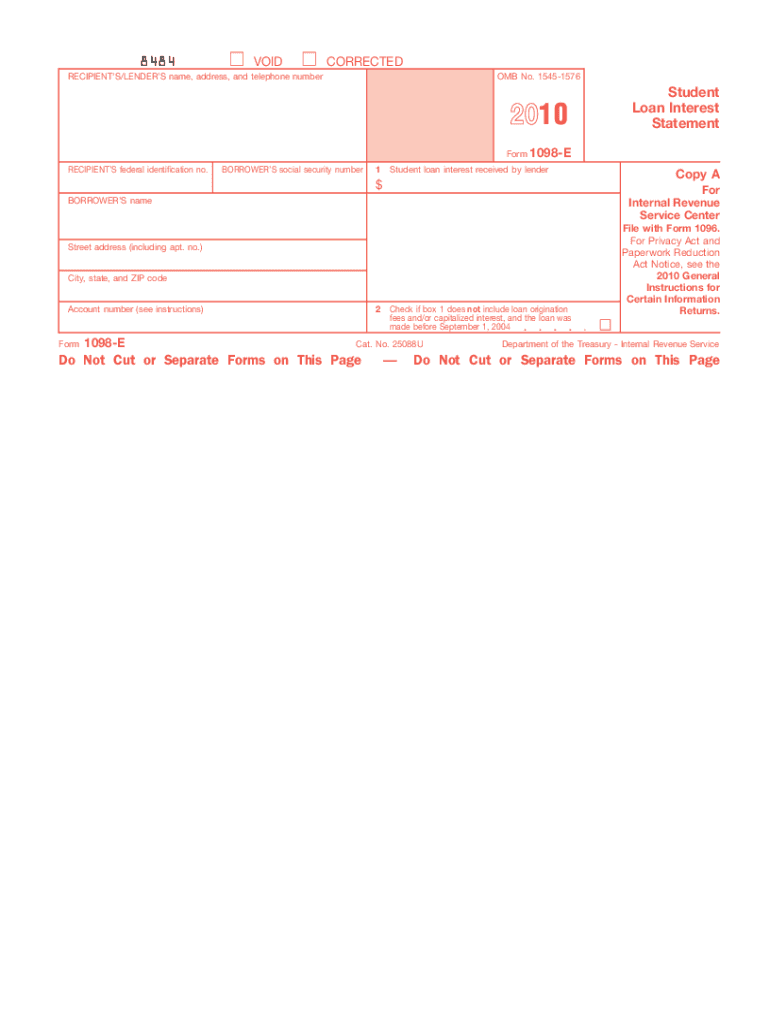

1098 Int Form Editable Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/23/100023739/large.png

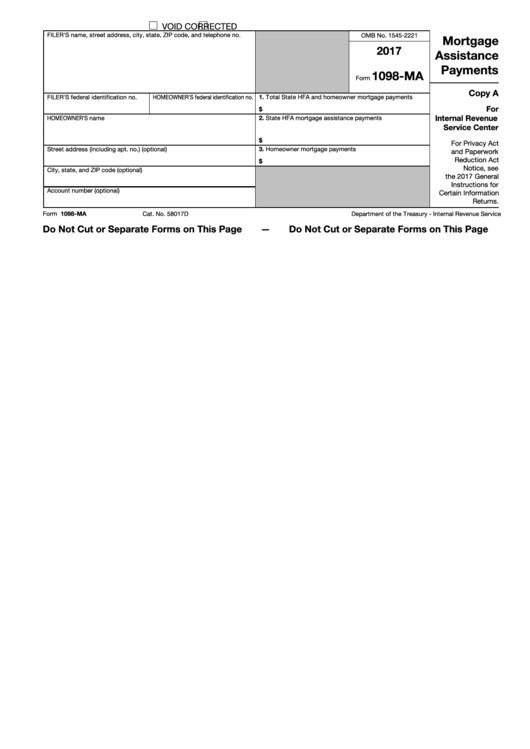

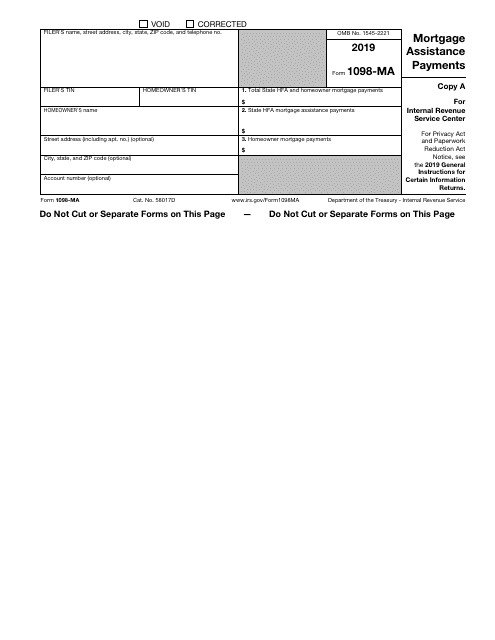

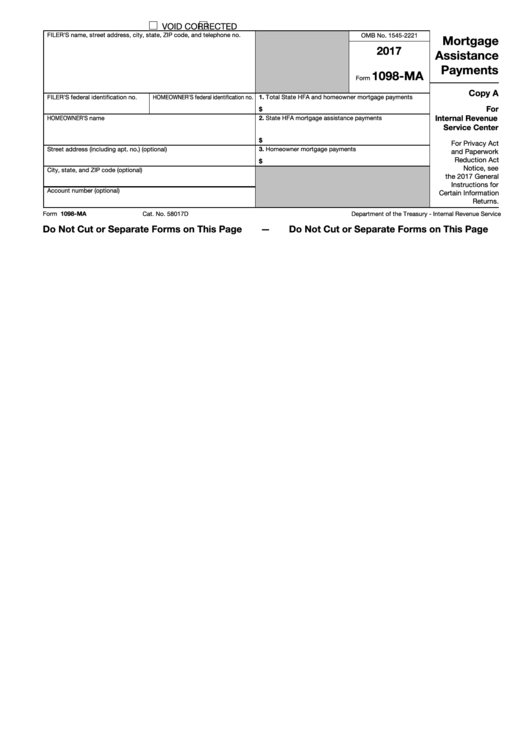

IRS Form 1098 MA Download Fillable PDF Or Fill Online Mortgage Assistance Payments 2019

https://data.templateroller.com/pdf_docs_html/1862/18622/1862226/irs-form-1098-ma-2019-mortgage-assistance-payments_big.png

Form 1098 is a form filed with the Internal Revenue Service IRS that details the amount of interest and mortgage related expenses paid on a mortgage during the tax year These expenses can be The 1098 form is a must file for entities such as financial institutions governmental units and cooperative housing corporations when they receive 600 or more mortgage interest from an individual during the fiscal year This critical document reports the interest payments facilitating accurate tax deductions for the payers

What is Form 1098 Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year Lenders are required to file a separate Form 1098 for each mortgage that they hold Please use the link below to download 2023 federal form 1098 pdf and you can print it directly from your computer More about the Federal Form 1098 eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes

More picture related to Free Printable Form 1098 Pdf

Free Printable 1098 Form Printable Templates

http://www.contrapositionmagazine.com/wp-content/uploads/2020/12/sample-1098-mortgage-interest-form.jpg

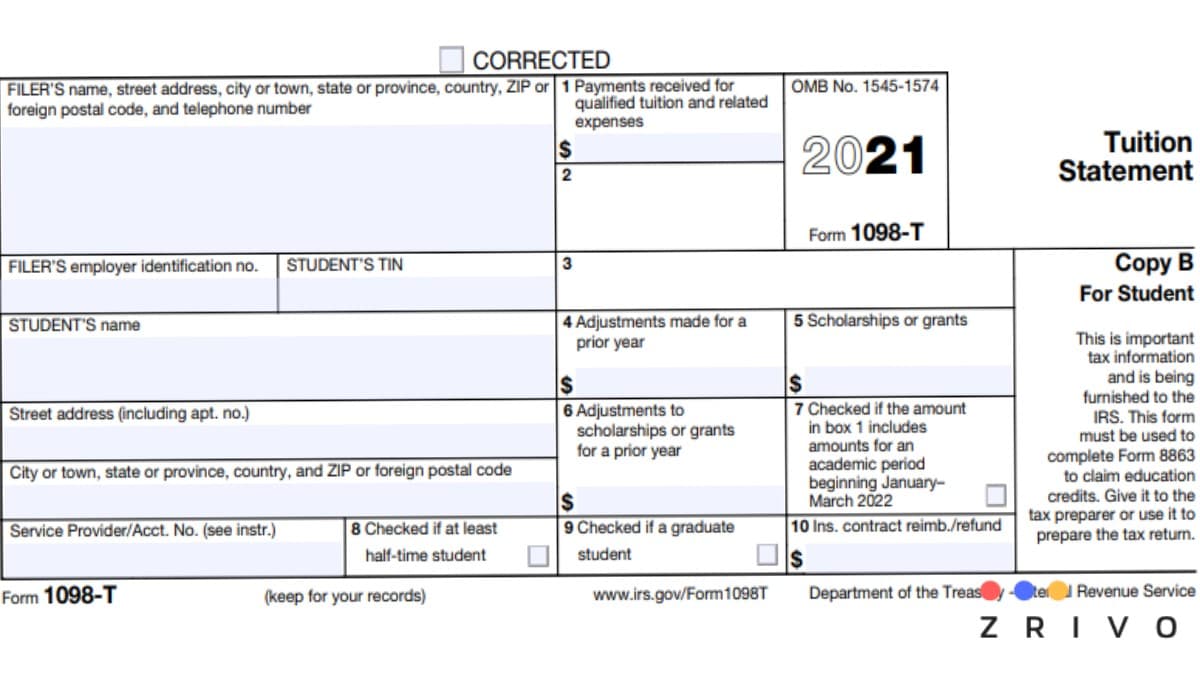

1098 T Form 2024

https://www.zrivo.com/wp-content/uploads/2020/11/1098-T-Form-2021.jpg

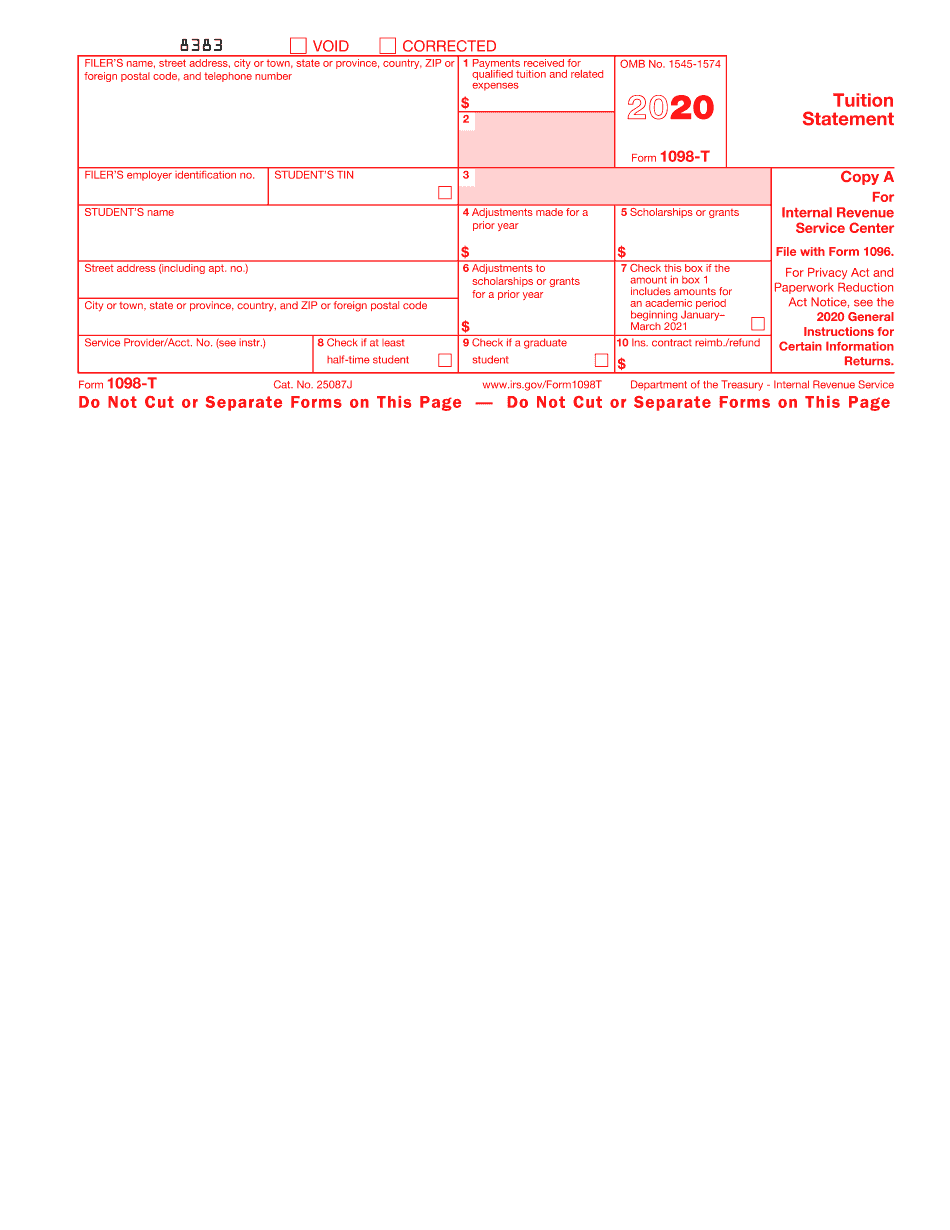

1098 t Form 2017 Fill Online Printable Fillable Blank Form 1098t printable

https://www.pdffiller.com/preview/487/372/487372991/big.png

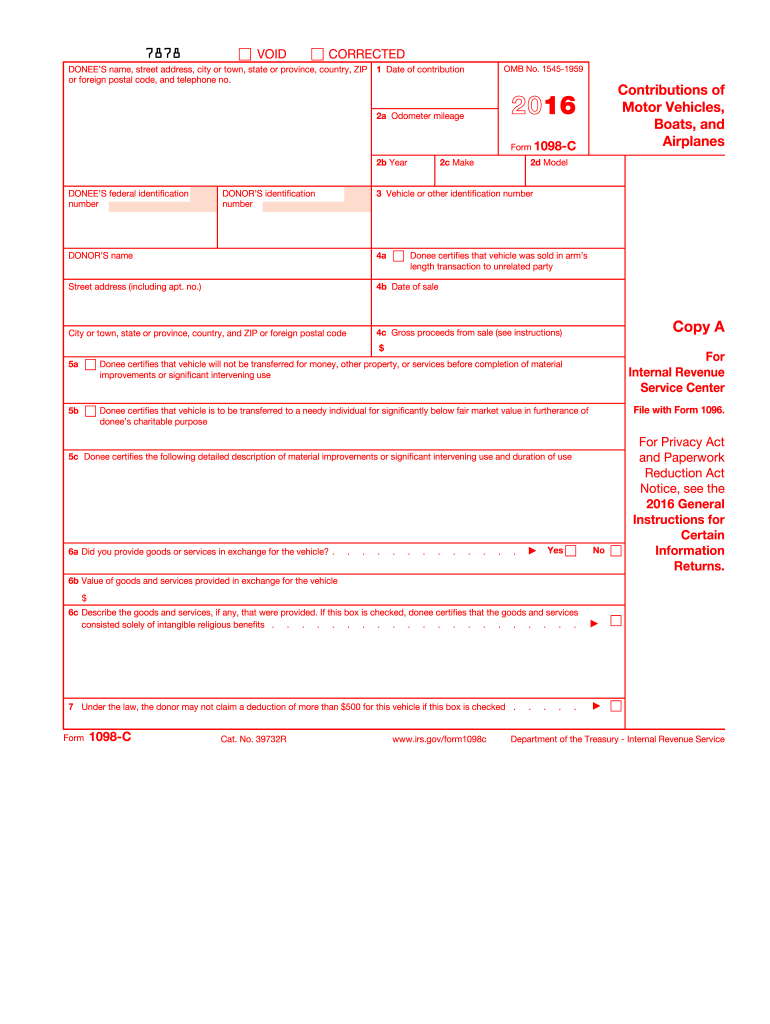

IRS Form 1098 C is a tax form used to report donations of qualified vehicles worth more than 500 Recipients of the donated vehicles or donees are required to file Form 1098 C with the IRS and send a copy to donors who use the information contained within it to file their annual tax returns Qualified Vehicles It provides a blank 1098 mortgage interest form that taxpayers can download and print Additionally federal form 1098 instructions are available guiding individuals through each step required to accurately report their mortgage interest payments

About VA Form 10 0998 Form name Your Rights to Seek Further Review of Our Healthcare Benefits Decision Related to VHA Form last updated March 2022 The 1098 C form is only required when the claimed value of the donated vehicle exceeds 500 According to the tax law a contemporaneous written acknowledgement is required within 30 days of the vehicle s donation Without this written acknowledgement the donor cannot legally claim a deduction of more than 500

IRS Form 1098 Mortgage Interest Statement Forms Docs 2023

https://blanker.org/files/images/irs-form-1098.png

How To Print And File Tax Form 1098 Mortgage Interest Statement

https://www.halfpricesoft.com/1099s_software/images/1098_recipient_copy.jpg

https://eforms.com/irs/form-1098/

IRS Form 1098 is a tax form used to report mortgage interest received in the course of a trade or business within a year Lenders file a copy with the IRS and send another copy to the payer of the interest A separate Form 1098 which is also known as a Mortgage Interest Statement should be filed for each mortgage on which interest was paid

https://www.taxformfinder.org/federal/form-1098

A form 1098 Mortgage Interest Statement is used to report mortgage interest including points of 600 or more paid to a lender for a mortgage We last updated the Mortgage Interest Statement Info Copy Only in February 2023 and the latest form we have available is for tax year 2022

2019 Form IRS 1098 Instructions Fill Online Printable Fillable Blank PdfFiller

IRS Form 1098 Mortgage Interest Statement Forms Docs 2023

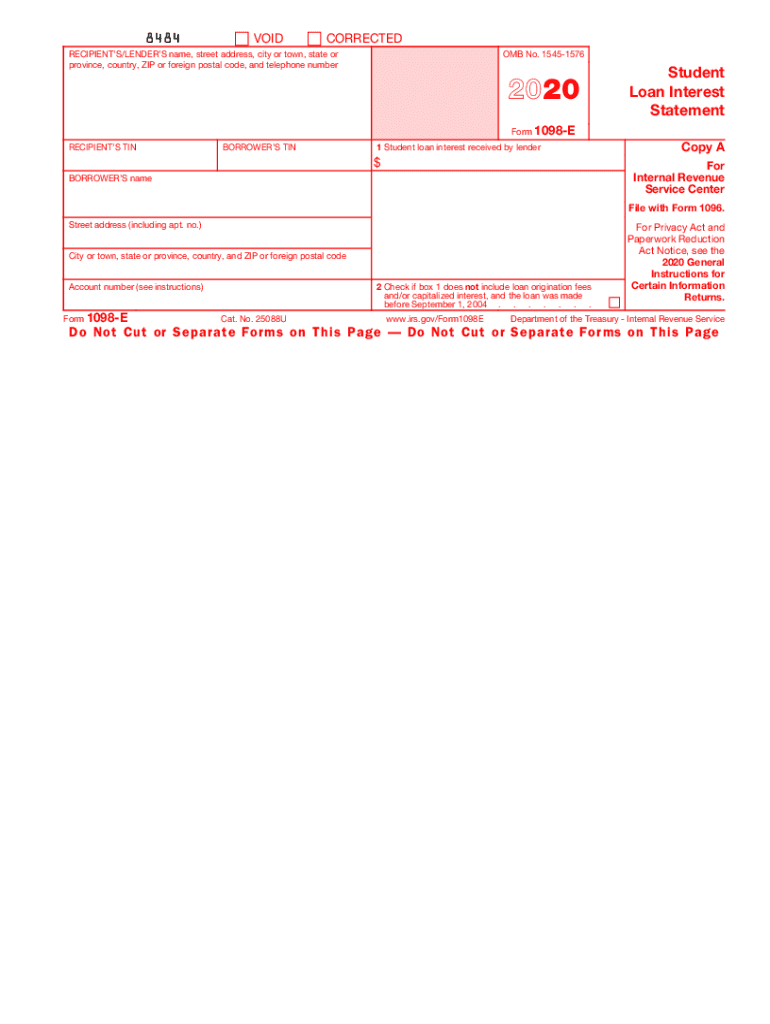

1098 E Fill Out And Sign Printable PDF Template SignNow

1098 C 2018 Fill Online Printable Fillable Blank PdfFiller

Irs Form 1098 C Printable

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

Free Printable 1098 Form Printable Forms Free Online

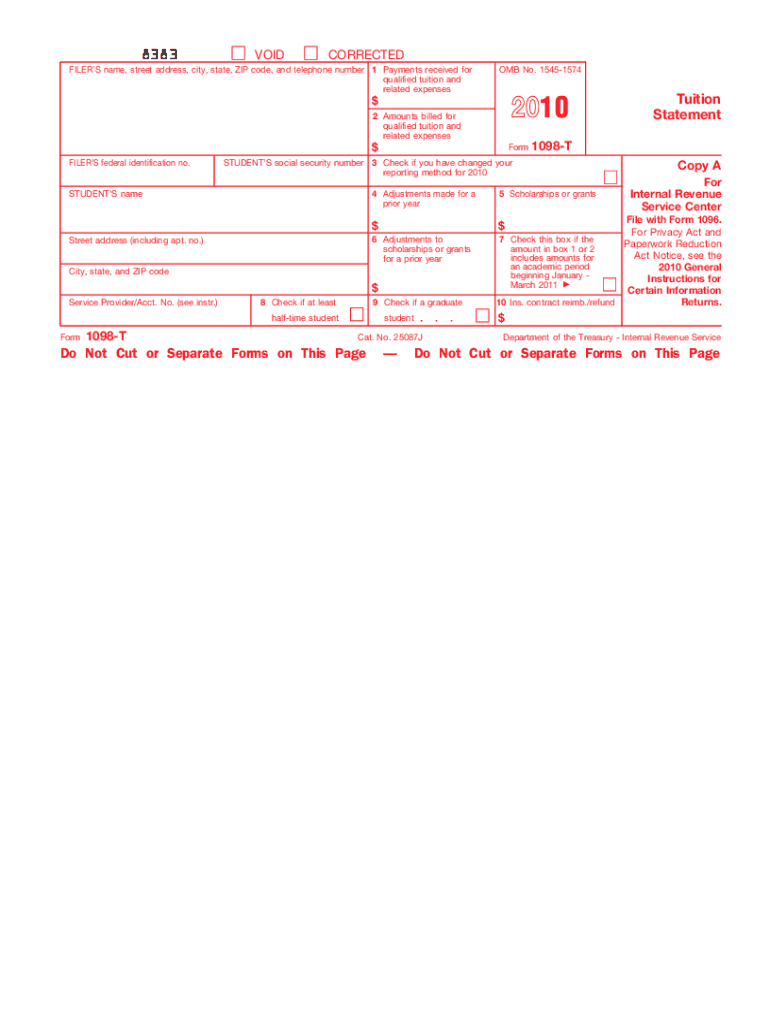

Form 1098 T Fill Out And Sign Printable PDF Template SignNow

2015 Form IRS 1098 Fill Online Printable Fillable Blank PdfFiller

Free Printable Form 1098 Pdf - What is Form 1098 Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year Lenders are required to file a separate Form 1098 for each mortgage that they hold