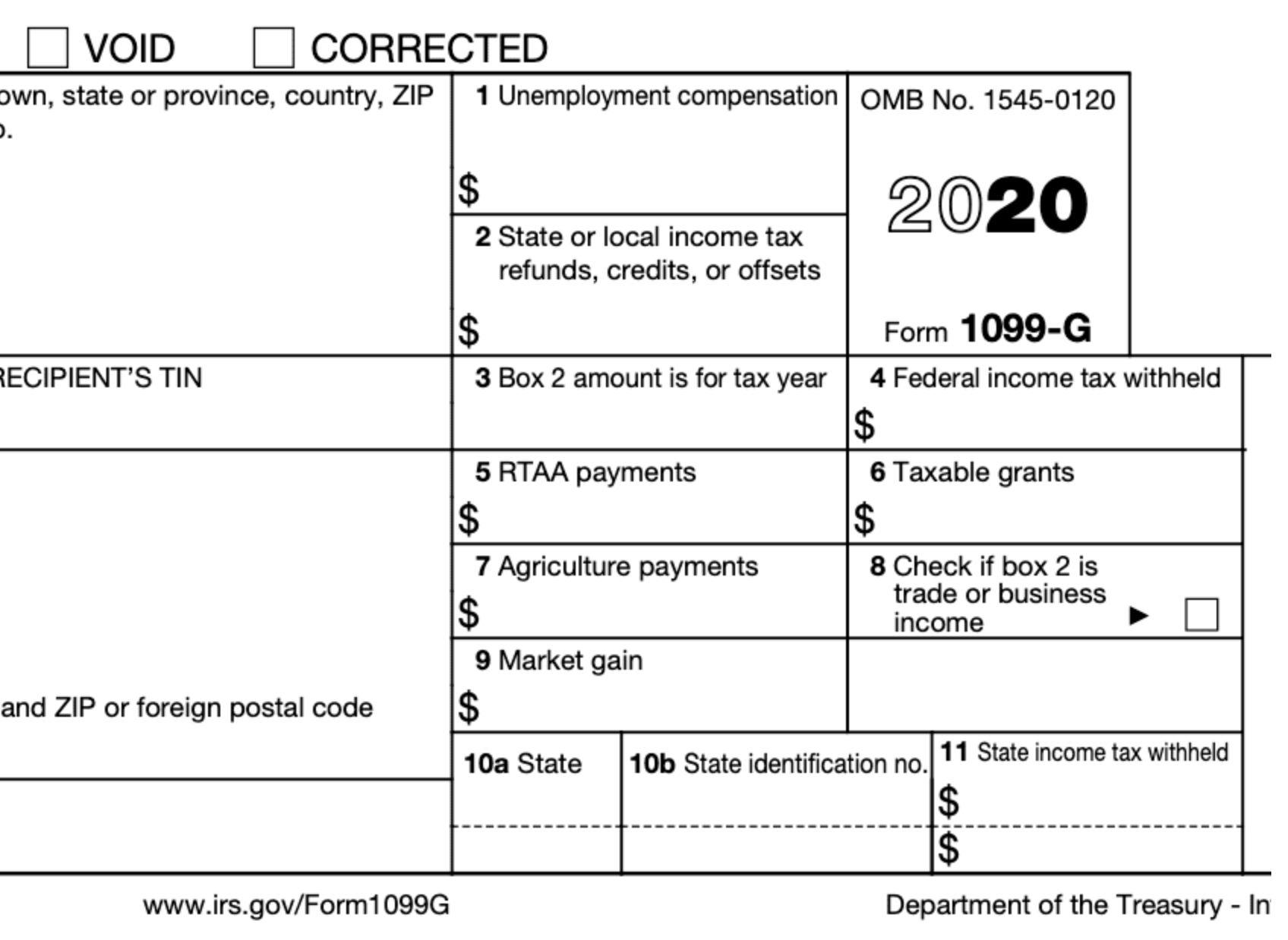

Printable 1099 G Tax Form Key Takeaways Form 1099 G is issued by a government agency to inform you of funds you have received that you may need to report on your federal income tax return Box 1 of the 1099 G Form shows your total unemployment compensation payments for the year which generally need to be reported as taxable income on Form 1040

What Is Form 1099 G 4 min read Federal state and local governments may issue taxpayers Form 1099 G for certain types of government payments While there are a handful of purposes for this form it s most commonly used for two payment types unemployment compensation state or local income tax refunds credits or offsets From the Unemployment Insurance Benefits Online page below under the Get your NYS 1099 G section select the year you want in the NYS 1099 G drop down menu box with an arrow and then select the Get Your NYS 1099 G button If you get a file titled null after you click the 1099 G button click on that file You may see

Printable 1099 G Tax Form

Printable 1099 G Tax Form

https://www.pdffiller.com/preview/624/450/624450133/large.png

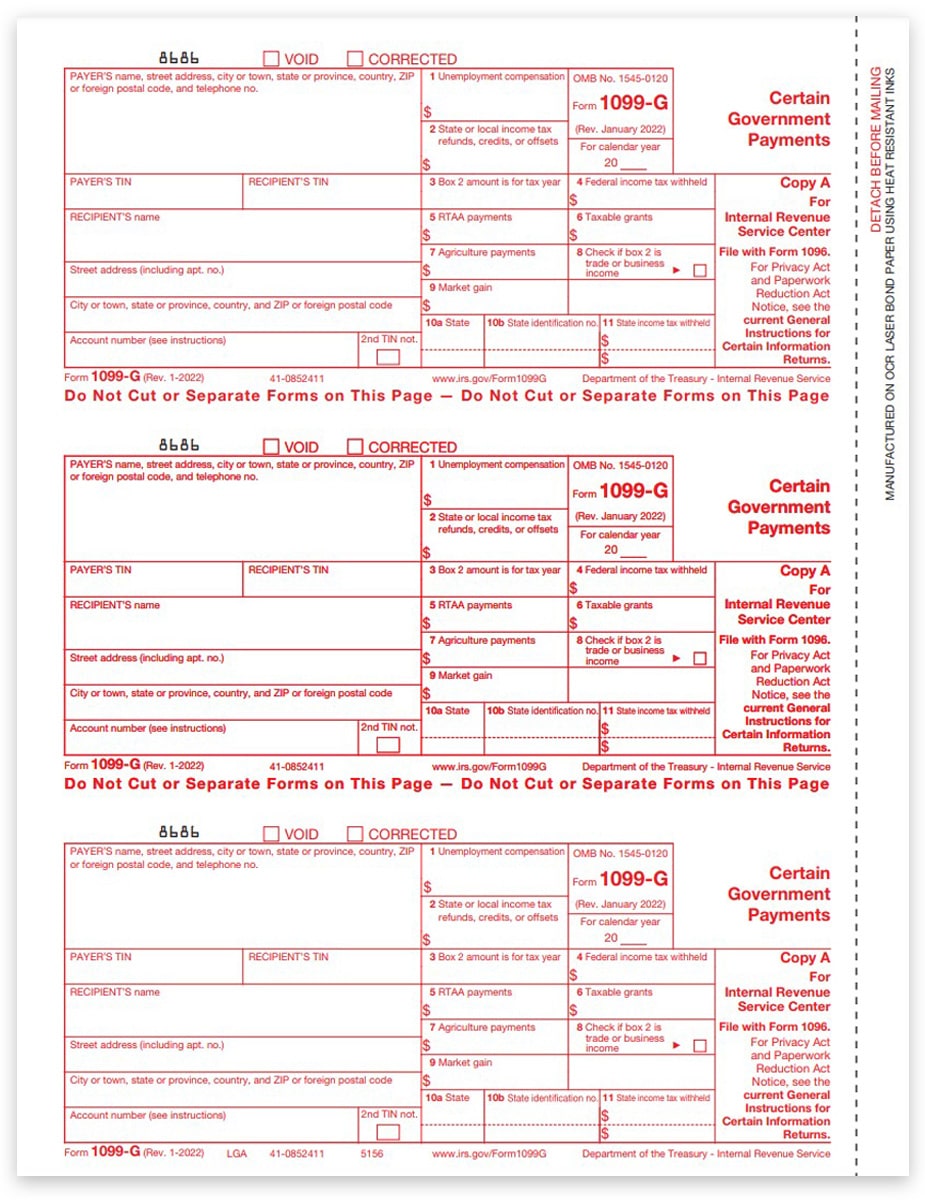

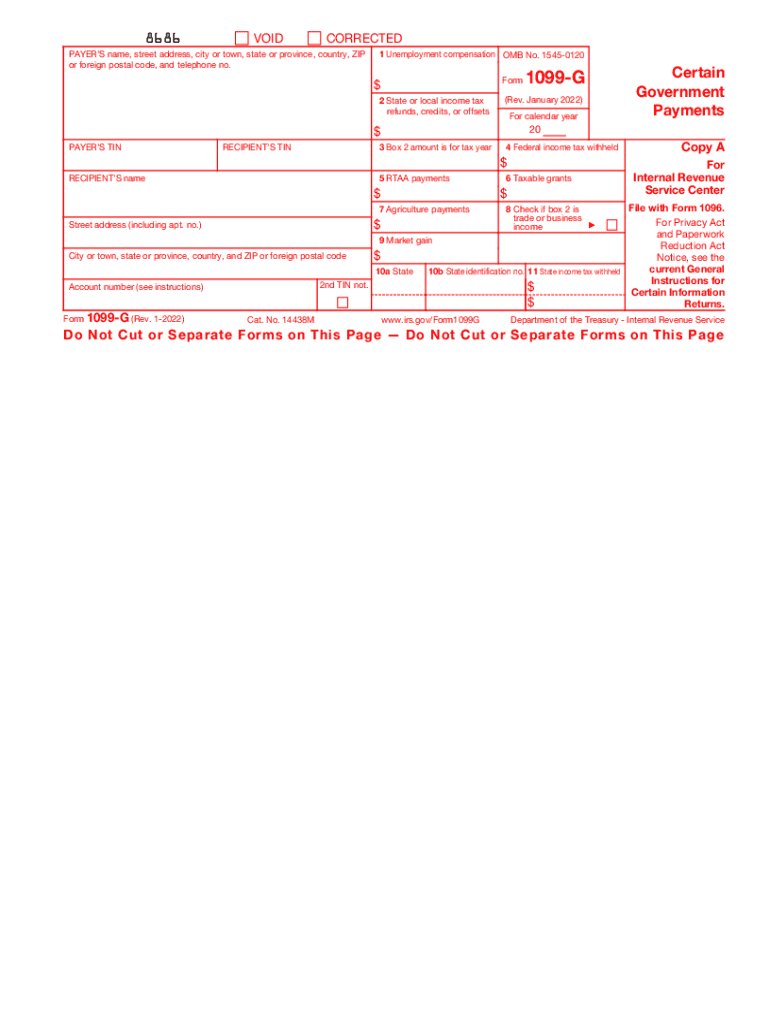

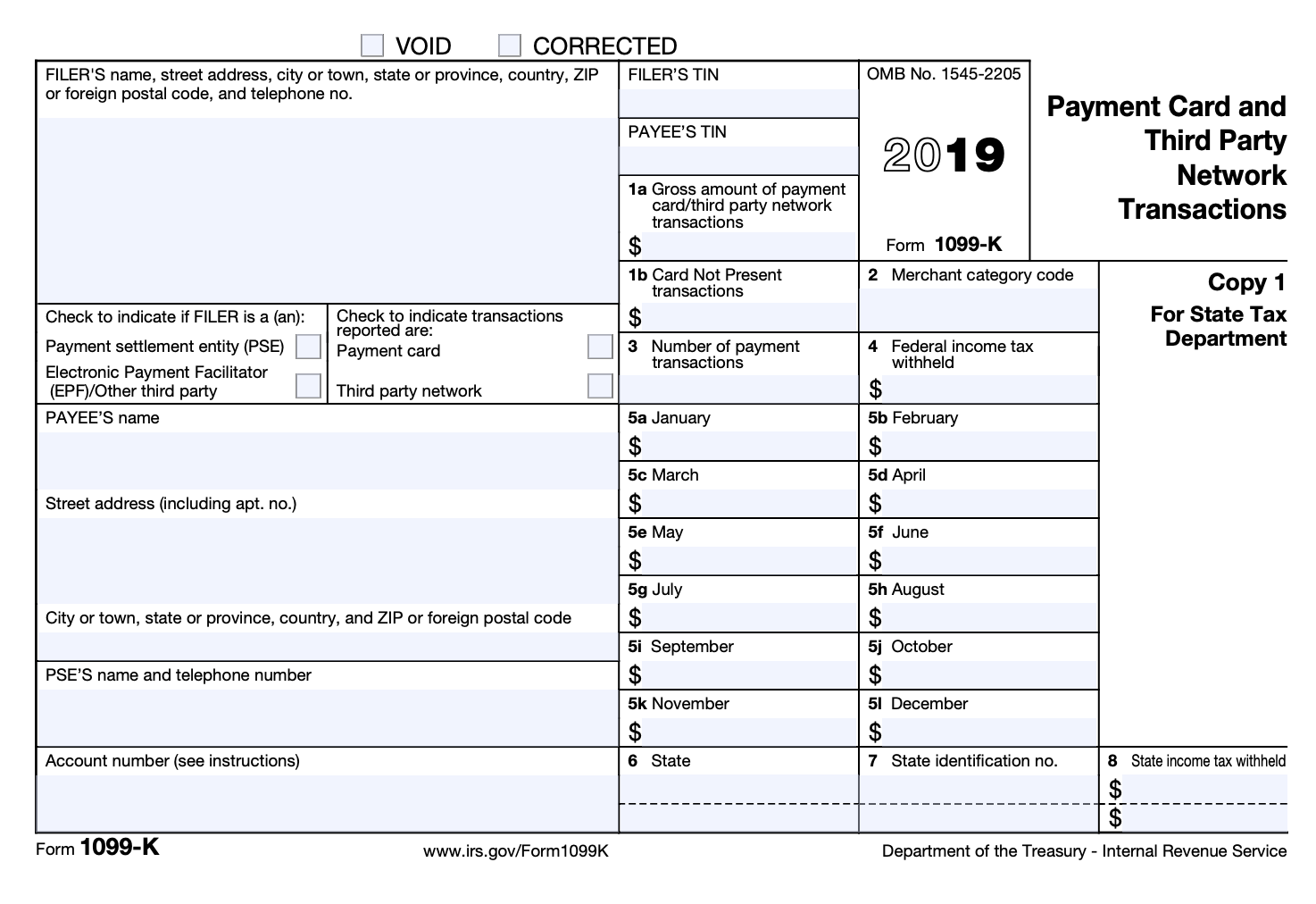

1099G Tax Forms For Government Payments IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1099G-Form-Copy-A-Federal-Red-LGA-FINAL-min.jpg

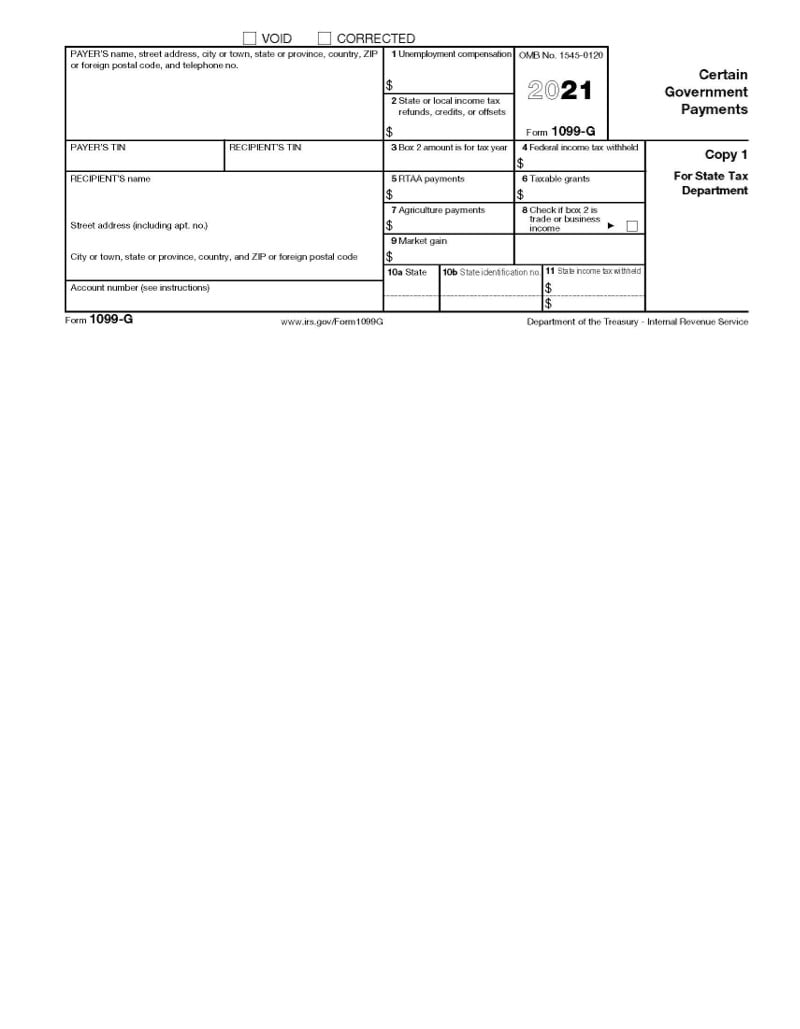

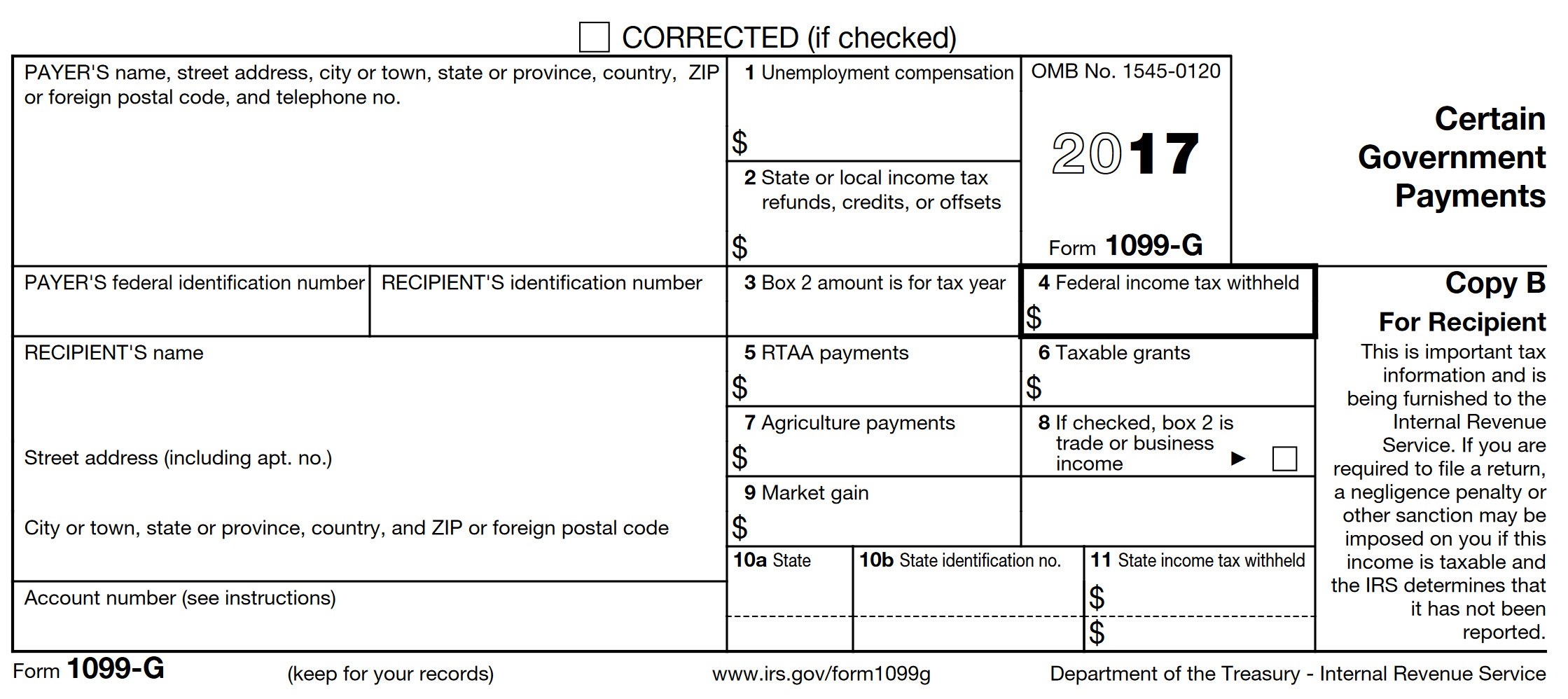

1099 G Form 2023 2024

https://www.zrivo.com/wp-content/uploads/2020/09/1099-G-Form-2021-1280x787.png

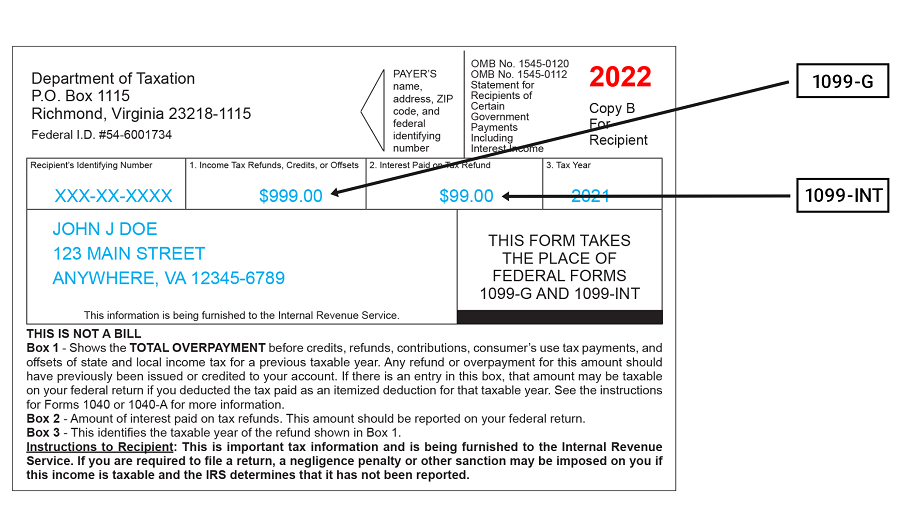

This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2023 as well as any adjustments or tax withholding made to your benefits Benefits paid to you are considered taxable income You must include this form with your tax filing for the 2023 calendar year Next Section How to get your 1099 G tax form The IRS Form 1099 G is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment Assistance payments during the calendar year January 1 to December 31 Every year we send a 1099 G to people who received unemployment benefits We also send this information to the IRS

1099 G Tax Forms DES has mailed 1099 G tax forms to claimants who received Unemployment Insurance UI and Pandemic Unemployment Assistance PUA benefits in 2023 to the address that DES has on file for you Beginning February 1 2024 if you received UI benefits in the calendar year 2023 you can log in to the Weekly Claims portal and view Watch on What is Form 1099 G Why did I receive a postcard about Form 1099 G Is my unemployment included in the 1099 G amount provided by the Missouri Department of Revenue How can I get a copy of the Form 1099 G What should I do with my Form 1099 G amount Do I need to pay the amount shown

More picture related to Printable 1099 G Tax Form

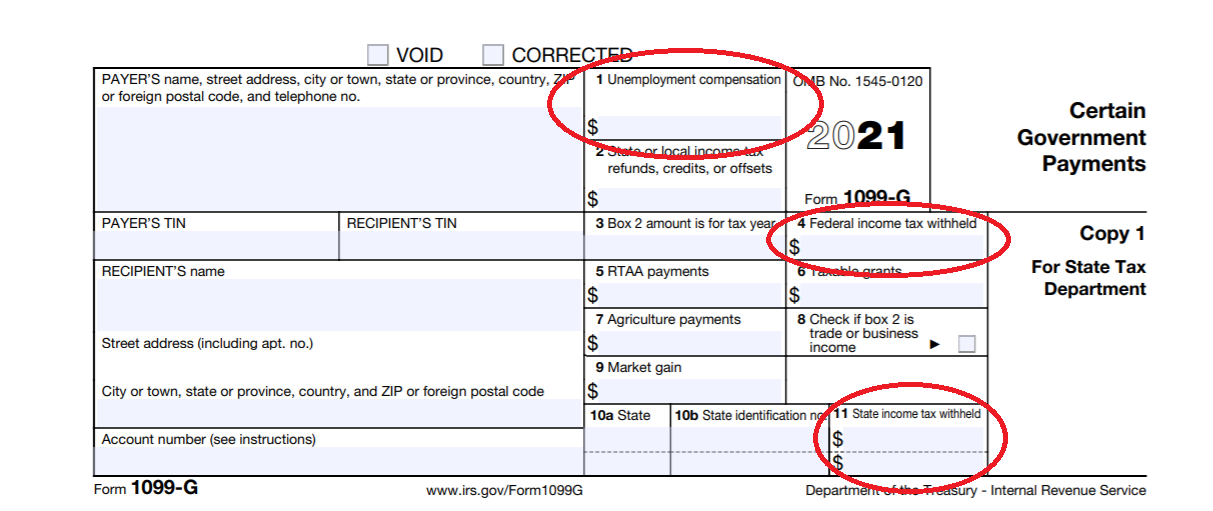

Understanding Form 1099 G Jackson Hewitt

https://www.jacksonhewitt.com/siteassets/tax-help-main/blogs/form-images/irs-notice_1099g.jpg

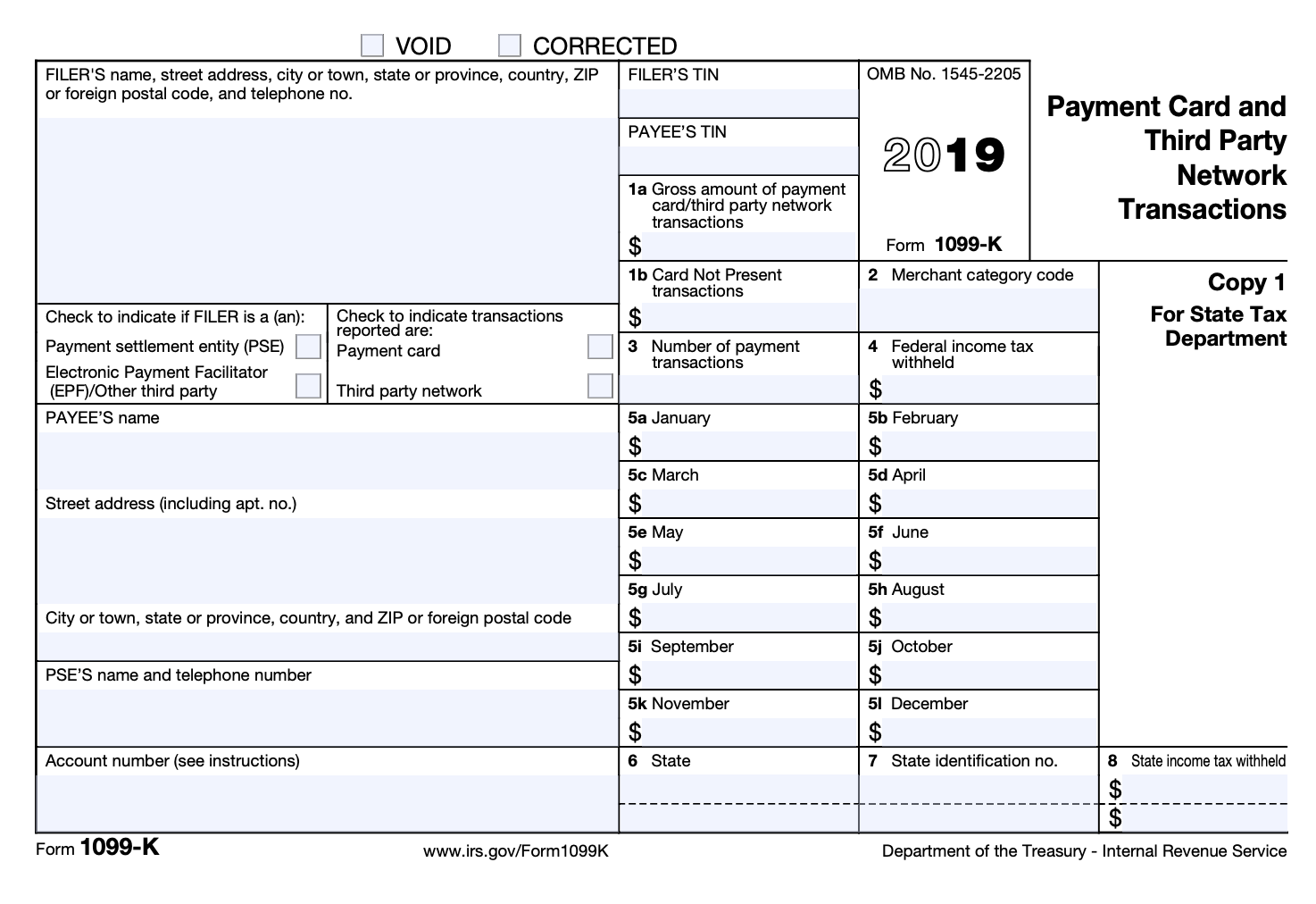

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

https://www.taxoutreach.org/wp-content/uploads/Form-1099G-1-1.png

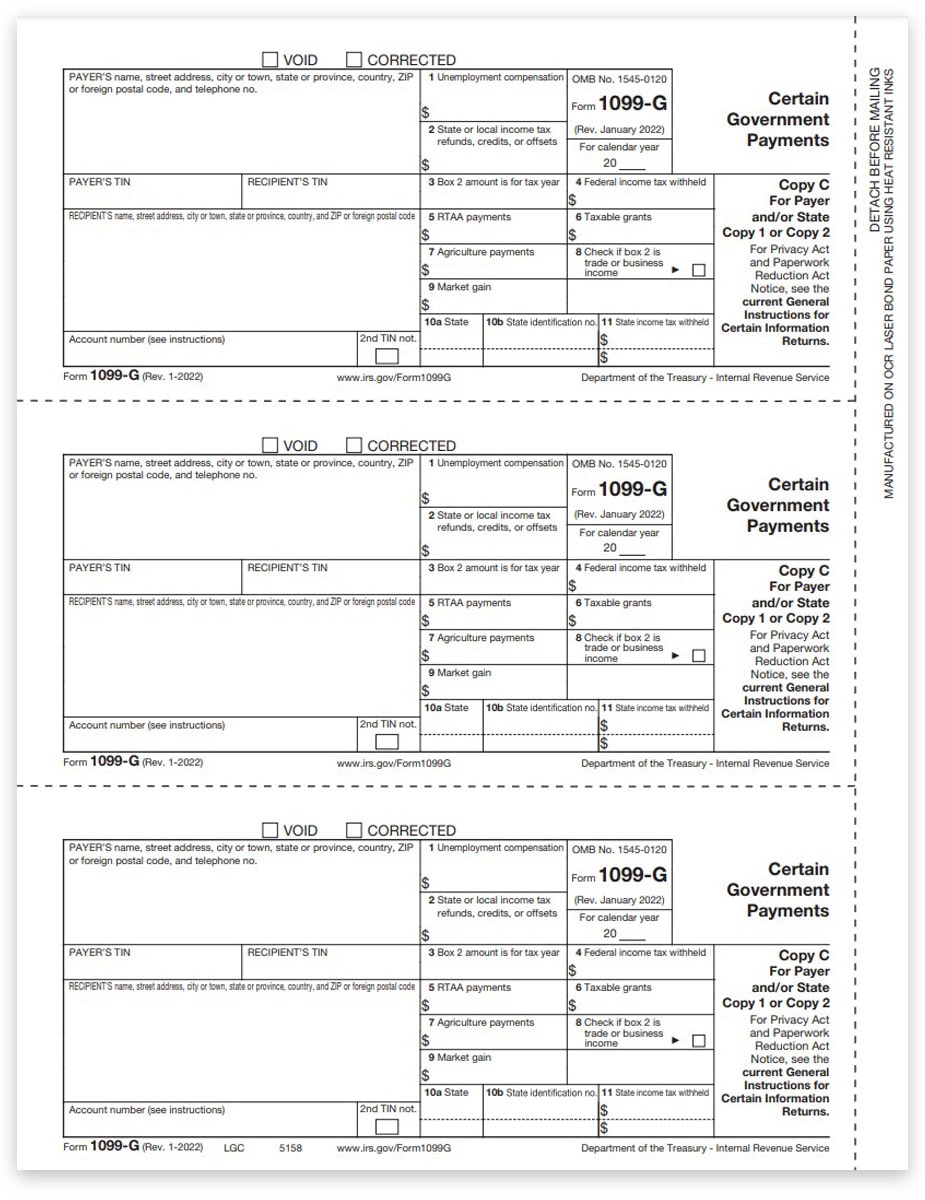

1099G Tax Forms For Government Payments Payer Copy C ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1099G-Form-Copy-C-1-2-Payer-State-LGC-FINAL-min.jpg

Log in to your NY Gov ID account Select Unemployment Services and View Print 1099 G Federal Form 1099 G Certain Government Payments is filed with the Internal Revenue Service IRS by New York State for each recipient of a New York State income tax refund of 10 or more Unemployment Insurance Payments IRS Form 1099 G are issued by the Georgia Department of Labor For Individuals the 1099 G will no longer be mailed Taxpayers now can search for their 1099 G and 1099 INT on the Georgia Tax Center by selecting the View your form 1099 G or 1099 INT link under Individuals This 1099 G form is for taxpayers

Print Email Did you know you can get your 1099 G tax form online These appointment slots are for 1099 G tax form pickup only Click the link below to schedule your appointment at the local office closest to you be sure to select Reschedule and not New Bookings to adjust the time to pick up your 1099 G form If further Withholding must be paid under the Federal Employer Identification Number of the entity that owes the tax as shown on the printed W 2 or 1099 R form issued to the employee payee However multiple employers can be reported in a single W 2 submission file and multiple payers can be reported in a single 1099 submission file

Irs gov Form 1099 G Universal Network

https://www.universalnetworkcable.com/wp-content/uploads/2019/02/irs.gov-form-1099-g.jpg

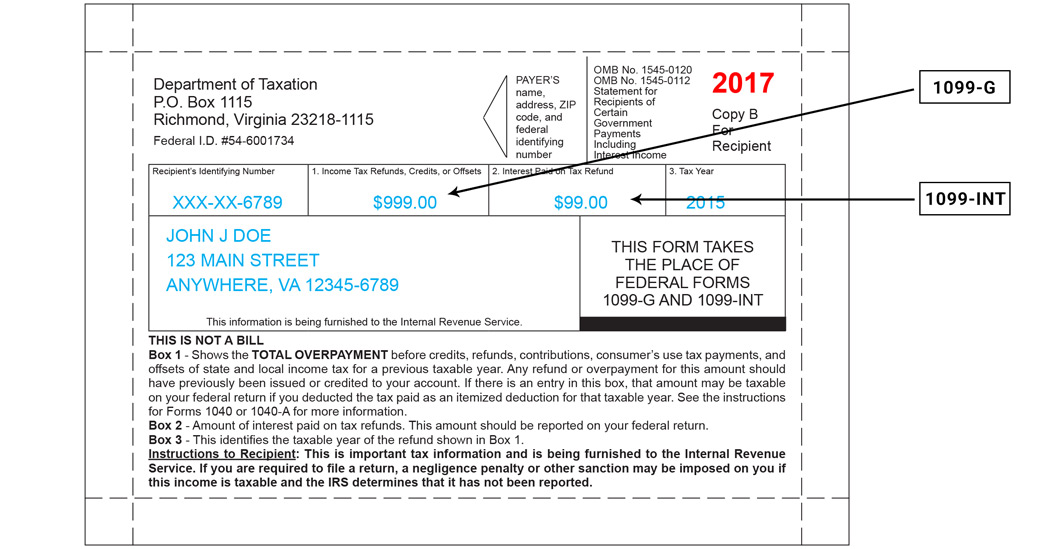

Your 1099 G 1099 INT What You Need To Know Virginia Tax

https://tax.virginia.gov/sites/default/files/inline-images/1099-g-example.jpg

https://turbotax.intuit.com/tax-tips/unemployment/what-is-a-1099-g-tax-form/L8j3PjezG

Key Takeaways Form 1099 G is issued by a government agency to inform you of funds you have received that you may need to report on your federal income tax return Box 1 of the 1099 G Form shows your total unemployment compensation payments for the year which generally need to be reported as taxable income on Form 1040

https://www.hrblock.com/tax-center/irs/forms/what-is-form-1099-g/

What Is Form 1099 G 4 min read Federal state and local governments may issue taxpayers Form 1099 G for certain types of government payments While there are a handful of purposes for this form it s most commonly used for two payment types unemployment compensation state or local income tax refunds credits or offsets

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

1099 Estimated Tax Form Printable Printable Forms Free Online

Irs gov Form 1099 G Universal Network

1099 G FAQs

1099 G California Form Fill Online Printable Fillable Blank PdfFiller

Peoples Choice Tax Tax Documents To Bring We Provide Income Tax Preparation Bookkeeping And

Printable 1099 Tax Forms Free Printable Form 2024

Printable 1099 Tax Forms Free Printable Form 2024

1099 G 1099 INTs Now Available Virginia Tax

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

Irs Printable 1099 Form Printable Form 2023

Printable 1099 G Tax Form - 1099 G tax forms are now available in MyUI for many claimants who received unemployment benefits To view your 1099 G form if available log into your MyUI account then select View Correspondences from the left hand navigation menu or in the hamburger menu at the top if you re on mobile Claimants will also receive a copy of their