Printable Boi Form Irs Pdf How do I get a FinCEN ID File File a report using the BOI E Filing System Create a FinCEN ID optional Need More Information View our FAQ page Need More Information Chat With Us Here Stay Informed Subscribe to FinCEN

Form W 8 Generally a foreign person that is a beneficial owner of the income should give you the Withholding Agent a Form W 8 There are various forms in the W 8 series The form to use depends on the type of certification being made As used in this discussion the term Form W 8 refers to the appropriate document Complete this form if your business is a Corporation Partnership Limited Liability Company LLC classified as a corporation Other LLC Note If your business is a sole proprietorship do not use this form Instead complete Form 433 A OIC Collection Information Statement for Wage Earners and Self Employed Individuals

Printable Boi Form Irs Pdf

Printable Boi Form Irs Pdf

https://imgv2-1-f.scribdassets.com/img/document/156739551/original/84b1ae4a84/1587277282?v=1

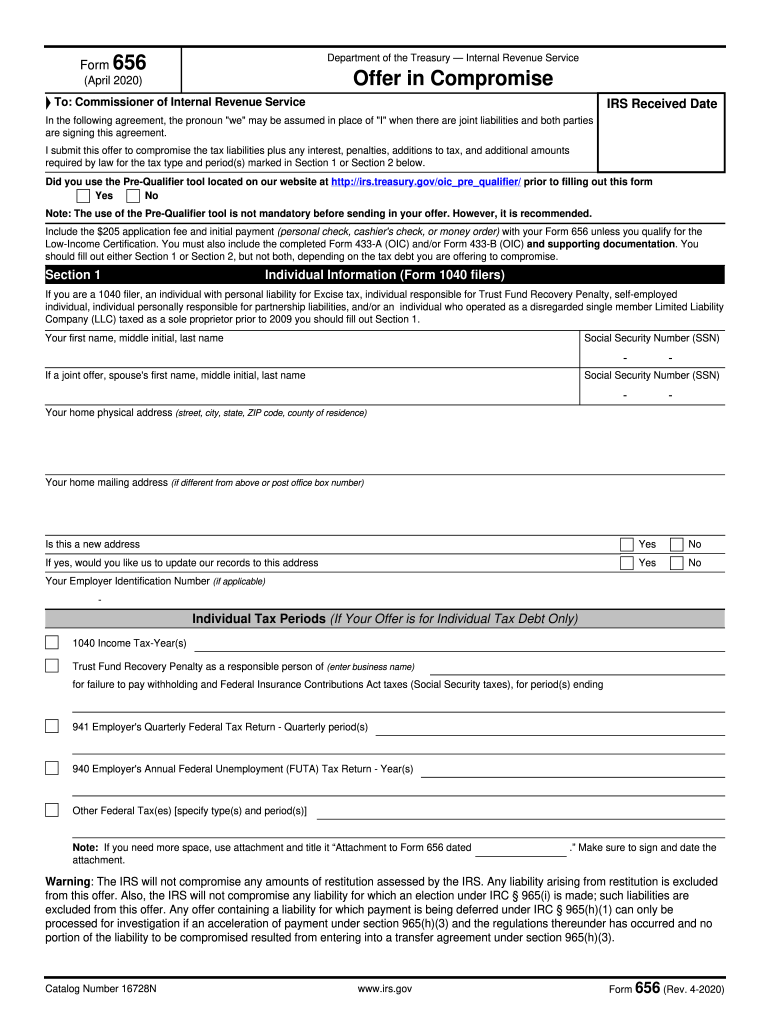

656 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/515/907/515907392/large.png

2018 Form IRS 4868 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/454/877/454877533/large.png

Request for Transcript of Tax Return Use this form to order a transcript or other return information free of charge or designate a third party to receive the information Form 4506 T PDF Related Form 4506 PDF Form 2848 PDF Reporting companies may complete BOIRs electronically by accessing the BOI E Filing portal at https boiefiling fincen gov accessible beginning on January 1 2024 The E Filing portal permits a reporting company to choose one of the following filing methods to submit a BOIR Upload finalized PDF version of BOIR and submit online

What is beneficial ownership information A 2 Why do companies have to report beneficial ownership information to the U S Department of the Treasury A 3 Under the Corporate Transparency Act who can access beneficial ownership information A 4 How will companies become aware of the BOI reporting requirements B Reporting Process B 1 Regarding the 5 000 000 filing threshold FinCEN proposes to make clear that the relevant filing may be a federal income tax or information return and that the 5 000 000 must be reported as gross receipts or sales net of returns and allowances on the entity s IRS Form 1120 consolidated IRS Form 1120 IRS Form 1120 S IRS Form 1065 or

More picture related to Printable Boi Form Irs Pdf

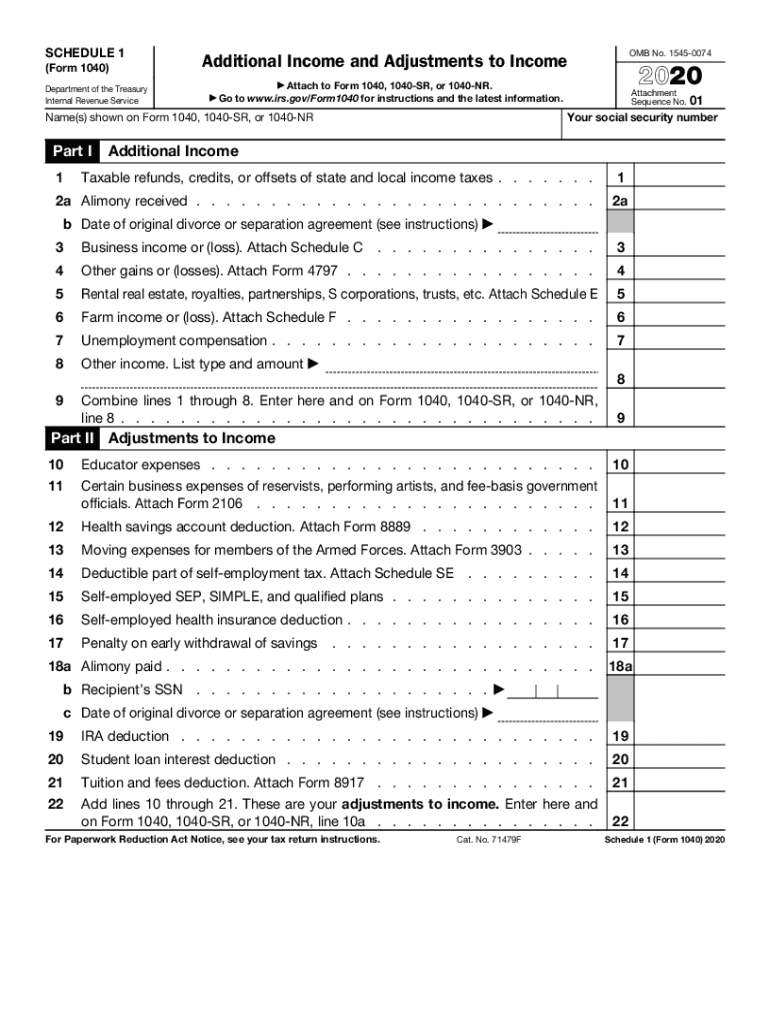

2020 Form IRS 1040 Schedule 1 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/539/40/539040412/large.png

2002 Form IRS 2553 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/1/662/1662572/large.png

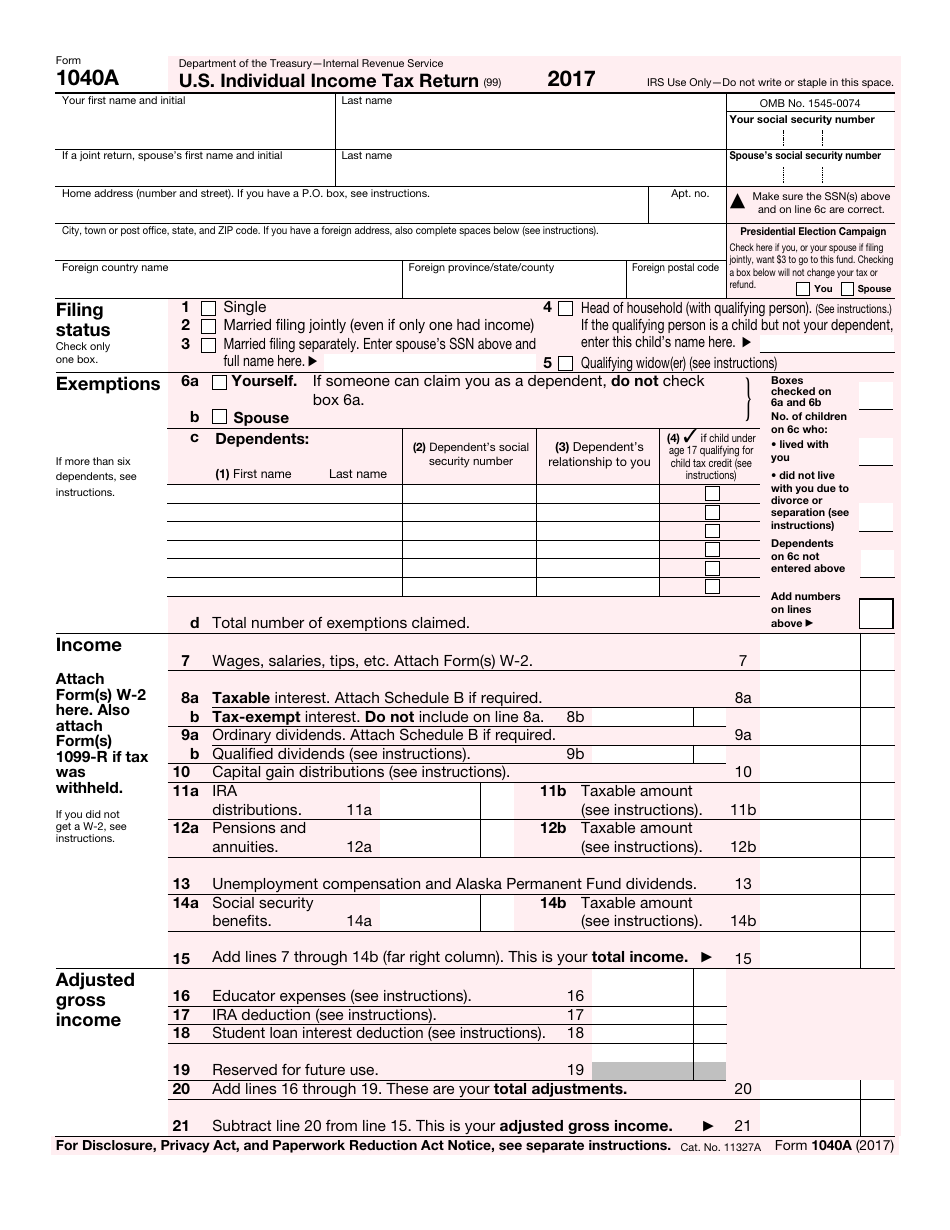

Printable Income Tax Forms

https://data.templateroller.com/pdf_docs_html/1352/13527/1352746/irs-form-1040a-2017-u-s-individual-income-tax-return_print_big.png

1 A corporation a limited liability company LLC or was otherwise created in the United States by filing a document with a secretary of state or any similar ofice under the law of a state or Indian tribe or 2 A foreign company and was registered to do business in any U S state or Indian tribe by such a filing Who Does Not Have to Report January 1 2024 Existing Companies Have One Year to File New Companies Must File Within 90 Days of Creation or Registration WASHINGTON Today the U S Department of the Treasury s Financial Crimes Enforcement Network FinCEN began accepting beneficial ownership information reports

Key filing dates PDF 338 KB Key questions PDF 312 KB Introductory video YouTube More detailed informational video YouTube Read a related FinCEN news release Note that FinCEN will not accept any beneficial ownership information before January 1 2024 Guidance regarding how to submit beneficial ownership information is forthcoming BOI E FILING

Boi Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/40/73/40073993/large.png

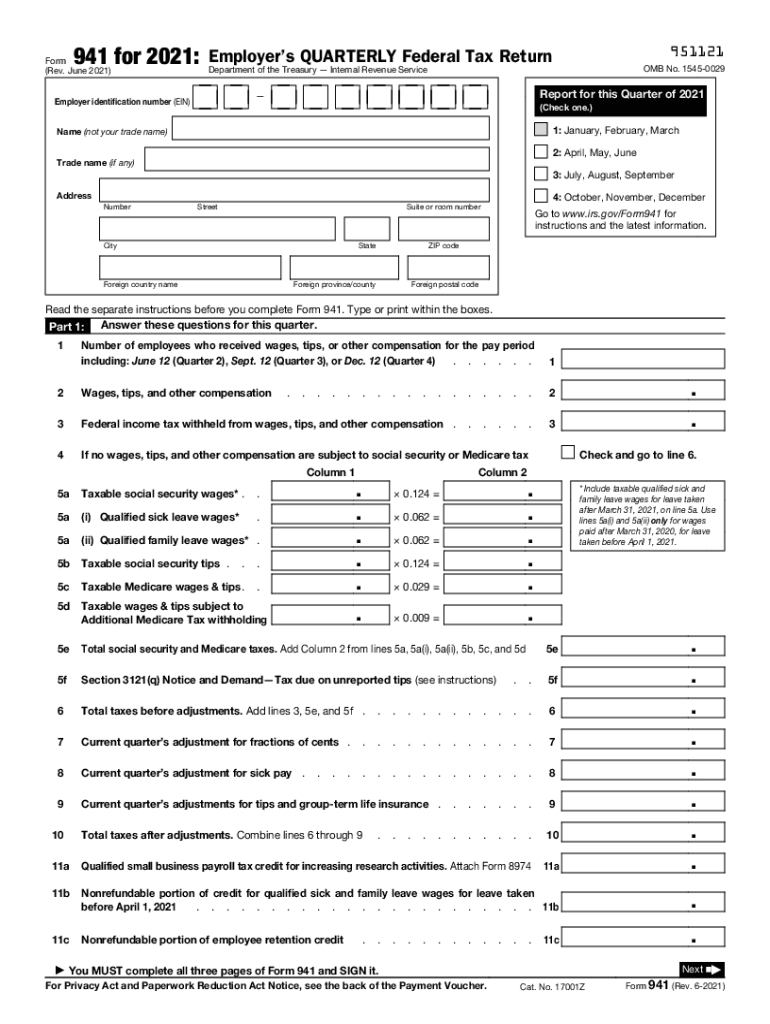

2021 Form IRS 941 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/570/749/570749526/large.png

https://www.fincen.gov/boi

How do I get a FinCEN ID File File a report using the BOI E Filing System Create a FinCEN ID optional Need More Information View our FAQ page Need More Information Chat With Us Here Stay Informed Subscribe to FinCEN

https://www.irs.gov/individuals/international-taxpayers/beneficial-owners

Form W 8 Generally a foreign person that is a beneficial owner of the income should give you the Withholding Agent a Form W 8 There are various forms in the W 8 series The form to use depends on the type of certification being made As used in this discussion the term Form W 8 refers to the appropriate document

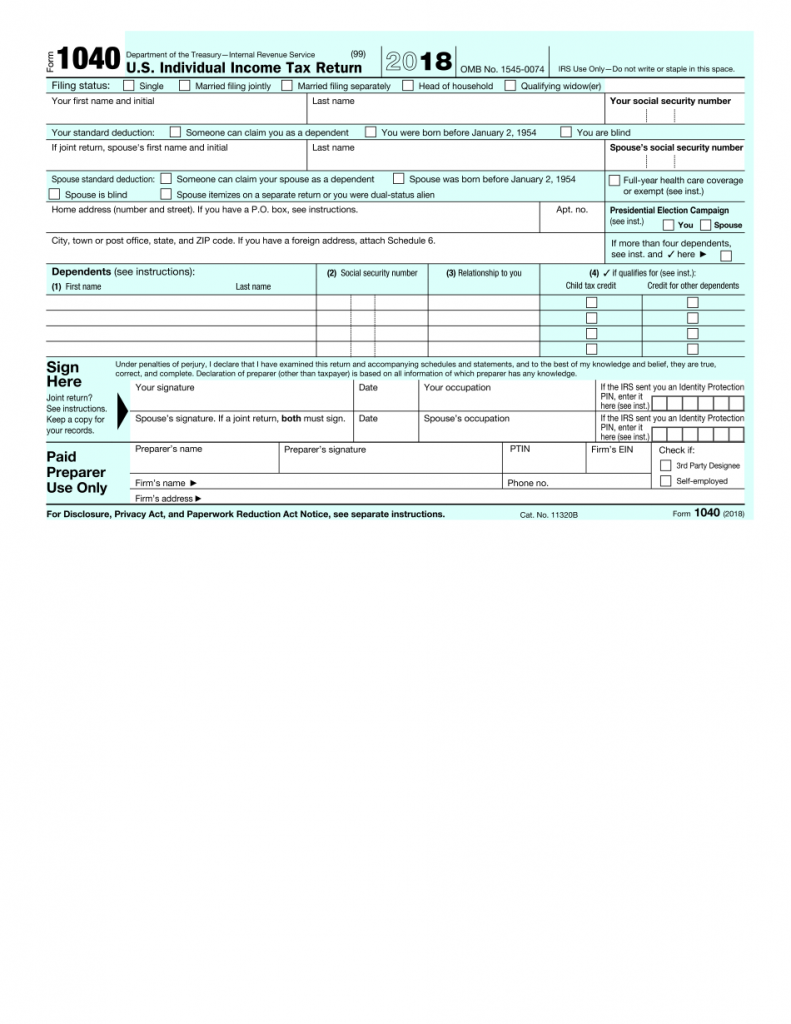

IRS 1040 Form Fillable Printable In PDF Printable Form 2021

Boi Form Fill Out Sign Online DocHub

IRS Forms Fillable Printable Free

Fill Free Fillable IRS PDF Forms

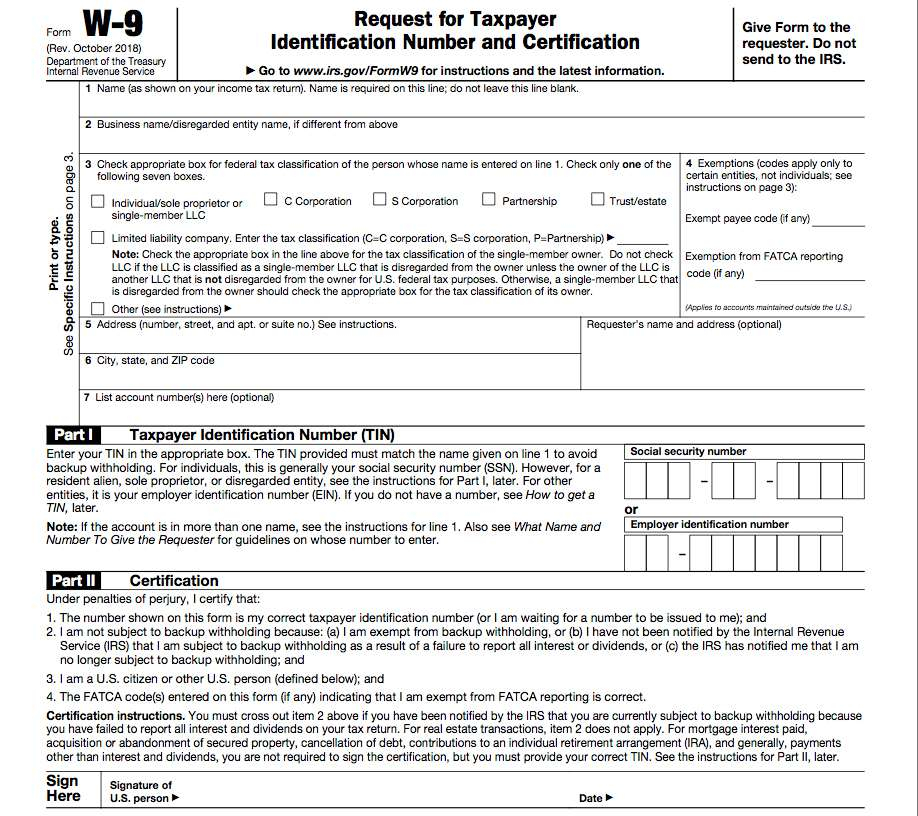

Current W 9 Form Irs Printable W9 Form 2023 Updated Version

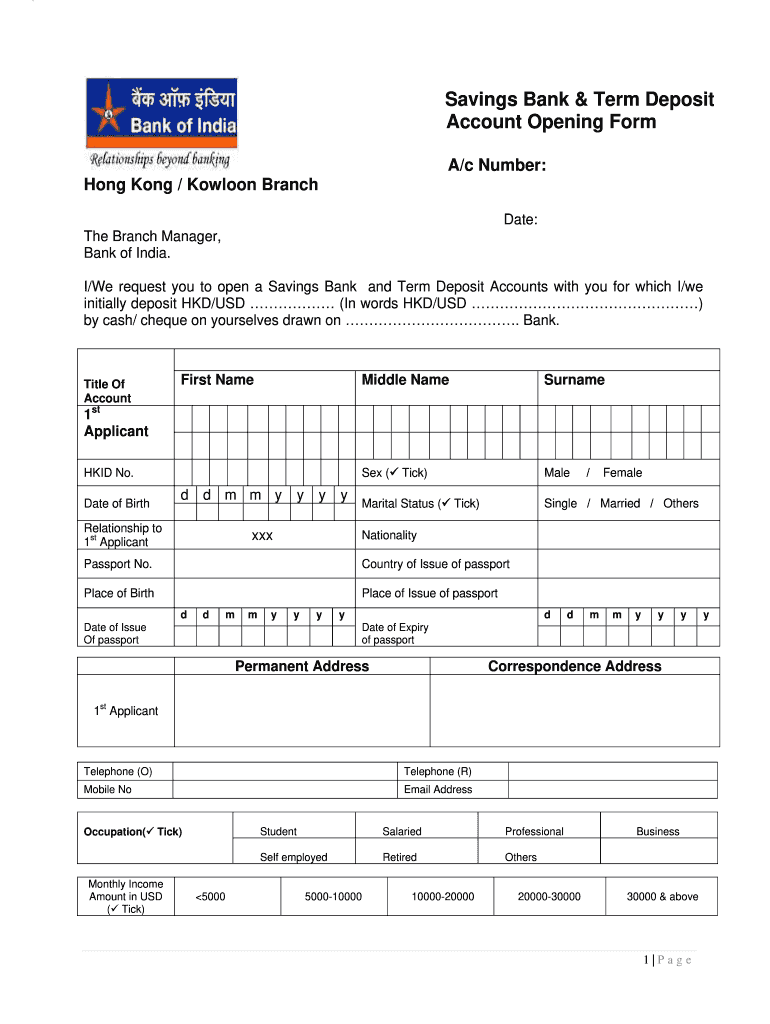

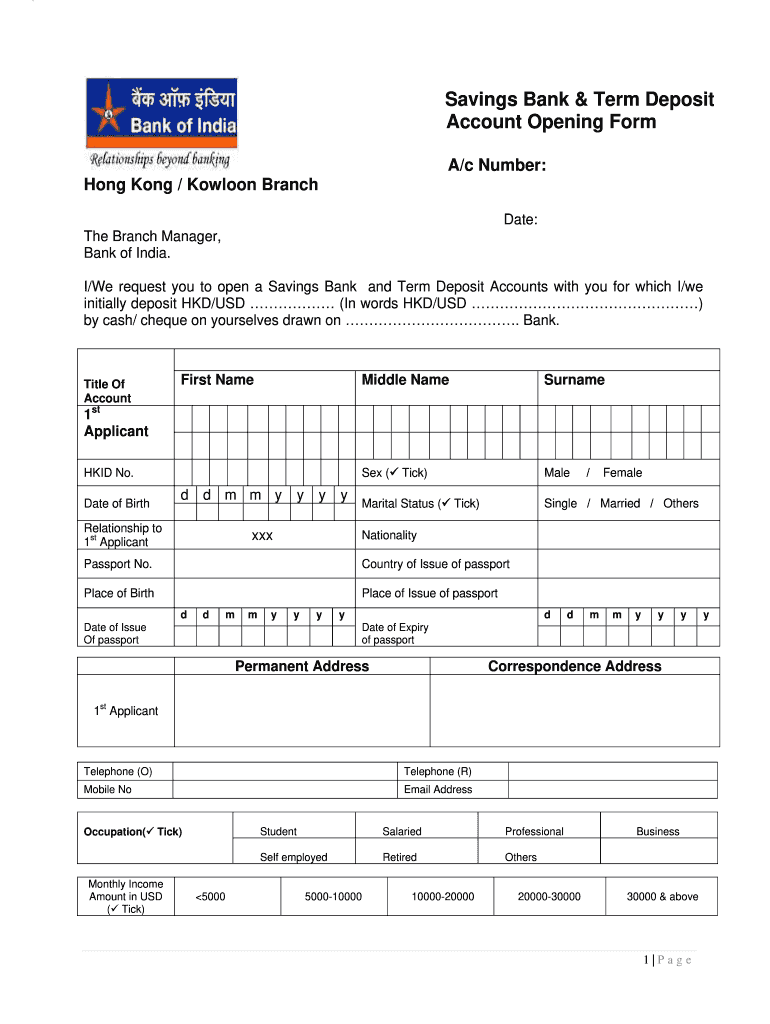

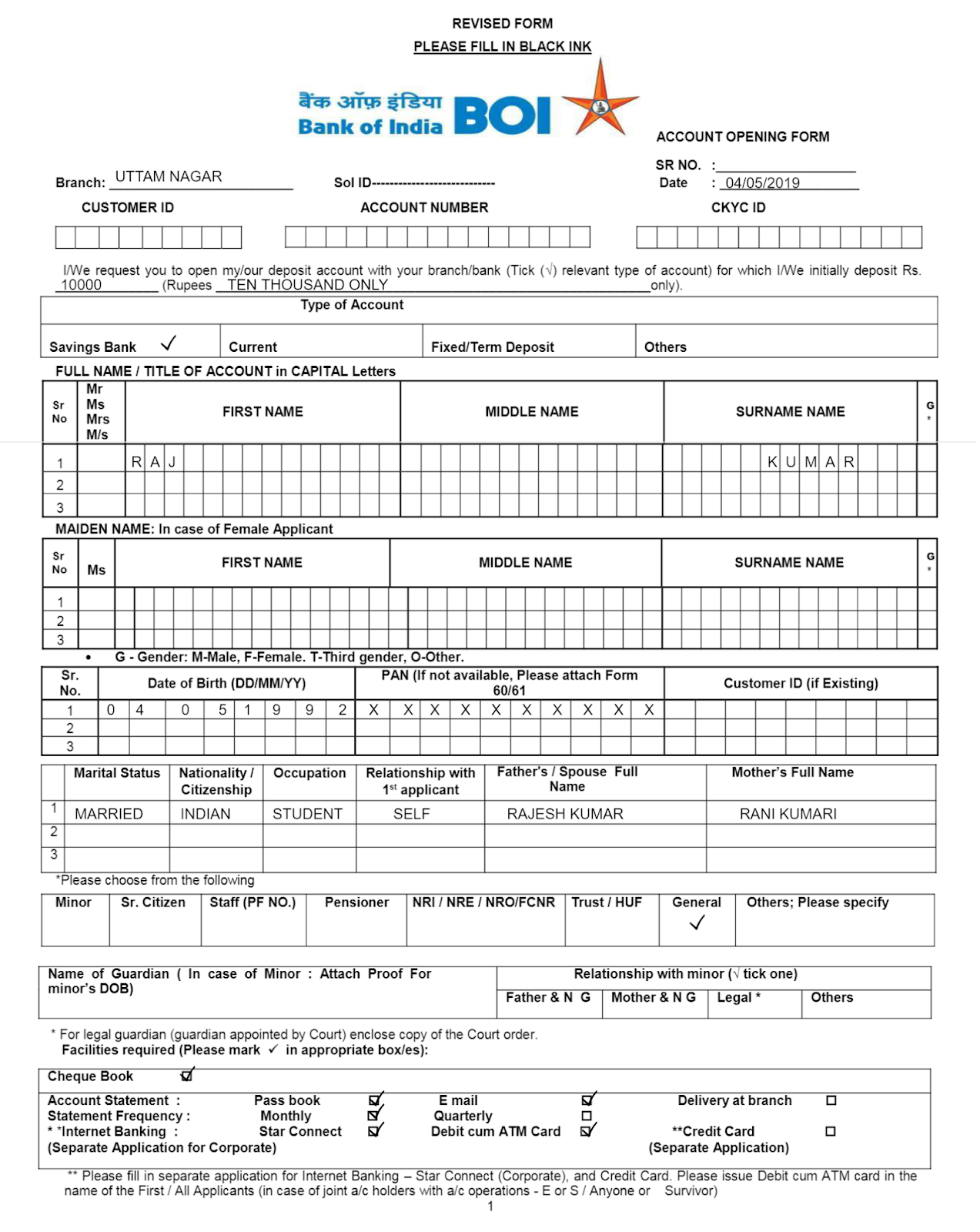

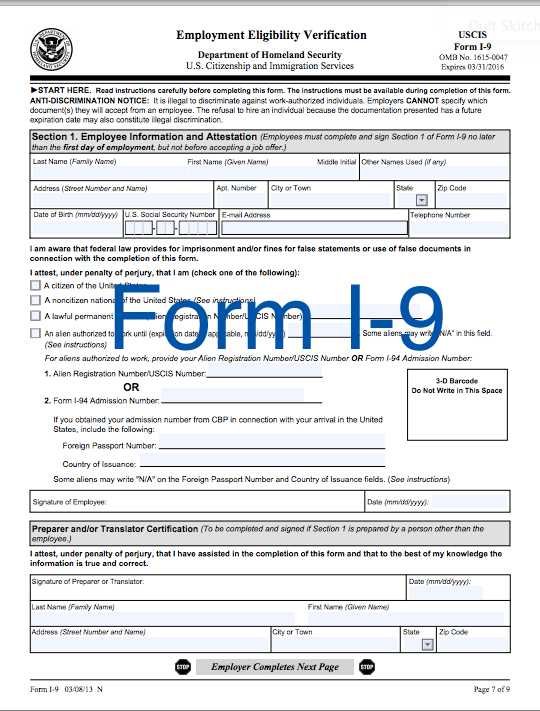

How To Fill Bank Of India Account Opening Form BOI Account Opening Form Fill Sample Pdf

How To Fill Bank Of India Account Opening Form BOI Account Opening Form Fill Sample Pdf

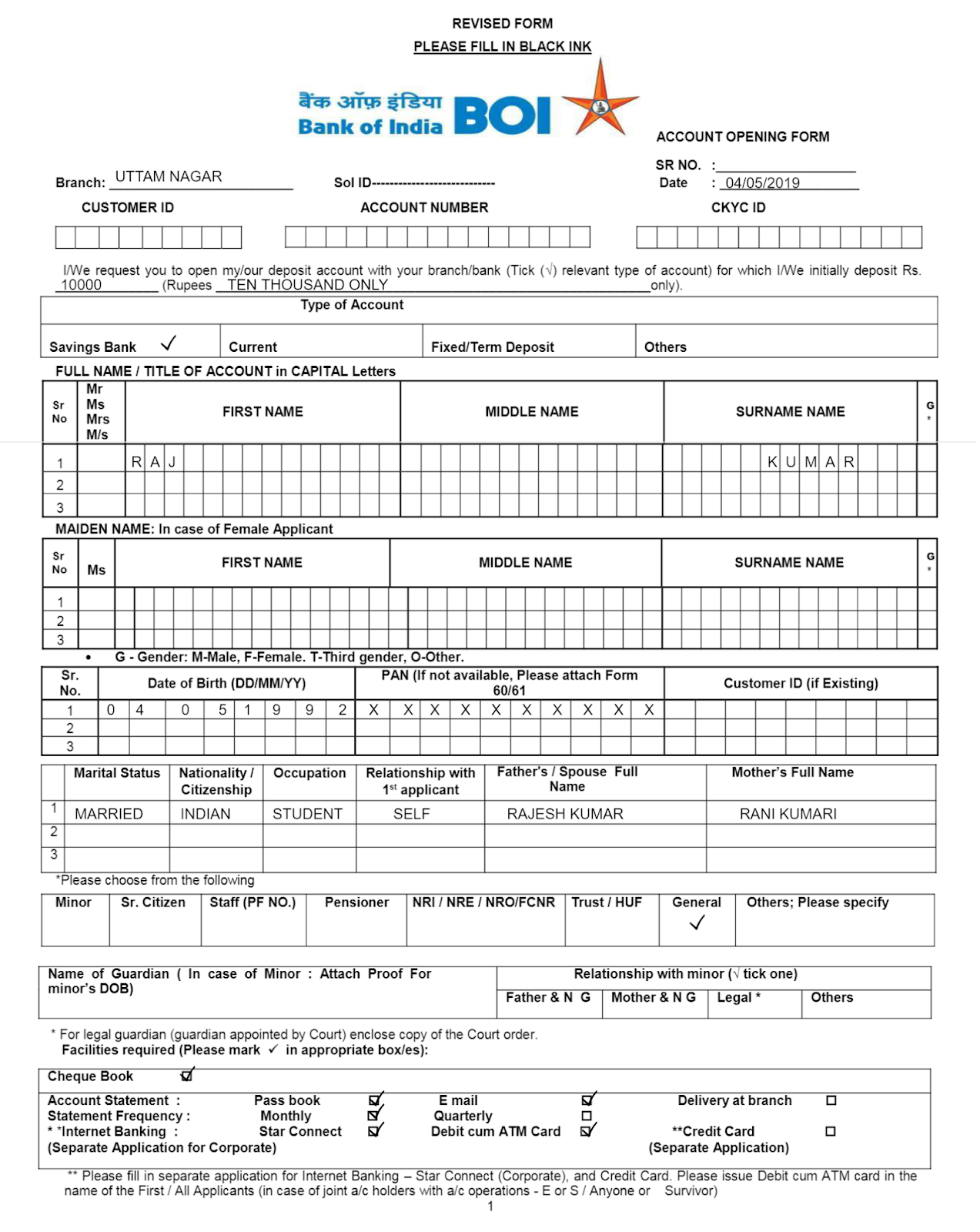

Fincen Form 107 Fill Out Sign Online DocHub

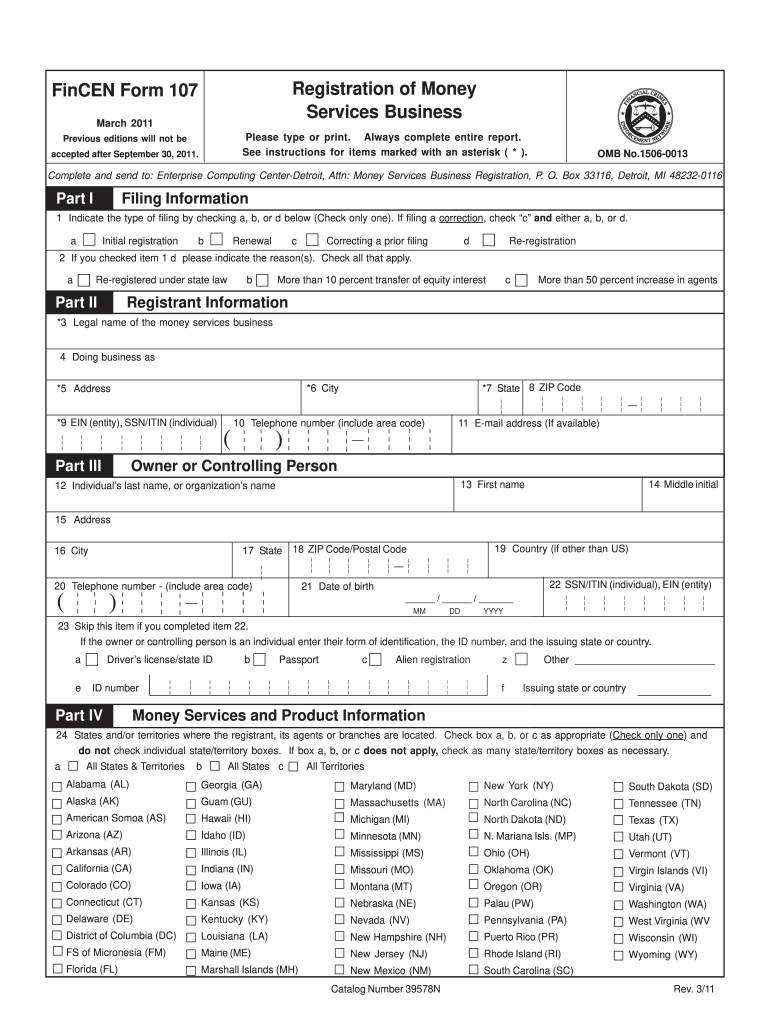

IRS Form I 9 I9 Form 2024

Irs Form 14039 Printable

Printable Boi Form Irs Pdf - Updated January 24 2024 A Beneficial Ownership Information Report is a report submitted to the Financial Crimes Enforcement Network FinCEN under the Corporate Transparency Act The report contains information about the company and identifies the individuals who own or control it either directly or indirectly New Filing Requirements