Printable 1099 Misc Tax Form A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

Form 1099 MISC used to be a self employed person s best friend at tax time However this form recently changed and it no longer includes nonemployee compensation the way it did in the past You may have looked in Box 7 of Form 1099 MISC to see how much a business or client reported that they paid you What Is the IRS Form 1099 MISC Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 October 19 2023 8 58 AM OVERVIEW Form 1099 MISC reports payments other than nonemployee compensation made by a trade or business to others This article answers the question What is the 1099 MISC form

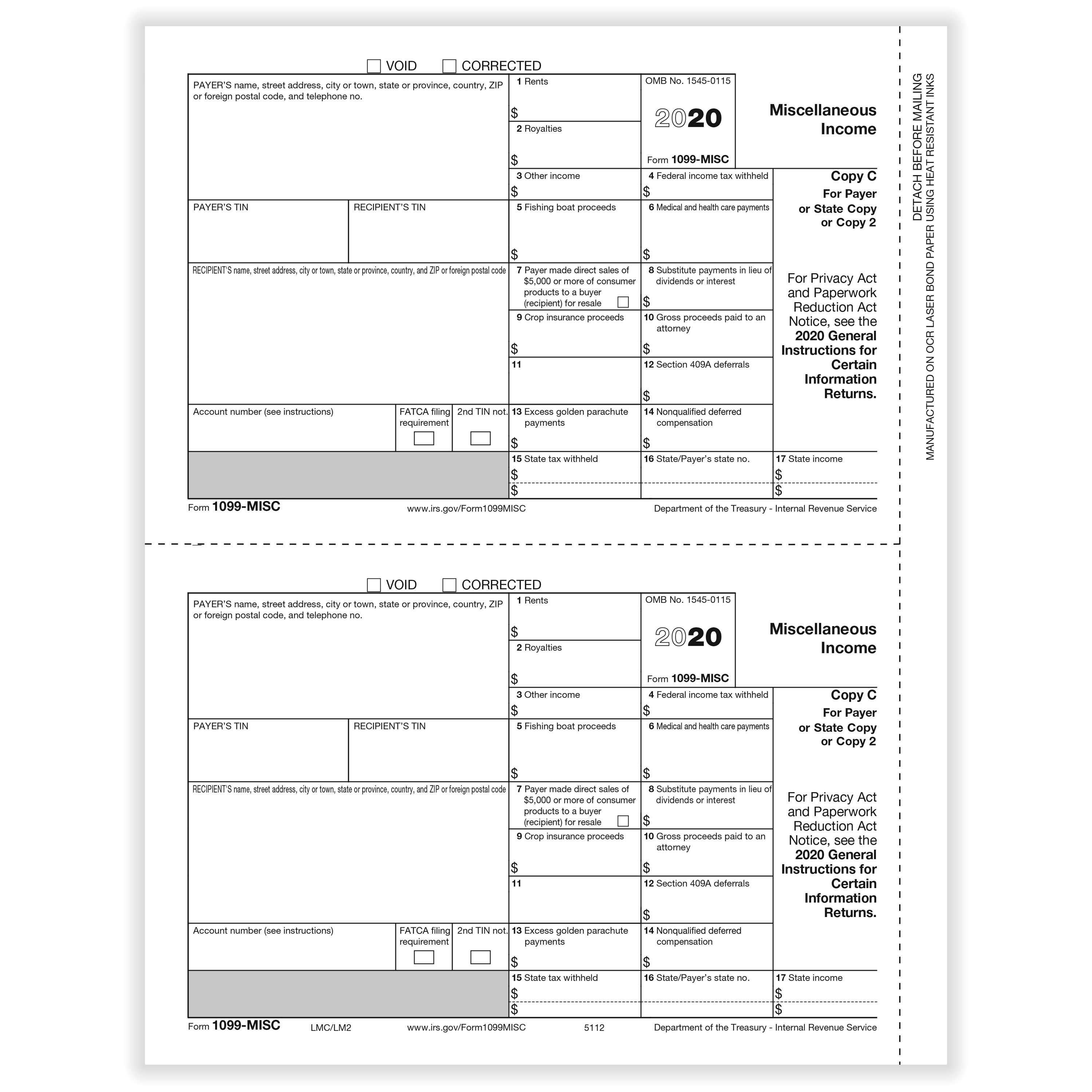

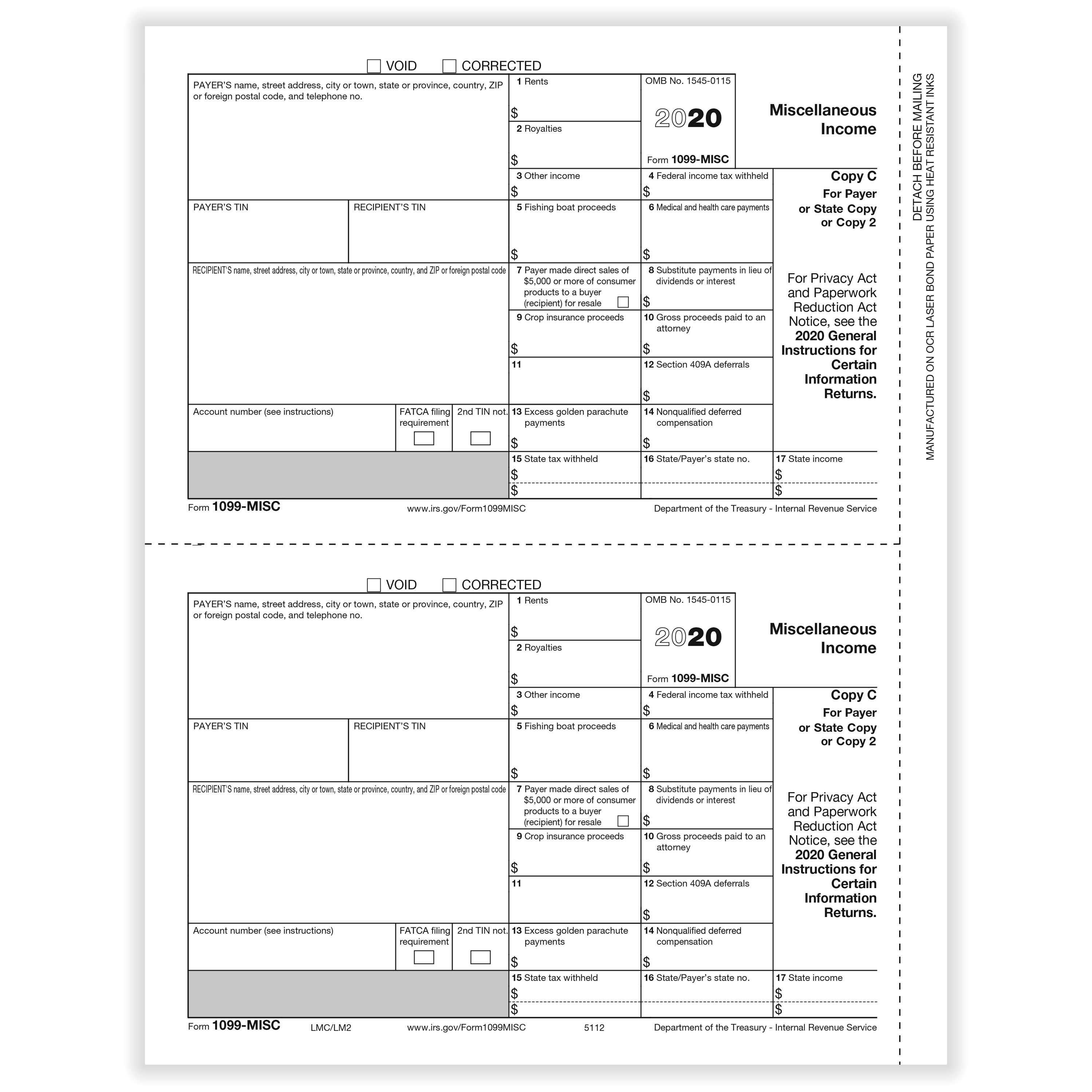

Printable 1099 Misc Tax Form

Printable 1099 Misc Tax Form

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

How To File A 1099 Misc As An Employee Printable Form Templates And Letter

https://jumbotron-production-f.squarecdn.com/assets/11075493e5b6812373621.png

A 1099 MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest 1 Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like

Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below 2023 Pre Printed 1099 MISC Kits Starting at 58 99 Use federal 1099 MISC tax forms to report payments of 600 or more for rents royalties medical and health care payments and gross proceeds paid to attorneys These continuous use forms no longer include the tax year QuickBooks will print the year on the forms for you

More picture related to Printable 1099 Misc Tax Form

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1099-misc-tax-basics.png

IRS Form 1099 Reporting For Small Business Owners

https://fitsmallbusiness.com/wp-content/uploads/2019/01/1099-form.png

How To PDF Printing 1099 misc Forms

https://www.halfpricesoft.com/images/1099_edit.jpg

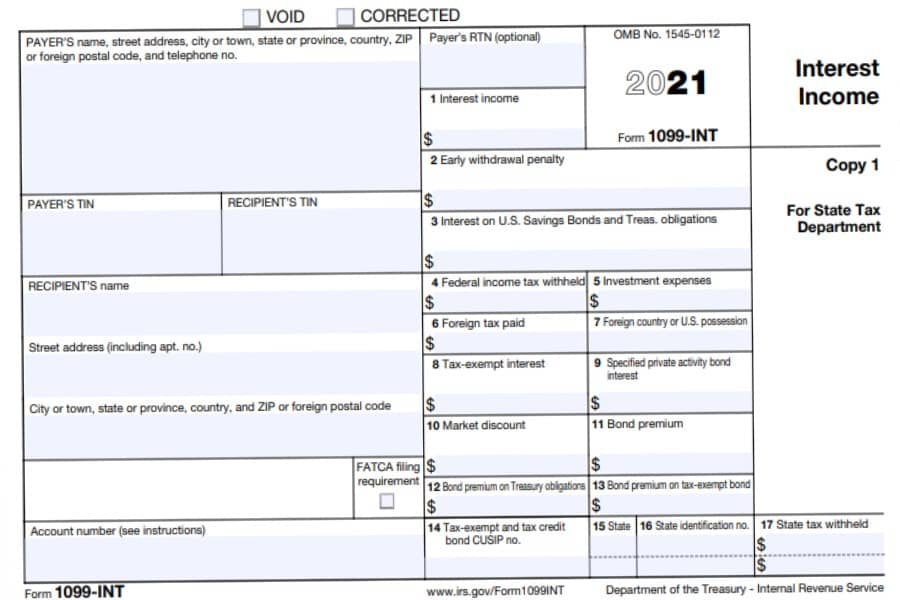

IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New

Form 1099 Misc is a tax form that reports the year end summary of all non employee compensation The 1099 Misc form covers rent royalties self employment and independent contractor income crop 1099 MISC forms for all purposes are due to the IRS by February 28 2024 or March 31 2024 if you re filing electronically You must issue the form to the recipient by February 15 2024 for gross proceeds paid to attorneys substitute dividends or tax exempt interest payments You should issue all other payments to the recipient by

1099 MISC Income Form 1099 Form Copy C 1099 Form Formstax

https://cdn.formstax.com/Images/Products/L0759-5112-2020-1099MISC-Laser-Copy-C_xl.jpg

How To Print And File 1099 MISC Miscellaneous Income

http://www.halfpricesoft.com/1099s_software/images/fill-1099-misc.jpg

https://eforms.com/irs/form-1099/misc/

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

https://turbotax.intuit.com/tax-tips/self-employment-taxes/how-to-read-a-1099-misc-tax-form/L2vTOzzJv

Form 1099 MISC used to be a self employed person s best friend at tax time However this form recently changed and it no longer includes nonemployee compensation the way it did in the past You may have looked in Box 7 of Form 1099 MISC to see how much a business or client reported that they paid you

Printable 1099 Misc Tax Form Template Printable Templates

1099 MISC Income Form 1099 Form Copy C 1099 Form Formstax

How To Fill Out And Print 1099 MISC Forms

1099 MISC 3 Part Continuous 1 Wide Formstax

Printable IRS Form 1099 MISC For Tax Year 2017 For 2018 Income Tax Season CPA Practice Advisor

Fillable 1099 Misc Fill Out Sign Online DocHub

Fillable 1099 Misc Fill Out Sign Online DocHub

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

Printable Form 1099 Misc For 2021 Printable Form 2023

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Printable 1099 Misc Tax Form - Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below