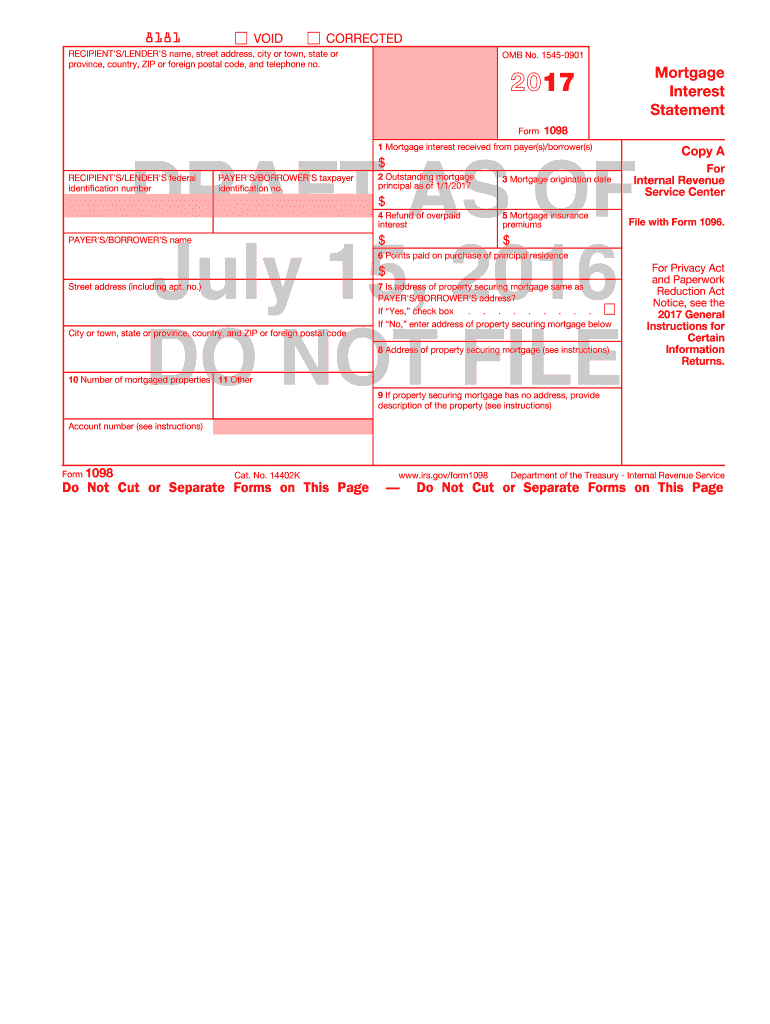

Printable 2108 1098 Mortgage Forms IRS Form 1098 is an essential document that serves as a mortgage interest statement for taxpayers in the United States It is issued by a mortgage lender to the borrower detailing the amount of interest and related expenses paid on a mortgage during the tax year

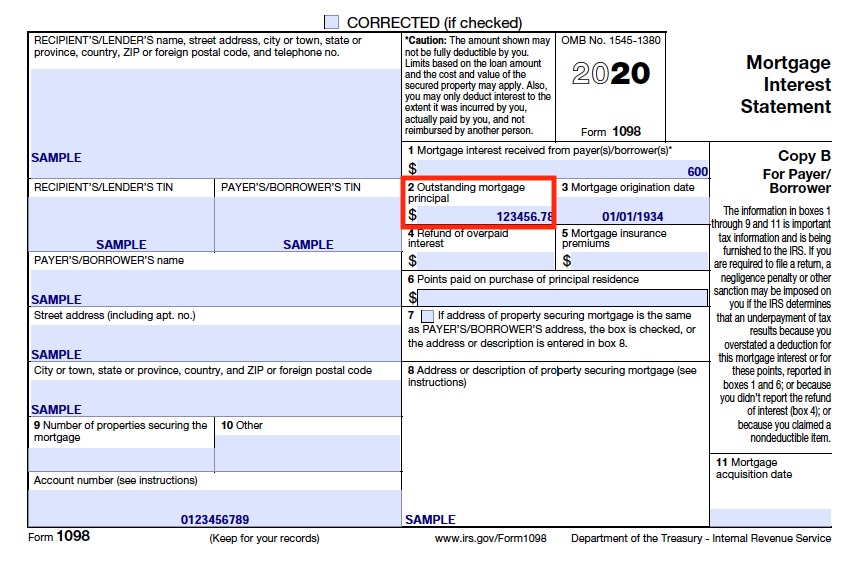

Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your trade or business from an individual including a sole proprietor Report only interest on a mortgage defined later File a separate Form 1098 for each mortgage Form 1098 Mortgage Interest Statement is an Internal Revenue Service IRS form used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax

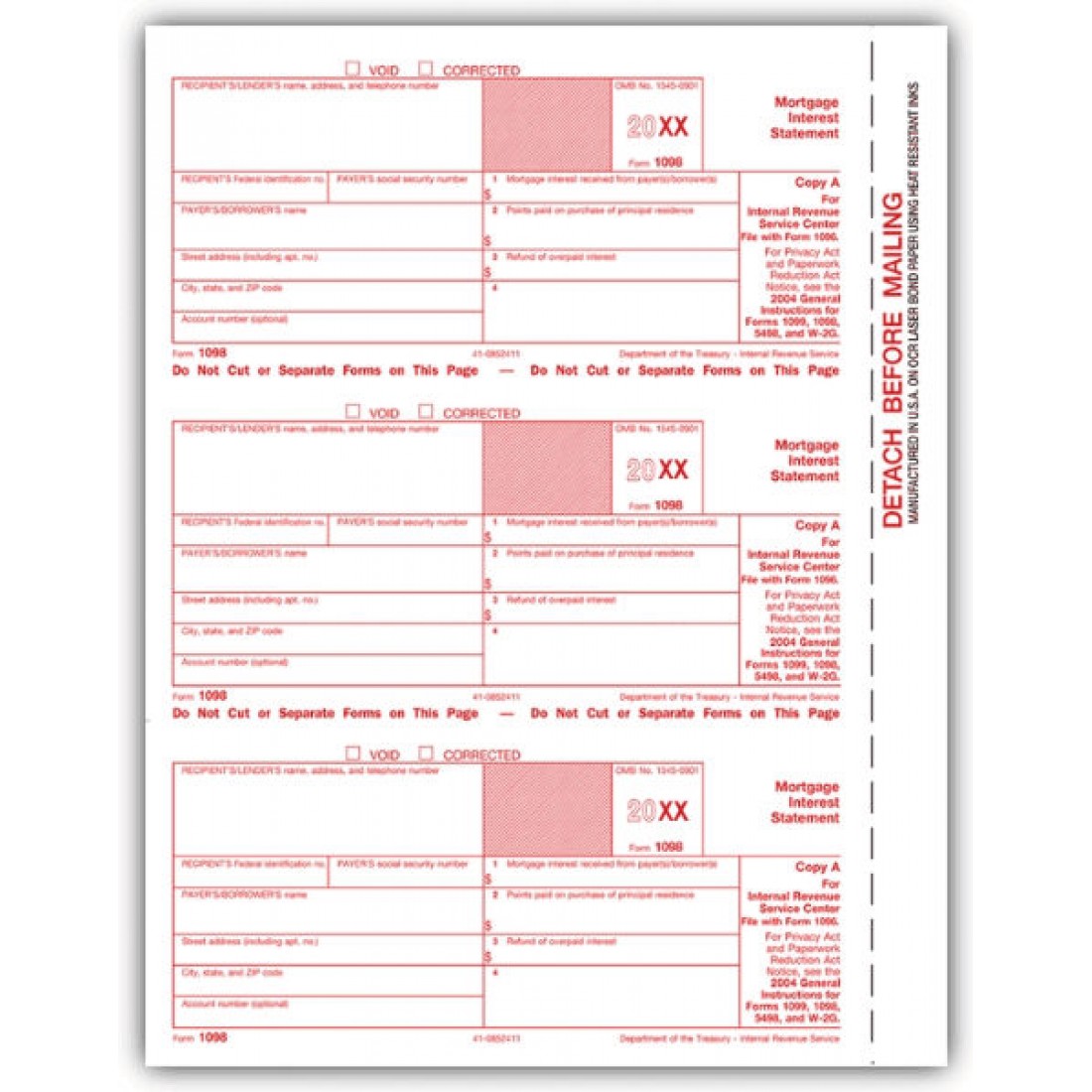

Printable 2108 1098 Mortgage Forms

Printable 2108 1098 Mortgage Forms

https://www.halfpricesoft.com/1098s-software/images/fill-1098-form.jpg

Free Fillable Form 1098 Printable Forms Free Online

https://www.pdffiller.com/preview/65/680/65680736/large.png

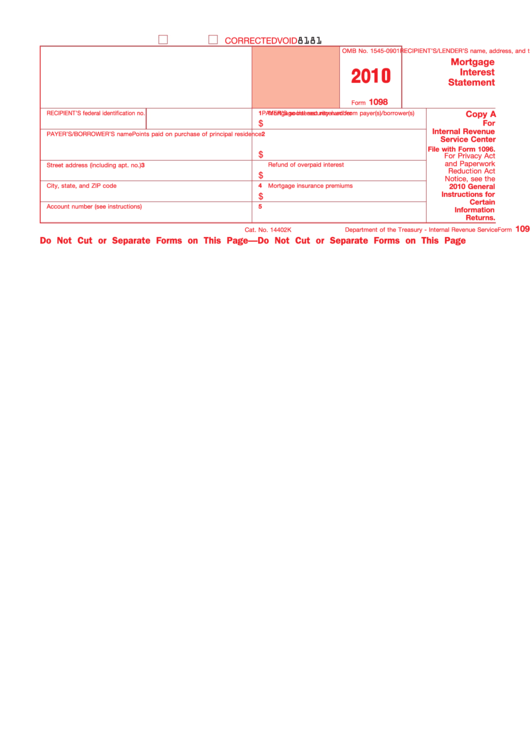

Form 1098 Mortgage Interest Statement 2010 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/279/2799/279952/page_1_thumb_big.png

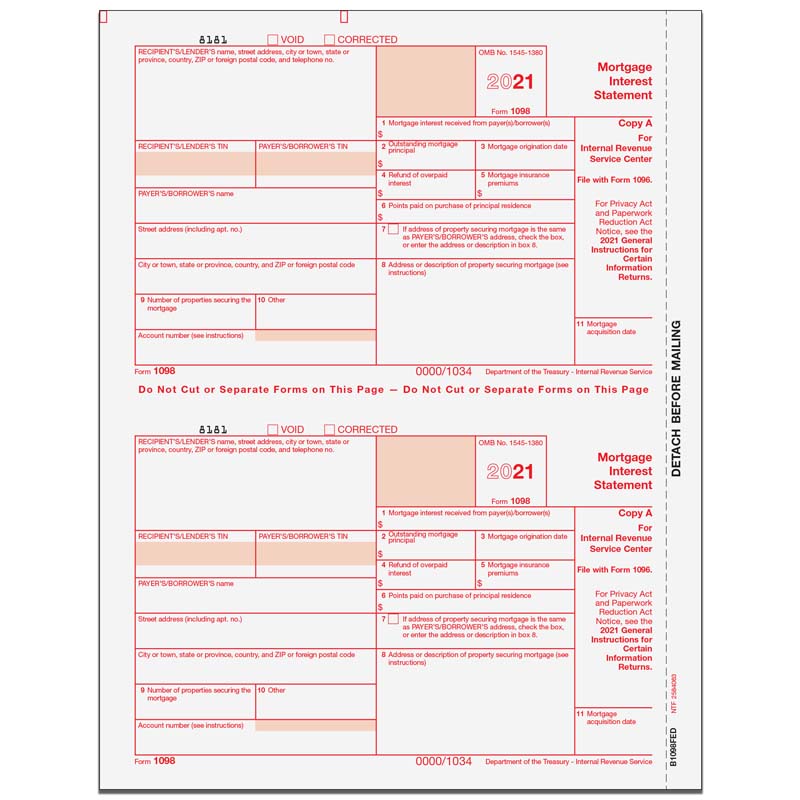

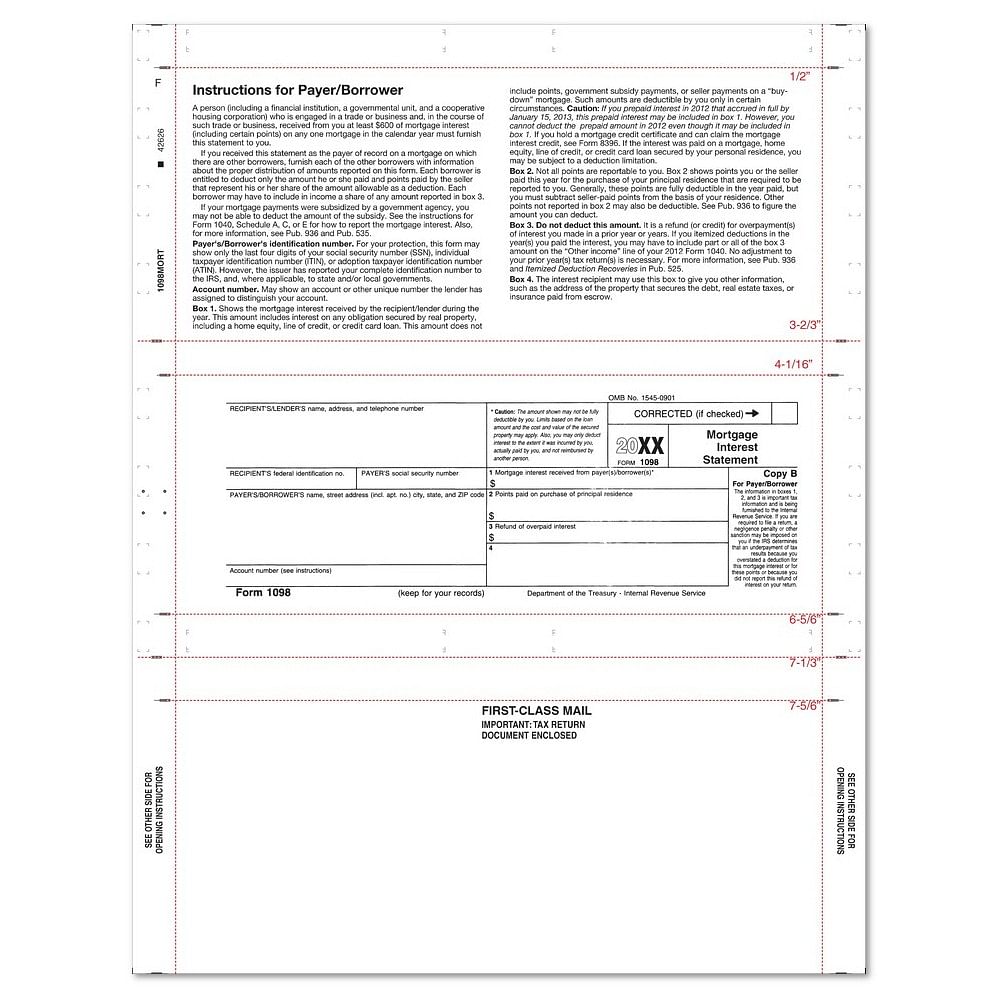

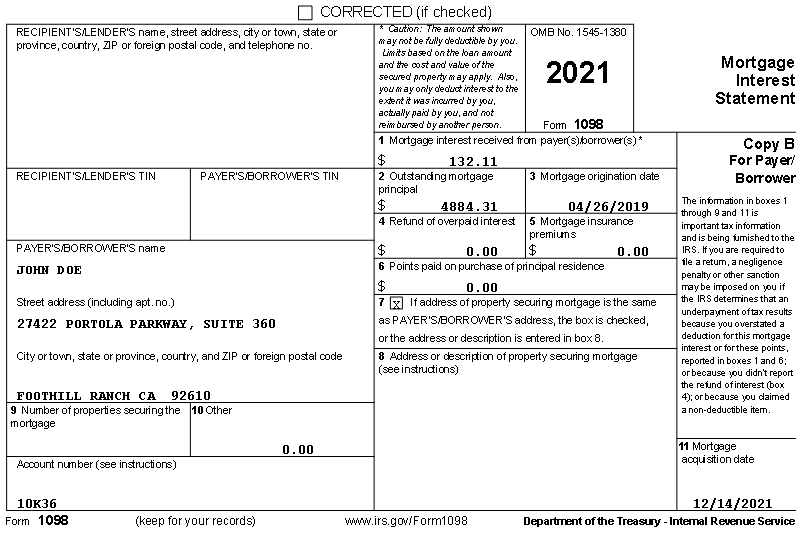

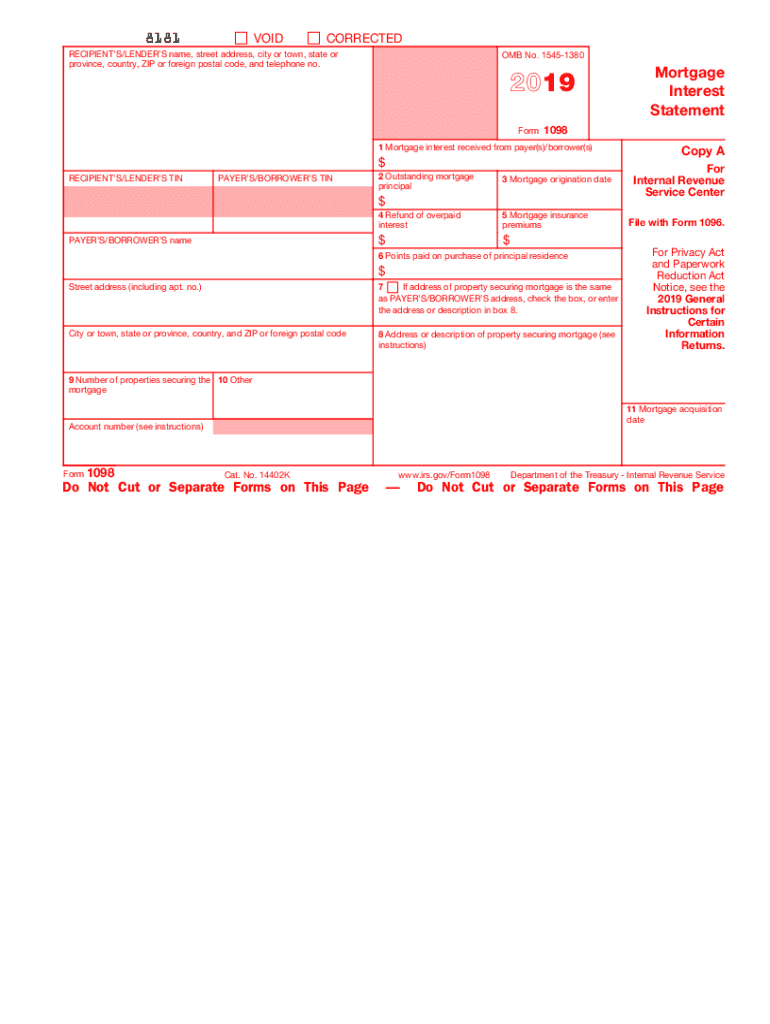

Form 1098 is used to payments of mortgage insurance premiums and in excess of 600 Lenders and businesses that receive these payments are required to record them on Form 1098 and provide borrowers with a copy of this form You should receive a Form 1098 Mortgage Interest Statement for each mortgage you have outstanding On your 1098 tax form is the following information Box 1 Interest paid not including points Box 2 Outstanding mortgage principal Box 3 Mortgage origination date Box 4 Refund of overpaid interest Box 5 Mortgage insurance premiums Box 6 Mortgage points you might be able to deduct

WHAT IS A MORTGAGE INTEREST STATEMENT 1098 A year end statement also known as IRS tax form 1098 is essentially a status update on a mortgage It s a document that is sent out and shows how much mortgage interest mortgage points and property taxes have been paid by the borrower that year A separate Form 1098 which is also known as a Mortgage Interest Statement should be filed for each mortgage on which interest was paid Reportable Interest Use Form 1098 to report only interest Worth 600 or more Paid received in the course of a trade business Not paid by a corporation partnership trust estate association or company

More picture related to Printable 2108 1098 Mortgage Forms

1098 Mortgage Interest Statement Copy A

https://computerforms.biz/uploads/image/Product_Images/L18A.jpg

8 1 2 X 11 Z Fold 1098 Mortgage Tax Forms Box Of 500

https://suppliesshops.gumlet.io/images/1098MORT-Front.jpg

43 What Is A 1098 Mortgage Interest Statement AnbreenTommie

https://www.phoenixphive.com/images/products/detail/b1098py05.2.png

Originally written December 3 2020 Last updated September 11 2023 Every year Rocket Mortgage is required to report Form 1098 the Mortgage Interest Statement to the Internal Revenue Service IRS for your mortgage and provide this statement to you This statement assists homeowners in filing their own tax forms required by the IRS particularly in helping to take advantage of home tax As a mortgage lender you are required to file Form 1098 annually with the IRS and provide a copy to the borrower The deadline for filing Form 1098 is January 31st of the year following the tax year in question For example if you are reporting mortgage interest paid in 2022 you must file Form 1098 by January 31 2023

Your year end tax documents The 1098 Statement One of the most important documents you should make sure you have is the year end 1098 Statement This statement provides the mortgage interest you have paid on your mortgage loan during the calendar year and is reported to the Internal Revenue Service While the 1098 statement provides the total I pay mortgage insurance premiums monthly Why isn t that listed in Box 5 Mortgage insurance premiums on my Form 1098 Box 5 Mortgage insurance premiums applies only to loans closed after December 31 2006 Also Box 5 may not be reported on Form 1098 if the deduction for mortgage insurance premiums paid is not extended for the current

How To Print And File Tax Form 1098 Mortgage Interest Statement

https://www.halfpricesoft.com/1099s_software/images/1098_recipient_copy.jpg

1098 Mortgage Interest Forms United Bank Of Union

https://www.ubu.bank/assets/files/aIsQVmDD/Graphic - 1098 Sample 2020.png

https://1098-taxform.com/

IRS Form 1098 is an essential document that serves as a mortgage interest statement for taxpayers in the United States It is issued by a mortgage lender to the borrower detailing the amount of interest and related expenses paid on a mortgage during the tax year

https://www.irs.gov/instructions/i1098

Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your trade or business from an individual including a sole proprietor Report only interest on a mortgage defined later File a separate Form 1098 for each mortgage

Form 1098 And Your Mortgage Interest Statement

How To Print And File Tax Form 1098 Mortgage Interest Statement

1098 Mortgage Fill Out Sign Online DocHub

IRS Tax Forms

:max_bytes(150000):strip_icc()/Form1098-30d7d922c32748bea2a293a28fbbe778.jpg)

1098 Form 2023 Printable Forms Free Online

1098 Forms The Purpose They Solve Print EZ

1098 Forms The Purpose They Solve Print EZ

Form 1098 Mortgage Interest 2019 Fill Out And Sign Printable PDF Template SignNow

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)

Form 1098 Mortgage Interest Statement Definition

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

Printable 2108 1098 Mortgage Forms - A separate Form 1098 which is also known as a Mortgage Interest Statement should be filed for each mortgage on which interest was paid Reportable Interest Use Form 1098 to report only interest Worth 600 or more Paid received in the course of a trade business Not paid by a corporation partnership trust estate association or company