Printable Clothing Donation Form Taxes Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property the claimed value of which exceeds 500

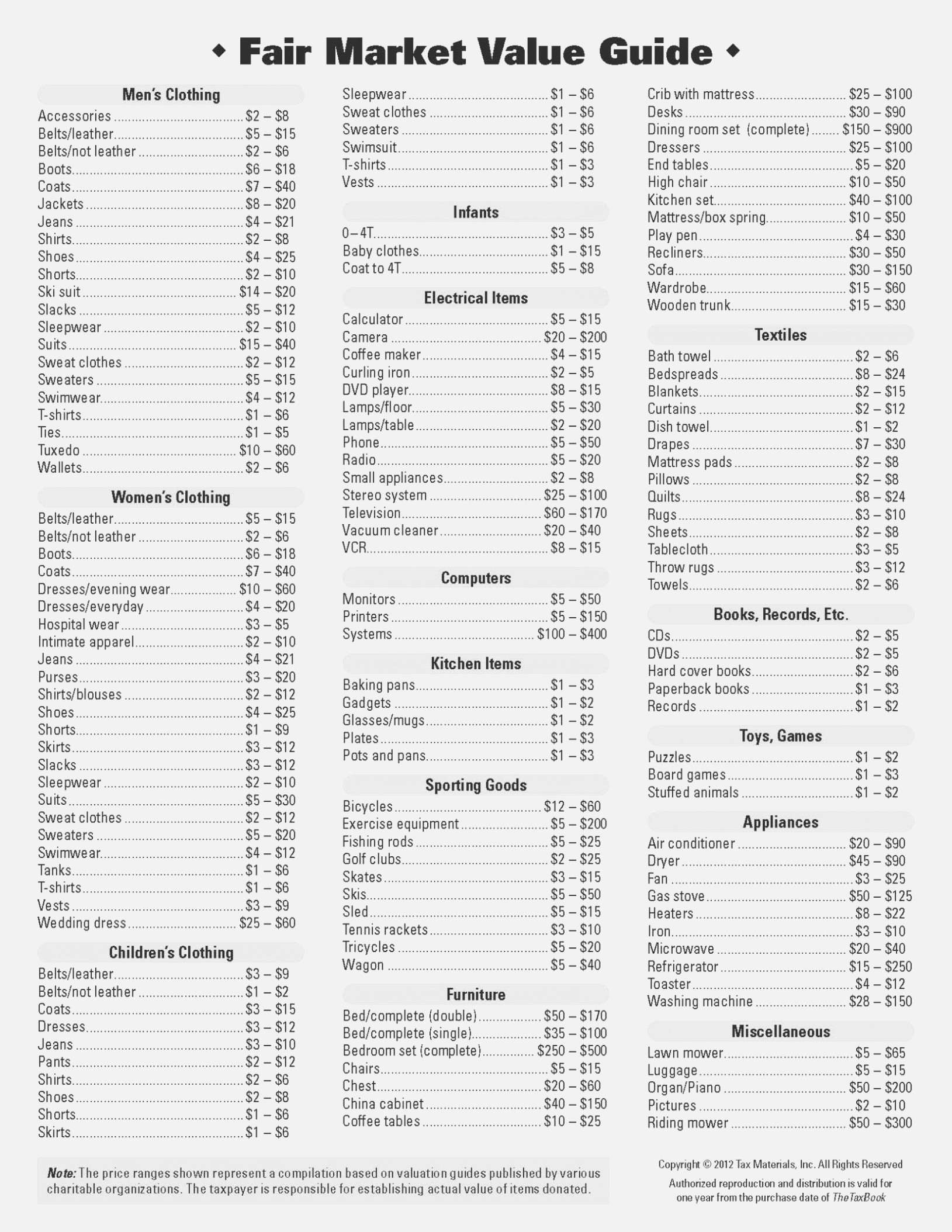

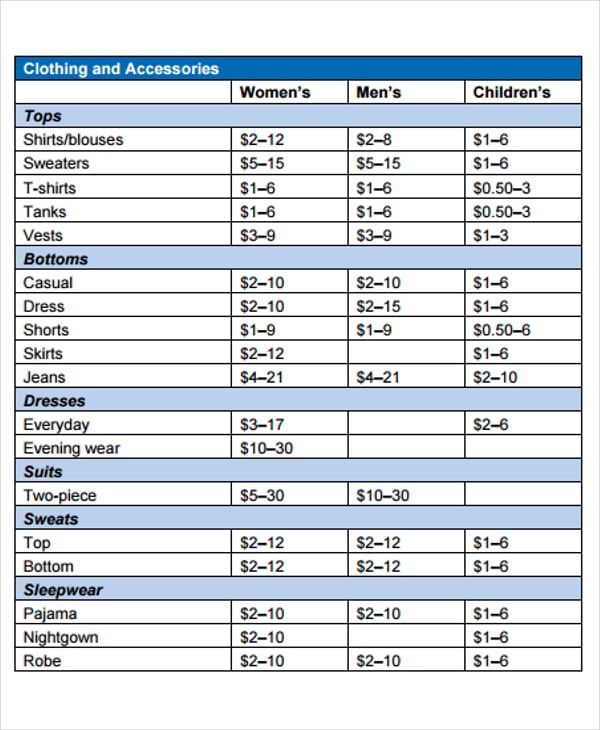

If you donate an item worth more than 50 000 you ll need to get a Statement of Value from the IRS which will cost you at least 7 500 Determining a Donated Item s Fair Market Value The IRS uses fair market value FMV to establish the amount you can deduct for almost all donated items 8283 Form Rev December 2023 Department of the Treasury Internal Revenue Service Noncash Charitable Contributions Attach one or more Forms 8283 to your tax return if you claimed a total deduction of over 500 for all contributed property Go to

Printable Clothing Donation Form Taxes

Printable Clothing Donation Form Taxes

http://www.templatesdoc.com/wp-content/uploads/2016/04/donation-form-example-7941.jpg

Clothing Donation List Template New Concept

https://lh3.googleusercontent.com/proxy/M1u-YSO4M2gfqvphNRsK1H1Jm4ORkkqoNzH8z4XCrwrrzQbxD6EVju8yEkxttssyEePlhDglD7g0ERG1oyn6Atu3HUtvXLzFZRYtdGlykgCS7hdXYtNA1_nMpUVCPBfG6VqR=s0-d

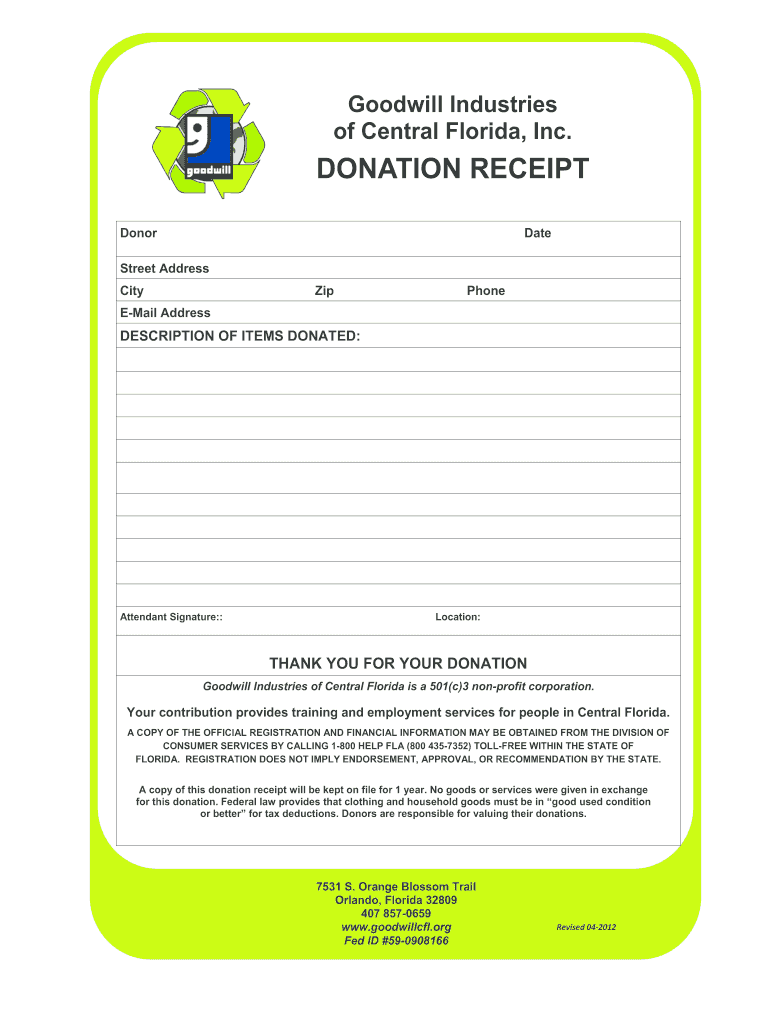

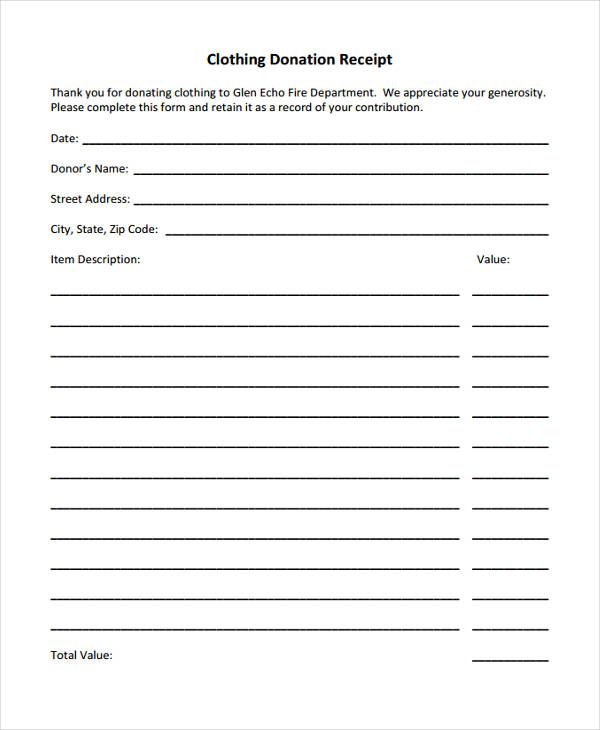

FREE 20 Donation Receipt Templates In PDF Google Docs Google Sheets Excel MS Word

https://images.sampletemplates.com/wp-content/uploads/2015/02/02071643/Tax-Deductible-Donation-Receipt-Template.jpeg

Planet Aid accepts donations of men s women s and children s clothes shoes and accessories as well as blankets bedspreads sheets towels curtains and fabric Planet Aid is a tax exempt nonprofit under IRS code 501 c 3 Tax number 04 3348171 After you ve dropped off a bag of clothes shoes or household textiles in one of our yellow Planet Aid bins makes sure to go to our website to easily get a receipt by filling out our simple form When determining the value of your donation keep in mind that the IRS only allows a deduction for items that are still in reasonably good

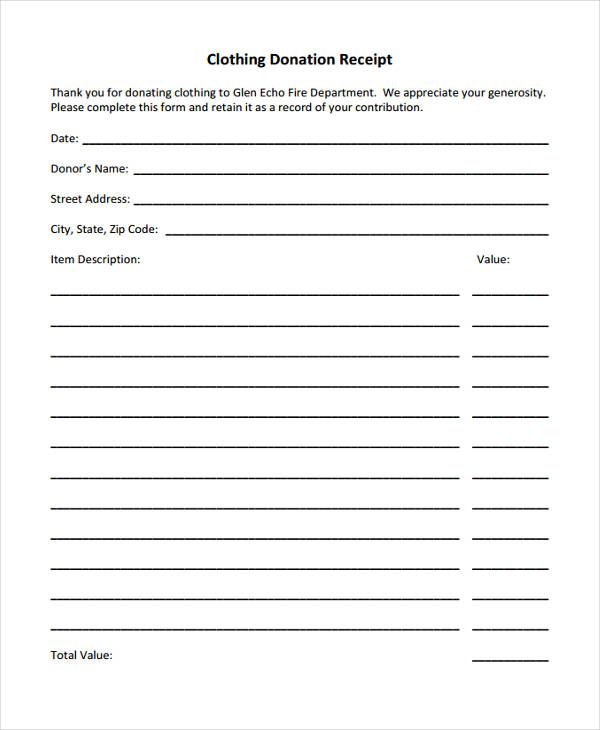

If you make a payment or transfer property to or for the use of a qualified organization and you receive or expect to receive a state or local tax credit or a state or local tax deduction in return your charitable contribution deduction may be reduced See State or local tax credit later Photographs of missing children Page 1 of 1 CLOTHING DONATION RECEIPT Charity Name Street Address City State Zip

More picture related to Printable Clothing Donation Form Taxes

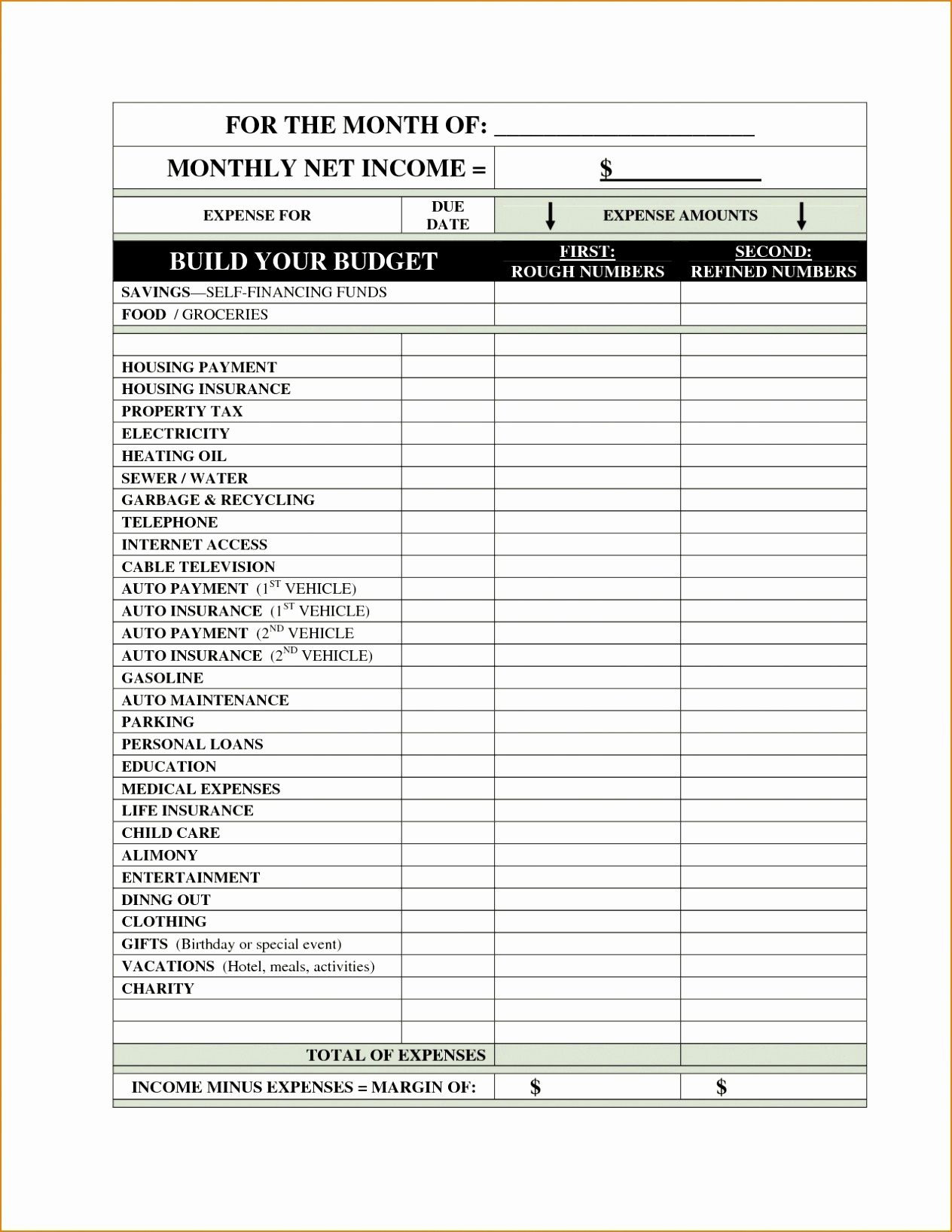

Clothing Donation Worksheet For Taxes Elegant Goodwill Donation Db excel

https://db-excel.com/wp-content/uploads/2019/09/clothing-donation-worksheet-for-taxes-elegant-goodwill-donation.jpg

Clothing Donation Receipt Template Restaurant Receipt Id Card Template Receipt Template Market

https://i.pinimg.com/originals/4d/d0/86/4dd0861cc873c705b5e524ee883d9fe4.jpg

FL Donation Receipt 2012 2022 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/100/92/100092121/large.png

The IRS says donated clothing and other household goods must be in good used condition or better If you claim a deduction of 500 or more for a used item that s not in good condition the Donation Receipt Template Create a high quality document now A Donation Receipt is used to claim a tax deduction for clothing and household property itemized on an individual s taxes A donor is responsible for valuing the donated items and it s important not to abuse or overvalue such items in the event of a tax audit

Clothing or household items unless the clothing or house hold item is in good used condition or better The IRS is au thorized by regulation to deny a deduction for any contri bution of clothing or a household item that has minimal monetary value such as used socks and undergarments Noncash Donation Tracker Items 501 to 5 000 Date of Part 1 Keeping Track of Your Donations Download Article 1 Make sure you donate to a tax exempt organization You ll be able to receive a tax deduction only if you donate to a tax exempt organization Make sure the organization is a 501 c 3 tax exempt organization registered with the IRS 1

FREE 12 Donation Receipt Forms In PDF MS Word Excel

https://images.sampleforms.com/wp-content/uploads/2017/04/Clothing-Donation-Receipt-Form.jpg

Clothing Donation Tax Deduction Worksheet Db excel

https://db-excel.com/wp-content/uploads/2019/09/clothing-donation-tax-deduction-worksheet-2.jpg

https://www.irs.gov/forms-pubs/about-form-8283

Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property the claimed value of which exceeds 500

https://www.thebalancemoney.com/donation-value-guide-4172778

If you donate an item worth more than 50 000 you ll need to get a Statement of Value from the IRS which will cost you at least 7 500 Determining a Donated Item s Fair Market Value The IRS uses fair market value FMV to establish the amount you can deduct for almost all donated items

Where Can I Donate My Clothes For Money

FREE 12 Donation Receipt Forms In PDF MS Word Excel

FREE 20 Donation Receipt Templates In PDF Google Docs Google Sheets Excel MS Word

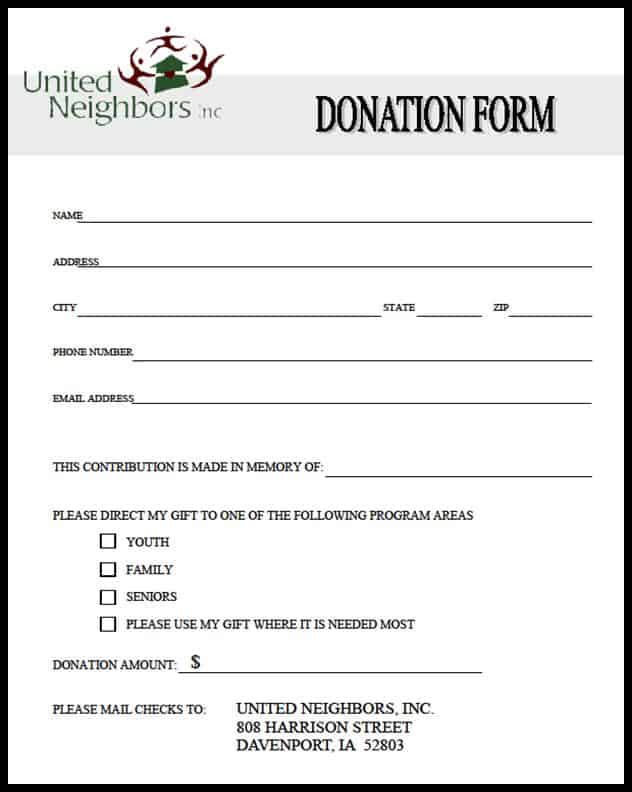

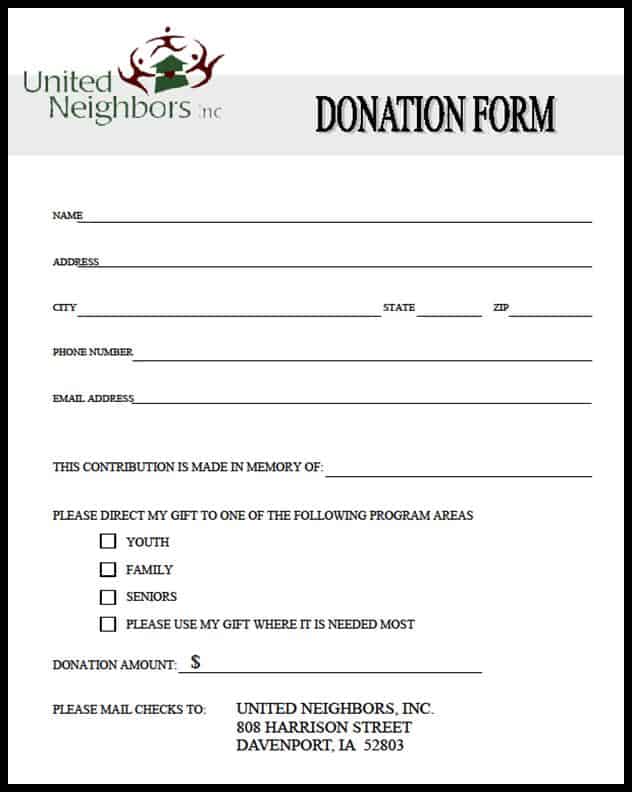

Tax Donation Form Template SampleTemplatess SampleTemplatess

Clothing Donation Form Template Latesttrailersongs

FREE 36 Printable Receipt Forms In PDF MS Word

FREE 36 Printable Receipt Forms In PDF MS Word

Clothing Donation List Template New Concept

Clothing Donation Form Template SampleTemplatess SampleTemplatess

Printable Goodwill Donation Receipt Printable Templates

Printable Clothing Donation Form Taxes - If you make a payment or transfer property to or for the use of a qualified organization and you receive or expect to receive a state or local tax credit or a state or local tax deduction in return your charitable contribution deduction may be reduced See State or local tax credit later Photographs of missing children