Printable Employer Quarterly Unemployment Insurance Tax Report Form Employers must report all wages paid to employees However taxes are due only on the first 9 500 per employee per year Qualified employers may defer quarterly taxes of 5 00 or less until January 31st of the following year Tax and wage reports may be filed using the preferred electronic filing methods available on the Employer Portal

Kentucky s Unemployment Insurance Self Service Web Submit quarterly tax reports over the Internet through either an on screen form or a file upload option 2024 Taxable Wage Base will increase to 11 400 per worker SCUF assessment will continue to be in effect for reporting year 2024 pursuant to KRS 341 243 Box 2 Amount paid Enter the amount paid with Form 940 Box 3 Name and address Enter your name and address as shown on Form 940 Enclose your check or money order made payable to United States Treasury Be sure to enter your EIN Form 940 and 2023 on your check or money order Don t send cash

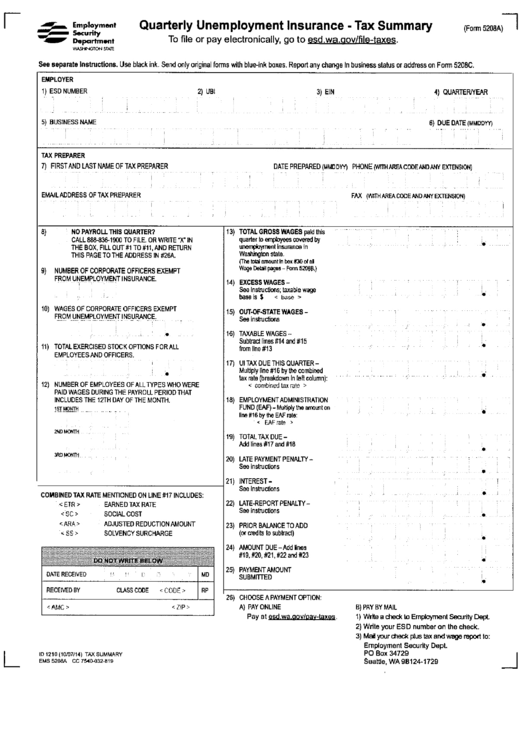

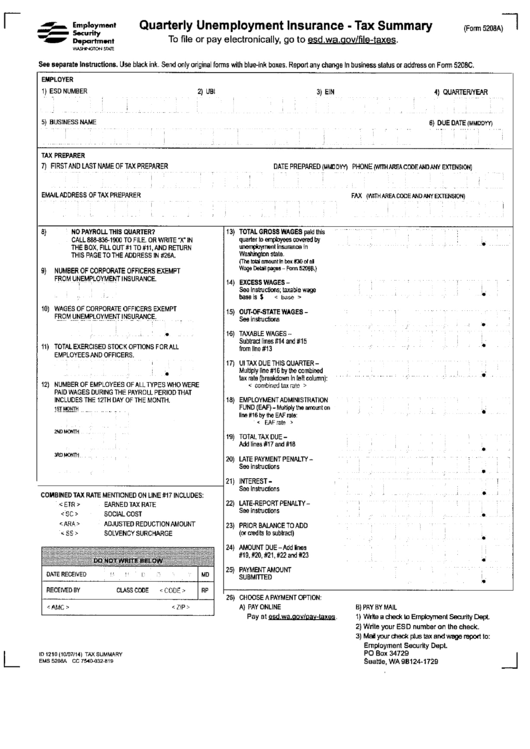

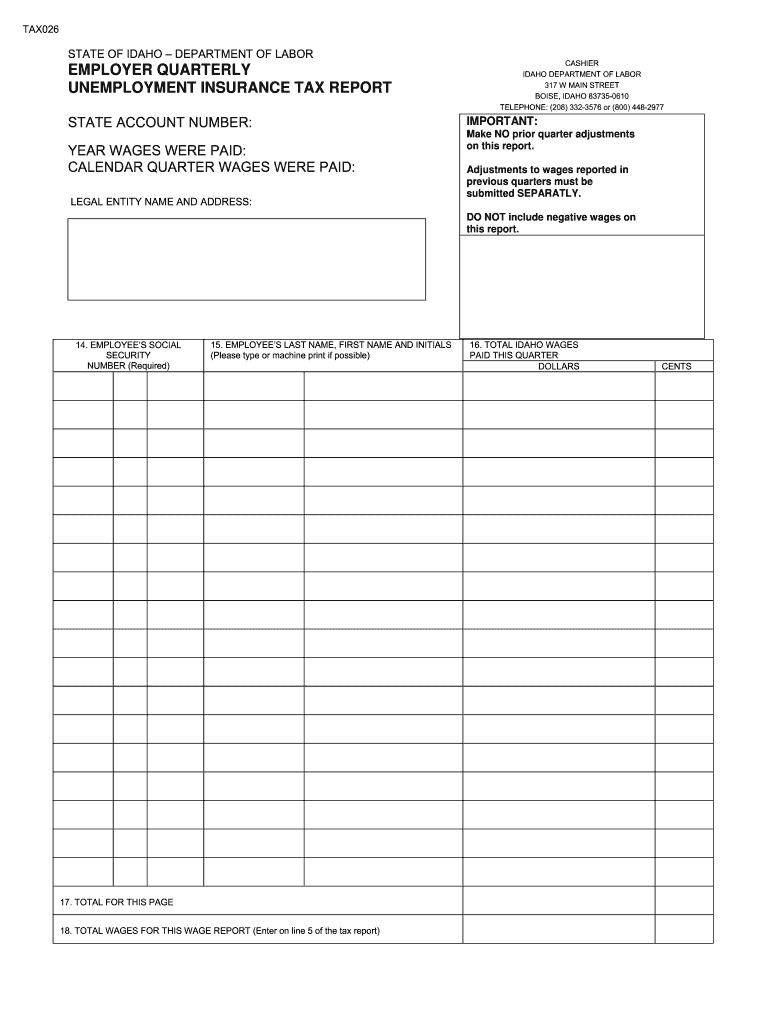

Printable Employer Quarterly Unemployment Insurance Tax Report Form

Printable Employer Quarterly Unemployment Insurance Tax Report Form

https://data.formsbank.com/pdf_docs_html/245/2455/245555/page_1_thumb_big.png

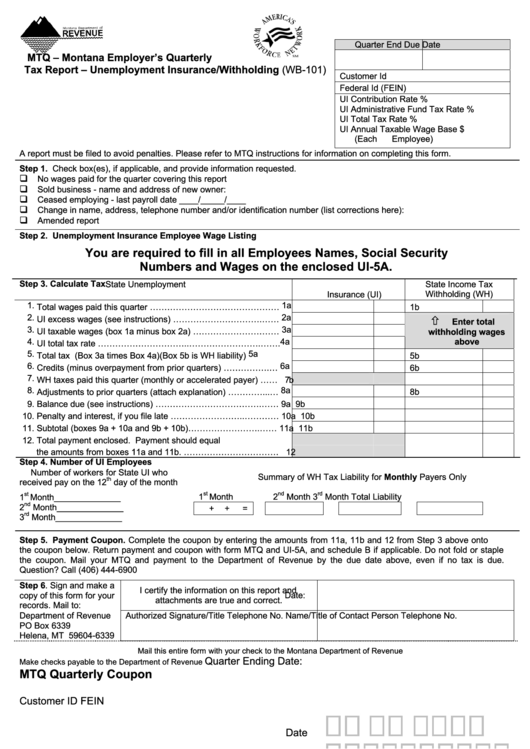

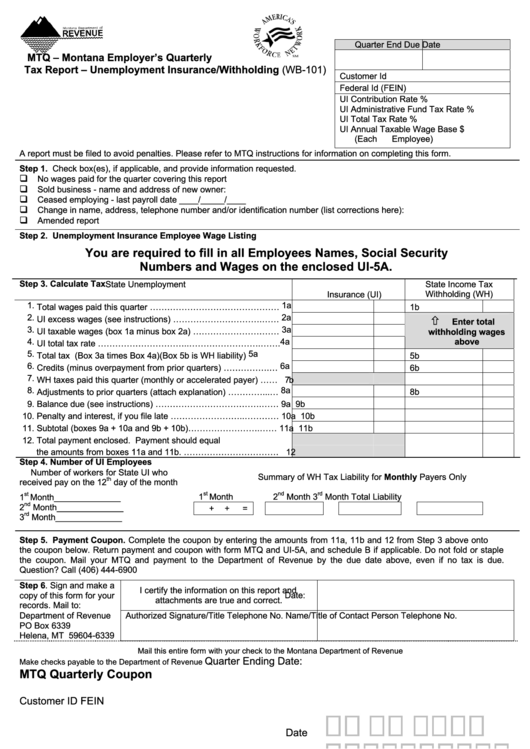

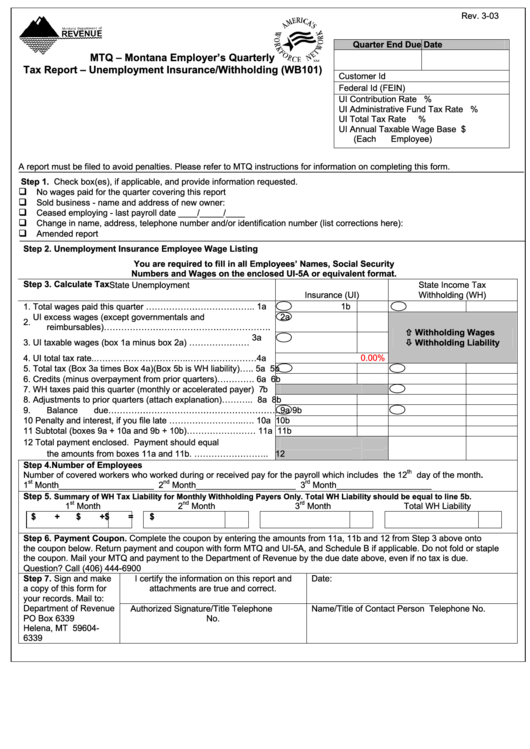

Form Wb 101 Mtq Montana Employer S Quarterly Tax Report Unemployment Insurance withholding

https://data.formsbank.com/pdf_docs_html/342/3421/342151/page_1_thumb_big.png

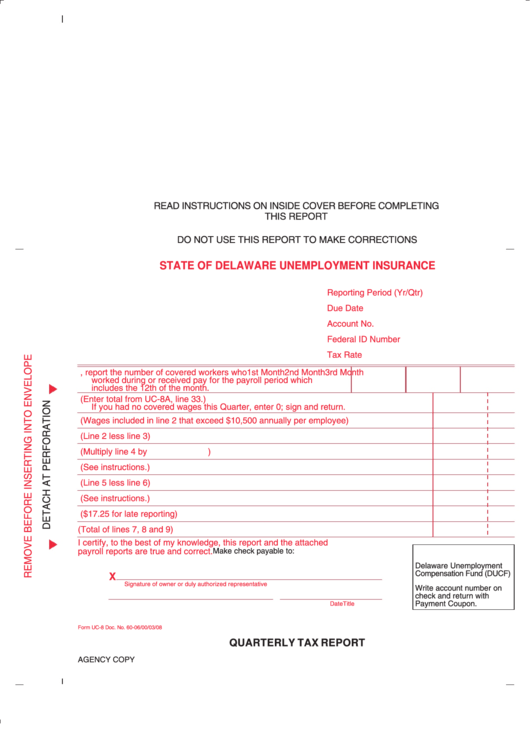

Quarterly Tax Report Form Unemployment Insurance Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/251/2516/251614/page_1_thumb_big.png

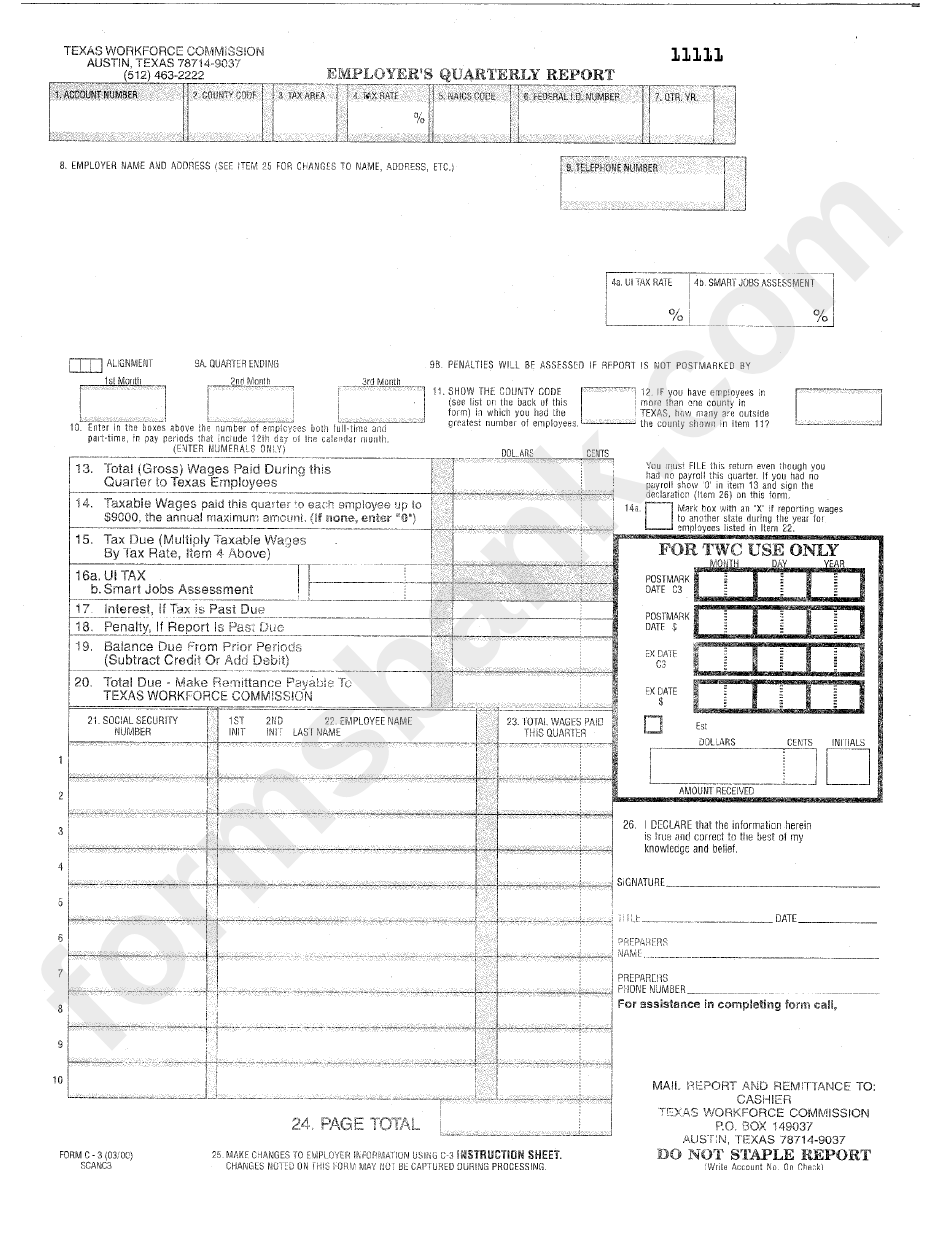

Tax Forms Instructions Most of the filing requirements for Texas employers may be accomplished online Registering and updating a tax account filing and adjusting wage reports and paying taxes are all possible online But sometimes a tax form is necessary Employer Registration Account Update Forms C 1 C 1AM Key features of eForms at the VEC No Sign Up required Quick and Easy to use Immediate confirmation for a filed report Print a copy of your filed report for your records Pay your taxes online with no additional fees For businesses with 1 25 employees

Employers are required to file the Quarterly Tax and Wage Report Form NCUI 101 for each quarter beginning with the quarter in which employment begins Tax must be paid on each employee s wages up to the taxable wage base for each calendar year Quarterly wages must be reported for each employee by name and Social Security number 1 total taxes due employer s quarterly tax and wage report a penalty will be applied to any reports that contain 10 or more wage items indicates a required field enter your federal tax number here if any changes occurred in the ownership telephone number or address complete form ncui 101 a penalty will be

More picture related to Printable Employer Quarterly Unemployment Insurance Tax Report Form

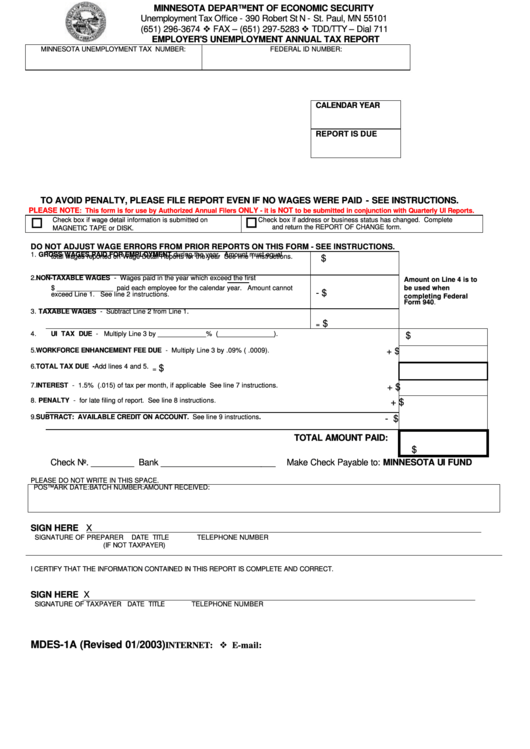

Form Mdes 1a Employer S Unemployment Annual Tax Report Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/311/3117/311701/page_1_thumb_big.png

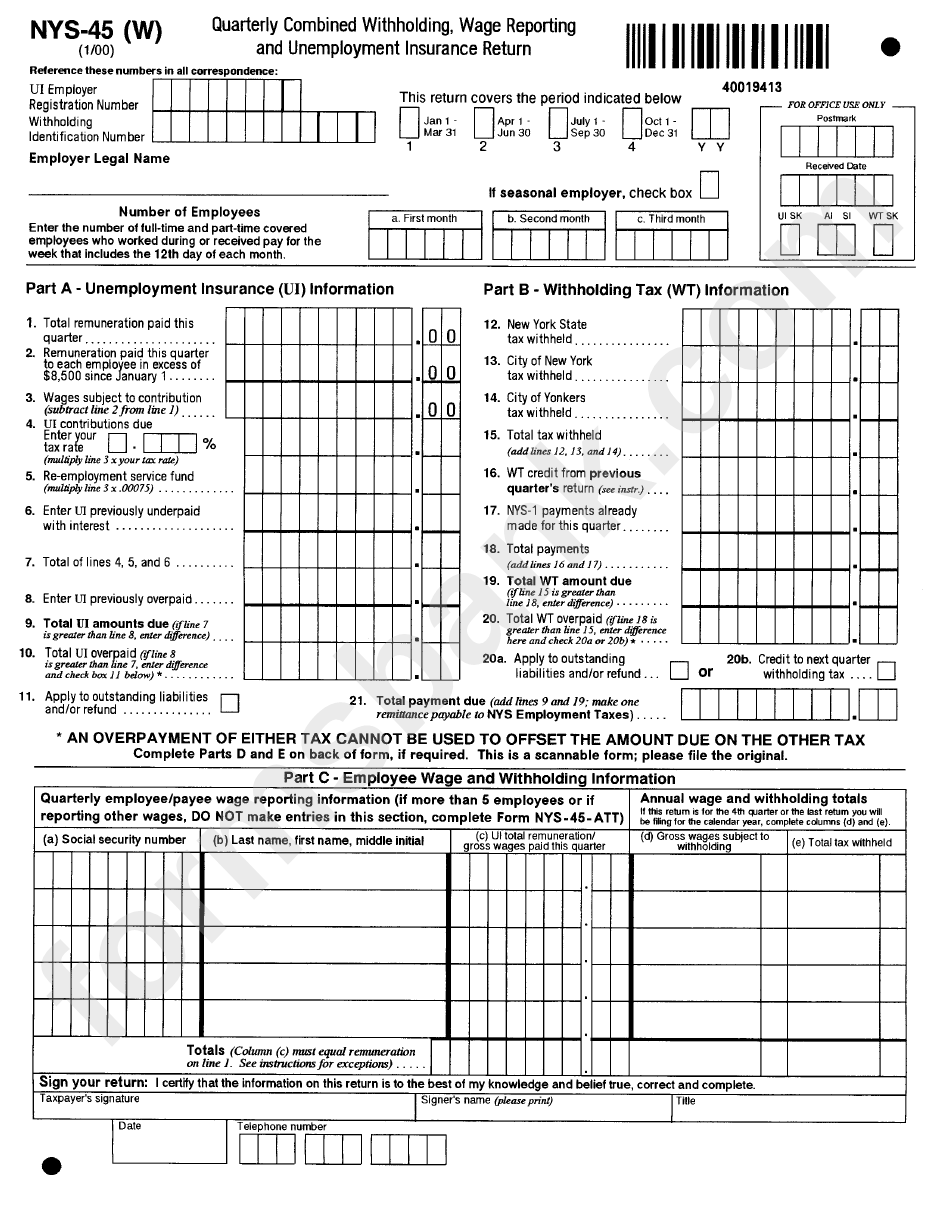

Form Nys 45 W Quarterly Combined Withholding Wage Reporting And Unemployment Insurance

https://data.formsbank.com/pdf_docs_html/268/2689/268959/page_1_bg.png

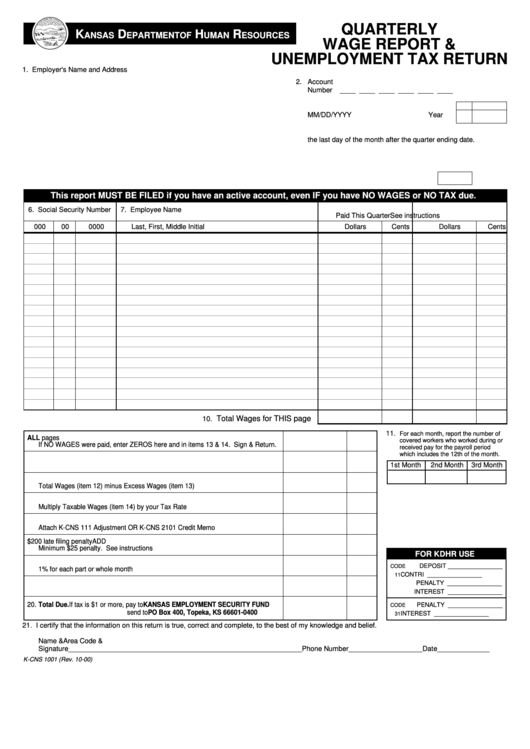

Fillable Form K Cns 1001 Quarterly Wage Report Unemployment Tax Return 2010 Printable Pdf

https://data.formsbank.com/pdf_docs_html/302/3021/302127/page_1_thumb_big.png

Use Form 940 to report your annual Federal Unemployment Tax Act FUTA tax Together with state unemployment tax systems the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs Most employers pay both a federal and a state unemployment tax Only employers pay FUTA tax Employers use Schedule D Form 941 to explain certain discrepancies between Forms W 2 Wage and Tax Statement and Forms 941 Employer s QUARTERLY Federal Tax Return for the totals of Social security wages Medicare wages and tips Social security tips federal income tax withheld Advance earned income credit EIC payments

Amend a prior quarter by using an Amended Quarterly Combined Withholding Wage Reporting and Unemployment Insurance Return Form NYS 45x You may also contact the NYS Department of Taxation and Finance at 518 457 5431 for a paper copy of the form For questions about amending a report the NYS Department of Taxation and Finance provides UNEMPLOYMENT INSURANCE TAX 573 751 1995 QUARTERLY CONTRIBUTION AND WAGE REPORT File online at uinteract labor mo gov 1 EMPLOYER NAME AND ADDRESS 14 FEDERALID NUMBER If mailing return this page with remittance to Division of Employment Security P O Box 888 Jefferson City MO 65102 0888

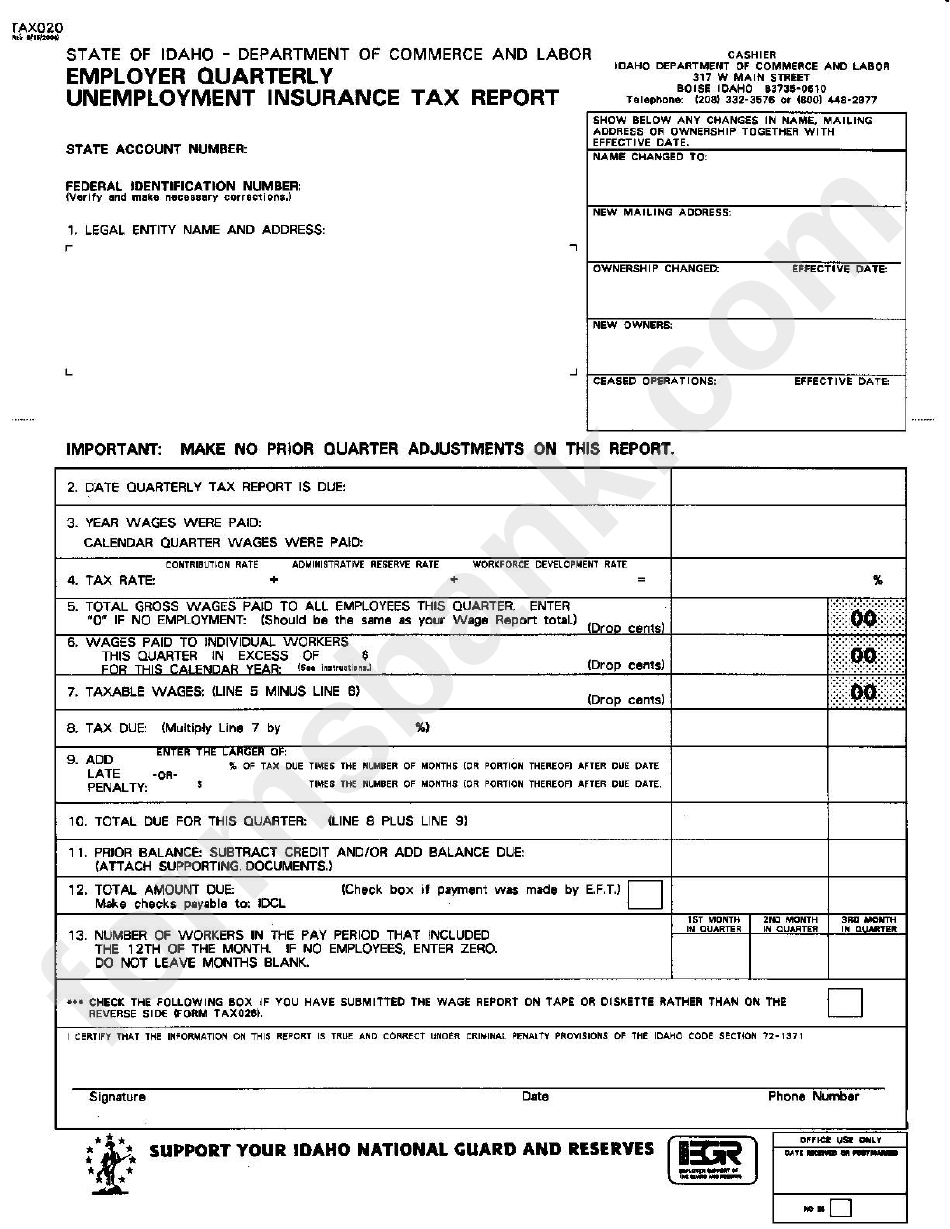

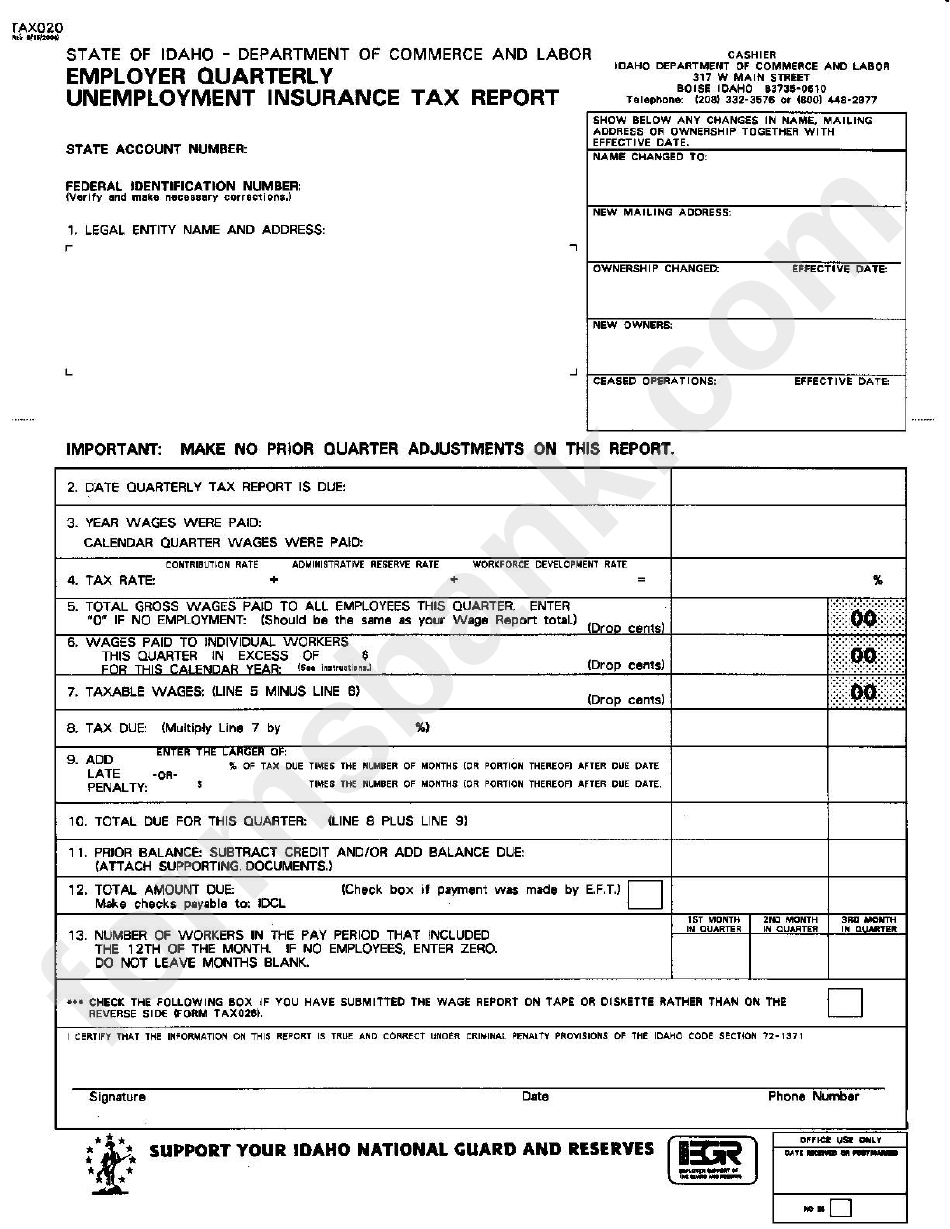

Form Tax020 Employer Quarterly Unemployment Insurance Tax Report 2004 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/228/2282/228214/page_1_bg.png

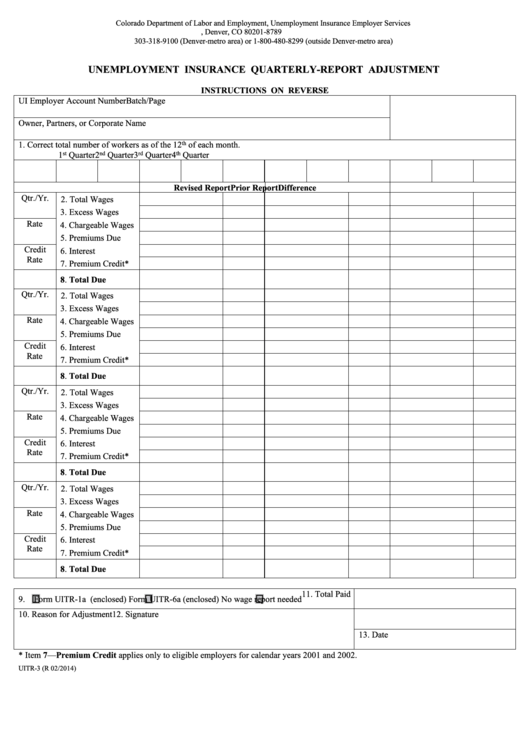

Form Uitr 3 Unemployment Insurance Quarterly report Adjustment Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/264/2649/264978/page_1_thumb_big.png

https://dol.georgia.gov/file-tax-and-wage-reports-and-make-payments

Employers must report all wages paid to employees However taxes are due only on the first 9 500 per employee per year Qualified employers may defer quarterly taxes of 5 00 or less until January 31st of the following year Tax and wage reports may be filed using the preferred electronic filing methods available on the Employer Portal

https://kewes.ky.gov/

Kentucky s Unemployment Insurance Self Service Web Submit quarterly tax reports over the Internet through either an on screen form or a file upload option 2024 Taxable Wage Base will increase to 11 400 per worker SCUF assessment will continue to be in effect for reporting year 2024 pursuant to KRS 341 243

Fillable Form Wb101 Mtq Montana Employer S Quarterly Tax Report Unemployment Insurance

Form Tax020 Employer Quarterly Unemployment Insurance Tax Report 2004 Printable Pdf Download

Unemployment Tax Form Fill Out Sign Online DocHub

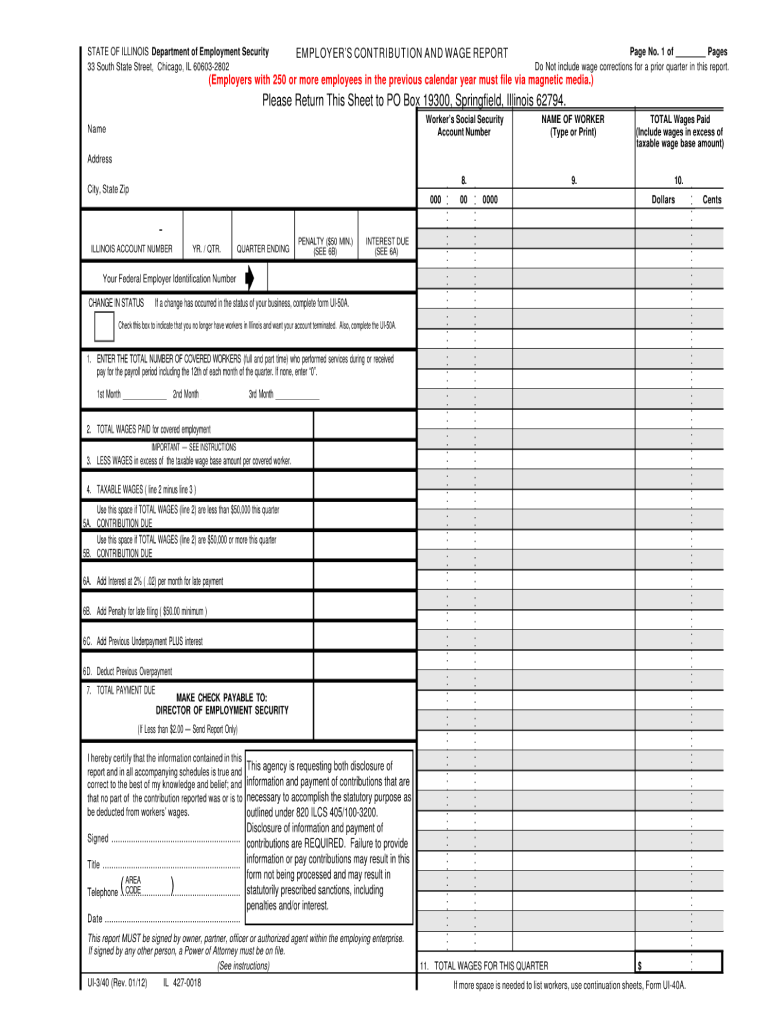

What Wages Are Subject To Illinois Unemployment Tax Fill Out Sign Online DocHub

Form C 3 Employer S Quarterly Report Printable Pdf Download

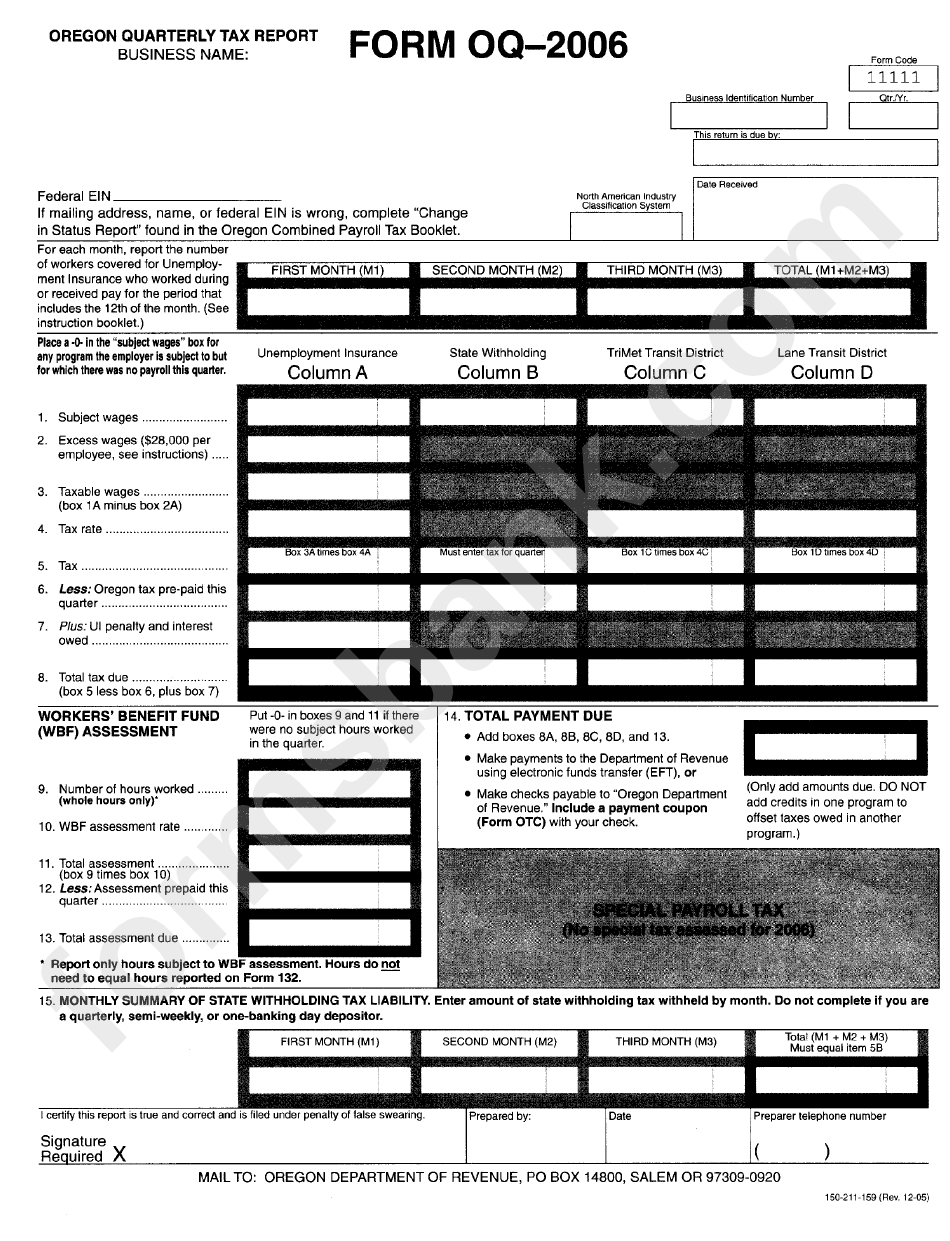

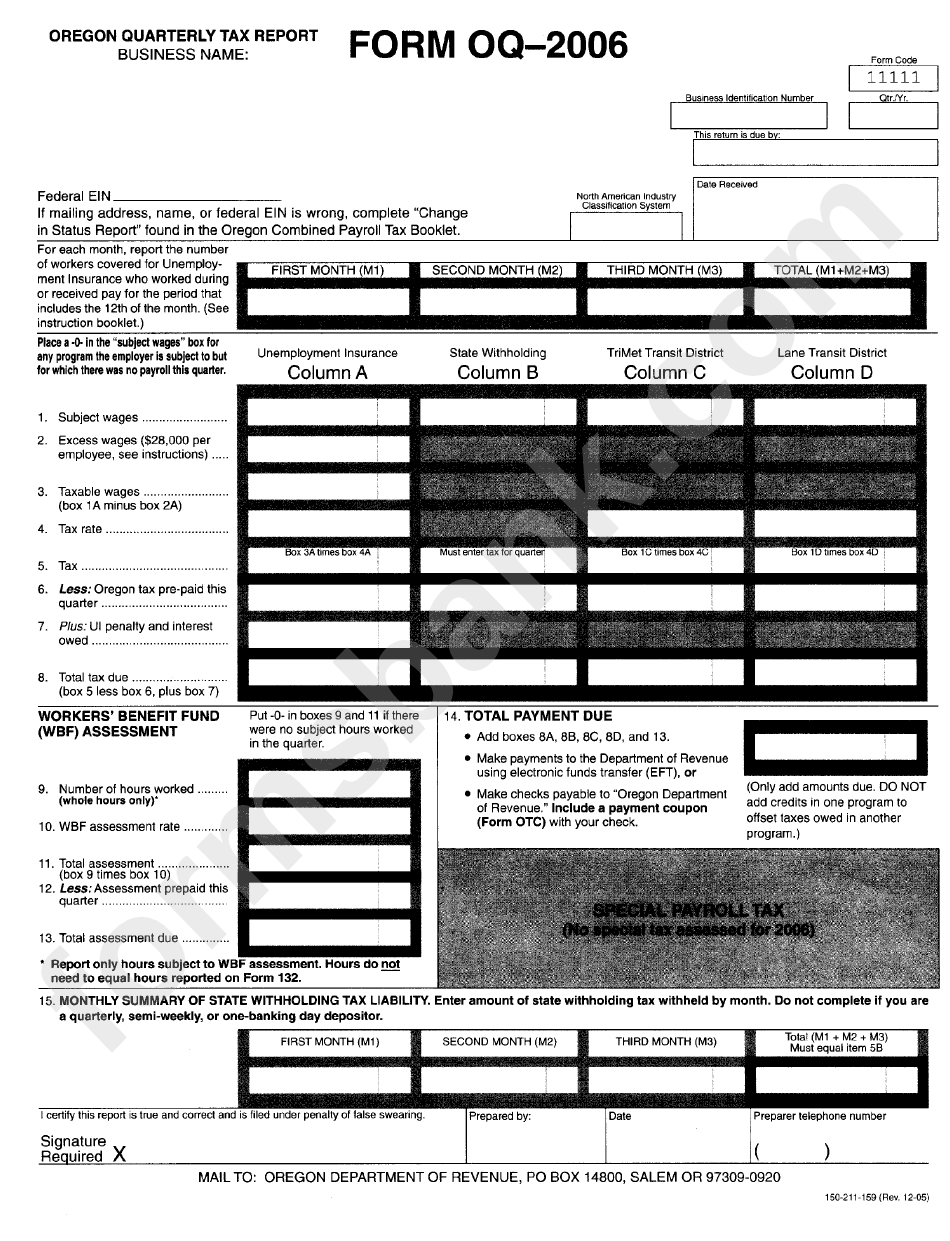

Form Oq 132 Oregon Quarterly Tax Report Unemployment Insurance Employee Detail Report 2006

Form Oq 132 Oregon Quarterly Tax Report Unemployment Insurance Employee Detail Report 2006

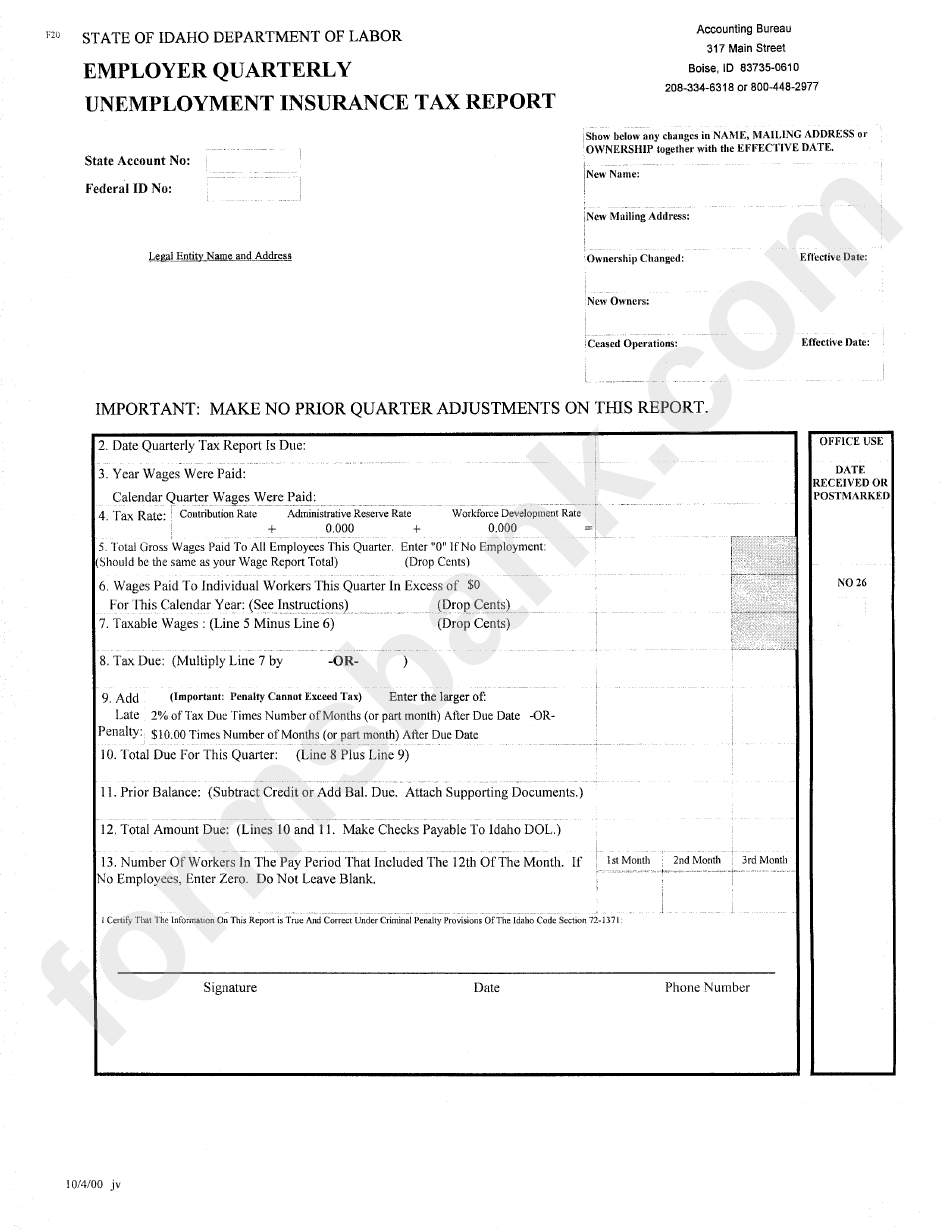

Employer Quarterly Unemployment Insurance Tax Report Form 2000 Printable Pdf Download

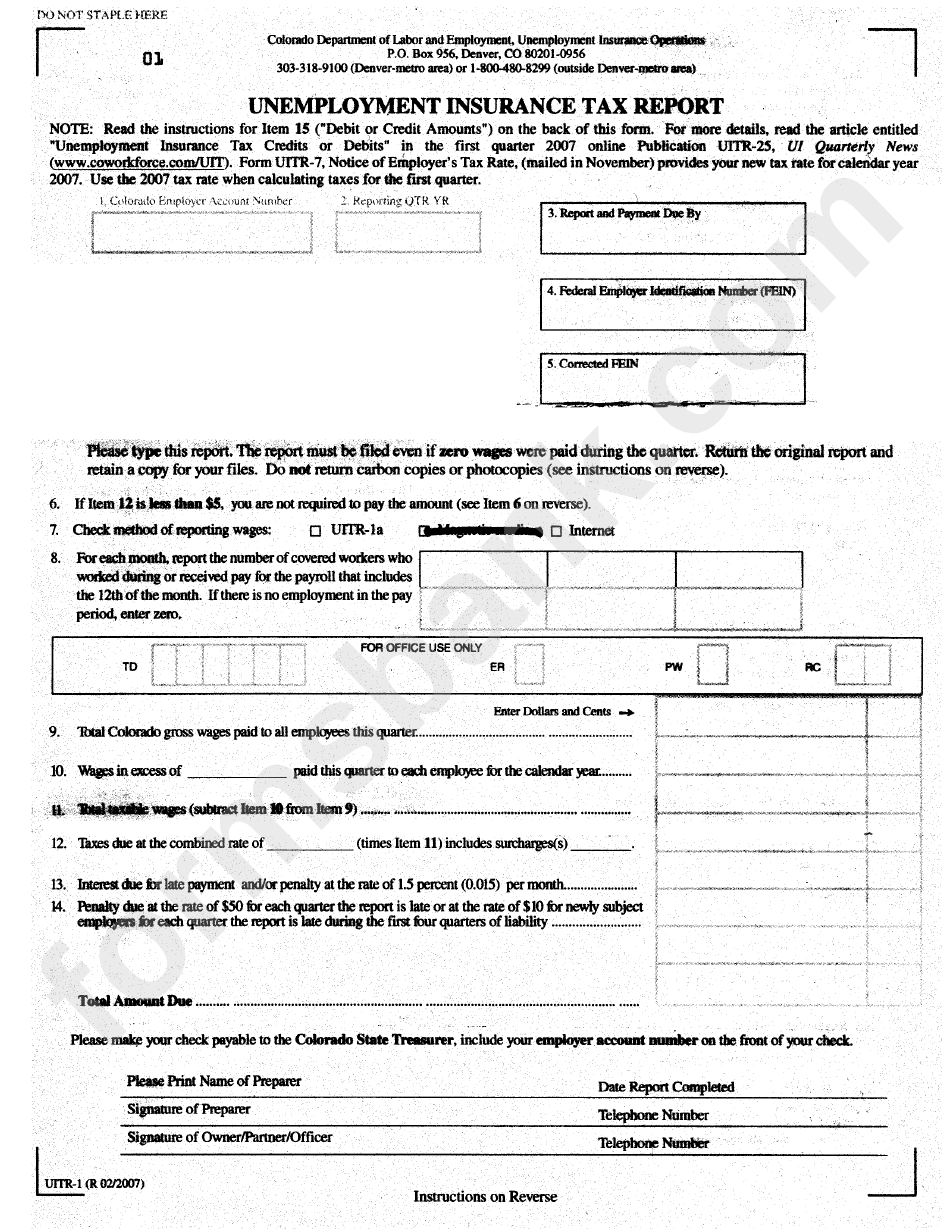

Form Uitr 1 Unemployment Insurance Tax Report Colorado Department Of Labor And Employment

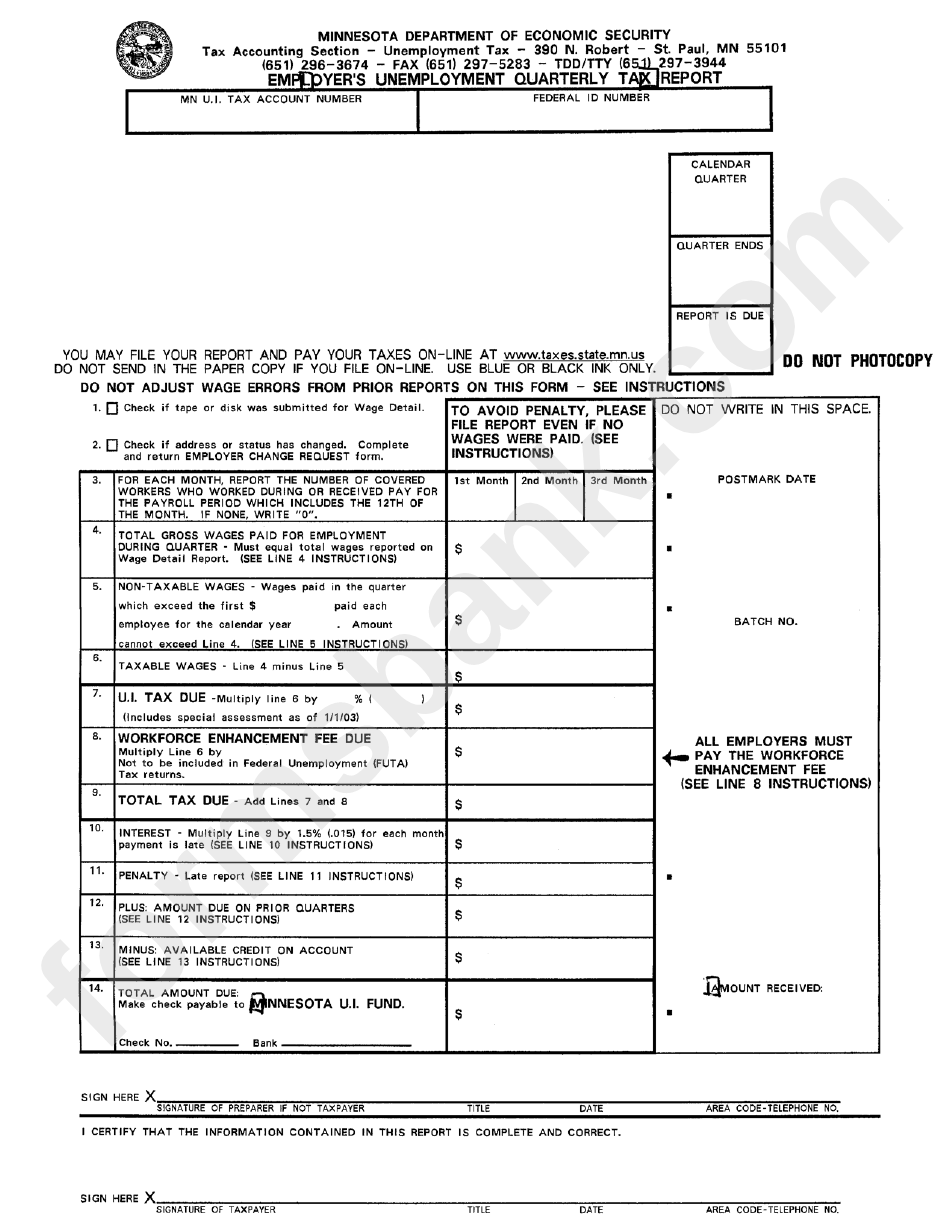

Employer S Unemployment Quarterly Tax Report Minnesota Department Of Economic Security

Printable Employer Quarterly Unemployment Insurance Tax Report Form - Forms You may obtain the following forms at Unemployment Insurance Tax Employer Portal Authorization Refund Request Corporate Officer Paperwork Exemption Form Reinstatement Form