Printable End Of Year 1099 Form Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New

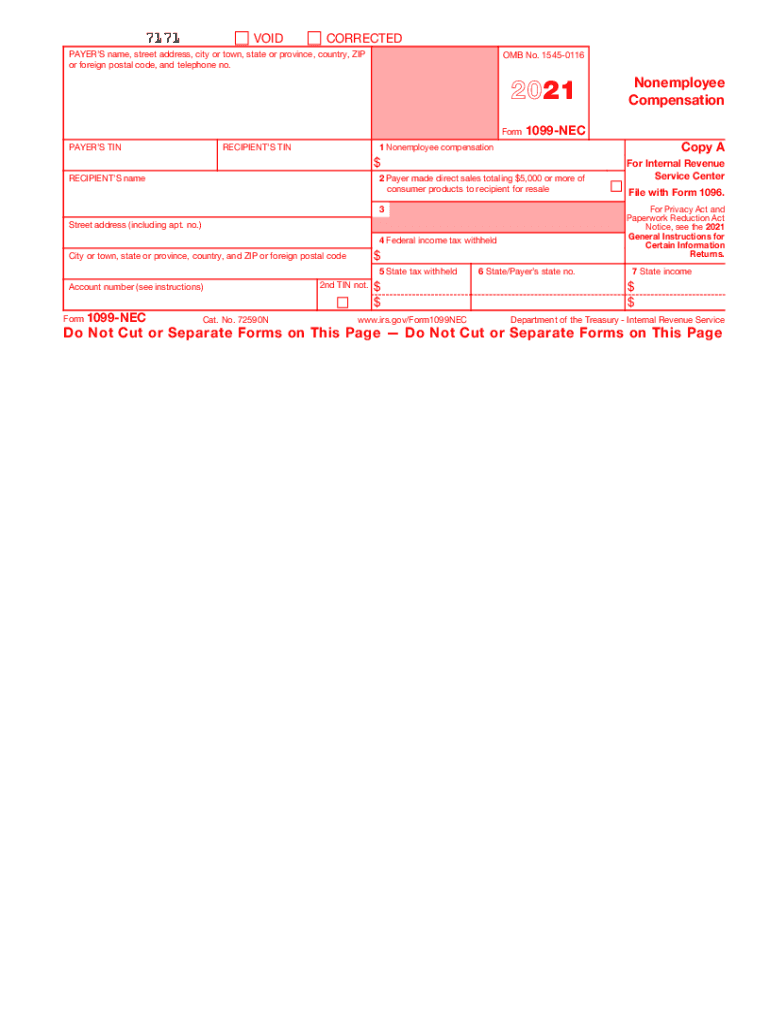

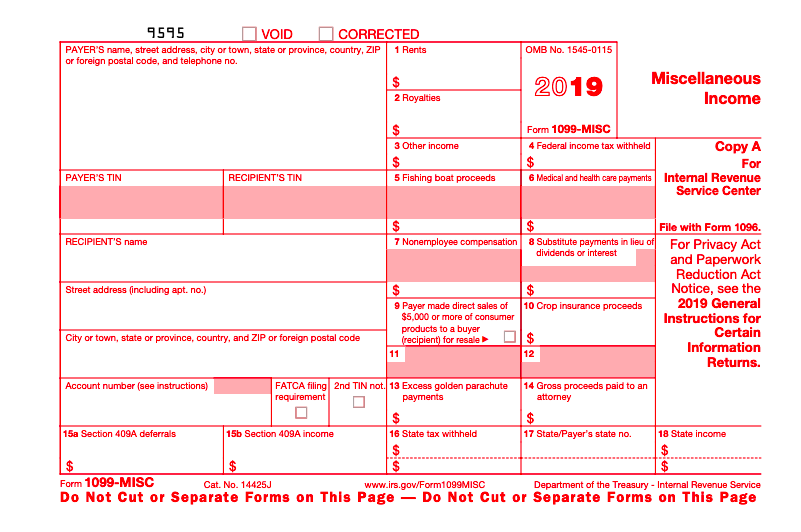

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more Beginning with Tax Year 2020 you must use Form 1099 NEC Nonemployee Compensation to report payments of nonemployee compensation NEC previously reported in box 7 on Form 1099 MISC The separate instructions for filers issuers for Form 1099 NEC are available in the Instructions for Forms 1099 MISC and 1099 NEC PDF

Printable End Of Year 1099 Form

Printable End Of Year 1099 Form

https://docs.oracle.com/cd/E16582_01/doc.91/e38288/img/ex_misc-1099.gif

Year End 1099 MISC State Copy 2 Forms P

https://online5.asurehcm.com/Help/HR_ENT/resources/images/reports/pay/pay00713p2.gif

Free Form 1099 MISC PDF Word

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

Download a copy of your 1099 or 1042S tax form so you can report your Social Security income on your tax return Your 2023 tax form will be available online on February 1 2024 Most people get a copy in the mail Sign in to your account Download your 1099 or 1042S tax form in your Social Security account Sign in Create account Starting tax year 2023 if you have 10 or more combined 1099s W 2s or other federal forms to file you must file them electronically Go to Vendors then select 1099 Forms then Print E file 1099 Forms Create your 1099s In the Choose a filing method window select Print 1099 NEC or Print 1099 MISC Specify the date range for the forms

A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC Thomson Reuters Help and Support Accounting CS Prepare form 1099 all variations Year end processing tips for Form 1099 Year end processing tips for Form 1099 We ve compiled a list of tasks to follow and resources to use as you prepare for year end 1099 form processing note

More picture related to Printable End Of Year 1099 Form

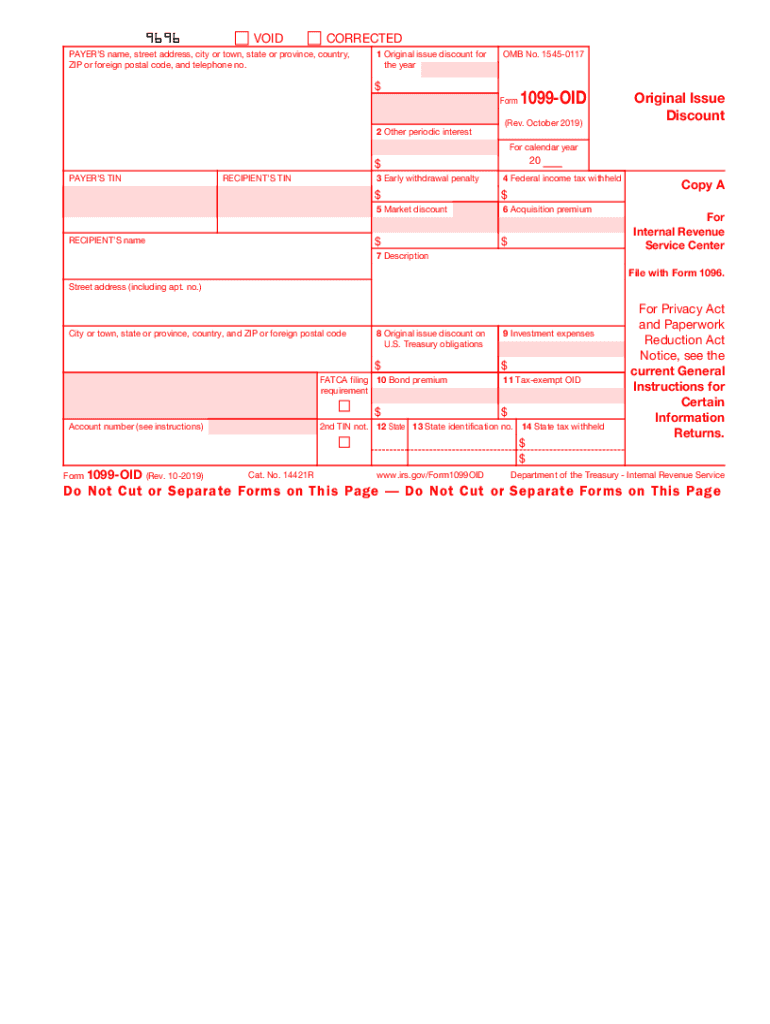

2019 2024 Form IRS 1099 OID Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/492/756/492756716/large.png

1099 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/533/156/533156765/large.png

Irs Printable 1099 Form Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/06/what-is-irs-form-1099-q-turbotax-tax-tips-videos.jpg

1099 INT reports interest income typically of 10 or more from your bank credit union or other financial institution The form reports the interest income you received any federal income taxes The Benefit Statement is also known as the SSA 1099 or the SSA 1042S Now you can get a copy of your 1099 anytime and anywhere you want using our online services A Social Security 1099 is a tax form Social Security mails each year in January to people who receive Social Security benefits It shows the total amount of benefits you received from

Follow these steps to generate either an export file or a printed 1099 statement that you can send to a vendor the IRS or a tax preparer who will transmit the 1099 forms to the IRS on behalf of your organization On the 1099 fields page Accounts payable Periodic tasks Tax 1099 1099 fields verify the information in the fields 1 Who Should Receive a 1099 Form Form 1099 is used to report certain types of non employment income to the IRS such as dividends from a stock or pay you received as an independent

1099 Form Template Create A Free 1099 Form Form

https://legaldocfinder.com/images/jumbotron/1099-form-sample.png

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/488/370/488370241/large.png

https://www.irs.gov/instructions/i1099mec

Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New

https://eforms.com/irs/form-1099/

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

IRS Form 1099 R 2023 Forms Docs 2023

1099 Form Template Create A Free 1099 Form Form

What Is A 1099 Misc Form Financial Strategy Center

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

1099 MISC Form The Ultimate Guide For Business Owners

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

1099 S Fillable Form Printable Forms Free Online

1099 Fillable Form Free Printable Form Templates And Letter

A 1099 Form Fill Out And Sign Printable PDF Template SignNow

Printable End Of Year 1099 Form - Form 1099 MISC Employers must file a Form 1099 MISC for each person or entity an employer has made payments of at least 10 in royalties 600 in rents medical and health care payments or certain miscellaneous forms of payment Employers must also furnish a copy to contractors by January 31 We take care of this for Justworks customers