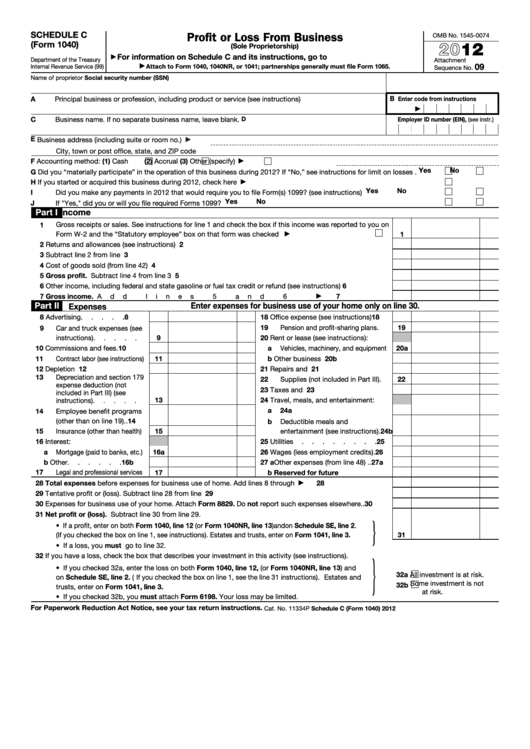

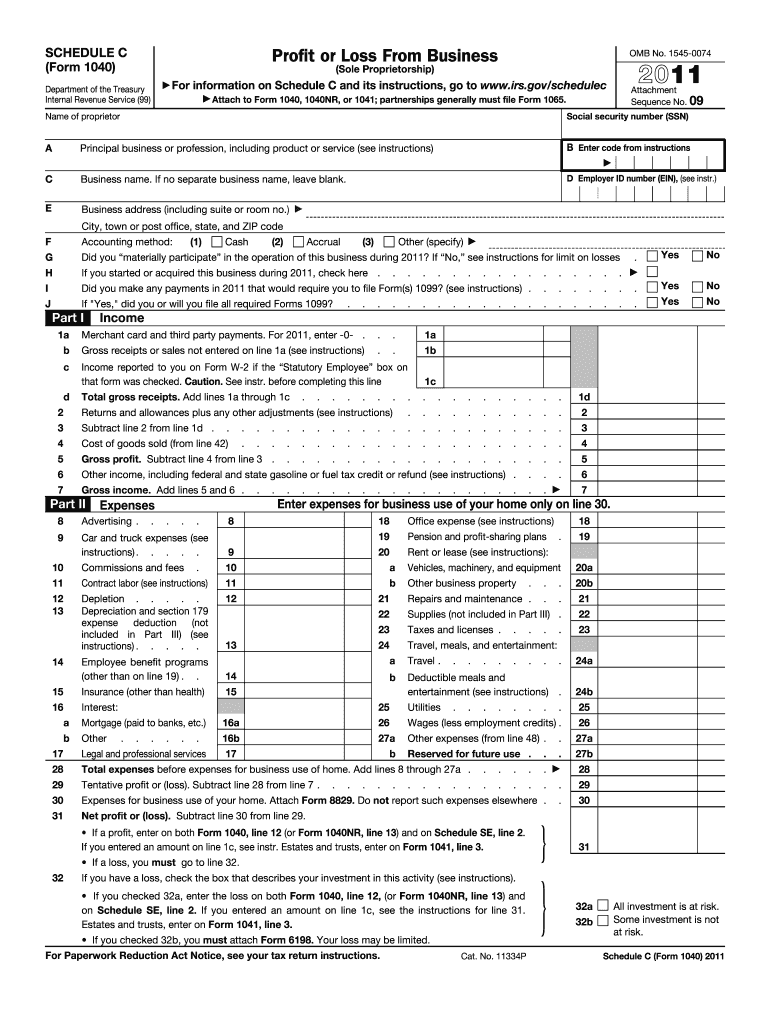

Printable Form 1040 Schedule C For My Records Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file

SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service Profit or Loss From Business Sole Proprietorship Go to www irs gov ScheduleC for instructions and the latest information Attach to Form 1040 1040 SR 1040 NR or 1041 partnerships must generally file Form 1065 OMB No 1545 0074 2022 Attachment Sequence No 09 What is Schedule C IRS Schedule C is a tax form for reporting profit or loss from a business You fill out Schedule C at tax time and attach it to or file it electronically with

Printable Form 1040 Schedule C For My Records

Printable Form 1040 Schedule C For My Records

https://1044form.com/wp-content/uploads/2020/08/how-to-file-schedule-c-form-1040-bench-accounting-1-768x694.png

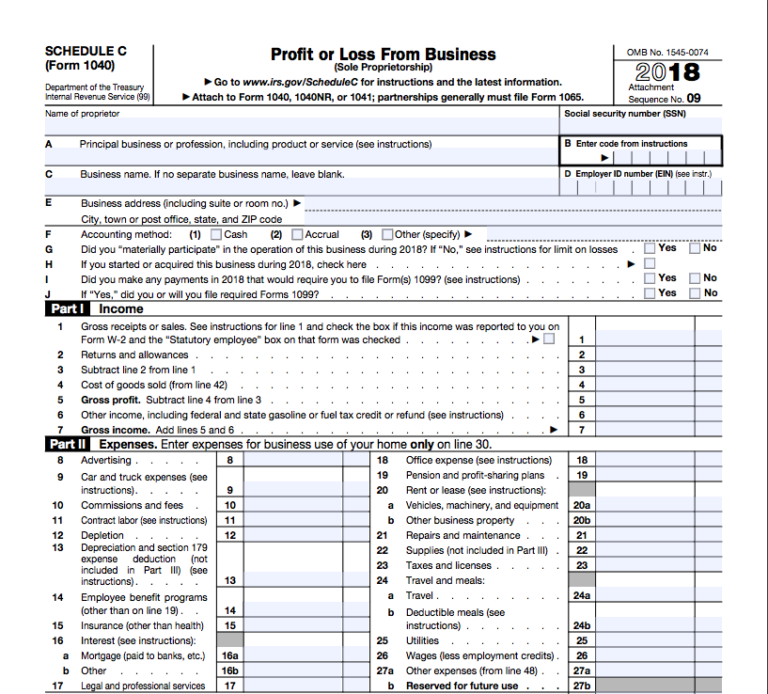

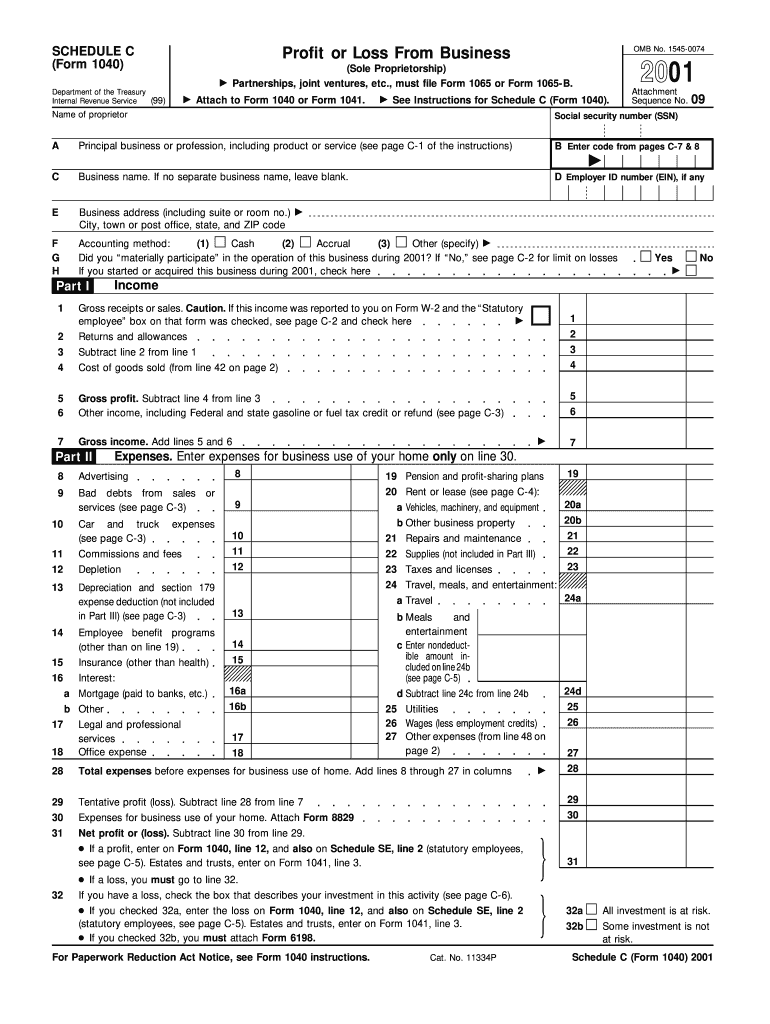

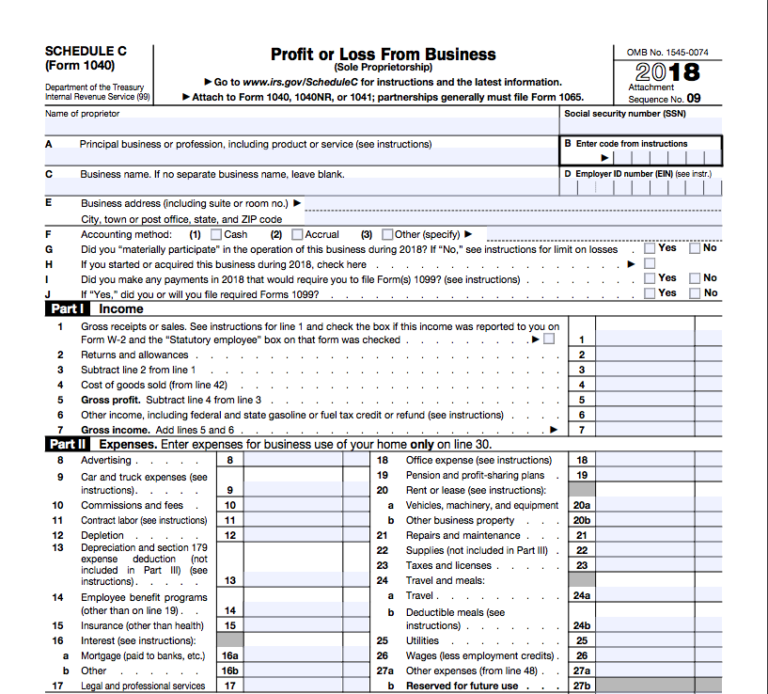

Schedule C Form 1040 Expense Cost Of Goods Sold

https://imgv2-2-f.scribdassets.com/img/document/21529586/original/30d5dde74c/1624602768?v=1

1040 Form 2022 Schedule C Season Schedule 2022

https://www.taxgirl.com/wp-content/uploads/2021/01/Screen-Shot-2021-01-10-at-3.08.56-PM-1200x1198.png

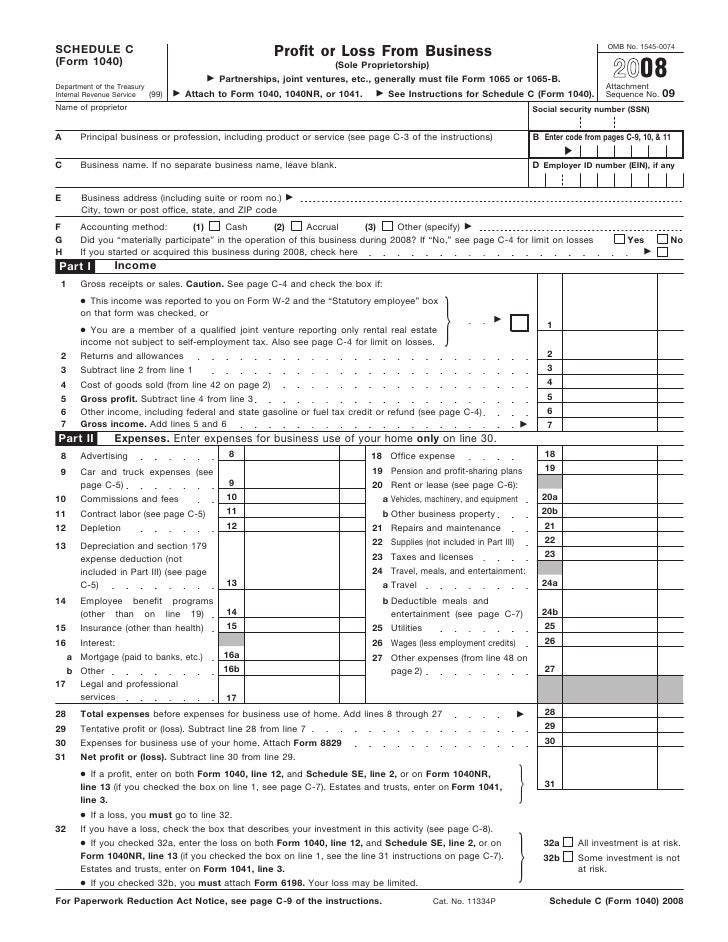

Schedule C whose full name is Form 1040 Schedule C Profit or Loss from Business is where most small business owners report their business net profit or loss Net profit or loss as Printable Form 1040 Schedule C Click any of the IRS Schedule C form links below to download save view and print the file for the corresponding year These free PDF files are unaltered and are sourced directly from the publisher 2023 Schedule C Form 2023 Schedule C Instructions ETA 12 15 2022 Schedule C Form 2022 Schedule C Instructions

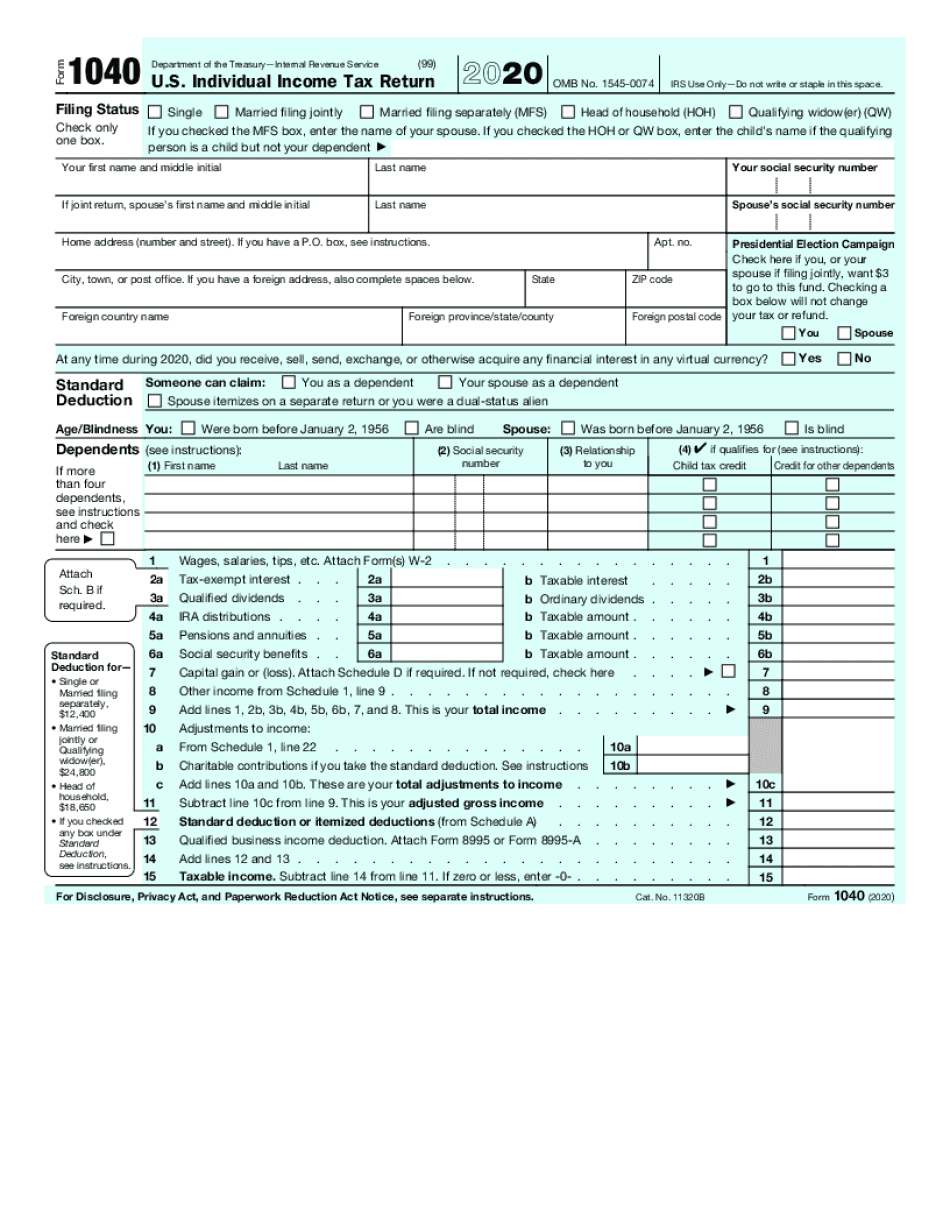

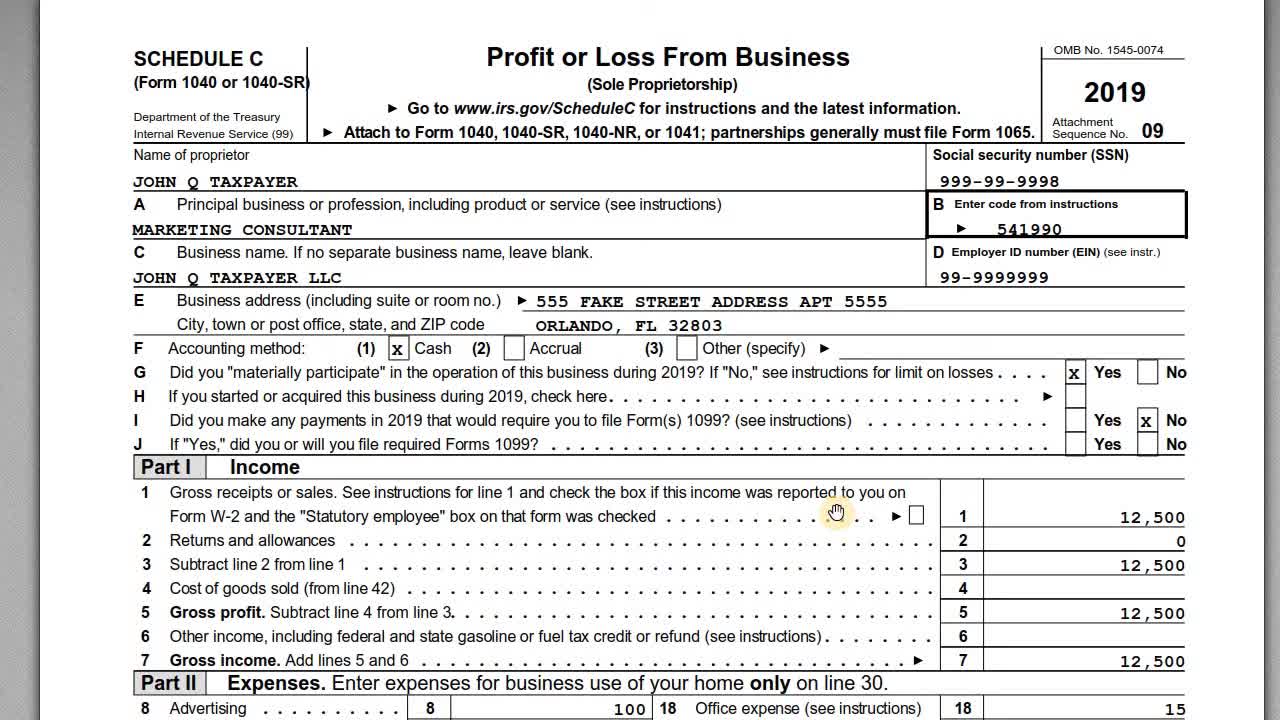

OMB 1545 0074 2020 Form 1040 Schedule C Document pdf Download PDF pdf SCHEDULE C Form 1040 Profit or Loss From Business Go OMB No 1545 0074 2020 Sole Proprietorship to www irs gov ScheduleC for instructions and the latest information To complete IRS Schedule C the form most small businesses need to fill out to state their income for tax purposes you ll need to know your business income cost of goods sold and business expenses You ll then need to calculate your gross profit and income

More picture related to Printable Form 1040 Schedule C For My Records

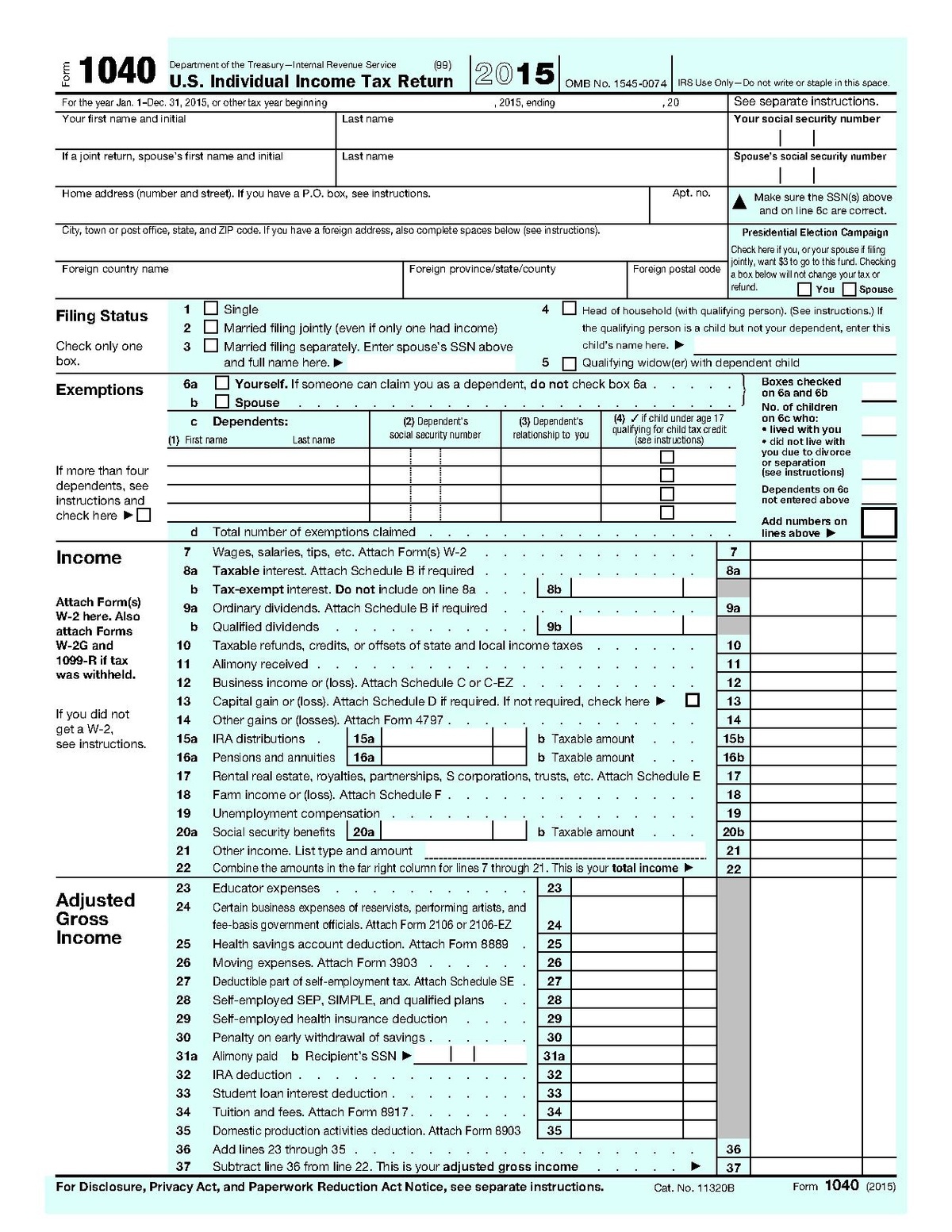

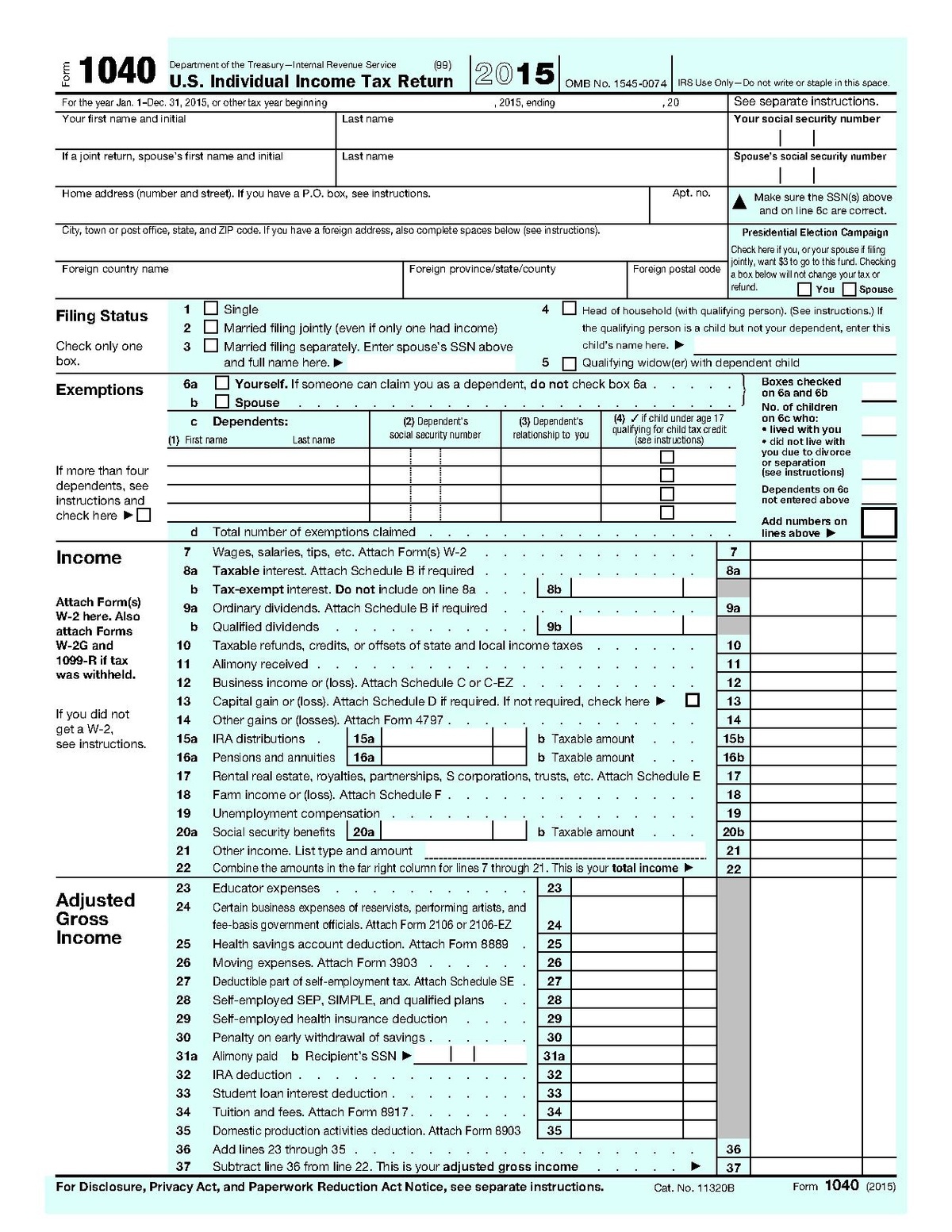

Irs Printable Form 1040

https://allfreeprintable4u.com/wp-content/uploads/2019/03/free-fillable-1040-tax-form-free-file-fillable-formspng-forms-form-free-printable-irs-1040-forms.jpg

Irs 1040 Form C Form 1040 Schedule C Sample Profit Or Loss From Business Printable Pdf

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2018/12/irs-tax-forms-1040-schedule-c.jpg

Form 1040 2020 2021 Fill Online Printable Fillable Printable Form 2021

https://www.printableform.net/wp-content/uploads/2021/03/form-1040-2020-2021-fill-online-printable-fillable-1.png

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business The resulting profit or loss is typically considered self employment income Usually if you fill out Schedule C you ll also have to fill out Schedule SE Self Employment Tax A form Schedule C Profit or Loss from Business Sole Proprietorship is a two page IRS form for reporting how much money you made or lost working for yourself hence the sole proprietorship In other words it s where you report the money you made and subtract your expenses to figure out your net profit Why do you need to know your net profit

Line 1 The form says Gross receipts or sales See instructions for Line 1 and check the box if this income was reported to you on Form W 2 and the statutory employee box on that form was checked Translation Total income not including sales tax goes here Forms Instructions and Publications Search Page Last Reviewed or Updated 14 Nov 2023 Access IRS forms instructions and publications in electronic and print media

Sample Schedule C Form Examples In PDF Word 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/sample-schedule-c-form-examples-in-pdf-word.jpg

Schedule C Tax Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/1/664/1664625/large.png

https://www.irs.gov/forms-pubs/about-schedule-c-form-1040

Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file

https://www.irs.gov/pub/irs-prior/f1040sc--2022.pdf

SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service Profit or Loss From Business Sole Proprietorship Go to www irs gov ScheduleC for instructions and the latest information Attach to Form 1040 1040 SR 1040 NR or 1041 partnerships must generally file Form 1065 OMB No 1545 0074 2022 Attachment Sequence No 09

Fillable Schedule C Form 1040 Profit Or Loss From Business 2012 Printable Pdf Download

Sample Schedule C Form Examples In PDF Word 2021 Tax Forms 1040 Printable

IRS Schedule C With Form 1040 Self Employment Taxes

Form 1040 Schedule C Profit Or Loss From Business

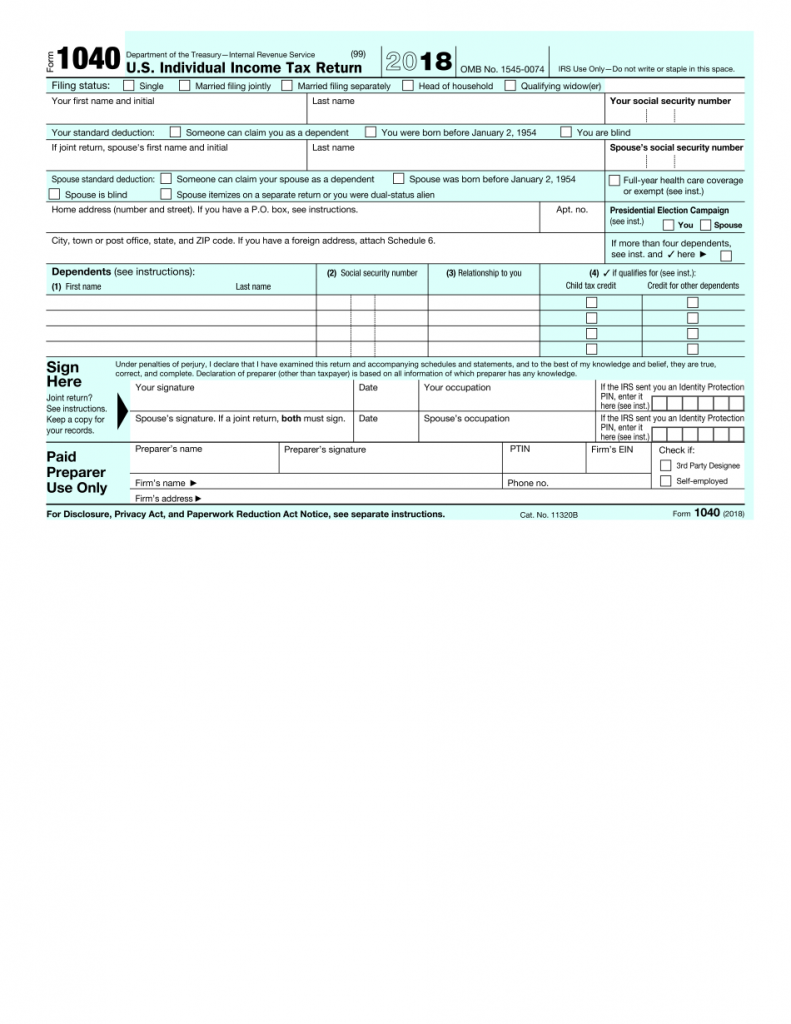

IRS 1040 Form Fillable Printable In PDF Printable Form 2021

1040 2018 Internal Revenue Service Free Printable Irs 1040 Forms Free Printable

1040 2018 Internal Revenue Service Free Printable Irs 1040 Forms Free Printable

FREE 9 Sample Schedule C Forms In PDF MS Word

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)

What Is Schedule C Of Form 1040

IRS 1040 Schedule C 2011 Fill And Sign Printable Template Online US Legal Forms

Printable Form 1040 Schedule C For My Records - Schedule C whose full name is Form 1040 Schedule C Profit or Loss from Business is where most small business owners report their business net profit or loss Net profit or loss as