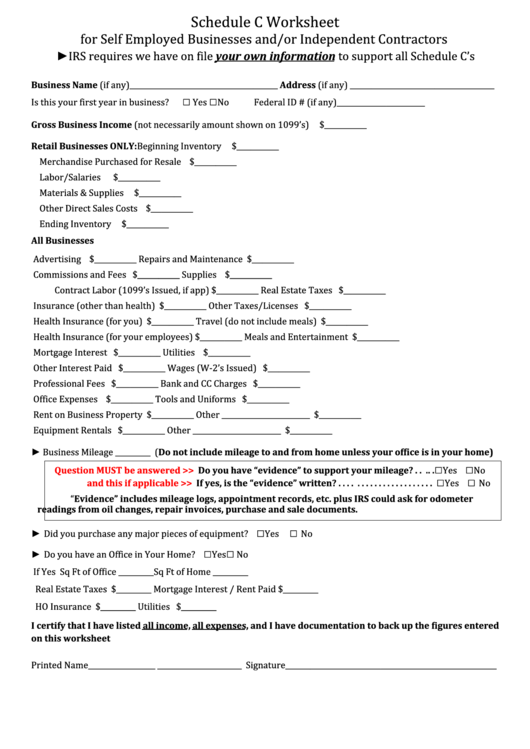

Printable Form For Expenses Self Employed Taxpayers Here s a shortlist of business related expenses self employed individuals can claim to lower their tax bills Business start up expenses legal costs business structure fees research expenses borrowing costs and expenses for technology Business use of your vehicle we ll review how to track these costs more below

Online learning tools Who is self employed Generally you are self employed if any of the following apply to you You carry on a trade or business as a sole proprietor or an independent contractor You are a member of a partnership that carries on a trade or business Report farm income and expenses File it with Form 1040 or 1040 SR 1041 1065 or 1065 B 1040 ES Estimated Tax for Individuals Use this form to pay tax on income that is not subject to withholding i e earnings from self employment rents etc 1040 or 1040 SR SE Self Employment Tax

Printable Form For Expenses Self Employed Taxpayers

Printable Form For Expenses Self Employed Taxpayers

https://www.pdffiller.com/preview/41/404/41404890/large.png

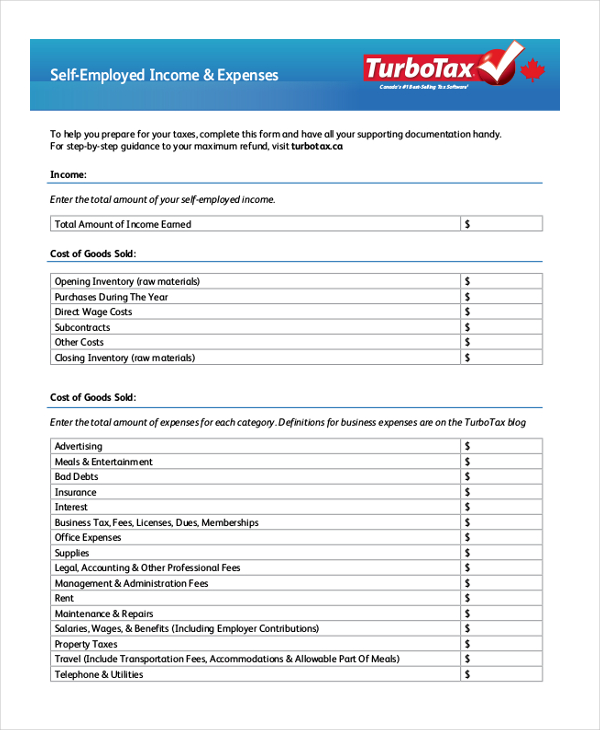

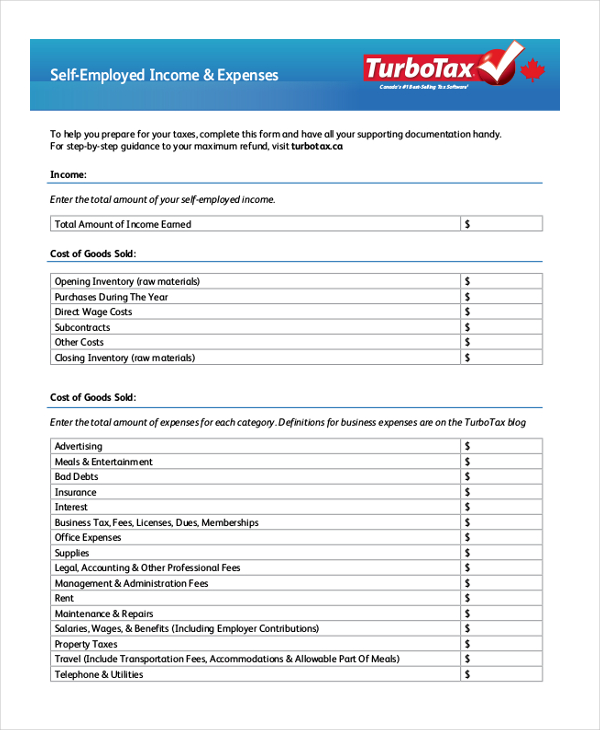

Self Employment Tax Form Editable Forms

http://www.editableforms.com/wp-content/uploads/2013/12/Self-Employment-Tax-Form-696x895.png

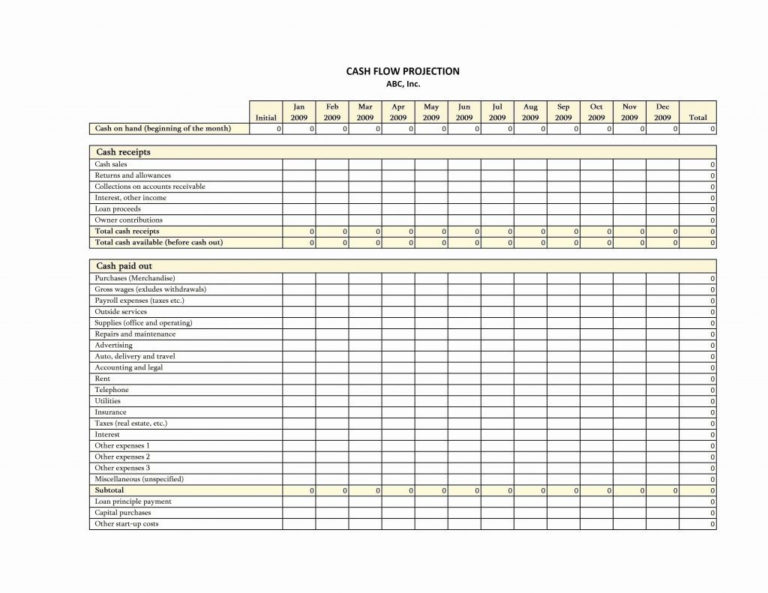

Free Business Expense Spreadsheet And Self Employed Business Tax Deduction Sheet A Success Of

https://i.pinimg.com/736x/6f/eb/d5/6febd52815bdd63ebb68a598d20ee5d5.jpg

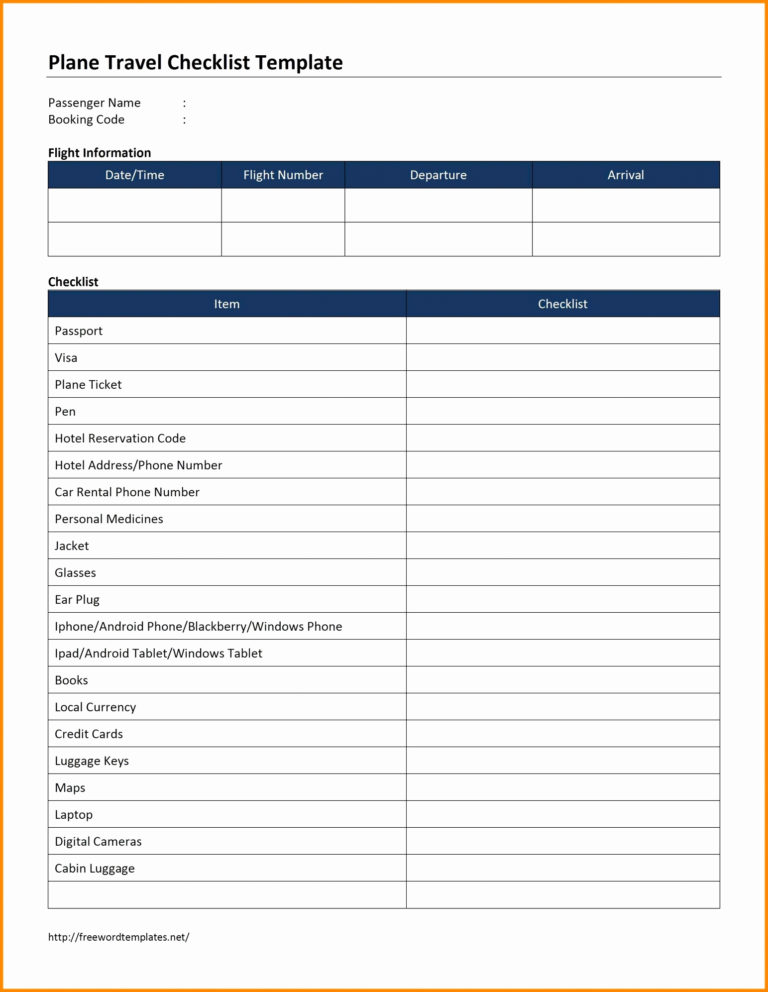

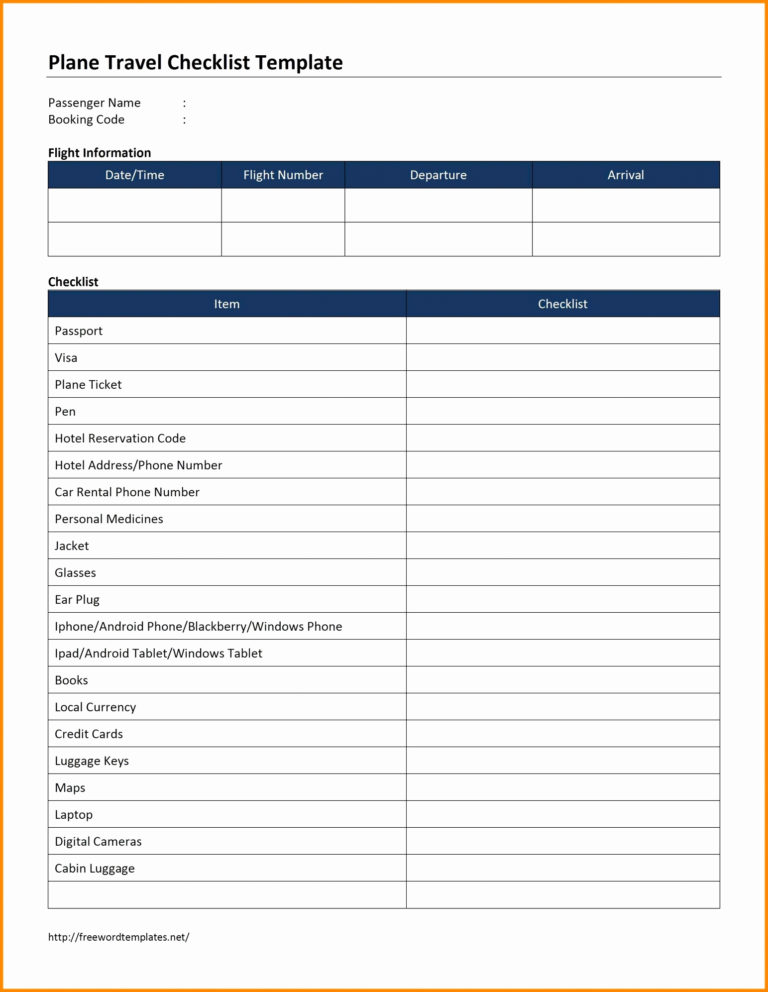

For 2023 the rate is 65 5 cents per mile The rate increases to 67 cents per miles for 2024 2 Depreciation and Section 179 expense deduction The law allows businesses to depreciate or gradually deduct the cost of assets such as equipment fixtures furniture etc that will last more than one year IRS Publication 535 has the details How it works It s an adjustment to income rather than an itemized deduction which means you don t necessarily have to itemize to claim it

The Tax Cuts and Jobs Act TCJA passed during the Trump administration is one of the U S Congress s most significant tax overhauls The TCJA became effective with the 2018 tax year and How it works Auto expenses Even if you work from home you still have to venture out into the world If you drive your car for work then you can write off your business related driving and other costs associated with the trip such as tolls and parking fees

More picture related to Printable Form For Expenses Self Employed Taxpayers

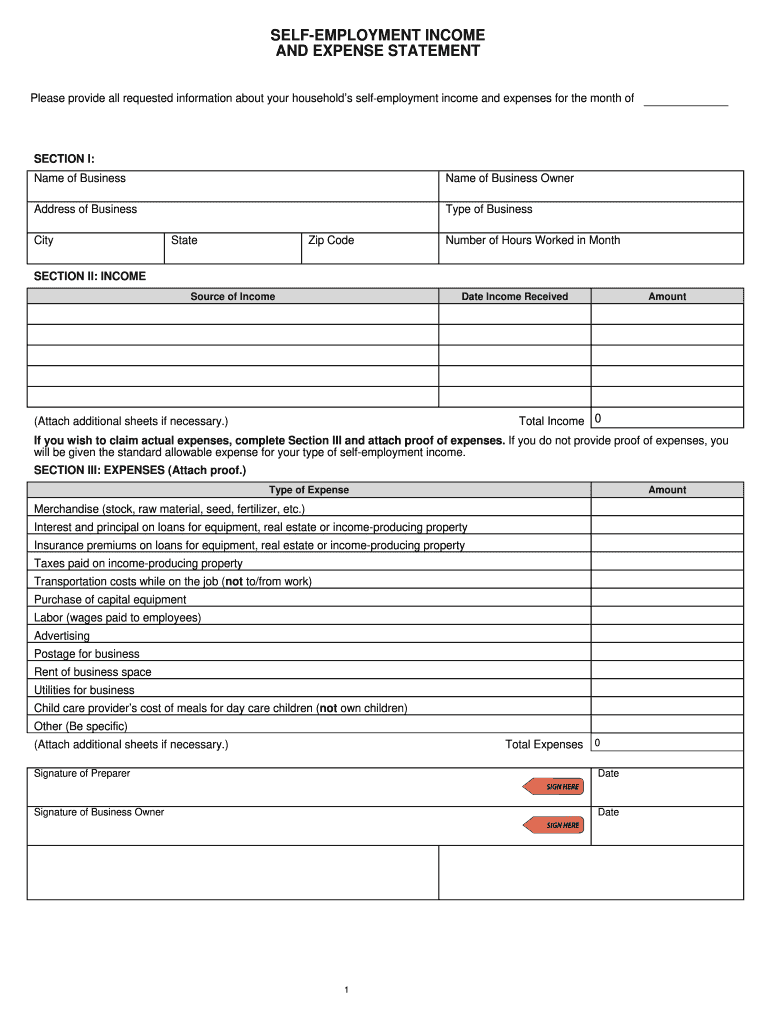

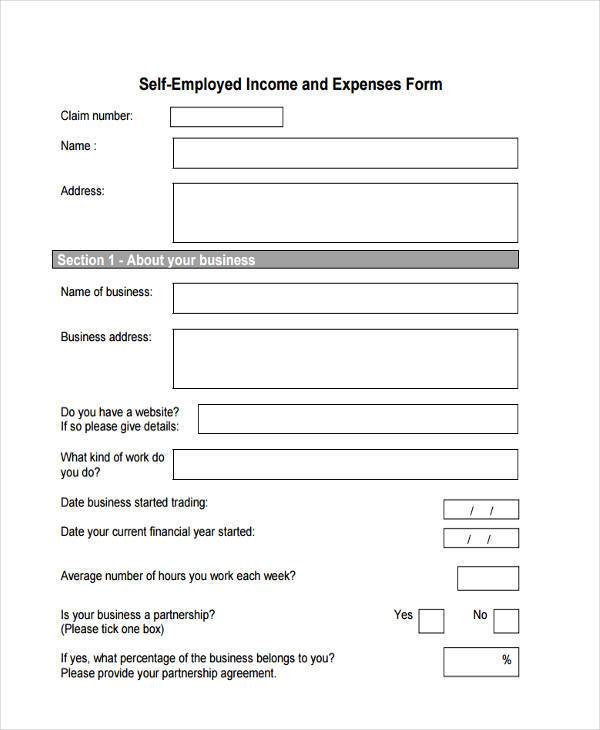

Self Employment Income And Expense Statement Free Download

https://www.formsbirds.com/formimg/self-employment-income-form/1306/self-employment-income-and-expense-statement-l1.png

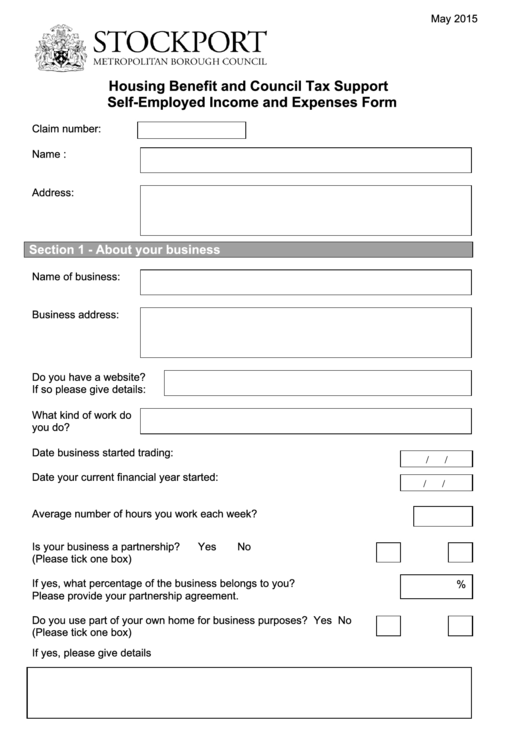

Top 23 Uk Tax Forms And Templates Free To Download In PDF Format

https://data.formsbank.com/pdf_docs_html/310/3100/310045/page_1_thumb_big.png

Printable Form For Expenses Self Employed Taxpayers Printable Forms Free Online

https://i.pinimg.com/originals/a7/48/de/a748def017f4f1c6292487587379e61f.jpg

This spreadsheet helps you track everything you buy for work and groups them according to their appropriate tax category You can use it to lower your self employed income and ultimately save on your taxes 1 Self employment tax How much can you deduct 50 of your self employed tax liability Examples of what you can deduct Social Security Medicare tax If you re self employed you re responsible for paying self employment tax Self employment tax is also known as Federal Insurance Contributions Act FICA

Calculators 2023 Here are some helpful calculators to help you estimate your self employment tax and eliminate any surprises Estimate your refund or what you ll owe with TaxCaster Know how much to set aside for 2023 taxes by answering questions about your life and income Apply business expenses and see how much they save you on taxes Free 30 day trial Health Insurance Deduction Line 29 of Form 1040 You can deduct the costs of your personal health insurance premiums as a self employed person as long as you meet certain criteria Your business is claiming a profit If your business claims a loss for the tax year you can t claim this deduction

FREE 11 Sample Self Employment Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2016/09/Self-Employment-Expenses-Form.jpg

Self Employment Income Expense Tracking Worksheet Excel 2020 2022 Fill And Sign Printable

https://www.pdffiller.com/preview/100/108/100108093/large.png

https://www.hellobonsai.com/blog/self-employed-tax-deductions-worksheet

Here s a shortlist of business related expenses self employed individuals can claim to lower their tax bills Business start up expenses legal costs business structure fees research expenses borrowing costs and expenses for technology Business use of your vehicle we ll review how to track these costs more below

https://www.irs.gov/businesses/small-businesses-self-employed/self-employed-individuals-tax-center

Online learning tools Who is self employed Generally you are self employed if any of the following apply to you You carry on a trade or business as a sole proprietor or an independent contractor You are a member of a partnership that carries on a trade or business

2005 Self Employment Tax Form Employment Form

FREE 11 Sample Self Employment Forms In PDF MS Word

Self Employed Expenses Spreadsheet Free Spreadsheet Downloa Self Employed Expenses Spreadsheet Free

Printable Form For Expenses Self Employed Taxpayers Printable Forms Free Online

39 Self Employed Expenses Worksheet Worksheet Resource

Self Employed Expenses Spreadsheet Template Db excel

Self Employed Expenses Spreadsheet Template Db excel

FREE 7 Sample Employment Expenses Forms In MS Word PDF

7 Self Employment Tax Forms Sample Templates

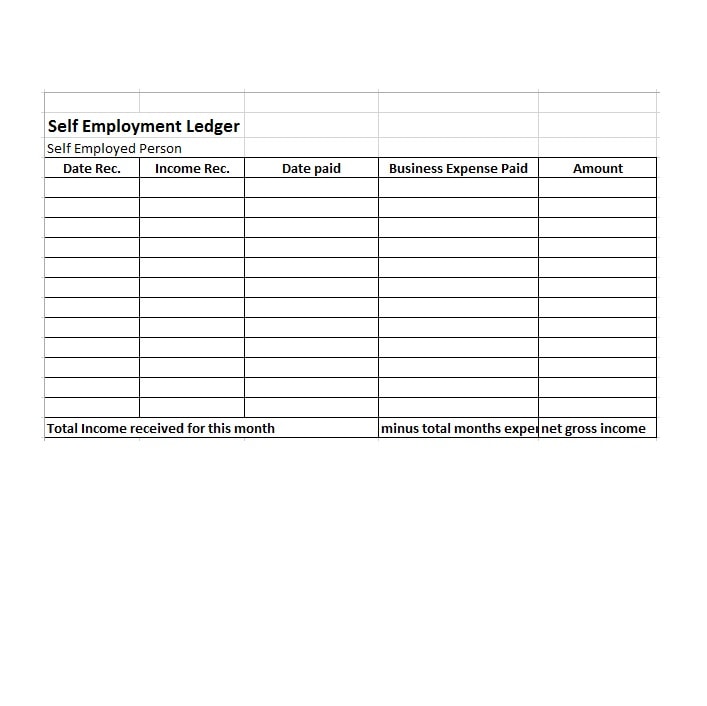

Printable Self Employment Ledger Template Templates Printable Download

Printable Form For Expenses Self Employed Taxpayers - IRS Publication 535 has the details How it works It s an adjustment to income rather than an itemized deduction which means you don t necessarily have to itemize to claim it