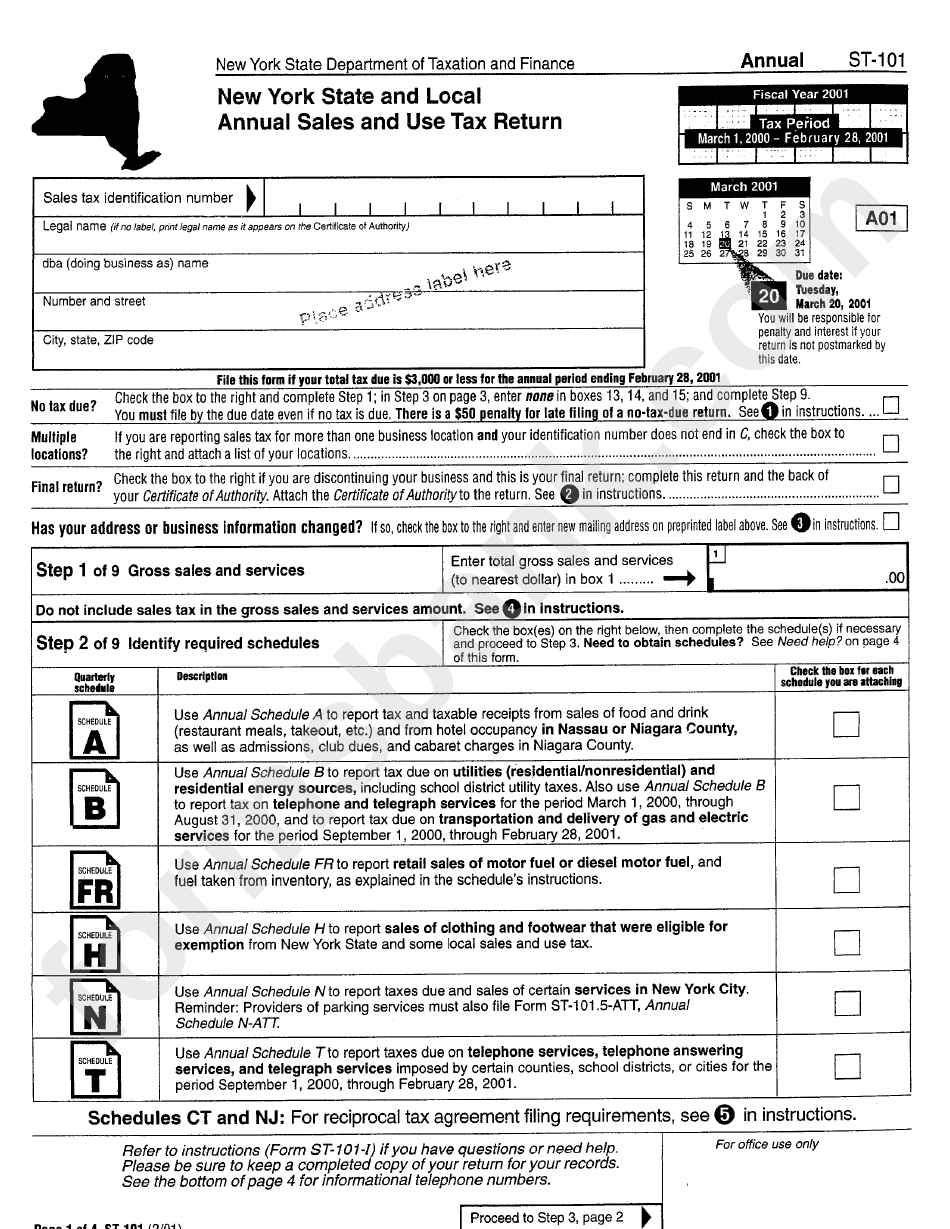

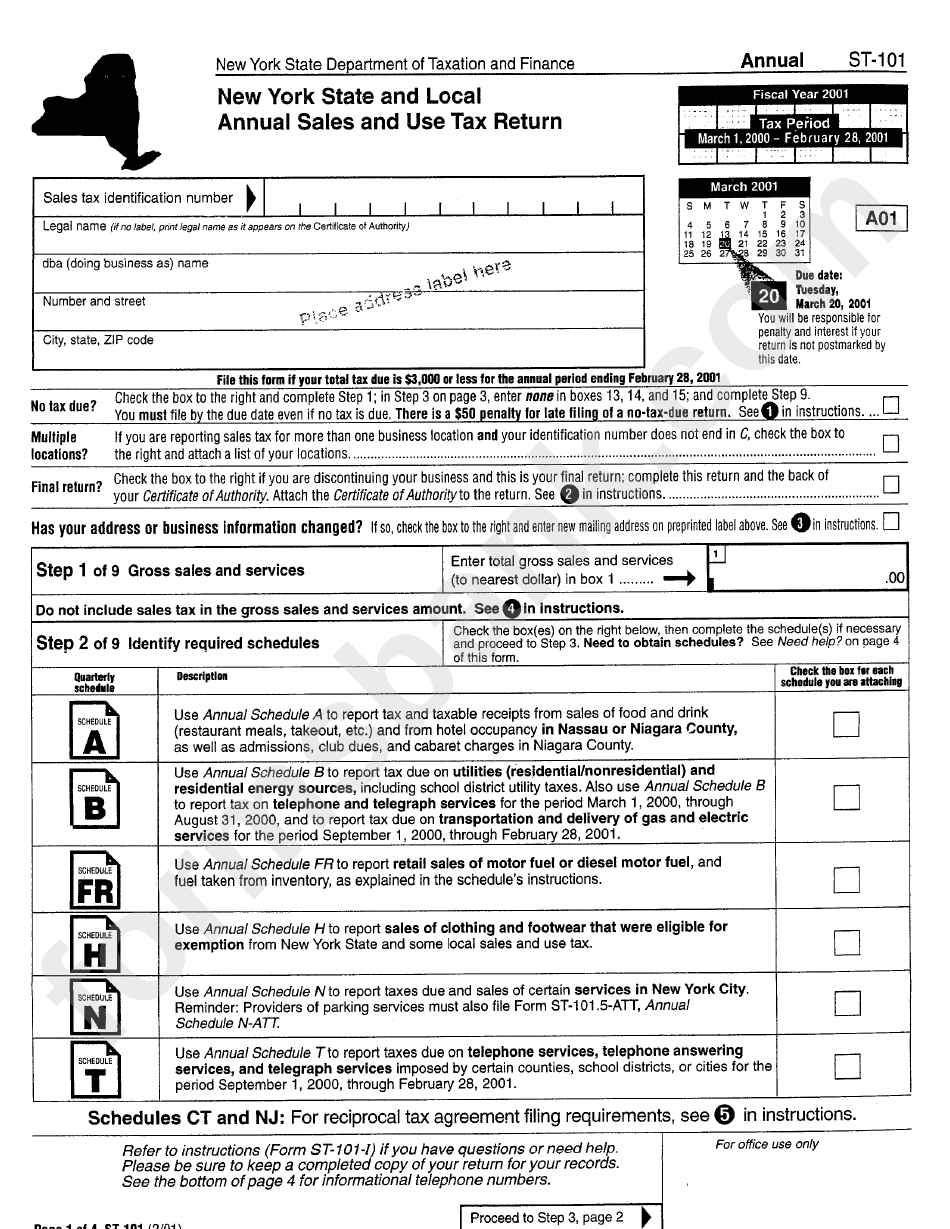

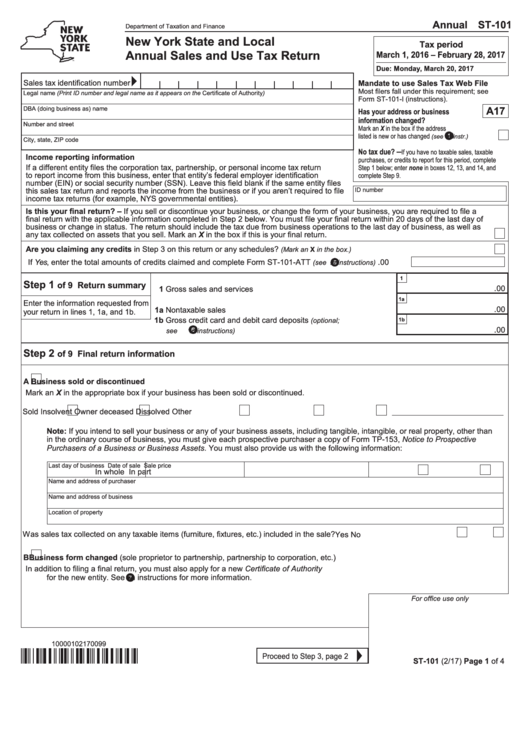

Printable Form St 101 Annual Sales Tax Annual ST 101 Tax period March 1 2022 February 28 2023 Due Monday March 20 2023 Mandate to use Sales Tax Web File Most filers fall under this requirement See Form ST 101 I Instructions for Form ST 101 Has your address or business A23 information changed Mark an X in the box if the address

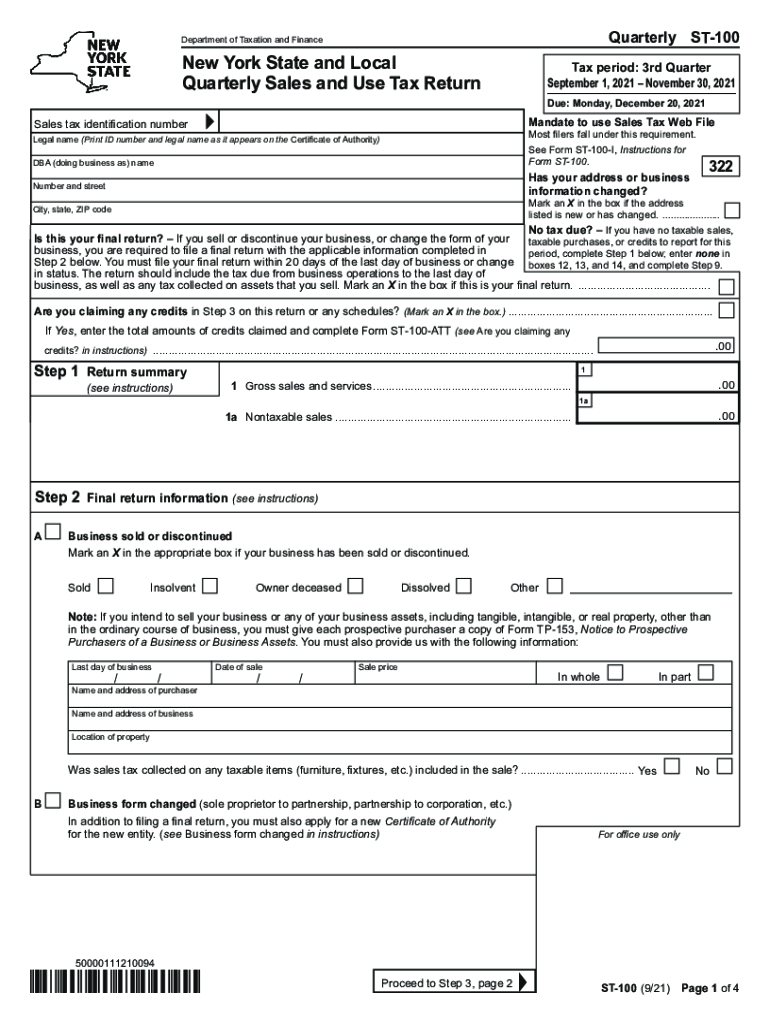

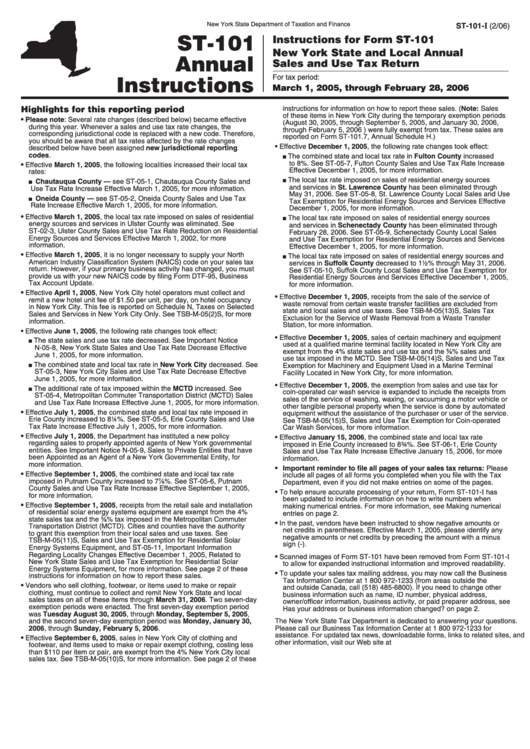

Form ST 101 Sales Tax Resale or Exemption Certificate Contractors improving real property use Form ST 103C Seller All purchases might not qualify for the exemption claimed Refer to the instructions for information about each exemption and items on which you should collect tax Buyer Complete the section that applies to you Commonly used forms Locality rate change notices Monthly filer forms Form ST 809 series Quarterly forms for monthly filers Form ST 810 series Quarterly filer forms Form ST 100 series Annual filer forms Form ST 101 series Other sales tax forms Form DTF 17 Application to Register for a Sales Tax Certificate of Authority Sales tax

Printable Form St 101 Annual Sales Tax

Printable Form St 101 Annual Sales Tax

https://data.formsbank.com/pdf_docs_html/254/2542/254218/page_1_thumb_big.png

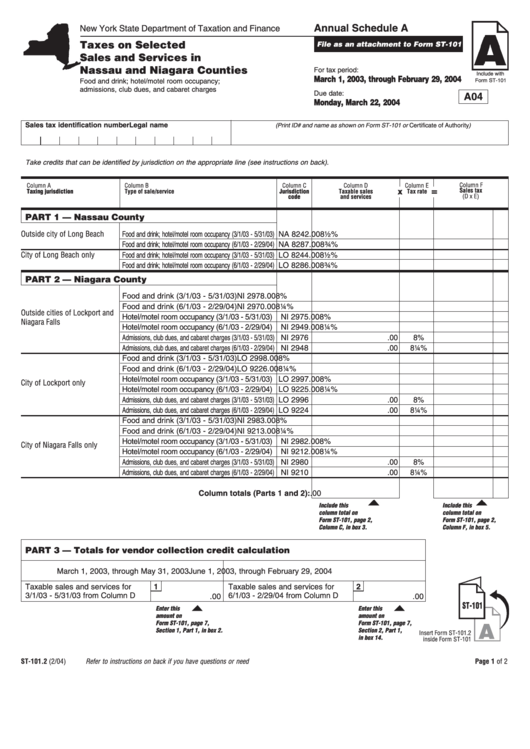

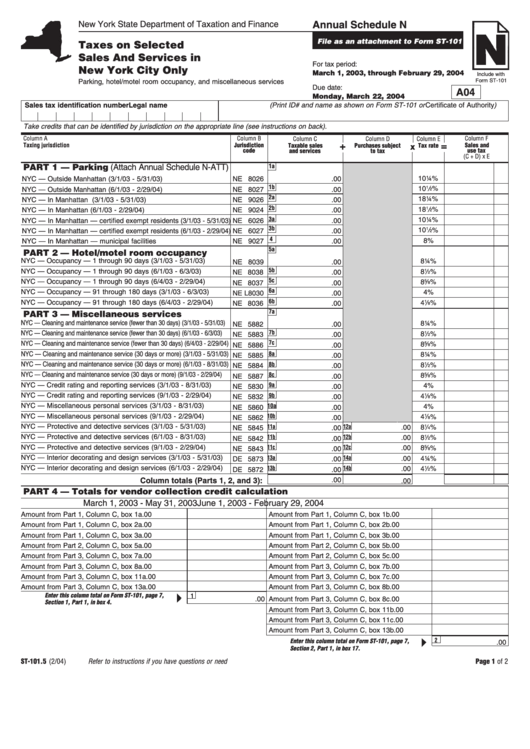

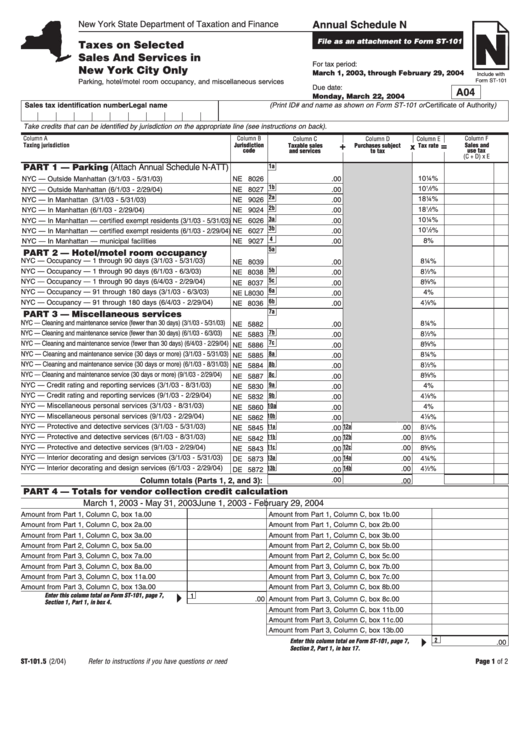

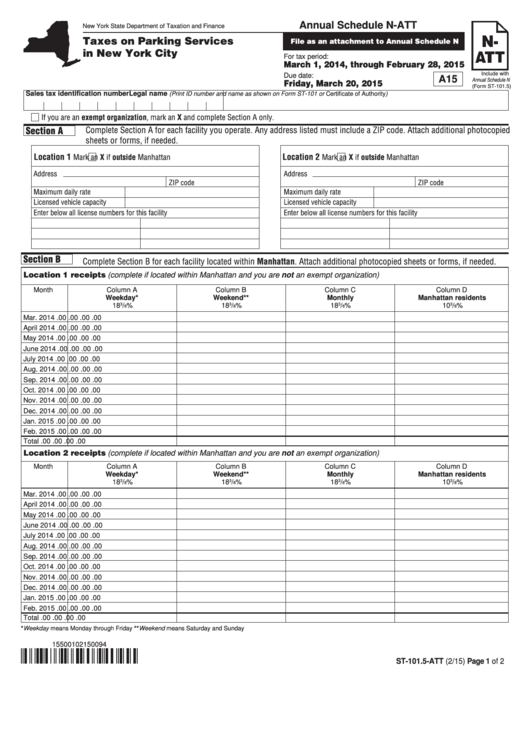

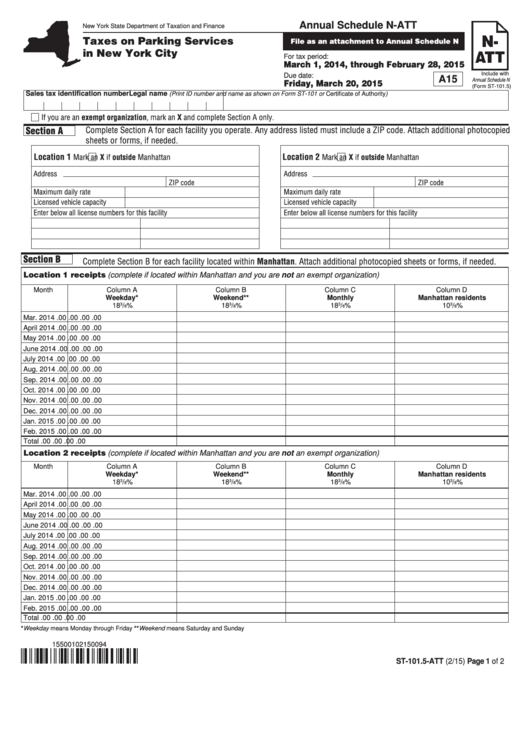

Form St 101 5 Annual Schedule N Taxes On Selected Sales And Services In New York City Only

https://data.formsbank.com/pdf_docs_html/253/2530/253084/page_1_thumb_big.png

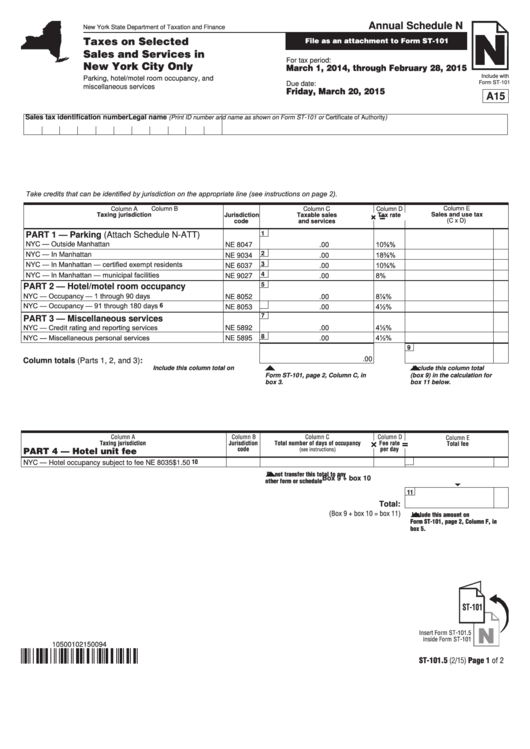

Form St 101 5 Annual Schedule N Taxes On Selected Sales And Services In New York City Only

https://data.formsbank.com/pdf_docs_html/321/3219/321995/page_1_thumb_big.png

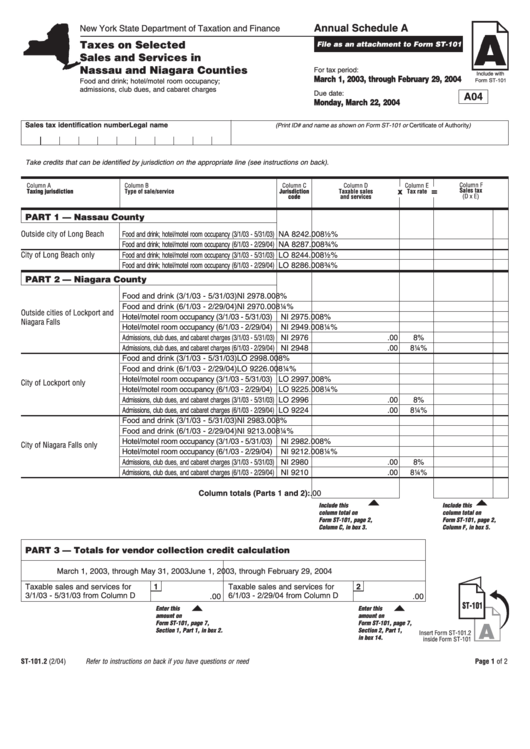

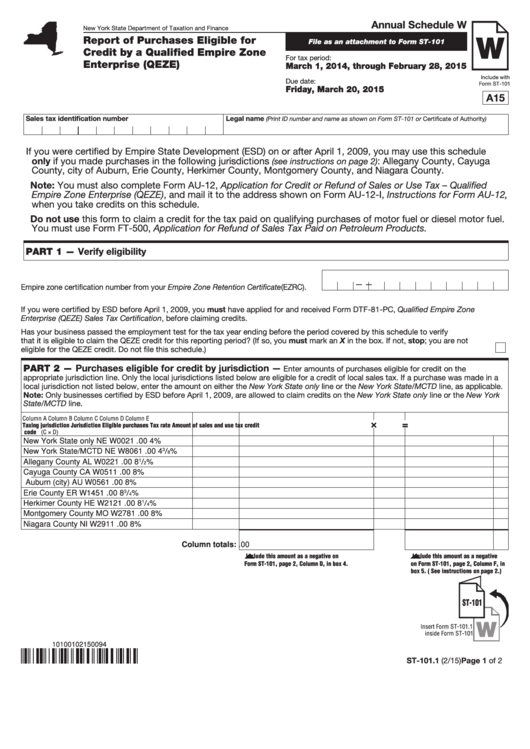

File as an attachment to Form ST 101 For tax period March 1 2022 through February 28 2023 Due date Monday March 20 2023 CW Include with Form ST 101 A23 Sales tax identification number Legal name Print ID number and name as shown on Form ST 101 or Certificate of Authority The annual return Form ST 101 New York State and Local Annual Sales and Use Tax Return covers the period March 1 through February 28 29 in a leap year Since sales tax returns are generally due within 20 days after the end of the reporting period annual returns are due by March 20 each year Quarterly filing

Form ST 101 New York State and Local Annual Sales and Use Tax Return Report in Step 3 of Form ST 101 any taxable sales and purchases not reported on this or any other schedule Specific instructions Identification number and name Print the sales tax identification number and legal name as shown on Form ST 101 or on your Sales and Use Tax Forms We don t have blank tax forms for PERMIT accounts on our website Find more information Form ID Form Name Revision Date Is Fillable ST 101 Sales Tax Resale or Exemption Certificate and Instructions 2023 05 24 2023 1152 Travel and Convention Return Instructions 2023 10 05 2023

More picture related to Printable Form St 101 Annual Sales Tax

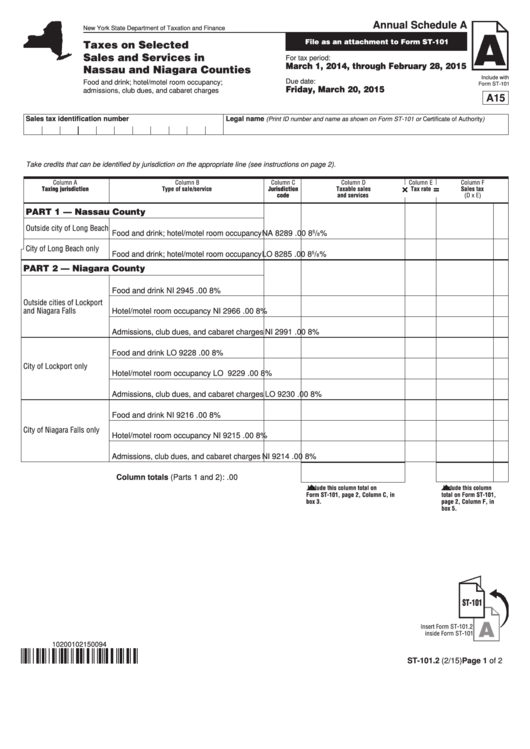

Form St 101 2 Taxes On Selected Sales And Services In Nassau And Niagara Counties 2015

https://data.formsbank.com/pdf_docs_html/321/3219/321981/page_1_thumb_big.png

Form St 9 Virginia Retail Sales And Use Tax Return Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/42/137/42137492/large.png

St 100 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/577/778/577778985/large.png

Form ST 101 New York State and Local Annual Sales and Use Tax Return Revised 2 22 Department of Taxation and Finance New York State and Local Annual Sales and Use Tax Return Sales tax identification number Legal name Print ID number and legal name as it appears on the Certificate of Authority DBA doing business as name Number and street Sales and Use Tax Forms and Publications Basic Forms State Local and District Sales and Use Tax Return CDTFA 401 A PDF General Resale Certificate CDTFA 230 PDF Publications

For tax period March 1 2022 through February 28 2023 New Efective March 1 2022 Dutchess County Beginning March 1 2022 sales of eligible clothing and footwear costing less than 110 in Dutchess County are exempt from the county s sales and use tax Form ST 101 File as an attachment to Form ST 101 For tax period March 1 2022 through February 28 2023 Due date Monday March 20 2023 A23 Sales tax identification number Legal name Print ID number and name as shown on Form ST 101 or Certificate of Authority See Form ST 101 3 I Annual Schedule B Instructions before completing this schedule

Form St 101 New York State And Local Annual Sales And Use Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/267/2673/267315/page_1_bg.png

St 101 Form 2023 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/463/845/463845302/large.png

https://www.tax.ny.gov/pdf/current_forms/st/st101.pdf

Annual ST 101 Tax period March 1 2022 February 28 2023 Due Monday March 20 2023 Mandate to use Sales Tax Web File Most filers fall under this requirement See Form ST 101 I Instructions for Form ST 101 Has your address or business A23 information changed Mark an X in the box if the address

https://tax.idaho.gov/document-mngr/forms_EFO00149/

Form ST 101 Sales Tax Resale or Exemption Certificate Contractors improving real property use Form ST 103C Seller All purchases might not qualify for the exemption claimed Refer to the instructions for information about each exemption and items on which you should collect tax Buyer Complete the section that applies to you

Form St 101 Fillable Printable Forms Free Online

Form St 101 New York State And Local Annual Sales And Use Tax Return Printable Pdf Download

Instructions For Form St 101 Printable Pdf Download

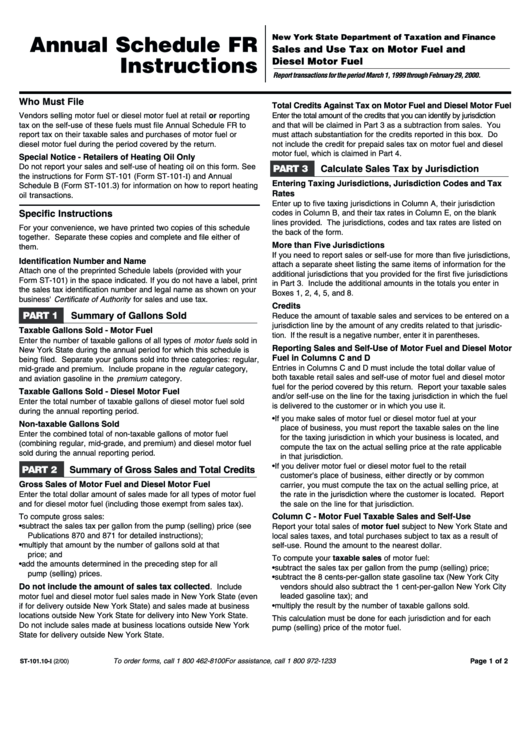

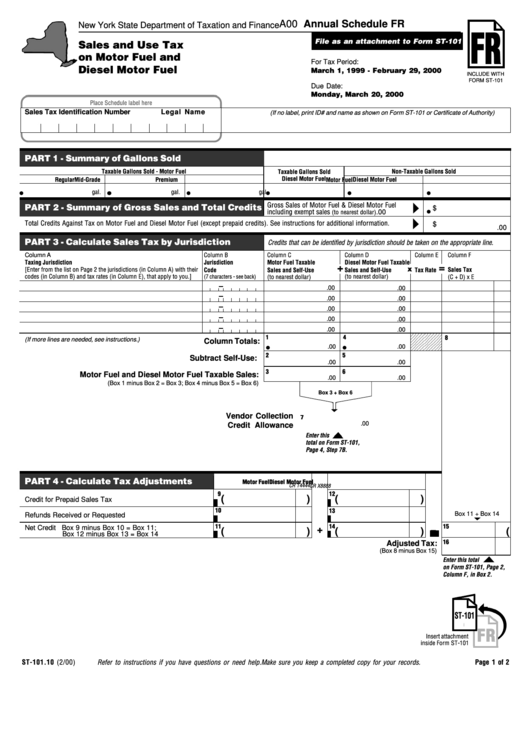

Form St 101 10 I Annual Schedule Fr Instructions New York State Department Of Taxation And

Printable State Tax Forms

Form St 101 5 Att Annual Schedule N Att Taxes On Parking Services In New York City 2015

Form St 101 5 Att Annual Schedule N Att Taxes On Parking Services In New York City 2015

Fillable Form St 101 New York State And Local Annual Sales And Use Tax Return Printable Pdf

Form St 101 Sales And Use Tax On Motor Fuel And Diesel Motor Fuel Annual Schedule For 2000

Instructions For Form St 101 Printable Pdf Download

Printable Form St 101 Annual Sales Tax - View download and print fillable St 101 New York State And Local Annual Sales And Use Tax Return in PDF format online Browse 106 New York State Form It 201 Templates collected for any of your needs Complete Form St 101 New York State And Local Annual Sales And Use Tax Return with your personal data all interactive fields are