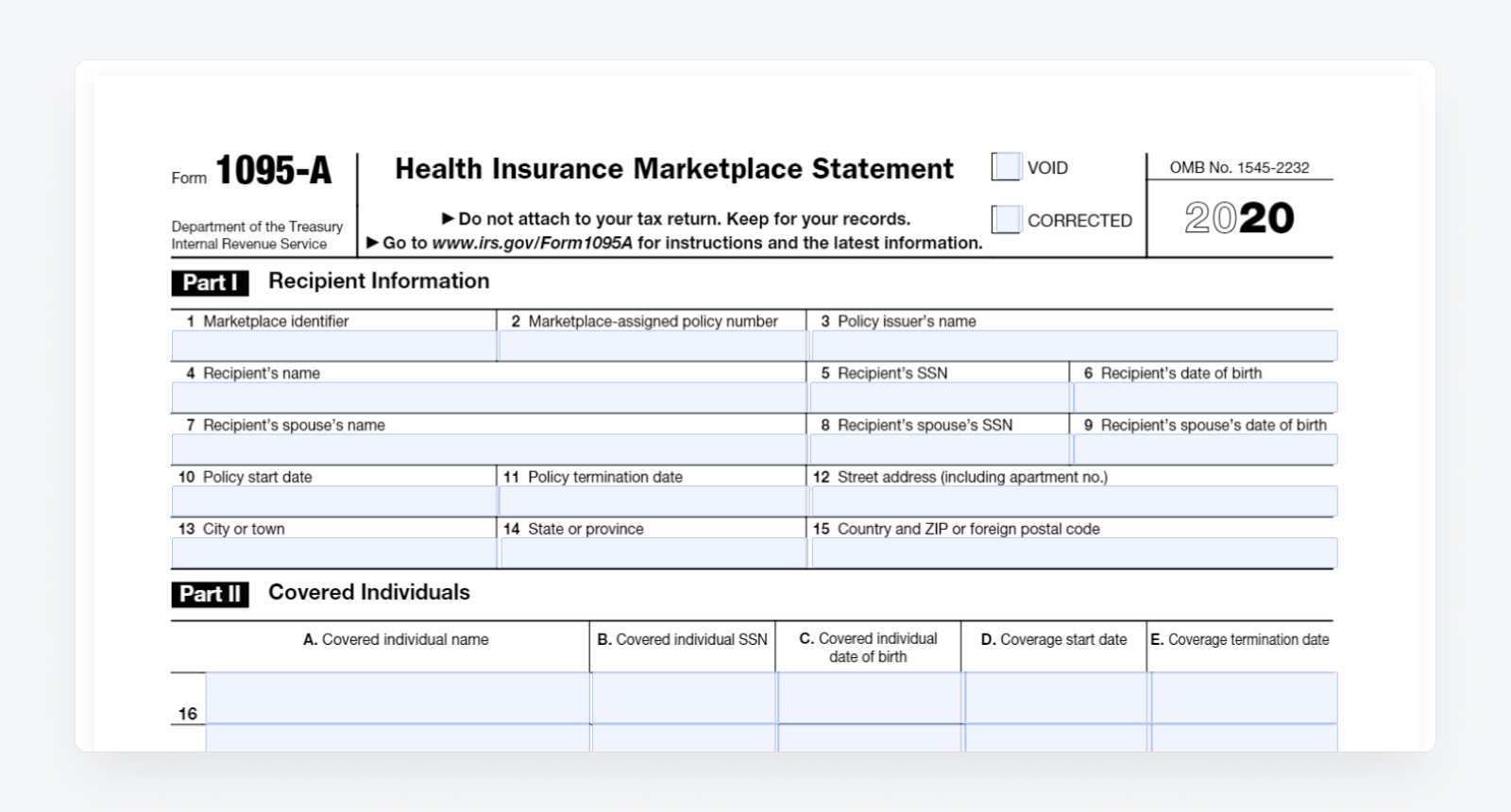

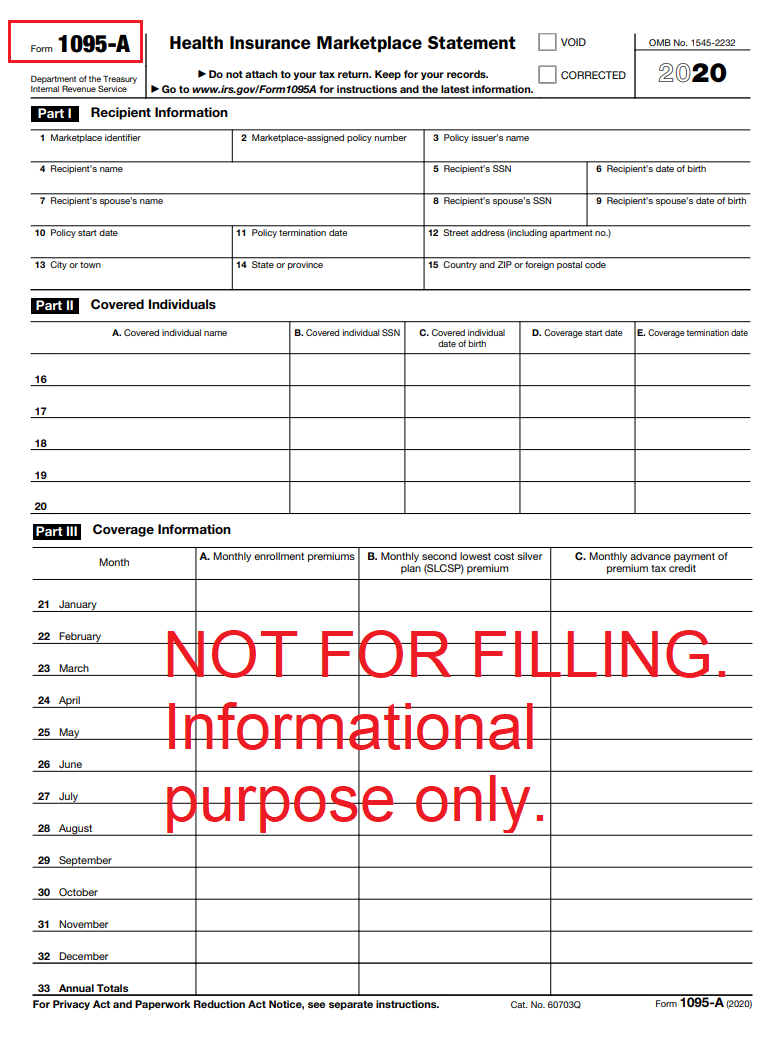

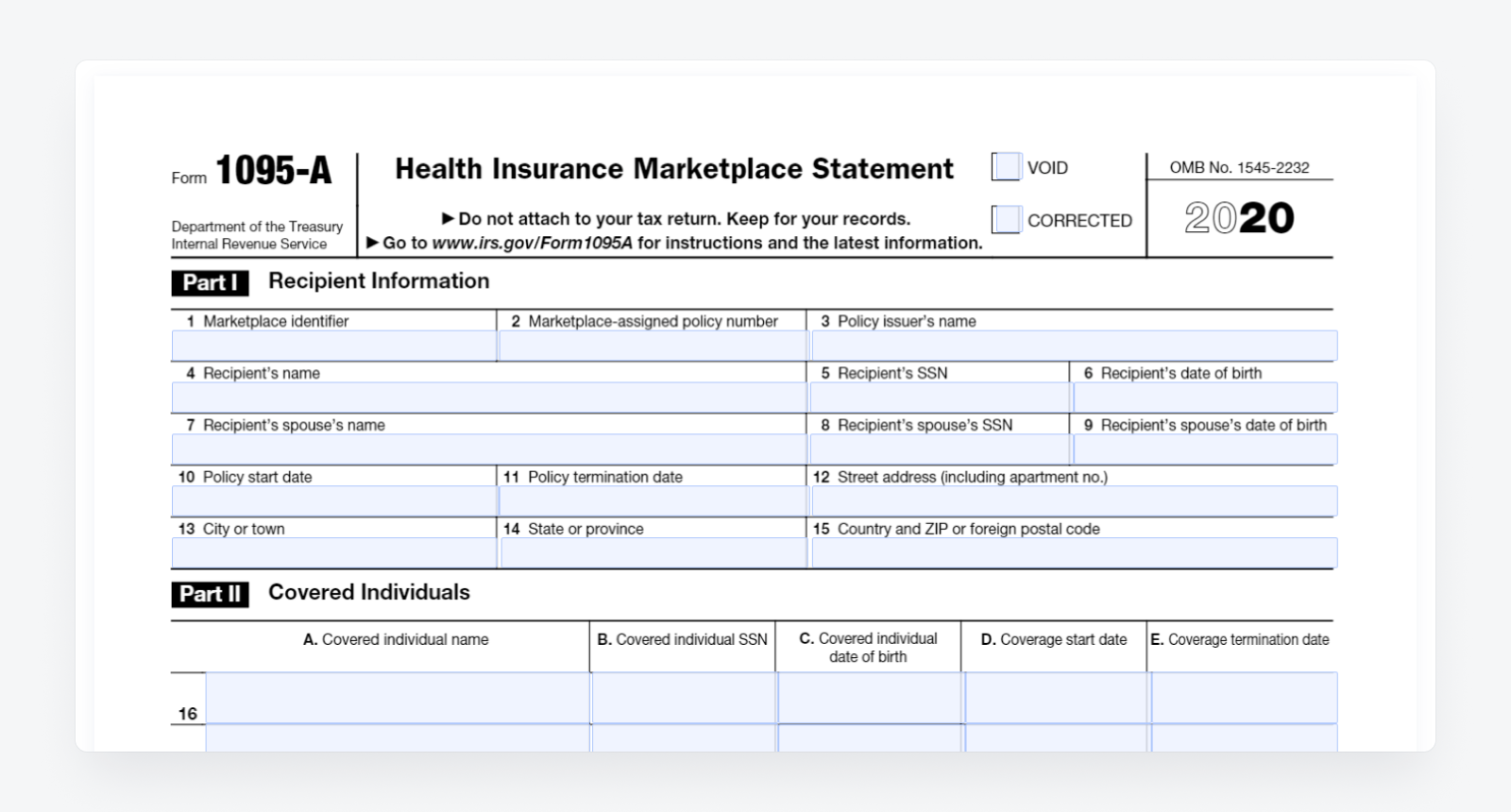

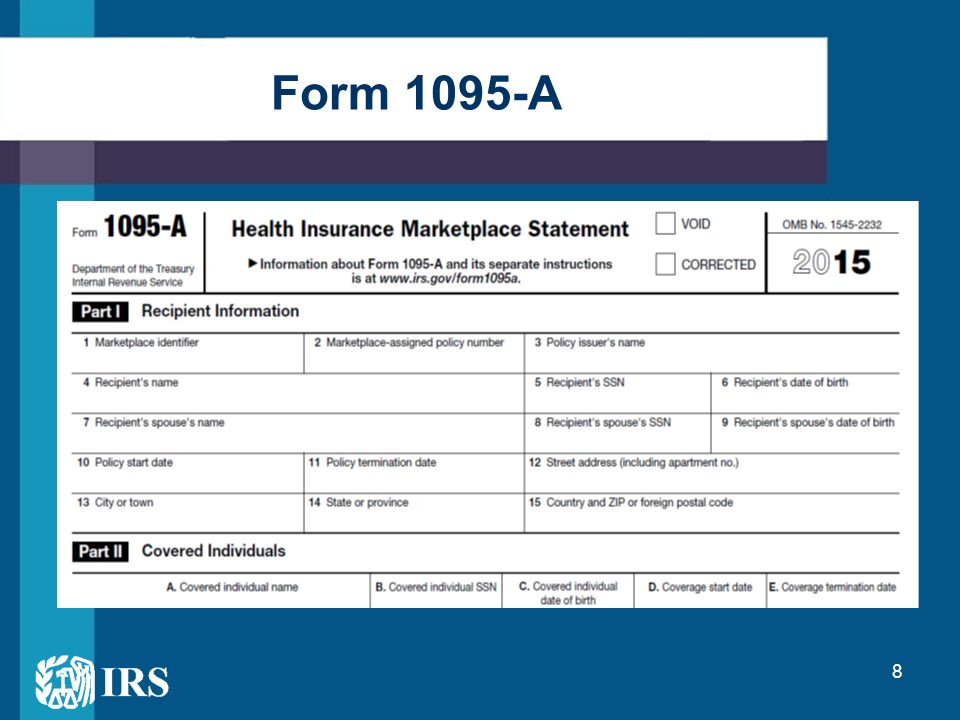

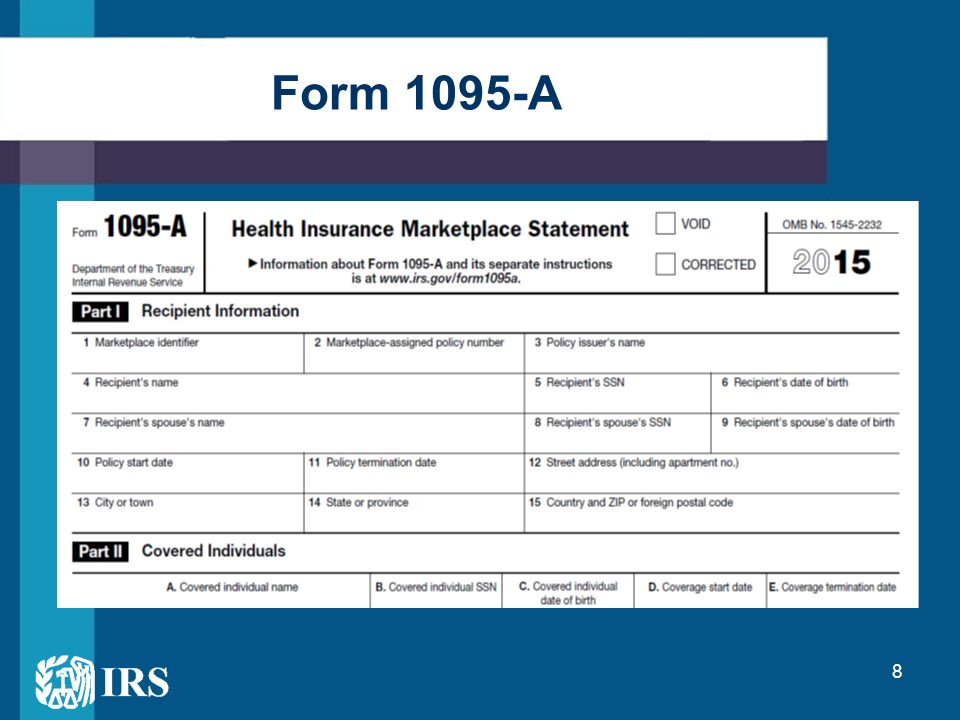

Printable Information On A Form 1095a If the CORRECTED box is checked at the top of the form use the information on this Form 1095 A to figure the premium tax credit and reconcile any advance credit payments on Form 8962 Don t use the information on the original Form 1095 A you received for this policy Part I Recipient Information lines 1 15

Information about Form 1095 A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file Form 1095 A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace Enter email address Select a state By checking this box you consent to our data privacy policy File IRS form 1095 A to get highest federal tax return Learn what to do how to file why you got form what to do if no 1095 A

Printable Information On A Form 1095a

Printable Information On A Form 1095a

https://pdfliner.com/howTo/img/tild3830-3336-4662-b234-616236653764__how-to-get-form-1095.png

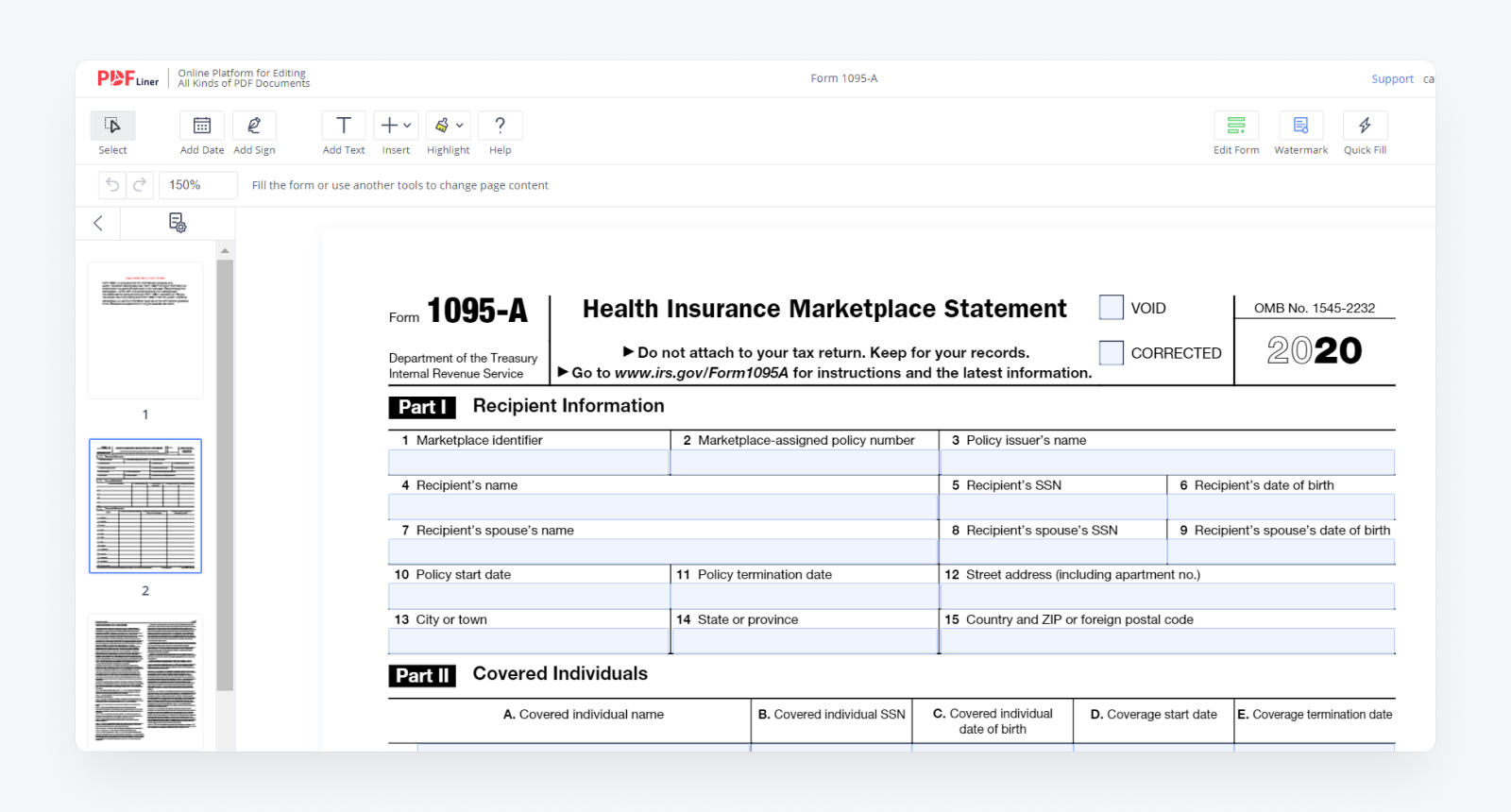

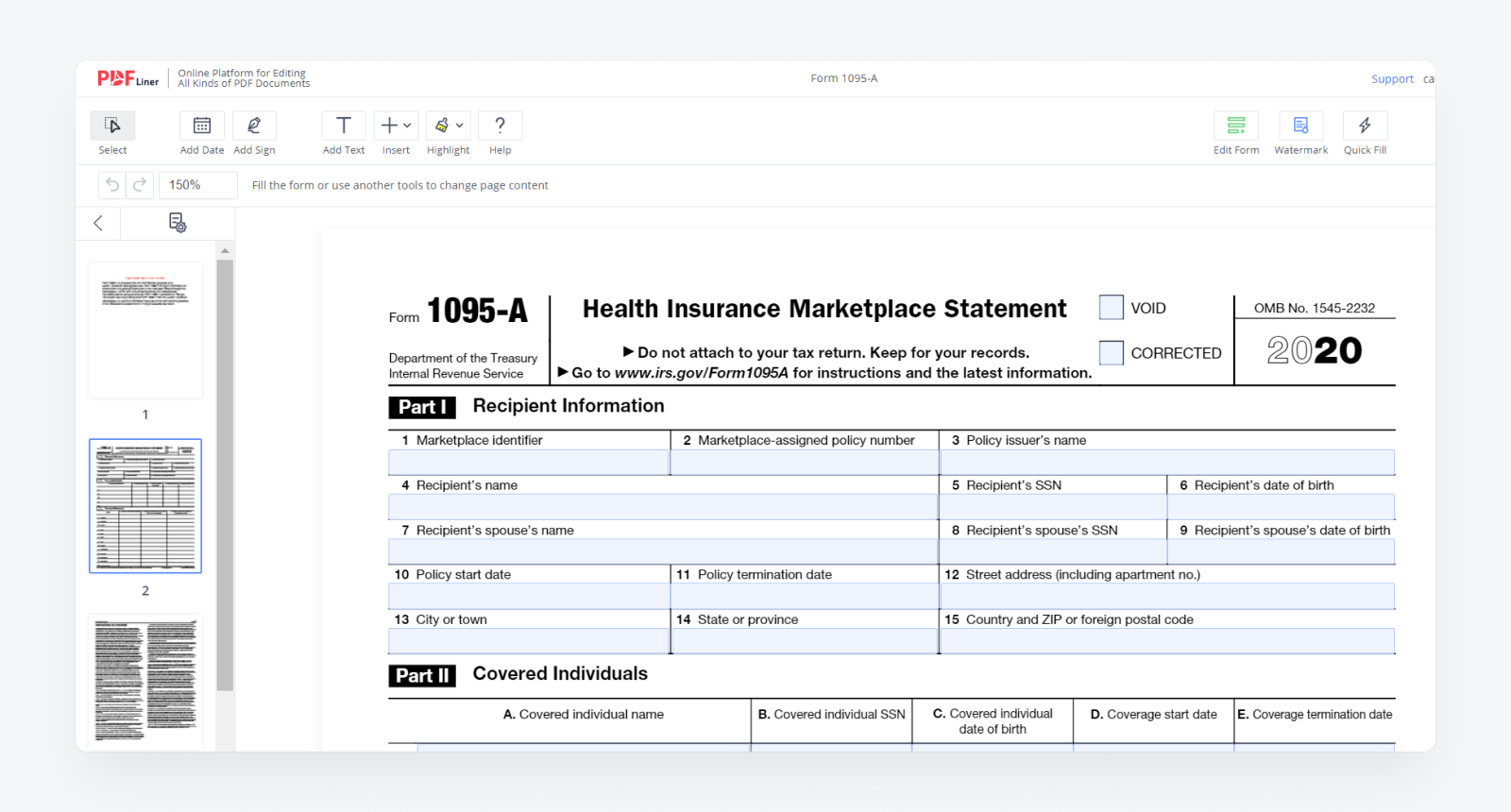

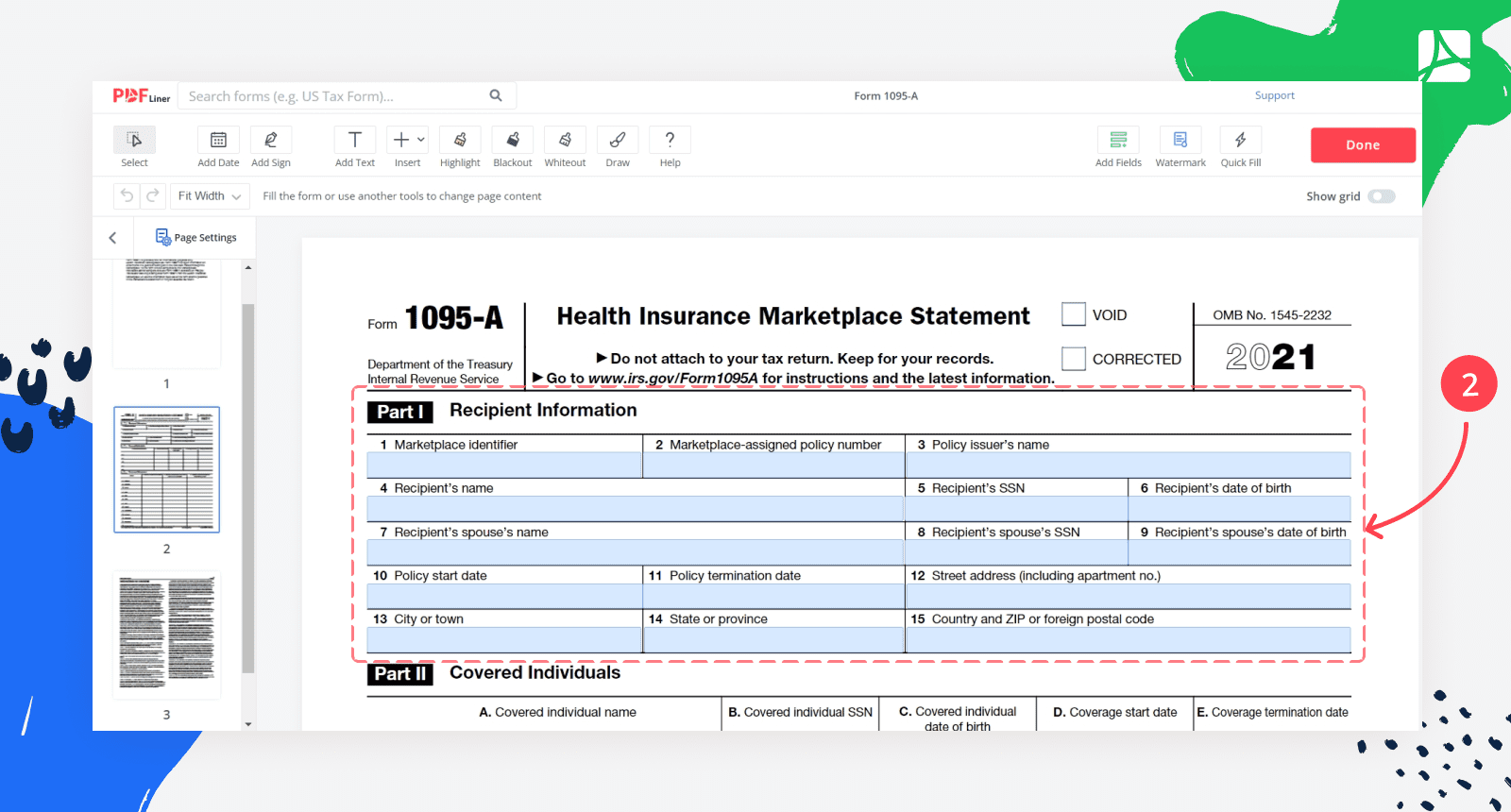

Instructions For Form 1095 A And How To Fill Out It PDFliner

https://pdfliner.com/howTo/img/tild6536-3761-4039-a239-346663353333__how-to-fill-out-form.png

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

https://www.investopedia.com/thmb/irRrzGQywwHt4TLkcYvmzx_LDYs=/1296x1062/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png

STEP 1 Log into your Marketplace account STEP 2 Under My Applications Coverage select your 2023 application not your 2024 application STEP 3 Select Tax Forms from the menu on the left How to find your Form 1095 A online Form 1095 A reports your amount of coverage any advance payment of tax credits you used to pay for health insurance and the names of people covered by the policy You can use the information on Form 1095 A to complete Form 8962 which you can file with your tax return to claim the premium tax credit You can use the information on Form 1095 A

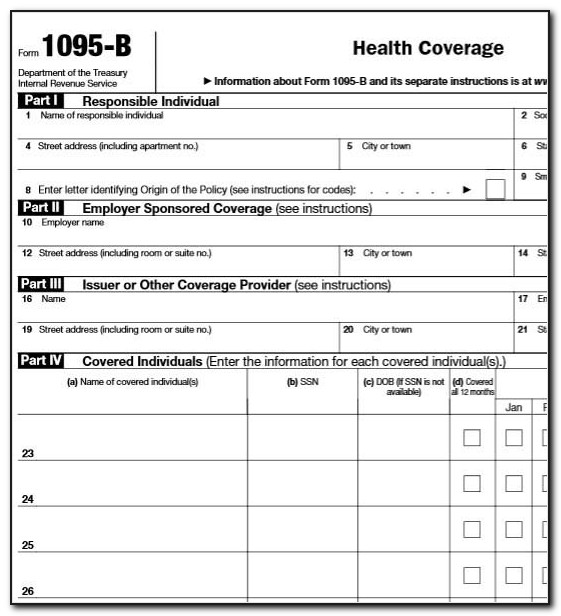

If it s accurate use the information on your 1095 A form to reconcile any premium tax credit you or your household qualified for or used To reconcile you compare two amounts the premium tax credit you used in advance during the year and the amount of tax credit you qualify for based on your final income This form can be mailed to the IRS and to the policyholder by health insurance carriers government sponsored plans such as Medicaid CHIP and Medicare and self insured small employers But you may have to request Form 1095 B if you want it as it may not be sent to you automatically the way it was in the past 1095 C

More picture related to Printable Information On A Form 1095a

1095 A Tax Form To Print Get IRS Form 1095A For 2022 Printable Blank PDF To Download For Free

https://1095a-form-print.com/images/uploads/2023-03-16/1095a-rain1-main-scrn-4ppds.jpg

Corrected Tax Form 1095 A Katz Insurance Group

https://vamedicalplans.com/wp-content/uploads/2015/02/irs-1095.jpg?w=282

How To Get The 1095 a Form Online Healthy Information Cebtralpainnervecenter

https://cebtralpainnervecenter.com/wp-content/uploads/2021/07/form-1095-a-sample.png

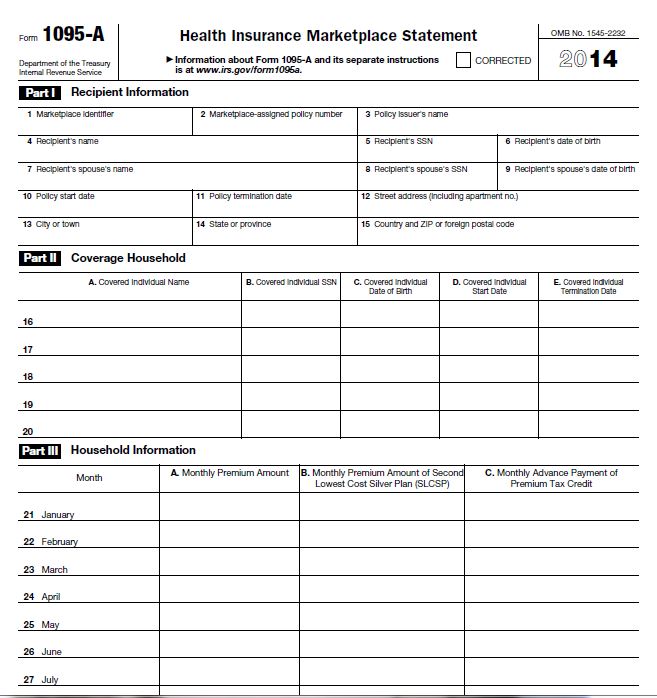

Tax Forms and Filing By Jan 31 of each year Covered California sends the federal IRS form 1095 A Health Insurance Marketplace statement to members This form is used to Provide information for your federal taxes Calculate the amount of Premium Tax Credit you received any credit you may be due after filing or the tax amount you owe See all legal notices If you had health insurance at any time during a calendar year you may get a version of form 1095 for tax purposes which details your health coverage Here we explain the types of forms and their purpose where they come from who receives them and more

Enter a date of birth only if line 8 is blank Line 10 Enter the date that coverage under the policy started If the policy was in effect at the start of the year enter 1 1 2021 Line 11 Enter the date of termination if the policy was terminated during the year Form 1095 B will report the months of MEC a Medi Cal beneficiary received during the calendar year DHCS will send your MEC information to the IRS and beneficiaries are not required to provide Form 1095 B to the IRS if they chose to file their taxes Beneficiaries should keep Form 1095 B for their records as proof they received health coverage

1095 A Tax Form H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2015/01/1095-banner-featured-825x510.jpg

1095 A Printable Form Download All Latest Free Printable Form For 2023

https://www.pdffiller.com/preview/527/848/527848229/big.png

https://www.irs.gov/pub/irs-access/f1095a_accessible.pdf

If the CORRECTED box is checked at the top of the form use the information on this Form 1095 A to figure the premium tax credit and reconcile any advance credit payments on Form 8962 Don t use the information on the original Form 1095 A you received for this policy Part I Recipient Information lines 1 15

https://www.irs.gov/forms-pubs/about-form-1095-a

Information about Form 1095 A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file Form 1095 A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace

Free Printable 1095 A Form Printable Templates

1095 A Tax Form H R Block

Form 1095 A Sample Amulette

1095a Form 2016 Printable TUTORE ORG Master Of Documents

IRS Form 1095 A Printable Healthcare 1095A Tax Form For 2022 Blank PDF To Print For Free

1095 A Printable Form Get Latest Free Printable Calendar Worksheets Template And More

1095 A Printable Form Get Latest Free Printable Calendar Worksheets Template And More

Form 1095 A 2023 Printable Form 1095 A Online PDFliner

Form 1095 A For Print IRS 1095A Tax Form For 2023 Printable Blank PDF To Download For Free

1095A Form Printable

Printable Information On A Form 1095a - Once downloaded open the IRS blank 1095 A form and meticulously read through all the instructions before you start filling it The instructions are meant to guide you toward providing accurate and complete information Ensure you fill out all sections of the document paying careful attention to your income tax deductions and health coverage