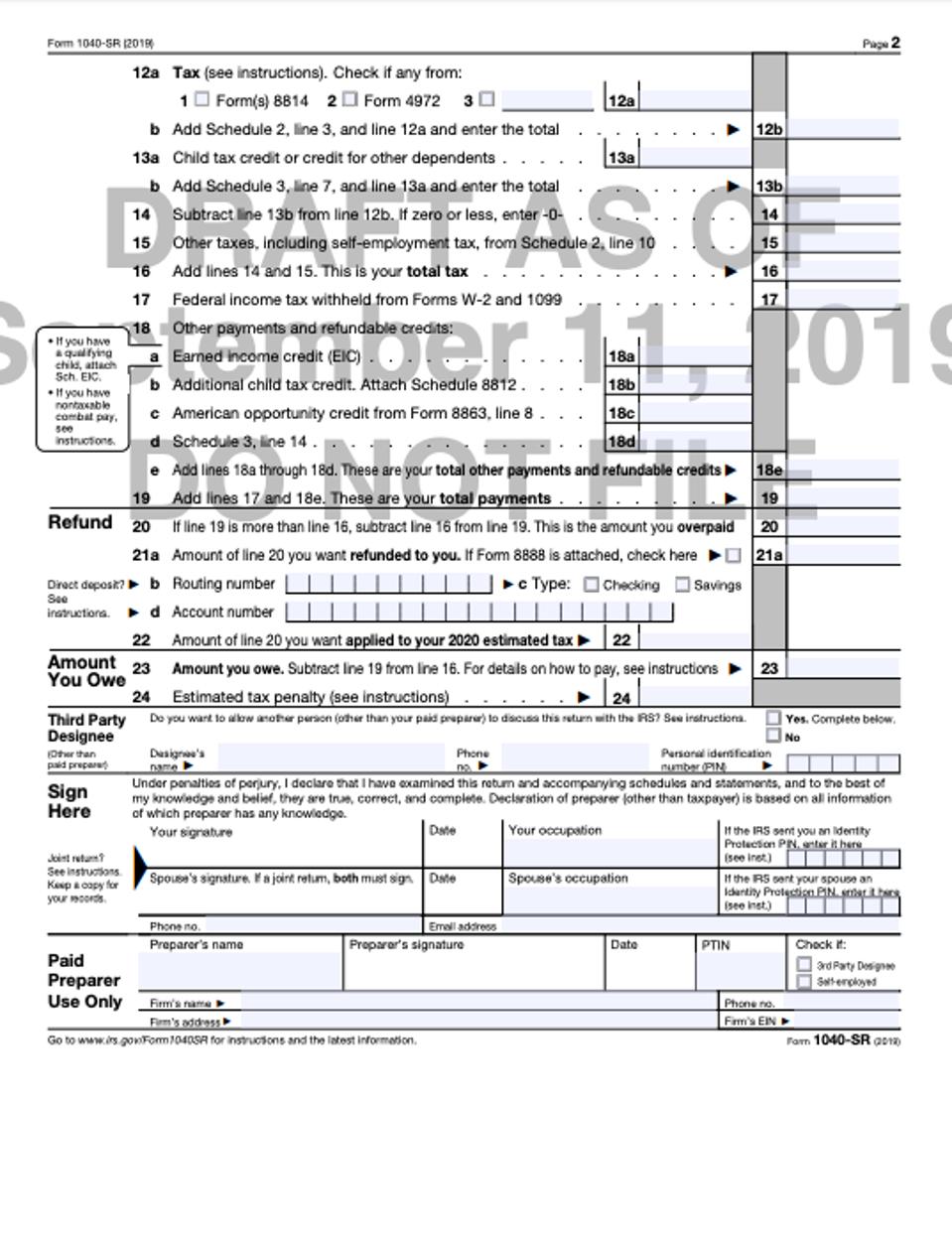

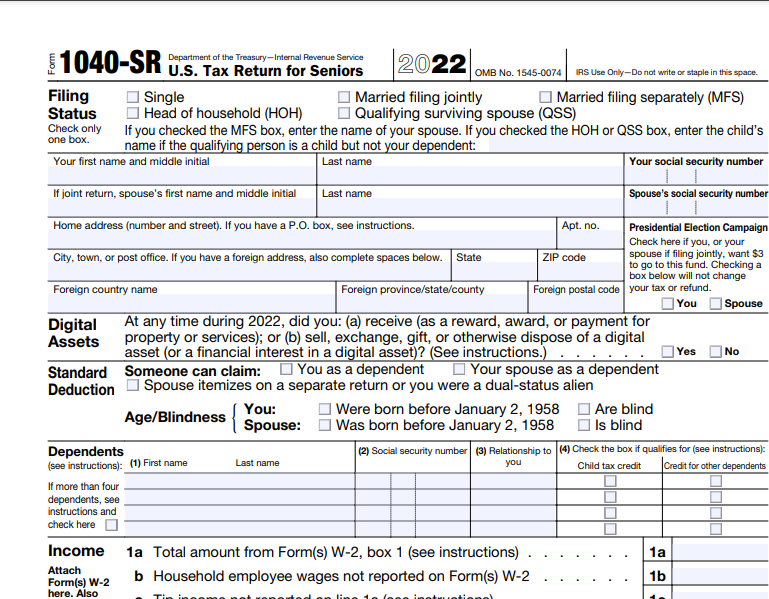

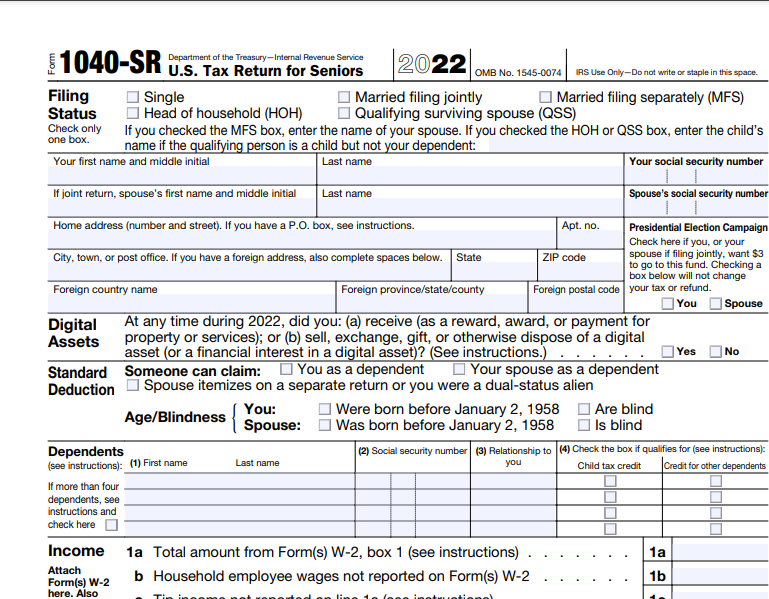

Printable Irs 1040 Sr Form Form 1040 SR Department of the Treasury Internal Revenue Service U S Tax Return for Seniors 2020 OMB No 1545 0074 IRS Use Only Do not write or staple in this space 99 Filing Status Check only one box Single Married filing jointly Married filing separately MFS Head of household HOH Qualifying widow er QW

Printable Form 1040 SR Click any of the IRS 1040 SR form links below to download save view and print the file for the corresponding year These free PDF files are unaltered and are sourced directly from the publisher The Form 1040 SR tax table can be found inside the instructions booklet 2023 1040 SR Form 2023 1040 SR Instructions Form 1040 SR is a large print version of Form 1040 that is designed for taxpayers who fill out their tax return by hand rather than online A standard deduction table is printed right on the form for easy reference You need to be 65 or older to use Form 1040 SR

Printable Irs 1040 Sr Form

Printable Irs 1040 Sr Form

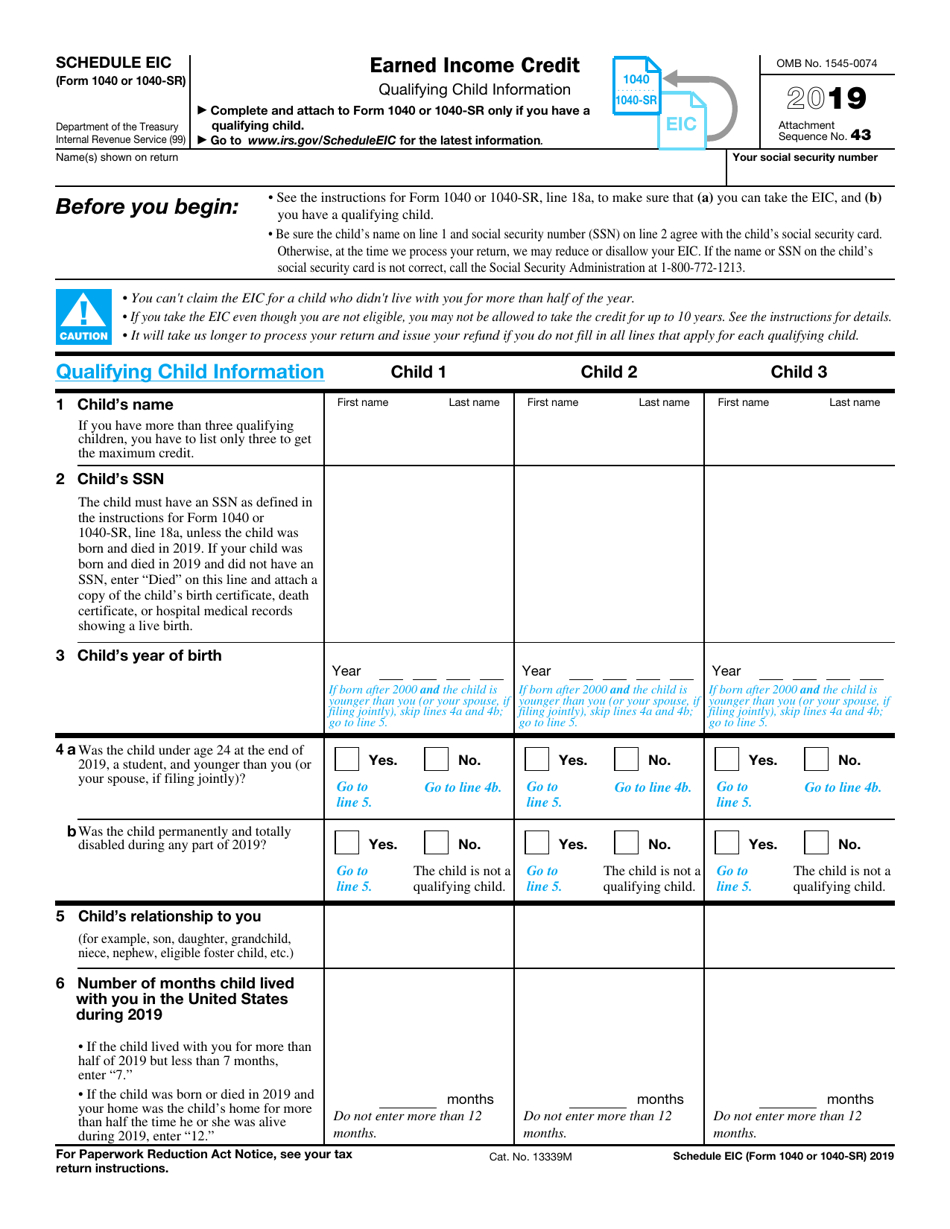

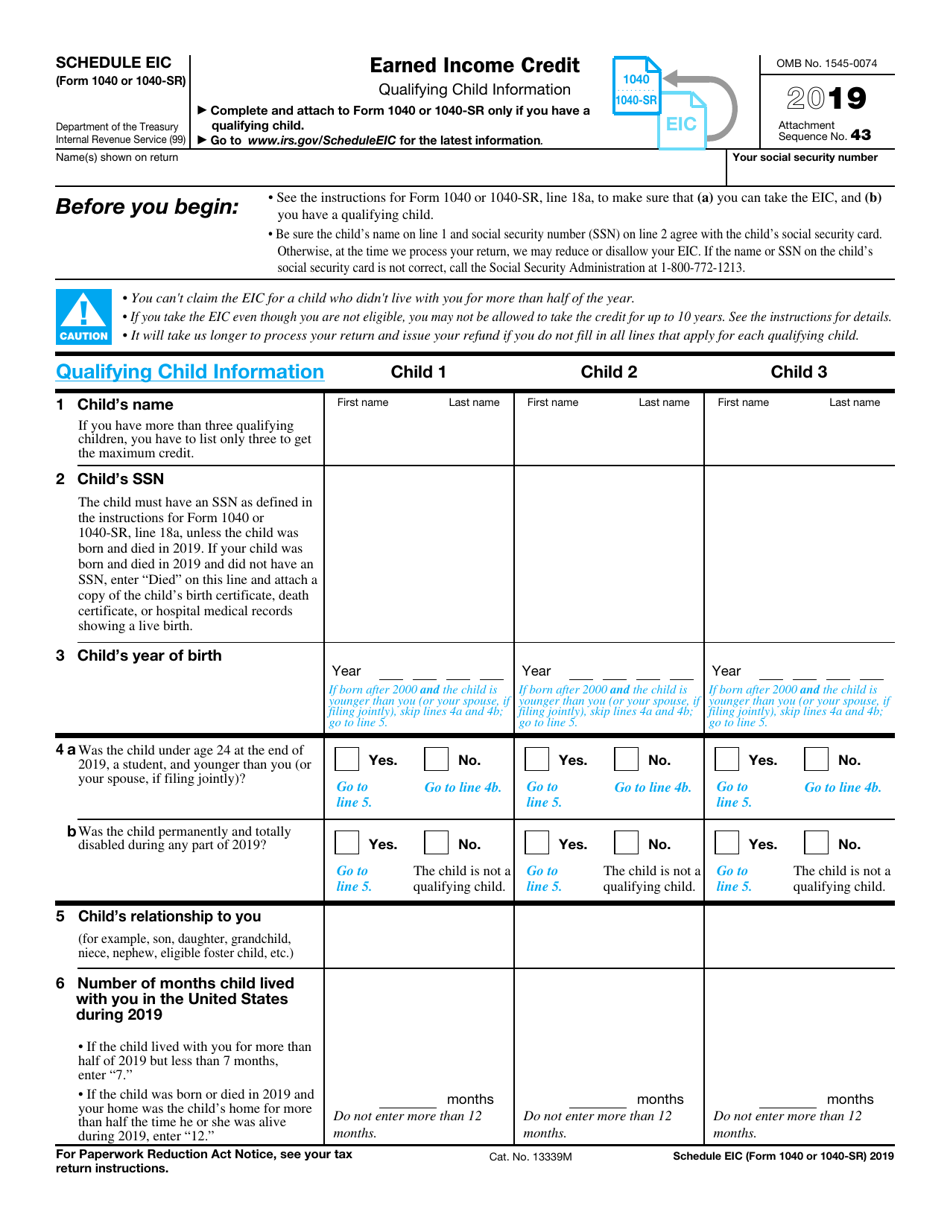

https://data.templateroller.com/pdf_docs_html/2000/20000/2000020/irs-form-1040-1040-sr-schedule-eic-earned-income-credit_print_big.png

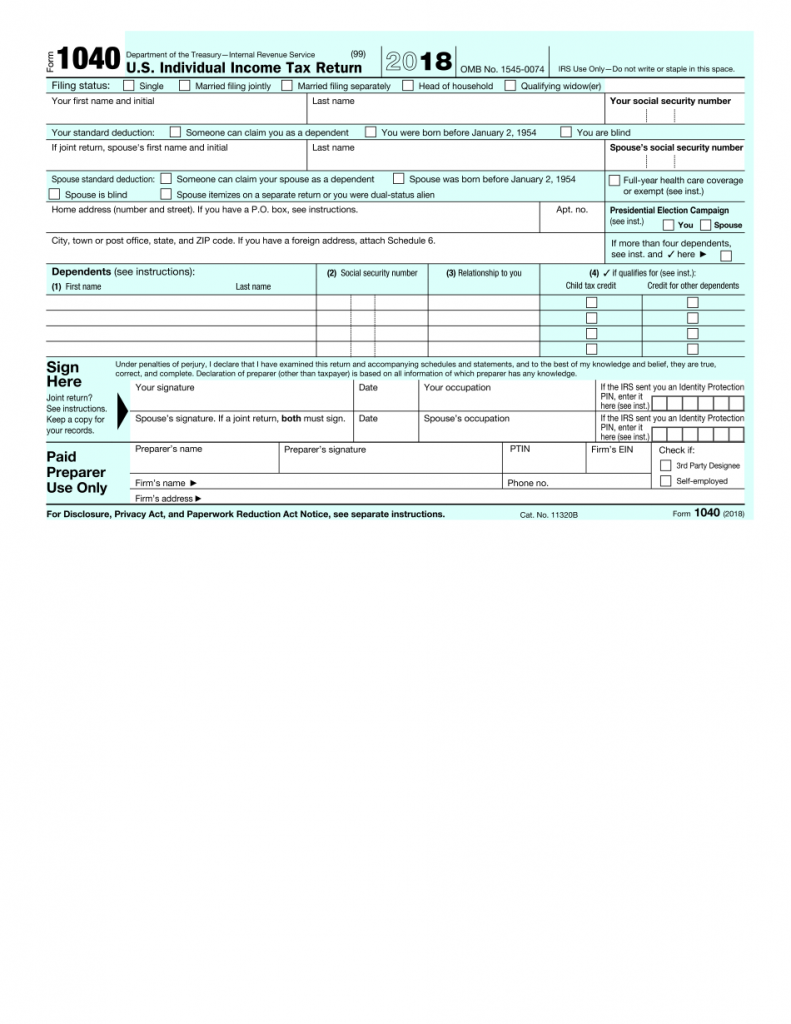

IRS 1040 Form Fillable Printable In PDF Printable Form 2021

https://www.printableform.net/wp-content/uploads/2021/07/irs-1040-form-fillable-printable-in-pdf-1-791x1024.png

Irs Fillable Form 1040 IRS Form 1040 1040 SR Schedule 1 Download Fillable PDF Create A

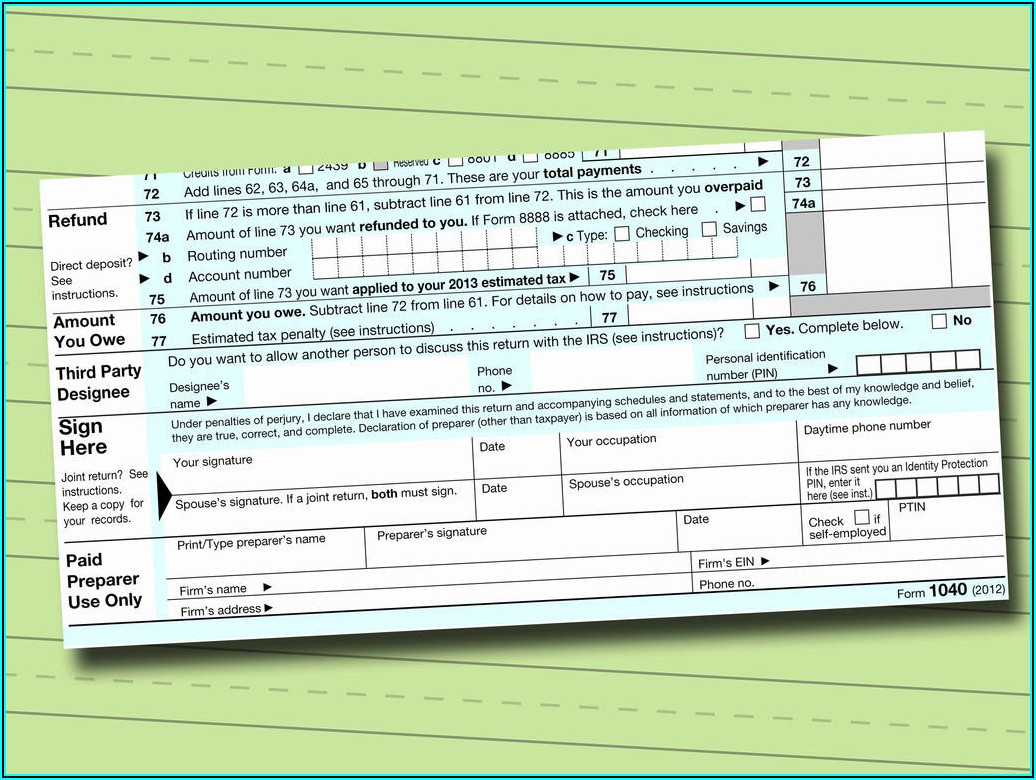

https://www.universalnetworkcable.com/wp-content/uploads/2019/03/irs-form-1040a-fillable-pdf.jpg

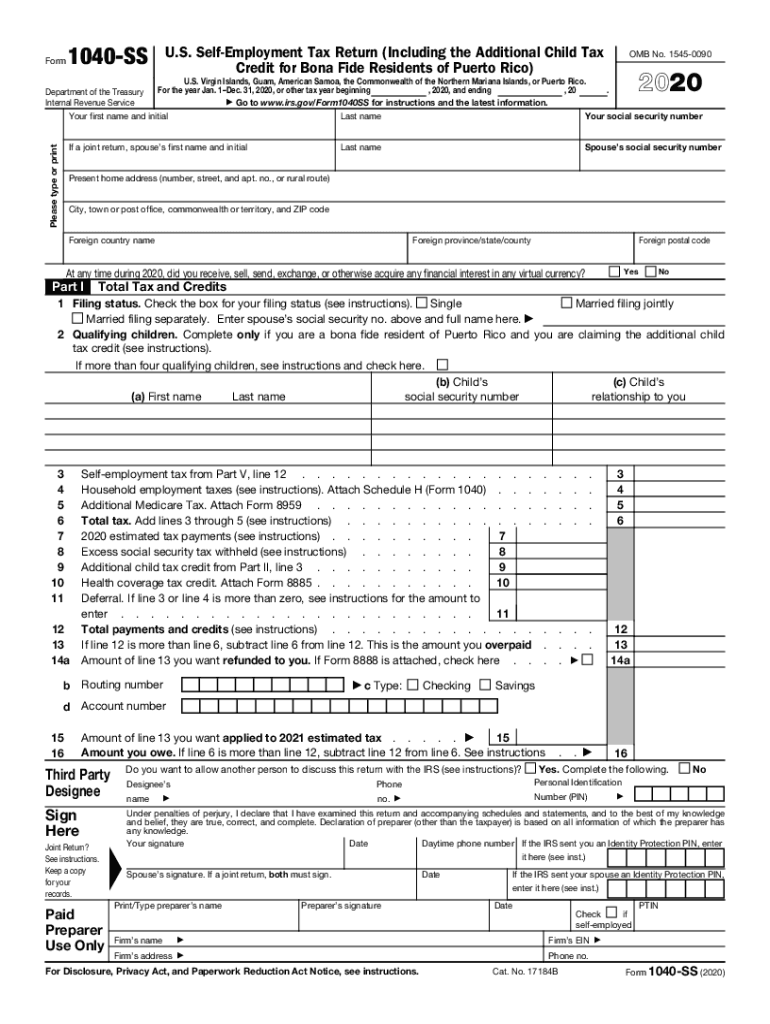

Form 1040 SR is a variation of the standard Form 1040 used by most taxpayers You can use either form if you were at least age 65 as of the last day of the tax year Form Form 1040 SR U S Tax Return for Seniors Department of the Treasury Internal Revenue Service 99 2020 OMB No 1545 0074 IRS Use Only Do not write or staple in this space Single Married filing jointly Married filing separately MFS Head of household HOH Qualifying widow er QW If you checked the MFS box enter the name of your spouse

IRS Form 1040 SR is a version of the 1040 tax return that s been created specifically for use by older adults over the age of 65 Key Takeaways Form 1040 SR is a tax return designed specifically to meet the needs of older adults Tax deductions for 1040 SR filers If you are at least 65 years old or blind you can claim an added 2023 standard deduction of 1 500 if your filing status is married filing jointly married filing separately or qualifying surviving spouse filing status You get an added 1 850 if using the single or head of household filing status

More picture related to Printable Irs 1040 Sr Form

Irs Fillable Form 1040 Irs Form 1040 1040 Sr Schedule Eic Download Fillable Pdf How To Vrogue

http://www.contrapositionmagazine.com/wp-content/uploads/2020/10/irs-fillable-form-1040.jpg

Irs 1040 Form And Instructions 2020 IRS Form 1040 SR Download Fillable PDF Or Fill Online U S

https://www.pdffiller.com/preview/549/394/549394086/large.png

IRS Offers New Look At Form 1040 SR U S Tax Return For Seniors Taxgirl

https://specials-images.forbesimg.com/imageserve/5d8a1ee718444200084e55cf/960x0.jpg?fit=scale

The Internal Revenue Service IRS has released tax form 1040 SR for senior taxpayers including instructions and printable forms for the years 2023 and 2024 The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040 Accessible federal tax forms

In conclusion the IRS tax form 1040 SR instructions and printable forms for 2023 and 2024 are now available providing senior taxpayers with a simplified and convenient way to file their taxes As a result Congress tasked the IRS with creating a tax form that would be easier for senior taxpayers to navigate and Form 1040SR was born Unlike 1040 EZ this form does not put any type of limit on the amount of interest dividends or capital gains that a taxpayer can earn nor does it cap their overall annual income When printed Form

1040 SR What You Need To Know About The New Tax Form For Seniors The Ugly Budget

https://i1.wp.com/uglybudget.com/wp-content/uploads/2019/09/Screen-Shot-2019-09-24-at-2.35.46-PM.png?resize=500%2C632&ssl=1

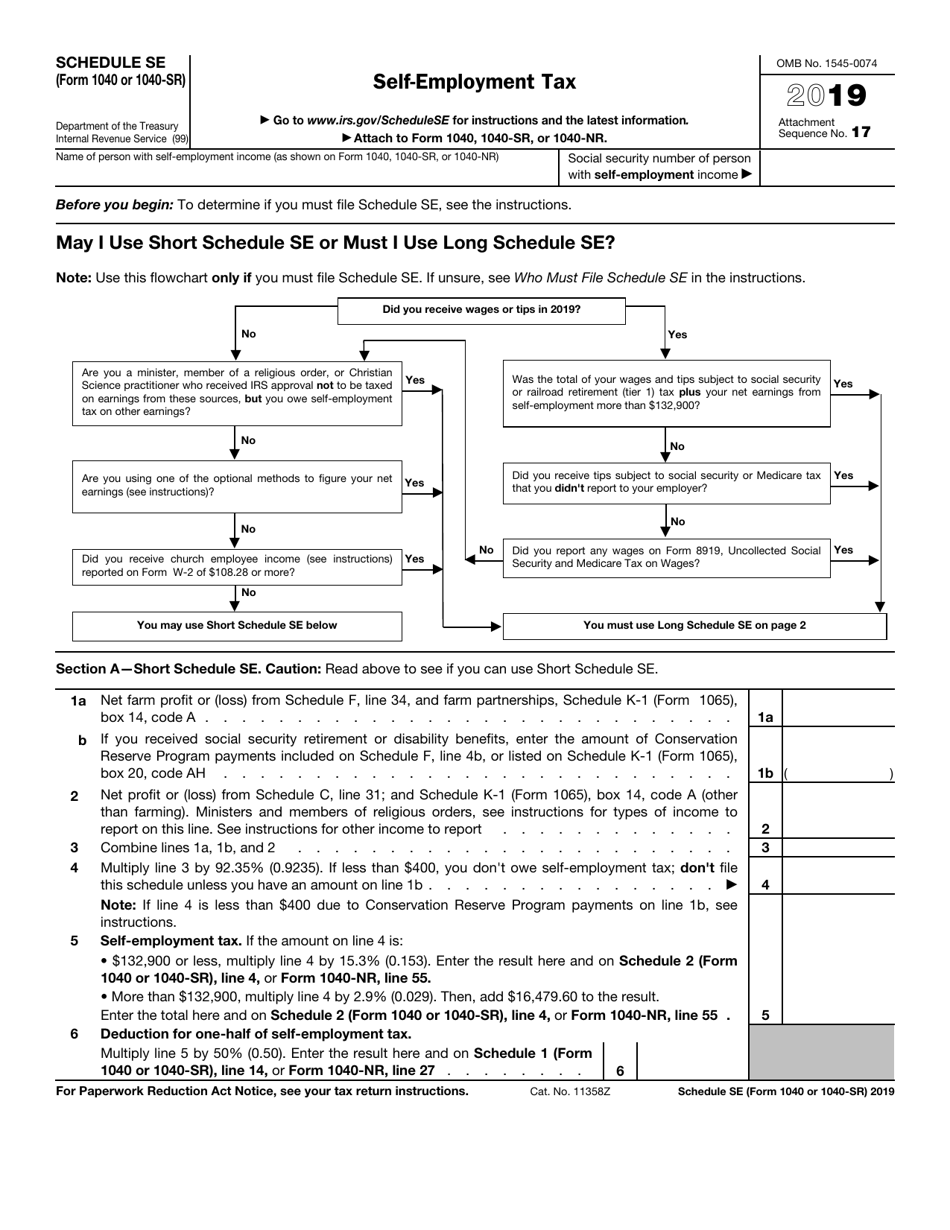

IRS Form 1040 1040 SR Schedule SE 2019 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/1932/19322/1932211/irs-form-1040-irs-form-1040-sr-schedule-se-self-employment-tax_print_big.png

https://www.irs.gov/pub/irs-prior/f1040s--2020.pdf

Form 1040 SR Department of the Treasury Internal Revenue Service U S Tax Return for Seniors 2020 OMB No 1545 0074 IRS Use Only Do not write or staple in this space 99 Filing Status Check only one box Single Married filing jointly Married filing separately MFS Head of household HOH Qualifying widow er QW

https://www.incometaxpro.net/tax-form/1040sr.htm

Printable Form 1040 SR Click any of the IRS 1040 SR form links below to download save view and print the file for the corresponding year These free PDF files are unaltered and are sourced directly from the publisher The Form 1040 SR tax table can be found inside the instructions booklet 2023 1040 SR Form 2023 1040 SR Instructions

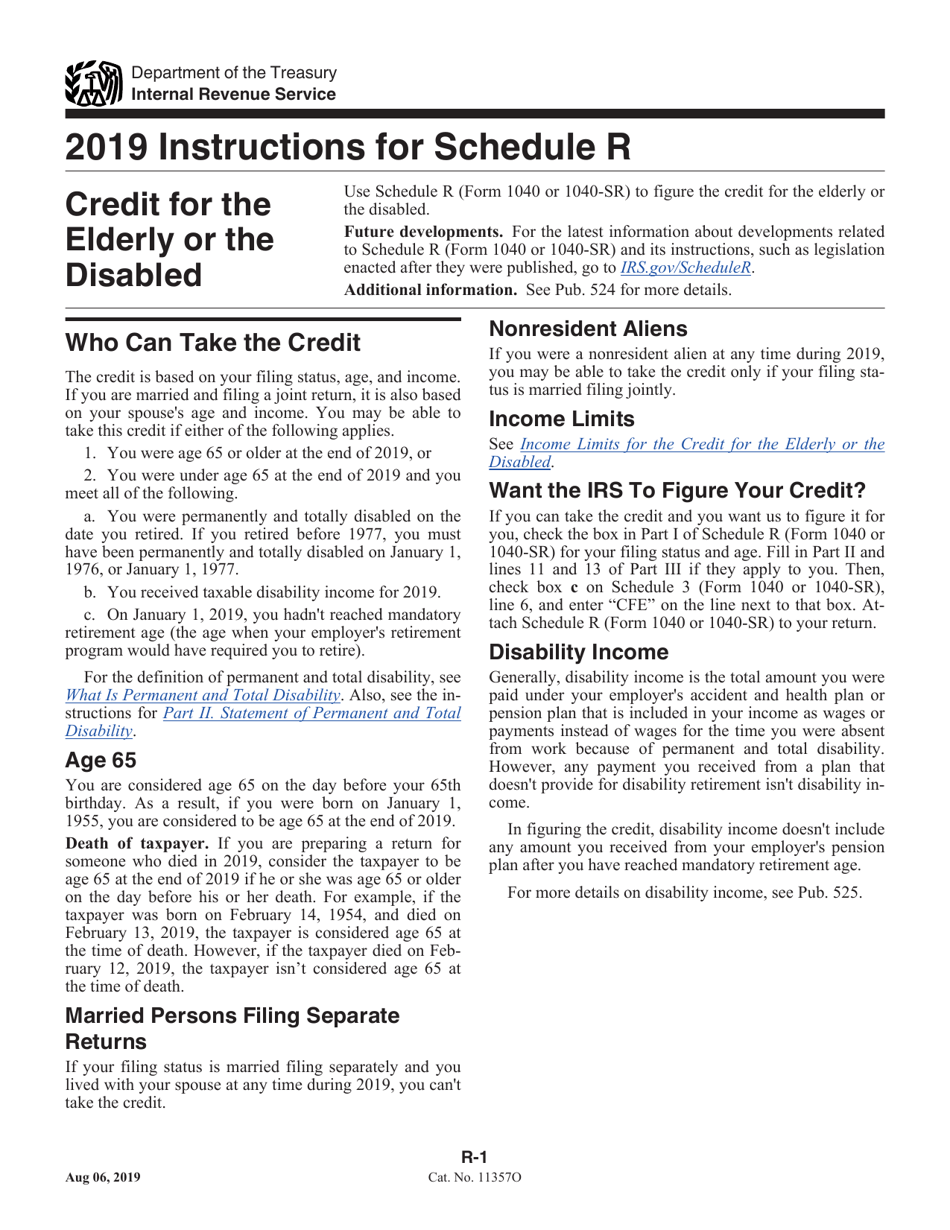

Download Instructions For IRS Form 1040 1040 SR Credit For The Elderly Or The Disabled PDF

1040 SR What You Need To Know About The New Tax Form For Seniors The Ugly Budget

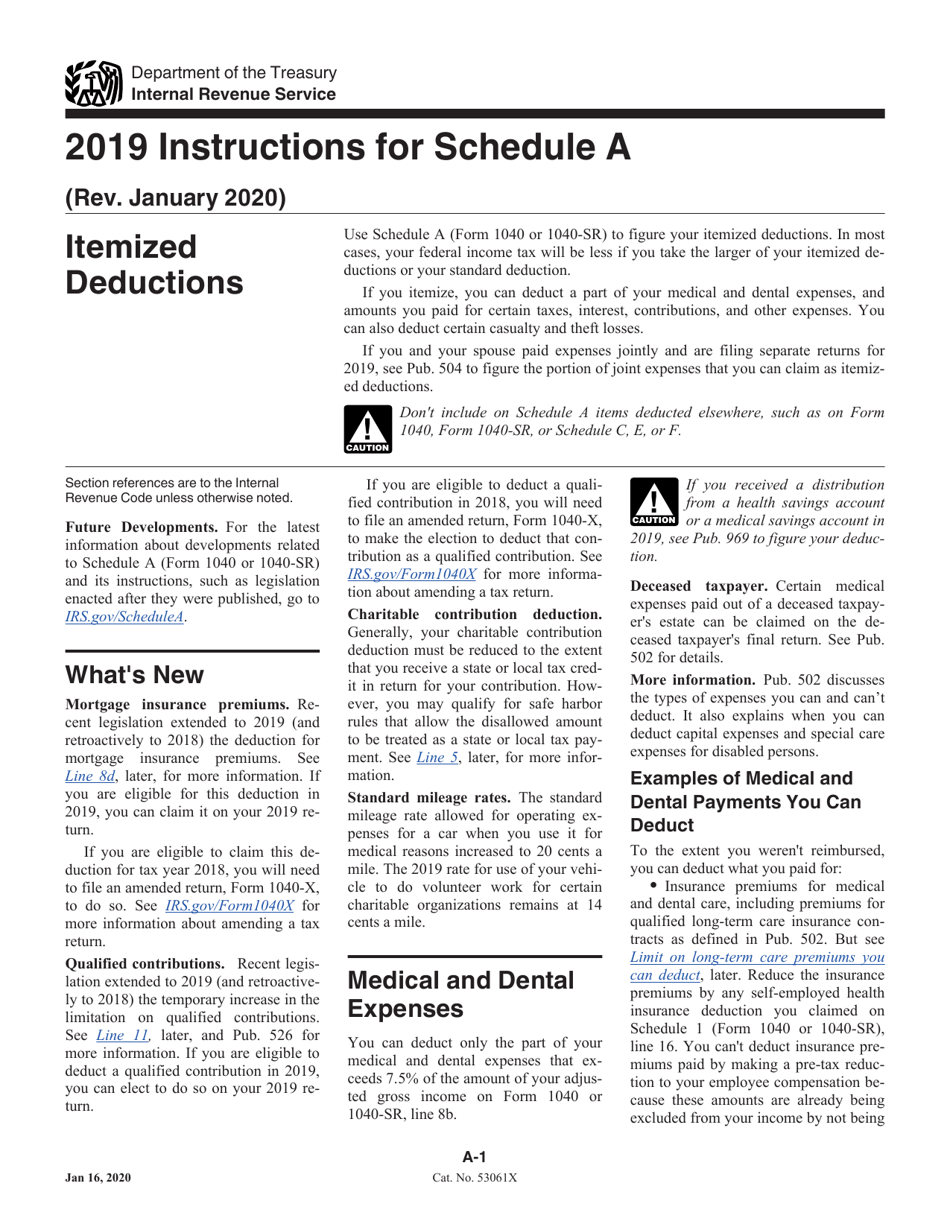

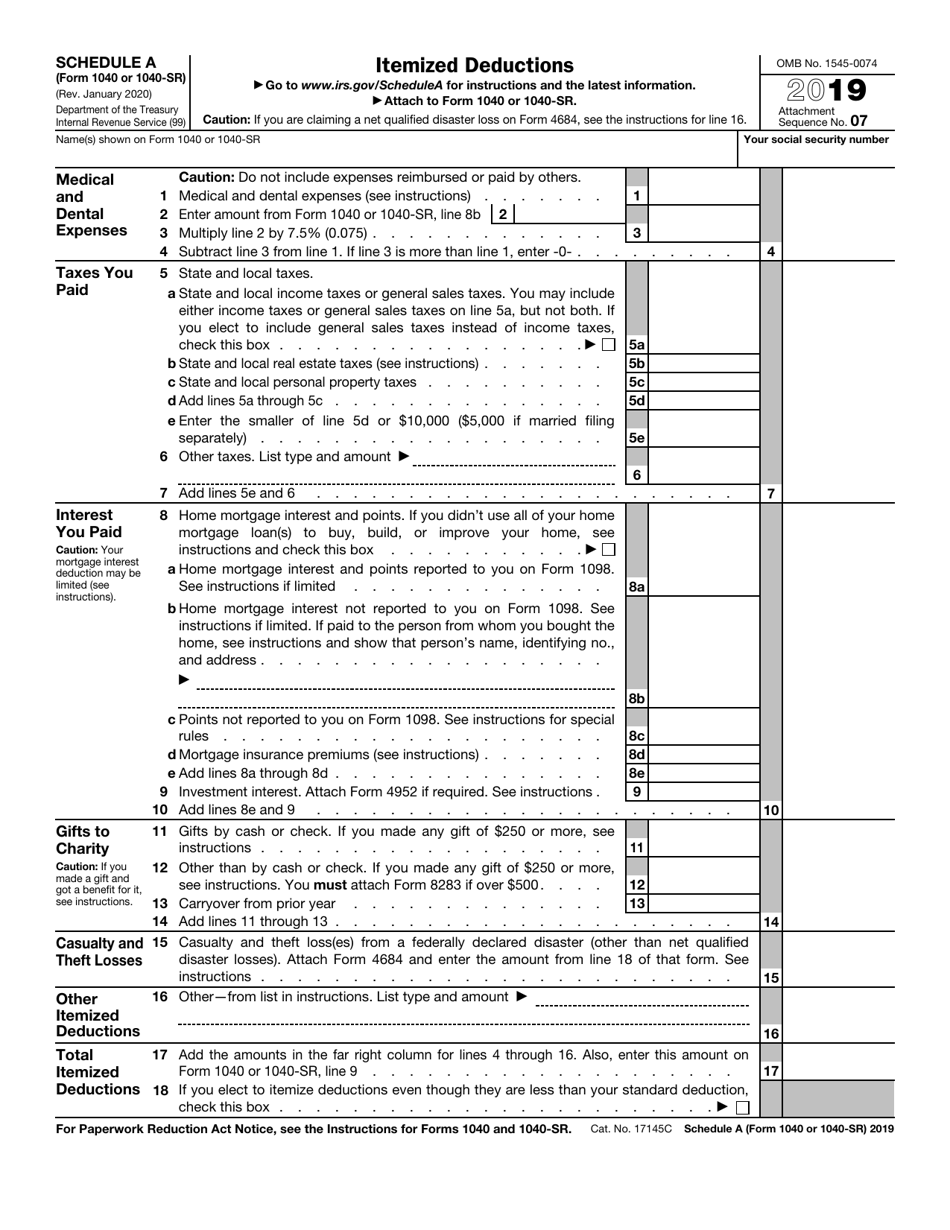

Download Instructions For IRS Form 1040 1040 SR Schedule A Itemized Deductions PDF 2019

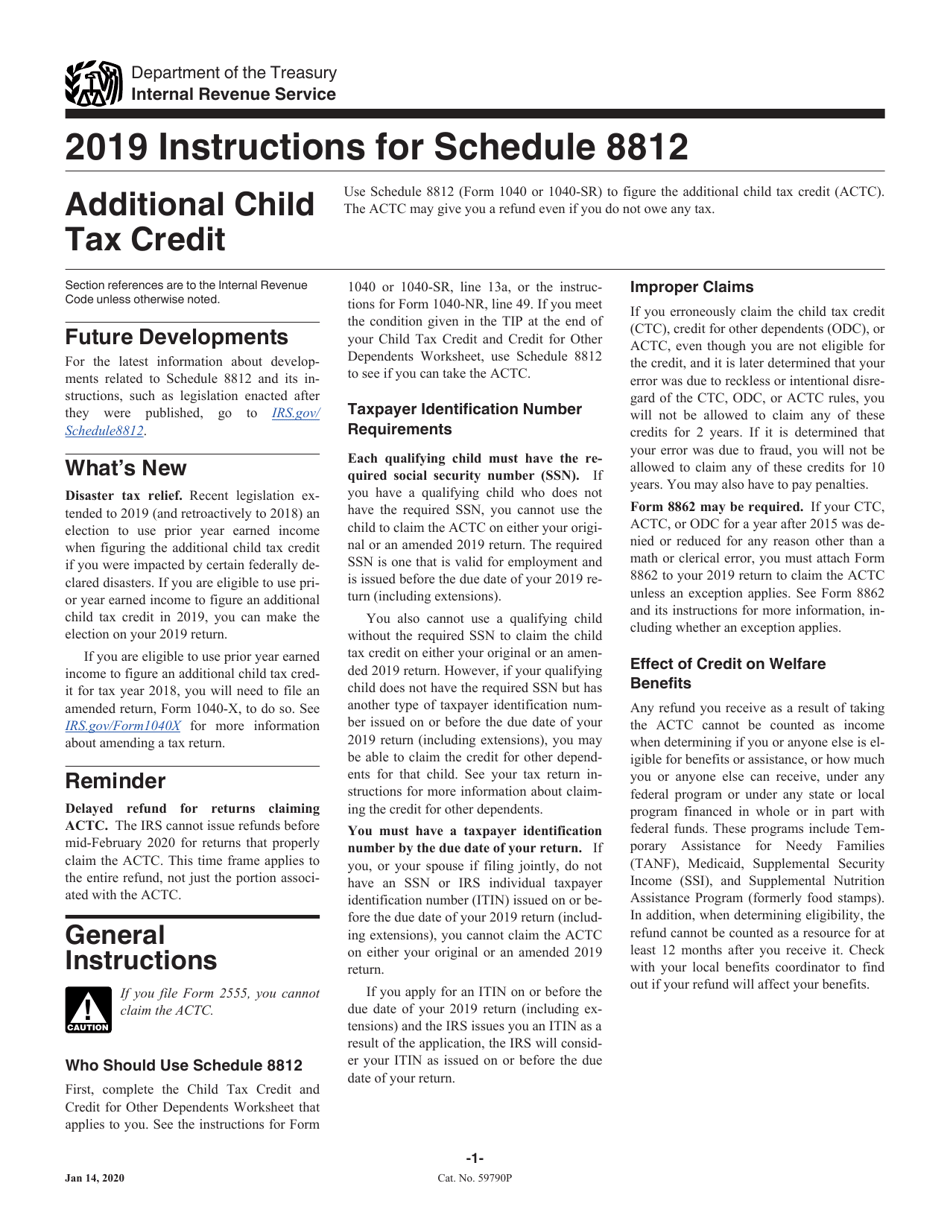

Download Instructions For IRS Form 1040 1040 SR Schedule 8812 Additional Child Tax Credit PDF

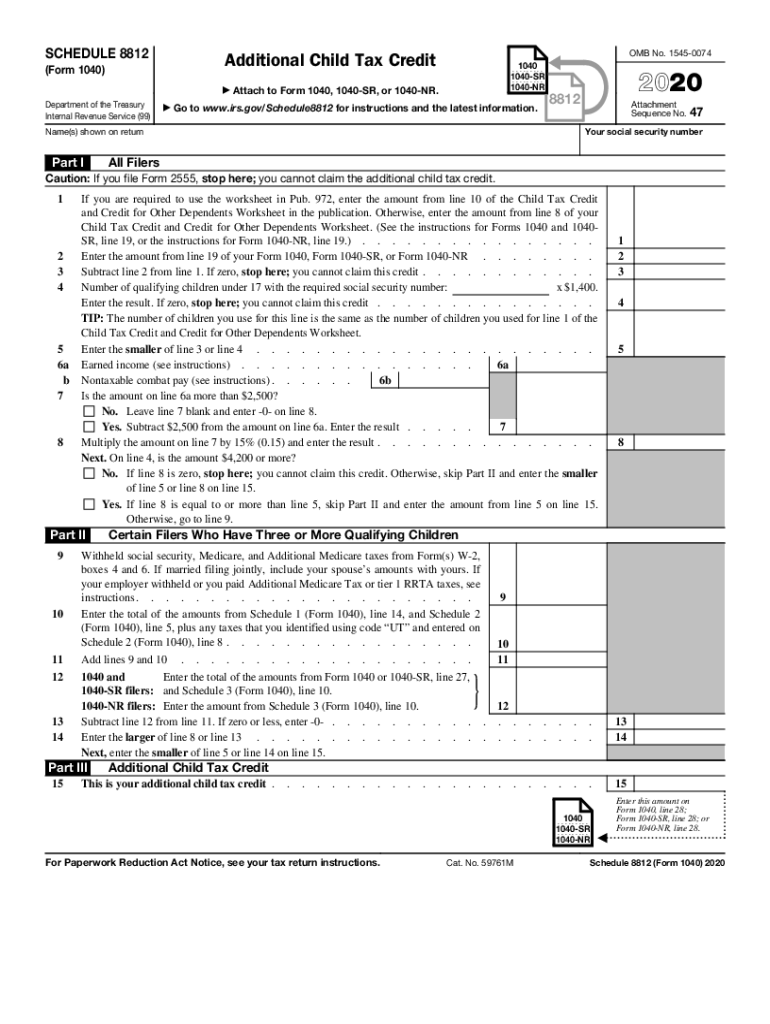

IRS 1040 Schedule 8812 2020 Fill Out Tax Template Online US Legal Forms

IRS Form 1040 SR Tax Return For Seniors Forms Docs 2023

IRS Form 1040 SR Tax Return For Seniors Forms Docs 2023

Guide On Filling Out Form 1040 SR

IRS Form 1040 1040 SR Schedule A 2019 Fill Out Sign Online And Download Fillable PDF

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial Nations

Printable Irs 1040 Sr Form - Tax deductions for 1040 SR filers If you are at least 65 years old or blind you can claim an added 2023 standard deduction of 1 500 if your filing status is married filing jointly married filing separately or qualifying surviving spouse filing status You get an added 1 850 if using the single or head of household filing status