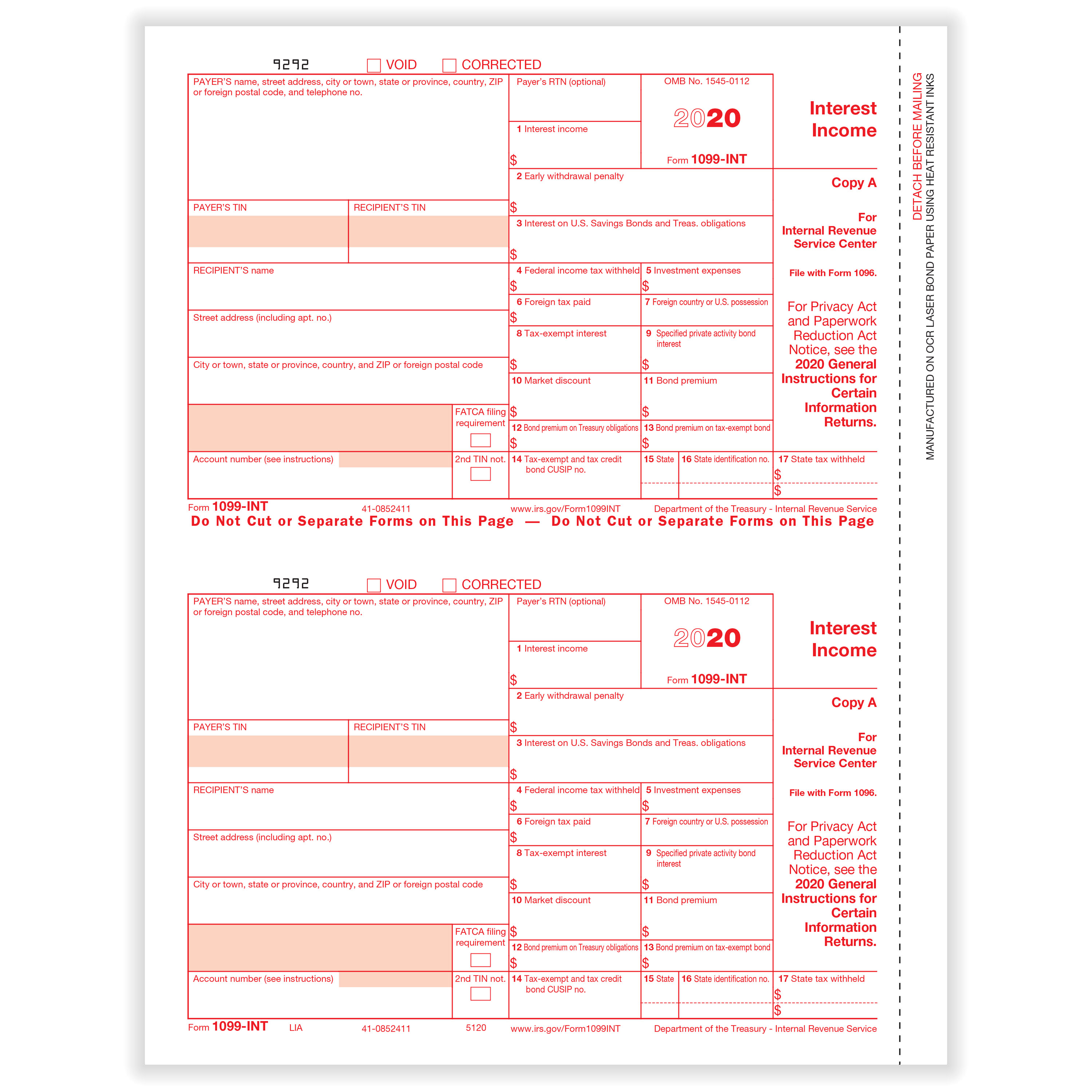

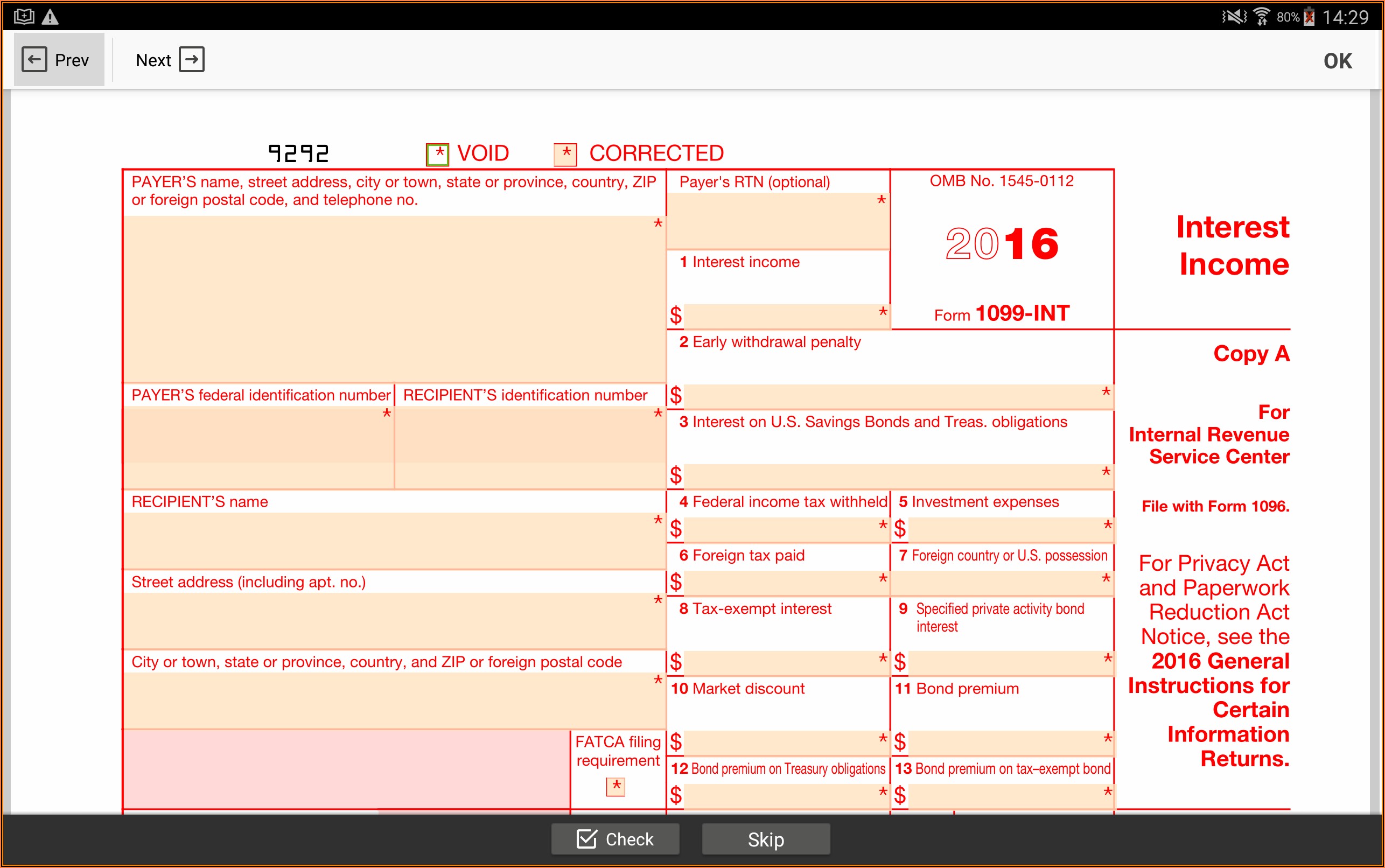

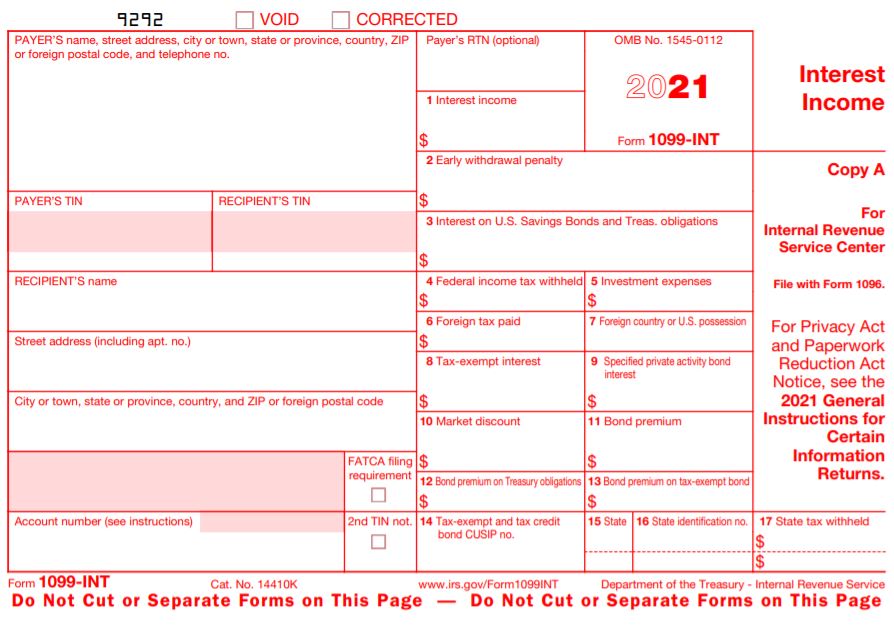

Printable Irs 1099 Int Forms File Form 1099 INT for each person To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10 For whom you withheld and paid any foreign tax on interest From whom you withheld and did not refund any federal income tax under the backup withholding rules regardless of the amount of the payment Current Revision Form 1099 INT PDF

IRS Form 1099 INT is a tax form used to report more than 10 worth of interest paid to an individual or more than 600 worth of interest paid to a trade or business in a year Revised 01 2024 Instructions for Forms 1099 INT and 1099 OID Introductory Material Future Developments For the latest information about developments related to Forms 1099 INT and 1099 OID and their instructions such as legislation enacted after they were published go to IRS gov Form1099INT and IRS gov Form1099OID Reminders

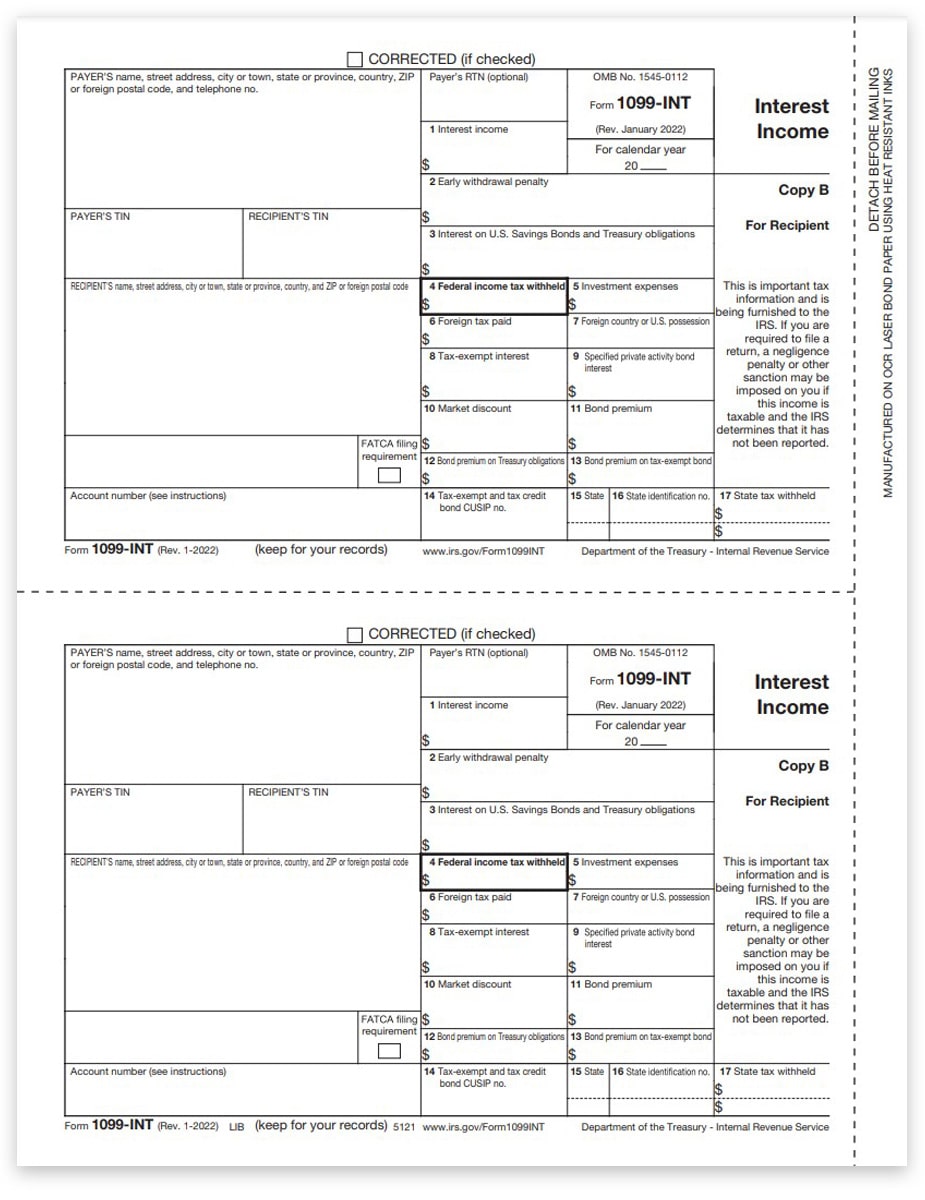

Printable Irs 1099 Int Forms

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)

Printable Irs 1099 Int Forms

https://www.investopedia.com/thmb/OGUDDvaXzzUl5Mccne0mYit28VM=/1668x1103/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png

Fillable Online Irs Form 1099 Int Fax Email Print PdfFiller

https://www.pdffiller.com/preview/21/158/21158127/large.png

1099INT Tax Forms 2022 Recipient Copy B DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1099INT-Form-Copy-B-Recipient-LIB-FINAL-min.jpg

You can e file any Form 1099 for tax year 2022 and later with the Information Returns Intake System IRIS The system also lets you file corrections and request automatic extensions for Forms 1099 For system availability check IRIS status There are 2 ways to e file with IRIS E file through the IRIS Taxpayer Portal For the latest information about developments related to Forms 1099 INT and 1099 OID and their instructions such as legislation enacted after they were published go to IRS gov Form1099INT and IRS gov Form1099OID Reminders

What is a 1099 INT The 1099 INT Form is used for tax filing purposes It is used to report interest earned Interest earned must be notified if the amount received is more significant than 10 This interest is usually paid from a bank or government agency Interest earned must be included as part of your earned income when you file your taxes If a bank financial institution or other entity pays you at least 10 of interest during the year it is required to prepare a Form 1099 INT send you a copy by January 31 and file a copy with the IRS If you receive a Form 1099 INT you ll need to include the amount shown in Box 1 on the taxable interest line of your tax return

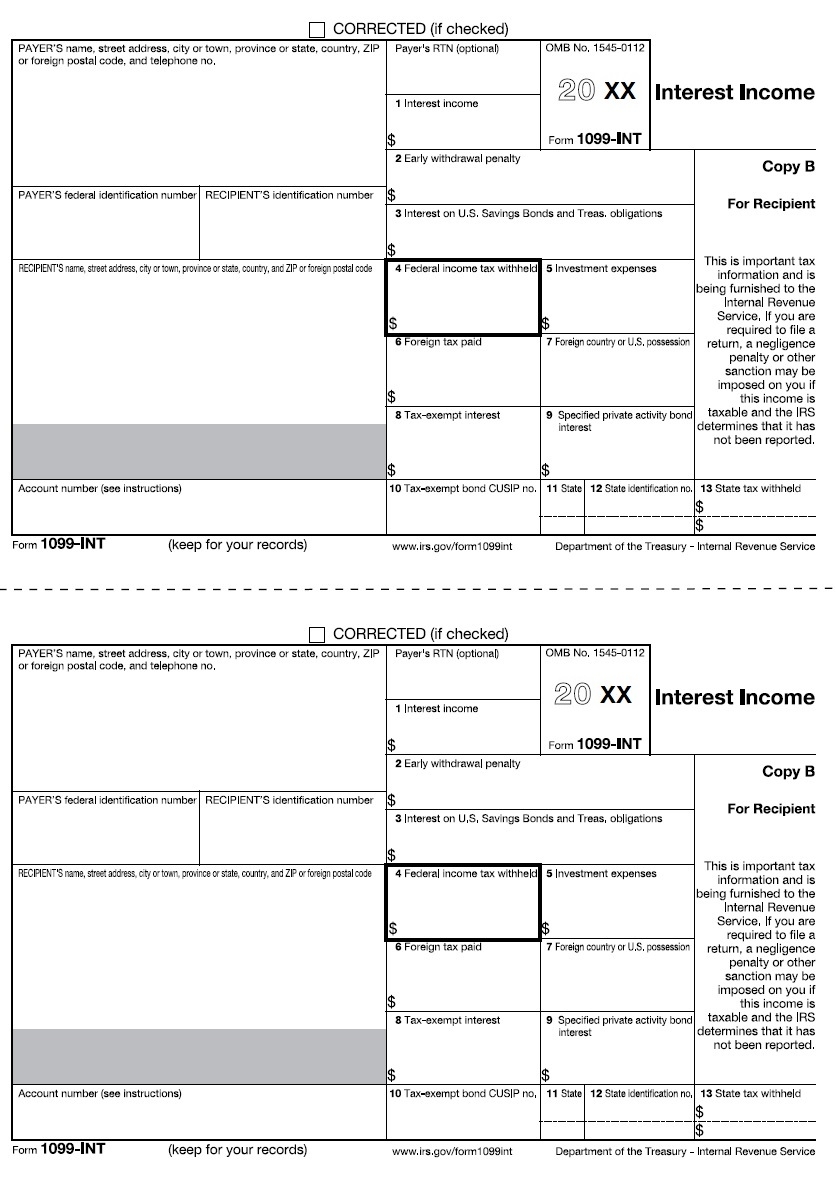

More picture related to Printable Irs 1099 Int Forms

1099 INT Recipient Copy B

https://www.formsmall.com/media/catalog/product/cache/1/image/5e06319eda06f020e43594a9c230972d/1/0/1099-Int-3up-copy-B.jpg

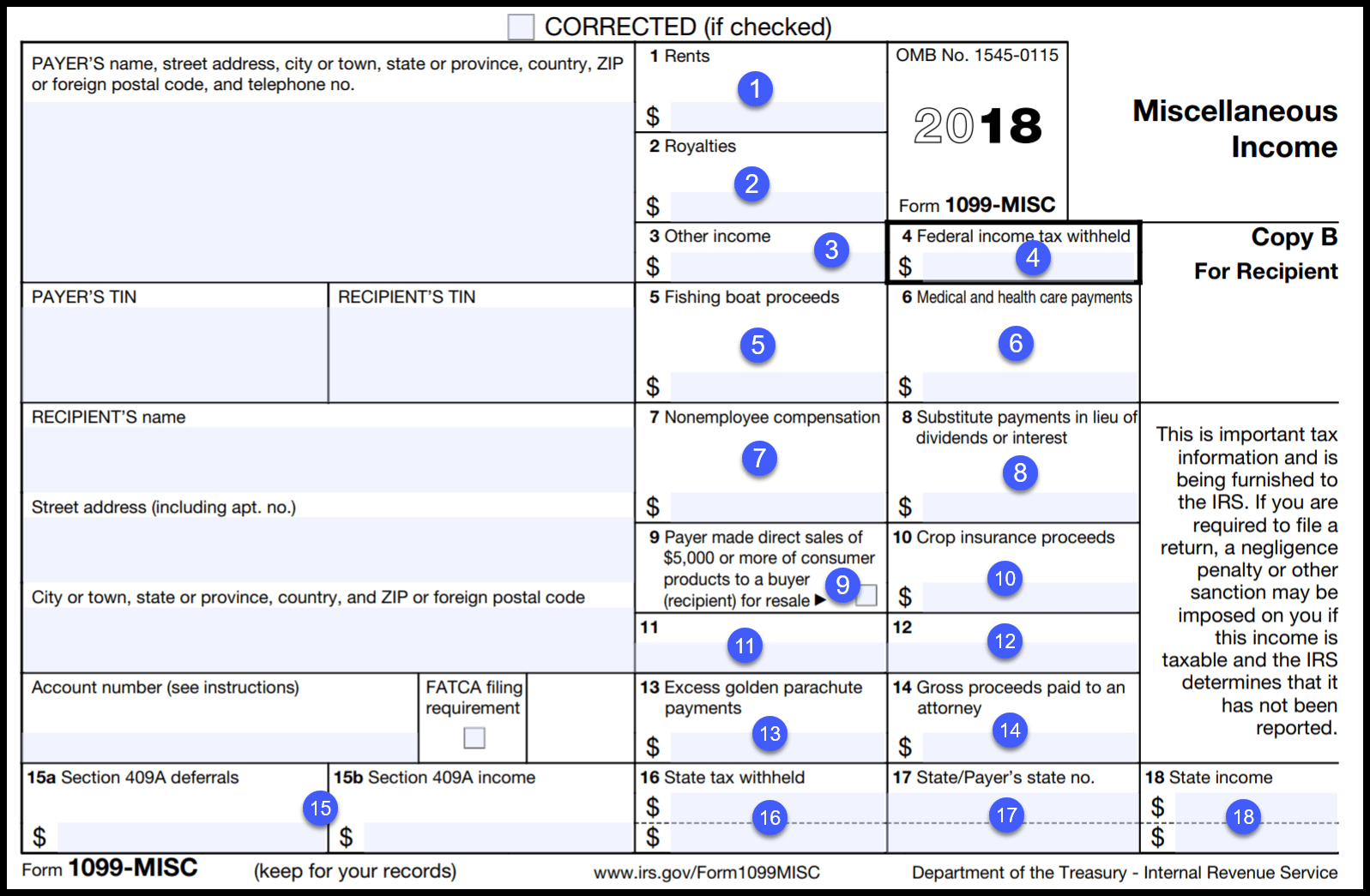

IRS Form 1099 Reporting For Small Business Owners

https://fitsmallbusiness.com/wp-content/uploads/2019/01/1099-form.png

1099 INT A Quick Guide To This Key Tax Form The Motley Fool

https://g.foolcdn.com/editorial/images/472740/1099-int.PNG

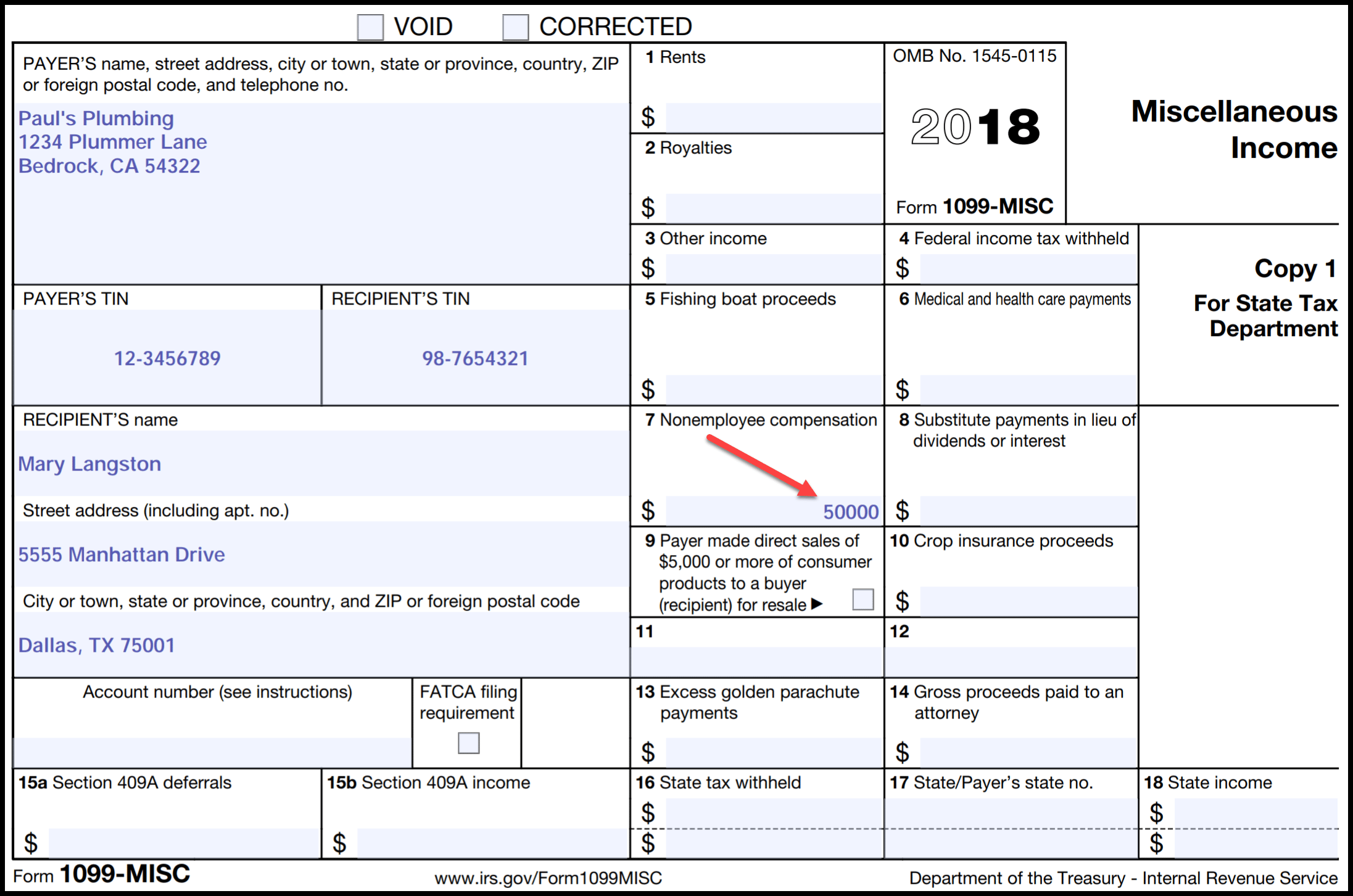

The 1099 INT is a type of IRS form that outlines how much interest an entity paid you throughout the year You might receive this tax form from your bank because it paid you interest on 9595 VOID Copy A For Internal Revenue Service Center File with Form 1096 For Privacy Act and Paperwork Reduction Act Notice see the current General Instructions for Certain Information Returns 2nd TIN not Cat No 14425J www irs gov Form1099MISC Do Not Cut or Separate Forms on This Page Do Not Cut or Separate Forms on This Page VOID Copy 1

Form 1099 INT is an IRS income tax form that reports interest income received by taxpayers Interest paying entities must issue Form 1099 INT to investors at year s end and Learn what a 1099 IRS tax form is and the different types of 1099 forms with the experts at H R Block Find out if you will receive 1099 forms from employers or investment companies Form 1099 INT Form 1099 INT is used to report interest income received When preparing your income tax return the following 1099 INT information will be

1099 Int Federal Form 1099 INT Formstax

https://cdn.formstax.com/Images/Products/L0143-5120-2020-1099INT-Federal-Copy-A-LSR_xl.jpg

1099 INT Forms Filing TaxFormExpress

https://www.taxformexpress.com/wp-content/uploads/2014/06/LIB-2022.jpg

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png?w=186)

https://www.irs.gov/forms-pubs/about-form-1099-int

File Form 1099 INT for each person To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10 For whom you withheld and paid any foreign tax on interest From whom you withheld and did not refund any federal income tax under the backup withholding rules regardless of the amount of the payment Current Revision Form 1099 INT PDF

https://eforms.com/irs/form-1099/int/

IRS Form 1099 INT is a tax form used to report more than 10 worth of interest paid to an individual or more than 600 worth of interest paid to a trade or business in a year

IRS Form 1099 Reporting For Small Business Owners

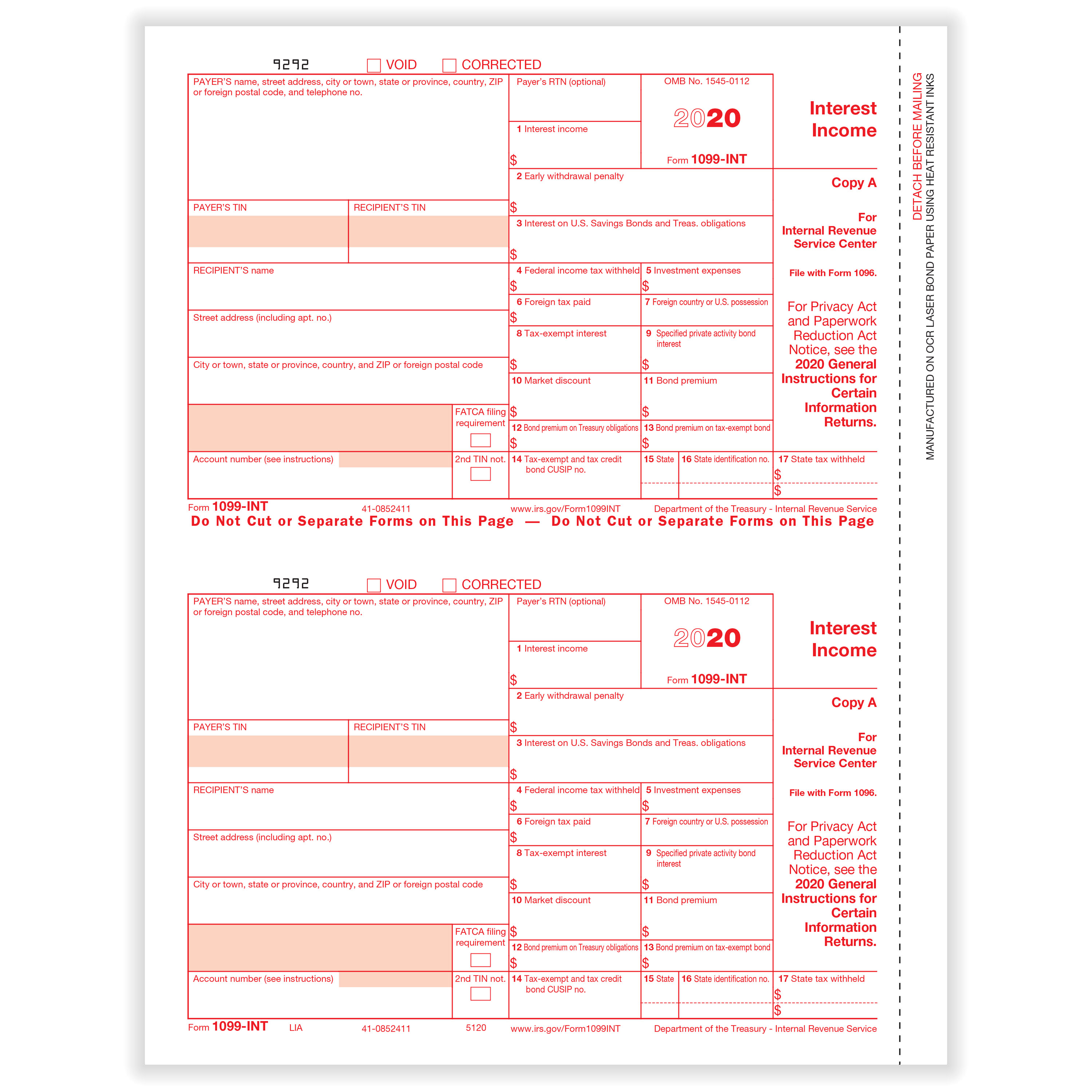

1099 Int Federal Form 1099 INT Formstax

1099 Form Fillable And Printable IRS PDF

Irs Printable 1099 Form Printable Form 2023

1099 INT Software To Create Print E File IRS Form 1099 INT

Form 1099 INT IRS Copy A

Form 1099 INT IRS Copy A

Irs Form 1099 Fillable Free Printable Forms Free Online

Free 1099 Int Fillable Form Printable Forms Free Online

Free Form 1099 MISC PDF Word

Printable Irs 1099 Int Forms - If a bank financial institution or other entity pays you at least 10 of interest during the year it is required to prepare a Form 1099 INT send you a copy by January 31 and file a copy with the IRS If you receive a Form 1099 INT you ll need to include the amount shown in Box 1 on the taxable interest line of your tax return