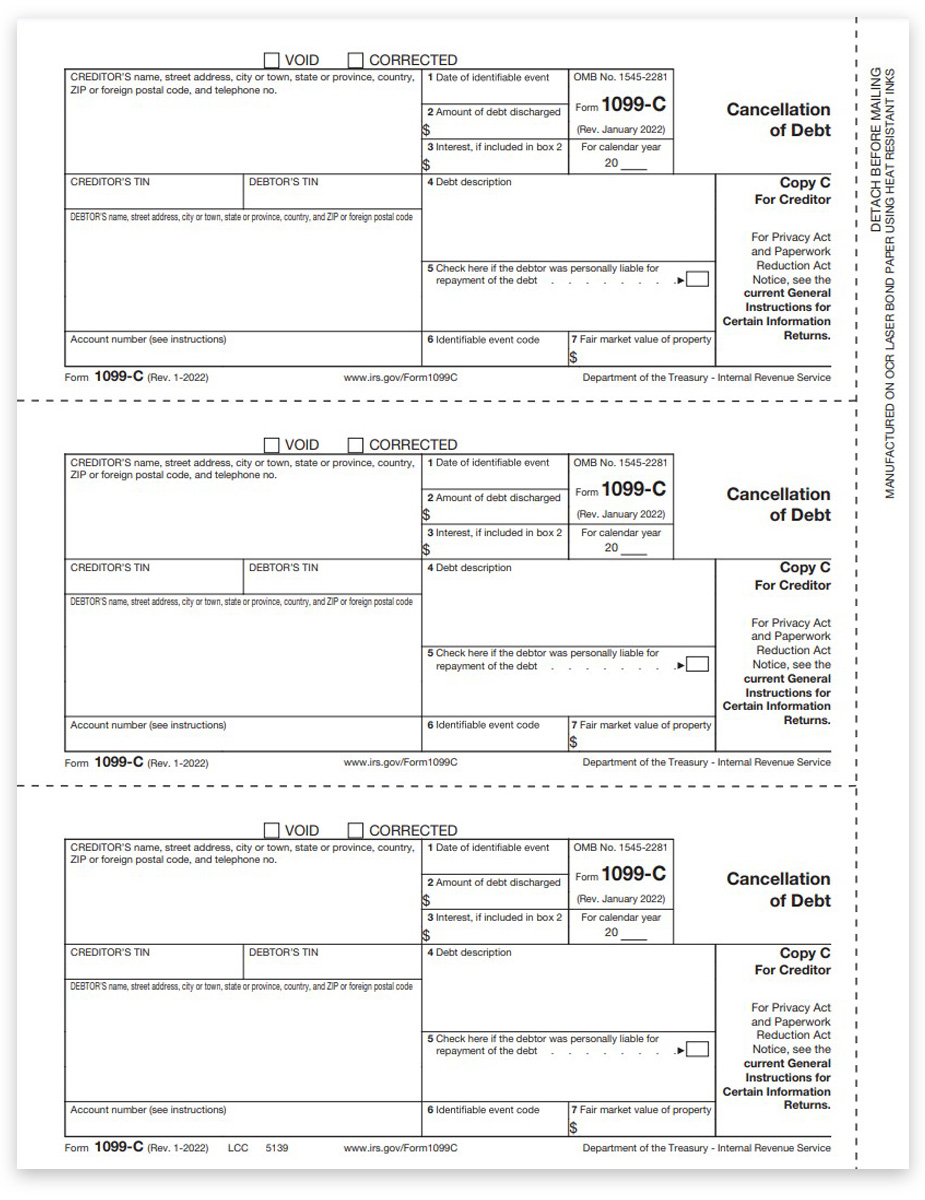

Printable Irs Form 1099 C Form File Form 1099 C for each debtor for whom you canceled 600 or more of a debt owed to you if You are an applicable financial entity An identifiable event has occurred Current Revision Form 1099 C PDF Instructions for Forms 1099 A and 1099 C Print Version PDF Recent Developments None at this time Other Items You May Find Useful

A 1099 C form is an IRS tax document used to report the cancellation of debt for an individual debtor due to bankruptcy foreclosure or another change in circumstances A creditor must file 1099 C for each debtor for whom at least 600 in debt has been canceled What Qualifies as Debt Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN

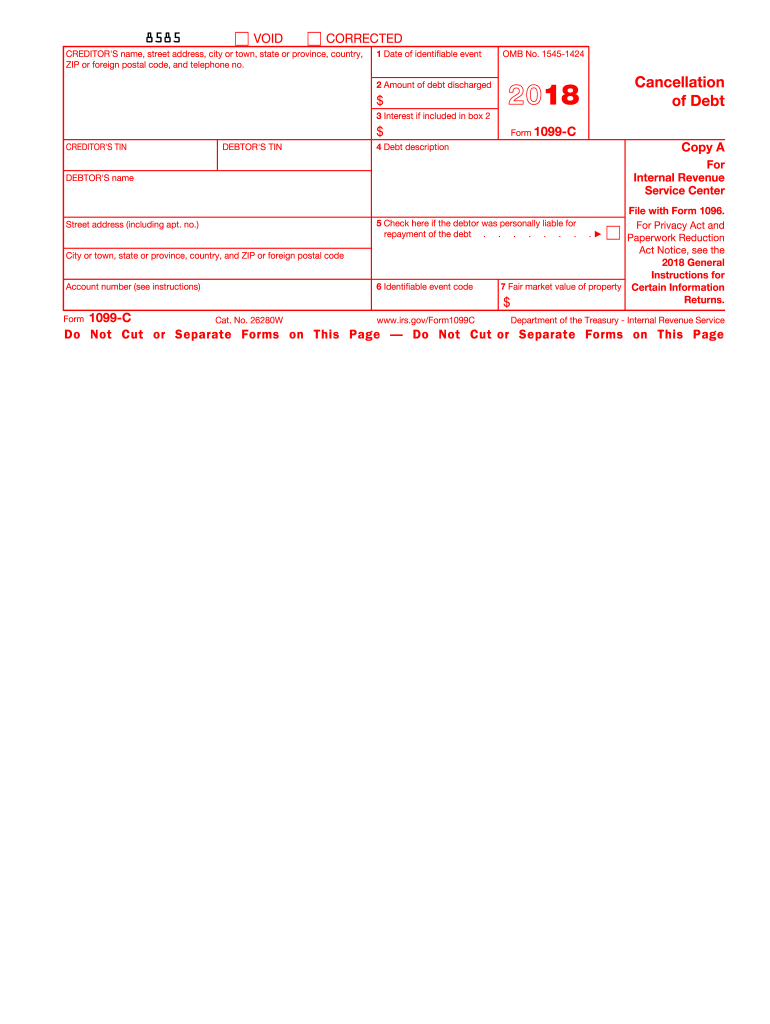

Printable Irs Form 1099 C Form

Printable Irs Form 1099 C Form

https://www.pdffiller.com/preview/418/28/418028865/large.png

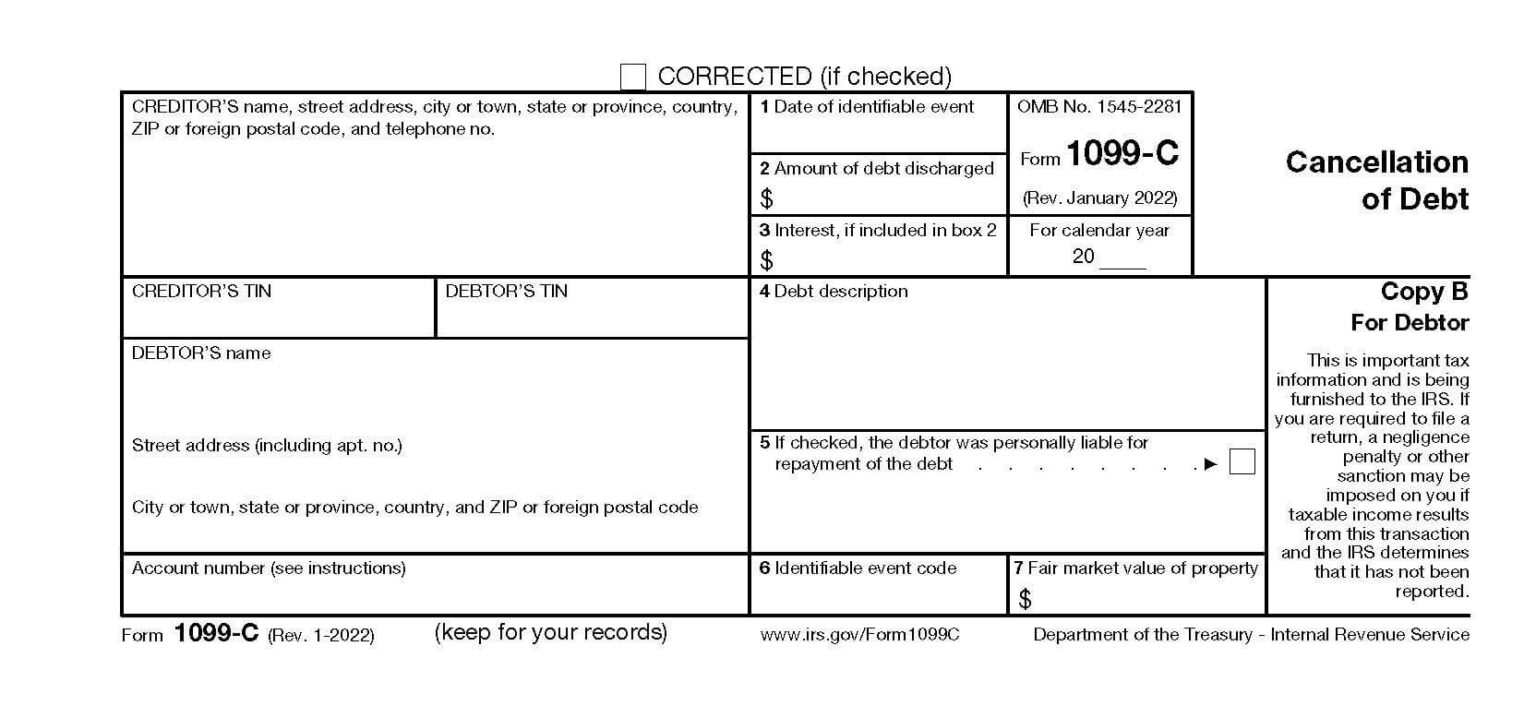

What To Do With The IRS 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

https://alleviatefinancial.com/app/plugins/phastpress/phast.php/c2VydmljZT1pbWFnZXMmc3JjPWh0dHBzJTNBJTJGJTJGYWxsZXZpYXRlZmluYW5jaWFsLmNvbSUyRmFwcCUyRnVwbG9hZHMlMkYyMDE5JTJGMDUlMkZTY3JlZW4tU2hvdC0yMDE5LTA1LTI3LWF0LTQuNDUuNTctUE0ucG5nJmNhY2hlTWFya2VyPTE2MDYyNDM1MDEtNTc5MzImdG9rZW49ZTBjNTllZjI1ODFiZDQzNQ.q.png

Who Uses IRS Form 1099 C

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/Form-1099c-instructions-1536x706.jpg

2021 Instructions for Forms 1099 A and 1099 C Introductory Material Future Developments For the latest information about developments related to Forms 1099 A and 1099 C and their instructions such as legislation enacted after they were published go to IRS gov Form1099A and IRS gov Form1099C What s New Form 1099 C Form 1099 C is used to report canceled or forgiven debt to the IRS A creditor must file one form with the IRS one form with the debtor and retain one form for its records for any amount of debt

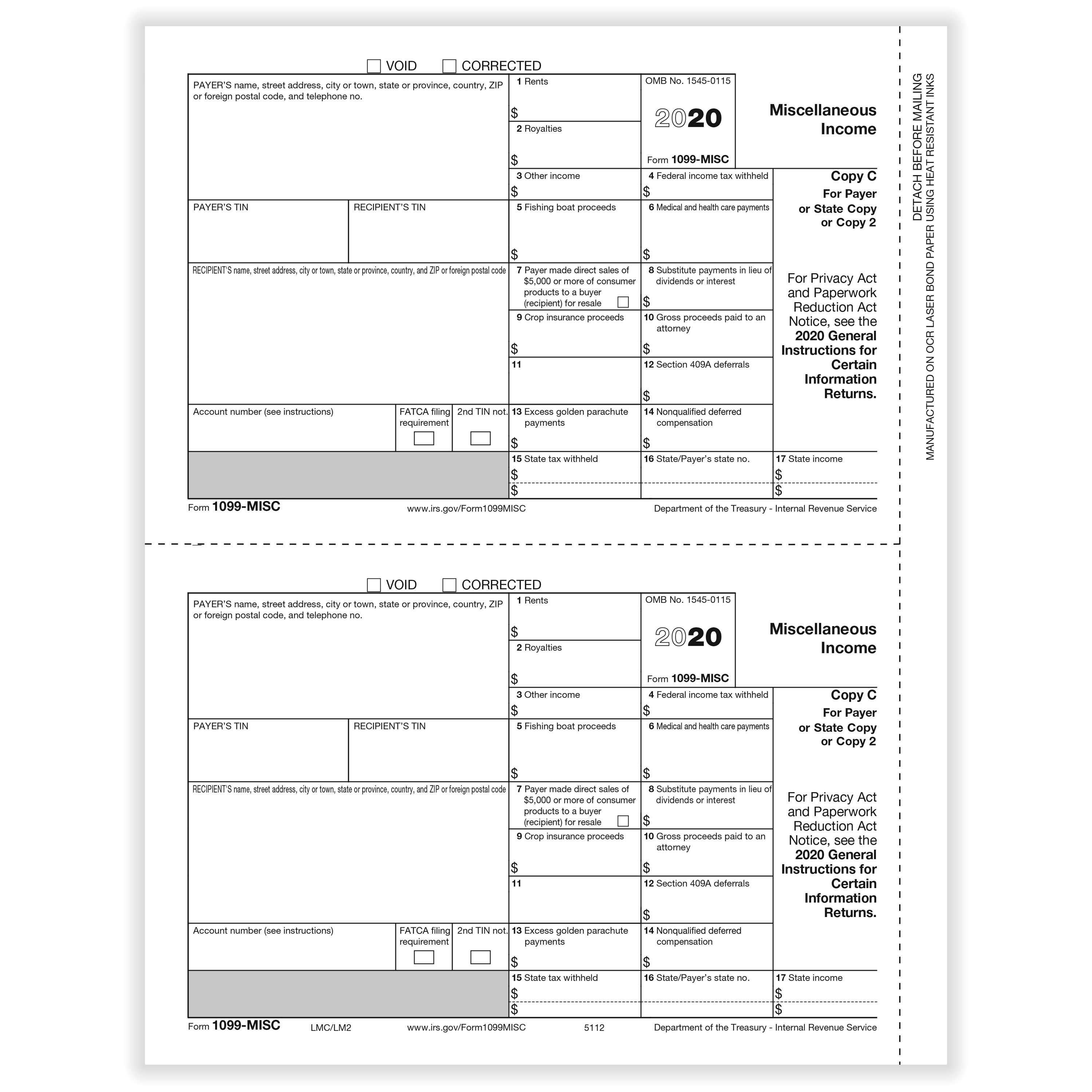

What is a 1099 C The 1099 C form reports a cancellation of debt creditors are required to issue Form 1099 C if they cancel a debt of 600 or more Form 1099 C must be issued when an identifiable event in connection with a cancellation of debt occurs Who files a 1099 C A lender files a 1099 C with the IRS and they ll send you a copy of Home About Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds

More picture related to Printable Irs Form 1099 C Form

Free Irs Form 1099 Printable Printable Templates

https://fitsmallbusiness.com/wp-content/uploads/2019/01/1099-form.png

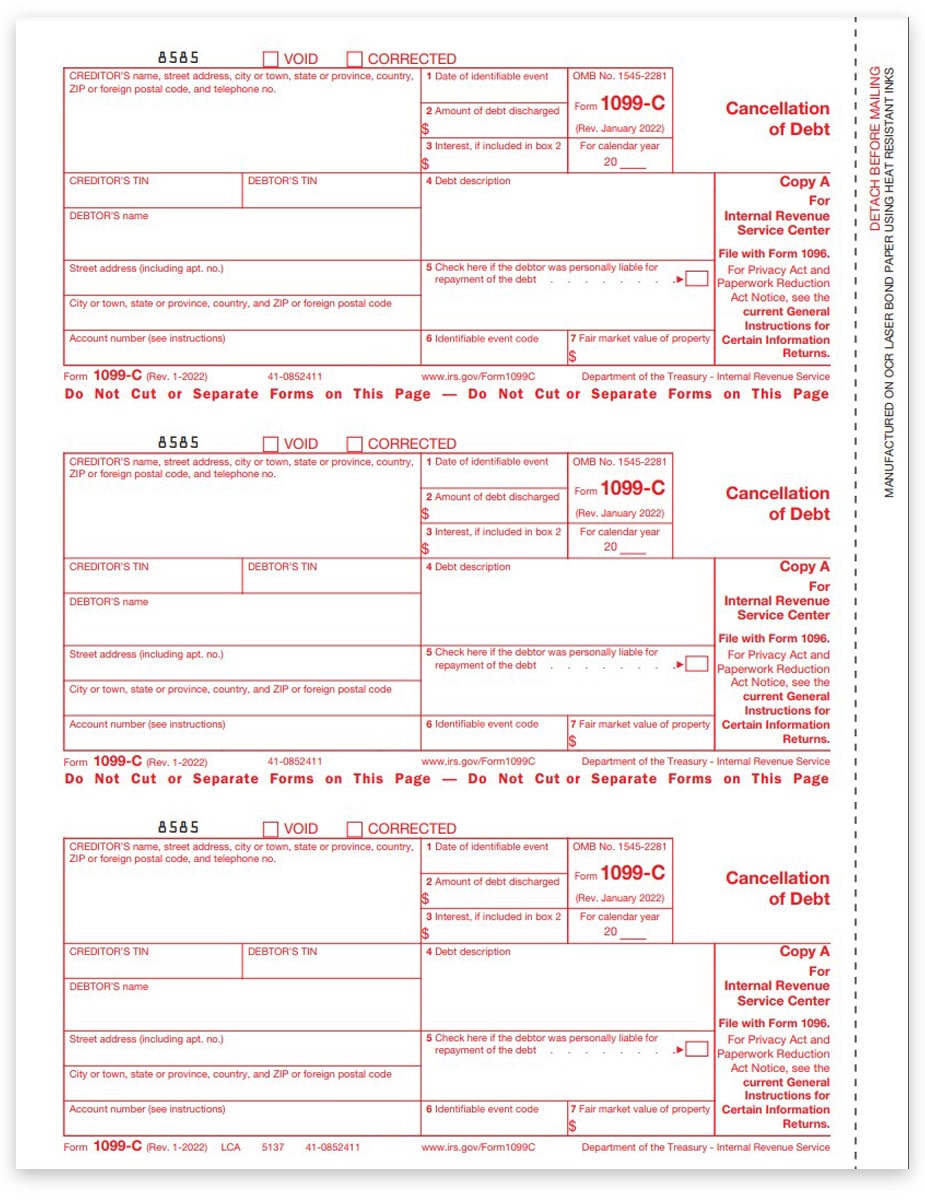

1099C Tax Form For Cancellation Of Debt IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1099C-Form-Copy-A-Federal-Red-LCA-FINAL-min.jpg

Printable Blank 1099 Form

https://www.printableform.net/wp-content/uploads/2021/07/free-printable-1099-form-2019-1099-form-printable.png

Assess the debt Review any IRS Form 1099 C Cancellation of Debt you received for the year If you believe the information on the form is wrong contact the lender to correct it If the payer lender won t correct the IRS Form 1099 C document report the amount on your tax return but include an explanation as to why the payer s information is incorrect Instructions Instructions for Forms 1099 MISC and 1099 NEC 01 2024 Miscellaneous Information and Nonemployee Compensation Section references are to the Internal Revenue Code unless otherwise noted Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments

According to the IRS nearly any debt you owe that is canceled forgiven or discharged becomes taxable income to you You should receive a Form 1099 C Cancellation of Debt from the lender that forgave the debt Common examples of when you might receive a Form 1099 C include charge off of a credit card balance repossession foreclosure Lenders and creditors are required to issue Form 1099 C if they cancel a debt of 600 or more If the debt canceled is less than 600 some lenders or creditors may send a letter or some other form of notification to the taxpayer Generally taxpayers must include all canceled amounts even if less than 600 on the Other Income line of Form 1040

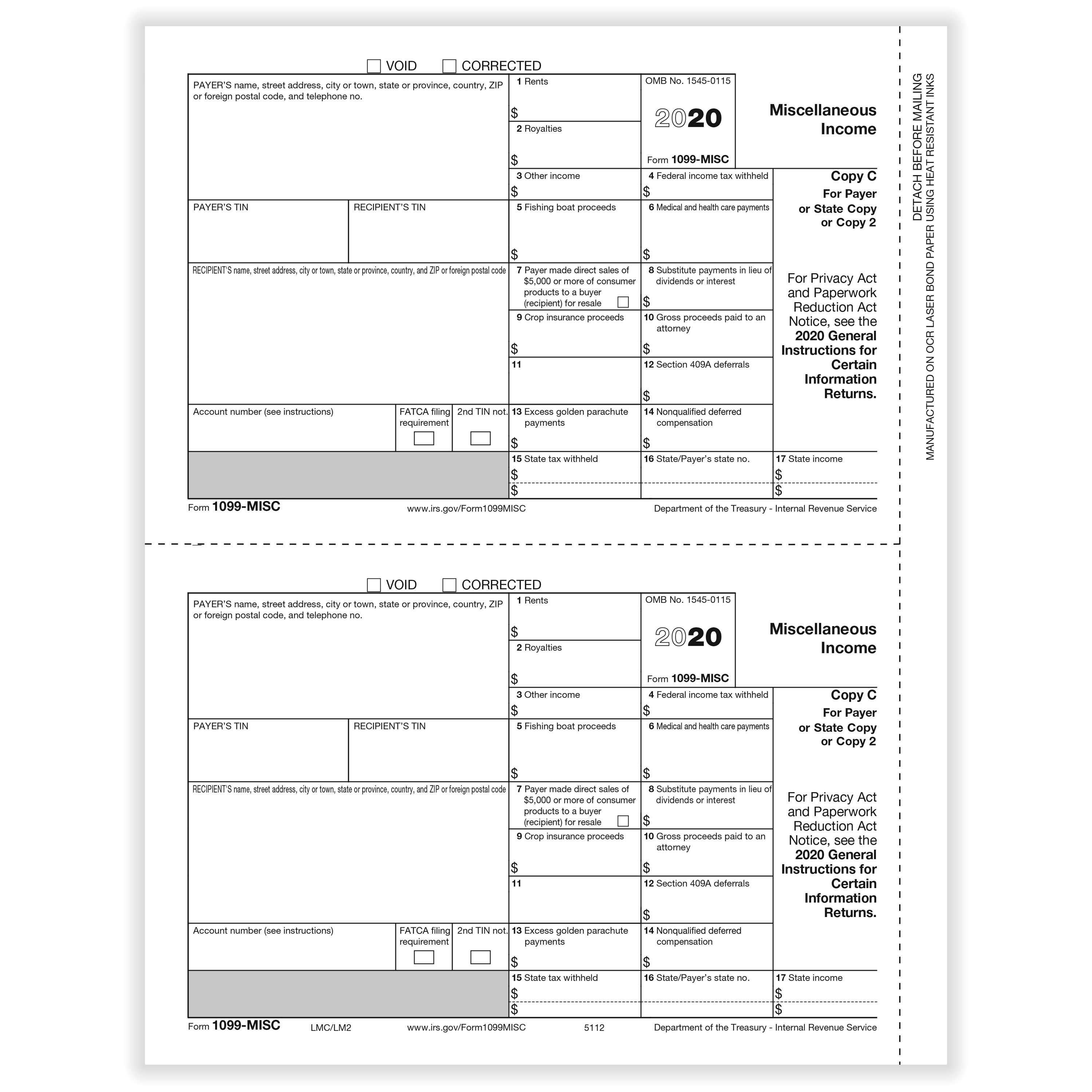

1099 MISC Income Form 1099 Form Copy C 1099 Form Formstax

https://cdn.formstax.com/Images/Products/L0759-5112-2020-1099MISC-Laser-Copy-C_xl.jpg

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/_h1CHqdnjvV-4nCTHDingOUQvJ4=/1288x1288/smart/filters:no_upscale()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg

https://www.irs.gov/forms-pubs/about-form-1099-c

File Form 1099 C for each debtor for whom you canceled 600 or more of a debt owed to you if You are an applicable financial entity An identifiable event has occurred Current Revision Form 1099 C PDF Instructions for Forms 1099 A and 1099 C Print Version PDF Recent Developments None at this time Other Items You May Find Useful

https://eforms.com/irs/form-1099/c/

A 1099 C form is an IRS tax document used to report the cancellation of debt for an individual debtor due to bankruptcy foreclosure or another change in circumstances A creditor must file 1099 C for each debtor for whom at least 600 in debt has been canceled What Qualifies as Debt

Irs gov Form 1099 C Universal Network

1099 MISC Income Form 1099 Form Copy C 1099 Form Formstax

Free Form 1099 MISC PDF Word

Free 1099 Fillable Form Printable Forms Free Online

Irs Printable 1099 Form Printable Form 2023

IRS Form 1099 C Software 79 Print 289 EFile 1099 C Software

IRS Form 1099 C Software 79 Print 289 EFile 1099 C Software

What Is A 1099 Tax Form Printable Form Resume Examples

1099C Forms For Cancellation Of Debt Creditor Copy C DiscountTaxForms

6 Must know Basics Form 1099 MISC For Independent Contractors Bonsai

Printable Irs Form 1099 C Form - 2021 Instructions for Forms 1099 A and 1099 C Introductory Material Future Developments For the latest information about developments related to Forms 1099 A and 1099 C and their instructions such as legislation enacted after they were published go to IRS gov Form1099A and IRS gov Form1099C What s New Form 1099 C